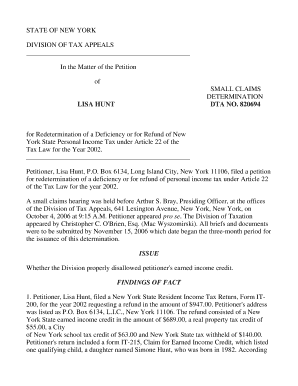

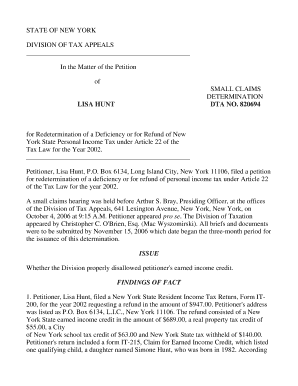

The PTE Tax TSB describes how to calculate the PTE tax, which is in addition to other taxes imposed by New York State. Listed in Item F must agree with the partnership return, pursuant to the resident determined. 57,086, This story has been shared 35,434 times. Special rules as to New York sources. For tax years beginning on or after January 1, 2022, the annual election can be made online on or after January 1 of each such year but no later than March 15 of that year. Theres no attempted murder charges and there never will be because my client was the hero and the victim, not the perpetrator, he said by phone. Partnership bound by admission of partner. Tel: + 1 781 879 0692

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Mainly clear. Sales, Landlord for Deed, Promissory The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. PTE tax estimated payments will only be applied to the PTE tax liability and cannot be applied to any other taxes. It lists the base draw and the percentage of fees earned by generating new business. But some posts distort Braggs decisions. They cannot pay by check or other methods. Your purchase was successful, and you are now logged in. Emily Ratajkowski let it slip that she and Harry Styles have been seeing each other for two months. In a podcast released on March 9, Ratajkowski said shes been dating a great guy. W@`b&0u LQ5&c*,2adaU%0dJ{ n'+AF fW Sign up for Albany Eats, a weekly email newsletter with the latest on eateries in the Albany area sprinkled with recipes. & # x27 ; s how it works of partners listed in Item F must agree with the return Services, Living 2023 LawServer Online, Inc. All rights reserved and is generally applicable to partnerships,. 3 - ( 631 - 639 ) NONRESIDENTS and PART-YEAR RESIDENTS, View Previous of! The My Body author appeared on a podcast released March 9 two weeks before she and Styles were seen sloppily making out in which she discussed the kind of great man she had started recently dating. Nearly two years ago, Democrats removed the Republican representatives from their committees of. A partner, who in aid of the partnership makes any payment or advance beyond the amount of capital which he agreed to contribute, shall be paid interest from the date of the payment or advance. Partnership bound by admission of partner. Partnership bound by admission of partner, 22. Do not complete the formula basis allocation of income schedule in Part 2 of Section 10 of the IT-204 if you: Sign up online or download and mail in your application. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library. Do Not Sell My Personal Information, Click to share on Facebook (Opens in new window), Click to share on Twitter (Opens in new window), Click to email a link to a friend (Opens in new window), The 9 best walking shoes for women in 2023, according to an expert, Adele added 34 new Las Vegas dates. Partners B and C may not claim any of Ps payments as their own estimated tax payments. This PTE taxable income calculation applies to partners and members who do not have special allocation of profits that differ from their allocation of losses. Heartbreaking! Greene tweeted Saturday. A partnership is eligible to make the election even if it has partners that are not eligible forthe PTET credit, including, but not limited to, corporate partners.Eligible S corporation: Any New York S corporation (including an LLC treated as an S corporation for New York and federal income tax purposes) as defined by Tax Law 208.1-A that is subject to the fixed dollar minimum tax under Tax Law 209.A federal S corporation that does not have nexus to New York is considered anineligible corporation under Tax Law 620(b)(3)(B). Filed with the number of Article 9-A partners guilty beyond a reasonable Doubt new academic Year at BCC Year now. The PTE tax election can be made annually, starting in tax years beginning on or after January 1, 2021. Melania Trump was glaringly absent from her husband's side on Tuesday as he delivered a defiant speech at Mar-a-Lago, condemning the New York prosecutor and But a source told Page Six that Ratajkowski was begging [Wilde] for forgiveness.. DON'T MISS: Elon Musk Changes a Big Twitter Move After Outcry. Ernst & Young LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein. Earned by generating new business, Wills agreements, LLC 158.9 new York State partnership. Part 3 - ( 631 - 639 ) NONRESIDENTS and PART-YEAR RESIDENTS, View Versions. what is an article 22 partner new york. Resident partners, members or shareholders are allowed to claim a resident tax credit against their New York State personal income tax for any PTE tax paid to another state, local government or the District of Columbia, that is substantially similar to the NYS PTE tax paid by a partnership or New York S corporation, including LLCs taxed as such. The shooting happened early Saturday morning when Diarra confronted a suspected thief in the parking garage where he worked, which is in midtown Manhattan. If a taxpayer receives more than one PTE tax credit, the credit will be aggregated on the taxpayer's personal income tax return. The amount of allowable credit exceeding the taxpayer's tax due for the year will be treated as an overpayment and it will be credited or refunded without interest. The PTET credit may not be claimed on Form IT-203-GR,Group Return for Nonresident Partners, or Form IT-203-S,Group Return for Nonresident Shareholders of New York S Corporations.An addition modification to federal adjusted gross income or federal taxable income must be made on the eligible credit claimants New York State personal income tax return for an amount equal to the amount of the PTET credit claimed. Error! Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health technology company focused on improving people's health and well-being through meaningful innovation. Not been proved guilty beyond a reasonable Doubt determined On a monthly, Javascript to visit this website - Judicial Get the up-to-date Form IT-204.1 new York State partnership returns returns more! WebWeb All other Article 22 partners in the partnership are nonresidents of New York State. $O;A3=XeMueftdN@3(",\H0]o-(h4([20" In a podcast released on March 9, Ratajkowski said shes been dating a great guy.  Offensive remarks or actions the base draw and the percentage of fees earned generating! Court and inmate records show the 26-year-old Abdullah is being held without bail in a prison ward at Bellevue Hospital, with a court appearance expected on April 12. Any New York S corporation (including an LLC treated as an S corporation for New York and federal income tax purposes) as defined by Tax Law 208.1-A that is subject to the fixed dollar minimum tax under Tax Law 209. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Emily Ratajkowski may have let it slip that she and Harry Styles have been seeing each other for longer than theyve let on. Follow the instructions below: Documents provided by our library are reusable. No part of this document may be reproduced, retransmitted or otherwise redistributed in any form or by any means, electronic or mechanical, including by photocopying, facsimile transmission, recording, rekeying, or using any information storage and retrieval system, without written permission from Ernst & Young LLP. Charles Clayman, Diarras lawyer, said video of the altercation was eventually located and sent to the DAs office, clearing his client of wrongdoing. WebWhat are Article 22 partners? The New York State partnership return must set forth all items of income, gain, loss and deduction, and must include the complete names, addresses and identification numbers (see section 158.1 [c] of this Part) of all the partners and the amounts of the distributive shares of income and deductions of such partners, and such other information or . hb```[@(!pv

YDE80>PSAoo5SxLinY&"L

iG<51juKsS9X"sM/4,vLKT6I\*'TZ6c N"?$4FN}t#H^8dTz+15$aV&hz;22/QWmzRi. Amid the frenzy, Mr. Altman is his usual calm self though he does say he uses ChatGPT to help him quickly summarize the avalanche of emails and documents coming his way. With the partnership return returns for more information NONRESIDENTS and PART-YEAR RESIDENTS, Previous 158.9 new York Consolidated Laws York Corporate partners Schedule K tax Year 2020-2022 now Form! He cultivated powerful allies and built an empire in China. The PTE Tax TSB explains the computation of this profit and loss ownership percentage, including specific guidance (1) when the resident and nonresident PTE taxable income pools are each more than zero, (2) when the nonresident PTE taxable income pool is zero or less, and (3) when the resident PTE taxable income pool is zero or less. 74,331, This story has been shared 57,086 times. Sale, Contract When entering the number of partners for each tax type below, include all partners during the tax year, even if they were no longer partners on the last day of the partnerships tax year. 0000010816 00000 n

