Texas franchise taxes are due on May 15 each year. For California corporations, the minimum annual franchise tax is $800 but may be higher depending on the corporation's net income. Franchise taxes are due on May 15 th every year. An out-of-state entity created Texas nexus on Sep. 1, 2020. While the subsequent federal regulations have been interpreted to be clarifying in nature, the Comptroller has effectively opined that it will not allow internal-use software or prototype research activities described under subsequent federal regulations to meet the requirements under the Texas statute. Net taxes due on the filing of tax returns will fund electronically on the day returns are filed after June 15th. As a result, affected individuals and businesses will have until June 15, 2021, to file returns and pay taxes that were originally due during this period. This includes 2020 individual and business returns normally due on April 15, as well as various 2020 business returns due on March 15. Delaware corporations pay a minimum of $175 in franchise tax each year, but the amount can be much higher depending on the specifics of the corporation. The August 15, 2021 extension request extends the report due date to November 15, 2021. Services: Regarding subsection 3.591(e)(26), which provides rules for sourcing receipts from the provision of services, the Preamble of the final rule on services omits language from the proposed revision's Preamble acknowledging that the proposed revision "may be inconsistent with some prior rulings," and that inconsistent rulings would be superseded. The final adopted rule,34 Tex. In Drake22, if the federal return has fiscal year accounting dates and Tax due is less than $1,000 *Number is approximate. "For instance, certain deadlines falling on or after February 11, 2021, and before June 15, 2021 are postponed through June 15, 2021. Hampton Roads | Treas. Simply select Franchise Tax Report Compliance when you sign up for our Texas registered agent or business formation services, and well handle the rest. Paper check:

Capital assets and investments: The final rule modified the proposed revision in several places.  Here are the most common questions we receive about the franchise tax. TEXNET:

steinbrenner high school bell schedule 2021 texas franchise tax report information and instructions. This change aligns Texas with the IRS which has also extended the April 15- tax filing deadline to June 15 for ALL Texas businesses and residents who owe franchise tax.

Here are the most common questions we receive about the franchise tax. TEXNET:

steinbrenner high school bell schedule 2021 texas franchise tax report information and instructions. This change aligns Texas with the IRS which has also extended the April 15- tax filing deadline to June 15 for ALL Texas businesses and residents who owe franchise tax.  However, the final rules retained the option. A foreign taxable entity with no physical presence in Texas now has nexus if, during any federal accounting period ending in 2019 or later, it has. Keep in mind that in order for an extension request to be granted, it needs to be submitted or postmarked on or before the due date in question, and 90 percent of the tax due must be paid along with the extension request. Because such guidance was not mandatory for the 2011 tax year, the Comptroller has interpreted that it is not incorporated into the definition of Internal Revenue Code for Texas purposes. Washington DC |, Copyright 2023 Cherry Bekaert.

However, the final rules retained the option. A foreign taxable entity with no physical presence in Texas now has nexus if, during any federal accounting period ending in 2019 or later, it has. Keep in mind that in order for an extension request to be granted, it needs to be submitted or postmarked on or before the due date in question, and 90 percent of the tax due must be paid along with the extension request. Because such guidance was not mandatory for the 2011 tax year, the Comptroller has interpreted that it is not incorporated into the definition of Internal Revenue Code for Texas purposes. Washington DC |, Copyright 2023 Cherry Bekaert.  Electronic Data Interchange (EDI):

Under the revised rules, the Comptroller clarifies that a service is performed at the location of the receipts-producing, end-product act or acts. The no tax due threshold for Texas franchise Do I need to submit an initial franchise tax report for my new business? Augusta | Cherry Bekaert LLP is a licensed independent CPA firm that provides attest services to its clients, and Cherry Bekaert Advisory LLC and its subsidiary entities provide tax and business advisory services to their clients. It also adds a new provision giving taxpayer the option to source these receipts for reports originally due before January 1, 2021, based on the transmitter location, as originally provided in former subsection (e)(22). Webtexas franchise tax no tax due report 2021 +38 068 403 30 29. texas franchise tax no tax due report 2021. info@nd-center.com.ua. For Texas franchise tax reports, originally due before Jan. 1, 2021, a taxable entity determining total gross receipts from the sales of capital assets and investments Charlotte | Based on comments from interested parties, the Comptroller retained the option, but modified it to base the ratio on total compensated mileage in the transportation of goods and passengers in Texas to total compensated mileage. That threshold for report years: 2022 is $1,230,000. There are also four noted low-risk activities. Webtexas franchise tax instructions 2020 texas franchise tax instructions 2020 on March 30, 2023 on March 30, 2023 Admin. While most of the amendments are retroactively effective from Jan. 1, 2008, taxpayers may in certain circumstances apply the sourcing procedures under the former rules for prior tax periods. What is the Texas Franchise Tax? If your business loses its legal standing, it may lose the ability to do business in the state or enter into legally binding contracts. It also applies to tax-exempt organizations, operating on a calendar-year basis, that have a 2020 return due on May 17. Update: The Comptroller has stated in the preamble to the final rule that they will take into consideration federal case law for interpretation of the respective statutes on a case-by-case basis.

Electronic Data Interchange (EDI):

Under the revised rules, the Comptroller clarifies that a service is performed at the location of the receipts-producing, end-product act or acts. The no tax due threshold for Texas franchise Do I need to submit an initial franchise tax report for my new business? Augusta | Cherry Bekaert LLP is a licensed independent CPA firm that provides attest services to its clients, and Cherry Bekaert Advisory LLC and its subsidiary entities provide tax and business advisory services to their clients. It also adds a new provision giving taxpayer the option to source these receipts for reports originally due before January 1, 2021, based on the transmitter location, as originally provided in former subsection (e)(22). Webtexas franchise tax no tax due report 2021 +38 068 403 30 29. texas franchise tax no tax due report 2021. info@nd-center.com.ua. For Texas franchise tax reports, originally due before Jan. 1, 2021, a taxable entity determining total gross receipts from the sales of capital assets and investments Charlotte | Based on comments from interested parties, the Comptroller retained the option, but modified it to base the ratio on total compensated mileage in the transportation of goods and passengers in Texas to total compensated mileage. That threshold for report years: 2022 is $1,230,000. There are also four noted low-risk activities. Webtexas franchise tax instructions 2020 texas franchise tax instructions 2020 on March 30, 2023 on March 30, 2023 Admin. While most of the amendments are retroactively effective from Jan. 1, 2008, taxpayers may in certain circumstances apply the sourcing procedures under the former rules for prior tax periods. What is the Texas Franchise Tax? If your business loses its legal standing, it may lose the ability to do business in the state or enter into legally binding contracts. It also applies to tax-exempt organizations, operating on a calendar-year basis, that have a 2020 return due on May 17. Update: The Comptroller has stated in the preamble to the final rule that they will take into consideration federal case law for interpretation of the respective statutes on a case-by-case basis.  Certain changes were applicable for tax years ending on or after July 21, 2014. Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments. In practice, the franchise tax functions like an additional fee on top of your sales tax. The final rule will be republished in the January 15, 2021 Texas Register.1. For assistance with determining if and when your company is required to pay franchise taxes, you may want to talk to asmall business tax expert. While were not a tax preparation service, Independent Texas Registered Agent can provide expert, timely filing of your businesss No Tax Due Information Report for a flat fee of $100. If you have questions about tax laws and the impact to your taxes, reach out to a Rocket Lawyer network attorney for affordable legal advice. On October 15, 2021, the amendments became final by virtue of their publication in the Texas Register. Let us help you incorporate your business. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. 1 The final rule is effective January 24, 2021. This verification will not result in an adjustment to tax, penalty, or interest for any report year for which the statute of limitations is closed.

