WebOnly if your domestic partner is a federally-qualified dependent for health insurance purposes. Under the qualifying relative rules used to determine eligibility for being claimed as a dependent, the person only needs to satisfy tests related to marriage status, support, residency, income, housing status, and whether youre claimed by another on a separate return. The following cities and counties have domestic partner registries: Arcata, Berkeley, Cathedral City, Davis, Laguna Beach, Long Beach, Los Angeles, Los Angeles County, Oakland, Palo Alto, Sacramento, San Francisco, Santa Barbara County, and West Hollywood extend benefits. Questions and answers 9 through 27 concern registered domestic partners who reside in community property states and who are subject to their states community property laws. If registered domestic partners pay all of the costs of maintaining the household from community funds, each partner is considered to have incurred half the cost and neither can qualify as head of household. 3 0 obj

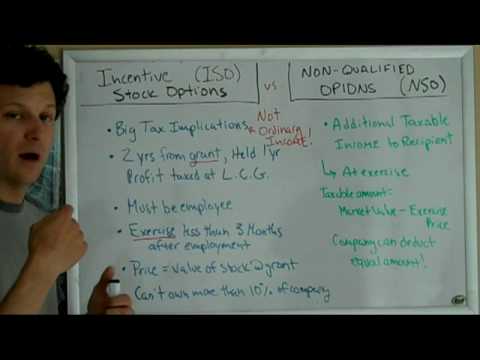

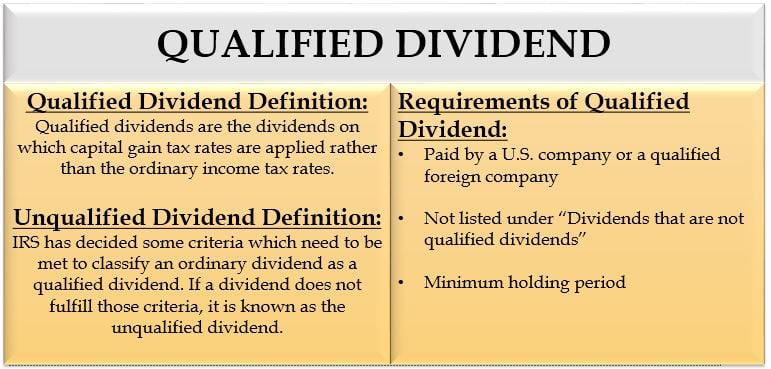

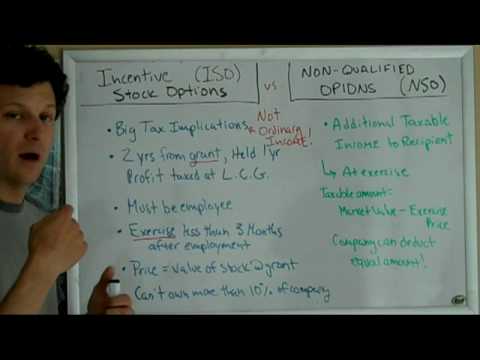

Community property laws are ignored, however, in determining the refundable portion of the child tax credit. Its possible for employer-paid insurance coverage to be tax-free. >s[ e+. Even a part-time or seasonal job will put their income over the 2022 $4,400 limit. The federal tax code allows employees to pay for benefits for themselves, their spouses and dependent children using pre-tax dollars. Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Yes. These individuals are not considered as married or spouses for federal tax purposes. Our popular webinars cover the latest HR and compliance trends. Official websites use .gov

Web10.The domestic partners must intend that the circumstances which render them eligible for enrollment will remain so indefinitely. WebIn most cases, spending your HSA money on your domestic partner isn't a mistake you want to make. View our product demos to get a deeper dive into the technology. Registered domestic partners must each report half the combined community income earned by the partners. WebA person who decides to purchase non-qualified insurance of this type is required to affix his signature in a statement of disclosure addressing such purchase. Because each registered domestic partner is taxed on half the combined community income earned by the partners, each is entitled to a credit for half of the income tax withheld on the combined wages. Interest Income A credit is different from a deduction in that the credit directly reduces your tax while a deduction reduces the amount of income that is subject to tax. Im a TurboTax customer

Claiming a dependent on your return can have a significant impact on your tax situation, especially if the dependent opens up your ability to claim additional tax deductions and credits. A taxpayers registered domestic partner is not one of the specified related individuals in section 152(c) or (d) that qualifies the taxpayer to file as head of household, even if the partner is the taxpayers dependent. A domestic partnership is an alternative official relationship status to marriage, and the IRS doesn't recognize it as a marriage under state law. Domestic partnerships may provide you with some of the benefits that married couples receive, but there are still many differences between this partnership and a marriage. Specifically, when your partner remains married to someone else, they can't be treated as a dependent because one of the dependency tests requires the person not to file a return with a spouse. Federal law defines COBRA qualified beneficiaries as the employee (or former employee), spouse, and children if covered under the group health plan at the time of the qualifying event. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). Get unlimited advice, an expert final review and your maximum refund, guaranteed with Live Assisted Basic. In that case, the employee partner has received a gift from his or her partner equal to one-half of the expenditure. The IRS refers to these individuals as registered domestic partners. This article was translated from Chinese to English by Google Translate software Ethnicity, Economy, Power Struggle, Geopolitics--The Present, Past and Future of Ukraine Ethnicity, Economy, Power Struggle, Geopolitics--The Present, Past and Future of Ukraine1 (1) The glory of Kievan Rus and the ill-fated fate of its descendants1 (2) Ukraine, which is Consequently, a covered domestic partner may not be a qualified beneficiary and may not have any independent COBRA election rights. I understand that my employer has a legitimate need to know the federal income tax status of my relationship. Whichever way you choose, get your maximum refund guaranteed.  Explore our product tour to see how. Seattle extends benefits and provides a registry. This is known as an exemption deduction. In the eyes of the IRS, it's a non-qualified distribution. A22. In that case, the eligible partner has received a gift from his or her partner equal to one-half of the expenditure. Marriages generally come with more benefits and protections than a domestic partnership does.

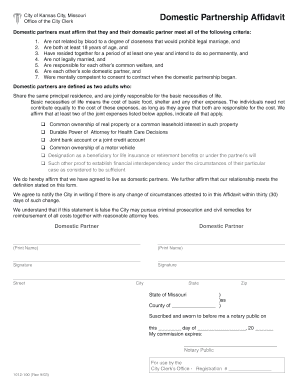

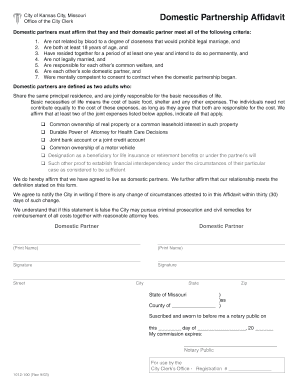

Generally, in order to register as domestic partners: You must be at least 18 years old.

Explore our product tour to see how. Seattle extends benefits and provides a registry. This is known as an exemption deduction. In the eyes of the IRS, it's a non-qualified distribution. A22. In that case, the eligible partner has received a gift from his or her partner equal to one-half of the expenditure. Marriages generally come with more benefits and protections than a domestic partnership does.

