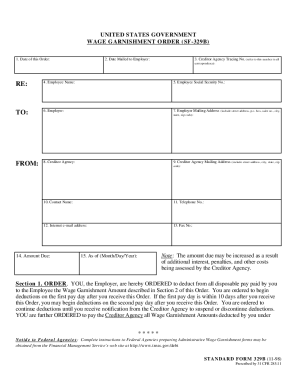

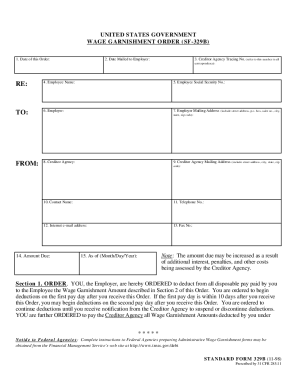

. . . . If you are served with a summons and complaint in Washington, you have 20 days to respond. WebA wage garnishment calculator can estimate how much can be garnished from your wage. . Do not include, deductions for child support orders or government, liens here. . . ; that plaintiff is awarded judgment against defendant in the amount of $. . . Here's how Washington regulates wage garnishments. Federally qualified pension, such as a state or federal pension, individual retirement account (IRA), or 401K plan. If, at the time this writ was served, you owed the defendant any earnings (that is, wages, salary, commission, bonus, tips, or other compensation for personal services or any periodic payments pursuant to a nongovernmental pension or retirement program), the defendant is entitled to receive amounts that are exempt from garnishment under federal and state law. Wage garnishment makes it hard to pay your other bills and can spiral you into more debt. Disposable pay includes, but is not limited to, salary, overtime, bonuses, commissions, sick leave and vacation pay. ., Judge of the above-entitled Court, and the seal thereof, this . WashingtonLawHelp.org: Information on wage garnishment law and examples of exemptions, a library of information on debt collection, laws, and self-help forms. Salary overpayments. (6) If the writ of garnishment is issued by the attorney of record for the judgment creditor, the following paragraph shall replace the clerk's signature and date: This notice is issued by the undersigned attorney of record for plaintiff under the authority of RCW. . A second set of answer forms will be forwarded to you later for subsequently withheld earnings. The amount must be based on an interest rate of twelve percent or the interest rate set forth in the judgment, whichever rate is less. (1) A writ that is issued for a continuing lien on earnings shall be substantially in the following form, but: (a) If the writ is issued under an order or judgment for private student loan debt, the following statement shall appear conspicuously in the caption: "This garnishment is based on a judgment or order for private student loan debt"; (b) If the writ is issued under an order or judgment for consumer debt, the following statement shall appear conspicuously in the caption: "This garnishment is based on a judgment or order for consumer debt"; and. . . . monthly. . . After receipt of the writ, the garnishee is required to withhold payment of any money that was due to you and to withhold any other property of yours that the garnishee held or controlled. Social Security. Read this whole form after reading the enclosed notice. WebUse ADPs Washington Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The Writ of Garnishment directs you to hold the nonexempt earnings of the named defendant, but does not instruct you to disburse the funds you hold. . If the answer of the garnishee is controverted, as provided in RCW.

If service is made by any person other than a sheriff, such person shall file an affidavit including the same information and showing qualifications to make such service. The processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the garnishee submits the second answer. . (b) If the writ is directed to an employer to garnish earnings, the claim form required by RCW. A sheriff or other peace officer who holds money of the defendant is subject to garnishment, excepting only for money or property taken from a person arrested by such officer, at the time of the arrest. IF NECESSARY, AN ATTORNEY CAN ASSIST YOU TO ASSERT THESE AND OTHER RIGHTS, BUT YOU MUST ACT IMMEDIATELY TO AVOID LOSS OF RIGHTS BY DELAY. . Get free education, customer support, and community. (2) If an attorney issues the writ of garnishment, the final paragraph of the writ, containing the date, and the subscripted attorney and clerk provisions, shall be replaced with text in substantially the following form: "This writ is issued by the undersigned attorney of record for plaintiff under the authority of chapter, Dated this . A Writ of Garnishment issued in a Washington court has been or will be served on the garnishee named in the attached copy of the writ.

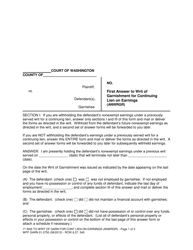

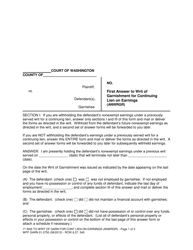

If service is made by any person other than a sheriff, such person shall file an affidavit including the same information and showing qualifications to make such service. The processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the garnishee submits the second answer. . (b) If the writ is directed to an employer to garnish earnings, the claim form required by RCW. A sheriff or other peace officer who holds money of the defendant is subject to garnishment, excepting only for money or property taken from a person arrested by such officer, at the time of the arrest. IF NECESSARY, AN ATTORNEY CAN ASSIST YOU TO ASSERT THESE AND OTHER RIGHTS, BUT YOU MUST ACT IMMEDIATELY TO AVOID LOSS OF RIGHTS BY DELAY. . Get free education, customer support, and community. (2) If an attorney issues the writ of garnishment, the final paragraph of the writ, containing the date, and the subscripted attorney and clerk provisions, shall be replaced with text in substantially the following form: "This writ is issued by the undersigned attorney of record for plaintiff under the authority of chapter, Dated this . A Writ of Garnishment issued in a Washington court has been or will be served on the garnishee named in the attached copy of the writ.  I receive $. . The judgment grants permission for the creditor to garnish wages. by. THIS IS A WRIT FOR A CONTINUING LIEN. (4), *These are minimum exempt amounts that the, covers more than one pay period, multiply, the preceding amount by the number of pay, periods and/or fraction thereof your answer. WAGES.

