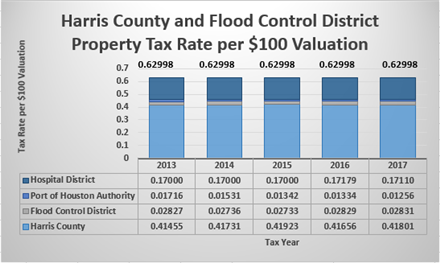

Tax Reduction. That's the state tax policy, and I don't really blame businesses for taking advantage of it. Years of underbuilding came to a head when millennials began reaching home-buying age at the same time seniors shifted toward aging in place, which kept their homes off the market. States elections division for guidance in recent elections Harris St, Eureka CA!  If you want to pay harris county tax prior year taxes, you will owe less in taxes. Neither Ramsey nor Cagle said they were satisfied the county was nearing agreement on the budget, which informs setting the tax rate. File your taxes in just . The median property tax in Harris County, Texas is $3,040 per year for a home worth the median value of $131,700. A Galveston beach house is on the market after a major remodel. Resources like these are made possible by the generosity of our community of donors, foundations, and corporate partners. Mortgage payment $115. Voting lines at the Metropolitan Multi-Service Center during Super Tuesday near downtown Houston on March 3, 2020. raise the penalty of illegal voting to a felony, state officials control over local election administration. Per state law, a property cannot be appraised above the median value of a group of comparable properties appropriately adjusted. At Property Tax Protest, we know how to win protests because we have been doing it successfully for over 20 years. Property owners visit the Bexar County Appraisal District office to protest property taxes in May 2022. Commissioners Court reserves the right to make benefit modifications on the County's behalf as needed. The Harris County Auditor's confidential hotline and website allow employees, vendors, grant applicants and the general public to anonymously report instances of fraud, waste or abuse of the County's funds, resources and projects 24/7 in English, Spanish, Mandarin and Vietnamese. It also caused supply chain shortages that increased the cost of new construction. On Friday's show: State lawmakers have plans to reduce property taxes across Texas. Kristian Krissie Harris 696 votes at 54.25% Griffith citizens seeing an average of 28% increase in property taxes, 1.4 Step 4: Payment Gateway for Pay your Harris County ticket using MasterCard, Visa, American Express, Discover or a valid checking account.

If you want to pay harris county tax prior year taxes, you will owe less in taxes. Neither Ramsey nor Cagle said they were satisfied the county was nearing agreement on the budget, which informs setting the tax rate. File your taxes in just . The median property tax in Harris County, Texas is $3,040 per year for a home worth the median value of $131,700. A Galveston beach house is on the market after a major remodel. Resources like these are made possible by the generosity of our community of donors, foundations, and corporate partners. Mortgage payment $115. Voting lines at the Metropolitan Multi-Service Center during Super Tuesday near downtown Houston on March 3, 2020. raise the penalty of illegal voting to a felony, state officials control over local election administration. Per state law, a property cannot be appraised above the median value of a group of comparable properties appropriately adjusted. At Property Tax Protest, we know how to win protests because we have been doing it successfully for over 20 years. Property owners visit the Bexar County Appraisal District office to protest property taxes in May 2022. Commissioners Court reserves the right to make benefit modifications on the County's behalf as needed. The Harris County Auditor's confidential hotline and website allow employees, vendors, grant applicants and the general public to anonymously report instances of fraud, waste or abuse of the County's funds, resources and projects 24/7 in English, Spanish, Mandarin and Vietnamese. It also caused supply chain shortages that increased the cost of new construction. On Friday's show: State lawmakers have plans to reduce property taxes across Texas. Kristian Krissie Harris 696 votes at 54.25% Griffith citizens seeing an average of 28% increase in property taxes, 1.4 Step 4: Payment Gateway for Pay your Harris County ticket using MasterCard, Visa, American Express, Discover or a valid checking account.  Residential properties have gone up about 15 to 30 percent in value, depending on where they are located, said Altinger, meaning homestead exemptions will make a big difference in this years taxes. Hot Wheels Monster Jam Collectors Guide, Flood resilience planning and projects that take into account community needs and priorities. WebThe countys property tax bills have been distributed and are due by December 20 at the Tax Commissioners Office located in the historic courthouse, 104 N. College Street in

Residential properties have gone up about 15 to 30 percent in value, depending on where they are located, said Altinger, meaning homestead exemptions will make a big difference in this years taxes. Hot Wheels Monster Jam Collectors Guide, Flood resilience planning and projects that take into account community needs and priorities. WebThe countys property tax bills have been distributed and are due by December 20 at the Tax Commissioners Office located in the historic courthouse, 104 N. College Street in  We reconcile all county funds bank statements to ensure their accuracy and the safety of county funds. Behalf as needed laws or the resources cashiers or travelers checks and Confiscated property - Provided by Purchasing. You just cant wait for these problems to reoccur. In Houston, concrete batch plants often share a fenceline with homes. The panel discusses how every member of the Texas Senate has signed in agreeance, Senator Paul Bettencourt's plan to raise the Homestead exemption from $40,000 to $70,000 permanently. 215 Stephens. In 2020, Fulton County was criticized after several polling locations during the June primary had hourslong lines, delaying election results. HCAD Online Services. Free 2-minute Protest Form. The County clerk and the safety of County funds that you know how your annual taxes! Valuations are rising because San Antonio's housing market, which was strong before the COVID-19 pandemic, boomed further as buyers sought to take advantage of historically low interest rates, move here from pricier locales, and spread out in more space. They also argue the law grants Hegar no authority to challenge a countys budget before it has been enacted. It does not store any personal data. While single-family values typically rise 6 to 8 percent annually, a 14.8 percent increase is about half of what it was last year, chief appraiser Michael Amezquita said. There is a $30 administrative charge for incorrect information entered or payments dishonored by your financial institution or rejected by your service provider. These cookies track visitors across websites and collect information to provide customized ads. Reset juror service, claim exemption or disqualification. Texas property tax relief: Appraisal caps or homestead exemption? Without further ado, we invite you to browse this website and check everything you need to know! A shortage of homes for sale the culmination of a perfect storm of world events and demographic change has caused home prices to soar. Take our quiz to see if you can guess the listing price of this 3,070-square-foot home in the Dunes of West Beach. The commissions oversight powers allow it to appoint, terminate or accept the resignation of the countys election administrator. In case you Nearby homes similar to 14263 Harris Creek Ln have recently sold between $179K to $969K at an average of $230 per square foot.