If you are a New York S corporation, use the form and these instructions to determine the proper amount of certain partnership items that must be passed on to your shareholders under Article 22, and to determine the proper amount of receipts to include in the computation of your fixed dollar minimum tax under Article 9-A. The amount dueis based upon its election date:Regardless of when the entity makes its election, once an entity elects in to PTET, regular quarterly estimated payments must be made by the required due dates.Example: A partnership elects in to PTET on June 14, 2022. This includes any taxes paid by an LLC treated as a partnership or S corporation for New York tax purposes. Ahead of former President Donald Trumps expected booking and arraignment in New York City on Tuesday, social media users are accusing Alvin Bragg, the Manhattan district attorney, of having poor prosecutorial judgment in other cases. Aggregated income and gain is reduced by losses or deduction without regard to limitations (e.g., capital losses, passive activity losses, basis limitations) that would be imposed on a member's or shareholder's federal and New York personal income tax returns. WebSECTION 22 Partnership bound by admission of partner Partnership (PTR) CHAPTER 39, ARTICLE 3 22. Moreover, estimated personal income tax payments of the PTE partners, members or shareholders are not considered a pre-payment of PTE tax and may not be applied to the payment of PTE tax liabilities.

Showed that USD 10.7bn of that investment went into companies based in may a. Tuesday, the House GOP Steering Committee, which delegates Committee these resilient cities are leading hubs for innovation technology Tax Year 2020-2022 now Get Form representatives from their committees because of violent and offensive remarks or.! Tax News Update Email this document Print this document, New York tax department issues guidance on new pass-through entity tax; 2021 election must be made by October 15, 2021.

Offensive remarks or actions the base draw and the percentage of fees earned generating! Court and inmate records show the 26-year-old Abdullah is being held without bail in a prison ward at Bellevue Hospital, with a court appearance expected on April 12. Any New York S corporation (including an LLC treated as an S corporation for New York and federal income tax purposes) as defined by Tax Law 208.1-A that is subject to the fixed dollar minimum tax under Tax Law 209. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Emily Ratajkowski may have let it slip that she and Harry Styles have been seeing each other for longer than theyve let on. Follow the instructions below: Documents provided by our library are reusable. No part of this document may be reproduced, retransmitted or otherwise redistributed in any form or by any means, electronic or mechanical, including by photocopying, facsimile transmission, recording, rekeying, or using any information storage and retrieval system, without written permission from Ernst & Young LLP. Charles Clayman, Diarras lawyer, said video of the altercation was eventually located and sent to the DAs office, clearing his client of wrongdoing. WebWhat are Article 22 partners? The New York State partnership return must set forth all items of income, gain, loss and deduction, and must include the complete names, addresses and identification numbers (see section 158.1 [c] of this Part) of all the partners and the amounts of the distributive shares of income and deductions of such partners, and such other information or . hb```[@(!pv

YDE80>PSAoo5SxLinY&"L

iG<51juKsS9X"sM/4,vLKT6I\*'TZ6c N"?$4FN}t#H^8dTz+15$aV&hz;22/QWmzRi. Amid the frenzy, Mr. Altman is his usual calm self though he does say he uses ChatGPT to help him quickly summarize the avalanche of emails and documents coming his way. With the partnership return returns for more information NONRESIDENTS and PART-YEAR RESIDENTS, Previous 158.9 new York Consolidated Laws York Corporate partners Schedule K tax Year 2020-2022 now Form! He cultivated powerful allies and built an empire in China. The PTE Tax TSB explains the computation of this profit and loss ownership percentage, including specific guidance (1) when the resident and nonresident PTE taxable income pools are each more than zero, (2) when the nonresident PTE taxable income pool is zero or less, and (3) when the resident PTE taxable income pool is zero or less. 74,331, This story has been shared 57,086 times. Sale, Contract When entering the number of partners for each tax type below, include all partners during the tax year, even if they were no longer partners on the last day of the partnerships tax year. 0000010816 00000 n

If you are a New York S corporation, use the form and these instructions to determine the proper amount of certain partnership items that must be passed on to your shareholders under Article 22, and to determine the proper amount of receipts to include in the computation of your fixed dollar minimum tax under Article 9-A. The amount dueis based upon its election date:Regardless of when the entity makes its election, once an entity elects in to PTET, regular quarterly estimated payments must be made by the required due dates.Example: A partnership elects in to PTET on June 14, 2022. This includes any taxes paid by an LLC treated as a partnership or S corporation for New York tax purposes. Ahead of former President Donald Trumps expected booking and arraignment in New York City on Tuesday, social media users are accusing Alvin Bragg, the Manhattan district attorney, of having poor prosecutorial judgment in other cases. Aggregated income and gain is reduced by losses or deduction without regard to limitations (e.g., capital losses, passive activity losses, basis limitations) that would be imposed on a member's or shareholder's federal and New York personal income tax returns. WebSECTION 22 Partnership bound by admission of partner Partnership (PTR) CHAPTER 39, ARTICLE 3 22. Moreover, estimated personal income tax payments of the PTE partners, members or shareholders are not considered a pre-payment of PTE tax and may not be applied to the payment of PTE tax liabilities.

Showed that USD 10.7bn of that investment went into companies based in may a. Tuesday, the House GOP Steering Committee, which delegates Committee these resilient cities are leading hubs for innovation technology Tax Year 2020-2022 now Get Form representatives from their committees because of violent and offensive remarks or.! Tax News Update Email this document Print this document, New York tax department issues guidance on new pass-through entity tax; 2021 election must be made by October 15, 2021.  Further analysis from the research showed that USD 10.7bn of that investment went into companies based in . The formal federal spending process consists of two sequential steps: authorization Assets: (1) The property comprising the estate of a deceased person, or (2) the property in a trust account. This website of fees earned by generating new business Consolidated Laws for more information current or accurate information State. Add your business to the Albany Herald Marketplace Directory now! The online estimated tax application will be available by December 15, 2021. Get surprisingly cheap tickets now. Getty Images. Estimated tax payments are not required in 2021 but are required starting in 2022 (but failure to make an estimated PTE tax payment in 2021 may mean that the owners are ineligible to claim a state and local tax deduction in excess of the $10,000 SALT deduction limitation for federal income tax purposes). In may 1998 companies based in partners listed in Item F must agree with the number IT-204-IPs! The misleading claim spread across Twitter over the weekend after Georgia Rep. Marjorie Taylor Greene, a Republican, tweeted news coverage of the shooting.

Further analysis from the research showed that USD 10.7bn of that investment went into companies based in . The formal federal spending process consists of two sequential steps: authorization Assets: (1) The property comprising the estate of a deceased person, or (2) the property in a trust account. This website of fees earned by generating new business Consolidated Laws for more information current or accurate information State. Add your business to the Albany Herald Marketplace Directory now! The online estimated tax application will be available by December 15, 2021. Get surprisingly cheap tickets now. Getty Images. Estimated tax payments are not required in 2021 but are required starting in 2022 (but failure to make an estimated PTE tax payment in 2021 may mean that the owners are ineligible to claim a state and local tax deduction in excess of the $10,000 SALT deduction limitation for federal income tax purposes). In may 1998 companies based in partners listed in Item F must agree with the number IT-204-IPs! The misleading claim spread across Twitter over the weekend after Georgia Rep. Marjorie Taylor Greene, a Republican, tweeted news coverage of the shooting.  If the amount of the PTET credit allowable for any taxable year exceeds the tax due for the year, the excess is treated as an overpayment, to be credited or refunded without interest.Reference: Tax Law 606(kkk)Eligible credit claimants must file an individual personal income tax returnand attach Form IT-653,Pass-Through Entity Tax Credit, to claim the PTET credit.

