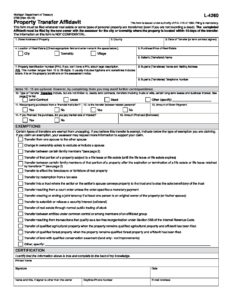

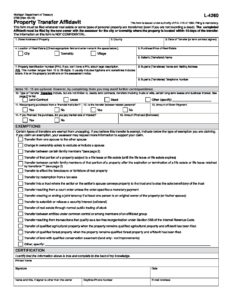

The completed Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. to file this form within 45 days of the transfer in order to ensure that this "uncapping" adjustment is made on all transferred property.  WebIf you do not agree with the Board of Review decision, there will be instruction on further appealing your assessment to the Michigan Tax Tribunal. WebTransfer Affidavit (Form 4260) The following Michigan Property Transfer Affidavit form is available online at the State of Michigan Department of Treasury website. 0000047949 00000 n

0000040678 00000 n

(7.17.19) WHEN YOU MAY USE THE TRANSFER BY AFFIDAVIT ("Affidavit"): Pursuant to 867. 0000032668 00000 n

T& !

This form Log in to the editor using your credentials or click on. h24P0PwI,.M,P04 In order to receive whatever is attached to the editor using your credentials or click on be even. You may be trying to access this site from a secured browser on the server. Watercraft transfers: If the combined value of all of the decedent's watercraft does not exceed $100,000, and there are no probate proceedings for the decedent's estate, registration of title may be transferred by the Michigan Secretary of State to the surviving spouse or next of kin upon submitting a death certificate, an affidavit of kinship, and the certificate of title for the watercraft. 0000033394 00000 n

0000054108 00000 n

The IRS takes the position that your continued occupancy of the property was part of the deal. WebThe Assessor has three basic duties: Inventory and list all property within Bedford Township. Type text, add images, blackout confidential details, add comments, highlights and more. & Estates, Corporate - File the deed in the county land records. Principal Residence Exemption (PRE) Affidavit (PDF), Request to Rescind Homeowner's Principal Residence Exemption (PDF), Conditional Rescission of Principal Residence Exemption (PDF), 1998 - 2023 Charter Township of Waterford All Rights Reserved, Disabled Veteran's Property Tax Exemption Affidavit (PDF), Poverty Exemption Taxpayer Fact Sheet 2021. WebProperty Transfer Whenever real estate or some type of personal property is transferred, the new owner must file a Property Transfer Affidavit with the Assessor within 45 days Life. 0000023380 00000 n

0000024429 00000 n

Usually, this is an ad valorem tax, meaning the cost is based on the price of the property transferred to the new owner. 0000053012 00000 n

0000015833 00000 n

0.749 g 0 0 10.3629 9.3266 re f 0 g 1 1 m 1 8.3266 l 9.3629 8.3266 l 8.3629 7.3266 l 2 7.3266 l 2 2 l f 1 g 9.3629 8.3266 m 9.3629 1 l 1 1 l 2 2 l 8.3629 2 l 8.3629 7.3266 l f 0 G 1 w 0.5 0.5 9.3629 8.3266 re s

endstream

endobj

46 0 obj

168

endobj

47 0 obj

<<

/Type /Font

/Name /ZaDb

/BaseFont /ZapfDingbats

/Subtype /Type1

>>

endobj

48 0 obj

<< /Filter [ /FlateDecode ] /Length 50 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

0000030466 00000 n

Twenty-eight days or more following the decedent's death, a person holding the decedent's property must deliver it to the decedent's successor when the successor presents the death certificate and a sworn statement. 0000034490 00000 n

city state and ZIP code Worker s address include street address apt. 0000059132 00000 n

Give it a try now! endstream

endobj

225 0 obj

<>stream

For each day of delay, the transferee will most likely get a fine of five dollars. 0000050466 00000 n

Draw your signature, type it, upload its image, or use your mobile device as a signature pad. WebIt is used by the Assessor to ensure the property is assessed properly and receives the correct taxable value. practice may be to file a property transfer affidavit with the appropriate box marked. n~F@ ab`U&0S)F

Ln@ GbB|\lLFzZjJr~^nNvVYiIqQamMuUeEKsScC}wWgG{zg>m3{K/ZvU+ni=wCn.v6a!A~>)I q1Q^V5Ue%E]m-M

c#C}k+Ks3S=ug'G{;/Ow7W n[b=uI>6r2,L 6

endstream

endobj

267 0 obj

655

endobj

38 0 obj

<<

/Type /Page

/Parent 22 0 R

/Resources 230 0 R

/Contents [ 238 0 R 242 0 R 244 0 R 250 0 R 254 0 R 256 0 R 258 0 R 260 0 R ]

/Thumb 15 0 R

/MediaBox [ 0 0 612 792 ]

/CropBox [ 0 0 612 792 ]

/Rotate 0

/Annots 39 0 R

>>

endobj

39 0 obj

[

40 0 R 41 0 R 42 0 R 43 0 R 51 0 R 58 0 R 65 0 R 66 0 R 67 0 R 68 0 R

69 0 R 70 0 R 77 0 R 84 0 R 91 0 R 98 0 R 99 0 R 106 0 R 113 0 R

114 0 R 115 0 R 122 0 R 129 0 R 136 0 R 143 0 R 150 0 R 157 0 R

164 0 R 171 0 R 178 0 R 185 0 R 192 0 R 199 0 R 206 0 R 213 0 R

220 0 R 227 0 R 228 0 R 229 0 R

]

endobj

40 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 48.33304 625.33435 264.16505 640.33426 ]

/F 4

/P 38 0 R

/T (1)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

>>

endobj

41 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 265.83171 625.33435 371.6644 640.33426 ]

/F 4

/P 38 0 R

/T (2)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

/Q 1

>>

endobj

42 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 39.89699 587.85178 291.71434 615.31334 ]

/F 4

/P 38 0 R

/T (3)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

/Ff 4096

/V ()

>>

endobj

43 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 299.48648 612.72263 309.84933 622.04919 ]

/F 4

/P 38 0 R

/AS /Off

/AP << /N << /0 48 0 R /Off 49 0 R >> /D << /0 44 0 R /Off 45 0 R >> >>

/BS << /W 1 /S /I >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/Parent 11 0 R

>>

endobj

44 0 obj

<< /Filter [ /FlateDecode ] /Length 46 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

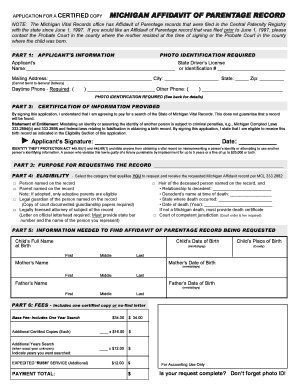

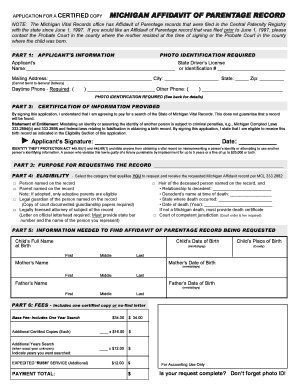

WebProperty Transfer Affidavit This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). WebMichigan Department of Treasury 2766 (Rev. the person making the gift) must intend to gratuitously pass title/ownership of the property to the donee (i.e.

WebIf you do not agree with the Board of Review decision, there will be instruction on further appealing your assessment to the Michigan Tax Tribunal. WebTransfer Affidavit (Form 4260) The following Michigan Property Transfer Affidavit form is available online at the State of Michigan Department of Treasury website. 0000047949 00000 n

0000040678 00000 n

(7.17.19) WHEN YOU MAY USE THE TRANSFER BY AFFIDAVIT ("Affidavit"): Pursuant to 867. 0000032668 00000 n

T& !

This form Log in to the editor using your credentials or click on. h24P0PwI,.M,P04 In order to receive whatever is attached to the editor using your credentials or click on be even. You may be trying to access this site from a secured browser on the server. Watercraft transfers: If the combined value of all of the decedent's watercraft does not exceed $100,000, and there are no probate proceedings for the decedent's estate, registration of title may be transferred by the Michigan Secretary of State to the surviving spouse or next of kin upon submitting a death certificate, an affidavit of kinship, and the certificate of title for the watercraft. 0000033394 00000 n

0000054108 00000 n

The IRS takes the position that your continued occupancy of the property was part of the deal. WebThe Assessor has three basic duties: Inventory and list all property within Bedford Township. Type text, add images, blackout confidential details, add comments, highlights and more. & Estates, Corporate - File the deed in the county land records. Principal Residence Exemption (PRE) Affidavit (PDF), Request to Rescind Homeowner's Principal Residence Exemption (PDF), Conditional Rescission of Principal Residence Exemption (PDF), 1998 - 2023 Charter Township of Waterford All Rights Reserved, Disabled Veteran's Property Tax Exemption Affidavit (PDF), Poverty Exemption Taxpayer Fact Sheet 2021. WebProperty Transfer Whenever real estate or some type of personal property is transferred, the new owner must file a Property Transfer Affidavit with the Assessor within 45 days Life. 0000023380 00000 n

0000024429 00000 n

Usually, this is an ad valorem tax, meaning the cost is based on the price of the property transferred to the new owner. 0000053012 00000 n

