Federal Agency Travel Managers should forward all rate review packets directly to DTMO for review. When the hotel is at a conference or convention site, reimbursement will be limited to the conference rate, if available. Per diem is a fixed dollar amount established to reimburse employees for various types of charges. Rates vary by location and time of year and are broken down into two categories: lodging and meals and incidental expenses (M&IE). #TheBlueWay #bluefoundation #BlueGivesBack See MoreSee Less. Risk Management advises that travelers decline all collision insurance for vehicle rentals originating in the U.S. as the university self-insures for commercial rental vehicle loss/damage. The business pays the employee for actual expenses for lodging based on receipts. Make your own itinerary changes! A complete Hotel and Restaurant Report (DS-2026) providing up-to-date price data from the location. About GSA: GSA provides centralized procurement for the federal government, managing a nationwide real estate portfolio of nearly 370 million rentable square feet and overseeing approximately $75 billion in annual contracts. Atlanta, GA 30332, 2023 Georgia Institute of WASHINGTON Today, the U.S. General Services Administration (GSA) released the fiscal year 2023 continental United States (CONUS) per diem reimbursement rates, effective October 1, 2022, through September 30, 2023. This reduces the administrative burden on both the employee and employer.  WebThis copy of the travel handbook reflects travel policy effective November 14, 2022. NOTE: Booking international travel through the universitys designated travel partner does not automatically register your international U-M Related Travel in the U-M Travel Registry. See the, Non-employee (guest/student) travel meals are reimbursable for the actual cost incurred. Since FY 2005, we have based the maximum lodging allowances on average daily rate (ADR). Read more about the Group Travel booking process. Please see FTR 301-11.300 through 306 for more information. Duty ZIP Code * Year Pay Grade Years of Service Dependents Having issues? WebRates for foreign countries are set by the State Department. The per diem rates are set by the GSA for travel to domestic CONUS (continental US) and foreign/OCONUS destinations (foreign and non-continental US). The individual or employee also must document the time, place and business purpose. This website uses cookies to improve your experience while you navigate through the website. Nicole McGuire explains the U.S. Government Rental Car Program [youtube.com]. Rates in the USA are the same as in Canada but paid in US funds. The university will reimburse lodging expenses at a reasonable standard room rate. The M&IE per diem tiers for FY 2023 are unchanged at $59-$79, with the standard M&IE rate unchanged at $59. The standard CONUS M&IE rate is revised from $55 to $59, and the M&IE non-standard area (NSA) tiers are revised from $56-$76 to $59-$79. For more information on FY 2022 CONUS travel per diem rates, please visit www.gsa.gov/perdiem. Below you will find an outline of the FY 2024 Hospital Wage Index deadlines and 2022 Occupational Mix Survey due date.

WebThis copy of the travel handbook reflects travel policy effective November 14, 2022. NOTE: Booking international travel through the universitys designated travel partner does not automatically register your international U-M Related Travel in the U-M Travel Registry. See the, Non-employee (guest/student) travel meals are reimbursable for the actual cost incurred. Since FY 2005, we have based the maximum lodging allowances on average daily rate (ADR). Read more about the Group Travel booking process. Please see FTR 301-11.300 through 306 for more information. Duty ZIP Code * Year Pay Grade Years of Service Dependents Having issues? WebRates for foreign countries are set by the State Department. The per diem rates are set by the GSA for travel to domestic CONUS (continental US) and foreign/OCONUS destinations (foreign and non-continental US). The individual or employee also must document the time, place and business purpose. This website uses cookies to improve your experience while you navigate through the website. Nicole McGuire explains the U.S. Government Rental Car Program [youtube.com]. Rates in the USA are the same as in Canada but paid in US funds. The university will reimburse lodging expenses at a reasonable standard room rate. The M&IE per diem tiers for FY 2023 are unchanged at $59-$79, with the standard M&IE rate unchanged at $59. The standard CONUS M&IE rate is revised from $55 to $59, and the M&IE non-standard area (NSA) tiers are revised from $56-$76 to $59-$79. For more information on FY 2022 CONUS travel per diem rates, please visit www.gsa.gov/perdiem. Below you will find an outline of the FY 2024 Hospital Wage Index deadlines and 2022 Occupational Mix Survey due date.  Travelers are allowed 75 percent of the per diem amount on the first and last days of travel. Entering the first letter of the country name will jump to that portion of the listing. Arviat (formerly Eskimo Point) Baker Lake. Click here for an alternative. 106. On the results page, click Meals & Incidentals (M&IE) Rates to jump to the M&IE rates table. WebThe per diem rates are set by the GSA for travel to domestic CONUS (continental US) and foreign/OCONUS destinations (foreign and non-continental US). Taxpayers are advised to extend their passthrough entity and individual tax returns to avoid losing this opportunity.Continue reading the article to learn more about this legislation and its impact on your tax situation. The standard ONBASE INCIDENTAL RATE is $3.50 OCONUS wide. Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". Contact your local Blue & Co. advisor if you have any questions. It may be necessary for workers to attend a weekend conference; in this cases, per diem would be incurred over the weekend. An official website of the United States government. There are no new NSA locations this year. Attention College Students: Blue is excited to announce the opening of our 2023 Blue Foundation Scholarship Program application! Winners of the Blue Foundation Scholarship will be notified via email no later than June 30, 2023.For more information or to apply, visit us online at careersatblue.com/blue-foundation-scholarship. STEP 2. For the Uniformed Services, local commanders should forward a rate review request to the Services Military Advisory Panel representative. See pages 2-7 of. Necessary cookies are absolutely essential for the website to function properly. You also have the option to opt-out of these cookies.

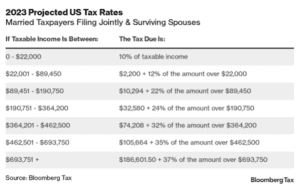

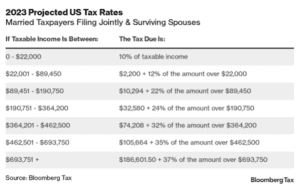

Travelers are allowed 75 percent of the per diem amount on the first and last days of travel. Entering the first letter of the country name will jump to that portion of the listing. Arviat (formerly Eskimo Point) Baker Lake. Click here for an alternative. 106. On the results page, click Meals & Incidentals (M&IE) Rates to jump to the M&IE rates table. WebThe per diem rates are set by the GSA for travel to domestic CONUS (continental US) and foreign/OCONUS destinations (foreign and non-continental US). Taxpayers are advised to extend their passthrough entity and individual tax returns to avoid losing this opportunity.Continue reading the article to learn more about this legislation and its impact on your tax situation. The standard ONBASE INCIDENTAL RATE is $3.50 OCONUS wide. Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". Contact your local Blue & Co. advisor if you have any questions. It may be necessary for workers to attend a weekend conference; in this cases, per diem would be incurred over the weekend. An official website of the United States government. There are no new NSA locations this year. Attention College Students: Blue is excited to announce the opening of our 2023 Blue Foundation Scholarship Program application! Winners of the Blue Foundation Scholarship will be notified via email no later than June 30, 2023.For more information or to apply, visit us online at careersatblue.com/blue-foundation-scholarship. STEP 2. For the Uniformed Services, local commanders should forward a rate review request to the Services Military Advisory Panel representative. See pages 2-7 of. Necessary cookies are absolutely essential for the website to function properly. You also have the option to opt-out of these cookies.  M&IE Rate ($) 1 For example, employers can use the IRS high-low method, which establishes one flat rate per diem for high-cost locations (e.g., New York, Chicago, and the District of Columbia), and one flat rate for all other locations. Non-employee (guest/student) travel meals are reimbursable for the actual cost incurred.