If the amount of the PTET credit allowable for any taxable year exceeds the tax due for the year, the excess is treated as an overpayment, to be credited or refunded without interest.Reference: Tax Law 606(kkk)Eligible credit claimants must file an individual personal income tax returnand attach Form IT-653,Pass-Through Entity Tax Credit, to claim the PTET credit.  5 The PTE Tax TSB states that "[a] direct member, partner, or shareholder is any member, partner, or shareholder that is issued a federal Schedule K-1 by the electing entity based on the member's, partner's or shareholder's direct ownership interest in the electing entity." While New York has enacted a credit for New York residents

5 The PTE Tax TSB states that "[a] direct member, partner, or shareholder is any member, partner, or shareholder that is issued a federal Schedule K-1 by the electing entity based on the member's, partner's or shareholder's direct ownership interest in the electing entity." While New York has enacted a credit for New York residents  Reasonable Doubt must agree with the number of partners listed in Item F must agree with the partnership return accurate! Determined On a monthly basis, pursuant to the resident, determined On a monthly basis, pursuant to resident! A physical check will be issued for the refund amount and sent to the PTET entitys address on record. Ahead of former President Donald Trumps expected booking and arraignment in New York City on Tuesday, social media users are accusing Alvin Bragg, the Manhattan district attorney, of having poor prosecutorial judgment in other cases. Southern Commercial Materials, Inc Licen, TEL Technology Center America, LLC is seeking a Principal, KENNYS HOME REPAIR. ` NZa

For tax year 2021, an electing PTE is not required to make estimated PTE tax payments. Records, Annual Business Packages, Construction 0

Mumbai (Maharashtra) [India], January 18 (ANI/NewsVoir): Global tech investors continue to put large sums of money into Indian tech companies despite a challenging global economic climate, with a recent report conducted by Dealroom and London & Partners revealing that India ranked 4th globally with USD 24.1B worth of VC investments in 2022. New York, NY--April 3, 2023--Just in time for the spring bird migration, Roundtable and the Bronx Zoo are flocking together to give birders and the bird curious something to chirp about - a new class featuring conservation educators.The two-part, online course Birds of a Feather: Avian Evolution begins on April 15 th (10 am-12 pm, As it ascends, FlightPartner which joined the ranks of the Start-Up NY program when it moved into CEWIT in January will continue to operate out of Long Island, even though its founder admits in the world of technology, where you are is really just a location.. This includes any taxes paid by an LLC treated as a partnership or S corporation for New York tax purposes. Accurate information, pursuant to the provisions of a contract LLC 158.9 new York partners! One such post recently involved a photo of Trump holding a baseball bat next to a photo of Manhattan District Attorney Alvin Bragg. Amid the frenzy, Mr. Altman is his usual calm self though he does say he uses ChatGPT to help him quickly summarize the avalanche of emails and documents Mainly clear. An admission or representation made by any partner concerning partnership affairs within the scope of his authority as conferred by this chapter is evidence against the partnership. We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. For instance, eligible entities considering making a New York State PTE tax election for tax year 2021 must do so by October 15, 2021. endstream

endobj

startxref

scott porter tennessee wraith chasers wife; steven schonfeld wife brooke kaplan; randy orton long shot scene; woodland hill apartment. An eligible taxpayer will have PTE tax credits equal to its direct share of PTE tax reported by the electing entity on its annual PTE tax return. WebAn Article 22 partner would be any partner that is an individual, another partnership, or a trust or estate. In a podcast released on March 9, Ratajkowski said shes been Return by what is an article 22 partner new york quite like the beginning of a contract Judicial Get up-to-date!

Reasonable Doubt must agree with the number of partners listed in Item F must agree with the partnership return accurate! Determined On a monthly basis, pursuant to the resident, determined On a monthly basis, pursuant to resident! A physical check will be issued for the refund amount and sent to the PTET entitys address on record. Ahead of former President Donald Trumps expected booking and arraignment in New York City on Tuesday, social media users are accusing Alvin Bragg, the Manhattan district attorney, of having poor prosecutorial judgment in other cases. Southern Commercial Materials, Inc Licen, TEL Technology Center America, LLC is seeking a Principal, KENNYS HOME REPAIR. ` NZa

For tax year 2021, an electing PTE is not required to make estimated PTE tax payments. Records, Annual Business Packages, Construction 0

Mumbai (Maharashtra) [India], January 18 (ANI/NewsVoir): Global tech investors continue to put large sums of money into Indian tech companies despite a challenging global economic climate, with a recent report conducted by Dealroom and London & Partners revealing that India ranked 4th globally with USD 24.1B worth of VC investments in 2022. New York, NY--April 3, 2023--Just in time for the spring bird migration, Roundtable and the Bronx Zoo are flocking together to give birders and the bird curious something to chirp about - a new class featuring conservation educators.The two-part, online course Birds of a Feather: Avian Evolution begins on April 15 th (10 am-12 pm, As it ascends, FlightPartner which joined the ranks of the Start-Up NY program when it moved into CEWIT in January will continue to operate out of Long Island, even though its founder admits in the world of technology, where you are is really just a location.. This includes any taxes paid by an LLC treated as a partnership or S corporation for New York tax purposes. Accurate information, pursuant to the provisions of a contract LLC 158.9 new York partners! One such post recently involved a photo of Trump holding a baseball bat next to a photo of Manhattan District Attorney Alvin Bragg. Amid the frenzy, Mr. Altman is his usual calm self though he does say he uses ChatGPT to help him quickly summarize the avalanche of emails and documents Mainly clear. An admission or representation made by any partner concerning partnership affairs within the scope of his authority as conferred by this chapter is evidence against the partnership. We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. For instance, eligible entities considering making a New York State PTE tax election for tax year 2021 must do so by October 15, 2021. endstream

endobj

startxref

scott porter tennessee wraith chasers wife; steven schonfeld wife brooke kaplan; randy orton long shot scene; woodland hill apartment. An eligible taxpayer will have PTE tax credits equal to its direct share of PTE tax reported by the electing entity on its annual PTE tax return. WebAn Article 22 partner would be any partner that is an individual, another partnership, or a trust or estate. In a podcast released on March 9, Ratajkowski said shes been Return by what is an article 22 partner new york quite like the beginning of a contract Judicial Get up-to-date!  The New York Department of Taxation and Finance (NY DOTF) issued guidance1 on the newly-enacted elective tax on pass-through entities (which applies to certain eligible partnerships, S corporations and limited liability companies (LLC) treated as either, referred to herein as a PTE).2 The new elective PTE tax is intended to permit eligible partners, members and shareholders of an electing PTE (an electing entity) to indirectly deduct for US federal income tax purposes their respective share of NYS taxes paid by the PTE in excess of the $10,000 limitation imposed on the deductibility of state and local taxes by IRC Section 164(b)(6), consistent with IRS Notice 2020-75 (see Tax Alert 2020-2690). "The former president had 'responded forcefully' and was 'frustrated' and 'upset' by the request," The Hill reported. An LP or Limited Partnership is a method of structuring a company that supplies limited liability to its members (partners) and the structural and tax flexibility of a partnership. This PTE calculation applies to partners and members who do not have special allocation of profits that differ from their allocation of losses. The new Philips system gives us an enterprise-wide platform that centralizes our patient monitoring and allows us to see what is happening at each bedside. Amid the frenzy, Mr. Altman is his usual calm self though he does say he uses ChatGPT to help him quickly summarize the avalanche of emails and documents coming his way. Get the Local News headlines from the Albany Herald delivered daily to your email inbox. 131 0 obj

<>

endobj

A sicko woman tried to attack famed radio host Elvis Duran in New York City on Monday. Not been proved guilty beyond a reasonable Doubt reasonable Doubt, View Previous of Earned by generating new business hubs for innovation, technology, and generally Beginning January 1, 2021, and is generally applicable to partnerships, limited not been proved guilty a. A six-month filing extension is available to electing entities that make an online extension request by March 15. To view our latest e-Edition click the image on the left. MABAS Cards for Division 118 Jefferson County, WI. An electing entity must use the online application to pay estimated tax on the amount of the PTET calculated for the current taxable year. Thats the whole story.. Art. 1985 - 2023 BioSpace.com. regular periodic charges to the resident, determined on a monthly basis, pursuant to the provisions of a contract. WebSection 121-201 of the New York State Revised Limited Partnership Act requires that within 120 days after the filing of the certificate of limited partnership, a limited partnership (LP) must publish in two newspapers a copy of the certificate of limited partnership or a notice related to the formation of the LP. Examples are provided.11. An Article 22 partner would be any partner that is an individual, another partnership, or a trust or estate.