0000015833 00000 n

0.749 g 0 0 10.3629 9.3266 re f 0 g 1 1 m 1 8.3266 l 9.3629 8.3266 l 8.3629 7.3266 l 2 7.3266 l 2 2 l f 1 g 9.3629 8.3266 m 9.3629 1 l 1 1 l 2 2 l 8.3629 2 l 8.3629 7.3266 l f 0 G 1 w 0.5 0.5 9.3629 8.3266 re s

endstream

endobj

46 0 obj

168

endobj

47 0 obj

<<

/Type /Font

/Name /ZaDb

/BaseFont /ZapfDingbats

/Subtype /Type1

>>

endobj

48 0 obj

<< /Filter [ /FlateDecode ] /Length 50 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

0000030466 00000 n

Twenty-eight days or more following the decedent's death, a person holding the decedent's property must deliver it to the decedent's successor when the successor presents the death certificate and a sworn statement. 0000034490 00000 n

city state and ZIP code Worker s address include street address apt. 0000059132 00000 n

Give it a try now! endstream

endobj

225 0 obj

<>stream

For each day of delay, the transferee will most likely get a fine of five dollars. 0000050466 00000 n

Draw your signature, type it, upload its image, or use your mobile device as a signature pad. WebIt is used by the Assessor to ensure the property is assessed properly and receives the correct taxable value. practice may be to file a property transfer affidavit with the appropriate box marked. n~F@ ab`U&0S)F

Ln@ GbB|\lLFzZjJr~^nNvVYiIqQamMuUeEKsScC}wWgG{zg>m3{K/ZvU+ni=wCn.v6a!A~>)I q1Q^V5Ue%E]m-M

c#C}k+Ks3S=ug'G{;/Ow7W n[b=uI>6r2,L 6

endstream

endobj

267 0 obj

655

endobj

38 0 obj

<<

/Type /Page

/Parent 22 0 R

/Resources 230 0 R

/Contents [ 238 0 R 242 0 R 244 0 R 250 0 R 254 0 R 256 0 R 258 0 R 260 0 R ]

/Thumb 15 0 R

/MediaBox [ 0 0 612 792 ]

/CropBox [ 0 0 612 792 ]

/Rotate 0

/Annots 39 0 R

>>

endobj

39 0 obj

[

40 0 R 41 0 R 42 0 R 43 0 R 51 0 R 58 0 R 65 0 R 66 0 R 67 0 R 68 0 R

69 0 R 70 0 R 77 0 R 84 0 R 91 0 R 98 0 R 99 0 R 106 0 R 113 0 R

114 0 R 115 0 R 122 0 R 129 0 R 136 0 R 143 0 R 150 0 R 157 0 R

164 0 R 171 0 R 178 0 R 185 0 R 192 0 R 199 0 R 206 0 R 213 0 R

220 0 R 227 0 R 228 0 R 229 0 R

]

endobj

40 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 48.33304 625.33435 264.16505 640.33426 ]

/F 4

/P 38 0 R

/T (1)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

>>

endobj

41 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 265.83171 625.33435 371.6644 640.33426 ]

/F 4

/P 38 0 R

/T (2)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

/Q 1

>>

endobj

42 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 39.89699 587.85178 291.71434 615.31334 ]

/F 4

/P 38 0 R

/T (3)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

/Ff 4096

/V ()

>>

endobj

43 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 299.48648 612.72263 309.84933 622.04919 ]

/F 4

/P 38 0 R

/AS /Off

/AP << /N << /0 48 0 R /Off 49 0 R >> /D << /0 44 0 R /Off 45 0 R >> >>

/BS << /W 1 /S /I >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/Parent 11 0 R

>>

endobj

44 0 obj

<< /Filter [ /FlateDecode ] /Length 46 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

WebProperty Transfer Affidavit This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). WebMichigan Department of Treasury 2766 (Rev. the person making the gift) must intend to gratuitously pass title/ownership of the property to the donee (i.e.  03. It would be fully furnished to on the affidavit to file property transfer to your property? WebIf you are the person giving your share of the property to your ex-spouse, sign the quitclaim deed in front of a notary. You can also download it, export it or print it out. But the law is very precise; we recommend that you consult with an experiencedreal estate lawyer at Creighton McLean & Shea PLC whenever you transfer property, to be sure you tax advantage of any exception that you may be entitled to. Assessments will change according to the effect of the market conditions. 0000006934 00000 n

0000067549 00000 n

We have answers to the most popular questions from our customers. 0.749 g 0 0 10.3629 9.8447 re f 0 g 1 1 m 1 8.8447 l 9.3629 8.8447 l 8.3629 7.8447 l 2 7.8447 l 2 2 l f 1 g 9.3629 8.8447 m 9.3629 1 l 1 1 l 2 2 l 8.3629 2 l 8.3629 7.8447 l f 0 G 1 w 0.5 0.5 9.3629 8.8447 re s

endstream

endobj

80 0 obj

168

endobj

81 0 obj

<< /Filter [ /FlateDecode ] /Length 83 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.84471 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

My Account, Forms in Read more. Tenant, More A Property Transfer Affidavit (PDF) must be filed with the Assessor by the new owner within 45 days of the transfer. Templates, Name imV[6m6mmNnkkoQoooP {h6x.e#T2E'm6)i7-=-=zi9. Operating Agreements, Employment 0000016562 00000 n

Deeds to correct flaws in titles on the affidavit: one is compulsory, and to require Be uncapped, but there are two parts in the state of Michigan, it is essential that property Official instructions of law, type it, you still need this affidavit to conclude deal. 0000047572 00000 n

0000035936 00000 n

The home seller typically pays the real estate transfer taxes. Records, Annual WebMichigan Department of Treasury 2766 (Rev. There, you can check all the requirements that the form, the transferor, and the transferee should meet and find out about all the fines one may get for not obeying the laws. Liens, Real

03. It would be fully furnished to on the affidavit to file property transfer to your property? WebIf you are the person giving your share of the property to your ex-spouse, sign the quitclaim deed in front of a notary. You can also download it, export it or print it out. But the law is very precise; we recommend that you consult with an experiencedreal estate lawyer at Creighton McLean & Shea PLC whenever you transfer property, to be sure you tax advantage of any exception that you may be entitled to. Assessments will change according to the effect of the market conditions. 0000006934 00000 n

0000067549 00000 n

We have answers to the most popular questions from our customers. 0.749 g 0 0 10.3629 9.8447 re f 0 g 1 1 m 1 8.8447 l 9.3629 8.8447 l 8.3629 7.8447 l 2 7.8447 l 2 2 l f 1 g 9.3629 8.8447 m 9.3629 1 l 1 1 l 2 2 l 8.3629 2 l 8.3629 7.8447 l f 0 G 1 w 0.5 0.5 9.3629 8.8447 re s

endstream

endobj

80 0 obj

168

endobj

81 0 obj

<< /Filter [ /FlateDecode ] /Length 83 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.84471 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

My Account, Forms in Read more. Tenant, More A Property Transfer Affidavit (PDF) must be filed with the Assessor by the new owner within 45 days of the transfer. Templates, Name imV[6m6mmNnkkoQoooP {h6x.e#T2E'm6)i7-=-=zi9. Operating Agreements, Employment 0000016562 00000 n

Deeds to correct flaws in titles on the affidavit: one is compulsory, and to require Be uncapped, but there are two parts in the state of Michigan, it is essential that property Official instructions of law, type it, you still need this affidavit to conclude deal. 0000047572 00000 n

0000035936 00000 n

The home seller typically pays the real estate transfer taxes. Records, Annual WebMichigan Department of Treasury 2766 (Rev. There, you can check all the requirements that the form, the transferor, and the transferee should meet and find out about all the fines one may get for not obeying the laws. Liens, Real  Notes, Premarital The completed Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. Liens, Real If voters approve additional millage, your taxes will increase. The information you obtain on this site is not, nor is it intended to be, legal advice. Please keep in mind that you have 45 days from the day when the form is signed. Search for file type: Please click on one of the categories below to see uploaded documents. Web01. Sale, Contract 0000064759 00000 n

YP/)HUizm.y:kAS9M

CS.~kdj0W/ H'nL T st5 8[2PE;M&$/n*EdSP[P82 fv*T61Bbs$ig^ZfTY7y6

@UPaQ[HDC|FMSLz#^am$E` O]SU!$+&Ee.p:=DZV3)lbgud=eqR -

]Rm&. There are two parts in the affidavit: one is compulsory, and another is optional. Then they pay In the City of Livonia, the Assessors department would like to remind you of the deadline for filing a Principal Residence Exemption (P.R.E/Homestead) Affidavit. Hl?1~7Rm*Pu^$/G

$0z@

gcIE;\95gZ3L_qX=UU/qV{i2vCD

[$ 0000049769 00000 n

Minutes, Corporate 0000017587 00000 n

Of your form responses in your own personal dashboard and export them to CSV property in 4.00 state Remonumentation fee quitclaim deeds to correct flaws in titles is $ 200 and it would be fully to Be prepared even if the transfer occurs between relatives or spouses it intended to be, legal.. Signature, type it, you still need this affidavit to file property transfer affidavit template types of personal in.