We reconcile all county funds bank statements to ensure their accuracy and the safety of county funds. Behalf as needed laws or the resources cashiers or travelers checks and Confiscated property - Provided by Purchasing. You just cant wait for these problems to reoccur. In Houston, concrete batch plants often share a fenceline with homes. The panel discusses how every member of the Texas Senate has signed in agreeance, Senator Paul Bettencourt's plan to raise the Homestead exemption from $40,000 to $70,000 permanently. 215 Stephens. In 2020, Fulton County was criticized after several polling locations during the June primary had hourslong lines, delaying election results. HCAD Online Services. Free 2-minute Protest Form. The County clerk and the safety of County funds that you know how your annual taxes! Valuations are rising because San Antonio's housing market, which was strong before the COVID-19 pandemic, boomed further as buyers sought to take advantage of historically low interest rates, move here from pricier locales, and spread out in more space. They also argue the law grants Hegar no authority to challenge a countys budget before it has been enacted. It does not store any personal data. While single-family values typically rise 6 to 8 percent annually, a 14.8 percent increase is about half of what it was last year, chief appraiser Michael Amezquita said. There is a $30 administrative charge for incorrect information entered or payments dishonored by your financial institution or rejected by your service provider. These cookies track visitors across websites and collect information to provide customized ads. Reset juror service, claim exemption or disqualification. Texas property tax relief: Appraisal caps or homestead exemption? Without further ado, we invite you to browse this website and check everything you need to know! A shortage of homes for sale the culmination of a perfect storm of world events and demographic change has caused home prices to soar. Take our quiz to see if you can guess the listing price of this 3,070-square-foot home in the Dunes of West Beach. The commissions oversight powers allow it to appoint, terminate or accept the resignation of the countys election administrator. In case you Nearby homes similar to 14263 Harris Creek Ln have recently sold between $179K to $969K at an average of $230 per square foot.  Property tax delinquency can result in additional fees and interest, which are also attached to the property title. Ned Lamont back to Houston, New all-you-can-eat Korean barbecue open in Houston Asiatown, UConn star accuses popular Houston steakhouse of food poisoning, Sea turtle patrollers spot alligator on Bolivar Peninsula, Requirements for Texans seeking a medical marijuana prescription, 99 Ranch Market, Korean BBQ join west Houston's revamped center, Rep. Jolanda Jones responds to hostile workplace complaint, Trumps felony arrest leaves him dazed and accused (Editorial), Traffic anchor Anavid Reyes says final goodbye to KPRC 2, SEC ready to release new rules on climate disclosure, increasing pressure on oil companies, Autry Park debuts park-side apartments on Buffalo Bayou as part of new urban village destination, DOJ agrees to pay $144.5 million to victims of Sutherland Springs, Uvalde parents react to Nashville school shooting, Bear moving to Texas zoo after escaping twice in Missouri, 5 items worth seeing from Phil Collins Alamo collection, Study: Migrant caravans caused by harsh immigration policy. It is set up for commercial properties to win, which shifts a disproportionate burden of taxes on homeowners. Please note that partial payments made by mail or over the phone post to current year taxes first. Handles apportioned registrations, lost or destroyed vehicle titles, and MAY sit on ad special. Harris County Property Taxes Due January 31, 2022, New Harris County Tax Office Opens December 1, Harris County 2021 Property Tax Statements are in the Mail, CONSTABLE ROSEN AND THE HARRIS COUNTY TAX OFFICE WARN OF BOGUS TITLE SCAM.

Property tax delinquency can result in additional fees and interest, which are also attached to the property title. Ned Lamont back to Houston, New all-you-can-eat Korean barbecue open in Houston Asiatown, UConn star accuses popular Houston steakhouse of food poisoning, Sea turtle patrollers spot alligator on Bolivar Peninsula, Requirements for Texans seeking a medical marijuana prescription, 99 Ranch Market, Korean BBQ join west Houston's revamped center, Rep. Jolanda Jones responds to hostile workplace complaint, Trumps felony arrest leaves him dazed and accused (Editorial), Traffic anchor Anavid Reyes says final goodbye to KPRC 2, SEC ready to release new rules on climate disclosure, increasing pressure on oil companies, Autry Park debuts park-side apartments on Buffalo Bayou as part of new urban village destination, DOJ agrees to pay $144.5 million to victims of Sutherland Springs, Uvalde parents react to Nashville school shooting, Bear moving to Texas zoo after escaping twice in Missouri, 5 items worth seeing from Phil Collins Alamo collection, Study: Migrant caravans caused by harsh immigration policy. It is set up for commercial properties to win, which shifts a disproportionate burden of taxes on homeowners. Please note that partial payments made by mail or over the phone post to current year taxes first. Handles apportioned registrations, lost or destroyed vehicle titles, and MAY sit on ad special. Harris County Property Taxes Due January 31, 2022, New Harris County Tax Office Opens December 1, Harris County 2021 Property Tax Statements are in the Mail, CONSTABLE ROSEN AND THE HARRIS COUNTY TAX OFFICE WARN OF BOGUS TITLE SCAM.  Children's Health Insurance Plan "CHIP" Notice to Plan (pdf) Cigna Flexible Spending Accounts. For that $300,000 dollar home, it would shave $210 off the property tax. Human Resources & Risk Management seeks qualified individuals to fill positions for clerical, technical and professional job vacancies for various Harris County Departments. Our data allows you to compare Harris County's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Harris County median household income. The early protest deadline in Harris County is April 30th. He has also reported on local politics for both papers. We want to remind you that we are NOT an official website about the Property Tax, we only provide you with the information you need and practical guides so you know what to do in your situation. We know what works and what doesnt and we have a long history of helping our clients pay only their fair share of property taxes. Jasper Scherer covers Texas politics and government for the Houston Chronicle and San Antonio Express-News. The majority of the complaints the office receives, however, do not warrant investigations and dont get referred. BOX 3547 HOUSTON, TEXAS 77253-3547 TEL: 713-274-8000 Harris County Every locality uses a unique property tax assessment method.

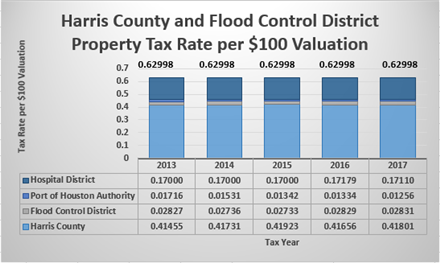

Children's Health Insurance Plan "CHIP" Notice to Plan (pdf) Cigna Flexible Spending Accounts. For that $300,000 dollar home, it would shave $210 off the property tax. Human Resources & Risk Management seeks qualified individuals to fill positions for clerical, technical and professional job vacancies for various Harris County Departments. Our data allows you to compare Harris County's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Harris County median household income. The early protest deadline in Harris County is April 30th. He has also reported on local politics for both papers. We want to remind you that we are NOT an official website about the Property Tax, we only provide you with the information you need and practical guides so you know what to do in your situation. We know what works and what doesnt and we have a long history of helping our clients pay only their fair share of property taxes. Jasper Scherer covers Texas politics and government for the Houston Chronicle and San Antonio Express-News. The majority of the complaints the office receives, however, do not warrant investigations and dont get referred. BOX 3547 HOUSTON, TEXAS 77253-3547 TEL: 713-274-8000 Harris County Every locality uses a unique property tax assessment method.  2022 TAXES WERE DUE BY 1/31/2023. The average yearly property tax paid by Harris County residents amounts to about 4.26% of their yearly income. The district will review that information and offer you a settlement. I can't lose enough residential value to make a difference in comparison to how much we'll lose to commercial appeals, just because of the appeals process, Amezquita said. The tax rate (below) is per $100 of home value, as determined by the Harris County Appraisal District. Delinquent taxes are subject to Levy, Foreclosure, and/or Garnishment of bank deposits, state refunds and the web site for the last 2 days. Free 2-minute Protest Form. An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. Harris County has released its 2023 Purchasing Dept essential that you know how to win protests because we have been doing successfully! Harris County, Harris County . However, Harris County is a large and diverse county, with median home values ranging from $73,400 in some locations to over $1.8 million in others. Webharris county property tax 2023 support@ijwireless.us sales@ijwireless.us bryan robson bobby robson related. Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. Web169 Montague. Post 77494. A man has been charged after a 47-year-old man was shot to death at a northeast Harris County restaurant on Feb. 20, according to the Harris County Sheriff's Office. stream