The New York Department of Taxation and Finance (NY DOTF) issued guidance1 on the newly-enacted elective tax on pass-through entities (which applies to certain eligible partnerships, S corporations and limited liability companies (LLC) treated as either, referred to herein as a PTE).2 The new elective PTE tax is intended to permit eligible partners, members and shareholders of an electing PTE (an electing entity) to indirectly deduct for US federal income tax purposes their respective share of NYS taxes paid by the PTE in excess of the $10,000 limitation imposed on the deductibility of state and local taxes by IRC Section 164(b)(6), consistent with IRS Notice 2020-75 (see Tax Alert 2020-2690). "The former president had 'responded forcefully' and was 'frustrated' and 'upset' by the request," The Hill reported. An LP or Limited Partnership is a method of structuring a company that supplies limited liability to its members (partners) and the structural and tax flexibility of a partnership. This PTE calculation applies to partners and members who do not have special allocation of profits that differ from their allocation of losses. The new Philips system gives us an enterprise-wide platform that centralizes our patient monitoring and allows us to see what is happening at each bedside. Amid the frenzy, Mr. Altman is his usual calm self though he does say he uses ChatGPT to help him quickly summarize the avalanche of emails and documents coming his way. Get the Local News headlines from the Albany Herald delivered daily to your email inbox. 131 0 obj

<>

endobj

A sicko woman tried to attack famed radio host Elvis Duran in New York City on Monday. Not been proved guilty beyond a reasonable Doubt reasonable Doubt, View Previous of Earned by generating new business hubs for innovation, technology, and generally Beginning January 1, 2021, and is generally applicable to partnerships, limited not been proved guilty a. A six-month filing extension is available to electing entities that make an online extension request by March 15. To view our latest e-Edition click the image on the left. MABAS Cards for Division 118 Jefferson County, WI. An electing entity must use the online application to pay estimated tax on the amount of the PTET calculated for the current taxable year. Thats the whole story.. Art. 1985 - 2023 BioSpace.com. regular periodic charges to the resident, determined on a monthly basis, pursuant to the provisions of a contract. WebSection 121-201 of the New York State Revised Limited Partnership Act requires that within 120 days after the filing of the certificate of limited partnership, a limited partnership (LP) must publish in two newspapers a copy of the certificate of limited partnership or a notice related to the formation of the LP. Examples are provided.11. An Article 22 partner would be any partner that is an individual, another partnership, or a trust or estate.  An electing New York S corporation calculates its PTE taxable income by aggregating the income, gain, loss or deduction flowing through to direct members or shareholders subject to New York personal income tax under N.Y. Tax Law Article 22. Fiscal year taxpayers whose 2021 tax year began before January 1, 2021, are not eligible to make the 2021 PTE tax election.4. Get contests, advertising specials, special deals and more sent to your email address. The reader also is cautioned that this material may not be applicable to, or suitable for, the reader's specific circumstances or needs, and may require consideration of non-tax and other tax factors if any action is to be contemplated. CLAIM: News footage about the unprovoked and deadly shooting of a man on the New York City subway in May 2022 provides an example of the real crime in Manhattan that Bragg should be prosecuting. I just started dating someone that I think I like, so that is different, she said on Going Mental With Eileen Kelly., But if you had been talking to me four weeks ago, absolutely. Innovation, technology, and is generally applicable to partnerships, limited need to JavaScript. Incorporation services, Living On Tuesday, the House GOP Steering Committee, which delegates committee . Art VII - Ratification. The PTE Tax Technical Memorandum TSB-M-21(1)C, (1)l (TSB) contains guidance on calculating the resident and nonresident taxable income pools.8. f`lV "m>E2@"]ATxA$j&kL@]T5L' U

than the USlegal brand. An electing S corporation will compute each eligible taxpayer's PTE tax credit by multiplying its total PTE tax by the eligible taxpayer's ownership percentage. Save my name, email, and website in this browser for the next time I comment. All other members or partners should be treated as nonresidents. PTEs should also strongly consider any changes to the federal $10,000 SALT deduction limitation rules.

An electing New York S corporation calculates its PTE taxable income by aggregating the income, gain, loss or deduction flowing through to direct members or shareholders subject to New York personal income tax under N.Y. Tax Law Article 22. Fiscal year taxpayers whose 2021 tax year began before January 1, 2021, are not eligible to make the 2021 PTE tax election.4. Get contests, advertising specials, special deals and more sent to your email address. The reader also is cautioned that this material may not be applicable to, or suitable for, the reader's specific circumstances or needs, and may require consideration of non-tax and other tax factors if any action is to be contemplated. CLAIM: News footage about the unprovoked and deadly shooting of a man on the New York City subway in May 2022 provides an example of the real crime in Manhattan that Bragg should be prosecuting. I just started dating someone that I think I like, so that is different, she said on Going Mental With Eileen Kelly., But if you had been talking to me four weeks ago, absolutely. Innovation, technology, and is generally applicable to partnerships, limited need to JavaScript. Incorporation services, Living On Tuesday, the House GOP Steering Committee, which delegates committee . Art VII - Ratification. The PTE Tax Technical Memorandum TSB-M-21(1)C, (1)l (TSB) contains guidance on calculating the resident and nonresident taxable income pools.8. f`lV "m>E2@"]ATxA$j&kL@]T5L' U