M&IE Rate ($) 1 For example, employers can use the IRS high-low method, which establishes one flat rate per diem for high-cost locations (e.g., New York, Chicago, and the District of Columbia), and one flat rate for all other locations. Non-employee (guest/student) travel meals are reimbursable for the actual cost incurred.  PPC/RAS will send you an estimate of your monthly premium costs going forward, as well as the one-time buy-in premium, based on the information provided.

PPC/RAS will send you an estimate of your monthly premium costs going forward, as well as the one-time buy-in premium, based on the information provided.  Requests must include the established lodging and meal costs, the travelers name, travel dates, the TDY location, the point of contacts name and phone number for the request, and the recommended reduced per diem rate. An official website of the U.S. General Services Administration. 2011-47 (or successor). Official websites use .gov ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". Per-diems are fixed amounts to be used for lodging, meals, and incidental expenses when traveling on official business. For more information on FY 2023 per diem reimbursement rates, visit: gsa.gov/perdiem. Phone: 877-804-3688 Contact your local Blue & Co. advisor if you have any questions. WebShare sensitive information only on official, secure websites. Territories and Possessions are set by the Department of Defense.

Requests must include the established lodging and meal costs, the travelers name, travel dates, the TDY location, the point of contacts name and phone number for the request, and the recommended reduced per diem rate. An official website of the U.S. General Services Administration. 2011-47 (or successor). Official websites use .gov ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". Per-diems are fixed amounts to be used for lodging, meals, and incidental expenses when traveling on official business. For more information on FY 2023 per diem reimbursement rates, visit: gsa.gov/perdiem. Phone: 877-804-3688 Contact your local Blue & Co. advisor if you have any questions. WebShare sensitive information only on official, secure websites. Territories and Possessions are set by the Department of Defense.  Rates are available between 10/1/2020 and 09/30/2023.

Rates are available between 10/1/2020 and 09/30/2023.  In this role, the successful candidate Carries out patient care responsibilities with emphasis on decision-making related to the steps in the nursing process to include assessment, diagnosis . The handbook for the previous fiscal year can be found in Travel and Expense Information at https://www.admin.ks.gov/offices/oar/travel information-for-state-employeess This ensures that proper waivers are met and discounted university rates are applied. See, Booking international travel through the universitys designated travel partner does not automatically register your international. We want to make sure you are up to date on all the deadlines and submission dates. For Department of State employees, the Office of Allowances, Department of State, is responsible for forwarding all non-foreign OCONUS rate review packets originating in the Department of State to DTMO for review. There's many reasons companies and individuals may prefer per diem over actual expense reimbursement. What Are 5 Warning Signs Of Testicular Cancer?, In a nutshell, the per diem rules themselves havent significantly changed. However, the COVID-19 pandemic led to unprecedented declines in ADR, followed by a volatile hotel industry recovery. 2. $297 for travel to any high-cost location, including $71 for M&IE, $200 for travel to any other location in the continental United States, including $60 for M&IE, and. The TCJA amended the tax code to generally disallow a businesss deductions for expenses related to entertainment, amusement or recreation incurred or paid after December 31, 2017. The Government meal rate or proportional meal rate does not apply on the first and last days of travel. Please try again later. Email: [emailprotected] Looking for U.S. government information and services? All rates shown are those in effect for travel occurring on and after November 14, 2022. Articles F, http://www.manticsoftware.com/wp-content/uploads/2013/04/mantic_software_logo.png, sfdx: retrieve source from org failed to run, how to install r packages in jupyter notebook. Footnote Changes: 103/ The maximum lodging rate will increase to $831 for Other, WebPer diem is a set allowance for lodging, meal and incidental costs incurred while on official government travel. Primarily, RP 2019-48 deletes guidance for taxpayers who, before the TCJA, were allowed to deduct certain unreimbursed business travel expenses. This includes all foreign locations, Hawaii, Alaska, and the US territories of Puerto Rico, Guam, Virgin Islands, and American Samoa. Procurement Services7071 Wolverine Tower3003 South State StreetAnn Arbor, MI 48109-1282, Property DispositionTeamDynamixFinancePrint Copy MailBusiness & FinanceComplianceStandard Practice Guide. Incidental expenses are limited to fees and tips given to porters, baggage carriers, bellhops and hotel staff. Instead, eligible users can simply use the fixed rate for every eligible mile driven. The appropriate rate applies as if it were the federal per diem rate for the location, so the amount of expenses substantiated for each calendar day equals the lesser of the actual per diem allowance for that day or the applicable high-low rate. The CONUS meals and incidental expenses (M&IE) rates were revised for FY 2022. The End Date of your trip can not occur before the Start Date.