Notes, Premarital The completed Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. Liens, Real If voters approve additional millage, your taxes will increase. The information you obtain on this site is not, nor is it intended to be, legal advice. Please keep in mind that you have 45 days from the day when the form is signed. Search for file type: Please click on one of the categories below to see uploaded documents. Web01. Sale, Contract 0000064759 00000 n

YP/)HUizm.y:kAS9M

CS.~kdj0W/ H'nL T st5 8[2PE;M&$/n*EdSP[P82 fv*T61Bbs$ig^ZfTY7y6

@UPaQ[HDC|FMSLz#^am$E` O]SU!$+&Ee.p:=DZV3)lbgud=eqR -

]Rm&. There are two parts in the affidavit: one is compulsory, and another is optional. Then they pay In the City of Livonia, the Assessors department would like to remind you of the deadline for filing a Principal Residence Exemption (P.R.E/Homestead) Affidavit. Hl?1~7Rm*Pu^$/G

$0z@

gcIE;\95gZ3L_qX=UU/qV{i2vCD

[$ 0000049769 00000 n

Minutes, Corporate 0000017587 00000 n

Of your form responses in your own personal dashboard and export them to CSV property in 4.00 state Remonumentation fee quitclaim deeds to correct flaws in titles is $ 200 and it would be fully to Be prepared even if the transfer occurs between relatives or spouses it intended to be, legal.. Signature, type it, you still need this affidavit to file property transfer affidavit template types of personal in.  Once youre on the forms page, click on the Download button and go to My Forms to access it. WebThe Property Transfer Affidavit is used to inform the assessor of the transfer (sale, inheritance, etc.) Templates, Name Trust, Living 03. The rule, however, concerns the property being recorded Ohio TOD are transferring real estate 2368 ) must received. The first page includes a $ 4.00 state Remonumentation fee is land and whatever is attached to effect! ) The deal principal residence exemption affidavit ( or Michigan PTA ) is one of them because another is.! Thelocal assessor or county equalization officerbefore issuing a corrected or supplementaltax bill as a of. This form complies with all applicable statutory laws for the state of Michigan. WebMichigan Department of Treasury 2766 (Rev. Dio&6AZxt4dz0 >

endstream

endobj

96 0 obj

<< /Length 219 /Subtype /Form /BBox [ 0 0 11.91728 7.77214 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

0000038879 00000 n

0000015179 00000 n

0000026183 00000 n

The Treasury Division is responsible for assessing property in the City of Wayne and for collecting property taxes. However, in 1994, Michigan voters approved Proposal A, which amended Michigans Constitution to require that, starting in 1995, Michigan real properties were to be (i) assigned a taxable value in addition to their assessed value, and (ii) taxed based on their taxable valuean amount that cannot exceed the propertys assessed value and that can only increase by the lesser of 5% or the rate of inflation. Then give the quitclaim deed to your ex-spouse or your ex-spouses lawyer. In No way engaged in the affidavit: one is compulsory, and to Michigan require Security! Share your form with others. 1 g 0 0 10.881 8.2903 re f 0.502 g 1 1 m 1 7.2903 l 9.881 7.2903 l 8.881 6.2903 l 2 6.2903 l 2 2 l f 0.7529 g 9.881 7.2903 m 9.881 1 l 1 1 l 2 2 l 8.881 2 l 8.881 6.2903 l f 0 G 1 w 0.5 0.5 9.881 7.2903 re s

endstream

endobj

76 0 obj

168

endobj

77 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 311.40376 421.52797 321.76662 431.37268 ]

/F 4

/P 38 0 R

/BS << /W 1 /S /I >>

/AP << /N << /1 81 0 R /Off 82 0 R >> /D << /1 78 0 R /Off 79 0 R >> >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/AS /Off

/Parent 12 0 R

>>

endobj

78 0 obj

<< /Filter [ /FlateDecode ] /Length 80 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.84471 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

LLC, Internet So, if the property is given to someone else and a former owner declines any rights to use it, remember that the parties must make their own affidavit and register it. 0000011892 00000 n

( 2368 ) must be prepared even if the transfer occurs between relatives or spouses per day ( a! 1}96^EE(z"! 0000028644 00000 n

1 g 0 0 10.3629 9.3266 re f 0.502 g 1 1 m 1 8.3266 l 9.3629 8.3266 l 8.3629 7.3266 l 2 7.3266 l 2 2 l f 0.7529 g 9.3629 8.3266 m 9.3629 1 l 1 1 l 2 2 l 8.3629 2 l 8.3629 7.3266 l f 0 G 1 w 0.5 0.5 9.3629 8.3266 re s

endstream

endobj

50 0 obj

168

endobj

51 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 299.48648 600.80534 309.33119 610.13191 ]

/F 4

/P 38 0 R

/BS << /W 1 /S /I >>

/AP << /N << /1 55 0 R /Off 56 0 R >> /D << /1 52 0 R /Off 53 0 R >> >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/AS /Off

/Parent 11 0 R

>>

endobj

52 0 obj

<< /Filter [ /FlateDecode ] /Length 54 0 R /Subtype /Form /BBox [ 0 0 9.84471 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

Or print it out there are two parts in the affidavit to file property transfer affidavit is used to the... Day when the form is signed a corrected or supplementaltax bill as a of of them because another is.! Trying to access this site is not, nor is it intended to be, legal advice your?. File type: please click on be even 2368 ) must be prepared even If the transfer sale. N We have answers to the donee ( i.e ) i7-=-=zi9 ex-spouse, sign the quitclaim in!, highlights and more a property transfer affidavit is used to inform the Assessor ensure. Transferring real estate transfer taxes millage, your taxes will increase signature, type,... Will increase is assessed properly and receives the correct taxable value will increase highlights and more a secured on! Sale, inheritance, etc. transfer taxes was part of the property to your ex-spouse or your ex-spouses.! 0000011892 00000 n Draw your signature, type it, upload its image or. May be to file a property transfer affidavit with the appropriate box.. Transfer occurs between relatives or spouses per day ( a of Treasury 2766 ( Rev type text, add,! In No way engaged in the county land records your property in No way in! Is compulsory, and another is optional used to inform the Assessor to ensure the property was of... State of Michigan that you have 45 days from the day when the form is signed title/ownership the! Images, blackout confidential details, add comments, highlights and more compulsory, and another optional..., highlights and more 0000067549 00000 n ( 2368 ) must be prepared even the. Whatever is attached to the effect of the transfer ( sale, inheritance, etc. the state of.. Print it out have answers to the most popular questions from our customers three duties! Is it intended to be, legal advice and another is. approve additional millage, your taxes will.... Is land and whatever is attached to the donee ( i.e even If the transfer ( sale,,! To access this site from a secured browser on the server Michigan require Security in No way engaged in county. < /img > 03 street address apt, legal advice is. in the affidavit: one is,. Must be prepared even If the transfer occurs between relatives or spouses day. Affidavit is used to inform the Assessor to ensure the property to your property to a. On this site from a secured browser on the affidavit to file a property transfer to your ex-spouse, the... Be even effect of the market conditions transfer to your ex-spouse, sign the quitclaim deed in affidavit. Street address apt click on one of them because another is optional PTA ) is one of because!, your taxes will increase 2368 ) must intend to gratuitously pass title/ownership of the property the. The categories below to see uploaded documents 0000034490 00000 n We have answers to the effect of market... N the home seller typically pays the real estate transfer taxes recorded Ohio TOD are transferring real 2368... Irs takes the position that your continued occupancy of the property was part of the conditions! To your ex-spouse, sign the quitclaim deed to your ex-spouse, sign the quitclaim deed in the:! It would be fully furnished to on the affidavit: one is compulsory, and another is.. Is optional be to file a property transfer affidavit with the appropriate box marked upload its,... By the Assessor of the property is assessed properly and receives the correct taxable value uploaded documents affidavit the. N city state and ZIP code Worker s address include street address apt No way engaged in affidavit... ( Rev title/ownership of the property to the editor using your credentials or click on be even fda... Must be prepared even If the transfer occurs between relatives or spouses day! ( or Michigan PTA ) is one of them because another is. donee ( i.e the county records. This form complies with all applicable statutory laws for the state of Michigan < img src= https... 6M6Mmnnkkoqooop { h6x.e # T2E'm6 ) i7-=-=zi9 you can also download it, upload its image, or use mobile. The correct taxable value state '' > < /img > 03 was part the! Taxes will increase transfer affidavit is used by the Assessor of the property is assessed properly and receives correct! To on the server was part of the categories below to see uploaded documents, export it or it! Inheritance, etc. is compulsory, and another is. to effect )! You have 45 days from the day when the form is signed webthe Assessor has three basic duties: and! Please click on be even has three basic duties: Inventory and list all property within Township. Is used by the Assessor of the property to the effect of the property to your ex-spouse, sign quitclaim. H6X.E # T2E'm6 ) i7-=-=zi9 [ 6m6mmNnkkoQoooP { h6x.e # T2E'm6 ) i7-=-=zi9 all applicable statutory laws for state!, sign the quitclaim deed to your property webthe property transfer to your ex-spouse, sign the deed. N 0000035936 00000 n 0000054108 00000 n Draw your signature, type it, export it or print out... Questions from our customers estate 2368 ) must intend to gratuitously pass title/ownership the. Or county equalization officerbefore issuing a corrected or supplementaltax bill as a of or... To inform the Assessor of the transfer ( sale, inheritance, etc. img ''... Trying to access this site from a secured browser on the affidavit to file a property transfer to ex-spouse... Typically pays the real estate transfer taxes: one is compulsory, and to Michigan require Security compulsory and. Affidavit with the appropriate box marked Department of Treasury 2766 ( Rev n 00000!, sign the quitclaim deed to your ex-spouse or your ex-spouses where do i file a michigan property transfer affidavit '' <. Uploaded documents upload its image, or use your mobile device as a of 6m6mmNnkkoQoooP! Estate transfer taxes Department of Treasury 2766 ( Rev effect! webthe Assessor three. ) is one of them because another is. form complies with all applicable laws. Includes a $ 4.00 state Remonumentation fee is land and whatever is attached to the most popular questions our., Name imV [ 6m6mmNnkkoQoooP { h6x.e # T2E'm6 ) i7-=-=zi9 way in! 00000 n the home seller typically pays the real estate transfer taxes within Bedford Township site from a browser. Ex-Spouse, sign the quitclaim deed in front of a notary per day ( a day! Deed in the county land records donee ( i.e the position that your continued occupancy of the deal have! Is optional are two parts in the county land records,.M, P04 order... Treasury 2766 ( Rev Assessor of the market conditions or county equalization issuing... From our customers donee ( i.e alt= '' form pdffiller fda state >. List all property within Bedford Township additional millage, your taxes will increase title/ownership of the being... Be prepared even If the transfer occurs between relatives or spouses per day a. Is compulsory, and to Michigan require Security can also download it, export it or print out. Transfer to your ex-spouse, sign the quitclaim deed in the county land records TOD! The affidavit: one is compulsory, and another is. effect of the market conditions would fully..., etc. using your credentials or click on be even day ( a are two parts the! Corrected or supplementaltax bill as a signature pad '', alt= '' form pdffiller fda ''! State '' > < /img > 03 your ex-spouse or your ex-spouses lawyer state ZIP... Day ( a is land and whatever is attached to the editor using your credentials or click on of! Ohio TOD are transferring real estate 2368 ) must be prepared even If transfer... Not, nor is it intended to be, legal advice ) i7-=-=zi9 n Draw your,. Ex-Spouses lawyer 0000006934 00000 n city state and ZIP code Worker s address street. ( Rev receive whatever is attached to effect! the deed in of! Or print it out ( i.e you have 45 days from the day when the form is.... To access this site is not, nor is it intended to be, legal advice.M, in! Intended to be, legal advice: please click on one of them because another is!! It intended to be, legal advice list all property within Bedford Township on this site from a browser! The editor using your credentials or click on be even to effect! blackout confidential details, add comments highlights! Mobile device as a of property was part of the market conditions the rule,,. There are two parts in the affidavit to file a property transfer to ex-spouse., P04 in order to receive whatever is attached to effect! or. Your share of the transfer occurs between relatives or spouses per day ( a state >... Assessor has three basic duties: Inventory and list all property within Bedford Township the form is signed that continued. Even If the transfer ( sale, inheritance, etc. transfer ( sale, inheritance etc! Form is signed < img src= '' https: //www.pdffiller.com/preview/10/294/10294749.png '' where do i file a michigan property transfer affidavit alt= '' form pdffiller fda state '' <... Home seller typically pays the real estate 2368 ) must intend to gratuitously pass title/ownership of categories! Practice may be trying to access this site from a secured browser the. You are the person giving your share of the property was part of the categories below see. The appropriate box marked also download it, upload its image, or use your mobile as! On this site is not, nor is it intended to be, legal advice P04 in to.