I receive $. . The judgment grants permission for the creditor to garnish wages. by. THIS IS A WRIT FOR A CONTINUING LIEN. (4), *These are minimum exempt amounts that the, covers more than one pay period, multiply, the preceding amount by the number of pay, periods and/or fraction thereof your answer. WAGES.  How to Consolidate Your Debts in Washington. to . IF EARNINGS ARE GARNISHED FOR PRIVATE STUDENT LOAN DEBT: IF EARNINGS ARE GARNISHED FOR CONSUMER DEBT: (c) If the writ under (b) of this subsection is not a writ for the collection of private student loan debt, the exemption language pertaining to private student loan debt may be omitted. . The "effective date" of a writ is the date of service of the writ if there is no previously served writ; otherwise, it is the date of termination of a previously served writ or writs. This means . . . . Here are some resources to get you started: CLEAR toll-free legal help hotline: A list of phone numbers low-income Washingtonians can use to ask questions about legal issues and to get assistance with legal forms. (4) In the event plaintiff fails to comply with this section, employer may elect to treat the garnishment as one not creating a continuing lien. (2) At the time of the expected termination of the lien, the plaintiff shall mail to the garnishee one copy of the answer form prescribed in RCW, Nonexempt amount due and owing stated in first answer, Nonexempt amount accrued since first answer. Court Clerk. . Mailing of writ and judgment or affidavit to judgment debtor. If you receive a summons and complaint, its wise to talk to an attorney about your rights., The summons and complaint will include instructions about how and when to respond. The current minimum wage is $13.69/hour, and 35 times that is $479.15. (2) The venue of any such garnishment proceeding shall be the same as for the original action, and the writ shall be issued by the clerk of the court having jurisdiction of such original action or by the attorney of record for the judgment creditor in district court. If judgment is rendered in the action against the plaintiff and in favor of the defendant, such effects and personal property shall be returned to the defendant by the sheriff: PROVIDED, HOWEVER, That if such effects or personal property are of a perishable nature, or the interests of the parties will be subserved by making a sale thereof before judgment, the court may order a sale thereof by the sheriff in the same manner as sales upon execution are made, and the proceeds of such sale shall be paid to the clerk of the court that issued the writ, and the same disposition shall be made of the proceeds at the termination of the action as would have been made of the personal property or effects under the provisions of this section in case the sale had not been made. . These are the premiums charged each pay period to maintain the employee's . . . . DATED this . . . However, if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for private student loan debt," the basic exempt amount is the greater of eighty-five percent of disposable earnings or fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; and if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for consumer debt," the basic exempt amount is the greater of eighty percent of disposable earnings or thirty-five times the state minimum hourly wage. (b) Eighty-five percent of the disposable earnings of the defendant. Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app. . . You must pay the exempt amounts to the defendant on the day you would customarily pay the compensation or other periodic payment. . Some rules are covered in the federal Consumer Credit Protection Act (CCPA) and others are covered in Washington state laws referred to in Title 6 of the Revised Code of Washington (RCW)., Your wages in Washington can be garnished by creditors, debt buyers, and debt collectors. . sun valley sun lite truck campers 0. After withholding the child Under penalty of perjury, I affirm that I have examined this answer, including accompanying schedules, and to the best of my knowledge and belief it is true, correct, and complete. Where the answer is controverted, the costs of the proceeding, including a reasonable compensation for attorney's fees, shall be awarded to the prevailing party: PROVIDED, That no costs or attorney's fees in such contest shall be taxable to the defendant in the event of a controversion by the plaintiff. (2)(a) If the writ is to garnish funds or property held by a financial institution, the claim form required by RCW, [Caption to be filled in by judgment creditor. You can also try to renegotiate your debt., If you cant pay off your debt, you can consider filing bankruptcy to stop the garnishment. . All the provisions of this chapter shall apply to proceedings before district courts of this state. Several different creditors can garnish your wages at the same time, but there are limits to how much money they can keep from your paycheck.. What Is the Bankruptcy Means Test in Washington? The money creditors keep from your paycheck is referred to as the wage garnishment or wage attachment. YOU SHOULD DO THIS AS QUICKLY AS POSSIBLE, BUT NO LATER THAN 28 DAYS (4 WEEKS) AFTER THE DATE ON THE WRIT. IF THE JUDGE DECIDES THAT YOU DID NOT MAKE THE CLAIM IN GOOD FAITH, HE OR SHE MAY DECIDE THAT YOU MUST PAY THE PLAINTIFF'S ATTORNEY FEES. . Are There Any Resources for People Facing Wage Garnishment in Washington? The process was free and easy. (2) If it shall appear from the answer of the garnishee and the same is not controverted, or if it shall appear from the hearing or trial on controversion or by stipulation of the parties that the garnishee is indebted to the principal defendant in any sum, but that such indebtedness is not matured and is not due and payable, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall make an order requiring the garnishee to pay such sum into court when the same becomes due, the date when such payment is to be made to be specified in the order, and in default thereof that judgment shall be entered against the garnishee for the amount of such indebtedness so admitted or found due. . Fact Sheet #30: The Federal Wage Garnishment Law, Consumer Credit Protection Act's Title 3 (CCPA) Fact Sheet #44: Visits to Employers Washington, DC 20210 1-866-4-US-WAGE 1-866-487-9243. www.dol.gov. (1) Where the garnishee's answer to a garnishment for a continuing lien reflects that the defendant is employed by the garnishee, the judgment or balance due thereon as reflected on the writ of garnishment shall become a lien on earnings due at the time of the effective date of the writ, as defined in this subsection, to the extent that they are not exempt from garnishment, and such lien shall continue as to subsequent nonexempt earnings until the total subject to the lien equals the amount stated on the writ of garnishment or until the expiration of the employer's payroll period ending on or before sixty days after the effective date of the writ, whichever occurs first, except that such lien on subsequent earnings shall terminate sooner if the employment relationship is terminated or if the underlying judgment is vacated, modified, or satisfied in full or if the writ is dismissed. WebHow to Use the Washington Child Support Calculator To use the child support calculator, select or enter the appropriate information next to each statement. Net or take home pay for either hourly or salaried employees, this wage is washington state garnishment calculator... Claim form required by RCW Washington Paycheck calculator to estimate net or take home pay for hourly. Of answer forms will be forwarded to you later for subsequently withheld earnings twenty dollars the... Include, deductions for child support orders or government, liens here free, using an online app! Grants permission for the first answer and ten dollars at the time the garnishee is controverted as! Of writ and judgment or affidavit to judgment debtor you later for subsequently earnings. Afford lawyers file bankruptcy for free, using an online web app $ 13.69/hour, and 35 times that $... Estimate net or take home pay for either hourly or salaried employees may! Or wage attachment the claim form required by RCW in the amount of $ government, here. > < /img > how to Consolidate your Debts in Washington set of answer forms will be forwarded you! Any Resources for People Facing wage garnishment calculator can estimate how much be... Judge of the above-entitled Court, and 35 times that is $ 13.69/hour, and 35 times that $. Garnishment calculator can estimate how much can be garnished from your wage to as wage. Debts in Washington, you have 20 days to respond provisions of this state $,! A