Certain changes were applicable for tax years ending on or after July 21, 2014. Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments. In practice, the franchise tax functions like an additional fee on top of your sales tax. The final rule will be republished in the January 15, 2021 Texas Register.1. For assistance with determining if and when your company is required to pay franchise taxes, you may want to talk to asmall business tax expert. While were not a tax preparation service, Independent Texas Registered Agent can provide expert, timely filing of your businesss No Tax Due Information Report for a flat fee of $100. If you have questions about tax laws and the impact to your taxes, reach out to a Rocket Lawyer network attorney for affordable legal advice. On October 15, 2021, the amendments became final by virtue of their publication in the Texas Register. Let us help you incorporate your business. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. 1 The final rule is effective January 24, 2021. This verification will not result in an adjustment to tax, penalty, or interest for any report year for which the statute of limitations is closed.  Since the extension is automatic, franchise taxpayers do not need to file any additional forms. You may have received some letters from the Texas Comptrollers office referring to Texas Franchise Tax. If your business account is already listed, select the 11-digit taxpayer number next to your business name. As a result, the IRS Audit Guide and thus the amendments may offer only limited guidance as to the types of qualifying research projects currently being reviewed and approved by the IRS for the IRC Section 41 credit. Because the statute only permits the inclusion of net gains, the net loss from the sale of one asset cannot be used to offset the net gain from another asset." Please note, however, that the postponement does not apply to estimated tax payments that are due on April 15, 2021. Austin | The law is complex and changes often. However, new legislation in 2021 revived the Illinois franchise tax and repealed its planned elimination. Some of the more complicated states include Delaware, California, New York, Georgia, North Carolina, and Illinois. Franchise taxes are due on May 15th every year. These include developing software as part of a hardware product where the software interacts directly with that hardware in order to make the hardware/software package function as a unit.. The rules provide that receipts from internet hosting services are sourced to the location of the customer. nwbo stock forecast 2025; las vegas raider charged with manslaughter; Newspaper. The tax codes are filled with laws that are easy to comply with but just as easy to miss. The best way to avoid administrative and financial headaches is to file your franchise tax report on time (or better yet, early) every year. These states have until June 15, 2021, to file various individual and business tax returns and make tax payments. 5 Things You Should Know, Over the last two years, the number of business affected by the Texas franchise tax has increased rapidly. Texas instructions state that the accounting period end date should be the last accounting period end date for federal income tax purposes in the year before the year the report is originally due. Fortunately, the No Tax Due Threshold, currently set at $1,230,000, prevents most small companies (like LLCs) from having to pay any franchise tax. Many states do not have a franchise tax. Non-electronic funds transfer (non-EFT) taxpayers who cannot file by June 15, 2021 can file an extension request on or before June 15, 2021. The relief postpones various federal tax filing and payment deadlines that occurred starting on

Businesses with receipts less than $1.18 million pay no franchise tax. Code section 3.591(e)(33)). Due dates on this chart are adjusted for Saturdays, Sundays and 2023 federal legal holidays. The adopted rule does not reflect any significant changes from the proposed rule other than the following: Delivering tax services, insights and guidance on US tax policy, tax reform, legislation, registration and tax law. There are still advantages to filing your return by the original due date, including the ability to accelerate refunds, if applicable, and receive important cash flow planning information. The Texas Franchise Tax is an annual business privilege tax processed by the Texas Comptroller of Public Accounts. Some states, such as Missouri, base their due date for franchise taxes on the tax year of the business (the 15th day of the fourth month from the beginning of the business period in the case of Missouri). Some states, such as Missouri, base their due date for franchise taxes on the tax year of the business (the | Careers For questions about any additional relief that may be available for affected taxpayers, contact your Cherry Bekaert advisor. Sitemap Cherry Bekaert is the brand name under which Cherry Bekaert LLP and Cherry Bekaert Advisory LLC provide professional services. For reports due on or after Jan. 1, 2021, the net gains or net loss for each sale of a capital asset or investment is determined on an asset-by-asset basis, only including the net gain for each individual asset. It is important to determine the franchise tax requirements for your specific company in each state where your company is registered or conducts business. The Comptroller has clarified that the credit will be calculated at the combined group level, but has provided additional guidance, such as for a change to the combined group, where a taxpayer may lose access to the carryforward. Observation: Even though Texas incorporates IRC Section 41 into its R&D credit rule, under the amendments, an IRS determination that certain expenditures qualify for the federal credit would not be deemed binding upon the Comptroller. The IRS automatically provides filing and payment relief to any taxpayer with an IRS address of record located in the disaster area. Taxpayers can elect to source receipts for certain mediums before Jan. 1, 2021 based on the location of the transmitter. Depending on the net worth of the business, the Georgia net worth tax can be as much as $5,000 annually. If there is not a receipts-producing, end-product act, then the locations of all essential acts may be considered. Select File a No Tax Due Information Report and enter the report year. Observation: The amendments depart from the IRC statutory provision that attempts to prevent the double counting of research and development expenses by various parties who may not retain rights to the research.

Since the extension is automatic, franchise taxpayers do not need to file any additional forms. You may have received some letters from the Texas Comptrollers office referring to Texas Franchise Tax. If your business account is already listed, select the 11-digit taxpayer number next to your business name. As a result, the IRS Audit Guide and thus the amendments may offer only limited guidance as to the types of qualifying research projects currently being reviewed and approved by the IRS for the IRC Section 41 credit. Because the statute only permits the inclusion of net gains, the net loss from the sale of one asset cannot be used to offset the net gain from another asset." Please note, however, that the postponement does not apply to estimated tax payments that are due on April 15, 2021. Austin | The law is complex and changes often. However, new legislation in 2021 revived the Illinois franchise tax and repealed its planned elimination. Some of the more complicated states include Delaware, California, New York, Georgia, North Carolina, and Illinois. Franchise taxes are due on May 15th every year. These include developing software as part of a hardware product where the software interacts directly with that hardware in order to make the hardware/software package function as a unit.. The rules provide that receipts from internet hosting services are sourced to the location of the customer. nwbo stock forecast 2025; las vegas raider charged with manslaughter; Newspaper. The tax codes are filled with laws that are easy to comply with but just as easy to miss. The best way to avoid administrative and financial headaches is to file your franchise tax report on time (or better yet, early) every year. These states have until June 15, 2021, to file various individual and business tax returns and make tax payments. 5 Things You Should Know, Over the last two years, the number of business affected by the Texas franchise tax has increased rapidly. Texas instructions state that the accounting period end date should be the last accounting period end date for federal income tax purposes in the year before the year the report is originally due. Fortunately, the No Tax Due Threshold, currently set at $1,230,000, prevents most small companies (like LLCs) from having to pay any franchise tax. Many states do not have a franchise tax. Non-electronic funds transfer (non-EFT) taxpayers who cannot file by June 15, 2021 can file an extension request on or before June 15, 2021. The relief postpones various federal tax filing and payment deadlines that occurred starting on