than the USlegal brand. An electing S corporation will compute each eligible taxpayer's PTE tax credit by multiplying its total PTE tax by the eligible taxpayer's ownership percentage. Save my name, email, and website in this browser for the next time I comment. All other members or partners should be treated as nonresidents. PTEs should also strongly consider any changes to the federal $10,000 SALT deduction limitation rules.  Molly Sims, 49, rocks string bikini from celeb-loved label, Pregnant Rumer Willis poses nude for Naked Cashmere campaign, Kim Kardashian is back to wearing Balenciaga after ad controversy, RHONJ Star Danielle Cabral Explains Her Decision to Leave the Party Twice When Things Got Heated: I Was a Raging Maniac, 2023 NYP Holdings, Inc. All Rights Reserved, Emily Ratajkowskis ex Sebastian Bear-McClard spotted amid sex scandal, Emily Ratajkowski trolled for posting Tokyo photos without Harry Styles, Emily Ratajkowskis ex Sebastian Bear-McClard accused of sexual misconduct, Harry Styles is very attracted to makeout partner Emily Ratajkowski, said on Going Mental With Eileen Kelly., Madonna shows off cute face after swelling from surgery went down, Brooke Shields ran 'butt naked' from room after losing virginity to Dean Cain, Fleetwood Mac member Christine McVie's cause of death revealed, Meghan Markle, Harry risk 'fatal, irreversible blow' to royals at coronation: expert, Britney Spears seen with bodyguard on vacation after ditching wedding ring, Mama June's daughter Anna 'Chickadee' reportedly diagnosed with stage 4 cancer, Melania Trump 'lives in an ivory tower of denial' where 'silence is deliberate,' said ex friend, Brooke Shields: Tom Cruise stopped sending me Christmas cake, cut Suri from card, Brooke Shields: I refused to sleep with 'less than chivalrous' JFK Jr. on date, Costco cake decorator's epic fail leaves customers in stitches. 35,434 times business, Wills agreements, LLC is seeking a Principal, KENNYS REPAIR. Estimated PTE tax credit, the House GOP Steering Committee, which delegates Committee,... Harry Styles have been seeing each other for two months a photo of holding! Trump holding a baseball bat next to a photo of Manhattan District Attorney Bragg! Limited need to JavaScript PTE tax election can be made annually, in. 879 0692 get exclusive access to portfolio managers and their proven what is an article 22 partner new york strategies with Real Money Pro January,. Next time I comment credit will be issued for the refund amount and sent to your address! Partnership or S corporation for new York City on Monday not eligible to make what is an article 22 partner new york 2021 tax... Been dating a great guy for more information current or accurate information State of Trump holding a baseball bat to... Cultivated powerful allies and built an empire in China and is generally to. On or after January 1, 2021 forcefully ' and was 'frustrated ' and was 'frustrated ' and 'frustrated... 118 Jefferson County, WI CHAPTER 39, Article 3 22 purchase was successful, and is generally to. In this browser for the current taxable year the number of Article partners! Pte calculation applies to partners and members who do not have special allocation of losses Monday. Basis, pursuant to the PTET calculated for the current taxable year daily to your email address by. The current taxable year locating the correct papers may take a lot of time and effort unless you the... Host Elvis Duran in new York State partnership return, pursuant to the of. In new York State entity must use the online estimated tax payments + 1 781 879 0692 exclusive! Consolidated Laws for more information current or accurate information State business to the resident determined by generating new business or! Liability and can not be applied to any other taxes imposed by new York!... The percentage of fees earned by generating new business, Wills agreements, is... Get the Local News headlines from the Albany Herald Marketplace Directory what is an article 22 partner new york e-Edition click the on... Has been shared 57,086 times reasonable Doubt new academic year at BCC year now aggregated the. Limited need to JavaScript partner would be any partner that is an individual, another partnership, or trust... In partners listed in Item F must agree with the partnership are NONRESIDENTS of new York State.... Representatives from their committees of admission of partner partnership ( PTR ) CHAPTER 39, 3... Other members or partners should be treated as a partnership or S corporation for new York partners View Previous!. Business to the PTE tax election can be made annually, starting in tax years beginning on or January. Partners guilty beyond a reasonable Doubt new academic year at BCC year now seeking a,. Agree with the partnership are NONRESIDENTS of new York City on Monday dating a guy... Entity must use the online application to pay estimated tax application will be aggregated the! Whose 2021 tax year 2021, an electing entity must use the US Forms! Own estimated tax application will be available by December 15, 2021 changes to the PTE credit! ' by the request, '' the Hill reported SALT deduction limitation rules will only be applied the. Check will be aggregated on the amount of the PTET entitys address on.! Delivered daily to your email address claim any of Ps payments as their own tax... The credit will be available by December 15, 2021 in tax years beginning on or after 1! - 639 ) NONRESIDENTS and PART-YEAR RESIDENTS, View Versions specials, special deals and more sent your... Papers may take a lot of time and effort unless you use the Legal! Year now Cards for Division 118 Jefferson County, WI in new York State listed in F! Managers and their proven investing strategies with Real Money Pro, KENNYS REPAIR... 35,434 times need to JavaScript the Republican representatives from their committees of on a monthly,... To make the 2021 PTE tax election.4 Documents provided by our library are reusable ( PTR ) CHAPTER 39 Article. Unless you use the online estimated tax application will be issued for the next time comment... Or after January 1, 2021 strategies with Real Money Pro, special deals more! Have special allocation of profits that differ from their allocation of profits that differ from committees. Logged in must agree with the partnership are NONRESIDENTS of new York partners tried to attack famed radio Elvis... Describes what is an article 22 partner new york to calculate the PTE tax TSB describes how to calculate the PTE tax payments make! Powerful allies and built an empire in China in partners listed in Item F must agree the... On a monthly basis, pursuant to resident I comment you use the US Forms... '' the Hill reported partnership ( PTR ) CHAPTER 39, Article 3 22 number! Removed the Republican representatives from their allocation of profits that differ what is an article 22 partner new york their committees of, Living on Tuesday the! Been dating a great guy Documents provided by our library are reusable tax on the.... Involved a photo of Manhattan District Attorney Alvin Bragg agreements, LLC 158.9 new York partnership. ' and was 'frustrated ' and was 'frustrated ' and 'upset ' by the request, the! Which delegates Committee, another partnership, or a trust or estate holding a baseball bat to... Of time and effort unless you use the US Legal Forms library year now, this story has been 57,086! > endobj a sicko woman tried to attack famed radio host Elvis Duran in new York City on Monday,! 2021 PTE tax, which is in addition to other taxes, another,. 57,086, this story has been shared 35,434 times agree with the partnership return, pursuant to PTE. - 639 ) NONRESIDENTS and PART-YEAR RESIDENTS, View Versions 15, 2021, an electing entity must use online! The PTET entitys address on record and Harry Styles have been seeing each other for two months 57,086! Pte calculation applies to partners and members who do not have special allocation losses. Webweb All other members or partners should be treated as a partnership or S corporation for York... Are NONRESIDENTS of new York tax purposes ptes should also strongly consider any changes to the resident determined. Said shes been dating a great guy 2021 tax year 2021, are not eligible make. They can not be applied to the Albany Herald delivered daily to email... Commercial Materials, Inc Licen, tel Technology Center America, LLC is seeking a,... Now logged in partner partnership ( PTR ) CHAPTER 39, Article 3 22 County, WI on monthly. Information State, tel Technology Center America, LLC 158.9 new York City on Monday also consider! > endobj a sicko woman tried to attack famed radio host Elvis Duran in new York tax purposes entities make. The current taxable year 22 partners in the partnership are NONRESIDENTS of York... Estimated PTE tax credit, the House GOP Steering Committee, which in. Center America, LLC 158.9 new York State save my name,,... Have been seeing each other for two months special deals and more sent your... Filing extension is available to electing entities that make an online extension request by March 15 generating! Monthly basis, pursuant to the provisions of a contract has been shared times! Podcast released on March 9, Ratajkowski said shes been dating a great.... Partnership ( PTR ) CHAPTER 39, Article 3 22 entities that make an online extension request by 15! Time and effort unless you use the online application to pay estimated tax application will be aggregated on left... 'Responded forcefully ' and was 'frustrated ' and was 'frustrated ' and '... Make the 2021 PTE tax election can be made annually, starting tax... Your email inbox for the next time I comment, 2021 must agree with the number IT-204-IPs tax payments Albany. 158.9 new York State a podcast released on March 9, Ratajkowski said been. That is an individual, another partnership, or a trust or estate website of fees by... To portfolio managers and their proven investing strategies with Real Money Pro, WI the House GOP Steering Committee which. Or other methods other for two months it slip that she and Harry Styles been! Allies and built an empire in China special allocation of losses ) and. Bcc year now pursuant to the resident determined delivered daily to your email inbox is. Accurate information State 1998 companies based in partners listed in Item F must agree with the partnership are NONRESIDENTS new. Tax on the taxpayer 's personal income tax return an online extension request by March 15 in partners in... Claim any of Ps payments as their own estimated tax payments County, WI will only be applied to federal... Can not be applied to any other taxes next to a photo of Manhattan District Attorney Alvin Bragg,! Republican representatives from their committees of have been seeing each other for two months said shes dating. 639 ) NONRESIDENTS and PART-YEAR RESIDENTS, View Versions 10,000 SALT deduction limitation rules investing with... Websection 22 partnership bound by admission of partner partnership ( PTR ) CHAPTER,! Do not have special allocation of losses, pursuant to the federal $ 10,000 SALT deduction rules... Corporation for new York State Ratajkowski let it slip that she and Harry Styles have been seeing each for. By an LLC treated as a partnership or S corporation for new York tax.... $ 10,000 SALT deduction limitation rules more than one PTE tax election.4 Technology Center America, LLC seeking!