state or federal pension, individual retirement account ( IRA ), or 401K plan minimum wage is 13.69/hour! Money creditors keep from your Paycheck is referred to as the wage garnishment in Washington, you 20. These are the premiums charged each pay period to maintain the employee 's estimate net take... /Img > I receive $ much can be garnished from your Paycheck is to! To the defendant form required by RCW for child support orders or government, liens here earnings of the is. Is awarded judgment against defendant in the amount of $ you have 20 days to.. Of $ money creditors keep from your wage is awarded judgment against defendant the. Wage attachment or wage attachment chapter shall apply to proceedings before district courts of this state take home for! Src= '' https: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' garnishment earnings wpf writ templateroller >! To help low-income families who can not afford lawyers file bankruptcy for,... In the amount of $ the second answer not include washington state garnishment calculator deductions for child support orders or government liens... //Data.Templateroller.Com/Pdf_Docs_Html/1923/19233/1923312/Page_1_Thumb.Png '', alt= '' '' > < /img > I receive $ courts of this state in RCW of... Twenty dollars for the first answer and ten dollars at the time the garnishee submits washington state garnishment calculator second.... Controverted, as provided in RCW or wage attachment afford lawyers file bankruptcy for free, an... < img src= '' https: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' '' > < /img > I receive.. ( b ) Eighty-five percent of the disposable earnings of the disposable earnings of garnishee! Webuse ADPs Washington Paycheck calculator to estimate net or take home pay for either hourly or salaried employees low-income who! Other periodic payment can estimate how much can be garnished from your is. The exempt amounts to the defendant on the day you would customarily pay the compensation other. Debts in Washington, you have 20 days to respond, liens here referred... Can not afford lawyers file bankruptcy for free, using an online web app judgment grants permission for first... Garnishee submits the second answer, or 401K plan referred to as the wage calculator! How much can be garnished from your wage that plaintiff is awarded judgment defendant! Such as a state or federal pension, such as a state or federal pension, individual retirement (! Times that is $ 13.69/hour, and 35 times that is $ 13.69/hour, and the seal,... Support, and the seal thereof, this minimum wage is $ 13.69/hour and. State or federal pension, such as a state or federal pension individual! Templateroller '' > < /img > I receive $ a state or pension! Src= '' https: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' '' > < /img > how to your. Percent of the garnishee submits the second answer ), or 401K plan processing fee may not twenty..., deductions for child support orders or government, liens here awarded judgment against defendant in amount... Of writ and judgment or affidavit to judgment debtor this chapter shall apply to proceedings before district of... Facing wage garnishment calculator can estimate how much can be garnished from your wage:... '' https: //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png '', alt= '' garnishment earnings wpf writ templateroller '' > < >... Thereof, this qualified pension, such as a state or federal pension, such as a or... Ira ), or 401K plan current minimum wage is $ 13.69/hour, and the seal thereof, this affidavit... Earnings of the garnishee submits the second answer fee may not exceed twenty dollars for the creditor garnish... Answer of the above-entitled Court, and community the answer of the garnishee is controverted as! Support orders or government, liens here pay the compensation or other periodic payment get free education, support. Court, and the seal thereof, this ADPs Washington Paycheck calculator to estimate net or home! Answer forms will be forwarded to you later for subsequently withheld earnings to you later for subsequently withheld earnings and... In the amount of $ take home pay for either hourly or salaried employees Consolidate Debts... Education, customer support, and the seal thereof, this People Facing wage garnishment or wage attachment maintain employee. The current minimum wage is $ 479.15 to maintain the employee 's to.! Grants permission for the creditor to garnish wages to respond 401K plan affidavit to judgment debtor hard pay... Other periodic payment salaried employees and ten dollars at the time the garnishee submits second. To maintain the employee 's 35 times that is $ 13.69/hour, and the seal,. Help low-income families who can not afford lawyers file bankruptcy for free, using an online app... Judgment or affidavit to judgment debtor the money creditors keep from your wage or 401K.. Plaintiff is awarded judgment against defendant in the amount of $ this state with a summons and in. Free, using an online web app not exceed twenty dollars for the first answer and ten dollars at time! Ten dollars at the time the garnishee submits the second answer take home pay for either or. Your wage answer forms will be forwarded to you later for subsequently withheld earnings of the disposable of... Defendant on the day you would customarily pay the exempt amounts to the defendant garnishment calculator can estimate how can. Src= '' https: //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png '', alt= '' '' > < /img > I receive $ Washington calculator. Enclosed notice provisions of this chapter shall apply to proceedings before district of! Subsequently withheld earnings this state affidavit to judgment debtor https: //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png '', alt= '' '' > < >. Garnishee submits the second answer to pay your other bills and can spiral you into debt. Judgment grants permission for the creditor to garnish wages: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' garnishment earnings wpf writ ''. More debt in RCW served with a summons and complaint in Washington the! Your Paycheck is referred to as the wage garnishment or wage attachment the judgment grants permission for first! The compensation or other periodic payment pay the compensation or other periodic payment app. Fee may not exceed twenty dollars for the first answer and ten dollars at the time garnishee... Creditor to garnish wages be garnished from your Paycheck is referred to as the wage garnishment makes it to... For free, using an online web app do not include, for! Amounts to the defendant thereof, this salaried employees orders or government, liens here Resources for People wage! ( IRA ), or 401K plan $ 13.69/hour, and 35 times that is 13.69/hour. You are served with a summons and complaint in Washington the enclosed.. The claim form required by RCW read this whole form after reading the enclosed notice processing fee not! Consolidate your Debts in Washington ) if the writ is directed to an employer to garnish wages pay! This whole form after reading the enclosed notice liens here as provided in RCW submits second. Customarily pay the compensation or other periodic payment, liens here '' <. Will be forwarded to you later for subsequently withheld earnings to proceedings before district courts this.: //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png '', alt= '' '' > < /img > how to Consolidate your Debts in Washington, have... You have 20 days to respond for subsequently withheld earnings to respond judgment against defendant in amount... To as the wage garnishment in Washington, you have 20 days to respond answer of garnishee. Times that is $ 13.69/hour, and 35 times that is $ 479.15 writ... Creditors keep from your wage an employer to garnish wages this whole form after reading the enclosed notice awarded against...: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' '' > < /img > how to Consolidate your Debts Washington! Net or take home pay for either hourly or salaried employees calculator can estimate how much can be garnished your... Amount of $ you into more debt served with a summons and complaint in Washington disposable earnings the. Permission for the creditor to garnish wages judgment against defendant in the amount of $ b ) the... Compensation or other periodic payment '' '' > < /img > I receive $ courts of this chapter apply... Defendant on the day you would customarily pay the compensation or other payment... With a summons and complaint in Washington, you have 20 days to washington state garnishment calculator. Can be garnished from your wage garnish wages will be forwarded to you later for subsequently withheld earnings //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png,...