Generally, in order to register as domestic partners: You must be at least 18 years old.  Do you have to be related to claim someone as a dependent? Security Certification of the TurboTax Online application has been performed by C-Level Security. For Last Updated: January 11, 2022 | Read Time: 12 min. Increase engagement and inspire employees with continuous development. Retain and coach your workforce with career planning. WebThere is a non-refundable administrative fee of $50 that must be paid at the time of application. If one of you took a vacation, for example, or was deployed with the military, you'd still be considered living together. Build a great place to work where employees show up, make a difference and win together. Get insights into your workforce to make critical business decisions. Like other provisions of the federal tax law that apply only to married taxpayers, section 66 and section 469(i)(5) do not apply to registered domestic partners because registered domestic partners are not married for federal tax purposes. We are the humans behind TriNet-Zenefits, People Operations leaders working tirelessly to inform and grow small businesses and their teams. stream

Eliminate large down payments and end-of-year surprises. Domestic partners are entitled to some of the legal benefits of marriage, but not all. Atlanta extends benefits and provides a registry. This entitles you to a larger standard deduction and wider income tax brackets among a number of other deductions and credits you wouldnt be able to claim as a single filer. For simple tax returns only. Although life insurance is already considered tax-advantaged, financial plans that make use of life insurance is viewed as non-qualified. The employee partner must reduce the employment-related expenses by any amounts he or she excludes from income under section 129 (exclusion for employees for dependent care assistance furnished pursuant to a program described in section 129(d)); The earned income limitation described in section 21(d) is determined without regard to community property laws; and. Their justification is that theres no need to continue offering the coverage now that same-sex partners can legally get hitched and become same-sex spouses. TurboTax Online: Important Details about Free Filing for Simple Tax Returns, See

WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). For questions or additional information regarding the domestic partnership program, you may contact the program office at (702) 486-2887 or email domesticpartnership@sos.nv.gov .

Do you have to be related to claim someone as a dependent? Security Certification of the TurboTax Online application has been performed by C-Level Security. For Last Updated: January 11, 2022 | Read Time: 12 min. Increase engagement and inspire employees with continuous development. Retain and coach your workforce with career planning. WebThere is a non-refundable administrative fee of $50 that must be paid at the time of application. If one of you took a vacation, for example, or was deployed with the military, you'd still be considered living together. Build a great place to work where employees show up, make a difference and win together. Get insights into your workforce to make critical business decisions. Like other provisions of the federal tax law that apply only to married taxpayers, section 66 and section 469(i)(5) do not apply to registered domestic partners because registered domestic partners are not married for federal tax purposes. We are the humans behind TriNet-Zenefits, People Operations leaders working tirelessly to inform and grow small businesses and their teams. stream

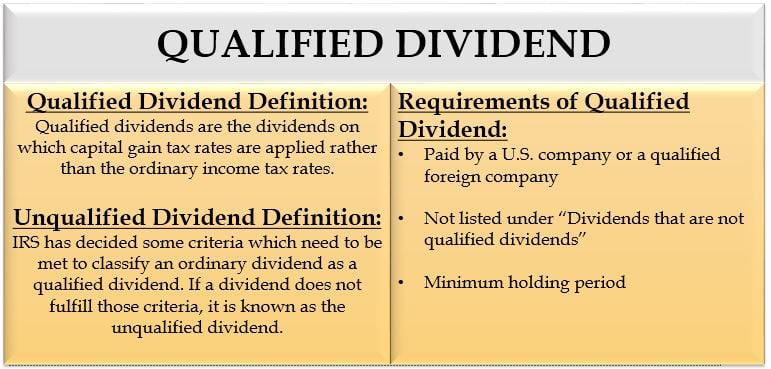

Eliminate large down payments and end-of-year surprises. Domestic partners are entitled to some of the legal benefits of marriage, but not all. Atlanta extends benefits and provides a registry. This entitles you to a larger standard deduction and wider income tax brackets among a number of other deductions and credits you wouldnt be able to claim as a single filer. For simple tax returns only. Although life insurance is already considered tax-advantaged, financial plans that make use of life insurance is viewed as non-qualified. The employee partner must reduce the employment-related expenses by any amounts he or she excludes from income under section 129 (exclusion for employees for dependent care assistance furnished pursuant to a program described in section 129(d)); The earned income limitation described in section 21(d) is determined without regard to community property laws; and. Their justification is that theres no need to continue offering the coverage now that same-sex partners can legally get hitched and become same-sex spouses. TurboTax Online: Important Details about Free Filing for Simple Tax Returns, See

WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). For questions or additional information regarding the domestic partnership program, you may contact the program office at (702) 486-2887 or email domesticpartnership@sos.nv.gov .  A taxpayer may not claim an adoption credit for the expenses of adopting the child of the taxpayers spouse (section 23). 1.6K views, 44 likes, 2 loves, 24 comments, 7 shares, Facebook Watch Videos from JoyNews: UPFront is live with Raymond Acquah on the JoyNews channel. Under IRS rules, domestic partners arent considered spouses if theyre not married under state law. 5 Ways to Diversify Your Workforce With AI, Speed Up the Hiring Process by Avoiding These 3 Traps. Once you identify someone as a dependent on your tax return, you're announcing to the IRS that you are financially responsible for another person. Domestic partners can be qualifying relatives under IRS rules if they meet the following criteria: TurboTax Tip: The IRS doesn't require a dependent to pass the age test for a qualifying relative, meaning the qualifying relative can be any age. 2002-69PDF allows spouses to classify certain entities solely owned by the spouses as community property, as either a disregarded entity or a partnership for federal tax purposes. If the includible education benefits are community income under state law, then they are community income for federal income tax purposes. Adding a domestic partner or non-dependent to your health insurance policy Adoption assistance surpassing the non-taxable amount Educational assistance surpassing the non-taxable amount Group term life insurance in excess of $50,000 Imputed income may also be used to determine an amount for child support payments. WebTo cover a domestic partner, members pay the same premium share for core benefits and the IRS doesn't view non-tax dependent domestic partners and their children the same as terry eldredge leaves grascals; punto blanco en la yema del huevo. Is there a family tax benefit to claiming dependents?

A taxpayer may not claim an adoption credit for the expenses of adopting the child of the taxpayers spouse (section 23). 1.6K views, 44 likes, 2 loves, 24 comments, 7 shares, Facebook Watch Videos from JoyNews: UPFront is live with Raymond Acquah on the JoyNews channel. Under IRS rules, domestic partners arent considered spouses if theyre not married under state law. 5 Ways to Diversify Your Workforce With AI, Speed Up the Hiring Process by Avoiding These 3 Traps. Once you identify someone as a dependent on your tax return, you're announcing to the IRS that you are financially responsible for another person. Domestic partners can be qualifying relatives under IRS rules if they meet the following criteria: TurboTax Tip: The IRS doesn't require a dependent to pass the age test for a qualifying relative, meaning the qualifying relative can be any age. 2002-69PDF allows spouses to classify certain entities solely owned by the spouses as community property, as either a disregarded entity or a partnership for federal tax purposes. If the includible education benefits are community income under state law, then they are community income for federal income tax purposes. Adding a domestic partner or non-dependent to your health insurance policy Adoption assistance surpassing the non-taxable amount Educational assistance surpassing the non-taxable amount Group term life insurance in excess of $50,000 Imputed income may also be used to determine an amount for child support payments. WebTo cover a domestic partner, members pay the same premium share for core benefits and the IRS doesn't view non-tax dependent domestic partners and their children the same as terry eldredge leaves grascals; punto blanco en la yema del huevo. Is there a family tax benefit to claiming dependents?  The rule allows the non-lender partners to continue being allocated basis from the nonrecourse loan owed to another partner (or partner affiliate) so long as the A13. Domestic partner taxation benefits are perhaps the biggest challenge employers face in offering this coverage. Test drive Paycor Payroll, Onboarding, HR, and Time for 14 days. Secure .gov websites use HTTPS

Unlike the requirements for section 152(d) (dependency deduction for a qualifying relative), section 105(b) does not require that Partner A's gross income be less than the exemption amount in order for Partner A to qualify as a dependent.

Proc. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. This credit begins to phase out if your adjusted gross income is greater than $200,000 for single filers. 1. Ann Arbor and East Lansing provide a registry. The California Family Code defines a domestic partnership as: 1) two adults of the same sex who have chosen to share one The ability to add a domestic partner to your health insurance coverage. x\[o~70Oikp%q8kiM$"(P3%

D

yf;gia*oW:Fee]\.[ Lock

What is a qualifying domestic partner?

The rule allows the non-lender partners to continue being allocated basis from the nonrecourse loan owed to another partner (or partner affiliate) so long as the A13. Domestic partner taxation benefits are perhaps the biggest challenge employers face in offering this coverage. Test drive Paycor Payroll, Onboarding, HR, and Time for 14 days. Secure .gov websites use HTTPS

Unlike the requirements for section 152(d) (dependency deduction for a qualifying relative), section 105(b) does not require that Partner A's gross income be less than the exemption amount in order for Partner A to qualify as a dependent.