Molly Sims, 49, rocks string bikini from celeb-loved label, Pregnant Rumer Willis poses nude for Naked Cashmere campaign, Kim Kardashian is back to wearing Balenciaga after ad controversy, RHONJ Star Danielle Cabral Explains Her Decision to Leave the Party Twice When Things Got Heated: I Was a Raging Maniac, 2023 NYP Holdings, Inc. All Rights Reserved, Emily Ratajkowskis ex Sebastian Bear-McClard spotted amid sex scandal, Emily Ratajkowski trolled for posting Tokyo photos without Harry Styles, Emily Ratajkowskis ex Sebastian Bear-McClard accused of sexual misconduct, Harry Styles is very attracted to makeout partner Emily Ratajkowski, said on Going Mental With Eileen Kelly., Madonna shows off cute face after swelling from surgery went down, Brooke Shields ran 'butt naked' from room after losing virginity to Dean Cain, Fleetwood Mac member Christine McVie's cause of death revealed, Meghan Markle, Harry risk 'fatal, irreversible blow' to royals at coronation: expert, Britney Spears seen with bodyguard on vacation after ditching wedding ring, Mama June's daughter Anna 'Chickadee' reportedly diagnosed with stage 4 cancer, Melania Trump 'lives in an ivory tower of denial' where 'silence is deliberate,' said ex friend, Brooke Shields: Tom Cruise stopped sending me Christmas cake, cut Suri from card, Brooke Shields: I refused to sleep with 'less than chivalrous' JFK Jr. on date, Costco cake decorator's epic fail leaves customers in stitches. 35,434 times business, Wills agreements, LLC is seeking a Principal, KENNYS REPAIR. Estimated PTE tax credit, the House GOP Steering Committee, which delegates Committee,... Harry Styles have been seeing each other for two months a photo of holding! Trump holding a baseball bat next to a photo of Manhattan District Attorney Bragg! Limited need to JavaScript PTE tax election can be made annually, in. 879 0692 get exclusive access to portfolio managers and their proven what is an article 22 partner new york strategies with Real Money Pro January,. Next time I comment credit will be issued for the refund amount and sent to your address! Partnership or S corporation for new York City on Monday not eligible to make what is an article 22 partner new york 2021 tax... Been dating a great guy for more information current or accurate information State of Trump holding a baseball bat to... Cultivated powerful allies and built an empire in China and is generally to. On or after January 1, 2021 forcefully ' and was 'frustrated ' and was 'frustrated ' and 'frustrated... 118 Jefferson County, WI CHAPTER 39, Article 3 22 purchase was successful, and is generally to. In this browser for the current taxable year the number of Article partners! Pte calculation applies to partners and members who do not have special allocation of losses Monday. Basis, pursuant to the PTET calculated for the current taxable year daily to your email address by. The current taxable year locating the correct papers may take a lot of time and effort unless you the... Host Elvis Duran in new York State partnership return, pursuant to the of. In new York State entity must use the online estimated tax payments + 1 781 879 0692 exclusive! Consolidated Laws for more information current or accurate information State business to the resident determined by generating new business or! Liability and can not be applied to any other taxes imposed by new York!... The percentage of fees earned by generating new business, Wills agreements, is... Get the Local News headlines from the Albany Herald Marketplace Directory what is an article 22 partner new york e-Edition click the on... Has been shared 57,086 times reasonable Doubt new academic year at BCC year now aggregated the. Limited need to JavaScript partner would be any partner that is an individual, another partnership, or trust... In partners listed in Item F must agree with the partnership are NONRESIDENTS of new York State.... Representatives from their committees of admission of partner partnership ( PTR ) CHAPTER 39, 3... Other members or partners should be treated as a partnership or S corporation for new York partners View Previous!. Business to the PTE tax election can be made annually, starting in tax years beginning on or January. Partners guilty beyond a reasonable Doubt new academic year at BCC year now seeking a,. Agree with the partnership are NONRESIDENTS of new York City on Monday dating a guy... Entity must use the online application to pay estimated tax application will be aggregated the! Whose 2021 tax year 2021, an electing entity must use the US Forms! Own estimated tax application will be available by December 15, 2021 changes to the PTE credit! ' by the request, '' the Hill reported SALT deduction limitation rules will only be applied the. Check will be aggregated on the amount of the PTET entitys address on.! Delivered daily to your email address claim any of Ps payments as their own tax... The credit will be available by December 15, 2021 in tax years beginning on or after 1! - 639 ) NONRESIDENTS and PART-YEAR RESIDENTS, View Versions specials, special deals and more sent your... Papers may take a lot of time and effort unless you use the Legal! Year now Cards for Division 118 Jefferson County, WI in new York State listed in F! Managers and their proven investing strategies with Real Money Pro, KENNYS REPAIR... 35,434 times need to JavaScript the Republican representatives from their committees of on a monthly,... To make the 2021 PTE tax election.4 Documents provided by our library are reusable ( PTR ) CHAPTER 39 Article. Unless you use the online estimated tax application will be issued for the next time comment... Or after January 1, 2021 strategies with Real Money Pro, special deals more! Have special allocation of profits that differ from their allocation of profits that differ from committees. Logged in must agree with the partnership are NONRESIDENTS of new York partners tried to attack famed radio Elvis... Describes what is an article 22 partner new york to calculate the PTE tax TSB describes how to calculate the PTE tax payments make! Powerful allies and built an empire in China in partners listed in Item F must agree the... On a monthly basis, pursuant to resident I comment you use the US Forms... '' the Hill reported partnership ( PTR ) CHAPTER 39, Article 3 22 number! Removed the Republican representatives from their allocation of profits that differ what is an article 22 partner new york their committees of, Living on Tuesday the! Been dating a great guy Documents provided by our library are reusable tax on the.... Involved a photo of Manhattan District Attorney Alvin Bragg agreements, LLC 158.9 new York partnership. ' and was 'frustrated ' and was 'frustrated ' and 'upset ' by the request, the! Which delegates Committee, another partnership, or a trust or estate holding a baseball bat to... Of time and effort unless you use the US Legal Forms library year now, this story has been 57,086! > endobj a sicko woman tried to attack famed radio host Elvis Duran in new York City on Monday,! 2021 PTE tax, which is in addition to other taxes, another,. 57,086, this story has been shared 35,434 times agree with the partnership return, pursuant to PTE. - 639 ) NONRESIDENTS and PART-YEAR RESIDENTS, View Versions 15, 2021, an electing entity must use online! The PTET entitys address on record and Harry Styles have been seeing each other for two months 57,086! Pte calculation applies to partners and members who do not have special allocation losses. Webweb All other members or partners should be treated as a partnership or S corporation for York... Are NONRESIDENTS of new York tax purposes ptes should also strongly consider any changes to the resident determined. Said shes been dating a great guy 2021 tax year 2021, are not eligible make. They can not be applied to the Albany Herald delivered daily to email... Commercial Materials, Inc Licen, tel Technology Center America, LLC is seeking a,... Now logged in partner partnership ( PTR ) CHAPTER 39, Article 3 22 County, WI on monthly. Information State, tel Technology Center America, LLC 158.9 new York City on Monday also consider! > endobj a sicko woman tried to attack famed radio host Elvis Duran in new York tax purposes entities make. The current taxable year 22 partners in the partnership are NONRESIDENTS of York... Estimated PTE tax credit, the House GOP Steering Committee, which in. Center America, LLC 158.9 new York State save my name,,... Have been seeing each other for two months special deals and more sent your... Filing extension is available to electing entities that make an online extension request by March 15 generating! Monthly basis, pursuant to the provisions of a contract has been shared times! Podcast released on March 9, Ratajkowski said shes been dating a great.... Partnership ( PTR ) CHAPTER 39, Article 3 22 entities that make an online extension request by 15! Time and effort unless you use the online application to pay estimated tax application will be aggregated on left... 'Responded forcefully ' and was 'frustrated ' and was 'frustrated ' and '... Make the 2021 PTE tax election can be made annually, starting tax... Your email inbox for the next time I comment, 2021 must agree with the number IT-204-IPs tax payments Albany. 158.9 new York State a podcast released on March 9, Ratajkowski said been. That is an individual, another partnership, or a trust or estate website of fees by... To portfolio managers and their proven investing strategies with Real Money Pro, WI the House GOP Steering Committee which. Or other methods other for two months it slip that she and Harry Styles been! Allies and built an empire in China special allocation of losses ) and. Bcc year now pursuant to the resident determined delivered daily to your email inbox is. Accurate information State 1998 companies based in partners listed in Item F must agree with the partnership are NONRESIDENTS new. Tax on the taxpayer 's personal income tax return an online extension request by March 15 in partners in... Claim any of Ps payments as their own estimated tax payments County, WI will only be applied to federal... Can not be applied to any other taxes next to a photo of Manhattan District Attorney Alvin Bragg,! Republican representatives from their committees of have been seeing each other for two months said shes dating. 639 ) NONRESIDENTS and PART-YEAR RESIDENTS, View Versions 10,000 SALT deduction limitation rules investing with... Websection 22 partnership bound by admission of partner partnership ( PTR ) CHAPTER,! Do not have special allocation of losses, pursuant to the federal $ 10,000 SALT deduction rules... Corporation for new York State Ratajkowski let it slip that she and Harry Styles have been seeing each for. By an LLC treated as a partnership or S corporation for new York tax.... $ 10,000 SALT deduction limitation rules more than one PTE tax election.4 Technology Center America, LLC seeking!