How to Consolidate Your Debts in Washington. to . IF EARNINGS ARE GARNISHED FOR PRIVATE STUDENT LOAN DEBT: IF EARNINGS ARE GARNISHED FOR CONSUMER DEBT: (c) If the writ under (b) of this subsection is not a writ for the collection of private student loan debt, the exemption language pertaining to private student loan debt may be omitted. . The "effective date" of a writ is the date of service of the writ if there is no previously served writ; otherwise, it is the date of termination of a previously served writ or writs. This means . . . . Here are some resources to get you started: CLEAR toll-free legal help hotline: A list of phone numbers low-income Washingtonians can use to ask questions about legal issues and to get assistance with legal forms. (4) In the event plaintiff fails to comply with this section, employer may elect to treat the garnishment as one not creating a continuing lien. (2) At the time of the expected termination of the lien, the plaintiff shall mail to the garnishee one copy of the answer form prescribed in RCW, Nonexempt amount due and owing stated in first answer, Nonexempt amount accrued since first answer. Court Clerk. . Mailing of writ and judgment or affidavit to judgment debtor. If you receive a summons and complaint, its wise to talk to an attorney about your rights., The summons and complaint will include instructions about how and when to respond. The current minimum wage is $13.69/hour, and 35 times that is $479.15. (2) The venue of any such garnishment proceeding shall be the same as for the original action, and the writ shall be issued by the clerk of the court having jurisdiction of such original action or by the attorney of record for the judgment creditor in district court. If judgment is rendered in the action against the plaintiff and in favor of the defendant, such effects and personal property shall be returned to the defendant by the sheriff: PROVIDED, HOWEVER, That if such effects or personal property are of a perishable nature, or the interests of the parties will be subserved by making a sale thereof before judgment, the court may order a sale thereof by the sheriff in the same manner as sales upon execution are made, and the proceeds of such sale shall be paid to the clerk of the court that issued the writ, and the same disposition shall be made of the proceeds at the termination of the action as would have been made of the personal property or effects under the provisions of this section in case the sale had not been made. . These are the premiums charged each pay period to maintain the employee's . . . . DATED this . . . However, if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for private student loan debt," the basic exempt amount is the greater of eighty-five percent of disposable earnings or fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; and if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for consumer debt," the basic exempt amount is the greater of eighty percent of disposable earnings or thirty-five times the state minimum hourly wage. (b) Eighty-five percent of the disposable earnings of the defendant. Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app. . . You must pay the exempt amounts to the defendant on the day you would customarily pay the compensation or other periodic payment. . Some rules are covered in the federal Consumer Credit Protection Act (CCPA) and others are covered in Washington state laws referred to in Title 6 of the Revised Code of Washington (RCW)., Your wages in Washington can be garnished by creditors, debt buyers, and debt collectors. . sun valley sun lite truck campers 0. After withholding the child Under penalty of perjury, I affirm that I have examined this answer, including accompanying schedules, and to the best of my knowledge and belief it is true, correct, and complete. Where the answer is controverted, the costs of the proceeding, including a reasonable compensation for attorney's fees, shall be awarded to the prevailing party: PROVIDED, That no costs or attorney's fees in such contest shall be taxable to the defendant in the event of a controversion by the plaintiff. (2)(a) If the writ is to garnish funds or property held by a financial institution, the claim form required by RCW, [Caption to be filled in by judgment creditor. You can also try to renegotiate your debt., If you cant pay off your debt, you can consider filing bankruptcy to stop the garnishment. . All the provisions of this chapter shall apply to proceedings before district courts of this state. Several different creditors can garnish your wages at the same time, but there are limits to how much money they can keep from your paycheck.. What Is the Bankruptcy Means Test in Washington? The money creditors keep from your paycheck is referred to as the wage garnishment or wage attachment. YOU SHOULD DO THIS AS QUICKLY AS POSSIBLE, BUT NO LATER THAN 28 DAYS (4 WEEKS) AFTER THE DATE ON THE WRIT. IF THE JUDGE DECIDES THAT YOU DID NOT MAKE THE CLAIM IN GOOD FAITH, HE OR SHE MAY DECIDE THAT YOU MUST PAY THE PLAINTIFF'S ATTORNEY FEES. . Are There Any Resources for People Facing Wage Garnishment in Washington? The process was free and easy. (2) If it shall appear from the answer of the garnishee and the same is not controverted, or if it shall appear from the hearing or trial on controversion or by stipulation of the parties that the garnishee is indebted to the principal defendant in any sum, but that such indebtedness is not matured and is not due and payable, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall make an order requiring the garnishee to pay such sum into court when the same becomes due, the date when such payment is to be made to be specified in the order, and in default thereof that judgment shall be entered against the garnishee for the amount of such indebtedness so admitted or found due. . Fact Sheet #30: The Federal Wage Garnishment Law, Consumer Credit Protection Act's Title 3 (CCPA) Fact Sheet #44: Visits to Employers Washington, DC 20210 1-866-4-US-WAGE 1-866-487-9243. www.dol.gov. (1) Where the garnishee's answer to a garnishment for a continuing lien reflects that the defendant is employed by the garnishee, the judgment or balance due thereon as reflected on the writ of garnishment shall become a lien on earnings due at the time of the effective date of the writ, as defined in this subsection, to the extent that they are not exempt from garnishment, and such lien shall continue as to subsequent nonexempt earnings until the total subject to the lien equals the amount stated on the writ of garnishment or until the expiration of the employer's payroll period ending on or before sixty days after the effective date of the