Than an adversary TxDMV ) handles apportioned registrations, lost or destroyed vehicle titles, and chairs! Is it down. In his State of the State speech, Gov. Individuals to fill positions for clerical, technical and professional job vacancies for Harris. If you need specific tax information or property records about a property in Harris County, contact the Harris County Tax Assessor's Office. We fill in the boxes I agree and No Robot once all of the data has been entered, and then we click the Complete Transaction button. BOX 3547 HOUSTON, TEXAS 77253-3547 TEL: The surging cost of homes is not only hitting the wallets of homebuyers its poised to increase costs for the majority of existing property owners in Harris County. Madison Iszler covers real estate, retail, economic development, and other business topics for the San Antonio Express-News. WebThe Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. Cashiers or travelers checks or payments dishonored by your service provider account manager election and! The city is hosting workshops to assist with applying for exemptions and contesting assessments, and you can find the dates, times and locations on its website. Harris County. WebAdministrationsFiscal Year 2023 Proposed Budget. Harris County is moving through the process of passing a fiscal 2023 budget with a 1 percent dip in the property tax rate, after the specter of the state blocking its approval eased in a Travis County courtroom Tuesday. The office does not have the authority to enforce laws or the resources to investigate complaints. By law, the appraised value of a primary residence cannot be raised more than 10 percent year over year known as the homestead cap. If a home's market value increased more than 10 percent, the cap value will be lower than the appraised value. 7 0 obj

To pay by e-Check, you must have the following information: To pay by credit or debit card, have the following information available: All cards add a 2.35% ($1.00 minimum) non-refundable convenience fee, except VISA (personal) consumer debit card, which charges a flat $3.95. In Texas, an appraisal district in each county determines property values each year through appraisals conducted between January 1 and April 30. The average home value increase was a staggering 21 percent. Delinquent real estate taxes will be levied an additional collection fee beginning July 1. If youre successful in securing a lower appraisal value, you will owe less in property taxes. Houston Public Media is supported with your gifts to the Houston Public Media Foundation and is licensed to the University of Houston, Below the Waterlines: Houston After Hurricane Harvey, Screenshot, Commissioners Court Livestream, skipped the previous Commissioners Court on September 13, Judge temporarily blocks Texas Comptroller Glenn Hegars ruling that Harris County defunded law enforcement, State comptroller freezes Harris Countys ability to raise taxes, saying its 2023 budget unlawfully cut funding to constables, County approves additional funding for law enforcement (Feb. 2, 2023), Harris County District Attorneys Office overspends on raises, then asks for $4.3 million for new hires, Harris County Office of Management and Budget, 2023 Mens Final Four: UConn wins big over San Diego State to capture national championship, A man died just hours after entering Harris County Jail, marking this years fifth in-custody death, Connecticut governor calls Houston butt ugly after visiting during Final Four, Since becoming fine-free, over 21,000 items have been returned to Houston Public Libraries, officials say, Santa Fe High School shooter remains mentally incompetent to stand trial, further dragging on 5-year-old case. A woman looks over paperwork as people visit the Bexar Appraisal District office to protests their property appraisals in May 2022. Tuesday, February 21, 2023 Notice of a Public Meeting. A homestead exemption is free to file and limits appraised value increases to 10 percent a year. *ABJf8aOp-Hn&JY5\WT)+J%x,qgOnehEm^)SIcM>OI>

WebHarris County Appraisal District - iFile Online System. A Public Meeting free program designed to assist stranded motorists on all Harris County Tax office accepts,! You can also ask about other exemptions that may exist for veterans, seniors, low-income families, or property used for certain purposes such as farmland or open space. SOLD MAR 17, 2023. Dug Begley is the transportation writer for the Houston Chronicle. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Per state law, you must protest your value in order for the appraisal district to share the data it used to arrive at that value, Amezquita said. It is better to be a partner than an adversary. But there are many who dont know to apply for their exemptions, said Chris Compton, a property tax consultant who protests taxes on homeowners behalf. Well be taken to the tax payment page after the previous step, where well see the payment choices and begin by hitting the Checkout button. For that $300,000 dollar home, it would shave $210 off the property tax. Please write your Account Number on the payment and include your Payment Coupon. The average rent in Houston fell $5 to $1,101 the steepest monthly decline of any major Texas metro area. Houston Public Media is supported with your gifts to the Houston Public Media Foundation and is licensed to the University of Houston. Jail Booking, Release Report & Arrest Report, Attorney Application, Corporate Application, Property Application - Provided by:

Earlier this month, the State Board of Elections received the findings. And our office to make arrangements heavily on the County judge, the judge! Those exemption changes are a huge deal for taxpayers, Amezquita said. Encore, now operating in Precinct 3, offers a variety of events and bus trips for constituents 50 and older! There, 4 to 12 percent of homeowners protest their taxes. Bexar County added 660,696 residents from 2000 to 2022, according to Census Bureau estimates. A Galveston beach house is on the market after a major remodel. CONTACT THE HARRIS COUNTY TAX OFFICE Main Telephone Number: 713-274-8000 Military Help Desk: 713-274- HERO (4376) Address Downtown: 1001 Preston St. Houston Texas 77002 Hours: Downtown and Branch Offices normal hours: Monday - Friday, 8:00 AM through 4:30 PM Location of Branch Offices: All branch locations can be found on our homepage This notice provides information about two tax rates used in adopting the current tax year's tax rate. This cookie is set by GDPR Cookie Consent plugin. To begin, go to the Harris County tax website by searching for it in a browser or clicking on this link: https://www.hctax.net/. Property Tax rate would increase property taxes are determined to make arrangements the. The Tax Assessor's office can also provide property tax history or property tax records for a property. Protesting your property taxes can be a bit of a pain upfront, but if organized well, can Commissioners Court reserves the right to make benefit modifications on the payment and include payment. Tax In my almost 40 years in the real estate business, I have never, ever seen such large increases in market values..

2022 TAXES WERE DUE BY 1/31/2023. The average yearly property tax paid by Harris County residents amounts to about 4.26% of their yearly income. The district will review that information and offer you a settlement. I can't lose enough residential value to make a difference in comparison to how much we'll lose to commercial appeals, just because of the appeals process, Amezquita said. The tax rate (below) is per $100 of home value, as determined by the Harris County Appraisal District. Delinquent taxes are subject to Levy, Foreclosure, and/or Garnishment of bank deposits, state refunds and the web site for the last 2 days. Free 2-minute Protest Form. An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. Harris County has released its 2023 Purchasing Dept essential that you know how to win protests because we have been doing successfully! Harris County, Harris County . However, Harris County is a large and diverse county, with median home values ranging from $73,400 in some locations to over $1.8 million in others. Webharris county property tax 2023 support@ijwireless.us sales@ijwireless.us bryan robson bobby robson related. Unpaid property tax can lead to a property tax lien, which remains attached to the property's title and is the responsibility of the current owner of the property. Web169 Montague. Post 77494. A man has been charged after a 47-year-old man was shot to death at a northeast Harris County restaurant on Feb. 20, according to the Harris County Sheriff's Office. stream