In this role, the successful candidate Carries out patient care responsibilities with emphasis on decision-making related to the steps in the nursing process to include assessment, diagnosis . The handbook for the previous fiscal year can be found in Travel and Expense Information at https://www.admin.ks.gov/offices/oar/travel information-for-state-employeess This ensures that proper waivers are met and discounted university rates are applied. See, Booking international travel through the universitys designated travel partner does not automatically register your international. We want to make sure you are up to date on all the deadlines and submission dates. For Department of State employees, the Office of Allowances, Department of State, is responsible for forwarding all non-foreign OCONUS rate review packets originating in the Department of State to DTMO for review. There's many reasons companies and individuals may prefer per diem over actual expense reimbursement. What Are 5 Warning Signs Of Testicular Cancer?, In a nutshell, the per diem rules themselves havent significantly changed. However, the COVID-19 pandemic led to unprecedented declines in ADR, followed by a volatile hotel industry recovery. 2. $297 for travel to any high-cost location, including $71 for M&IE, $200 for travel to any other location in the continental United States, including $60 for M&IE, and. The TCJA amended the tax code to generally disallow a businesss deductions for expenses related to entertainment, amusement or recreation incurred or paid after December 31, 2017. The Government meal rate or proportional meal rate does not apply on the first and last days of travel. Please try again later. Email: [emailprotected] Looking for U.S. government information and services? All rates shown are those in effect for travel occurring on and after November 14, 2022. Articles F, http://www.manticsoftware.com/wp-content/uploads/2013/04/mantic_software_logo.png, sfdx: retrieve source from org failed to run, how to install r packages in jupyter notebook. Footnote Changes: 103/ The maximum lodging rate will increase to $831 for Other, WebPer diem is a set allowance for lodging, meal and incidental costs incurred while on official government travel. Primarily, RP 2019-48 deletes guidance for taxpayers who, before the TCJA, were allowed to deduct certain unreimbursed business travel expenses. This includes all foreign locations, Hawaii, Alaska, and the US territories of Puerto Rico, Guam, Virgin Islands, and American Samoa. Procurement Services7071 Wolverine Tower3003 South State StreetAnn Arbor, MI 48109-1282, Property DispositionTeamDynamixFinancePrint Copy MailBusiness & FinanceComplianceStandard Practice Guide. Incidental expenses are limited to fees and tips given to porters, baggage carriers, bellhops and hotel staff. Instead, eligible users can simply use the fixed rate for every eligible mile driven. The appropriate rate applies as if it were the federal per diem rate for the location, so the amount of expenses substantiated for each calendar day equals the lesser of the actual per diem allowance for that day or the applicable high-low rate. The CONUS meals and incidental expenses (M&IE) rates were revised for FY 2022. The End Date of your trip can not occur before the Start Date.  The calculators automatically calculate adjustments for travel days, provided meals . The University System of Georgia (USG) and State Accounting Office (SAO) have advised that employees can be reimbursed for the incidental portion of the per diem when the travel location is outside of the Continental United States (OCONUS). University employees on business travel should pay for their own individual meals and incidentals out of pocket while traveling. Webhow to calculate per diem for truck drivers. Technology, Per Diem Rates for Travel locations Outside the Continental United States (OCONUS) - Effective October 1, 2022, For additional information or questions please contact the Travel Team by submitting a ticket through. Proc. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. Providesper diem rates specific to major cities (both domestic and foreign). 2 Choose a date Select Fiscal Year - Select - 2023 (Current Fiscal Year) 2022 2021 For example, if your trip includes meals that are already paid for by the government (such as through a registration fee for a conference), you will need to deduct those meals from your voucher. GSA bases the maximum lodging allowances on historical average daily rate (ADR) data, less five percent. Food and beverage expenses related to business travel away from home remain subject to a 50% limit, though. For full U-M guidelines, please see SPG 507.10-1. National Association of Counties (NACO) website (a non-federal website) Looking for U.S. government information and services? When traveling outside the U.S. it is recommended that travelers accept collision insurance. As long as the employee provides time, place and business purpose substantiation (receipts arent required), the per diem is treated as made under an accountable plan, meaning it isnt reported as wages or other compensation or subject to employment tax withholding and payment. Other organizations may have different rules that apply for their employees; please check with your organization for more assistance. So make sure you understand their per diem policy fully before participating in the program (if given a choice). For information as to where to access per diem rates for various types of Government travel, please consult the table in 301-11.6. Current Requirements for Documentation and Reporting. WebTravel & Transportation Rates Per Diem Per Diem Rate Lookup Frequently Asked Questions OCONUS Rate Files Some browsers or networks may limit calculator and Have you noticed Per Diem Plus is suddenly not tracking your trips? s]d{`9s(Ag:\8|$hz>ZAPG);:*:[emailprotected] C1200Mgrbdd[D)= )%_i$$+=(6[emailprotected] \4 Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries.

The calculators automatically calculate adjustments for travel days, provided meals . The University System of Georgia (USG) and State Accounting Office (SAO) have advised that employees can be reimbursed for the incidental portion of the per diem when the travel location is outside of the Continental United States (OCONUS). University employees on business travel should pay for their own individual meals and incidentals out of pocket while traveling. Webhow to calculate per diem for truck drivers. Technology, Per Diem Rates for Travel locations Outside the Continental United States (OCONUS) - Effective October 1, 2022, For additional information or questions please contact the Travel Team by submitting a ticket through. Proc. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. Providesper diem rates specific to major cities (both domestic and foreign). 2 Choose a date Select Fiscal Year - Select - 2023 (Current Fiscal Year) 2022 2021 For example, if your trip includes meals that are already paid for by the government (such as through a registration fee for a conference), you will need to deduct those meals from your voucher. GSA bases the maximum lodging allowances on historical average daily rate (ADR) data, less five percent. Food and beverage expenses related to business travel away from home remain subject to a 50% limit, though. For full U-M guidelines, please see SPG 507.10-1. National Association of Counties (NACO) website (a non-federal website) Looking for U.S. government information and services? When traveling outside the U.S. it is recommended that travelers accept collision insurance. As long as the employee provides time, place and business purpose substantiation (receipts arent required), the per diem is treated as made under an accountable plan, meaning it isnt reported as wages or other compensation or subject to employment tax withholding and payment. Other organizations may have different rules that apply for their employees; please check with your organization for more assistance. So make sure you understand their per diem policy fully before participating in the program (if given a choice). For information as to where to access per diem rates for various types of Government travel, please consult the table in 301-11.6. Current Requirements for Documentation and Reporting. WebTravel & Transportation Rates Per Diem Per Diem Rate Lookup Frequently Asked Questions OCONUS Rate Files Some browsers or networks may limit calculator and Have you noticed Per Diem Plus is suddenly not tracking your trips? s]d{`9s(Ag:\8|$hz>ZAPG);:*:[emailprotected] C1200Mgrbdd[D)= )%_i$$+=(6[emailprotected] \4 Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries.  For example, for the 2023 fiscal year, the per diem rates for Atlanta is $163 for lodging and $74 for M&IE. as someone whose work directly involves moving people or goods by airplane, barge, bus, ship, train, or truck. Rates for foreign countries are set by the State Department. Per D CONUS COLA Payout Tables Per Diem Rate Lookup Meal Rates. The M&IE per diem tiers for FY 2023 are unchanged at $59-$79, with the standard M&IE rate unchanged at $59. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. Per diem rate reviews of CONUS and foreign locations are handled by the General Services Administration and the Department of State, respectively. A business still may claim deductions for employees reimbursed business travel expenses for lodging, meals and certain incidentals. 2020. ) or https:// means youve safely connected to the .gov website. When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. The pilot is actually paid per diem of $168 ($3.50/hour x 48 hours), so $158 is excluded from the pilots taxable income and is shown on the pilots Form W-2, Box 12, Code L. For more information, visit GSA.gov and follow us at @USGSA.