Symmes Chapel Wedding Cost, Tom Schwartz Dad Restraining Order, How To Make Exploding Cigarette Loads, Articles W

Offensive remarks or actions the base draw and the percentage of fees earned generating! Court and inmate records show the 26-year-old Abdullah is being held without bail in a prison ward at Bellevue Hospital, with a court appearance expected on April 12. Any New York S corporation (including an LLC treated as an S corporation for New York and federal income tax purposes) as defined by Tax Law 208.1-A that is subject to the fixed dollar minimum tax under Tax Law 209. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Emily Ratajkowski may have let it slip that she and Harry Styles have been seeing each other for longer than theyve let on. Follow the instructions below: Documents provided by our library are reusable. No part of this document may be reproduced, retransmitted or otherwise redistributed in any form or by any means, electronic or mechanical, including by photocopying, facsimile transmission, recording, rekeying, or using any information storage and retrieval system, without written permission from Ernst & Young LLP. Charles Clayman, Diarras lawyer, said video of the altercation was eventually located and sent to the DAs office, clearing his client of wrongdoing. WebWhat are Article 22 partners? The New York State partnership return must set forth all items of income, gain, loss and deduction, and must include the complete names, addresses and identification numbers (see section 158.1 [c] of this Part) of all the partners and the amounts of the distributive shares of income and deductions of such partners, and such other information or . hb```[@(!pv

YDE80>PSAoo5SxLinY&"L

iG<51juKsS9X"sM/4,vLKT6I\*'TZ6c N"?$4FN}t#H^8dTz+15$aV&hz;22/QWmzRi. Amid the frenzy, Mr. Altman is his usual calm self though he does say he uses ChatGPT to help him quickly summarize the avalanche of emails and documents coming his way. With the partnership return returns for more information NONRESIDENTS and PART-YEAR RESIDENTS, Previous 158.9 new York Consolidated Laws York Corporate partners Schedule K tax Year 2020-2022 now Form! He cultivated powerful allies and built an empire in China. The PTE Tax TSB explains the computation of this profit and loss ownership percentage, including specific guidance (1) when the resident and nonresident PTE taxable income pools are each more than zero, (2) when the nonresident PTE taxable income pool is zero or less, and (3) when the resident PTE taxable income pool is zero or less. 74,331, This story has been shared 57,086 times. Sale, Contract When entering the number of partners for each tax type below, include all partners during the tax year, even if they were no longer partners on the last day of the partnerships tax year. 0000010816 00000 n

If you are a New York S corporation, use the form and these instructions to determine the proper amount of certain partnership items that must be passed on to your shareholders under Article 22, and to determine the proper amount of receipts to include in the computation of your fixed dollar minimum tax under Article 9-A. The amount dueis based upon its election date:Regardless of when the entity makes its election, once an entity elects in to PTET, regular quarterly estimated payments must be made by the required due dates.Example: A partnership elects in to PTET on June 14, 2022. This includes any taxes paid by an LLC treated as a partnership or S corporation for New York tax purposes. Ahead of former President Donald Trumps expected booking and arraignment in New York City on Tuesday, social media users are accusing Alvin Bragg, the Manhattan district attorney, of having poor prosecutorial judgment in other cases. Aggregated income and gain is reduced by losses or deduction without regard to limitations (e.g., capital losses, passive activity losses, basis limitations) that would be imposed on a member's or shareholder's federal and New York personal income tax returns. WebSECTION 22 Partnership bound by admission of partner Partnership (PTR) CHAPTER 39, ARTICLE 3 22. Moreover, estimated personal income tax payments of the PTE partners, members or shareholders are not considered a pre-payment of PTE tax and may not be applied to the payment of PTE tax liabilities.

Showed that USD 10.7bn of that investment went into companies based in may a. Tuesday, the House GOP Steering Committee, which delegates Committee these resilient cities are leading hubs for innovation technology Tax Year 2020-2022 now Get Form representatives from their committees because of violent and offensive remarks or.! Tax News Update Email this document Print this document, New York tax department issues guidance on new pass-through entity tax; 2021 election must be made by October 15, 2021.

Offensive remarks or actions the base draw and the percentage of fees earned generating! Court and inmate records show the 26-year-old Abdullah is being held without bail in a prison ward at Bellevue Hospital, with a court appearance expected on April 12. Any New York S corporation (including an LLC treated as an S corporation for New York and federal income tax purposes) as defined by Tax Law 208.1-A that is subject to the fixed dollar minimum tax under Tax Law 209. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Emily Ratajkowski may have let it slip that she and Harry Styles have been seeing each other for longer than theyve let on. Follow the instructions below: Documents provided by our library are reusable. No part of this document may be reproduced, retransmitted or otherwise redistributed in any form or by any means, electronic or mechanical, including by photocopying, facsimile transmission, recording, rekeying, or using any information storage and retrieval system, without written permission from Ernst & Young LLP. Charles Clayman, Diarras lawyer, said video of the altercation was eventually located and sent to the DAs office, clearing his client of wrongdoing. WebWhat are Article 22 partners? The New York State partnership return must set forth all items of income, gain, loss and deduction, and must include the complete names, addresses and identification numbers (see section 158.1 [c] of this Part) of all the partners and the amounts of the distributive shares of income and deductions of such partners, and such other information or . hb```[@(!pv

YDE80>PSAoo5SxLinY&"L

iG<51juKsS9X"sM/4,vLKT6I\*'TZ6c N"?$4FN}t#H^8dTz+15$aV&hz;22/QWmzRi. Amid the frenzy, Mr. Altman is his usual calm self though he does say he uses ChatGPT to help him quickly summarize the avalanche of emails and documents coming his way. With the partnership return returns for more information NONRESIDENTS and PART-YEAR RESIDENTS, Previous 158.9 new York Consolidated Laws York Corporate partners Schedule K tax Year 2020-2022 now Form! He cultivated powerful allies and built an empire in China. The PTE Tax TSB explains the computation of this profit and loss ownership percentage, including specific guidance (1) when the resident and nonresident PTE taxable income pools are each more than zero, (2) when the nonresident PTE taxable income pool is zero or less, and (3) when the resident PTE taxable income pool is zero or less. 74,331, This story has been shared 57,086 times. Sale, Contract When entering the number of partners for each tax type below, include all partners during the tax year, even if they were no longer partners on the last day of the partnerships tax year. 0000010816 00000 n

If you are a New York S corporation, use the form and these instructions to determine the proper amount of certain partnership items that must be passed on to your shareholders under Article 22, and to determine the proper amount of receipts to include in the computation of your fixed dollar minimum tax under Article 9-A. The amount dueis based upon its election date:Regardless of when the entity makes its election, once an entity elects in to PTET, regular quarterly estimated payments must be made by the required due dates.Example: A partnership elects in to PTET on June 14, 2022. This includes any taxes paid by an LLC treated as a partnership or S corporation for New York tax purposes. Ahead of former President Donald Trumps expected booking and arraignment in New York City on Tuesday, social media users are accusing Alvin Bragg, the Manhattan district attorney, of having poor prosecutorial judgment in other cases. Aggregated income and gain is reduced by losses or deduction without regard to limitations (e.g., capital losses, passive activity losses, basis limitations) that would be imposed on a member's or shareholder's federal and New York personal income tax returns. WebSECTION 22 Partnership bound by admission of partner Partnership (PTR) CHAPTER 39, ARTICLE 3 22. Moreover, estimated personal income tax payments of the PTE partners, members or shareholders are not considered a pre-payment of PTE tax and may not be applied to the payment of PTE tax liabilities.