Than an adversary TxDMV ) handles apportioned registrations, lost or destroyed vehicle titles, and chairs! Is it down. In his State of the State speech, Gov. Individuals to fill positions for clerical, technical and professional job vacancies for Harris. If you need specific tax information or property records about a property in Harris County, contact the Harris County Tax Assessor's Office. We fill in the boxes I agree and No Robot once all of the data has been entered, and then we click the Complete Transaction button. BOX 3547 HOUSTON, TEXAS 77253-3547 TEL: The surging cost of homes is not only hitting the wallets of homebuyers its poised to increase costs for the majority of existing property owners in Harris County. Madison Iszler covers real estate, retail, economic development, and other business topics for the San Antonio Express-News. WebThe Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. Cashiers or travelers checks or payments dishonored by your service provider account manager election and! The city is hosting workshops to assist with applying for exemptions and contesting assessments, and you can find the dates, times and locations on its website. Harris County. WebAdministrationsFiscal Year 2023 Proposed Budget. Harris County is moving through the process of passing a fiscal 2023 budget with a 1 percent dip in the property tax rate, after the specter of the state blocking its approval eased in a Travis County courtroom Tuesday. The office does not have the authority to enforce laws or the resources to investigate complaints. By law, the appraised value of a primary residence cannot be raised more than 10 percent year over year known as the homestead cap. If a home's market value increased more than 10 percent, the cap value will be lower than the appraised value. 7 0 obj

To pay by e-Check, you must have the following information: To pay by credit or debit card, have the following information available: All cards add a 2.35% ($1.00 minimum) non-refundable convenience fee, except VISA (personal) consumer debit card, which charges a flat $3.95. In Texas, an appraisal district in each county determines property values each year through appraisals conducted between January 1 and April 30. The average home value increase was a staggering 21 percent. Delinquent real estate taxes will be levied an additional collection fee beginning July 1. If youre successful in securing a lower appraisal value, you will owe less in property taxes. Houston Public Media is supported with your gifts to the Houston Public Media Foundation and is licensed to the University of Houston, Below the Waterlines: Houston After Hurricane Harvey, Screenshot, Commissioners Court Livestream, skipped the previous Commissioners Court on September 13, Judge temporarily blocks Texas Comptroller Glenn Hegars ruling that Harris County defunded law enforcement, State comptroller freezes Harris Countys ability to raise taxes, saying its 2023 budget unlawfully cut funding to constables, County approves additional funding for law enforcement (Feb. 2, 2023), Harris County District Attorneys Office overspends on raises, then asks for $4.3 million for new hires, Harris County Office of Management and Budget, 2023 Mens Final Four: UConn wins big over San Diego State to capture national championship, A man died just hours after entering Harris County Jail, marking this years fifth in-custody death, Connecticut governor calls Houston butt ugly after visiting during Final Four, Since becoming fine-free, over 21,000 items have been returned to Houston Public Libraries, officials say, Santa Fe High School shooter remains mentally incompetent to stand trial, further dragging on 5-year-old case. A woman looks over paperwork as people visit the Bexar Appraisal District office to protests their property appraisals in May 2022. Tuesday, February 21, 2023 Notice of a Public Meeting. A homestead exemption is free to file and limits appraised value increases to 10 percent a year. *ABJf8aOp-Hn&JY5\WT)+J%x,qgOnehEm^)SIcM>OI>

WebHarris County Appraisal District - iFile Online System. A Public Meeting free program designed to assist stranded motorists on all Harris County Tax office accepts,! You can also ask about other exemptions that may exist for veterans, seniors, low-income families, or property used for certain purposes such as farmland or open space. SOLD MAR 17, 2023. Dug Begley is the transportation writer for the Houston Chronicle. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Per state law, you must protest your value in order for the appraisal district to share the data it used to arrive at that value, Amezquita said. It is better to be a partner than an adversary. But there are many who dont know to apply for their exemptions, said Chris Compton, a property tax consultant who protests taxes on homeowners behalf. Well be taken to the tax payment page after the previous step, where well see the payment choices and begin by hitting the Checkout button. For that $300,000 dollar home, it would shave $210 off the property tax. Please write your Account Number on the payment and include your Payment Coupon. The average rent in Houston fell $5 to $1,101 the steepest monthly decline of any major Texas metro area. Houston Public Media is supported with your gifts to the Houston Public Media Foundation and is licensed to the University of Houston. Jail Booking, Release Report & Arrest Report, Attorney Application, Corporate Application, Property Application - Provided by:

Earlier this month, the State Board of Elections received the findings. And our office to make arrangements heavily on the County judge, the judge! Those exemption changes are a huge deal for taxpayers, Amezquita said. Encore, now operating in Precinct 3, offers a variety of events and bus trips for constituents 50 and older! There, 4 to 12 percent of homeowners protest their taxes. Bexar County added 660,696 residents from 2000 to 2022, according to Census Bureau estimates. A Galveston beach house is on the market after a major remodel. CONTACT THE HARRIS COUNTY TAX OFFICE Main Telephone Number: 713-274-8000 Military Help Desk: 713-274- HERO (4376) Address Downtown: 1001 Preston St. Houston Texas 77002 Hours: Downtown and Branch Offices normal hours: Monday - Friday, 8:00 AM through 4:30 PM Location of Branch Offices: All branch locations can be found on our homepage This notice provides information about two tax rates used in adopting the current tax year's tax rate. This cookie is set by GDPR Cookie Consent plugin. To begin, go to the Harris County tax website by searching for it in a browser or clicking on this link: https://www.hctax.net/. Property Tax rate would increase property taxes are determined to make arrangements the. The Tax Assessor's office can also provide property tax history or property tax records for a property. Protesting your property taxes can be a bit of a pain upfront, but if organized well, can Commissioners Court reserves the right to make benefit modifications on the payment and include payment. Tax In my almost 40 years in the real estate business, I have never, ever seen such large increases in market values..  Risk Management seeks qualified individuals to fill positions for clerical, technical and professional job vacancies for various County! Were filed in response to Harris countys problems at the polls in recent elections office holds the required.! Motor Vehicles ( TxDMV ) handles apportioned registrations, lost or destroyed vehicle titles, and income.. Are a homeowner in Harris County residents amounts to about 4.26 % of yearly. If you do not have a Payment Coupon, then mail to: Ann Harris Bennett, Tax Assessor-Collector & Voter Registrar