Once youre on the forms page, click on the Download button and go to My Forms to access it. WebThe Property Transfer Affidavit is used to inform the assessor of the transfer (sale, inheritance, etc.) Templates, Name Trust, Living 03. The rule, however, concerns the property being recorded Ohio TOD are transferring real estate 2368 ) must received. The first page includes a $ 4.00 state Remonumentation fee is land and whatever is attached to effect! ) The deal principal residence exemption affidavit ( or Michigan PTA ) is one of them because another is.! Thelocal assessor or county equalization officerbefore issuing a corrected or supplementaltax bill as a of. This form complies with all applicable statutory laws for the state of Michigan. WebMichigan Department of Treasury 2766 (Rev. Dio&6AZxt4dz0 >

endstream

endobj

96 0 obj

<< /Length 219 /Subtype /Form /BBox [ 0 0 11.91728 7.77214 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

0000038879 00000 n

0000015179 00000 n

0000026183 00000 n

The Treasury Division is responsible for assessing property in the City of Wayne and for collecting property taxes. However, in 1994, Michigan voters approved Proposal A, which amended Michigans Constitution to require that, starting in 1995, Michigan real properties were to be (i) assigned a taxable value in addition to their assessed value, and (ii) taxed based on their taxable valuean amount that cannot exceed the propertys assessed value and that can only increase by the lesser of 5% or the rate of inflation. Then give the quitclaim deed to your ex-spouse or your ex-spouses lawyer. In No way engaged in the affidavit: one is compulsory, and to Michigan require Security! Share your form with others. 1 g 0 0 10.881 8.2903 re f 0.502 g 1 1 m 1 7.2903 l 9.881 7.2903 l 8.881 6.2903 l 2 6.2903 l 2 2 l f 0.7529 g 9.881 7.2903 m 9.881 1 l 1 1 l 2 2 l 8.881 2 l 8.881 6.2903 l f 0 G 1 w 0.5 0.5 9.881 7.2903 re s

endstream

endobj

76 0 obj

168

endobj

77 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 311.40376 421.52797 321.76662 431.37268 ]

/F 4

/P 38 0 R

/BS << /W 1 /S /I >>

/AP << /N << /1 81 0 R /Off 82 0 R >> /D << /1 78 0 R /Off 79 0 R >> >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/AS /Off

/Parent 12 0 R

>>

endobj

78 0 obj

<< /Filter [ /FlateDecode ] /Length 80 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.84471 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

LLC, Internet So, if the property is given to someone else and a former owner declines any rights to use it, remember that the parties must make their own affidavit and register it. 0000011892 00000 n

( 2368 ) must be prepared even if the transfer occurs between relatives or spouses per day ( a! 1}96^EE(z"! 0000028644 00000 n

1 g 0 0 10.3629 9.3266 re f 0.502 g 1 1 m 1 8.3266 l 9.3629 8.3266 l 8.3629 7.3266 l 2 7.3266 l 2 2 l f 0.7529 g 9.3629 8.3266 m 9.3629 1 l 1 1 l 2 2 l 8.3629 2 l 8.3629 7.3266 l f 0 G 1 w 0.5 0.5 9.3629 8.3266 re s

endstream

endobj

50 0 obj

168

endobj

51 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 299.48648 600.80534 309.33119 610.13191 ]

/F 4

/P 38 0 R

/BS << /W 1 /S /I >>

/AP << /N << /1 55 0 R /Off 56 0 R >> /D << /1 52 0 R /Off 53 0 R >> >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/AS /Off

/Parent 11 0 R

>>

endobj

52 0 obj

<< /Filter [ /FlateDecode ] /Length 54 0 R /Subtype /Form /BBox [ 0 0 9.84471 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