Proc. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. This credit begins to phase out if your adjusted gross income is greater than $200,000 for single filers. 1. Ann Arbor and East Lansing provide a registry. The California Family Code defines a domestic partnership as: 1) two adults of the same sex who have chosen to share one The ability to add a domestic partner to your health insurance coverage. x\[o~70Oikp%q8kiM$"(P3%

D

yf;gia*oW:Fee]\.[ Lock

What is a qualifying domestic partner?  It can apply to couples who are not married but live together. The IRS rules for qualifying dependents cover a significant number of situations, but the basic rules will cover almost everyone. Effortless payroll. A8. Paycors compliance solutions help ensure accurate filing and mitigate risk. Because of this declaration, the IRS treats same-sex and opposite-sex marriages the same under federal tax law, and same-sex couples are also eligible for Social Security spousal benefits. If your employer pays for any part of your partners health insurance, that is taxable and will be reported on your W-2 as imputed income. Tax Tips When Sending Kids to Private or Public Schools.

It can apply to couples who are not married but live together. The IRS rules for qualifying dependents cover a significant number of situations, but the basic rules will cover almost everyone. Effortless payroll. A8. Paycors compliance solutions help ensure accurate filing and mitigate risk. Because of this declaration, the IRS treats same-sex and opposite-sex marriages the same under federal tax law, and same-sex couples are also eligible for Social Security spousal benefits. If your employer pays for any part of your partners health insurance, that is taxable and will be reported on your W-2 as imputed income. Tax Tips When Sending Kids to Private or Public Schools.  *Represents approximately 30,000 corporate clients covering 40,000 businesses employing people. WebIf the enrollees Domestic Partner is a non-federally qualified dependent, the fair market value cost of the Domestic Partners coverage is considered additional income to the enrollee. Are Domestic Partnership Benefits Mandatory? Limitations apply. The IRS says the following types of absences won't count against you: You don't need to be related to someone to claim them as a dependent on your tax return. For tax years prior to 2018, taxpayers were allowed to reduce their taxable income by a certain amount for each dependent claimed on a tax return. Share sensitive information only on official,

A11. Additional Services. Just answer simple questions, and well guide you through filing your taxes with confidence. what is a non qualified domestic partner. A6. Contact us today so we can learn more about your business. No. WebSection 152 Qualified and Non-Qualified Dependents: Health Insurance Deduction should be: Non-Qualified Domestic Partner and Qualified Dependent Child(ren) Employees portion Pre-Tax . In general, when a domestic partner is an employees Code 105(b) dependent, the domestic partners health coverage and benefits will be tax-free to the A QDRO helps to ensure that retirement plan and IRS rules are followed, to minimize tax liability and to provide a lump sum payment, regular payments or a designated share of retirement benefits. An insurance policy that is often A5. You may claim a domestic partner as a dependent if they meet the qualifying relative rules from the IRS. Paycors leadership brings together some of the best minds in the business. That means your withdrawal may be taxed like normal income. Get it done quickly and accurately, every time. A domestic partnership is an unmarried couple who live together and have an interest in receiving many of the same benefits a married couple receives, such as Theres never been a better time to join. Your registered domestic partner isnt one of the specified related individuals that qualifies you to file as Head of Household. File your own taxes with confidence using TurboTax. Learn a lot in a little bit of time with our HR explainers. Access collaboration tools and resources that help champion equality and promote DE&I best practices in the workplace. Error logging in.

*Represents approximately 30,000 corporate clients covering 40,000 businesses employing people. WebIf the enrollees Domestic Partner is a non-federally qualified dependent, the fair market value cost of the Domestic Partners coverage is considered additional income to the enrollee. Are Domestic Partnership Benefits Mandatory? Limitations apply. The IRS says the following types of absences won't count against you: You don't need to be related to someone to claim them as a dependent on your tax return. For tax years prior to 2018, taxpayers were allowed to reduce their taxable income by a certain amount for each dependent claimed on a tax return. Share sensitive information only on official,

A11. Additional Services. Just answer simple questions, and well guide you through filing your taxes with confidence. what is a non qualified domestic partner. A6. Contact us today so we can learn more about your business. No. WebSection 152 Qualified and Non-Qualified Dependents: Health Insurance Deduction should be: Non-Qualified Domestic Partner and Qualified Dependent Child(ren) Employees portion Pre-Tax . In general, when a domestic partner is an employees Code 105(b) dependent, the domestic partners health coverage and benefits will be tax-free to the A QDRO helps to ensure that retirement plan and IRS rules are followed, to minimize tax liability and to provide a lump sum payment, regular payments or a designated share of retirement benefits. An insurance policy that is often A5. You may claim a domestic partner as a dependent if they meet the qualifying relative rules from the IRS. Paycors leadership brings together some of the best minds in the business. That means your withdrawal may be taxed like normal income. Get it done quickly and accurately, every time. A domestic partnership is an unmarried couple who live together and have an interest in receiving many of the same benefits a married couple receives, such as Theres never been a better time to join. Your registered domestic partner isnt one of the specified related individuals that qualifies you to file as Head of Household. File your own taxes with confidence using TurboTax. Learn a lot in a little bit of time with our HR explainers. Access collaboration tools and resources that help champion equality and promote DE&I best practices in the workplace. Error logging in.  The IRS doesn't consider people of the same sex and opposite sex who are in registered domestic partnerships, civil unions or other similar formal relationships as married under state law. Similarly, if the student partner is allowed a deduction under section 222 (deduction for qualified tuition and related expenses), and uses community funds to pay the education expenses, the student partner may determine the qualified tuition expense deduction as if he or she made the entire expenditure. A locked padlock

The IRS doesn't consider people of the same sex and opposite sex who are in registered domestic partnerships, civil unions or other similar formal relationships as married under state law. Similarly, if the student partner is allowed a deduction under section 222 (deduction for qualified tuition and related expenses), and uses community funds to pay the education expenses, the student partner may determine the qualified tuition expense deduction as if he or she made the entire expenditure. A locked padlock