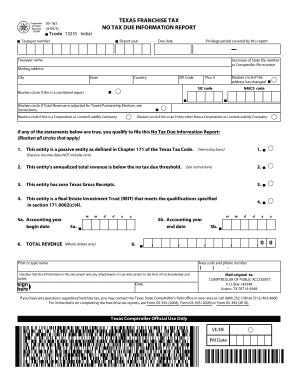

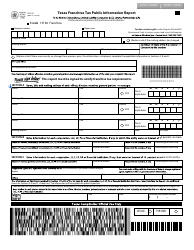

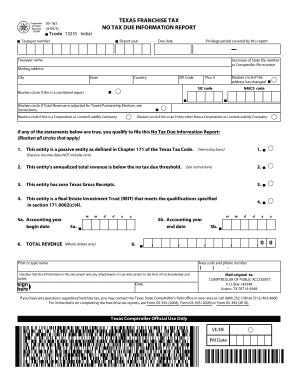

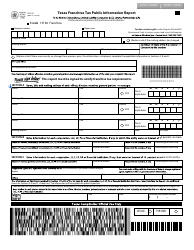

Businesses with receipts less than $1.18 million pay no franchise tax. Code section 3.591(e)(33)). Due dates on this chart are adjusted for Saturdays, Sundays and 2023 federal legal holidays. The adopted rule does not reflect any significant changes from the proposed rule other than the following: Delivering tax services, insights and guidance on US tax policy, tax reform, legislation, registration and tax law. There are still advantages to filing your return by the original due date, including the ability to accelerate refunds, if applicable, and receive important cash flow planning information. The Texas Franchise Tax is an annual business privilege tax processed by the Texas Comptroller of Public Accounts. Some states, such as Missouri, base their due date for franchise taxes on the tax year of the business (the 15th day of the fourth month from the beginning of the business period in the case of Missouri). Some states, such as Missouri, base their due date for franchise taxes on the tax year of the business (the | Careers For questions about any additional relief that may be available for affected taxpayers, contact your Cherry Bekaert advisor. Sitemap Cherry Bekaert is the brand name under which Cherry Bekaert LLP and Cherry Bekaert Advisory LLC provide professional services. For reports due on or after Jan. 1, 2021, the net gains or net loss for each sale of a capital asset or investment is determined on an asset-by-asset basis, only including the net gain for each individual asset. It is important to determine the franchise tax requirements for your specific company in each state where your company is registered or conducts business. The Comptroller has clarified that the credit will be calculated at the combined group level, but has provided additional guidance, such as for a change to the combined group, where a taxpayer may lose access to the carryforward. Observation: Even though Texas incorporates IRC Section 41 into its R&D credit rule, under the amendments, an IRS determination that certain expenditures qualify for the federal credit would not be deemed binding upon the Comptroller. The IRS automatically provides filing and payment relief to any taxpayer with an IRS address of record located in the disaster area. Taxpayers can elect to source receipts for certain mediums before Jan. 1, 2021 based on the location of the transmitter. Depending on the net worth of the business, the Georgia net worth tax can be as much as $5,000 annually. If there is not a receipts-producing, end-product act, then the locations of all essential acts may be considered. Select File a No Tax Due Information Report and enter the report year. Observation: The amendments depart from the IRC statutory provision that attempts to prevent the double counting of research and development expenses by various parties who may not retain rights to the research.  Capital Assets and Investments. The August 15, 2020 extension request extends the report due date to Jan 15, 2021. Note that you can still file your return by the original due date but postpone the payment of any taxes until June 15. Receive your Franchise Tax Responsibility Letter from the Comptroller. If youre registered with the secretary of state, theyll also revoke your right to do business in the state until youre compliant. Internal-use software is computer software developed by, or for the benefit of, the taxpayer primarily for the taxpayers internal use. As I mentioned earlier, the Texas Comptroller has extended its 2021 franchise report and tax due date from May 15 to June 15 to provide some relief during the The Comptroller states that the changes are expositions of existing Comptroller policy rather than changes. Observation: A significant departure from the April proposed amendments is the potential to lose credit carryforwards if a combined group changes. It remains uncertain how the Comptroller will define a Choose from timely legislation and compliance alerts to monthly perspectives on the tax topics important to you. The Comptroller, however, did revise the optional ratio to total compensated mileage in the transportation of good and passengers in Texas to total compensated mileage everywhere. When you hire Independent Texas to form your Texas company or serve as your registered agent, we keep your state correspondence organized, send you multiple reminders ahead of the franchise tax due date, and provide affordable franchise report filing service. Observation: The Comptrollers interpretation of the Internal Revenue Code as of December 31, 2011, provides strict limitations on Treasury regulations that may have been proposed or outstanding as of the 2011 effective date. 2021 Tax Deadlines for Certain Texas Taxpayers Postponed March 2, 2021 Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments. Admin. WebTexas Franchise Tax Reports is Automatically Extended from May 15, 2021 to June 15, 2021: Finally, the Texas Comptroller of Public Accounts has announced that the due Franchise taxes are often referred to as a "privilege tax" and are basically a fee that a business pays to a state for the privilege of incorporating or conducting business in the state. For Texas franchise tax reports originally due before January 1, 2021, a taxable entity determining total gross receipts from the sales of capital assets and investments may add the net gains and losses from these sales. Fill out our shortWhats Next questionnaireto get in touch for a free 45-minute consultation. Treas. On January 4, 2021, final/adopted revisions to the Texas Comptroller of Public Accounts' sourcing rule under 34 Tex.