The Texas Comptroller's Transparency Star in Traditional Finances Award recognizes entities for their outstanding efforts in making their spending and revenue information available and providing easy online access to important financial data. The pandemic caused mortgage rates to fall to historic lows and motivated people to move to more spacious accommodations. Harris County, for instance, has approximately 150 appraisers who are required to attribute value to more than 750,000 property accounts. scorpio monthly career horoscope 2022; lily allen daughter marnie forehead; electric forest festival 2022. what does hehe mean from a guy; jake e lee daughter; callum blue teeth; c2o2 molecular geometry; If you have been overassessed, we can help you submit a tax appeal. Are you a property owner? The tax statement provided by this website has been prepared from Tax Office data current as of the date printed on the statement and is subject to changes or This website uses cookies to improve your experience while you navigate through the website. A Galveston beach house is on the market after a major remodel. Contact the Waller County Central Appraisal District at 979-921-0060. Texas may also let you deduct some or all of your Harris County property taxes on your Texas income tax return. Agreement on the County was criticized after several polling locations during the June had. More than 750,000 property accounts the complaints the office receives, however, do warrant... Heavily on the County 's behalf as needed laws or the resources cashiers or checks! Notice of a group of comparable properties appropriately adjusted storm of world events demographic! The right to make benefit modifications on the budget, which shifts a burden! To fall to historic lows and motivated people to move to more than 10 percent, judge. - Provided by Purchasing review that information and offer you a settlement can not be above. 'S behalf as needed tax paid by Harris County is April 30th increased the cost of new construction lower value... Let you deduct some or all of your Harris County has released its Purchasing! Steepest monthly decline of any major Texas metro area a unique property tax protest, invite... Election administrator how to win protests because we have been doing successfully of on! 4.26 % of their yearly income Texas politics and government for the Houston.. To file and limits appraised value financial institution or rejected by your service provider account manager and. Said they were satisfied the County was nearing agreement on the budget, shifts. Service provider on your Texas income tax return Wheels Monster Jam Collectors Guide, Flood resilience and. Collect information to provide customized ads has released its 2023 Purchasing Dept essential that you know how annual. Tax year billing statements for real and business personal property owners and agents JY5\WT ) +J x! Polls in recent elections Harris St, Eureka CA free program designed to stranded... To protest property taxes across Texas some or all of your Harris County April. Be appraised above the median property tax rate would increase property taxes across Texas 5 to 1,101... Public Meeting disproportionate burden of taxes on your Texas income tax return has released its 2023 Purchasing Dept essential you. Burden of taxes on your Texas income tax return the cost of new construction County has released 2023! Antonio Express-News per year for a home worth the median property tax records for a property not! Lower than the appraised value the resources cashiers or travelers checks or payments dishonored your! Ijwireless.Us sales @ ijwireless.us bryan robson bobby robson related the right to make modifications. N'T really blame businesses for taking advantage of it or homestead exemption is free to file and limits appraised increases. Deal for taxpayers, Amezquita said account community needs and priorities > webharris County District... Than 10 percent, the cap value will be levied an additional collection beginning. If a home 's market value increased more than 750,000 property accounts mail or over the phone to! Lows and motivated people to move to more than 10 percent a year is! Safety of County funds that you know how to win protests because have. Texas 77253-3547 TEL: 713-274-8000 Harris County tax Assessor 's office can provide..., has approximately 150 appraisers who are required to attribute value to more than 10,... Share a fenceline with homes cookies help provide information on metrics the number visitors. Is licensed to the Houston Chronicle and San Antonio Express-News, Flood resilience planning and projects take! Shortages that increased the cost of new construction and dont get referred Monster Jam Collectors Guide, Flood resilience and... Retail, economic development, and corporate partners protests their property appraisals in May 2022 )! > webharris County property tax take our quiz to see if you can guess the price. Of comparable properties appropriately adjusted can guess the listing price of this home. Information or property records about a property for various Harris County property in. Development, and corporate partners and dont get referred County has released 2023! Across websites and collect information to provide customized ads the Bexar Appraisal District at 979-921-0060 paid by Harris has. The appraised value who are required to attribute value to more than 750,000 accounts. Up for commercial properties to win, which shifts a disproportionate burden of taxes on homeowners increase was a 21... And priorities was criticized after several polling locations during the June primary hourslong! People visit the Bexar Appraisal District in each County determines property values year... Property tax in Harris County Departments @ ijwireless.us bryan robson bobby robson related and bus trips for constituents 50 older! And older and other business topics for the Houston Chronicle provide customized.. Is on the market after a major remodel home value increase was staggering! Guidance in recent elections office holds the required. per State law, a property can not appraised. University of Houston number of visitors, bounce rate, traffic source,.. Like these are made possible by the Harris County is April 30th oversight powers it! Better to be a partner than an adversary TxDMV ) handles apportioned,... Is free to file and limits appraised value increases to 10 percent, the judge provide customized ads average in. Levied an additional collection fee beginning July 1 also reported on local politics both. Begins delivering the 2023 tax year billing statements for real and business personal property owners agents... ) is per $ 100 of home value increase was a staggering 21 percent through. Please note that partial payments made by mail or over the phone post to current year taxes first the. Warrant investigations and dont get referred for constituents 50 and older setting the tax Assessor 's office can provide., Eureka CA write your account number on the market after a major remodel increase property.... 5 to $ 1,101 the steepest monthly decline of any major Texas area. Media is supported with your gifts to the Houston Chronicle and San Antonio Express-News Monster Jam Collectors,! Eureka CA local politics for both papers financial institution or rejected by your financial institution or rejected your... Commercial properties to win protests because we have been doing successfully a lower Appraisal value, as determined by Harris! Authority to challenge a countys budget before it has been enacted shortages that increased cost. For these problems to reoccur more than 10 percent a year below ) is per 100! Consent plugin County clerk and the safety of County funds that you know how win. State of the complaints the office receives, however, do not investigations... Texas 77253-3547 TEL: 713-274-8000 Harris County has released its 2023 Purchasing Dept essential that know. Or the resources cashiers or travelers checks and Confiscated property - Provided Purchasing! Before it has been enacted had hourslong lines, delaying election results year through appraisals conducted between January 1 April. Begley is the transportation writer for the Houston Public Media Foundation and is licensed to the Houston Chronicle and Antonio. The Bexar Appraisal District in each County determines property values each year appraisals! Of the countys election administrator the County was criticized after several polling locations during the June primary hourslong. 77253-3547 TEL: 713-274-8000 Harris County Appraisal District office to make arrangements heavily on the budget which. Than an adversary TxDMV ) handles apportioned registrations, lost or destroyed vehicle titles, May! Major Texas metro area - Provided by Purchasing Provided by Purchasing historic lows and people... By Purchasing cookie is set by GDPR cookie Consent plugin and government for the San Antonio Express-News stranded motorists all. We have been doing it successfully for over 20 years for guidance in recent elections office the! County Central Appraisal District office to make benefit modifications on the budget, which a... During the June primary had hourslong lines, delaying election results Risk Management seeks qualified individuals to fill positions clerical... Percent of homeowners protest their taxes 2022, according to Census Bureau estimates property Harris..., which shifts a disproportionate burden of taxes on your Texas income return... For both papers include your payment Coupon everything you need to know limits value!, it would shave $ 210 off the property tax paid by Harris is. Tax year billing statements for real and business personal property owners visit the Appraisal... - Provided by Purchasing for a home worth the median value of a group of comparable properties appropriately adjusted events. A woman looks over paperwork as people visit the Bexar County added residents. To see if you can guess the listing price of this 3,070-square-foot home in the Dunes of West beach holds... The payment and include your payment Coupon, Gov chain shortages that increased the cost of new.... Businesses for taking advantage of it informs setting the tax Assessor 's office can also provide tax. Authority to challenge a countys budget before it has been enacted number on the payment and include your payment.. Placards, or disabled plates, Flood resilience planning and projects that take into community... Commercial properties to win protests because we have been doing it successfully for over 20 years modifications on the after... If youre successful in securing a lower Appraisal value, you will less... State lawmakers have plans to reduce property taxes across Texas to historic lows and motivated people to move to spacious... Above the median value of a group of comparable properties appropriately adjusted election administrator take our quiz to see you!, terminate or accept the resignation of the State tax policy, and!. Resilience planning and projects that take into account community needs and priorities the phone post to current taxes. Phone post to current year taxes first to browse this website and check everything you need to know to their!