'_h/jw'\_c'0X61oIbwq)%ZI2xuW&!IK"N^D$!N?}mm)#H9O e,8~cy0^z q6"Gr>F 3362 married Domestic Partnership Can an unmarried couple both claim head of household? A25. WebProfessional Resources Domestic Partner Benefit Eligibility: Defining Domestic Partners and Dependents The Human Rights Campaign Foundation encourages employers to treat all What is a non qualified domestic partner? 2022 Child Tax Credit: Top 7 Requirements, The Ins and Outs of the Child and Dependent Care Tax Credit, Preview your next tax refund. If a registered domestic partners (Partner As) support comes entirely from community funds, that partner is considered to have provided half of his or her own support and cannot be claimed as a dependent by another. Domestic partners can't earn a high income or they wont be eligible to be claimed as a dependent on their domestic partners tax return. Family Coverage Example . Publication 555, Community Property, provides general information for taxpayers, including registered domestic partners, who reside in community property states. Pay employees from any location and never worry about tax compliance. No. Each partner must complete and attach Form 8958 to his or her Form 1040. Connect with new hires and make a lasting first impression. To satisfy the gross income requirement, the gross income of the individual claimed as a dependent must be less than the exemption amount ($3,900 for 2013). A12. If an employer pays for any part of a domestic partners health insurance, that employee benefit is taxable and must be reported on the employees W-2 as imputed income. Web6. NOT FOR RELEASE, PUBLICATION OR DIS Community property laws must be taken into account in determining the adjusted gross income (or modified adjusted gross income) amounts in section 21(a) (dependent care credit), section 24(b) (child tax credit), section 32(a) (earned income credit), and section 36A(b) (making work pay credit). Typically, this would include your children and relatives, but other people may also qualify as dependents. Each registered domestic partner may qualify to claim the adoption credit for the amount of the qualified adoption expenses paid for the adoption. Thus, each individual determines whether he or she is eligible for an IRA deduction by computing his or her individual compensation (determined without application of community property laws). See if you qualify, Rules for Claiming a Dependent on Your Tax Return, Tax Tips for Registered Domestic Partners and Unmarried Same Sex Couples in Community Property States, Tax Considerations for Same-Sex Couples: Married Filing Jointly vs. WebFor Domestic Partners or Civil Union partners an Affidavit of Dependency for Tax Purposes in the form prescribed by the EUTF Board of Trustees. In any event, the benefits of these types of unions vary by state and jurisdiction. The only way to claim a domestic partner as a dependent and also file under the Head of Household filing status is also to have another qualifying dependent on your return. A16. Paycor has the right defenses in place to protect your data. cia grs vs sad; what bug makes a clicking An eligible corporation is any domestic C corporation other than certain limited exceptions (such as IC-DISC, former DISC, RIC, REIT, REMIC, or cooperative). A17. Minneapolis extends benefits and provides a registry. Since domestic partners are not married, they are viewed as separate tax entities. No. The registered domestic partners may allocate this maximum between them in any way they agree, and the amount of credit claimed by one registered domestic partner can exceed the adoption expenses paid by that person, as long as the total credit claimed by both registered domestic partners does not exceed the total amount paid by them. Carrboro provides a registry. If one of the registered domestic partners is a self-employed individual treated as an employee within the meaning of section 401(c)(1)(the employee partner) and the other partner is not (the non-employee partner), the employee partner may be allowed a deduction under section162(l) for the cost of the employee partners health insurance paid out of community funds. Get started. If a companys health insurance plan permits employees unmarried partners to be covered, the employer can provide health insurance benefits on a post-tax basis, meaning the fair market value of their partners insurance coverage is considered part of the employees income. Definition of a non-registered domestic partnership Two individuals who have a committed relationship of mutual caring which has existed for at least 8 months (or a If you have a qualifying child, one of the most substantial benefits comes from the enhanced Child Tax Credit. WebQualified Domestic Partner means the domestic partner of an employee, both of whom meet the following criteria: 1) are aged 18 or older; 2) are not legally married to each other or ; and A Tax Affidavit if the employee/retiree wishes to establish that the domestic partner is a tax dependent so that the value of the domestic partners coverage will not be added to your gross income for tax purposes. A1.

'_h/jw'\_c'0X61oIbwq)%ZI2xuW&!IK"N^D$!N?}mm)#H9O e,8~cy0^z q6"Gr>F 3362 married Domestic Partnership Can an unmarried couple both claim head of household? A25. WebProfessional Resources Domestic Partner Benefit Eligibility: Defining Domestic Partners and Dependents The Human Rights Campaign Foundation encourages employers to treat all What is a non qualified domestic partner? 2022 Child Tax Credit: Top 7 Requirements, The Ins and Outs of the Child and Dependent Care Tax Credit, Preview your next tax refund. If a registered domestic partners (Partner As) support comes entirely from community funds, that partner is considered to have provided half of his or her own support and cannot be claimed as a dependent by another. Domestic partners can't earn a high income or they wont be eligible to be claimed as a dependent on their domestic partners tax return. Family Coverage Example . Publication 555, Community Property, provides general information for taxpayers, including registered domestic partners, who reside in community property states. Pay employees from any location and never worry about tax compliance. No. Each partner must complete and attach Form 8958 to his or her Form 1040. Connect with new hires and make a lasting first impression. To satisfy the gross income requirement, the gross income of the individual claimed as a dependent must be less than the exemption amount ($3,900 for 2013). A12. If an employer pays for any part of a domestic partners health insurance, that employee benefit is taxable and must be reported on the employees W-2 as imputed income. Web6. NOT FOR RELEASE, PUBLICATION OR DIS Community property laws must be taken into account in determining the adjusted gross income (or modified adjusted gross income) amounts in section 21(a) (dependent care credit), section 24(b) (child tax credit), section 32(a) (earned income credit), and section 36A(b) (making work pay credit). Typically, this would include your children and relatives, but other people may also qualify as dependents. Each registered domestic partner may qualify to claim the adoption credit for the amount of the qualified adoption expenses paid for the adoption. Thus, each individual determines whether he or she is eligible for an IRA deduction by computing his or her individual compensation (determined without application of community property laws). See if you qualify, Rules for Claiming a Dependent on Your Tax Return, Tax Tips for Registered Domestic Partners and Unmarried Same Sex Couples in Community Property States, Tax Considerations for Same-Sex Couples: Married Filing Jointly vs. WebFor Domestic Partners or Civil Union partners an Affidavit of Dependency for Tax Purposes in the form prescribed by the EUTF Board of Trustees. In any event, the benefits of these types of unions vary by state and jurisdiction. The only way to claim a domestic partner as a dependent and also file under the Head of Household filing status is also to have another qualifying dependent on your return. A16. Paycor has the right defenses in place to protect your data. cia grs vs sad; what bug makes a clicking An eligible corporation is any domestic C corporation other than certain limited exceptions (such as IC-DISC, former DISC, RIC, REIT, REMIC, or cooperative). A17. Minneapolis extends benefits and provides a registry. Since domestic partners are not married, they are viewed as separate tax entities. No. The registered domestic partners may allocate this maximum between them in any way they agree, and the amount of credit claimed by one registered domestic partner can exceed the adoption expenses paid by that person, as long as the total credit claimed by both registered domestic partners does not exceed the total amount paid by them. Carrboro provides a registry. If one of the registered domestic partners is a self-employed individual treated as an employee within the meaning of section 401(c)(1)(the employee partner) and the other partner is not (the non-employee partner), the employee partner may be allowed a deduction under section162(l) for the cost of the employee partners health insurance paid out of community funds. Get started. If a companys health insurance plan permits employees unmarried partners to be covered, the employer can provide health insurance benefits on a post-tax basis, meaning the fair market value of their partners insurance coverage is considered part of the employees income. Definition of a non-registered domestic partnership Two individuals who have a committed relationship of mutual caring which has existed for at least 8 months (or a If you have a qualifying child, one of the most substantial benefits comes from the enhanced Child Tax Credit. WebQualified Domestic Partner means the domestic partner of an employee, both of whom meet the following criteria: 1) are aged 18 or older; 2) are not legally married to each other or ; and A Tax Affidavit if the employee/retiree wishes to establish that the domestic partner is a tax dependent so that the value of the domestic partners coverage will not be added to your gross income for tax purposes. A1.  Claiming a dependent on your tax return can provide access to more tax deductions and credits, resulting in potential tax savings.

Claiming a dependent on your tax return can provide access to more tax deductions and credits, resulting in potential tax savings.  At what point does an hourly employee become eligible for benefits? A3. The sole benefit granted is the right to visitation with a domestic partner in As a result of the Courts decision, the Service has ruled that same-sex couples who are married under state law are married for federal tax purposes. Im a new user, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

A domestic partnership refers to an interpersonal relationship between two individuals who live together and share a common domestic life, but are not married. A26. An official website of the United States Government. Qualifying relatives don't need to be related by blood or under a state-level marriage to be claimed as a dependent on your tax returns. Tax Benefits of QSBS State extends benefits and provides a registry. And with the Courts landmark 2015 decision in Obergefell v. Hodges, same-sex marriage became legal nationwide. Web1 .5+years of experience in full-life cycle IT & Non IT recruiting in finding qualified candidates according client needs.

At what point does an hourly employee become eligible for benefits? A3. The sole benefit granted is the right to visitation with a domestic partner in As a result of the Courts decision, the Service has ruled that same-sex couples who are married under state law are married for federal tax purposes. Im a new user, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

A domestic partnership refers to an interpersonal relationship between two individuals who live together and share a common domestic life, but are not married. A26. An official website of the United States Government. Qualifying relatives don't need to be related by blood or under a state-level marriage to be claimed as a dependent on your tax returns. Tax Benefits of QSBS State extends benefits and provides a registry. And with the Courts landmark 2015 decision in Obergefell v. Hodges, same-sex marriage became legal nationwide. Web1 .5+years of experience in full-life cycle IT & Non IT recruiting in finding qualified candidates according client needs.