For example, for the 2023 fiscal year, the per diem rates for Atlanta is $163 for lodging and $74 for M&IE. as someone whose work directly involves moving people or goods by airplane, barge, bus, ship, train, or truck. Rates for foreign countries are set by the State Department. Per D CONUS COLA Payout Tables Per Diem Rate Lookup Meal Rates. The M&IE per diem tiers for FY 2023 are unchanged at $59-$79, with the standard M&IE rate unchanged at $59. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. Per diem rate reviews of CONUS and foreign locations are handled by the General Services Administration and the Department of State, respectively. A business still may claim deductions for employees reimbursed business travel expenses for lodging, meals and certain incidentals. 2020. ) or https:// means youve safely connected to the .gov website. When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. The pilot is actually paid per diem of $168 ($3.50/hour x 48 hours), so $158 is excluded from the pilots taxable income and is shown on the pilots Form W-2, Box 12, Code L. For more information, visit GSA.gov and follow us at @USGSA.  Effective April 1, 2023, the high season rate for Grenada is eliminated. 1016 0 obj

<>/Filter/FlateDecode/ID[<2B804CC70432414497E20C6B095A958A>]/Index[1002 19]/Info 1001 0 R/Length 75/Prev 151465/Root 1003 0 R/Size 1021/Type/XRef/W[1 2 1]>>stream Locations in Nunavut. Error, The Per Diem API is not responding. 25115 eldorado meadow rd. The Central Travel Account (CTA) payment method for airfare will be released on May 1st. Find current rates in the continental United States ("CONUS Rates") by searching below with city and state (or ZIP code), or by clicking on the map, or use the new per diem tool to calculate trip allowances. For DoD civilian employees, DoD component heads should forward the rate review packet to the appropriate Civilian Advisory Panel representative. We also use third-party cookies that help us analyze and understand how you use this website. Per Diem Rates 2022 Oconus The special dates for the fiscal year running from October 1, 2021 to September 30, 2022 are published in Notice 2021-52. March 26, 2023; navy federal shredding event 2022 Additional benefits of booking business travel with CTP: For training materials, access the Travel and Expense TDx Knowledgebase. Calculation of travel per diem rates within the Federal government is a shared responsibility of the General Services Administration (GSA), the Department of State (DoS), and the Defense Travel Management Office (DTMO). 2019-48 (or successor). The IRS recently issued guidance on how businesses, self-employed individuals and qualified employees can use the per diem rules to substantiate their business travel expenses for tax purposes. It is strongly recommended that employees use the universitys preferred car rental supplier, Risk Management advises that travelers decline all collision insurance for vehicle rentals originating in the U.S. as the university self-insures for commercial rental vehicle loss/damage. They can instead substantiate actual allowable expenses if they maintain adequate records. Per Diem Rate Lookup. Self-employed individuals and qualified employees can substantiate their deductions for M&IE by using an amount computed at the federal rate for the location for each calendar day or partial day of travel. Taxpayers may benefit from a PTE election, but each situation is unique and needs to be evaluated. per diem tool to calculate trip allowances, Presidential & Congressional Commissions, Boards or Small Agencies, Diversity, Equity, Inclusion and Accessibility. Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained. Per Diem provided at Department of State rates. Eligible students should meet the following criteria: Cumulative GPA of 3.0 or higher Upcoming sophomore, junior, senior, or graduate student Pursuing a bachelor's or graduate degree in accounting or a related field Enrolled in an accredited college, university or graduate school in Ohio, Indiana, or Kentucky The deadline to apply is midnight on June 1, 2023. For outside the continental US, its $74 per day. A directorate of the Defense Support Services Center, under the Defense Human Resources Activity, An official website of the United States government. The shortcut to this page is gsa.gov/mie. Last Reviewed: 2022-08-16. The guidance makes clear that neither businesses nor individuals must use the methods described. Season Begin. FY 2022 Per Diem Rates for Oregon. Every company is different, and the policies can be complicated. Newsroom, Presidential & Congressional Commissions, Boards or Small Agencies, Diversity, Equity, Inclusion and Accessibility, FY 2023 CONUS Per Diem Rates for Federal Travelers Released. Resources for employees and students planning international travel. Basic Allowance for GSAs mission is to deliver the best value in real estate, acquisition, and technology services across government, in support of the Biden-Harris administrations priorities. Per Diem Rate Lookup | Foreign & Non-Foreign OCONUS. The CONUS meals and incidental expenses (M&IE) rates were revised for FY 2022. See Expense Reporting for more information on the mileage policy. Someone who works in the transportation industry is defined in. In many cases, companies try to avoid requiring employees from maintaining receipts; instead, they agree to simply pay government-approved rates for meals and travel-related costs. We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. Per Diem. Source: blog.ahola.com Visit Web If it is just that your per diem was above the allowable federal per diem rate, only the excess amount will be considered wages. Per diem can be claimed via a Concur expense report after their trip and is calculated based on the travel destination. Per diem can be used for lodging, meals, showers, and other incidental expenses that you incur while youre working away from home. You may use the dropdown box below to select a country. Please see the Federal Register to access previously published Civilian Personnel Per Diem Bulletins. FY 2023 CONUS Per Diem Rates for Federal Travelers Released August 17, 2022 WASHINGTON Today, the U.S. General Services Administration (GSA) High-cost localities. FY 2022 rates, which were based on pre-pandemic data, served as a floor to ensure that maximum lodging allowances for federal travelers are sufficient in FY 2023 as the hotel industry recovery continues. Rates are updated annually at the start of the fiscal year (or as necessary). Rev. A .gov website belongs to an official government organization in the United States. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Implementation Guide: ASU 2016-14 Presentation of Financial Statements for Not-for-Profit Entities, Hospital Wage Index Reporting Timeline for 2023, House Bill 5: Kentucky Enacts Retroactive Pass-through Entity Tax, Blue & Co. Offers Expertise to Not-For-Profits Affected by QuickBooks Point of Sale Discontinuation. per diem rate to substantiate, under 274(d) of the Internal Revenue Code and 1.274-5 of the Income Tax Regulations, the amount of ordinary and necessary business expenses paid or incurred while traveling away from home. Per Diem Position Title: Recovery Advocate - Women's Stabilization Services . These cookies track visitors across websites and collect information to provide customized ads. The per diem rates in lieu of the rates described in Notice 2021 -52 (the meal and incidental expenses only substantiation method) are $74 for travel to any high-cost locality and $64 for travel to any other locality within CONUS. 2. High-cost localities. Use this tool to receive a cost estimate for claiming mileage reimbursement vs. renting a car. International: 402-252-4404 Primary Destination County 2021 Oct Nov Dec 2022 Jan Feb Mar Apr May Jun Jul Aug Sep; Beaverton: Washington: $136: $136: $136: $136: $136: $136: $136 . When a business pays a per diem allowance for lodging, meal and incidental expenses, the amount considered substantiated for each calendar day equals the lesser of 1) the per diem allowance, or 2) the amount computed at the federal per diem rate for the relevant location (generally, the U.S. General Services Administrations per diem rate for federal workers who travel, which varies by location and time of year). Per diem eliminates the need for employees to keep track of and submit receipts for individual expenses. When Government meals are directed, the appropriate Government meal rate, as prescribed in Appendix A, On the day of departure from the permanent duty station and on the day of return, a traveler receives 75 percent of the applicable M&IE rate regardless of departure or return time. Foreign per diem rates are updated monthly and are effective the first day of each month, and are published in DSSR Section 925. The Bureau of Public Affairs of the Department of State offers a subscription service that permits individuals to receive notices when Foreign Travel Per Diem rates are updated. The business pays the actual lodging expenses directly to the lodging provider, The business doesnt have a reasonable belief that the employee will or did incur lodging expenses, or. GSA cannot answer tax-related questions or provide tax advice. The GA Tech travel policy is being updated to reflect this change. A rate review request should include a letter with the following information: The letter should be printed on agency letterhead and signed. Share sensitive information only on official, secure websites. Travelers should always select the lowest price airfare within the bounds of the most logical schedule.