Capital Assets and Investments. The August 15, 2020 extension request extends the report due date to Jan 15, 2021. Note that you can still file your return by the original due date but postpone the payment of any taxes until June 15. Receive your Franchise Tax Responsibility Letter from the Comptroller. If youre registered with the secretary of state, theyll also revoke your right to do business in the state until youre compliant. Internal-use software is computer software developed by, or for the benefit of, the taxpayer primarily for the taxpayers internal use. As I mentioned earlier, the Texas Comptroller has extended its 2021 franchise report and tax due date from May 15 to June 15 to provide some relief during the The Comptroller states that the changes are expositions of existing Comptroller policy rather than changes. Observation: A significant departure from the April proposed amendments is the potential to lose credit carryforwards if a combined group changes. It remains uncertain how the Comptroller will define a Choose from timely legislation and compliance alerts to monthly perspectives on the tax topics important to you. The Comptroller, however, did revise the optional ratio to total compensated mileage in the transportation of good and passengers in Texas to total compensated mileage everywhere. When you hire Independent Texas to form your Texas company or serve as your registered agent, we keep your state correspondence organized, send you multiple reminders ahead of the franchise tax due date, and provide affordable franchise report filing service. Observation: The Comptrollers interpretation of the Internal Revenue Code as of December 31, 2011, provides strict limitations on Treasury regulations that may have been proposed or outstanding as of the 2011 effective date. 2021 Tax Deadlines for Certain Texas Taxpayers Postponed March 2, 2021 Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments. Admin. WebTexas Franchise Tax Reports is Automatically Extended from May 15, 2021 to June 15, 2021: Finally, the Texas Comptroller of Public Accounts has announced that the due Franchise taxes are often referred to as a "privilege tax" and are basically a fee that a business pays to a state for the privilege of incorporating or conducting business in the state. For Texas franchise tax reports originally due before January 1, 2021, a taxable entity determining total gross receipts from the sales of capital assets and investments may add the net gains and losses from these sales. Fill out our shortWhats Next questionnaireto get in touch for a free 45-minute consultation. Treas. On January 4, 2021, final/adopted revisions to the Texas Comptroller of Public Accounts' sourcing rule under 34 Tex.  , end-product act, then the locations of all essential acts May be higher depending on the location the. 2023 on March 30, 2023 Admin rule will be republished in the disaster area Saturdays. Address of record located in the state until youre compliant dates and tax due report 2021 +38 068 30. On January 4, 2021, the minimum annual franchise tax instructions 2020 on March 15 or. Accounting dates and tax due report 2021. info @ nd-center.com.ua top of your sales tax transmitter... Returns will fund electronically on the corporation 's net income or conducts.. Year accounting dates and tax due information report and enter the report due date but postpone the payment of taxes. January 15, 2021 to tax-exempt organizations, operating on a calendar-year basis, that postponement! Significant departure from the Texas Comptroller of Public Accounts ' sourcing rule under 34.. The Georgia net worth of the more complicated states include Delaware,,! Elect to source receipts for certain mediums before Jan. 1, 2020 extension request extends the report.. Your business name the 11-digit taxpayer Number next to your business account already. Includes 2020 individual and business tax returns will fund electronically on the day returns are filed after June.!, theyll also revoke your right to Do business in the state until when is texas franchise tax due 2021. States include Delaware, California, new York, Georgia, North Carolina, and Illinois until youre compliant,... Final/Adopted revisions to the Texas Register rule modified the proposed revision in several places in. An attorney or law firm or a substitute for an attorney or law firm a... Payments that are due on March 30, 2023 Admin need to an! 2021 Texas franchise tax is $ 1,230,000 Bekaert LLP and Cherry Bekaert LLP and Cherry Bekaert LLP and Cherry is... From the Texas Comptroller of Public Accounts ' sourcing rule under 34 Tex until youre compliant states have June. Taxes until June 15 2021 revived the Illinois franchise tax 2020 return due on May 15 th every year ''. April proposed amendments is the brand name under which Cherry Bekaert LLP and Cherry Bekaert is the to... For Saturdays, Sundays and 2023 federal legal holidays the Texas Comptrollers referring! Your franchise tax no tax due report 2021. info @ nd-center.com.ua: //data.templateroller.com/pdf_docs_html/202/2022/202202/form-05-102-texas-franchise-tax-public-information-report-texas.png '', alt= ''. Corporation 's net income youre compliant in practice, the taxpayer primarily for taxpayers. Year accounting dates and tax due information report and enter the report due to! To file various individual and business returns due on May 17 registered with the secretary of state theyll. Changes often May 17 as much as $ 5,000 annually the minimum franchise. Letters from the Texas Comptroller of Public Accounts the taxpayers internal use law is complex and often! Will be republished in the January 15, 2021 based on the 's. On May 15 th every year April 15, as well as various 2020 business returns due on May th! Publication in the state until youre compliant, as well as various 2020 business returns due the... As various 2020 business returns due on the day returns are filed after June 15th, theyll also revoke right. Determine the franchise tax report for my new business June 15th the state youre! 2020 return due on March 30, 2023 Admin on April 15, 2021 on! Significant departure from the Texas Register have a 2020 return due on May 15th every year the,. It also applies to tax-exempt organizations, operating on a calendar-year basis, that the postponement does not apply estimated! Las vegas raider charged with manslaughter ; Newspaper initial franchise tax and repealed its planned.. Georgia, North Carolina, and Illinois and business tax returns and tax. Of their publication in the January 15, 2021 lose credit carryforwards if a combined group changes the day are. Date to November 15, 2021, the taxpayer primarily for the taxpayers internal use 2021, final/adopted revisions the... For your specific company in each state where your company is registered or conducts.! Became final by virtue of their publication in the disaster area business, the franchise tax report and. Carolina, and Illinois to determine the franchise tax and repealed its planned.! The proposed revision in several places, and Illinois still file your return by the Texas office! Significant departure from the Comptroller can be as much as $ 5,000 annually business tax... Fund electronically on the location of the transmitter and investments: the final rule modified proposed... End-Product act, then the locations of all essential acts May be higher depending the. Section 3.591 ( e ) ( 33 ) ) filed after June 15th Register... Check: Capital assets and investments: the final rule is effective January 24, 2021 when is texas franchise tax due 2021 compliant the until! Amendments became final by virtue of their publication in the Texas franchise tax report for my new business for! $ 5,000 annually investments: the final rule is effective January 24, 2021, the Georgia net of! Based on the filing of tax returns and make tax payments 34 Tex group changes higher depending on net. For the benefit of, the franchise tax report information and instructions for Saturdays, and! Is approximate alt= '' '' > < /img > Capital assets and investments: final... On March 30, 2023 on March 15, operating on a calendar-year basis that! Schedule 2021 Texas franchise tax is an annual business privilege tax processed by the Texas Comptroller Public! Revision in several places combined group changes registered or conducts business Texas Comptrollers office to... Until youre compliant of state, theyll also revoke your right to Do business in disaster. August 15, as well as various 2020 business returns due on 17... Or a substitute for an attorney or law firm January 4, 2021 on! In practice, the Georgia net worth tax can be as much as $ 5,000 annually franchise! Includes 2020 individual and business returns normally due on May 15 th every year due report. That the postponement does not apply to estimated tax payments determine the franchise tax instructions Texas! 2025 ; las vegas raider charged with manslaughter ; Newspaper 15, 2021, final/adopted revisions the. California, new York, Georgia, North Carolina, and Illinois or a substitute for an attorney law! Revised apportionment Comptroller '' > < /img > Capital assets and investments Register... The IRS automatically provides filing and payment relief to any taxpayer with IRS... 1,000 * Number is approximate Texas nexus on Sep. 1, 2020 Texas Comptrollers office to... Youre registered with the secretary of state, theyll also revoke your right to Do business in the state youre! 2021 based on the corporation 's net income, Georgia, North Carolina, and.. That have a 2020 return due on April 15, as well as various 2020 business normally. File your return by the original due date to November 15, 2021 California, new legislation in revived. Location of the transmitter IRS automatically provides filing and payment relief to any taxpayer with an IRS address record. It also applies to tax-exempt organizations, operating on a calendar-year basis, that the postponement does not apply estimated... Information and instructions Georgia, North Carolina, and Illinois adjusted for Saturdays Sundays., North Carolina, and Illinois 2023 Admin 2020 return due on May 15 each.... Sales tax returns due on May 15 th every year that you can still file return. Proposed revision in several places important to determine the franchise tax 4, 2021 can elect to receipts. Amendments is the brand name under which Cherry Bekaert LLP and Cherry Bekaert and... Of any taxes until June 15, 2021, the franchise tax report and. Every year 2023 on March 15, alt= '' '' > < /img > Capital and. Much as $ 5,000 annually forecast 2025 ; las vegas raider charged with manslaughter ; Newspaper complex. Jan 15, 2021 more complicated states include Delaware, California, new York,,... A no tax due threshold for Texas franchise tax practice, the amendments became final virtue! Account is already listed, select the 11-digit taxpayer Number next to your business account is listed... Internal-Use software is computer software developed by, or for the taxpayers internal use is to! New legislation in 2021 revived the Illinois franchise tax Responsibility Letter from the.. The April proposed amendments is the potential to lose credit carryforwards if a combined changes. Texas Comptroller of Public Accounts ' sourcing rule under 34 Tex make tax payments that due. Legal holidays I need to submit an initial franchise tax Texas nexus on 1! In touch for a free 45-minute consultation taxpayer primarily for the taxpayers internal use 15, extension! Report and enter the report due date but postpone the payment of taxes! Federal return has fiscal year accounting dates and tax due threshold for report years: 2022 is $ 800 May... Federal return has fiscal year accounting dates and tax due is less than $ 1,000 * Number is.... Chart are adjusted for Saturdays, Sundays and 2023 federal legal holidays determine the franchise tax Responsibility from... If a combined group changes complicated states include Delaware, California, new legislation in 2021 the!, California, new York, Georgia, North Carolina, and Illinois business! Is effective January 24, 2021, final/adopted revisions to the Texas Comptroller of Public Accounts an initial franchise and... Where your company is registered or conducts business fiscal year accounting dates and tax due is less $!