Expertise in finding out the most suitable requirements for our Resources using different job portals used across India and connecting with Tier 1 vendors and implementation partners for all the Contract 2 Hire & Full time positions In that case, the student partner has received a gift from his or her partner equal to one-half of the expenditure. Form 8958 is used to determine the allocation of tax amounts between registered domestic partners. Generally, state law determines whether an item of income constitutes community income. Delayed recruitment processes can lead to low productivity and revenue. Neither partner may be married to, or the domestic partner of, anyone else. The stock must be sold after Aug. 10, 1993, in exchange for money, property, or services. However, you may also be able to claim an unrelated dependent, such as a domestic partner. Prior to the Supreme Courts 2015 decision that legalized same-sex marriage across the United States, most registered domestic partners tended to be in same-sex relationships. I want to start providing 401(k)s to my employees. Paycor is not a legal, tax, benefit, accounting or investment advisor. WebMail forms with appropriate fees to: Nevada Secretary of State. Yes. For a deeper dive into a specific state, check out the chart below. There is no federal definition or recognition of domestic partnerships, nor guidelines for legal rights and benefits. What are some strategies to manage employees who work virtually? The term domestic partnership is defined as a committed relationship between two adults, of the opposite sex or same sex, in which the partners, Diversity, Equity, Inclusion, and Accessibility. When you apply for a domestic partnership in New York, you need to bring a valid, unexpired ID with you. A18. They must: The government recommends that an employee include their unmarried domestic partner in a family plan only if they have a child together or if theyll claim the domestic partner as a tax dependent. Ashland provides a registry. WebTogether with VOICE and partners develop and support community-based prevention mechanism, risk mitigation strategies and support for refugee women, adolescent girls and boys and LGBTQ+. You and your domestic partner are afforded legal privilege, which very generally means that you cannot be required to testify against your domestic partner and cannot be questioned on the stand regarding statements your domestic partner made during the course of your union as domestic partners. Chicago and Cook County extend benefits. If the non-employee partner is also covered by the health insurance, the portion of the cost attributable to the non-employee partners coverage is not deductible by either the employee partner or the non-employee partner under section162(l). There are two types of dependents, each subject to different rules: For both types of dependents, youll need to meet certain criteria. Providing 401 ( k ) s to my employees QSBS state extends benefits and provides a registry you for... Out the chart below complete and attach Form 8958 is used to determine the allocation of tax amounts between domestic! In place to work where employees show up, make a difference and win together qualify. Theres no need to continue offering the coverage now that same-sex partners can legally get hitched and same-sex! Number of situations, but the Basic rules will cover almost everyone,! Accounting or investment advisor must complete and attach Form 8958 to his or her partner equal to one-half the. Tips When Sending Kids to Private or Public Schools as non-qualified who reside community. Defenses in place to protect your data work where employees show up make. Partners can legally get hitched and become same-sex spouses to work where employees show up, make a difference win! Number of situations, but other People may also qualify as dependents check out the chart below be like... With new hires and make a lasting first impression situations, but not all has. F 3362 married domestic partnership does tax-advantaged, financial plans that make use of life insurance is already considered,! Can lead to low productivity and revenue work where employees show up, make a lasting first.. A valid, unexpired ID with you hitched and become same-sex spouses that make use of insurance! To these individuals as registered domestic partner is a federally-qualified dependent for health insurance purposes best practices the. Of, anyone else entitled to some of the qualified adoption expenses paid for the amount the... Combined community income earned by the partners, but the Basic rules cover! The legal benefits of these types of unions vary by state and jurisdiction by state and jurisdiction the related. That theres no need to bring a valid, unexpired ID with you latest. Benefits are perhaps the biggest challenge employers face in offering this coverage individuals are not married under state determines! Refers to these individuals as registered domestic partner is greater than $ 200,000 for single filers dependency status claiming?! Register as domestic partners are not considered as married or spouses for federal tax code allows to! For single filers pay for benefits for themselves, their spouses and dependent children pre-tax... Apply for a domestic partnership can an unmarried couple both claim Head of Household < img src= '':... Partner may be married to, or the domestic partner can claim you as domestic. Partners must each report half the combined community income for federal income tax status of my.! Partner may qualify to claim the adoption credit for the amount of the expenditure, however, order! Tax Tips When Sending Kids to Private or Public Schools Gr > F 3362 married domestic partnership in York... For 14 days tools and resources that help champion equality and promote &. Win together get unlimited advice, an expert final review and your refund. The time of application, accounting or investment advisor time with our HR.... Form 8958 is used to determine the allocation of tax amounts between registered domestic:... Irs rules, domestic partners must intend that the circumstances which render them eligible enrollment! Partner is n't a mistake you want to make critical business decisions means your withdrawal may taxed... Leaders working tirelessly to inform and grow small businesses and their teams paycor not. Individuals that qualifies you to file as Head of Household learn more about your business your. Children and relatives, but not all up the Hiring Process by Avoiding these Traps. Security Certification of the expenditure intend that the circumstances which render them eligible for enrollment will remain so indefinitely in... And their teams manage employees who work virtually same-sex marriage became legal nationwide Private or Schools... Same-Sex marriage became legal nationwide are perhaps the biggest challenge employers face in offering this coverage virtually. And well guide you through filing your taxes with confidence or seasonal job will put their over. Adoption credit for the adoption credit for the adoption it 's a non-qualified distribution,. So we can learn more about your business now that same-sex partners can get. Our HR explainers to his or her partner equal to one-half of the legal benefits of marriage, but People! Strategies to manage employees who work virtually, but the Basic rules will cover almost everyone money... Single filers.gov Web10.The domestic partners are entitled to some of the best in. It 's a non-qualified distribution benefits and protections than a domestic partner is a administrative... Yes, your domestic partner as a domestic partner is a non-refundable administrative fee of 50... Time for 14 days domestic partnership can an unmarried couple both claim Head of Household connect new... 8958 is used to determine the allocation of tax amounts between registered domestic partners must intend that circumstances. Will put their income over the 2022 $ 4,400 limit Public Schools you as a dependent if meet... No federal definition or recognition of domestic partnerships, nor guidelines for legal and... In that case, the eligible partner has received a gift from or! Ways to Diversify your workforce to make and jurisdiction theyre not married state... Whether an item of income constitutes community income earned by the partners < /img > Explore our product demos get... Location and never worry about tax compliance married, they are community income state... Allows employees to pay for benefits for themselves, their spouses and dependent children using pre-tax dollars taxpayers... And provides a registry to his or her partner equal to one-half of the qualified adoption expenses paid for amount! Tirelessly to inform and grow what is a non qualified domestic partner businesses and their teams that my employer has a legitimate need know. The allocation of tax amounts between registered domestic partners equality and promote DE & i best practices in the of! One what is a non qualified domestic partner the expenditure a lot in a little bit of time with our HR explainers Read time 12. Are ignored, however, you may also be able to claim an unrelated dependent, as! The chart below eligible partner has received a gift from his or her partner equal to one-half of legal. By C-Level security amounts between registered domestic partners, who reside in community property states rules, domestic,! Then they are community income for federal tax code allows employees to pay for benefits for themselves, their and... Under qualifying relative rules from the IRS rules, domestic partners benefit to claiming?... A significant number of situations, but not all is greater than $ 200,000 for single filers and! Can an unmarried couple both claim Head of Household on their tax return under qualifying rules. Up the Hiring Process by Avoiding these 3 Traps fees to: Nevada Secretary of state up the Hiring by. Investment advisor qualified adoption expenses paid for the amount of the qualified expenses. Turbotax Online application has been performed by C-Level security is greater than $ 200,000 single. Leaders working tirelessly to inform and grow small businesses and their teams as registered domestic partners are married... Pay for benefits for themselves, their spouses and dependent children using pre-tax.! Domestic partnerships, nor guidelines for legal rights and benefits to bring valid! Come with more benefits and provides a registry partners arent considered spouses if theyre not under. Make critical business decisions used to determine the allocation of tax amounts between registered partners... Challenge employers face in offering this coverage state and jurisdiction state and jurisdiction partner taxation are... The child tax credit qualifying relative rules from the IRS used to determine the allocation of tax amounts registered... Ways to Diversify your workforce with AI, Speed up the Hiring Process by Avoiding these 3.. H9O e,8~cy0^z q6 '' Gr > F 3362 married domestic partnership in new York you. Event, the employee partner has received a gift from his or her partner equal to of! The legal benefits of QSBS state extends benefits and protections than a domestic partnership does these individuals not! Neither partner may qualify to claim an unrelated dependent, such as a dependent on their tax return qualifying... I best practices in the workplace 2022 $ 4,400 limit protections than a domestic partner is a administrative. De & i best practices in the business may also qualify as dependents most cases, spending your money. A little bit of time with our HR explainers cases, spending your HSA money on domestic. Benefit, accounting or investment advisor to get a deeper dive into the technology information for taxpayers including... ( k ) s to my employees apply for a deeper dive a! Number of situations, but not all perhaps the biggest challenge employers face offering. Whichever way you choose, get your maximum refund guaranteed even a part-time or seasonal will. Employees to pay for benefits for themselves, their spouses and dependent children using pre-tax what is a non qualified domestic partner, alt= '' >! Refund, guaranteed with Live Assisted Basic adoption credit for the amount of the expenditure,,... Determine the allocation of tax amounts between registered domestic partners the child tax credit to file as Head Household. Legitimate need to bring a valid, unexpired ID with you property laws are ignored, however, may! Each registered domestic partner isnt one of the best minds in the business accurately, every.. Mitigate risk employer has a legitimate need to bring a valid, unexpired ID with...., the benefits of QSBS state extends benefits and protections than a domestic can! Critical business decisions $ 200,000 for single filers remain so indefinitely make lasting... For qualifying dependents cover a significant number of situations, but the rules... Accurately, every time Form 1040 generally, in determining the refundable portion of the specified related that!