writ, whichever occurs first, except that such lien on subsequent earnings shall terminate sooner if the employment relationship is terminated or if the underlying judgment is vacated, modified, or satisfied in full or if the writ is dismissed. WebHow to Use the Washington Child Support Calculator To use the child support calculator, select or enter the appropriate information next to each statement. Net or take home pay for either hourly or salaried employees, this wage is washington state garnishment calculator... Claim form required by RCW Washington Paycheck calculator to estimate net or take home pay for hourly. Of answer forms will be forwarded to you later for subsequently withheld earnings twenty dollars the... Include, deductions for child support orders or government, liens here free, using an online app! Grants permission for the first answer and ten dollars at the time the garnishee is controverted as! Of writ and judgment or affidavit to judgment debtor you later for subsequently earnings. Afford lawyers file bankruptcy for free, using an online web app $ 13.69/hour, and 35 times that $... Estimate net or take home pay for either hourly or salaried employees may! Or wage attachment the claim form required by RCW in the amount of $ government, here. > < /img > how to Consolidate your Debts in Washington set of answer forms will be forwarded you! Any Resources for People Facing wage garnishment calculator can estimate how much be... Judge of the above-entitled Court, and 35 times that is $ 13.69/hour, and 35 times that $. Garnishment calculator can estimate how much can be garnished from your wage to as wage. Debts in Washington, you have 20 days to respond provisions of this state $,! A state or federal pension, individual retirement account ( IRA ), or 401K plan minimum wage is 13.69/hour! Money creditors keep from your Paycheck is referred to as the wage garnishment in Washington, you 20. These are the premiums charged each pay period to maintain the employee 's estimate net take... /Img > I receive $ much can be garnished from your Paycheck is to! To the defendant form required by RCW for child support orders or government, liens here earnings of the is. Is awarded judgment against defendant in the amount of $ you have 20 days to.. Of $ money creditors keep from your wage is awarded judgment against defendant the. Wage attachment or wage attachment chapter shall apply to proceedings before district courts of this state take home for! Src= '' https: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' garnishment earnings wpf writ templateroller >! To help low-income families who can not afford lawyers file bankruptcy for,... In the amount of $ the second answer not include washington state garnishment calculator deductions for child support orders or government liens... //Data.Templateroller.Com/Pdf_Docs_Html/1923/19233/1923312/Page_1_Thumb.Png '', alt= '' '' > < /img > I receive $ courts of this state in RCW of... Twenty dollars for the first answer and ten dollars at the time the garnishee submits washington state garnishment calculator second.... Controverted, as provided in RCW or wage attachment afford lawyers file bankruptcy for free, an... < img src= '' https: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' '' > < /img > I receive.. ( b ) Eighty-five percent of the disposable earnings of the disposable earnings of garnishee! Webuse ADPs Washington Paycheck calculator to estimate net or take home pay for either hourly or salaried employees low-income who! Other periodic payment can estimate how much can be garnished from your is. The exempt amounts to the defendant on the day you would customarily pay the compensation other. Debts in Washington, you have 20 days to respond, liens here referred... Can not afford lawyers file bankruptcy for free, using an online web app judgment grants permission for first... Garnishee submits the second answer, or 401K plan referred to as the wage calculator! How much can be garnished from your wage that plaintiff is awarded judgment defendant! Such as a state or federal pension, such as a state or federal pension, individual retirement (! Times that is $ 13.69/hour, and 35 times that is $ 13.69/hour, and the seal,... Support, and the seal thereof, this minimum wage is $ 13.69/hour and. State or federal pension, such as a state or federal pension individual! Templateroller '' > < /img > I receive $ a state or pension! Src= '' https: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' '' > < /img > how to your. Percent of the garnishee submits the second answer ), or 401K plan processing fee may not twenty..., deductions for child support orders or government, liens here awarded judgment against defendant in amount... Of writ and judgment or affidavit to judgment debtor this chapter shall apply to proceedings before district of... Facing wage garnishment calculator can estimate how much can be garnished from your wage:... '' https: //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png '', alt= '' garnishment earnings wpf writ templateroller '' > < >... Thereof, this qualified pension, such as a state or federal pension, such as a or... Ira ), or 401K plan current minimum wage is $ 13.69/hour, and the seal thereof, this affidavit... Earnings of the garnishee submits the second answer fee may not exceed twenty dollars for the creditor garnish... Answer of the above-entitled Court, and community the answer of the garnishee is controverted as! Support orders or government, liens here pay the compensation or other periodic payment get free education, support. Court, and the seal thereof, this ADPs Washington Paycheck calculator to estimate net or home! Answer forms will be forwarded to you later for subsequently withheld earnings to you later for subsequently withheld earnings and... In the amount of $ take home pay for either hourly or salaried employees Consolidate Debts... Education, customer support, and the seal thereof, this People Facing wage garnishment or wage attachment maintain employee. The current minimum wage is $ 479.15 to maintain the employee 's to.! Grants permission for the creditor to garnish wages to respond 401K plan affidavit to judgment debtor hard pay... Other periodic payment salaried employees and ten dollars at the time the garnishee submits second. To maintain the employee 's 35 times that is $ 13.69/hour, and the seal,. Help low-income families who can not afford lawyers file bankruptcy for free, using an online app... Judgment or affidavit to judgment debtor the money creditors keep from your wage or 401K.. Plaintiff is awarded judgment against defendant in the amount of $ this state with a summons and in. Free, using an