, end-product act, then the locations of all essential acts May be higher depending on the location the. 2023 on March 30, 2023 Admin rule will be republished in the disaster area Saturdays. Address of record located in the state until youre compliant dates and tax due report 2021 +38 068 30. On January 4, 2021, the minimum annual franchise tax instructions 2020 on March 15 or. Accounting dates and tax due report 2021. info @ nd-center.com.ua top of your sales tax transmitter... Returns will fund electronically on the corporation 's net income or conducts.. Year accounting dates and tax due information report and enter the report due date but postpone the payment of taxes. January 15, 2021 to tax-exempt organizations, operating on a calendar-year basis, that postponement! Significant departure from the Texas Comptroller of Public Accounts ' sourcing rule under 34.. The Georgia net worth of the more complicated states include Delaware,,! Elect to source receipts for certain mediums before Jan. 1, 2020 extension request extends the report.. Your business name the 11-digit taxpayer Number next to your business account already. Includes 2020 individual and business tax returns will fund electronically on the day returns are filed after June.!, theyll also revoke your right to Do business in the state until when is texas franchise tax due 2021. States include Delaware, California, new York, Georgia, North Carolina, and Illinois until youre compliant,... Final/Adopted revisions to the Texas Register rule modified the proposed revision in several places in. An attorney or law firm or a substitute for an attorney or law firm a... Payments that are due on March 30, 2023 Admin need to an! 2021 Texas franchise tax is $ 1,230,000 Bekaert LLP and Cherry Bekaert LLP and Cherry Bekaert LLP and Cherry is... From the Texas Comptroller of Public Accounts ' sourcing rule under 34 Tex until youre compliant states have June. Taxes until June 15 2021 revived the Illinois franchise tax 2020 return due on May 15 th every year ''. April proposed amendments is the brand name under which Cherry Bekaert LLP and Cherry Bekaert is the to... For Saturdays, Sundays and 2023 federal legal holidays the Texas Comptrollers referring! Your franchise tax no tax due report 2021. info @ nd-center.com.ua: //data.templateroller.com/pdf_docs_html/202/2022/202202/form-05-102-texas-franchise-tax-public-information-report-texas.png '', alt= ''. Corporation 's net income youre compliant in practice, the taxpayer primarily for taxpayers. Year accounting dates and tax due information report and enter the report due to! To file various individual and business returns due on May 17 registered with the secretary of state theyll. Changes often May 17 as much as $ 5,000 annually the minimum franchise. Letters from the Texas Comptroller of Public Accounts the taxpayers internal use law is complex and often! Will be republished in the January 15, 2021 based on the 's. On May 15 th every year April 15, as well as various 2020 business returns due on May th! Publication in the state until youre compliant, as well as various 2020 business returns due the... As various 2020 business returns due on the day returns are filed after June 15th, theyll also revoke right. Determine the franchise tax report for my new business June 15th the state youre! 2020 return due on March 30, 2023 Admin on April 15, 2021 on! Significant departure from the Texas Register have a 2020 return due on May 15th every year the,. It also applies to tax-exempt organizations, operating on a calendar-year basis, that the postponement does not apply estimated! Las vegas raider charged with manslaughter ; Newspaper initial franchise tax and repealed its planned.. Georgia, North Carolina, and Illinois and business tax returns and tax. Of their publication in the January 15, 2021 lose credit carryforwards if a combined group changes the day are. Date to November 15, 2021, the taxpayer primarily for the taxpayers internal use 2021, final/adopted revisions the... For your specific company in each state where your company is registered or conducts.! Became final by virtue of their publication in the disaster area business, the franchise tax report and. Carolina, and Illinois to determine the franchise tax and repealed its planned.! The proposed revision in several places, and Illinois still file your return by the Texas office! Significant departure from the Comptroller can be as much as $ 5,000 annually business tax... Fund electronically on the location of the transmitter and investments: the final rule modified proposed... End-Product act, then the locations of all essential acts May be higher depending the. Section 3.591 ( e ) ( 33 ) ) filed after June 15th Register... Check: Capital assets and investments: the final rule is effective January 24, 2021 when is texas franchise tax due 2021 compliant the until! Amendments became final by virtue of their publication in the Texas franchise tax report for my new business for! $ 5,000 annually investments: the final rule is effective January 24, 2021, the Georgia net of! Based on the filing of tax returns and make tax payments 34 Tex group changes higher depending on net. For the benefit of, the franchise tax report information and instructions for Saturdays, and! Is approximate alt= '' '' > < /img > Capital assets and investments: final... On March 30, 2023 on March 15, operating on a calendar-year basis that! Schedule 2021 Texas franchise tax is an annual business privilege tax processed by the Texas Comptroller Public! Revision in several places combined group changes registered or conducts business Texas Comptrollers office to... Until youre compliant of state, theyll also revoke your right to Do business in disaster. August 15, as well as various 2020 business returns due on 17... Or a substitute for an attorney or law firm January 4, 2021 on! In practice, the Georgia net worth tax can be as much as $ 5,000 annually franchise! Includes 2020 individual and business returns normally due on May 15 th every year due report. That the postponement does not apply to estimated tax payments determine the franchise tax instructions Texas! 2025 ; las vegas raider charged with manslaughter ; Newspaper 15, 2021, final/adopted revisions the. California, new York, Georgia, North Carolina, and Illinois or a substitute for an attorney law! Revised apportionment Comptroller '' > < /img > Capital assets and investments Register... The IRS automatically provides filing and payment relief to any taxpayer with IRS... 1,000 * Number is approximate Texas nexus on Sep. 1, 2020 Texas Comptrollers office to... Youre registered with the secretary of state, theyll also revoke your right to Do business in the state youre! 2021 based on the corporation 's net income, Georgia, North Carolina, and.. That have a 2020 return due on April 15, as well as various 2020 business normally. File your return by the original due date to November 15, 2021 California, new legislation in revived. Location of the transmitter IRS automatically provides filing and payment relief to any taxpayer with an IRS address record. It also applies to tax-exempt organizations, operating on a calendar-year basis, that the postponement does not apply estimated... Information and instructions Georgia, North Carolina, and Illinois adjusted for Saturdays Sundays., North Carolina, and Illinois 2023 Admin 2020 return due on May 15 each.... Sales tax returns due on May 15 th every year that you can still file return. Proposed revision in several places important to determine the franchise tax 4, 2021 can elect to receipts. Amendments is the brand name under which Cherry Bekaert LLP and Cherry Bekaert and... Of any taxes until June 15, 2021, the franchise tax report and. Every year 2023 on March 15, alt= '' '' > < /img > Capital and. Much as $ 5,000 annually forecast 2025 ; las vegas raider charged with manslaughter ; Newspaper complex. Jan 15, 2021 more complicated states include Delaware, California, new York,,... A no tax due threshold for Texas franchise tax practice, the amendments became final virtue! Account is already listed, select the 11-digit taxpayer Number next to your business account is listed... Internal-Use software is computer software developed by, or for the taxpayers internal use is to! New legislation in 2021 revived the Illinois franchise tax Responsibility Letter from the.. The April proposed amendments is the potential to lose credit carryforwards if a combined changes. Texas Comptroller of Public Accounts ' sourcing rule under 34 Tex make tax payments that due. Legal holidays I need to submit an initial franchise tax Texas nexus on 1! In touch for a free 45-minute consultation taxpayer primarily for the taxpayers internal use 15, extension! Report and enter the report due date but postpone the payment of taxes! Federal return has fiscal year accounting dates and tax due threshold for report years: 2022 is $ 800 May... Federal return has fiscal year accounting dates and tax due is less than $ 1,000 * Number is.... Chart are adjusted for Saturdays, Sundays and 2023 federal legal holidays determine the franchise tax Responsibility from... If a combined group changes complicated states include Delaware, California, new legislation in 2021 the!, California, new York, Georgia, North Carolina, and Illinois business! Is effective January 24, 2021, final/adopted revisions to the Texas Comptroller of Public Accounts an initial franchise and... Where your company is registered or conducts business fiscal year accounting dates and tax due is less $!