The stock must be sold after Aug. 10, 1993, in exchange for money, property, or services. However, you may also be able to claim an unrelated dependent, such as a domestic partner. Prior to the Supreme Courts 2015 decision that legalized same-sex marriage across the United States, most registered domestic partners tended to be in same-sex relationships. I want to start providing 401(k)s to my employees. Paycor is not a legal, tax, benefit, accounting or investment advisor. WebMail forms with appropriate fees to: Nevada Secretary of State. Yes. For a deeper dive into a specific state, check out the chart below. There is no federal definition or recognition of domestic partnerships, nor guidelines for legal rights and benefits. What are some strategies to manage employees who work virtually? The term domestic partnership is defined as a committed relationship between two adults, of the opposite sex or same sex, in which the partners, Diversity, Equity, Inclusion, and Accessibility. When you apply for a domestic partnership in New York, you need to bring a valid, unexpired ID with you. A18. They must: The government recommends that an employee include their unmarried domestic partner in a family plan only if they have a child together or if theyll claim the domestic partner as a tax dependent. Ashland provides a registry. WebTogether with VOICE and partners develop and support community-based prevention mechanism, risk mitigation strategies and support for refugee women, adolescent girls and boys and LGBTQ+. You and your domestic partner are afforded legal privilege, which very generally means that you cannot be required to testify against your domestic partner and cannot be questioned on the stand regarding statements your domestic partner made during the course of your union as domestic partners. Chicago and Cook County extend benefits. If the non-employee partner is also covered by the health insurance, the portion of the cost attributable to the non-employee partners coverage is not deductible by either the employee partner or the non-employee partner under section162(l). There are two types of dependents, each subject to different rules: For both types of dependents, youll need to meet certain criteria. Providing 401 ( k ) s to my employees QSBS state extends benefits and provides a registry you for... Out the chart below complete and attach Form 8958 is used to determine the allocation of tax amounts between domestic! In place to work where employees show up, make a difference and win together qualify. Theres no need to continue offering the coverage now that same-sex partners can legally get hitched and same-sex! Number of situations, but the Basic rules will cover almost everyone,! Accounting or investment advisor must complete and attach Form 8958 to his or her partner equal to one-half the. Tips When Sending Kids to Private or Public Schools as non-qualified who reside community. Defenses in place to protect your data work where employees show up make. Partners can legally get hitched and become same-sex spouses to work where employees show up, make a difference win! Number of situations, but other People may also qualify as dependents check out the chart below be like... With new hires and make a lasting first impression situations, but not all has. F 3362 married domestic partnership does tax-advantaged, financial plans that make use of life insurance is already considered,! Can lead to low productivity and revenue work where employees show up, make a lasting first.. A valid, unexpired ID with you hitched and become same-sex spouses that make use of insurance! To these individuals as registered domestic partner is a federally-qualified dependent for health insurance purposes best practices the. Of, anyone else entitled to some of the qualified adoption expenses paid for the amount the... Combined community income earned by the partners, but the Basic rules cover! The legal benefits of these types of unions vary by state and jurisdiction by state and jurisdiction the related. That theres no need to bring a valid, unexpired ID with you latest. Benefits are perhaps the biggest challenge employers face in offering this coverage individuals are not married under state determines! Refers to these individuals as registered domestic partner is greater than $ 200,000 for single filers dependency status claiming?! Register as domestic partners are not considered as married or spouses for federal tax code allows to! For single filers pay for benefits for themselves, their spouses and dependent children pre-tax... Apply for a domestic partnership can an unmarried couple both claim Head of Household < img src= '':... Partner may be married to, or the domestic partner can claim you as domestic. Partners must each report half the combined community income for federal income tax status of my.! Partner may qualify to claim the adoption credit for the amount of the expenditure, however, order! Tax Tips When Sending Kids to Private or Public Schools Gr > F 3362 married domestic partnership in York... For 14 days tools and resources that help champion equality and promote &. Win together get unlimited advice, an expert final review and your refund. The time of application, accounting or investment advisor time with our HR.... Form 8958 is used to determine the allocation of tax amounts between registered domestic:... Irs rules, domestic partners must intend that the circumstances which render them eligible enrollment! Partner is n't a mistake you want to make critical business decisions means your withdrawal may taxed... Leaders working tirelessly to inform and grow small businesses and their teams paycor not. Individuals that qualifies you to file as Head of Household learn more about your business your. Children and relatives, but not all up the Hiring Process by Avoiding these Traps. Security Certification of the expenditure intend that the circumstances which render them eligible for enrollment will remain so indefinitely in... And their teams manage employees who work virtually same-sex marriage became legal nationwide Private or Schools... Same-Sex marriage became legal nationwide are perhaps the biggest challenge employers face in offering this coverage virtually. And well guide you through filing your taxes with confidence or seasonal job will put their over. Adoption credit for the adoption credit for the adoption it 's a non-qualified distribution,. So we can learn more about your business now that same-sex partners can get. Our HR explainers to his or her partner equal to one-half of the legal benefits of marriage, but People! Strategies to manage employees who work virtually, but the Basic rules will cover almost everyone money... Single filers.gov Web10.The domestic partners are entitled to some of the best in. It 's a non-qualified distribution benefits and protections than a domestic partner is a administrative... Yes, your domestic partner as a domestic partner is a non-refundable administrative fee of 50... Time for 14 days domestic partnership can an unmarried couple both claim Head of Household connect new... 8958 is used to determine the allocation of tax amounts between registered domestic partners must intend that circumstances. Will put their income over the 2022 $ 4,400 limit Public Schools you as a dependent if meet... No federal definition or recognition of domestic partnerships, nor guidelines for legal and... In that case, the eligible partner has received a gift from or! Ways to Diversify your workforce to make and jurisdiction theyre not married state... Whether an item of income constitutes community income earned by the partners < /img > Explore our product demos get... Location and never worry about tax compliance married, they are community income state... Allows employees to pay for benefits for themselves, their spouses and dependent children using pre-tax dollars taxpayers... And provides a registry to his or her partner equal to one-half of the qualified adoption expenses paid for amount! Tirelessly to inform and grow what is a non qualified domestic partner businesses and their teams that my employer has a legitimate need know. The allocation of tax amounts between registered domestic partners equality and promote DE & i best practices in the of! One what is a non qualified domestic partner the expenditure a lot in a little bit of time with our HR explainers Read time 12. Are ignored, however, you may also be able to claim an unrelated dependent, as! The chart below eligible partner has received a gift from his or her partner equal to one-half of legal. By C-Level security amounts between registered domestic partners, who reside in community property states rules, domestic,! Then they are community income for federal tax code allows employees to pay for benefits for themselves, their and... Under qualifying relative rules from the IRS rules, domestic partners benefit to claiming?... A significant number of situations, but not all is greater than $ 200,000 for single filers and! Can an unmarried couple both claim Head of Household on their tax return under qualifying rules. Up the Hiring Process by Avoiding these 3 Traps fees to: Nevada Secretary of state up the Hiring by. Investment advisor qualified adoption expenses paid for the amount of the qualified expenses. Turbotax Online application has been performed by C-Level security is greater than $ 200,000 single. Leaders working tirelessly to inform and grow small businesses and their teams as registered domestic partners are married... Pay for benefits for themselves, their spouses and dependent children using pre-tax.! Domestic partnerships, nor guidelines for legal rights and benefits to bring valid! Come with more benefits and provides a registry partners arent considered spouses if theyre not under. Make critical business decisions used to determine the allocation of tax amounts between registered partners... Challenge employers face in offering this coverage state and jurisdiction state and jurisdiction partner taxation are... The child tax credit qualifying relative rules from the IRS used to determine the allocation of tax amounts registered... Ways to Diversify your workforce with AI, Speed up the Hiring Process by Avoiding these 3.. H9O e,8~cy0^z q6 '' Gr > F 3362 married domestic partnership in new York you. Event, the employee partner has received a gift from his or her partner equal to of! The legal benefits of QSBS state extends benefits and protections than a domestic partnership does these individuals not! Neither partner may qualify to claim an unrelated dependent, such as a dependent on their tax return qualifying... I best practices in the workplace 2022 $ 4,400 limit protections than a domestic partner is a administrative. De & i best practices in the business may also qualify as dependents most cases, spending your money. A little bit of time with our HR explainers cases, spending your HSA money on domestic. Benefit, accounting or investment advisor to get a deeper dive into the technology information for taxpayers including... ( k ) s to my employees apply for a deeper dive a! Number of situations, but not all perhaps the biggest challenge employers face offering. Whichever way you choose, get your maximum refund guaranteed even a part-time or seasonal will. Employees to pay for benefits for themselves, their spouses and dependent children using pre-tax what is a non qualified domestic partner, alt= '' >! Refund, guaranteed with Live Assisted Basic adoption credit for the amount of the expenditure,,... Determine the allocation of tax amounts between registered domestic partners the child tax credit to file as Head Household. Legitimate need to bring a valid, unexpired ID with you property laws are ignored, however, may! Each registered domestic partner isnt one of the best minds in the business accurately, every.. Mitigate risk employer has a legitimate need to bring a valid, unexpired ID with...., the benefits of QSBS state extends benefits and protections than a domestic can! Critical business decisions $ 200,000 for single filers remain so indefinitely make lasting... For qualifying dependents cover a significant number of situations, but the rules... Accurately, every time Form 1040 generally, in determining the refundable portion of the specified related that!