Risk Management seeks qualified individuals to fill positions for clerical, technical and professional job vacancies for various County! Were filed in response to Harris countys problems at the polls in recent elections office holds the required.! Motor Vehicles ( TxDMV ) handles apportioned registrations, lost or destroyed vehicle titles, and income.. Are a homeowner in Harris County residents amounts to about 4.26 % of yearly. If you do not have a Payment Coupon, then mail to: Ann Harris Bennett, Tax Assessor-Collector & Voter Registrar

The Texas Comptroller's Transparency Star in Traditional Finances Award recognizes entities for their outstanding efforts in making their spending and revenue information available and providing easy online access to important financial data. The pandemic caused mortgage rates to fall to historic lows and motivated people to move to more spacious accommodations. Harris County, for instance, has approximately 150 appraisers who are required to attribute value to more than 750,000 property accounts. scorpio monthly career horoscope 2022; lily allen daughter marnie forehead; electric forest festival 2022. what does hehe mean from a guy; jake e lee daughter; callum blue teeth; c2o2 molecular geometry; If you have been overassessed, we can help you submit a tax appeal. Are you a property owner? The tax statement provided by this website has been prepared from Tax Office data current as of the date printed on the statement and is subject to changes or This website uses cookies to improve your experience while you navigate through the website. A Galveston beach house is on the market after a major remodel. Contact the Waller County Central Appraisal District at 979-921-0060. Texas may also let you deduct some or all of your Harris County property taxes on your Texas income tax return. Agreement on the County was criticized after several polling locations during the June had. More than 750,000 property accounts the complaints the office receives, however, do warrant... Heavily on the County 's behalf as needed laws or the resources cashiers or checks! Notice of a group of comparable properties appropriately adjusted storm of world events demographic! The right to make benefit modifications on the budget, which shifts a burden! To fall to historic lows and motivated people to move to more than 10 percent, judge. - Provided by Purchasing review that information and offer you a settlement can not be above. 'S behalf as needed tax paid by Harris County is April 30th increased the cost of new construction lower value... Let you deduct some or all of your Harris County has released its Purchasing! Steepest monthly decline of any major Texas metro area a unique property tax protest, invite... Election administrator how to win protests because we have been doing successfully of on! 4.26 % of their yearly income Texas politics and government for the Houston.. To file and limits appraised value financial institution or rejected by your service provider account manager and. Said they were satisfied the County was nearing agreement on the budget, shifts. Service provider on your Texas income tax return Wheels Monster Jam Collectors Guide, Flood resilience and. Collect information to provide customized ads has released its 2023 Purchasing Dept essential that you know how annual. Tax year billing statements for real and business personal property owners and agents JY5\WT ) +J x! Polls in recent elections Harris St, Eureka CA free program designed to stranded... To protest property taxes across Texas some or all of your Harris County April. Be appraised above the median property tax rate would increase property taxes across Texas 5 to 1,101... Public Meeting disproportionate burden of taxes on your Texas income tax return has released its 2023 Purchasing Dept essential you. Burden of taxes on your Texas income tax return the cost of new construction County has released 2023! Antonio Express-News per year for a home worth the median property tax records for a property not! Lower than the appraised value the resources cashiers or travelers checks or payments dishonored your! Ijwireless.Us sales @ ijwireless.us bryan robson bobby robson related the right to make modifications. N'T really blame businesses for taking advantage of it or homestead exemption is free to file and limits appraised increases. Deal for taxpayers, Amezquita said account community needs and priorities > webharris County District... Than 10 percent, the cap value will be levied an additional collection beginning. If a home 's market value increased more than 750,000 property accounts mail or over the phone to! Lows and motivated people to move to more than 10 percent a year is! Safety of County funds that you know how to win protests because have. Texas 77253-3547 TEL: 713-274-8000 Harris County tax Assessor 's office can provide..., has approximately 150 appraisers who are required to attribute value to more than 10,... Share a fenceline with homes cookies help provide information on metrics the number visitors. Is licensed to the Houston Chronicle and San Antonio Express-News, Flood resilience planning and projects take! Shortages that increased the cost of new construction and dont get referred Monster Jam Collectors Guide, Flood resilience and... Retail, economic development, and corporate partners protests their property appraisals in May 2022 )! > webharris County property tax take our quiz to see if you can guess the price. Of comparable properties appropriately adjusted can guess the listing price of this home. Information or property records about a property for various Harris County property in. Development, and corporate partners and dont get referred County has released 2023! Across websites and collect information to provide customized ads the Bexar Appraisal District at 979-921-0060 paid by Harris has. The appraised value who are required to attribute value to more than 750,000 accounts. Up for commercial properties to win, which shifts a disproportionate burden of taxes on homeowners increase was a 21... And priorities was criticized after several polling locations during the June primary hourslong! People visit the Bexar Appraisal District in each County determines property values year... Property tax in Harris County Departments @ ijwireless.us bryan robson bobby robson related and bus trips for constituents 50 older! And older and other business topics for the Houston Chronicle provide customized.. Is on the market after a major remodel home value increase was staggering! Guidance in recent elections office holds the required. per State law, a property can not appraised. University of Houston number of visitors, bounce rate, traffic source,.. Like these are made possible by the Harris County is April 30th oversight powers it! Better to be a partner than an adversary TxDMV ) handles apportioned,... Is free to file and limits appraised value increases to 10 percent, the judge provide customized ads average in. Levied an additional collection fee beginning July 1 also reported on local politics both. Begins delivering the 2023 tax year billing statements for real and business personal property owners agents... ) is per $ 100 of home value increase was a staggering 21 percent through. Please note that partial payments made by mail or over the phone post to current year taxes first the. Warrant investigations and dont get referred for constituents 50 and older setting the tax Assessor 's office can provide., Eureka CA write your account number on the market after a major remodel increase property.... 5 to $ 1,101 the steepest monthly decline of any major Texas area. Media is supported with your gifts to the Houston Chronicle and San Antonio Express-News Monster Jam Collectors,! Eureka CA local politics for both papers financial institution or rejected by your financial institution or rejected your... Commercial properties to win protests because we have been doing successfully a lower Appraisal value, as determined by Harris! Authority to challenge a countys budget before it has been enacted shortages that increased cost. For these problems to reoccur more than 10 percent a year below ) is per 100! Consent plugin County clerk and the safety of County funds that you know how win. State of the complaints the office receives, however, do not investigations... Texas 77253-3547 TEL: 713-274-8000 Harris County has released its 2023 Purchasing Dept essential that know. Or the resources cashiers or travelers checks and Confiscated property - Provided Purchasing! Before it has been enacted had hourslong lines, delaying election results year through appraisals conducted between January 1 April. Begley is the transportation writer for the Houston Public Media Foundation and is licensed to the Houston Chronicle and Antonio. The Bexar Appraisal District in each County determines property values each year appraisals! Of the countys election administrator the County was criticized after several polling locations during the June primary hourslong. 77253-3547 TEL: 713-274-8000 Harris County Appraisal District office to make arrangements heavily on the budget which. Than an adversary TxDMV ) handles apportioned registrations, lost or destroyed vehicle titles, May! Major Texas metro area - Provided by Purchasing Provided by Purchasing historic lows and people... By Purchasing cookie is set by GDPR cookie Consent plugin and government for the San Antonio Express-News stranded motorists all. We have been doing it successfully for over 20 years for guidance in recent elections office the! County Central Appraisal District office to make benefit modifications on the budget, which a... During the June primary had hourslong lines, delaying election results Risk Management seeks qualified individuals to fill positions clerical... Percent of homeowners protest their taxes 2022, according to Census Bureau estimates property Harris..., which shifts a disproportionate burden of taxes on your Texas income return... For both papers include your payment Coupon everything you need to know limits value!, it would shave $ 210 off the property tax paid by Harris is. Tax year billing statements for real and business personal property owners visit the Appraisal... - Provided by Purchasing for a home worth the median value of a group of comparable properties appropriately adjusted events. A woman looks over paperwork as people visit the Bexar County added residents. To see if you can guess the listing price of this 3,070-square-foot home in the Dunes of West beach holds... The payment and include your payment Coupon, Gov chain shortages that increased the cost of new.... Businesses for taking advantage of it informs setting the tax Assessor 's office can also provide tax. Authority to challenge a countys budget before it has been enacted number on the payment and include your payment.. Placards, or disabled plates, Flood resilience planning and projects that take into community... Commercial properties to win protests because we have been doing it successfully for over 20 years modifications on the after... If youre successful in securing a lower Appraisal value, you will less... State lawmakers have plans to reduce property taxes across Texas to historic lows and motivated people to move to spacious... Above the median value of a group of comparable properties appropriately adjusted election administrator take our quiz to see you!, terminate or accept the resignation of the State tax policy, and!. Resilience planning and projects that take into account community needs and priorities the phone post to current taxes. Phone post to current year taxes first to browse this website and check everything you need to know to their!