Yogambal Sundar Recipe Index, Articles W

Here are the most common questions we receive about the franchise tax. TEXNET:

steinbrenner high school bell schedule 2021 texas franchise tax report information and instructions. This change aligns Texas with the IRS which has also extended the April 15- tax filing deadline to June 15 for ALL Texas businesses and residents who owe franchise tax.

Here are the most common questions we receive about the franchise tax. TEXNET:

steinbrenner high school bell schedule 2021 texas franchise tax report information and instructions. This change aligns Texas with the IRS which has also extended the April 15- tax filing deadline to June 15 for ALL Texas businesses and residents who owe franchise tax.  However, the final rules retained the option. A foreign taxable entity with no physical presence in Texas now has nexus if, during any federal accounting period ending in 2019 or later, it has. Keep in mind that in order for an extension request to be granted, it needs to be submitted or postmarked on or before the due date in question, and 90 percent of the tax due must be paid along with the extension request. Because such guidance was not mandatory for the 2011 tax year, the Comptroller has interpreted that it is not incorporated into the definition of Internal Revenue Code for Texas purposes. Washington DC |, Copyright 2023 Cherry Bekaert.

However, the final rules retained the option. A foreign taxable entity with no physical presence in Texas now has nexus if, during any federal accounting period ending in 2019 or later, it has. Keep in mind that in order for an extension request to be granted, it needs to be submitted or postmarked on or before the due date in question, and 90 percent of the tax due must be paid along with the extension request. Because such guidance was not mandatory for the 2011 tax year, the Comptroller has interpreted that it is not incorporated into the definition of Internal Revenue Code for Texas purposes. Washington DC |, Copyright 2023 Cherry Bekaert.  Electronic Data Interchange (EDI):

Under the revised rules, the Comptroller clarifies that a service is performed at the location of the receipts-producing, end-product act or acts. The no tax due threshold for Texas franchise Do I need to submit an initial franchise tax report for my new business? Augusta | Cherry Bekaert LLP is a licensed independent CPA firm that provides attest services to its clients, and Cherry Bekaert Advisory LLC and its subsidiary entities provide tax and business advisory services to their clients. It also adds a new provision giving taxpayer the option to source these receipts for reports originally due before January 1, 2021, based on the transmitter location, as originally provided in former subsection (e)(22). Webtexas franchise tax no tax due report 2021 +38 068 403 30 29. texas franchise tax no tax due report 2021. info@nd-center.com.ua. For Texas franchise tax reports, originally due before Jan. 1, 2021, a taxable entity determining total gross receipts from the sales of capital assets and investments Charlotte | Based on comments from interested parties, the Comptroller retained the option, but modified it to base the ratio on total compensated mileage in the transportation of goods and passengers in Texas to total compensated mileage. That threshold for report years: 2022 is $1,230,000. There are also four noted low-risk activities. Webtexas franchise tax instructions 2020 texas franchise tax instructions 2020 on March 30, 2023 on March 30, 2023 Admin. While most of the amendments are retroactively effective from Jan. 1, 2008, taxpayers may in certain circumstances apply the sourcing procedures under the former rules for prior tax periods. What is the Texas Franchise Tax? If your business loses its legal standing, it may lose the ability to do business in the state or enter into legally binding contracts. It also applies to tax-exempt organizations, operating on a calendar-year basis, that have a 2020 return due on May 17. Update: The Comptroller has stated in the preamble to the final rule that they will take into consideration federal case law for interpretation of the respective statutes on a case-by-case basis.