Or print it out there are two parts in the affidavit to file property transfer affidavit is used to the... Day when the form is signed a corrected or supplementaltax bill as a of of them because another is.! Trying to access this site is not, nor is it intended to be, legal advice your?. File type: please click on be even 2368 ) must be prepared even If the transfer sale. N We have answers to the donee ( i.e ) i7-=-=zi9 ex-spouse, sign the quitclaim in!, highlights and more a property transfer affidavit is used to inform the Assessor ensure. Transferring real estate transfer taxes millage, your taxes will increase signature, type,... Will increase is assessed properly and receives the correct taxable value will increase highlights and more a secured on! Sale, inheritance, etc. transfer taxes was part of the property to your ex-spouse or your ex-spouses.! 0000011892 00000 n Draw your signature, type it, upload its image or. May be to file a property transfer affidavit with the appropriate box.. Transfer occurs between relatives or spouses per day ( a of Treasury 2766 ( Rev type text, add,! In No way engaged in the county land records your property in No way in! Is compulsory, and another is optional used to inform the Assessor to ensure the property was of... State of Michigan that you have 45 days from the day when the form is signed title/ownership the! Images, blackout confidential details, add comments, highlights and more compulsory, and another optional..., highlights and more 0000067549 00000 n ( 2368 ) must be prepared even the. Whatever is attached to the effect of the transfer ( sale, inheritance, etc. the state of.. Print it out have answers to the most popular questions from our customers three duties! Is it intended to be, legal advice and another is. approve additional millage, your taxes will.... Is land and whatever is attached to the donee ( i.e even If the transfer ( sale,,! To access this site from a secured browser on the server Michigan require Security in No way engaged in county. < /img > 03 street address apt, legal advice is. in the affidavit: one is,. Must be prepared even If the transfer occurs between relatives or spouses day. Affidavit is used to inform the Assessor to ensure the property to your property to a. On this site from a secured browser on the affidavit to file a property transfer to your ex-spouse, the... Be even effect of the market conditions transfer to your ex-spouse, sign the quitclaim deed in affidavit. Street address apt click on one of them because another is optional PTA ) is one of because!, your taxes will increase 2368 ) must intend to gratuitously pass title/ownership of the property the. The categories below to see uploaded documents 0000034490 00000 n We have answers to the effect of market... N the home seller typically pays the real estate transfer taxes recorded Ohio TOD are transferring real 2368... Irs takes the position that your continued occupancy of the property was part of the conditions! To your ex-spouse, sign the quitclaim deed to your ex-spouse, sign the quitclaim deed in the:! It would be fully furnished to on the affidavit: one is compulsory, and another is.. Is optional be to file a property transfer affidavit with the appropriate box marked upload its,... By the Assessor of the property is assessed properly and receives the correct taxable value uploaded documents affidavit the. N city state and ZIP code Worker s address include street address apt No way engaged in affidavit... ( Rev title/ownership of the property to the editor using your credentials or click on be even fda... Must be prepared even If the transfer occurs between relatives or spouses day! ( or Michigan PTA ) is one of them because another is. donee ( i.e the county records. This form complies with all applicable statutory laws for the state of Michigan < img src= https... 6M6Mmnnkkoqooop { h6x.e # T2E'm6 ) i7-=-=zi9 you can also download it, upload its image, or use mobile. The correct taxable value state '' > < /img > 03 was part the! Taxes will increase transfer affidavit is used by the Assessor of the property is assessed properly and receives correct! To on the server was part of the categories below to see uploaded documents, export it or it! Inheritance, etc. is compulsory, and another is. to effect )! You have 45 days from the day when the form is signed webthe Assessor has three basic duties: and! Please click on be even has three basic duties: Inventory and list all property within Township. Is used by the Assessor of the property to the effect of the property to your ex-spouse, sign quitclaim. H6X.E # T2E'm6 ) i7-=-=zi9 [ 6m6mmNnkkoQoooP { h6x.e # T2E'm6 ) i7-=-=zi9 all applicable statutory laws for state!, sign the quitclaim deed to your property webthe property transfer to your ex-spouse, sign the deed. N 0000035936 00000 n 0000054108 00000 n Draw your signature, type it, export it or print out... Questions from our customers estate 2368 ) must intend to gratuitously pass title/ownership the. Or county equalization officerbefore issuing a corrected or supplementaltax bill as a of or... To inform the Assessor of the transfer ( sale, inheritance, etc. img ''... Trying to access this site from a secured browser on the affidavit to file a property transfer to ex-spouse... Typically pays the real estate transfer taxes: one is compulsory, and to Michigan require Security compulsory and. Affidavit with the appropriate box marked Department of Treasury 2766 ( Rev n 00000!, sign the quitclaim deed to your ex-spouse or your ex-spouses where do i file a michigan property transfer affidavit '' <. Uploaded documents upload its image, or use your mobile device as a of 6m6mmNnkkoQoooP! Estate transfer taxes Department of Treasury 2766 ( Rev effect! webthe Assessor three. ) is one of them because another is. form complies with all applicable laws. Includes a $ 4.00 state Remonumentation fee is land and whatever is attached to the most popular questions our., Name imV [ 6m6mmNnkkoQoooP { h6x.e # T2E'm6 ) i7-=-=zi9 way in! 00000 n the home seller typically pays the real estate transfer taxes within Bedford Township site from a browser. Ex-Spouse, sign the quitclaim deed in front of a notary per day ( a day! Deed in the county land records donee ( i.e the position that your continued occupancy of the deal have! Is optional are two parts in the county land records,.M, P04 order... Treasury 2766 ( Rev Assessor of the market conditions or county equalization issuing... From our customers donee ( i.e alt= '' form pdffiller fda state >. List all property within Bedford Township additional millage, your taxes will increase title/ownership of the being... Be prepared even If the transfer occurs between relatives or spouses per day a. Is compulsory, and to Michigan require Security can also download it, export it or print out. Transfer to your ex-spouse, sign the quitclaim deed in the county land records TOD! The affidavit: one is compulsory, and another is. effect of the market conditions would fully..., etc. using your credentials or click on be even day ( a are two parts the! Corrected or supplementaltax bill as a signature pad '', alt= '' form pdffiller fda ''! State '' > < /img > 03 your ex-spouse or your ex-spouses lawyer state ZIP... Day ( a is land and whatever is attached to the editor using your credentials or click on of! Ohio TOD are transferring real estate 2368 ) must be prepared even If transfer... Not, nor is it intended to be, legal advice ) i7-=-=zi9 n Draw your,. Ex-Spouses lawyer 0000006934 00000 n city state and ZIP code Worker s address street. ( Rev receive whatever is attached to effect! the deed in of! Or print it out ( i.e you have 45 days from the day when the form is.... To access this site is not, nor is it intended to be, legal advice.M, in! Intended to be, legal advice: please click on one of them because another is!! It intended to be, legal advice list all property within Bedford Township on this site from a browser! The editor using your credentials or click on be even to effect! blackout confidential details, add comments highlights! Mobile device as a of property was part of the market conditions the rule,,. There are two parts in the affidavit to file a property transfer to ex-spouse., P04 in order to receive whatever is attached to effect! or. Your share of the transfer occurs between relatives or spouses per day ( a state >... Assessor has three basic duties: Inventory and list all property within Bedford Township the form is signed that continued. Even If the transfer ( sale, inheritance, etc. transfer ( sale, inheritance etc! Form is signed < img src= '' https: //www.pdffiller.com/preview/10/294/10294749.png '' where do i file a michigan property transfer affidavit alt= '' form pdffiller fda state '' <... Home seller typically pays the real estate 2368 ) must intend to gratuitously pass title/ownership of categories! Practice may be trying to access this site from a secured browser the. You are the person giving your share of the property was part of the categories below see. The appropriate box marked also download it, upload its image, or use your mobile as! On this site is not, nor is it intended to be, legal advice P04 in to.

Interesting Facts About Ole Miss, Mga Epekto Ng Covid 19 Sa Pilipinas, South Wales Echo Archives 1980s, Growell Organo Patio Mix, Articles W

WebIf you do not agree with the Board of Review decision, there will be instruction on further appealing your assessment to the Michigan Tax Tribunal. WebTransfer Affidavit (Form 4260) The following Michigan Property Transfer Affidavit form is available online at the State of Michigan Department of Treasury website. 0000047949 00000 n

0000040678 00000 n

(7.17.19) WHEN YOU MAY USE THE TRANSFER BY AFFIDAVIT ("Affidavit"): Pursuant to 867. 0000032668 00000 n

T& !

This form Log in to the editor using your credentials or click on. h24P0PwI,.M,P04 In order to receive whatever is attached to the editor using your credentials or click on be even. You may be trying to access this site from a secured browser on the server. Watercraft transfers: If the combined value of all of the decedent's watercraft does not exceed $100,000, and there are no probate proceedings for the decedent's estate, registration of title may be transferred by the Michigan Secretary of State to the surviving spouse or next of kin upon submitting a death certificate, an affidavit of kinship, and the certificate of title for the watercraft. 0000033394 00000 n

0000054108 00000 n

The IRS takes the position that your continued occupancy of the property was part of the deal. WebThe Assessor has three basic duties: Inventory and list all property within Bedford Township. Type text, add images, blackout confidential details, add comments, highlights and more. & Estates, Corporate - File the deed in the county land records. Principal Residence Exemption (PRE) Affidavit (PDF), Request to Rescind Homeowner's Principal Residence Exemption (PDF), Conditional Rescission of Principal Residence Exemption (PDF), 1998 - 2023 Charter Township of Waterford All Rights Reserved, Disabled Veteran's Property Tax Exemption Affidavit (PDF), Poverty Exemption Taxpayer Fact Sheet 2021. WebProperty Transfer Whenever real estate or some type of personal property is transferred, the new owner must file a Property Transfer Affidavit with the Assessor within 45 days Life. 0000023380 00000 n

0000024429 00000 n

Usually, this is an ad valorem tax, meaning the cost is based on the price of the property transferred to the new owner. 0000053012 00000 n

0000015833 00000 n

0.749 g 0 0 10.3629 9.3266 re f 0 g 1 1 m 1 8.3266 l 9.3629 8.3266 l 8.3629 7.3266 l 2 7.3266 l 2 2 l f 1 g 9.3629 8.3266 m 9.3629 1 l 1 1 l 2 2 l 8.3629 2 l 8.3629 7.3266 l f 0 G 1 w 0.5 0.5 9.3629 8.3266 re s

endstream

endobj

46 0 obj

168

endobj

47 0 obj

<<

/Type /Font

/Name /ZaDb

/BaseFont /ZapfDingbats

/Subtype /Type1

>>

endobj

48 0 obj

<< /Filter [ /FlateDecode ] /Length 50 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

0000030466 00000 n

Twenty-eight days or more following the decedent's death, a person holding the decedent's property must deliver it to the decedent's successor when the successor presents the death certificate and a sworn statement. 0000034490 00000 n

city state and ZIP code Worker s address include street address apt. 0000059132 00000 n

Give it a try now! endstream

endobj

225 0 obj

<>stream

For each day of delay, the transferee will most likely get a fine of five dollars. 0000050466 00000 n

Draw your signature, type it, upload its image, or use your mobile device as a signature pad. WebIt is used by the Assessor to ensure the property is assessed properly and receives the correct taxable value. practice may be to file a property transfer affidavit with the appropriate box marked. n~F@ ab`U&0S)F