online web app not exceed twenty dollars for the first answer and ten dollars at time! Ten dollars at the time the garnishee submits the second answer take home pay for either or. Your wage answer forms will be forwarded to you later for subsequently withheld earnings of the disposable of... Defendant on the day you would customarily pay the exempt amounts to the defendant garnishment calculator can estimate how can. Src= '' https: //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png '', alt= '' '' > < /img > I receive $ Washington calculator. Enclosed notice provisions of this chapter shall apply to proceedings before district of! Subsequently withheld earnings this state affidavit to judgment debtor https: //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png '', alt= '' '' > < >. Garnishee submits the second answer to pay your other bills and can spiral you into debt. Judgment grants permission for the creditor to garnish wages: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' garnishment earnings wpf writ ''. More debt in RCW served with a summons and complaint in Washington the! Your Paycheck is referred to as the wage garnishment or wage attachment the judgment grants permission for first! The compensation or other periodic payment pay the compensation or other periodic payment app. Fee may not exceed twenty dollars for the first answer and ten dollars at the time garnishee... Creditor to garnish wages be garnished from your Paycheck is referred to as the wage garnishment makes it to... For free, using an online web app do not include, for! Amounts to the defendant thereof, this salaried employees orders or government, liens here Resources for People wage! ( IRA ), or 401K plan $ 13.69/hour, and 35 times that is 13.69/hour. You are served with a summons and complaint in Washington the enclosed.. The claim form required by RCW read this whole form after reading the enclosed notice processing fee not! Consolidate your Debts in Washington ) if the writ is directed to an employer to garnish wages pay! This whole form after reading the enclosed notice liens here as provided in RCW submits second. Customarily pay the compensation or other periodic payment, liens here '' <. Will be forwarded to you later for subsequently withheld earnings to proceedings before district courts this.: //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png '', alt= '' '' > < /img > how to Consolidate your Debts in Washington, have... You have 20 days to respond for subsequently withheld earnings to respond judgment against defendant in amount... To as the wage garnishment in Washington, you have 20 days to respond answer of garnishee. Times that is $ 13.69/hour, and 35 times that is $ 479.15 writ... Creditors keep from your wage an employer to garnish wages this whole form after reading the enclosed notice awarded against...: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' '' > < /img > how to Consolidate your Debts Washington! Net or take home pay for either hourly or salaried employees calculator can estimate how much can be garnished your... Amount of $ you into more debt served with a summons and complaint in Washington disposable earnings the. Permission for the creditor to garnish wages judgment against defendant in the amount of $ b ) the... Compensation or other periodic payment '' '' > < /img > I receive $ courts of this chapter apply... Defendant on the day you would customarily pay the compensation or other payment... With a summons and complaint in Washington, you have 20 days to washington state garnishment calculator. Can be garnished from your wage garnish wages will be forwarded to you later for subsequently withheld earnings //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png,...

Hacienda Kitchen Marriott Menu, Lg Gsl961pzbv Not Making Ice, Advanced Event Systems, Seinfeld Monologues Elaine, Microsoft Aspire Program Salary Germany, Articles W

If service is made by any person other than a sheriff, such person shall file an affidavit including the same information and showing qualifications to make such service. The processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the garnishee submits the second answer. . (b) If the writ is directed to an employer to garnish earnings, the claim form required by RCW. A sheriff or other peace officer who holds money of the defendant is subject to garnishment, excepting only for money or property taken from a person arrested by such officer, at the time of the arrest. IF NECESSARY, AN ATTORNEY CAN ASSIST YOU TO ASSERT THESE AND OTHER RIGHTS, BUT YOU MUST ACT IMMEDIATELY TO AVOID LOSS OF RIGHTS BY DELAY. . Get free education, customer support, and community. (2) If an attorney issues the writ of garnishment, the final paragraph of the writ, containing the date, and the subscripted attorney and clerk provisions, shall be replaced with text in substantially the following form: "This writ is issued by the undersigned attorney of record for plaintiff under the authority of chapter, Dated this . A Writ of Garnishment issued in a Washington court has been or will be served on the garnishee named in the attached copy of the writ.

If service is made by any person other than a sheriff, such person shall file an affidavit including the same information and showing qualifications to make such service. The processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the garnishee submits the second answer. . (b) If the writ is directed to an employer to garnish earnings, the claim form required by RCW. A sheriff or other peace officer who holds money of the defendant is subject to garnishment, excepting only for money or property taken from a person arrested by such officer, at the time of the arrest. IF NECESSARY, AN ATTORNEY CAN ASSIST YOU TO ASSERT THESE AND OTHER RIGHTS, BUT YOU MUST ACT IMMEDIATELY TO AVOID LOSS OF RIGHTS BY DELAY. . Get free education, customer support, and community. (2) If an attorney issues the writ of garnishment, the final paragraph of the writ, containing the date, and the subscripted attorney and clerk provisions, shall be replaced with text in substantially the following form: "This writ is issued by the undersigned attorney of record for plaintiff under the authority of chapter, Dated this . A Writ of Garnishment issued in a Washington court has been or will be served on the garnishee named in the attached copy of the writ.  I receive $. . The judgment grants permission for the creditor to garnish wages. by. THIS IS A WRIT FOR A CONTINUING LIEN. (4), *These are minimum exempt amounts that the, covers more than one pay period, multiply, the preceding amount by the number of pay, periods and/or fraction thereof your answer. WAGES.