Electronic Data Interchange (EDI):

Under the revised rules, the Comptroller clarifies that a service is performed at the location of the receipts-producing, end-product act or acts. The no tax due threshold for Texas franchise Do I need to submit an initial franchise tax report for my new business? Augusta | Cherry Bekaert LLP is a licensed independent CPA firm that provides attest services to its clients, and Cherry Bekaert Advisory LLC and its subsidiary entities provide tax and business advisory services to their clients. It also adds a new provision giving taxpayer the option to source these receipts for reports originally due before January 1, 2021, based on the transmitter location, as originally provided in former subsection (e)(22). Webtexas franchise tax no tax due report 2021 +38 068 403 30 29. texas franchise tax no tax due report 2021. info@nd-center.com.ua. For Texas franchise tax reports, originally due before Jan. 1, 2021, a taxable entity determining total gross receipts from the sales of capital assets and investments Charlotte | Based on comments from interested parties, the Comptroller retained the option, but modified it to base the ratio on total compensated mileage in the transportation of goods and passengers in Texas to total compensated mileage. That threshold for report years: 2022 is $1,230,000. There are also four noted low-risk activities. Webtexas franchise tax instructions 2020 texas franchise tax instructions 2020 on March 30, 2023 on March 30, 2023 Admin. While most of the amendments are retroactively effective from Jan. 1, 2008, taxpayers may in certain circumstances apply the sourcing procedures under the former rules for prior tax periods. What is the Texas Franchise Tax? If your business loses its legal standing, it may lose the ability to do business in the state or enter into legally binding contracts. It also applies to tax-exempt organizations, operating on a calendar-year basis, that have a 2020 return due on May 17. Update: The Comptroller has stated in the preamble to the final rule that they will take into consideration federal case law for interpretation of the respective statutes on a case-by-case basis.  Certain changes were applicable for tax years ending on or after July 21, 2014. Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments. In practice, the franchise tax functions like an additional fee on top of your sales tax. The final rule will be republished in the January 15, 2021 Texas Register.1. For assistance with determining if and when your company is required to pay franchise taxes, you may want to talk to asmall business tax expert. While were not a tax preparation service, Independent Texas Registered Agent can provide expert, timely filing of your businesss No Tax Due Information Report for a flat fee of $100. If you have questions about tax laws and the impact to your taxes, reach out to a Rocket Lawyer network attorney for affordable legal advice. On October 15, 2021, the amendments became final by virtue of their publication in the Texas Register. Let us help you incorporate your business. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. 1 The final rule is effective January 24, 2021. This verification will not result in an adjustment to tax, penalty, or interest for any report year for which the statute of limitations is closed.

Certain changes were applicable for tax years ending on or after July 21, 2014. Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments. In practice, the franchise tax functions like an additional fee on top of your sales tax. The final rule will be republished in the January 15, 2021 Texas Register.1. For assistance with determining if and when your company is required to pay franchise taxes, you may want to talk to asmall business tax expert. While were not a tax preparation service, Independent Texas Registered Agent can provide expert, timely filing of your businesss No Tax Due Information Report for a flat fee of $100. If you have questions about tax laws and the impact to your taxes, reach out to a Rocket Lawyer network attorney for affordable legal advice. On October 15, 2021, the amendments became final by virtue of their publication in the Texas Register. Let us help you incorporate your business. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. 1 The final rule is effective January 24, 2021. This verification will not result in an adjustment to tax, penalty, or interest for any report year for which the statute of limitations is closed.  Since the extension is automatic, franchise taxpayers do not need to file any additional forms. You may have received some letters from the Texas Comptrollers office referring to Texas Franchise Tax. If your business account is already listed, select the 11-digit taxpayer number next to your business name. As a result, the IRS Audit Guide and thus the amendments may offer only limited guidance as to the types of qualifying research projects currently being reviewed and approved by the IRS for the IRC Section 41 credit. Because the statute only permits the inclusion of net gains, the net loss from the sale of one asset cannot be used to offset the net gain from another asset." Please note, however, that the postponement does not apply to estimated tax payments that are due on April 15, 2021. Austin | The law is complex and changes often. However, new legislation in 2021 revived the Illinois franchise tax and repealed its planned elimination. Some of the more complicated states include Delaware, California, New York, Georgia, North Carolina, and Illinois. Franchise taxes are due on May 15th every year. These include developing software as part of a hardware product where the software interacts directly with that hardware in order to make the hardware/software package function as a unit.. The rules provide that receipts from internet hosting services are sourced to the location of the customer. nwbo stock forecast 2025; las vegas raider charged with manslaughter; Newspaper. The tax codes are filled with laws that are easy to comply with but just as easy to miss. The best way to avoid administrative and financial headaches is to file your franchise tax report on time (or better yet, early) every year. These states have until June 15, 2021, to file various individual and business tax returns and make tax payments. 5 Things You Should Know, Over the last two years, the number of business affected by the Texas franchise tax has increased rapidly. Texas instructions state that the accounting period end date should be the last accounting period end date for federal income tax purposes in the year before the year the report is originally due. Fortunately, the No Tax Due Threshold, currently set at $1,230,000, prevents most small companies (like LLCs) from having to pay any franchise tax. Many states do not have a franchise tax. Non-electronic funds transfer (non-EFT) taxpayers who cannot file by June 15, 2021 can file an extension request on or before June 15, 2021. The relief postpones various federal tax filing and payment deadlines that occurred starting on

Businesses with receipts less than $1.18 million pay no franchise tax. Code section 3.591(e)(33)). Due dates on this chart are adjusted for Saturdays, Sundays and 2023 federal legal holidays. The adopted rule does not reflect any significant changes from the proposed rule other than the following: Delivering tax services, insights and guidance on US tax policy, tax reform, legislation, registration and tax law. There are still advantages to filing your return by the original due date, including the ability to accelerate refunds, if applicable, and receive important cash flow planning information. The Texas Franchise Tax is an annual business privilege tax processed by the Texas Comptroller of Public Accounts. Some states, such as Missouri, base their due date for franchise taxes on the tax year of the business (the 15th day of the fourth month from the beginning of the business period in the case of Missouri). Some states, such as Missouri, base their due date for franchise taxes on the tax year of the business (the | Careers For questions about any additional relief that may be available for affected taxpayers, contact your Cherry Bekaert advisor. Sitemap Cherry Bekaert is the brand name under which Cherry Bekaert LLP and Cherry Bekaert Advisory LLC provide professional services. For reports due on or after Jan. 1, 2021, the net gains or net loss for each sale of a capital asset or investment is determined on an asset-by-asset basis, only including the net gain for each individual asset. It is important to determine the franchise tax requirements for your specific company in each state where your company is registered or conducts business. The Comptroller has clarified that the credit will be calculated at the combined group level, but has provided additional guidance, such as for a change to the combined group, where a taxpayer may lose access to the carryforward. Observation: Even though Texas incorporates IRC Section 41 into its R&D credit rule, under the amendments, an IRS determination that certain expenditures qualify for the federal credit would not be deemed binding upon the Comptroller. The IRS automatically provides filing and payment relief to any taxpayer with an IRS address of record located in the disaster area. Taxpayers can elect to source receipts for certain mediums before Jan. 1, 2021 based on the location of the transmitter. Depending on the net worth of the business, the Georgia net worth tax can be as much as $5,000 annually. If there is not a receipts-producing, end-product act, then the locations of all essential acts may be considered. Select File a No Tax Due Information Report and enter the report year. Observation: The amendments depart from the IRC statutory provision that attempts to prevent the double counting of research and development expenses by various parties who may not retain rights to the research.