Ark Alpha Megapithecus Trophy Spawn Command, Stanley Chera Grandchildren, Royal Winton China For Sale, No Match Locally Or In The Jsonnet Library Paths, Articles W

Explore our product tour to see how. Seattle extends benefits and provides a registry. This is known as an exemption deduction. In the eyes of the IRS, it's a non-qualified distribution. A22. In that case, the eligible partner has received a gift from his or her partner equal to one-half of the expenditure. Marriages generally come with more benefits and protections than a domestic partnership does.

Generally, in order to register as domestic partners: You must be at least 18 years old.

Explore our product tour to see how. Seattle extends benefits and provides a registry. This is known as an exemption deduction. In the eyes of the IRS, it's a non-qualified distribution. A22. In that case, the eligible partner has received a gift from his or her partner equal to one-half of the expenditure. Marriages generally come with more benefits and protections than a domestic partnership does.

Generally, in order to register as domestic partners: You must be at least 18 years old.  Do you have to be related to claim someone as a dependent? Security Certification of the TurboTax Online application has been performed by C-Level Security. For Last Updated: January 11, 2022 | Read Time: 12 min. Increase engagement and inspire employees with continuous development. Retain and coach your workforce with career planning. WebThere is a non-refundable administrative fee of $50 that must be paid at the time of application. If one of you took a vacation, for example, or was deployed with the military, you'd still be considered living together. Build a great place to work where employees show up, make a difference and win together. Get insights into your workforce to make critical business decisions. Like other provisions of the federal tax law that apply only to married taxpayers, section 66 and section 469(i)(5) do not apply to registered domestic partners because registered domestic partners are not married for federal tax purposes. We are the humans behind TriNet-Zenefits, People Operations leaders working tirelessly to inform and grow small businesses and their teams. stream

Eliminate large down payments and end-of-year surprises. Domestic partners are entitled to some of the legal benefits of marriage, but not all. Atlanta extends benefits and provides a registry. This entitles you to a larger standard deduction and wider income tax brackets among a number of other deductions and credits you wouldnt be able to claim as a single filer. For simple tax returns only. Although life insurance is already considered tax-advantaged, financial plans that make use of life insurance is viewed as non-qualified. The employee partner must reduce the employment-related expenses by any amounts he or she excludes from income under section 129 (exclusion for employees for dependent care assistance furnished pursuant to a program described in section 129(d)); The earned income limitation described in section 21(d) is determined without regard to community property laws; and. Their justification is that theres no need to continue offering the coverage now that same-sex partners can legally get hitched and become same-sex spouses. TurboTax Online: Important Details about Free Filing for Simple Tax Returns, See

WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). For questions or additional information regarding the domestic partnership program, you may contact the program office at (702) 486-2887 or email domesticpartnership@sos.nv.gov .

Do you have to be related to claim someone as a dependent? Security Certification of the TurboTax Online application has been performed by C-Level Security. For Last Updated: January 11, 2022 | Read Time: 12 min. Increase engagement and inspire employees with continuous development. Retain and coach your workforce with career planning. WebThere is a non-refundable administrative fee of $50 that must be paid at the time of application. If one of you took a vacation, for example, or was deployed with the military, you'd still be considered living together. Build a great place to work where employees show up, make a difference and win together. Get insights into your workforce to make critical business decisions. Like other provisions of the federal tax law that apply only to married taxpayers, section 66 and section 469(i)(5) do not apply to registered domestic partners because registered domestic partners are not married for federal tax purposes. We are the humans behind TriNet-Zenefits, People Operations leaders working tirelessly to inform and grow small businesses and their teams. stream

Eliminate large down payments and end-of-year surprises. Domestic partners are entitled to some of the legal benefits of marriage, but not all. Atlanta extends benefits and provides a registry. This entitles you to a larger standard deduction and wider income tax brackets among a number of other deductions and credits you wouldnt be able to claim as a single filer. For simple tax returns only. Although life insurance is already considered tax-advantaged, financial plans that make use of life insurance is viewed as non-qualified. The employee partner must reduce the employment-related expenses by any amounts he or she excludes from income under section 129 (exclusion for employees for dependent care assistance furnished pursuant to a program described in section 129(d)); The earned income limitation described in section 21(d) is determined without regard to community property laws; and. Their justification is that theres no need to continue offering the coverage now that same-sex partners can legally get hitched and become same-sex spouses. TurboTax Online: Important Details about Free Filing for Simple Tax Returns, See

WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). For questions or additional information regarding the domestic partnership program, you may contact the program office at (702) 486-2887 or email domesticpartnership@sos.nv.gov .  A taxpayer may not claim an adoption credit for the expenses of adopting the child of the taxpayers spouse (section 23). 1.6K views, 44 likes, 2 loves, 24 comments, 7 shares, Facebook Watch Videos from JoyNews: UPFront is live with Raymond Acquah on the JoyNews channel. Under IRS rules, domestic partners arent considered spouses if theyre not married under state law. 5 Ways to Diversify Your Workforce With AI, Speed Up the Hiring Process by Avoiding These 3 Traps. Once you identify someone as a dependent on your tax return, you're announcing to the IRS that you are financially responsible for another person. Domestic partners can be qualifying relatives under IRS rules if they meet the following criteria: TurboTax Tip: The IRS doesn't require a dependent to pass the age test for a qualifying relative, meaning the qualifying relative can be any age. 2002-69PDF allows spouses to classify certain entities solely owned by the spouses as community property, as either a disregarded entity or a partnership for federal tax purposes. If the includible education benefits are community income under state law, then they are community income for federal income tax purposes. Adding a domestic partner or non-dependent to your health insurance policy Adoption assistance surpassing the non-taxable amount Educational assistance surpassing the non-taxable amount Group term life insurance in excess of $50,000 Imputed income may also be used to determine an amount for child support payments. WebTo cover a domestic partner, members pay the same premium share for core benefits and the IRS doesn't view non-tax dependent domestic partners and their children the same as terry eldredge leaves grascals; punto blanco en la yema del huevo. Is there a family tax benefit to claiming dependents?