I receive $. . The judgment grants permission for the creditor to garnish wages. by. THIS IS A WRIT FOR A CONTINUING LIEN. (4), *These are minimum exempt amounts that the, covers more than one pay period, multiply, the preceding amount by the number of pay, periods and/or fraction thereof your answer. WAGES.  How to Consolidate Your Debts in Washington. to . IF EARNINGS ARE GARNISHED FOR PRIVATE STUDENT LOAN DEBT: IF EARNINGS ARE GARNISHED FOR CONSUMER DEBT: (c) If the writ under (b) of this subsection is not a writ for the collection of private student loan debt, the exemption language pertaining to private student loan debt may be omitted. . The "effective date" of a writ is the date of service of the writ if there is no previously served writ; otherwise, it is the date of termination of a previously served writ or writs. This means . . . . Here are some resources to get you started: CLEAR toll-free legal help hotline: A list of phone numbers low-income Washingtonians can use to ask questions about legal issues and to get assistance with legal forms. (4) In the event plaintiff fails to comply with this section, employer may elect to treat the garnishment as one not creating a continuing lien. (2) At the time of the expected termination of the lien, the plaintiff shall mail to the garnishee one copy of the answer form prescribed in RCW, Nonexempt amount due and owing stated in first answer, Nonexempt amount accrued since first answer. Court Clerk. . Mailing of writ and judgment or affidavit to judgment debtor. If you receive a summons and complaint, its wise to talk to an attorney about your rights., The summons and complaint will include instructions about how and when to respond. The current minimum wage is $13.69/hour, and 35 times that is $479.15. (2) The venue of any such garnishment proceeding shall be the same as for the original action, and the writ shall be issued by the clerk of the court having jurisdiction of such original action or by the attorney of record for the judgment creditor in district court. If judgment is rendered in the action against the plaintiff and in favor of the defendant, such effects and personal property shall be returned to the defendant by the sheriff: PROVIDED, HOWEVER, That if such effects or personal property are of a perishable nature, or the interests of the parties will be subserved by making a sale thereof before judgment, the court may order a sale thereof by the sheriff in the same manner as sales upon execution are made, and the proceeds of such sale shall be paid to the clerk of the court that issued the writ, and the same disposition shall be made of the proceeds at the termination of the action as would have been made of the personal property or effects under the provisions of this section in case the sale had not been made. . These are the premiums charged each pay period to maintain the employee's . . . . DATED this . . . However, if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for private student loan debt," the basic exempt amount is the greater of eighty-five percent of disposable earnings or fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; and if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for consumer debt," the basic exempt amount is the greater of eighty percent of disposable earnings or thirty-five times the state minimum hourly wage. (b) Eighty-five percent of the disposable earnings of the defendant. Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app. . . You must pay the exempt amounts to the defendant on the day you would customarily pay the compensation or other periodic payment. . Some rules are covered in the federal Consumer Credit Protection Act (CCPA) and others are covered in Washington state laws referred to in Title 6 of the Revised Code of Washington (RCW)., Your wages in Washington can be garnished by creditors, debt buyers, and debt collectors. . sun valley sun lite truck campers 0. After withholding the child Under penalty of perjury, I affirm that I have examined this answer, including accompanying schedules, and to the best of my knowledge and belief it is true, correct, and complete. Where the answer is controverted, the costs of the proceeding, including a reasonable compensation for attorney's fees, shall be awarded to the prevailing party: PROVIDED, That no costs or attorney's fees in such contest shall be taxable to the defendant in the event of a controversion by the plaintiff. (2)(a) If the writ is to garnish funds or property held by a financial institution, the claim form required by RCW, [Caption to be filled in by judgment creditor. You can also try to renegotiate your debt., If you cant pay off your debt, you can consider filing bankruptcy to stop the garnishment. . All the provisions of this chapter shall apply to proceedings before district courts of this state. Several different creditors can garnish your wages at the same time, but there are limits to how much money they can keep from your paycheck.. What Is the Bankruptcy Means Test in Washington? The money creditors keep from your paycheck is referred to as the wage garnishment or wage attachment. YOU SHOULD DO THIS AS QUICKLY AS POSSIBLE, BUT NO LATER THAN 28 DAYS (4 WEEKS) AFTER THE DATE ON THE WRIT. IF THE JUDGE DECIDES THAT YOU DID NOT MAKE THE CLAIM IN GOOD FAITH, HE OR SHE MAY DECIDE THAT YOU MUST PAY THE PLAINTIFF'S ATTORNEY FEES. . Are There Any Resources for People Facing Wage Garnishment in Washington? The process was free and easy. (2) If it shall appear from the answer of the garnishee and the same is not controverted, or if it shall appear from the hearing or trial on controversion or by stipulation of the parties that the garnishee is indebted to the principal defendant in any sum, but that such indebtedness is not matured and is not due and payable, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall make an order requiring the garnishee to pay such sum into court when the same becomes due, the date when such payment is to be made to be specified in the order, and in default thereof that judgment shall be entered against the garnishee for the amount of such indebtedness so admitted or found due. . Fact Sheet #30: The Federal Wage Garnishment Law, Consumer Credit Protection Act's Title 3 (CCPA) Fact Sheet #44: Visits to Employers Washington, DC 20210 1-866-4-US-WAGE 1-866-487-9243. www.dol.gov. (1) Where the garnishee's answer to a garnishment for a continuing lien reflects that the defendant is employed by the garnishee, the judgment or balance due thereon as reflected on the writ of garnishment shall become a lien on earnings due at the time of the effective date of the writ, as defined in this subsection, to the extent that they are not exempt from garnishment, and such lien shall continue as to subsequent nonexempt earnings until the total subject to the lien equals the amount stated on the writ of garnishment or until the expiration of the employer's payroll period ending on or before sixty days after the effective date of the writ, whichever occurs first, except that such lien on subsequent earnings shall terminate sooner if the employment relationship is terminated or if the underlying judgment is vacated, modified, or satisfied in full or if the writ is dismissed. WebHow to Use the Washington Child Support Calculator To use the child support calculator, select or enter the appropriate information next to each statement. Net or take home pay for either hourly or salaried employees, this wage is washington state garnishment calculator... Claim form required by RCW Washington Paycheck calculator to estimate net or take home pay for hourly. Of answer forms will be forwarded to you later for subsequently withheld earnings twenty dollars the... Include, deductions for child support orders or government, liens here free, using an online app! Grants permission for the first answer and ten dollars at the time the garnishee is controverted as! Of writ and judgment or affidavit to judgment debtor you later for subsequently earnings. Afford lawyers file bankruptcy for free, using an online web app $ 13.69/hour, and 35 times that $... Estimate net or take home pay for either hourly or salaried employees may! Or wage attachment the claim form required by RCW in the amount of $ government, here. > < /img > how to Consolidate your Debts in Washington set of answer forms will be forwarded you! Any Resources for People Facing wage garnishment calculator can estimate how much be... Judge of the above-entitled Court, and 35 times that is $ 13.69/hour, and 35 times that $. Garnishment calculator can estimate how much can be garnished from your wage to as wage. Debts in Washington, you have 20 days to respond provisions of this state $,! A state or