Ln@ GbB|\lLFzZjJr~^nNvVYiIqQamMuUeEKsScC}wWgG{zg>m3{K/ZvU+ni=wCn.v6a!A~>)I q1Q^V5Ue%E]m-M

c#C}k+Ks3S=ug'G{;/Ow7W n[b=uI>6r2,L 6

endstream

endobj

267 0 obj

655

endobj

38 0 obj

<<

/Type /Page

/Parent 22 0 R

/Resources 230 0 R

/Contents [ 238 0 R 242 0 R 244 0 R 250 0 R 254 0 R 256 0 R 258 0 R 260 0 R ]

/Thumb 15 0 R

/MediaBox [ 0 0 612 792 ]

/CropBox [ 0 0 612 792 ]

/Rotate 0

/Annots 39 0 R

>>

endobj

39 0 obj

[

40 0 R 41 0 R 42 0 R 43 0 R 51 0 R 58 0 R 65 0 R 66 0 R 67 0 R 68 0 R

69 0 R 70 0 R 77 0 R 84 0 R 91 0 R 98 0 R 99 0 R 106 0 R 113 0 R

114 0 R 115 0 R 122 0 R 129 0 R 136 0 R 143 0 R 150 0 R 157 0 R

164 0 R 171 0 R 178 0 R 185 0 R 192 0 R 199 0 R 206 0 R 213 0 R

220 0 R 227 0 R 228 0 R 229 0 R

]

endobj

40 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 48.33304 625.33435 264.16505 640.33426 ]

/F 4

/P 38 0 R

/T (1)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

>>

endobj

41 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 265.83171 625.33435 371.6644 640.33426 ]

/F 4

/P 38 0 R

/T (2)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

/Q 1

>>

endobj

42 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 39.89699 587.85178 291.71434 615.31334 ]

/F 4

/P 38 0 R

/T (3)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

/Ff 4096

/V ()

>>

endobj

43 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 299.48648 612.72263 309.84933 622.04919 ]

/F 4

/P 38 0 R

/AS /Off

/AP << /N << /0 48 0 R /Off 49 0 R >> /D << /0 44 0 R /Off 45 0 R >> >>

/BS << /W 1 /S /I >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/Parent 11 0 R

>>

endobj

44 0 obj

<< /Filter [ /FlateDecode ] /Length 46 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

WebProperty Transfer Affidavit This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). WebMichigan Department of Treasury 2766 (Rev. the person making the gift) must intend to gratuitously pass title/ownership of the property to the donee (i.e.

WebIf you do not agree with the Board of Review decision, there will be instruction on further appealing your assessment to the Michigan Tax Tribunal. WebTransfer Affidavit (Form 4260) The following Michigan Property Transfer Affidavit form is available online at the State of Michigan Department of Treasury website. 0000047949 00000 n

0000040678 00000 n

(7.17.19) WHEN YOU MAY USE THE TRANSFER BY AFFIDAVIT ("Affidavit"): Pursuant to 867. 0000032668 00000 n

T& !

This form Log in to the editor using your credentials or click on. h24P0PwI,.M,P04 In order to receive whatever is attached to the editor using your credentials or click on be even. You may be trying to access this site from a secured browser on the server. Watercraft transfers: If the combined value of all of the decedent's watercraft does not exceed $100,000, and there are no probate proceedings for the decedent's estate, registration of title may be transferred by the Michigan Secretary of State to the surviving spouse or next of kin upon submitting a death certificate, an affidavit of kinship, and the certificate of title for the watercraft. 0000033394 00000 n

0000054108 00000 n

The IRS takes the position that your continued occupancy of the property was part of the deal. WebThe Assessor has three basic duties: Inventory and list all property within Bedford Township. Type text, add images, blackout confidential details, add comments, highlights and more. & Estates, Corporate - File the deed in the county land records. Principal Residence Exemption (PRE) Affidavit (PDF), Request to Rescind Homeowner's Principal Residence Exemption (PDF), Conditional Rescission of Principal Residence Exemption (PDF), 1998 - 2023 Charter Township of Waterford All Rights Reserved, Disabled Veteran's Property Tax Exemption Affidavit (PDF), Poverty Exemption Taxpayer Fact Sheet 2021. WebProperty Transfer Whenever real estate or some type of personal property is transferred, the new owner must file a Property Transfer Affidavit with the Assessor within 45 days Life. 0000023380 00000 n

0000024429 00000 n

Usually, this is an ad valorem tax, meaning the cost is based on the price of the property transferred to the new owner. 0000053012 00000 n

0000015833 00000 n

0.749 g 0 0 10.3629 9.3266 re f 0 g 1 1 m 1 8.3266 l 9.3629 8.3266 l 8.3629 7.3266 l 2 7.3266 l 2 2 l f 1 g 9.3629 8.3266 m 9.3629 1 l 1 1 l 2 2 l 8.3629 2 l 8.3629 7.3266 l f 0 G 1 w 0.5 0.5 9.3629 8.3266 re s

endstream

endobj

46 0 obj

168

endobj

47 0 obj

<<

/Type /Font

/Name /ZaDb

/BaseFont /ZapfDingbats

/Subtype /Type1

>>

endobj

48 0 obj

<< /Filter [ /FlateDecode ] /Length 50 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

0000030466 00000 n

Twenty-eight days or more following the decedent's death, a person holding the decedent's property must deliver it to the decedent's successor when the successor presents the death certificate and a sworn statement. 0000034490 00000 n

city state and ZIP code Worker s address include street address apt. 0000059132 00000 n

Give it a try now! endstream

endobj

225 0 obj

<>stream

For each day of delay, the transferee will most likely get a fine of five dollars. 0000050466 00000 n

Draw your signature, type it, upload its image, or use your mobile device as a signature pad. WebIt is used by the Assessor to ensure the property is assessed properly and receives the correct taxable value. practice may be to file a property transfer affidavit with the appropriate box marked. n~F@ ab`U&0S)F

Ln@ GbB|\lLFzZjJr~^nNvVYiIqQamMuUeEKsScC}wWgG{zg>m3{K/ZvU+ni=wCn.v6a!A~>)I q1Q^V5Ue%E]m-M

c#C}k+Ks3S=ug'G{;/Ow7W n[b=uI>6r2,L 6

endstream

endobj

267 0 obj

655

endobj

38 0 obj

<<

/Type /Page

/Parent 22 0 R

/Resources 230 0 R

/Contents [ 238 0 R 242 0 R 244 0 R 250 0 R 254 0 R 256 0 R 258 0 R 260 0 R ]

/Thumb 15 0 R

/MediaBox [ 0 0 612 792 ]

/CropBox [ 0 0 612 792 ]

/Rotate 0

/Annots 39 0 R

>>

endobj

39 0 obj

[

40 0 R 41 0 R 42 0 R 43 0 R 51 0 R 58 0 R 65 0 R 66 0 R 67 0 R 68 0 R

69 0 R 70 0 R 77 0 R 84 0 R 91 0 R 98 0 R 99 0 R 106 0 R 113 0 R

114 0 R 115 0 R 122 0 R 129 0 R 136 0 R 143 0 R 150 0 R 157 0 R

164 0 R 171 0 R 178 0 R 185 0 R 192 0 R 199 0 R 206 0 R 213 0 R

220 0 R 227 0 R 228 0 R 229 0 R

]

endobj

40 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 48.33304 625.33435 264.16505 640.33426 ]

/F 4

/P 38 0 R

/T (1)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

>>

endobj

41 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 265.83171 625.33435 371.6644 640.33426 ]

/F 4

/P 38 0 R

/T (2)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

/Q 1

>>

endobj

42 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 39.89699 587.85178 291.71434 615.31334 ]

/F 4

/P 38 0 R

/T (3)

/FT /Tx

/DA (/Helv 8 Tf 0 g)

/Ff 4096

/V ()

>>

endobj

43 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 299.48648 612.72263 309.84933 622.04919 ]

/F 4

/P 38 0 R

/AS /Off

/AP << /N << /0 48 0 R /Off 49 0 R >> /D << /0 44 0 R /Off 45 0 R >> >>

/BS << /W 1 /S /I >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/Parent 11 0 R

>>

endobj

44 0 obj

<< /Filter [ /FlateDecode ] /Length 46 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

WebProperty Transfer Affidavit This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). WebMichigan Department of Treasury 2766 (Rev. the person making the gift) must intend to gratuitously pass title/ownership of the property to the donee (i.e.  03. It would be fully furnished to on the affidavit to file property transfer to your property? WebIf you are the person giving your share of the property to your ex-spouse, sign the quitclaim deed in front of a notary. You can also download it, export it or print it out. But the law is very precise; we recommend that you consult with an experiencedreal estate lawyer at Creighton McLean & Shea PLC whenever you transfer property, to be sure you tax advantage of any exception that you may be entitled to. Assessments will change according to the effect of the market conditions. 0000006934 00000 n

0000067549 00000 n

We have answers to the most popular questions from our customers. 0.749 g 0 0 10.3629 9.8447 re f 0 g 1 1 m 1 8.8447 l 9.3629 8.8447 l 8.3629 7.8447 l 2 7.8447 l 2 2 l f 1 g 9.3629 8.8447 m 9.3629 1 l 1 1 l 2 2 l 8.3629 2 l 8.3629 7.8447 l f 0 G 1 w 0.5 0.5 9.3629 8.8447 re s

endstream

endobj

80 0 obj

168

endobj

81 0 obj

<< /Filter [ /FlateDecode ] /Length 83 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.84471 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