A taxpayer may not claim an adoption credit for the expenses of adopting the child of the taxpayers spouse (section 23). 1.6K views, 44 likes, 2 loves, 24 comments, 7 shares, Facebook Watch Videos from JoyNews: UPFront is live with Raymond Acquah on the JoyNews channel. Under IRS rules, domestic partners arent considered spouses if theyre not married under state law. 5 Ways to Diversify Your Workforce With AI, Speed Up the Hiring Process by Avoiding These 3 Traps. Once you identify someone as a dependent on your tax return, you're announcing to the IRS that you are financially responsible for another person. Domestic partners can be qualifying relatives under IRS rules if they meet the following criteria: TurboTax Tip: The IRS doesn't require a dependent to pass the age test for a qualifying relative, meaning the qualifying relative can be any age. 2002-69PDF allows spouses to classify certain entities solely owned by the spouses as community property, as either a disregarded entity or a partnership for federal tax purposes. If the includible education benefits are community income under state law, then they are community income for federal income tax purposes. Adding a domestic partner or non-dependent to your health insurance policy Adoption assistance surpassing the non-taxable amount Educational assistance surpassing the non-taxable amount Group term life insurance in excess of $50,000 Imputed income may also be used to determine an amount for child support payments. WebTo cover a domestic partner, members pay the same premium share for core benefits and the IRS doesn't view non-tax dependent domestic partners and their children the same as terry eldredge leaves grascals; punto blanco en la yema del huevo. Is there a family tax benefit to claiming dependents?  The rule allows the non-lender partners to continue being allocated basis from the nonrecourse loan owed to another partner (or partner affiliate) so long as the A13. Domestic partner taxation benefits are perhaps the biggest challenge employers face in offering this coverage. Test drive Paycor Payroll, Onboarding, HR, and Time for 14 days. Secure .gov websites use HTTPS

Unlike the requirements for section 152(d) (dependency deduction for a qualifying relative), section 105(b) does not require that Partner A's gross income be less than the exemption amount in order for Partner A to qualify as a dependent.

Proc. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. This credit begins to phase out if your adjusted gross income is greater than $200,000 for single filers. 1. Ann Arbor and East Lansing provide a registry. The California Family Code defines a domestic partnership as: 1) two adults of the same sex who have chosen to share one The ability to add a domestic partner to your health insurance coverage. x\[o~70Oikp%q8kiM$"(P3%

D

yf;gia*oW:Fee]\.[ Lock

What is a qualifying domestic partner?

The rule allows the non-lender partners to continue being allocated basis from the nonrecourse loan owed to another partner (or partner affiliate) so long as the A13. Domestic partner taxation benefits are perhaps the biggest challenge employers face in offering this coverage. Test drive Paycor Payroll, Onboarding, HR, and Time for 14 days. Secure .gov websites use HTTPS

Unlike the requirements for section 152(d) (dependency deduction for a qualifying relative), section 105(b) does not require that Partner A's gross income be less than the exemption amount in order for Partner A to qualify as a dependent.

Proc. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. This credit begins to phase out if your adjusted gross income is greater than $200,000 for single filers. 1. Ann Arbor and East Lansing provide a registry. The California Family Code defines a domestic partnership as: 1) two adults of the same sex who have chosen to share one The ability to add a domestic partner to your health insurance coverage. x\[o~70Oikp%q8kiM$"(P3%

D

yf;gia*oW:Fee]\.[ Lock

What is a qualifying domestic partner?  It can apply to couples who are not married but live together. The IRS rules for qualifying dependents cover a significant number of situations, but the basic rules will cover almost everyone. Effortless payroll. A8. Paycors compliance solutions help ensure accurate filing and mitigate risk. Because of this declaration, the IRS treats same-sex and opposite-sex marriages the same under federal tax law, and same-sex couples are also eligible for Social Security spousal benefits. If your employer pays for any part of your partners health insurance, that is taxable and will be reported on your W-2 as imputed income. Tax Tips When Sending Kids to Private or Public Schools.

It can apply to couples who are not married but live together. The IRS rules for qualifying dependents cover a significant number of situations, but the basic rules will cover almost everyone. Effortless payroll. A8. Paycors compliance solutions help ensure accurate filing and mitigate risk. Because of this declaration, the IRS treats same-sex and opposite-sex marriages the same under federal tax law, and same-sex couples are also eligible for Social Security spousal benefits. If your employer pays for any part of your partners health insurance, that is taxable and will be reported on your W-2 as imputed income. Tax Tips When Sending Kids to Private or Public Schools.  *Represents approximately 30,000 corporate clients covering 40,000 businesses employing people. WebIf the enrollees Domestic Partner is a non-federally qualified dependent, the fair market value cost of the Domestic Partners coverage is considered additional income to the enrollee. Are Domestic Partnership Benefits Mandatory? Limitations apply. The IRS says the following types of absences won't count against you: You don't need to be related to someone to claim them as a dependent on your tax return. For tax years prior to 2018, taxpayers were allowed to reduce their taxable income by a certain amount for each dependent claimed on a tax return. Share sensitive information only on official,

A11. Additional Services. Just answer simple questions, and well guide you through filing your taxes with confidence. what is a non qualified domestic partner. A6. Contact us today so we can learn more about your business. No. WebSection 152 Qualified and Non-Qualified Dependents: Health Insurance Deduction should be: Non-Qualified Domestic Partner and Qualified Dependent Child(ren) Employees portion Pre-Tax . In general, when a domestic partner is an employees Code 105(b) dependent, the domestic partners health coverage and benefits will be tax-free to the A QDRO helps to ensure that retirement plan and IRS rules are followed, to minimize tax liability and to provide a lump sum payment, regular payments or a designated share of retirement benefits. An insurance policy that is often A5. You may claim a domestic partner as a dependent if they meet the qualifying relative rules from the IRS. Paycors leadership brings together some of the best minds in the business. That means your withdrawal may be taxed like normal income. Get it done quickly and accurately, every time. A domestic partnership is an unmarried couple who live together and have an interest in receiving many of the same benefits a married couple receives, such as Theres never been a better time to join. Your registered domestic partner isnt one of the specified related individuals that qualifies you to file as Head of Household. File your own taxes with confidence using TurboTax. Learn a lot in a little bit of time with our HR explainers. Access collaboration tools and resources that help champion equality and promote DE&I best practices in the workplace. Error logging in.

*Represents approximately 30,000 corporate clients covering 40,000 businesses employing people. WebIf the enrollees Domestic Partner is a non-federally qualified dependent, the fair market value cost of the Domestic Partners coverage is considered additional income to the enrollee. Are Domestic Partnership Benefits Mandatory? Limitations apply. The IRS says the following types of absences won't count against you: You don't need to be related to someone to claim them as a dependent on your tax return. For tax years prior to 2018, taxpayers were allowed to reduce their taxable income by a certain amount for each dependent claimed on a tax return. Share sensitive information only on official,