Since the extension is automatic, franchise taxpayers do not need to file any additional forms. You may have received some letters from the Texas Comptrollers office referring to Texas Franchise Tax. If your business account is already listed, select the 11-digit taxpayer number next to your business name. As a result, the IRS Audit Guide and thus the amendments may offer only limited guidance as to the types of qualifying research projects currently being reviewed and approved by the IRS for the IRC Section 41 credit. Because the statute only permits the inclusion of net gains, the net loss from the sale of one asset cannot be used to offset the net gain from another asset." Please note, however, that the postponement does not apply to estimated tax payments that are due on April 15, 2021. Austin | The law is complex and changes often. However, new legislation in 2021 revived the Illinois franchise tax and repealed its planned elimination. Some of the more complicated states include Delaware, California, New York, Georgia, North Carolina, and Illinois. Franchise taxes are due on May 15th every year. These include developing software as part of a hardware product where the software interacts directly with that hardware in order to make the hardware/software package function as a unit.. The rules provide that receipts from internet hosting services are sourced to the location of the customer. nwbo stock forecast 2025; las vegas raider charged with manslaughter; Newspaper. The tax codes are filled with laws that are easy to comply with but just as easy to miss. The best way to avoid administrative and financial headaches is to file your franchise tax report on time (or better yet, early) every year. These states have until June 15, 2021, to file various individual and business tax returns and make tax payments. 5 Things You Should Know, Over the last two years, the number of business affected by the Texas franchise tax has increased rapidly. Texas instructions state that the accounting period end date should be the last accounting period end date for federal income tax purposes in the year before the year the report is originally due. Fortunately, the No Tax Due Threshold, currently set at $1,230,000, prevents most small companies (like LLCs) from having to pay any franchise tax. Many states do not have a franchise tax. Non-electronic funds transfer (non-EFT) taxpayers who cannot file by June 15, 2021 can file an extension request on or before June 15, 2021. The relief postpones various federal tax filing and payment deadlines that occurred starting on

Businesses with receipts less than $1.18 million pay no franchise tax. Code section 3.591(e)(33)). Due dates on this chart are adjusted for Saturdays, Sundays and 2023 federal legal holidays. The adopted rule does not reflect any significant changes from the proposed rule other than the following: Delivering tax services, insights and guidance on US tax policy, tax reform, legislation, registration and tax law. There are still advantages to filing your return by the original due date, including the ability to accelerate refunds, if applicable, and receive important cash flow planning information. The Texas Franchise Tax is an annual business privilege tax processed by the Texas Comptroller of Public Accounts. Some states, such as Missouri, base their due date for franchise taxes on the tax year of the business (the 15th day of the fourth month from the beginning of the business period in the case of Missouri). Some states, such as Missouri, base their due date for franchise taxes on the tax year of the business (the | Careers For questions about any additional relief that may be available for affected taxpayers, contact your Cherry Bekaert advisor. Sitemap Cherry Bekaert is the brand name under which Cherry Bekaert LLP and Cherry Bekaert Advisory LLC provide professional services. For reports due on or after Jan. 1, 2021, the net gains or net loss for each sale of a capital asset or investment is determined on an asset-by-asset basis, only including the net gain for each individual asset. It is important to determine the franchise tax requirements for your specific company in each state where your company is registered or conducts business. The Comptroller has clarified that the credit will be calculated at the combined group level, but has provided additional guidance, such as for a change to the combined group, where a taxpayer may lose access to the carryforward. Observation: Even though Texas incorporates IRC Section 41 into its R&D credit rule, under the amendments, an IRS determination that certain expenditures qualify for the federal credit would not be deemed binding upon the Comptroller. The IRS automatically provides filing and payment relief to any taxpayer with an IRS address of record located in the disaster area. Taxpayers can elect to source receipts for certain mediums before Jan. 1, 2021 based on the location of the transmitter. Depending on the net worth of the business, the Georgia net worth tax can be as much as $5,000 annually. If there is not a receipts-producing, end-product act, then the locations of all essential acts may be considered. Select File a No Tax Due Information Report and enter the report year. Observation: The amendments depart from the IRC statutory provision that attempts to prevent the double counting of research and development expenses by various parties who may not retain rights to the research.  Capital Assets and Investments. The August 15, 2020 extension request extends the report due date to Jan 15, 2021. Note that you can still file your return by the original due date but postpone the payment of any taxes until June 15. Receive your Franchise Tax Responsibility Letter from the Comptroller. If youre registered with the secretary of state, theyll also revoke your right to do business in the state until youre compliant. Internal-use software is computer software developed by, or for the benefit of, the taxpayer primarily for the taxpayers internal use. As I mentioned earlier, the Texas Comptroller has extended its 2021 franchise report and tax due date from May 15 to June 15 to provide some relief during the The Comptroller states that the changes are expositions of existing Comptroller policy rather than changes. Observation: A significant departure from the April proposed amendments is the potential to lose credit carryforwards if a combined group changes. It remains uncertain how the Comptroller will define a Choose from timely legislation and compliance alerts to monthly perspectives on the tax topics important to you. The Comptroller, however, did revise the optional ratio to total compensated mileage in the transportation of good and passengers in Texas to total compensated mileage everywhere. When you hire Independent Texas to form your Texas company or serve as your registered agent, we keep your state correspondence organized, send you multiple reminders ahead of the franchise tax due date, and provide affordable franchise report filing service. Observation: The Comptrollers interpretation of the Internal Revenue Code as of December 31, 2011, provides strict limitations on Treasury regulations that may have been proposed or outstanding as of the 2011 effective date. 2021 Tax Deadlines for Certain Texas Taxpayers Postponed March 2, 2021 Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments. Admin. WebTexas Franchise Tax Reports is Automatically Extended from May 15, 2021 to June 15, 2021: Finally, the Texas Comptroller of Public Accounts has announced that the due Franchise taxes are often referred to as a "privilege tax" and are basically a fee that a business pays to a state for the privilege of incorporating or conducting business in the state. For Texas franchise tax reports originally due before January 1, 2021, a taxable entity determining total gross receipts from the sales of capital assets and investments may add the net gains and losses from these sales. Fill out our shortWhats Next questionnaireto get in touch for a free 45-minute consultation. Treas. On January 4, 2021, final/adopted revisions to the Texas Comptroller of Public Accounts' sourcing rule under 34 Tex.