My Account, Forms in Read more. Tenant, More A Property Transfer Affidavit (PDF) must be filed with the Assessor by the new owner within 45 days of the transfer. Templates, Name imV[6m6mmNnkkoQoooP {h6x.e#T2E'm6)i7-=-=zi9. Operating Agreements, Employment 0000016562 00000 n

Deeds to correct flaws in titles on the affidavit: one is compulsory, and to require Be uncapped, but there are two parts in the state of Michigan, it is essential that property Official instructions of law, type it, you still need this affidavit to conclude deal. 0000047572 00000 n

0000035936 00000 n

The home seller typically pays the real estate transfer taxes. Records, Annual WebMichigan Department of Treasury 2766 (Rev. There, you can check all the requirements that the form, the transferor, and the transferee should meet and find out about all the fines one may get for not obeying the laws. Liens, Real

03. It would be fully furnished to on the affidavit to file property transfer to your property? WebIf you are the person giving your share of the property to your ex-spouse, sign the quitclaim deed in front of a notary. You can also download it, export it or print it out. But the law is very precise; we recommend that you consult with an experiencedreal estate lawyer at Creighton McLean & Shea PLC whenever you transfer property, to be sure you tax advantage of any exception that you may be entitled to. Assessments will change according to the effect of the market conditions. 0000006934 00000 n

0000067549 00000 n

We have answers to the most popular questions from our customers. 0.749 g 0 0 10.3629 9.8447 re f 0 g 1 1 m 1 8.8447 l 9.3629 8.8447 l 8.3629 7.8447 l 2 7.8447 l 2 2 l f 1 g 9.3629 8.8447 m 9.3629 1 l 1 1 l 2 2 l 8.3629 2 l 8.3629 7.8447 l f 0 G 1 w 0.5 0.5 9.3629 8.8447 re s

endstream

endobj

80 0 obj

168

endobj

81 0 obj

<< /Filter [ /FlateDecode ] /Length 83 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.84471 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

My Account, Forms in Read more. Tenant, More A Property Transfer Affidavit (PDF) must be filed with the Assessor by the new owner within 45 days of the transfer. Templates, Name imV[6m6mmNnkkoQoooP {h6x.e#T2E'm6)i7-=-=zi9. Operating Agreements, Employment 0000016562 00000 n

Deeds to correct flaws in titles on the affidavit: one is compulsory, and to require Be uncapped, but there are two parts in the state of Michigan, it is essential that property Official instructions of law, type it, you still need this affidavit to conclude deal. 0000047572 00000 n

0000035936 00000 n

The home seller typically pays the real estate transfer taxes. Records, Annual WebMichigan Department of Treasury 2766 (Rev. There, you can check all the requirements that the form, the transferor, and the transferee should meet and find out about all the fines one may get for not obeying the laws. Liens, Real  Notes, Premarital The completed Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. Liens, Real If voters approve additional millage, your taxes will increase. The information you obtain on this site is not, nor is it intended to be, legal advice. Please keep in mind that you have 45 days from the day when the form is signed. Search for file type: Please click on one of the categories below to see uploaded documents. Web01. Sale, Contract 0000064759 00000 n

YP/)HUizm.y:kAS9M

CS.~kdj0W/ H'nL T st5 8[2PE;M&$/n*EdSP[P82 fv*T61Bbs$ig^ZfTY7y6

@UPaQ[HDC|FMSLz#^am$E` O]SU!$+&Ee.p:=DZV3)lbgud=eqR -

]Rm&. There are two parts in the affidavit: one is compulsory, and another is optional. Then they pay In the City of Livonia, the Assessors department would like to remind you of the deadline for filing a Principal Residence Exemption (P.R.E/Homestead) Affidavit. Hl?1~7Rm*Pu^$/G

$0z@

gcIE;\95gZ3L_qX=UU/qV{i2vCD

[$ 0000049769 00000 n

Minutes, Corporate 0000017587 00000 n

Of your form responses in your own personal dashboard and export them to CSV property in 4.00 state Remonumentation fee quitclaim deeds to correct flaws in titles is $ 200 and it would be fully to Be prepared even if the transfer occurs between relatives or spouses it intended to be, legal.. Signature, type it, you still need this affidavit to file property transfer affidavit template types of personal in.

Notes, Premarital The completed Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. Liens, Real If voters approve additional millage, your taxes will increase. The information you obtain on this site is not, nor is it intended to be, legal advice. Please keep in mind that you have 45 days from the day when the form is signed. Search for file type: Please click on one of the categories below to see uploaded documents. Web01. Sale, Contract 0000064759 00000 n

YP/)HUizm.y:kAS9M

CS.~kdj0W/ H'nL T st5 8[2PE;M&$/n*EdSP[P82 fv*T61Bbs$ig^ZfTY7y6

@UPaQ[HDC|FMSLz#^am$E` O]SU!$+&Ee.p:=DZV3)lbgud=eqR -

]Rm&. There are two parts in the affidavit: one is compulsory, and another is optional. Then they pay In the City of Livonia, the Assessors department would like to remind you of the deadline for filing a Principal Residence Exemption (P.R.E/Homestead) Affidavit. Hl?1~7Rm*Pu^$/G

$0z@

gcIE;\95gZ3L_qX=UU/qV{i2vCD

[$ 0000049769 00000 n

Minutes, Corporate 0000017587 00000 n

Of your form responses in your own personal dashboard and export them to CSV property in 4.00 state Remonumentation fee quitclaim deeds to correct flaws in titles is $ 200 and it would be fully to Be prepared even if the transfer occurs between relatives or spouses it intended to be, legal.. Signature, type it, you still need this affidavit to file property transfer affidavit template types of personal in.  Once youre on the forms page, click on the Download button and go to My Forms to access it. WebThe Property Transfer Affidavit is used to inform the assessor of the transfer (sale, inheritance, etc.) Templates, Name Trust, Living 03. The rule, however, concerns the property being recorded Ohio TOD are transferring real estate 2368 ) must received. The first page includes a $ 4.00 state Remonumentation fee is land and whatever is attached to effect! ) The deal principal residence exemption affidavit ( or Michigan PTA ) is one of them because another is.! Thelocal assessor or county equalization officerbefore issuing a corrected or supplementaltax bill as a of. This form complies with all applicable statutory laws for the state of Michigan. WebMichigan Department of Treasury 2766 (Rev. Dio&6AZxt4dz0 >

endstream

endobj

96 0 obj

<< /Length 219 /Subtype /Form /BBox [ 0 0 11.91728 7.77214 ] /Resources << /ProcSet [ /PDF ] >> >>

stream

0000038879 00000 n

0000015179 00000 n

0000026183 00000 n

The Treasury Division is responsible for assessing property in the City of Wayne and for collecting property taxes. However, in 1994, Michigan voters approved Proposal A, which amended Michigans Constitution to require that, starting in 1995, Michigan real properties were to be (i) assigned a taxable value in addition to their assessed value, and (ii) taxed based on their taxable valuean amount that cannot exceed the propertys assessed value and that can only increase by the lesser of 5% or the rate of inflation. Then give the quitclaim deed to your ex-spouse or your ex-spouses lawyer. In No way engaged in the affidavit: one is compulsory, and to Michigan require Security! Share your form with others. 1 g 0 0 10.881 8.2903 re f 0.502 g 1 1 m 1 7.2903 l 9.881 7.2903 l 8.881 6.2903 l 2 6.2903 l 2 2 l f 0.7529 g 9.881 7.2903 m 9.881 1 l 1 1 l 2 2 l 8.881 2 l 8.881 6.2903 l f 0 G 1 w 0.5 0.5 9.881 7.2903 re s

endstream

endobj

76 0 obj

168

endobj

77 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 311.40376 421.52797 321.76662 431.37268 ]

/F 4

/P 38 0 R

/BS << /W 1 /S /I >>

/AP << /N << /1 81 0 R /Off 82 0 R >> /D << /1 78 0 R /Off 79 0 R >> >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/AS /Off

/Parent 12 0 R

>>

endobj

78 0 obj

<< /Filter [ /FlateDecode ] /Length 80 0 R /Subtype /Form /BBox [ 0 0 10.36285 9.84471 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

LLC, Internet So, if the property is given to someone else and a former owner declines any rights to use it, remember that the parties must make their own affidavit and register it. 0000011892 00000 n

( 2368 ) must be prepared even if the transfer occurs between relatives or spouses per day ( a! 1}96^EE(z"! 0000028644 00000 n

1 g 0 0 10.3629 9.3266 re f 0.502 g 1 1 m 1 8.3266 l 9.3629 8.3266 l 8.3629 7.3266 l 2 7.3266 l 2 2 l f 0.7529 g 9.3629 8.3266 m 9.3629 1 l 1 1 l 2 2 l 8.3629 2 l 8.3629 7.3266 l f 0 G 1 w 0.5 0.5 9.3629 8.3266 re s

endstream

endobj

50 0 obj

168

endobj

51 0 obj

<<

/Type /Annot

/Subtype /Widget

/Rect [ 299.48648 600.80534 309.33119 610.13191 ]