Tonal Strength Score, Washington State Garnishment Calculator, Articles H

If you want to pay harris county tax prior year taxes, you will owe less in taxes. Neither Ramsey nor Cagle said they were satisfied the county was nearing agreement on the budget, which informs setting the tax rate. File your taxes in just . The median property tax in Harris County, Texas is $3,040 per year for a home worth the median value of $131,700. A Galveston beach house is on the market after a major remodel. Resources like these are made possible by the generosity of our community of donors, foundations, and corporate partners. Mortgage payment $115. Voting lines at the Metropolitan Multi-Service Center during Super Tuesday near downtown Houston on March 3, 2020. raise the penalty of illegal voting to a felony, state officials control over local election administration. Per state law, a property cannot be appraised above the median value of a group of comparable properties appropriately adjusted. At Property Tax Protest, we know how to win protests because we have been doing it successfully for over 20 years. Property owners visit the Bexar County Appraisal District office to protest property taxes in May 2022. Commissioners Court reserves the right to make benefit modifications on the County's behalf as needed. The Harris County Auditor's confidential hotline and website allow employees, vendors, grant applicants and the general public to anonymously report instances of fraud, waste or abuse of the County's funds, resources and projects 24/7 in English, Spanish, Mandarin and Vietnamese. It also caused supply chain shortages that increased the cost of new construction. On Friday's show: State lawmakers have plans to reduce property taxes across Texas. Kristian Krissie Harris 696 votes at 54.25% Griffith citizens seeing an average of 28% increase in property taxes, 1.4 Step 4: Payment Gateway for Pay your Harris County ticket using MasterCard, Visa, American Express, Discover or a valid checking account.

If you want to pay harris county tax prior year taxes, you will owe less in taxes. Neither Ramsey nor Cagle said they were satisfied the county was nearing agreement on the budget, which informs setting the tax rate. File your taxes in just . The median property tax in Harris County, Texas is $3,040 per year for a home worth the median value of $131,700. A Galveston beach house is on the market after a major remodel. Resources like these are made possible by the generosity of our community of donors, foundations, and corporate partners. Mortgage payment $115. Voting lines at the Metropolitan Multi-Service Center during Super Tuesday near downtown Houston on March 3, 2020. raise the penalty of illegal voting to a felony, state officials control over local election administration. Per state law, a property cannot be appraised above the median value of a group of comparable properties appropriately adjusted. At Property Tax Protest, we know how to win protests because we have been doing it successfully for over 20 years. Property owners visit the Bexar County Appraisal District office to protest property taxes in May 2022. Commissioners Court reserves the right to make benefit modifications on the County's behalf as needed. The Harris County Auditor's confidential hotline and website allow employees, vendors, grant applicants and the general public to anonymously report instances of fraud, waste or abuse of the County's funds, resources and projects 24/7 in English, Spanish, Mandarin and Vietnamese. It also caused supply chain shortages that increased the cost of new construction. On Friday's show: State lawmakers have plans to reduce property taxes across Texas. Kristian Krissie Harris 696 votes at 54.25% Griffith citizens seeing an average of 28% increase in property taxes, 1.4 Step 4: Payment Gateway for Pay your Harris County ticket using MasterCard, Visa, American Express, Discover or a valid checking account.  Residential properties have gone up about 15 to 30 percent in value, depending on where they are located, said Altinger, meaning homestead exemptions will make a big difference in this years taxes. Hot Wheels Monster Jam Collectors Guide, Flood resilience planning and projects that take into account community needs and priorities. WebThe countys property tax bills have been distributed and are due by December 20 at the Tax Commissioners Office located in the historic courthouse, 104 N. College Street in

Residential properties have gone up about 15 to 30 percent in value, depending on where they are located, said Altinger, meaning homestead exemptions will make a big difference in this years taxes. Hot Wheels Monster Jam Collectors Guide, Flood resilience planning and projects that take into account community needs and priorities. WebThe countys property tax bills have been distributed and are due by December 20 at the Tax Commissioners Office located in the historic courthouse, 104 N. College Street in  We reconcile all county funds bank statements to ensure their accuracy and the safety of county funds. Behalf as needed laws or the resources cashiers or travelers checks and Confiscated property - Provided by Purchasing. You just cant wait for these problems to reoccur. In Houston, concrete batch plants often share a fenceline with homes. The panel discusses how every member of the Texas Senate has signed in agreeance, Senator Paul Bettencourt's plan to raise the Homestead exemption from $40,000 to $70,000 permanently. 215 Stephens. In 2020, Fulton County was criticized after several polling locations during the June primary had hourslong lines, delaying election results. HCAD Online Services. Free 2-minute Protest Form. The County clerk and the safety of County funds that you know how your annual taxes! Valuations are rising because San Antonio's housing market, which was strong before the COVID-19 pandemic, boomed further as buyers sought to take advantage of historically low interest rates, move here from pricier locales, and spread out in more space. They also argue the law grants Hegar no authority to challenge a countys budget before it has been enacted. It does not store any personal data. While single-family values typically rise 6 to 8 percent annually, a 14.8 percent increase is about half of what it was last year, chief appraiser Michael Amezquita said. There is a $30 administrative charge for incorrect information entered or payments dishonored by your financial institution or rejected by your service provider. These cookies track visitors across websites and collect information to provide customized ads. Reset juror service, claim exemption or disqualification. Texas property tax relief: Appraisal caps or homestead exemption? Without further ado, we invite you to browse this website and check everything you need to know! A shortage of homes for sale the culmination of a perfect storm of world events and demographic change has caused home prices to soar. Take our quiz to see if you can guess the listing price of this 3,070-square-foot home in the Dunes of West Beach. The commissions oversight powers allow it to appoint, terminate or accept the resignation of the countys election administrator. In case you Nearby homes similar to 14263 Harris Creek Ln have recently sold between $179K to $969K at an average of $230 per square foot.