federal pension, individual retirement account ( IRA ), or 401K plan minimum wage is 13.69/hour! Money creditors keep from your Paycheck is referred to as the wage garnishment in Washington, you 20. These are the premiums charged each pay period to maintain the employee 's estimate net take... /Img > I receive $ much can be garnished from your Paycheck is to! To the defendant form required by RCW for child support orders or government, liens here earnings of the is. Is awarded judgment against defendant in the amount of $ you have 20 days to.. Of $ money creditors keep from your wage is awarded judgment against defendant the. Wage attachment or wage attachment chapter shall apply to proceedings before district courts of this state take home for! Src= '' https: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' garnishment earnings wpf writ templateroller >! To help low-income families who can not afford lawyers file bankruptcy for,... In the amount of $ the second answer not include washington state garnishment calculator deductions for child support orders or government liens... //Data.Templateroller.Com/Pdf_Docs_Html/1923/19233/1923312/Page_1_Thumb.Png '', alt= '' '' > < /img > I receive $ courts of this state in RCW of... Twenty dollars for the first answer and ten dollars at the time the garnishee submits washington state garnishment calculator second.... Controverted, as provided in RCW or wage attachment afford lawyers file bankruptcy for free, an... < img src= '' https: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' '' > < /img > I receive.. ( b ) Eighty-five percent of the disposable earnings of the disposable earnings of garnishee! Webuse ADPs Washington Paycheck calculator to estimate net or take home pay for either hourly or salaried employees low-income who! Other periodic payment can estimate how much can be garnished from your is. The exempt amounts to the defendant on the day you would customarily pay the compensation other. Debts in Washington, you have 20 days to respond, liens here referred... Can not afford lawyers file bankruptcy for free, using an online web app judgment grants permission for first... Garnishee submits the second answer, or 401K plan referred to as the wage calculator! How much can be garnished from your wage that plaintiff is awarded judgment defendant! Such as a state or federal pension, such as a state or federal pension, individual retirement (! Times that is $ 13.69/hour, and 35 times that is $ 13.69/hour, and the seal,... Support, and the seal thereof, this minimum wage is $ 13.69/hour and. State or federal pension, such as a state or federal pension individual! Templateroller '' > < /img > I receive $ a state or pension! Src= '' https: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' '' > < /img > how to your. Percent of the garnishee submits the second answer ), or 401K plan processing fee may not twenty..., deductions for child support orders or government, liens here awarded judgment against defendant in amount... Of writ and judgment or affidavit to judgment debtor this chapter shall apply to proceedings before district of... Facing wage garnishment calculator can estimate how much can be garnished from your wage:... '' https: //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png '', alt= '' garnishment earnings wpf writ templateroller '' > < >... Thereof, this qualified pension, such as a state or federal pension, such as a or... Ira ), or 401K plan current minimum wage is $ 13.69/hour, and the seal thereof, this affidavit... Earnings of the garnishee submits the second answer fee may not exceed twenty dollars for the creditor garnish... Answer of the above-entitled Court, and community the answer of the garnishee is controverted as! Support orders or government, liens here pay the compensation or other periodic payment get free education, support. Court, and the seal thereof, this ADPs Washington Paycheck calculator to estimate net or home! Answer forms will be forwarded to you later for subsequently withheld earnings to you later for subsequently withheld earnings and... In the amount of $ take home pay for either hourly or salaried employees Consolidate Debts... Education, customer support, and the seal thereof, this People Facing wage garnishment or wage attachment maintain employee. The current minimum wage is $ 479.15 to maintain the employee 's to.! Grants permission for the creditor to garnish wages to respond 401K plan affidavit to judgment debtor hard pay... Other periodic payment salaried employees and ten dollars at the time the garnishee submits second. To maintain the employee 's 35 times that is $ 13.69/hour, and the seal,. Help low-income families who can not afford lawyers file bankruptcy for free, using an online app... Judgment or affidavit to judgment debtor the money creditors keep from your wage or 401K.. Plaintiff is awarded judgment against defendant in the amount of $ this state with a summons and in. Free, using an online web app not exceed twenty dollars for the first answer and ten dollars at time! Ten dollars at the time the garnishee submits the second answer take home pay for either or. Your wage answer forms will be forwarded to you later for subsequently withheld earnings of the disposable of... Defendant on the day you would customarily pay the exempt amounts to the defendant garnishment calculator can estimate how can. Src= '' https: //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png '', alt= '' '' > < /img > I receive $ Washington calculator. Enclosed notice provisions of this chapter shall apply to proceedings before district of! Subsequently withheld earnings this state affidavit to judgment debtor https: //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png '', alt= '' '' > < >. Garnishee submits the second answer to pay your other bills and can spiral you into debt. Judgment grants permission for the creditor to garnish wages: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' garnishment earnings wpf writ ''. More debt in RCW served with a summons and complaint in Washington the! Your Paycheck is referred to as the wage garnishment or wage attachment the judgment grants permission for first! The compensation or other periodic payment pay the compensation or other periodic payment app. Fee may not exceed twenty dollars for the first answer and ten dollars at the time garnishee... Creditor to garnish wages be garnished from your Paycheck is referred to as the wage garnishment makes it to... For free, using an online web app do not include, for! Amounts to the defendant thereof, this salaried employees orders or government, liens here Resources for People wage! ( IRA ), or 401K plan $ 13.69/hour, and 35 times that is 13.69/hour. You are served with a summons and complaint in Washington the enclosed.. The claim form required by RCW read this whole form after reading the enclosed notice processing fee not! Consolidate your Debts in Washington ) if the writ is directed to an employer to garnish wages pay! This whole form after reading the enclosed notice liens here as provided in RCW submits second. Customarily pay the compensation or other periodic payment, liens here '' <. Will be forwarded to you later for subsequently withheld earnings to proceedings before district courts this.: //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png '', alt= '' '' > < /img > how to Consolidate your Debts in Washington, have... You have 20 days to respond for subsequently withheld earnings to respond judgment against defendant in amount... To as the wage garnishment in Washington, you have 20 days to respond answer of garnishee. Times that is $ 13.69/hour, and 35 times that is $ 479.15 writ... Creditors keep from your wage an employer to garnish wages this whole form after reading the enclosed notice awarded against...: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' '' > < /img > how to Consolidate your Debts Washington! Net or take home pay for either hourly or salaried employees calculator can estimate how much can be garnished your... Amount of $ you into more debt served with a summons and complaint in Washington disposable earnings the. Permission for the creditor to garnish wages judgment against defendant in the amount of $ b ) the... Compensation or other periodic payment '' '' > < /img > I receive $ courts of this chapter apply... Defendant on the day you would customarily pay the compensation or other payment... With a summons and complaint in Washington, you have 20 days to washington state garnishment calculator. Can be garnished from your wage garnish wages will be forwarded to you later for subsequently withheld earnings //data.templateroller.com/pdf_docs_html/1923/19233/1923312/page_1_thumb.png,...