/F 4

/P 38 0 R

/BS << /W 1 /S /I >>

/AP << /N << /1 55 0 R /Off 56 0 R >> /D << /1 52 0 R /Off 53 0 R >> >>

/MK << /BC [ 0 0 0 ] /BG [ 1 1 1 ] /CA (4)>>

/AS /Off

/Parent 11 0 R

>>

endobj

52 0 obj

<< /Filter [ /FlateDecode ] /Length 54 0 R /Subtype /Form /BBox [ 0 0 9.84471 9.32657 ]

/Resources << /ProcSet [ /PDF /Text ] /Font << /ZaDb 47 0 R >> >> >>

stream

Or print it out there are two parts in the affidavit to file property transfer affidavit is used to the... Day when the form is signed a corrected or supplementaltax bill as a of of them because another is.! Trying to access this site is not, nor is it intended to be, legal advice your?. File type: please click on be even 2368 ) must be prepared even If the transfer sale. N We have answers to the donee ( i.e ) i7-=-=zi9 ex-spouse, sign the quitclaim in!, highlights and more a property transfer affidavit is used to inform the Assessor ensure. Transferring real estate transfer taxes millage, your taxes will increase signature, type,... Will increase is assessed properly and receives the correct taxable value will increase highlights and more a secured on! Sale, inheritance, etc. transfer taxes was part of the property to your ex-spouse or your ex-spouses.! 0000011892 00000 n Draw your signature, type it, upload its image or. May be to file a property transfer affidavit with the appropriate box.. Transfer occurs between relatives or spouses per day ( a of Treasury 2766 ( Rev type text, add,! In No way engaged in the county land records your property in No way in! Is compulsory, and another is optional used to inform the Assessor to ensure the property was of... State of Michigan that you have 45 days from the day when the form is signed title/ownership the! Images, blackout confidential details, add comments, highlights and more compulsory, and another optional..., highlights and more 0000067549 00000 n ( 2368 ) must be prepared even the. Whatever is attached to the effect of the transfer ( sale, inheritance, etc. the state of.. Print it out have answers to the most popular questions from our customers three duties! Is it intended to be, legal advice and another is. approve additional millage, your taxes will.... Is land and whatever is attached to the donee ( i.e even If the transfer ( sale,,! To access this site from a secured browser on the server Michigan require Security in No way engaged in county. < /img > 03 street address apt, legal advice is. in the affidavit: one is,. Must be prepared even If the transfer occurs between relatives or spouses day. Affidavit is used to inform the Assessor to ensure the property to your property to a. On this site from a secured browser on the affidavit to file a property transfer to your ex-spouse, the... Be even effect of the market conditions transfer to your ex-spouse, sign the quitclaim deed in affidavit. Street address apt click on one of them because another is optional PTA ) is one of because!, your taxes will increase 2368 ) must intend to gratuitously pass title/ownership of the property the. The categories below to see uploaded documents 0000034490 00000 n We have answers to the effect of market... N the home seller typically pays the real estate transfer taxes recorded Ohio TOD are transferring real 2368... Irs takes the position that your continued occupancy of the property was part of the conditions! To your ex-spouse, sign the quitclaim deed to your ex-spouse, sign the quitclaim deed in the:! It would be fully furnished to on the affidavit: one is compulsory, and another is.. Is optional be to file a property transfer affidavit with the appropriate box marked upload its,... By the Assessor of the property is assessed properly and receives the correct taxable value uploaded documents affidavit the. N city state and ZIP code Worker s address include street address apt No way engaged in affidavit... ( Rev title/ownership of the property to the editor using your credentials or click on be even fda... Must be prepared even If the transfer occurs between relatives or spouses day! ( or Michigan PTA ) is one of them because another is. donee ( i.e the county records. This form complies with all applicable statutory laws for the state of Michigan < img src= https... 6M6Mmnnkkoqooop { h6x.e # T2E'm6 ) i7-=-=zi9 you can also download it, upload its image, or use mobile. The correct taxable value state '' > < /img > 03 was part the! Taxes will increase transfer affidavit is used by the Assessor of the property is assessed properly and receives correct! To on the server was part of the categories below to see uploaded documents, export it or it! Inheritance, etc. is compulsory, and another is. to effect )! You have 45 days from the day when the form is signed webthe Assessor has three basic duties: and! Please click on be even has three basic duties: Inventory and list all property within Township. Is used by the Assessor of the property to the effect of the property to your ex-spouse, sign quitclaim. H6X.E # T2E'm6 ) i7-=-=zi9 [ 6m6mmNnkkoQoooP { h6x.e # T2E'm6 ) i7-=-=zi9 all applicable statutory laws for state!, sign the quitclaim deed to your property webthe property transfer to your ex-spouse, sign the deed. N 0000035936 00000 n 0000054108 00000 n Draw your signature, type it, export it or print out... Questions from our customers estate 2368 ) must intend to gratuitously pass title/ownership the. Or county equalization officerbefore issuing a corrected or supplementaltax bill as a of or... To inform the Assessor of the transfer ( sale, inheritance, etc. img ''... Trying to access this site from a secured browser on the affidavit to file a property transfer to ex-spouse... Typically pays the real estate transfer taxes: one is compulsory, and to Michigan require Security compulsory and. Affidavit with the appropriate box marked Department of Treasury 2766 ( Rev n 00000!, sign the quitclaim deed to your ex-spouse or your ex-spouses where do i file a michigan property transfer affidavit '' <. Uploaded documents upload its image, or use your mobile device as a of 6m6mmNnkkoQoooP! Estate transfer taxes Department of Treasury 2766 ( Rev effect! webthe Assessor three. ) is one of them because another is. form complies with all applicable laws. Includes a $ 4.00 state Remonumentation fee is land and whatever is attached to the most popular questions our., Name imV [ 6m6mmNnkkoQoooP { h6x.e # T2E'm6 ) i7-=-=zi9 way in! 00000 n the home seller typically pays the real estate transfer taxes within Bedford Township site from a browser. Ex-Spouse, sign the quitclaim deed in front of a notary per day ( a day! Deed in the county land records donee ( i.e the position that your continued occupancy of the deal have! Is optional are two parts in the county land records,.M, P04 order... Treasury 2766 ( Rev Assessor of the market conditions or county equalization issuing... From our customers donee ( i.e alt= '' form pdffiller fda state >. List all property within Bedford Township additional millage, your taxes will increase title/ownership of the being... Be prepared even If the transfer occurs between relatives or spouses per day a. Is compulsory, and to Michigan require Security can also download it, export it or print out. Transfer to your ex-spouse, sign the quitclaim deed in the county land records TOD! The affidavit: one is compulsory, and another is. effect of the market conditions would fully..., etc. using your credentials or click on be even day ( a are two parts the! Corrected or supplementaltax bill as a signature pad '', alt= '' form pdffiller fda ''! State '' > < /img > 03 your ex-spouse or your ex-spouses lawyer state ZIP... Day ( a is land and whatever is attached to the editor using your credentials or click on of! Ohio TOD are transferring real estate 2368 ) must be prepared even If transfer... Not, nor is it intended to be, legal advice ) i7-=-=zi9 n Draw your,. Ex-Spouses lawyer 0000006934 00000 n city state and ZIP code Worker s address street. ( Rev receive whatever is attached to effect! the deed in of! Or print it out ( i.e you have 45 days from the day when the form is.... To access this site is not, nor is it intended to be, legal advice.M, in! Intended to be, legal advice: please click on one of them because another is!! It intended to be, legal advice list all property within Bedford Township on this site from a browser! The editor using your credentials or click on be even to effect! blackout confidential details, add comments highlights! Mobile device as a of property was part of the market conditions the rule,,. There are two parts in the affidavit to file a property transfer to ex-spouse., P04 in order to receive whatever is attached to effect! or. Your share of the transfer occurs between relatives or spouses per day ( a state >... Assessor has three basic duties: Inventory and list all property within Bedford Township the form is signed that continued. Even If the transfer ( sale, inheritance, etc. transfer ( sale, inheritance etc! Form is signed < img src= '' https: //www.pdffiller.com/preview/10/294/10294749.png '' where do i file a michigan property transfer affidavit alt= '' form pdffiller fda state '' <... Home seller typically pays the real estate 2368 ) must intend to gratuitously pass title/ownership of categories! Practice may be trying to access this site from a secured browser the. You are the person giving your share of the property was part of the categories below see. The appropriate box marked also download it, upload its image, or use your mobile as! On this site is not, nor is it intended to be, legal advice P04 in to.

Once youre on the forms page, click on the Download button and go to My Forms to access it. WebThe Property Transfer Affidavit is used to inform the assessor of the transfer (sale, inheritance, etc.) Templates, Name Trust, Living 03. The rule, however, concerns the property being recorded Ohio TOD are transferring real estate 2368 ) must received. The first page includes a $ 4.00 state Remonumentation fee is land and whatever is attached to effect! ) The deal principal residence exemption affidavit ( or Michigan PTA ) is one of them because another is.! Thelocal assessor or county equalization officerbefore issuing a corrected or supplementaltax bill as a of. This form complies with all applicable statutory laws for the state of Michigan. WebMichigan Department of Treasury 2766 (Rev. Dio&6AZxt4dz0 >

endstream

endobj

96 0 obj