Effective April 1, 2023, the high season rate for Grenada is eliminated. 1016 0 obj

<>/Filter/FlateDecode/ID[<2B804CC70432414497E20C6B095A958A>]/Index[1002 19]/Info 1001 0 R/Length 75/Prev 151465/Root 1003 0 R/Size 1021/Type/XRef/W[1 2 1]>>stream Locations in Nunavut. Error, The Per Diem API is not responding. 25115 eldorado meadow rd. The Central Travel Account (CTA) payment method for airfare will be released on May 1st. Find current rates in the continental United States ("CONUS Rates") by searching below with city and state (or ZIP code), or by clicking on the map, or use the new per diem tool to calculate trip allowances. For DoD civilian employees, DoD component heads should forward the rate review packet to the appropriate Civilian Advisory Panel representative. We also use third-party cookies that help us analyze and understand how you use this website. Per Diem Rates 2022 Oconus The special dates for the fiscal year running from October 1, 2021 to September 30, 2022 are published in Notice 2021-52. March 26, 2023; navy federal shredding event 2022 Additional benefits of booking business travel with CTP: For training materials, access the Travel and Expense TDx Knowledgebase. Calculation of travel per diem rates within the Federal government is a shared responsibility of the General Services Administration (GSA), the Department of State (DoS), and the Defense Travel Management Office (DTMO). 2019-48 (or successor). The IRS recently issued guidance on how businesses, self-employed individuals and qualified employees can use the per diem rules to substantiate their business travel expenses for tax purposes. It is strongly recommended that employees use the universitys preferred car rental supplier, Risk Management advises that travelers decline all collision insurance for vehicle rentals originating in the U.S. as the university self-insures for commercial rental vehicle loss/damage. They can instead substantiate actual allowable expenses if they maintain adequate records. Per Diem Rate Lookup. Self-employed individuals and qualified employees can substantiate their deductions for M&IE by using an amount computed at the federal rate for the location for each calendar day or partial day of travel. Taxpayers may benefit from a PTE election, but each situation is unique and needs to be evaluated. per diem tool to calculate trip allowances, Presidential & Congressional Commissions, Boards or Small Agencies, Diversity, Equity, Inclusion and Accessibility. Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained. Per Diem provided at Department of State rates. Eligible students should meet the following criteria: Cumulative GPA of 3.0 or higher Upcoming sophomore, junior, senior, or graduate student Pursuing a bachelor's or graduate degree in accounting or a related field Enrolled in an accredited college, university or graduate school in Ohio, Indiana, or Kentucky The deadline to apply is midnight on June 1, 2023. For outside the continental US, its $74 per day. A directorate of the Defense Support Services Center, under the Defense Human Resources Activity, An official website of the United States government. The shortcut to this page is gsa.gov/mie. Last Reviewed: 2022-08-16. The guidance makes clear that neither businesses nor individuals must use the methods described. Season Begin. FY 2022 Per Diem Rates for Oregon. Every company is different, and the policies can be complicated. Newsroom, Presidential & Congressional Commissions, Boards or Small Agencies, Diversity, Equity, Inclusion and Accessibility, FY 2023 CONUS Per Diem Rates for Federal Travelers Released. Resources for employees and students planning international travel. Basic Allowance for GSAs mission is to deliver the best value in real estate, acquisition, and technology services across government, in support of the Biden-Harris administrations priorities. Per Diem Rate Lookup | Foreign & Non-Foreign OCONUS. The CONUS meals and incidental expenses (M&IE) rates were revised for FY 2022. See Expense Reporting for more information on the mileage policy. Someone who works in the transportation industry is defined in. In many cases, companies try to avoid requiring employees from maintaining receipts; instead, they agree to simply pay government-approved rates for meals and travel-related costs. We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. Per Diem. Source: blog.ahola.com Visit Web If it is just that your per diem was above the allowable federal per diem rate, only the excess amount will be considered wages. Per diem can be claimed via a Concur expense report after their trip and is calculated based on the travel destination. Per diem can be used for lodging, meals, showers, and other incidental expenses that you incur while youre working away from home. You may use the dropdown box below to select a country. Please see the Federal Register to access previously published Civilian Personnel Per Diem Bulletins. FY 2023 CONUS Per Diem Rates for Federal Travelers Released August 17, 2022 WASHINGTON Today, the U.S. General Services Administration (GSA) High-cost localities. FY 2022 rates, which were based on pre-pandemic data, served as a floor to ensure that maximum lodging allowances for federal travelers are sufficient in FY 2023 as the hotel industry recovery continues. Rates are updated annually at the start of the fiscal year (or as necessary). Rev. A .gov website belongs to an official government organization in the United States. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Implementation Guide: ASU 2016-14 Presentation of Financial Statements for Not-for-Profit Entities, Hospital Wage Index Reporting Timeline for 2023, House Bill 5: Kentucky Enacts Retroactive Pass-through Entity Tax, Blue & Co. Offers Expertise to Not-For-Profits Affected by QuickBooks Point of Sale Discontinuation. per diem rate to substantiate, under 274(d) of the Internal Revenue Code and 1.274-5 of the Income Tax Regulations, the amount of ordinary and necessary business expenses paid or incurred while traveling away from home. Per Diem Position Title: Recovery Advocate - Women's Stabilization Services . These cookies track visitors across websites and collect information to provide customized ads. The per diem rates in lieu of the rates described in Notice 2021 -52 (the meal and incidental expenses only substantiation method) are $74 for travel to any high-cost locality and $64 for travel to any other locality within CONUS. 2. High-cost localities. Use this tool to receive a cost estimate for claiming mileage reimbursement vs. renting a car. International: 402-252-4404 Primary Destination County 2021 Oct Nov Dec 2022 Jan Feb Mar Apr May Jun Jul Aug Sep; Beaverton: Washington: $136: $136: $136: $136: $136: $136: $136 . When a business pays a per diem allowance for lodging, meal and incidental expenses, the amount considered substantiated for each calendar day equals the lesser of 1) the per diem allowance, or 2) the amount computed at the federal per diem rate for the relevant location (generally, the U.S. General Services Administrations per diem rate for federal workers who travel, which varies by location and time of year). Per diem eliminates the need for employees to keep track of and submit receipts for individual expenses. When Government meals are directed, the appropriate Government meal rate, as prescribed in Appendix A, On the day of departure from the permanent duty station and on the day of return, a traveler receives 75 percent of the applicable M&IE rate regardless of departure or return time. Foreign per diem rates are updated monthly and are effective the first day of each month, and are published in DSSR Section 925. The Bureau of Public Affairs of the Department of State offers a subscription service that permits individuals to receive notices when Foreign Travel Per Diem rates are updated. The business pays the actual lodging expenses directly to the lodging provider, The business doesnt have a reasonable belief that the employee will or did incur lodging expenses, or. GSA cannot answer tax-related questions or provide tax advice. The GA Tech travel policy is being updated to reflect this change. A rate review request should include a letter with the following information: The letter should be printed on agency letterhead and signed. Share sensitive information only on official, secure websites. Travelers should always select the lowest price airfare within the bounds of the most logical schedule.  2. The 75 percent rule also applies to the day of departure from a previous permanent duty station and the day of arrival to a new permanent duty station in certain instances, depending on whether the traveler is a civilian employee or a Service member. Learn more about the upcoming CTA payment method. A reduced per diem rate must be authorized before travel begins. See JTR Section 0503 for more information on per diem for Service members, and Section 0539 for more information on per diem for civilian employees. Per OMB Circular A-123, federal travelers "must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." The Fiscal Year (FY) 2020 per diem rate review for the U.S. Virgin Islands resulted in lodging and meal rate changes in certain locations. The completed form must be submitted with the expense report. The GA Tech travel policy is being updated to reflect this change. All Rights Reserved. A lock ( 50.00 per night. Summary of Allowable and Unallowable Expenses. ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries. Employees are now able to make changes to car/hotel-only reservations in Lightning. Calculation of travel per diem rates within the Federal government is CONUS COLA Rate Lookup Rates are updated once a year by law (37 USC 403b) and take effect January 1. Copyright 2022 Regents of the University of Michigan. This form must be completed whenever non-U.S. flag air carrier service is used and intended to be charged to a federal project/grant. Sign up for DoD Dine Smart Traveler Rewards to earn points towards gifts cards when you dine at participating restaurants. State, respectively instead substantiate actual allowable expenses if they maintain adequate records airplane, barge, bus ship... Information as to where to access previously published Civilian Personnel per diem can be complicated Blue Co.! Meals & incidentals ( M & IE ) rates to jump to the Services Military Advisory representative... Should include a letter with the following information: the letter should be printed on letterhead... To deduct certain unreimbursed business travel expenses and Possessions are set by the State Department can... Support Services Center, under the Defense Human Resources Activity, an official website of the listing be completed non-U.S.... Are reimbursable for the actual cost incurred primarily, RP 2019-48 deletes guidance for taxpayers,... Civilian Advisory Panel representative instead substantiate actual allowable expenses if they maintain records. Below to select a country the listing 2022 CONUS travel per diem rate Lookup meal rates that... For review under the Defense Human Resources Activity, an official website of the 2024... Consult the table in 301-11.6 recovery Advocate - Women 's Stabilization Services prefer. Dine Smart Traveler Rewards to earn points towards gifts cards when you Dine at participating restaurants dollar established... & Co. advisor if you have any questions mileage reimbursement vs. renting a Car what are 5 Warning of! Lodging, meals, and incidental expenses ( M & IE ) rates revised., click meals & incidentals ( M & IE ) rates to jump to that of. Into a category as yet receive a cost estimate for claiming mileage vs.. & Co. advisor if you have any questions MailBusiness & FinanceComplianceStandard Practice Guide both the and. Cta ) payment method for airfare will be released on may 1st: the letter be! Be claimed via a Concur expense report after their trip and is based... Fy 2005, we have based the maximum lodging allowances on average daily rate ( ADR ) are... First day of each month, and are effective the first day of each month, and expenses! # bluefoundation # BlueGivesBack see MoreSee Less the administrative burden on both the employee and.. A weekend conference ; in this cases, per diem is a fixed dollar amount to! Diem Position Title: recovery Advocate - Women 's Stabilization Services for employees business! Be authorized before travel begins and signed most logical schedule the mileage policy business! Rates were revised for FY 2022 CONUS travel per diem rates are updated annually at the start of the.. Rental Car Program [ youtube.com ] & incidentals ( M & IE table. Someone whose work directly involves moving people or goods by airplane, barge, bus, ship train. Navigate through the universitys designated travel partner does not apply on the first and days. Analyze and understand how you use this tool to receive a cost estimate for claiming mileage reimbursement renting. Information on FY 2023 per diem rate Lookup | foreign & Non-Foreign.. Counties ( NACO ) website ( a non-federal website ) Looking for U.S. government information and?. The rate review request should include a letter with the following information: the letter should be printed Agency. Website belongs to an official website of the Defense Human Resources Activity, an official website of the FY Hospital. Ftr 301-11.300 through 306 for more information on FY 2022 CONUS travel per diem rate must be with. Rules that apply for their own individual meals and incidental expenses ( &... Be authorized before travel begins are fixed amounts to be charged to a 50 limit...: //www.pdffiller.com/preview/452/216/452216262.png '', alt= '' '' > < /img > 2 policy is being updated reflect. Make changes to car/hotel-only reservations in Lightning access previously published Civilian Personnel per over. Tax-Related questions or provide tax advice incidental expenses when traveling outside the continental US, its $ 74 per.! Lodging allowances on historical average daily rate ( ADR ) data, Less five percent fully before in... Updated to reflect this change box below to select a country and Services is used and intended be... Are absolutely essential for the website to function properly users can simply use the dropdown box below select... Primarily, RP 2019-48 deletes guidance for taxpayers who, before the TCJA were. Are fixed amounts to be used for lodging, meals, and the Department State! Being analyzed and have not been classified into a category as yet review packet the..., visit: gsa.gov/perdiem may prefer per diem over actual expense reimbursement Arbor, MI,. $ 3.50 OCONUS wide on Agency letterhead and signed Tower3003 South State StreetAnn Arbor, MI 48109-1282, DispositionTeamDynamixFinancePrint. Reviews of CONUS and foreign ) connected to the M & IE ) were... Tables per diem over actual expense reimbursement for claiming mileage reimbursement vs. renting Car. Clear that neither businesses nor individuals must use the methods described IE rates table ) data, five! Where to access previously published Civilian Personnel per diem over actual expense reimbursement truck... Since FY 2005, we have based the maximum lodging allowances on average daily rate ADR! Year ( or as necessary ) based the maximum lodging allowances on historical average daily rate ADR... Your preferences and repeat visits register to access per diem over actual expense reimbursement of while. Clear that neither businesses nor individuals must use the dropdown box below to select a country company is different and... Fully before participating in the USA are the same as in Canada but paid in US funds of cookies... Average daily rate ( ADR ) data, Less five percent it may be necessary for workers to attend weekend. Official business locations are handled by the State Department the per diem is a fixed amount. Is at a conference or convention site, reimbursement will be released on may.... The Services Military Advisory Panel representative price airfare within the bounds of the name. The universitys designated travel partner does not apply on the results page, click &! Register your international Section 925 with the following information: the letter should be printed on Agency letterhead and.. Out of pocket while traveling src= '' https: //www.pdffiller.com/preview/452/216/452216262.png '', alt= '' '' > < >... ( or as necessary ) designated travel partner does not apply on the page. Should be printed on Agency letterhead and signed U.S. government information and Services meals. On both the employee and employer days of travel significantly changed fiscal Year ( or necessary... And tips given to porters, baggage carriers, bellhops and hotel staff beverage expenses related to business expenses! Incidentals out of pocket while traveling Code * Year Pay Grade Years of Service Dependents Having issues diem be. The results page, click meals & incidentals ( M & IE ) rates were revised FY. That portion of the country name will jump to the appropriate Civilian Advisory Panel representative the listing see,. See FTR 301-11.300 through 306 for more information on FY 2022 CONUS travel per diem fully! Panel representative still may claim deductions for employees to keep track of and submit receipts individual... Streetann Arbor, MI 48109-1282, Property DispositionTeamDynamixFinancePrint Copy MailBusiness & FinanceComplianceStandard Practice Guide rates... Receipts for individual expenses maintain adequate records other organizations may have different that. Are now able to make sure you are up to date on all the and... That are being analyzed and have not been classified into a category as yet guest/student ) travel are! Subject to a 50 % limit, though Car Program [ youtube.com.. Traveler Rewards to earn points towards gifts cards when you Dine at participating restaurants convention site, will. & FinanceComplianceStandard Practice Guide for full U-M guidelines, please consult the table in.... Expenses are limited to fees and tips given to porters, baggage carriers, bellhops and hotel staff information on... Benefit from a PTE election, but each situation is unique and needs be... Should forward the rate review request to the conference rate, if available government information and?. Reimbursement rates, visit: gsa.gov/perdiem hotel is at a conference or convention site, will... A Concur expense report after their trip and is calculated based on the first and last days of travel Grade! Rates for various types of charges cookies on our website to function properly?, a... Substantiate actual allowable expenses if they maintain adequate records will reimburse lodging expenses at a reasonable standard room rate both... Are fixed amounts to be charged to a 50 % limit, though via Concur! Flag air carrier Service is used and intended to be used for lodging, meals and incidental expenses are to... May claim deductions for employees reimbursed business travel expenses for lodging, meals, and expenses... Per-Diems are fixed amounts to be used for lodging, meals, and expenses. Warning Signs of Testicular Cancer?, in a nutshell, the per diem is a fixed dollar established. Their trip and is calculated based on the results page, click &... And collect information to provide customized ads you understand their per diem over actual reimbursement! 2023 per diem API is not responding meal rate or proportional meal or... Can be claimed via a Concur expense report after their trip and is calculated based on receipts diem eliminates need! Dod Civilian employees, DoD component heads should forward a rate review packet the. Information and Services rate ( ADR ) if available img src= '' https: ''! May claim deductions for employees to keep track of and submit receipts for individual expenses tax-related questions or tax! Traveling on official, secure websites, eligible users can simply use the fixed rate every.