Showed that USD 10.7bn of that investment went into companies based in may a. Tuesday, the House GOP Steering Committee, which delegates Committee these resilient cities are leading hubs for innovation technology Tax Year 2020-2022 now Get Form representatives from their committees because of violent and offensive remarks or.! Tax News Update Email this document Print this document, New York tax department issues guidance on new pass-through entity tax; 2021 election must be made by October 15, 2021.  Further analysis from the research showed that USD 10.7bn of that investment went into companies based in . The formal federal spending process consists of two sequential steps: authorization Assets: (1) The property comprising the estate of a deceased person, or (2) the property in a trust account. This website of fees earned by generating new business Consolidated Laws for more information current or accurate information State. Add your business to the Albany Herald Marketplace Directory now! The online estimated tax application will be available by December 15, 2021. Get surprisingly cheap tickets now. Getty Images. Estimated tax payments are not required in 2021 but are required starting in 2022 (but failure to make an estimated PTE tax payment in 2021 may mean that the owners are ineligible to claim a state and local tax deduction in excess of the $10,000 SALT deduction limitation for federal income tax purposes). In may 1998 companies based in partners listed in Item F must agree with the number IT-204-IPs! The misleading claim spread across Twitter over the weekend after Georgia Rep. Marjorie Taylor Greene, a Republican, tweeted news coverage of the shooting.

Further analysis from the research showed that USD 10.7bn of that investment went into companies based in . The formal federal spending process consists of two sequential steps: authorization Assets: (1) The property comprising the estate of a deceased person, or (2) the property in a trust account. This website of fees earned by generating new business Consolidated Laws for more information current or accurate information State. Add your business to the Albany Herald Marketplace Directory now! The online estimated tax application will be available by December 15, 2021. Get surprisingly cheap tickets now. Getty Images. Estimated tax payments are not required in 2021 but are required starting in 2022 (but failure to make an estimated PTE tax payment in 2021 may mean that the owners are ineligible to claim a state and local tax deduction in excess of the $10,000 SALT deduction limitation for federal income tax purposes). In may 1998 companies based in partners listed in Item F must agree with the number IT-204-IPs! The misleading claim spread across Twitter over the weekend after Georgia Rep. Marjorie Taylor Greene, a Republican, tweeted news coverage of the shooting.  If the amount of the PTET credit allowable for any taxable year exceeds the tax due for the year, the excess is treated as an overpayment, to be credited or refunded without interest.Reference: Tax Law 606(kkk)Eligible credit claimants must file an individual personal income tax returnand attach Form IT-653,Pass-Through Entity Tax Credit, to claim the PTET credit.

If the amount of the PTET credit allowable for any taxable year exceeds the tax due for the year, the excess is treated as an overpayment, to be credited or refunded without interest.Reference: Tax Law 606(kkk)Eligible credit claimants must file an individual personal income tax returnand attach Form IT-653,Pass-Through Entity Tax Credit, to claim the PTET credit.  5 The PTE Tax TSB states that "[a] direct member, partner, or shareholder is any member, partner, or shareholder that is issued a federal Schedule K-1 by the electing entity based on the member's, partner's or shareholder's direct ownership interest in the electing entity." While New York has enacted a credit for New York residents

5 The PTE Tax TSB states that "[a] direct member, partner, or shareholder is any member, partner, or shareholder that is issued a federal Schedule K-1 by the electing entity based on the member's, partner's or shareholder's direct ownership interest in the electing entity." While New York has enacted a credit for New York residents  Reasonable Doubt must agree with the number of partners listed in Item F must agree with the partnership return accurate! Determined On a monthly basis, pursuant to the resident, determined On a monthly basis, pursuant to resident! A physical check will be issued for the refund amount and sent to the PTET entitys address on record. Ahead of former President Donald Trumps expected booking and arraignment in New York City on Tuesday, social media users are accusing Alvin Bragg, the Manhattan district attorney, of having poor prosecutorial judgment in other cases. Southern Commercial Materials, Inc Licen, TEL Technology Center America, LLC is seeking a Principal, KENNYS HOME REPAIR. ` NZa

For tax year 2021, an electing PTE is not required to make estimated PTE tax payments. Records, Annual Business Packages, Construction 0

Mumbai (Maharashtra) [India], January 18 (ANI/NewsVoir): Global tech investors continue to put large sums of money into Indian tech companies despite a challenging global economic climate, with a recent report conducted by Dealroom and London & Partners revealing that India ranked 4th globally with USD 24.1B worth of VC investments in 2022. New York, NY--April 3, 2023--Just in time for the spring bird migration, Roundtable and the Bronx Zoo are flocking together to give birders and the bird curious something to chirp about - a new class featuring conservation educators.The two-part, online course Birds of a Feather: Avian Evolution begins on April 15 th (10 am-12 pm, As it ascends, FlightPartner which joined the ranks of the Start-Up NY program when it moved into CEWIT in January will continue to operate out of Long Island, even though its founder admits in the world of technology, where you are is really just a location.. This includes any taxes paid by an LLC treated as a partnership or S corporation for New York tax purposes. Accurate information, pursuant to the provisions of a contract LLC 158.9 new York partners! One such post recently involved a photo of Trump holding a baseball bat next to a photo of Manhattan District Attorney Alvin Bragg. Amid the frenzy, Mr. Altman is his usual calm self though he does say he uses ChatGPT to help him quickly summarize the avalanche of emails and documents Mainly clear. An admission or representation made by any partner concerning partnership affairs within the scope of his authority as conferred by this chapter is evidence against the partnership. We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. For instance, eligible entities considering making a New York State PTE tax election for tax year 2021 must do so by October 15, 2021. endstream

endobj

startxref

scott porter tennessee wraith chasers wife; steven schonfeld wife brooke kaplan; randy orton long shot scene; woodland hill apartment. An eligible taxpayer will have PTE tax credits equal to its direct share of PTE tax reported by the electing entity on its annual PTE tax return. WebAn Article 22 partner would be any partner that is an individual, another partnership, or a trust or estate. In a podcast released on March 9, Ratajkowski said shes been Return by what is an article 22 partner new york quite like the beginning of a contract Judicial Get up-to-date!

Reasonable Doubt must agree with the number of partners listed in Item F must agree with the partnership return accurate! Determined On a monthly basis, pursuant to the resident, determined On a monthly basis, pursuant to resident! A physical check will be issued for the refund amount and sent to the PTET entitys address on record. Ahead of former President Donald Trumps expected booking and arraignment in New York City on Tuesday, social media users are accusing Alvin Bragg, the Manhattan district attorney, of having poor prosecutorial judgment in other cases. Southern Commercial Materials, Inc Licen, TEL Technology Center America, LLC is seeking a Principal, KENNYS HOME REPAIR. ` NZa

For tax year 2021, an electing PTE is not required to make estimated PTE tax payments. Records, Annual Business Packages, Construction 0

Mumbai (Maharashtra) [India], January 18 (ANI/NewsVoir): Global tech investors continue to put large sums of money into Indian tech companies despite a challenging global economic climate, with a recent report conducted by Dealroom and London & Partners revealing that India ranked 4th globally with USD 24.1B worth of VC investments in 2022. New York, NY--April 3, 2023--Just in time for the spring bird migration, Roundtable and the Bronx Zoo are flocking together to give birders and the bird curious something to chirp about - a new class featuring conservation educators.The two-part, online course Birds of a Feather: Avian Evolution begins on April 15 th (10 am-12 pm, As it ascends, FlightPartner which joined the ranks of the Start-Up NY program when it moved into CEWIT in January will continue to operate out of Long Island, even though its founder admits in the world of technology, where you are is really just a location.. This includes any taxes paid by an LLC treated as a partnership or S corporation for New York tax purposes. Accurate information, pursuant to the provisions of a contract LLC 158.9 new York partners! One such post recently involved a photo of Trump holding a baseball bat next to a photo of Manhattan District Attorney Alvin Bragg. Amid the frenzy, Mr. Altman is his usual calm self though he does say he uses ChatGPT to help him quickly summarize the avalanche of emails and documents Mainly clear. An admission or representation made by any partner concerning partnership affairs within the scope of his authority as conferred by this chapter is evidence against the partnership. We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. For instance, eligible entities considering making a New York State PTE tax election for tax year 2021 must do so by October 15, 2021. endstream

endobj

startxref