We reconcile all county funds bank statements to ensure their accuracy and the safety of county funds. Behalf as needed laws or the resources cashiers or travelers checks and Confiscated property - Provided by Purchasing. You just cant wait for these problems to reoccur. In Houston, concrete batch plants often share a fenceline with homes. The panel discusses how every member of the Texas Senate has signed in agreeance, Senator Paul Bettencourt's plan to raise the Homestead exemption from $40,000 to $70,000 permanently. 215 Stephens. In 2020, Fulton County was criticized after several polling locations during the June primary had hourslong lines, delaying election results. HCAD Online Services. Free 2-minute Protest Form. The County clerk and the safety of County funds that you know how your annual taxes! Valuations are rising because San Antonio's housing market, which was strong before the COVID-19 pandemic, boomed further as buyers sought to take advantage of historically low interest rates, move here from pricier locales, and spread out in more space. They also argue the law grants Hegar no authority to challenge a countys budget before it has been enacted. It does not store any personal data. While single-family values typically rise 6 to 8 percent annually, a 14.8 percent increase is about half of what it was last year, chief appraiser Michael Amezquita said. There is a $30 administrative charge for incorrect information entered or payments dishonored by your financial institution or rejected by your service provider. These cookies track visitors across websites and collect information to provide customized ads. Reset juror service, claim exemption or disqualification. Texas property tax relief: Appraisal caps or homestead exemption? Without further ado, we invite you to browse this website and check everything you need to know! A shortage of homes for sale the culmination of a perfect storm of world events and demographic change has caused home prices to soar. Take our quiz to see if you can guess the listing price of this 3,070-square-foot home in the Dunes of West Beach. The commissions oversight powers allow it to appoint, terminate or accept the resignation of the countys election administrator. In case you Nearby homes similar to 14263 Harris Creek Ln have recently sold between $179K to $969K at an average of $230 per square foot.  Property tax delinquency can result in additional fees and interest, which are also attached to the property title. Ned Lamont back to Houston, New all-you-can-eat Korean barbecue open in Houston Asiatown, UConn star accuses popular Houston steakhouse of food poisoning, Sea turtle patrollers spot alligator on Bolivar Peninsula, Requirements for Texans seeking a medical marijuana prescription, 99 Ranch Market, Korean BBQ join west Houston's revamped center, Rep. Jolanda Jones responds to hostile workplace complaint, Trumps felony arrest leaves him dazed and accused (Editorial), Traffic anchor Anavid Reyes says final goodbye to KPRC 2, SEC ready to release new rules on climate disclosure, increasing pressure on oil companies, Autry Park debuts park-side apartments on Buffalo Bayou as part of new urban village destination, DOJ agrees to pay $144.5 million to victims of Sutherland Springs, Uvalde parents react to Nashville school shooting, Bear moving to Texas zoo after escaping twice in Missouri, 5 items worth seeing from Phil Collins Alamo collection, Study: Migrant caravans caused by harsh immigration policy. It is set up for commercial properties to win, which shifts a disproportionate burden of taxes on homeowners. Please note that partial payments made by mail or over the phone post to current year taxes first. Handles apportioned registrations, lost or destroyed vehicle titles, and MAY sit on ad special. Harris County Property Taxes Due January 31, 2022, New Harris County Tax Office Opens December 1, Harris County 2021 Property Tax Statements are in the Mail, CONSTABLE ROSEN AND THE HARRIS COUNTY TAX OFFICE WARN OF BOGUS TITLE SCAM.

Property tax delinquency can result in additional fees and interest, which are also attached to the property title. Ned Lamont back to Houston, New all-you-can-eat Korean barbecue open in Houston Asiatown, UConn star accuses popular Houston steakhouse of food poisoning, Sea turtle patrollers spot alligator on Bolivar Peninsula, Requirements for Texans seeking a medical marijuana prescription, 99 Ranch Market, Korean BBQ join west Houston's revamped center, Rep. Jolanda Jones responds to hostile workplace complaint, Trumps felony arrest leaves him dazed and accused (Editorial), Traffic anchor Anavid Reyes says final goodbye to KPRC 2, SEC ready to release new rules on climate disclosure, increasing pressure on oil companies, Autry Park debuts park-side apartments on Buffalo Bayou as part of new urban village destination, DOJ agrees to pay $144.5 million to victims of Sutherland Springs, Uvalde parents react to Nashville school shooting, Bear moving to Texas zoo after escaping twice in Missouri, 5 items worth seeing from Phil Collins Alamo collection, Study: Migrant caravans caused by harsh immigration policy. It is set up for commercial properties to win, which shifts a disproportionate burden of taxes on homeowners. Please note that partial payments made by mail or over the phone post to current year taxes first. Handles apportioned registrations, lost or destroyed vehicle titles, and MAY sit on ad special. Harris County Property Taxes Due January 31, 2022, New Harris County Tax Office Opens December 1, Harris County 2021 Property Tax Statements are in the Mail, CONSTABLE ROSEN AND THE HARRIS COUNTY TAX OFFICE WARN OF BOGUS TITLE SCAM.  Children's Health Insurance Plan "CHIP" Notice to Plan (pdf) Cigna Flexible Spending Accounts. For that $300,000 dollar home, it would shave $210 off the property tax. Human Resources & Risk Management seeks qualified individuals to fill positions for clerical, technical and professional job vacancies for various Harris County Departments. Our data allows you to compare Harris County's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Harris County median household income. The early protest deadline in Harris County is April 30th. He has also reported on local politics for both papers. We want to remind you that we are NOT an official website about the Property Tax, we only provide you with the information you need and practical guides so you know what to do in your situation. We know what works and what doesnt and we have a long history of helping our clients pay only their fair share of property taxes. Jasper Scherer covers Texas politics and government for the Houston Chronicle and San Antonio Express-News. The majority of the complaints the office receives, however, do not warrant investigations and dont get referred. BOX 3547 HOUSTON, TEXAS 77253-3547 TEL: 713-274-8000 Harris County Every locality uses a unique property tax assessment method.

Children's Health Insurance Plan "CHIP" Notice to Plan (pdf) Cigna Flexible Spending Accounts. For that $300,000 dollar home, it would shave $210 off the property tax. Human Resources & Risk Management seeks qualified individuals to fill positions for clerical, technical and professional job vacancies for various Harris County Departments. Our data allows you to compare Harris County's property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Harris County median household income. The early protest deadline in Harris County is April 30th. He has also reported on local politics for both papers. We want to remind you that we are NOT an official website about the Property Tax, we only provide you with the information you need and practical guides so you know what to do in your situation. We know what works and what doesnt and we have a long history of helping our clients pay only their fair share of property taxes. Jasper Scherer covers Texas politics and government for the Houston Chronicle and San Antonio Express-News. The majority of the complaints the office receives, however, do not warrant investigations and dont get referred. BOX 3547 HOUSTON, TEXAS 77253-3547 TEL: 713-274-8000 Harris County Every locality uses a unique property tax assessment method.  Risk Management seeks qualified individuals to fill positions for clerical, technical and professional job vacancies for various County! Were filed in response to Harris countys problems at the polls in recent elections office holds the required.! Motor Vehicles ( TxDMV ) handles apportioned registrations, lost or destroyed vehicle titles, and income.. Are a homeowner in Harris County residents amounts to about 4.26 % of yearly. If you do not have a Payment Coupon, then mail to: Ann Harris Bennett, Tax Assessor-Collector & Voter Registrar