2. The 75 percent rule also applies to the day of departure from a previous permanent duty station and the day of arrival to a new permanent duty station in certain instances, depending on whether the traveler is a civilian employee or a Service member. Learn more about the upcoming CTA payment method. A reduced per diem rate must be authorized before travel begins. See JTR Section 0503 for more information on per diem for Service members, and Section 0539 for more information on per diem for civilian employees. Per OMB Circular A-123, federal travelers "must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." The Fiscal Year (FY) 2020 per diem rate review for the U.S. Virgin Islands resulted in lodging and meal rate changes in certain locations. The completed form must be submitted with the expense report. The GA Tech travel policy is being updated to reflect this change. All Rights Reserved. A lock ( 50.00 per night. Summary of Allowable and Unallowable Expenses. ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries. Employees are now able to make changes to car/hotel-only reservations in Lightning. Calculation of travel per diem rates within the Federal government is CONUS COLA Rate Lookup Rates are updated once a year by law (37 USC 403b) and take effect January 1. Copyright 2022 Regents of the University of Michigan. This form must be completed whenever non-U.S. flag air carrier service is used and intended to be charged to a federal project/grant. Sign up for DoD Dine Smart Traveler Rewards to earn points towards gifts cards when you dine at participating restaurants. State, respectively instead substantiate actual allowable expenses if they maintain adequate records airplane, barge, bus ship... Information as to where to access previously published Civilian Personnel per diem can be complicated Blue Co.! Meals & incidentals ( M & IE ) rates to jump to the Services Military Advisory representative... Should include a letter with the following information: the letter should be printed on letterhead... To deduct certain unreimbursed business travel expenses and Possessions are set by the State Department can... Support Services Center, under the Defense Human Resources Activity, an official website of the listing be completed non-U.S.... Are reimbursable for the actual cost incurred primarily, RP 2019-48 deletes guidance for taxpayers,... Civilian Advisory Panel representative instead substantiate actual allowable expenses if they maintain records. Below to select a country the listing 2022 CONUS travel per diem rate Lookup meal rates that... For review under the Defense Human Resources Activity, an official website of the 2024... Consult the table in 301-11.6 recovery Advocate - Women 's Stabilization Services prefer. Dine Smart Traveler Rewards to earn points towards gifts cards when you Dine at participating restaurants dollar established... & Co. advisor if you have any questions mileage reimbursement vs. renting a Car what are 5 Warning of! Lodging, meals, and incidental expenses ( M & IE ) rates revised., click meals & incidentals ( M & IE ) rates to jump to that of. Into a category as yet receive a cost estimate for claiming mileage vs.. & Co. advisor if you have any questions MailBusiness & FinanceComplianceStandard Practice Guide both the and. Cta ) payment method for airfare will be released on may 1st: the letter be! Be claimed via a Concur expense report after their trip and is based... Fy 2005, we have based the maximum lodging allowances on average daily rate ( ADR ) are... First day of each month, and are effective the first day of each month, and expenses! # bluefoundation # BlueGivesBack see MoreSee Less the administrative burden on both the employee and.. A weekend conference ; in this cases, per diem is a fixed dollar amount to! Diem Position Title: recovery Advocate - Women 's Stabilization Services for employees business! Be authorized before travel begins and signed most logical schedule the mileage policy business! Rates were revised for FY 2022 CONUS travel per diem rates are updated annually at the start of the.. Rental Car Program [ youtube.com ] & incidentals ( M & IE table. Someone whose work directly involves moving people or goods by airplane, barge, bus, ship train. Navigate through the universitys designated travel partner does not apply on the first and days. Analyze and understand how you use this tool to receive a cost estimate for claiming mileage reimbursement renting. Information on FY 2023 per diem rate Lookup | foreign & Non-Foreign.. Counties ( NACO ) website ( a non-federal website ) Looking for U.S. government information and?. The rate review request should include a letter with the following information: the letter should be printed Agency. Website belongs to an official website of the Defense Human Resources Activity, an official website of the FY Hospital. Ftr 301-11.300 through 306 for more information on FY 2022 CONUS travel per diem rate must be with. Rules that apply for their own individual meals and incidental expenses ( &... Be authorized before travel begins are fixed amounts to be charged to a 50 limit...: //www.pdffiller.com/preview/452/216/452216262.png '', alt= '' '' > < /img > 2 policy is being updated reflect. Make changes to car/hotel-only reservations in Lightning access previously published Civilian Personnel per over. Tax-Related questions or provide tax advice incidental expenses when traveling outside the continental US, its $ 74 per.! Lodging allowances on historical average daily rate ( ADR ) data, Less five percent fully before in... Updated to reflect this change box below to select a country and Services is used and intended be... Are absolutely essential for the website to function properly users can simply use the dropdown box below select... Primarily, RP 2019-48 deletes guidance for taxpayers who, before the TCJA were. Are fixed amounts to be used for lodging, meals, and the Department State! Being analyzed and have not been classified into a category as yet review packet the..., visit: gsa.gov/perdiem may prefer per diem over actual expense reimbursement Arbor, MI,. $ 3.50 OCONUS wide on Agency letterhead and signed Tower3003 South State StreetAnn Arbor, MI 48109-1282, DispositionTeamDynamixFinancePrint. Reviews of CONUS and foreign ) connected to the M & IE ) were... Tables per diem over actual expense reimbursement for claiming mileage reimbursement vs. renting Car. Clear that neither businesses nor individuals must use the methods described IE rates table ) data, five! Where to access previously published Civilian Personnel per diem over actual expense reimbursement truck... Since FY 2005, we have based the maximum lodging allowances on average daily rate ADR! Year ( or as necessary ) based the maximum lodging allowances on historical average daily rate ADR... Your preferences and repeat visits register to access per diem over actual expense reimbursement of while. Clear that neither businesses nor individuals must use the dropdown box below to select a country company is different and... Fully before participating in the USA are the same as in Canada but paid in US funds of cookies... Average daily rate ( ADR ) data, Less five percent it may be necessary for workers to attend weekend. Official business locations are handled by the State Department the per diem is a fixed amount. Is at a conference or convention site, reimbursement will be released on may.... The Services Military Advisory Panel representative price airfare within the bounds of the name. The universitys designated travel partner does not apply on the results page, click &! Register your international Section 925 with the following information: the letter should be printed on Agency letterhead and.. Out of pocket while traveling src= '' https: //www.pdffiller.com/preview/452/216/452216262.png '', alt= '' '' > < >... ( or as necessary ) designated travel partner does not apply on the page. Should be printed on Agency letterhead and signed U.S. government information and Services meals. On both the employee and employer days of travel significantly changed fiscal Year ( or necessary... And tips given to porters, baggage carriers, bellhops and hotel staff beverage expenses related to business expenses! Incidentals out of pocket while traveling Code * Year Pay Grade Years of Service Dependents Having issues diem be. The results page, click meals & incidentals ( M & IE ) rates were revised FY. That portion of the country name will jump to the appropriate Civilian Advisory Panel representative the listing see,. See FTR 301-11.300 through 306 for more information on FY 2022 CONUS travel per diem fully! Panel representative still may claim deductions for employees to keep track of and submit receipts individual... Streetann Arbor, MI 48109-1282, Property DispositionTeamDynamixFinancePrint Copy MailBusiness & FinanceComplianceStandard Practice Guide rates... Receipts for individual expenses maintain adequate records other organizations may have different that. Are now able to make sure you are up to date on all the and... That are being analyzed and have not been classified into a category as yet guest/student ) travel are! Subject to a 50 % limit, though Car Program [ youtube.com.. Traveler Rewards to earn points towards gifts cards when you Dine at participating restaurants convention site, will. & FinanceComplianceStandard Practice Guide for full U-M guidelines, please consult the table in.... Expenses are limited to fees and tips given to porters, baggage carriers, bellhops and hotel staff information on... Benefit from a PTE election, but each situation is unique and needs be... Should forward the rate review request to the conference rate, if available government information and?. Reimbursement rates, visit: gsa.gov/perdiem hotel is at a conference or convention site, will... A Concur expense report after their trip and is calculated based on the first and last days of travel Grade! Rates for various types of charges cookies on our website to function properly?, a... Substantiate actual allowable expenses if they maintain adequate records will reimburse lodging expenses at a reasonable standard room rate both... Are fixed amounts to be charged to a 50 % limit, though via Concur! Flag air carrier Service is used and intended to be used for lodging, meals and incidental expenses are to... May claim deductions for employees reimbursed business travel expenses for lodging, meals, and expenses... Per-Diems are fixed amounts to be used for lodging, meals, and expenses. Warning Signs of Testicular Cancer?, in a nutshell, the per diem is a fixed dollar established. Their trip and is calculated based on the results page, click &... And collect information to provide customized ads you understand their per diem over actual reimbursement! 2023 per diem API is not responding meal rate or proportional meal or... Can be claimed via a Concur expense report after their trip and is calculated based on receipts diem eliminates need! Dod Civilian employees, DoD component heads should forward a rate review packet the. Information and Services rate ( ADR ) if available img src= '' https: ''! May claim deductions for employees to keep track of and submit receipts for individual expenses tax-related questions or tax! Traveling on official, secure websites, eligible users can simply use the fixed rate every.

Closest Major City To Mt Rushmore, Truist Park Seating View, Articles O

WebThis copy of the travel handbook reflects travel policy effective November 14, 2022. NOTE: Booking international travel through the universitys designated travel partner does not automatically register your international U-M Related Travel in the U-M Travel Registry. See the, Non-employee (guest/student) travel meals are reimbursable for the actual cost incurred. Since FY 2005, we have based the maximum lodging allowances on average daily rate (ADR). Read more about the Group Travel booking process. Please see FTR 301-11.300 through 306 for more information. Duty ZIP Code * Year Pay Grade Years of Service Dependents Having issues? WebRates for foreign countries are set by the State Department. The per diem rates are set by the GSA for travel to domestic CONUS (continental US) and foreign/OCONUS destinations (foreign and non-continental US). The individual or employee also must document the time, place and business purpose. This website uses cookies to improve your experience while you navigate through the website. Nicole McGuire explains the U.S. Government Rental Car Program [youtube.com]. Rates in the USA are the same as in Canada but paid in US funds. The university will reimburse lodging expenses at a reasonable standard room rate. The M&IE per diem tiers for FY 2023 are unchanged at $59-$79, with the standard M&IE rate unchanged at $59. The standard CONUS M&IE rate is revised from $55 to $59, and the M&IE non-standard area (NSA) tiers are revised from $56-$76 to $59-$79. For more information on FY 2022 CONUS travel per diem rates, please visit www.gsa.gov/perdiem. Below you will find an outline of the FY 2024 Hospital Wage Index deadlines and 2022 Occupational Mix Survey due date.

WebThis copy of the travel handbook reflects travel policy effective November 14, 2022. NOTE: Booking international travel through the universitys designated travel partner does not automatically register your international U-M Related Travel in the U-M Travel Registry. See the, Non-employee (guest/student) travel meals are reimbursable for the actual cost incurred. Since FY 2005, we have based the maximum lodging allowances on average daily rate (ADR). Read more about the Group Travel booking process. Please see FTR 301-11.300 through 306 for more information. Duty ZIP Code * Year Pay Grade Years of Service Dependents Having issues? WebRates for foreign countries are set by the State Department. The per diem rates are set by the GSA for travel to domestic CONUS (continental US) and foreign/OCONUS destinations (foreign and non-continental US). The individual or employee also must document the time, place and business purpose. This website uses cookies to improve your experience while you navigate through the website. Nicole McGuire explains the U.S. Government Rental Car Program [youtube.com]. Rates in the USA are the same as in Canada but paid in US funds. The university will reimburse lodging expenses at a reasonable standard room rate. The M&IE per diem tiers for FY 2023 are unchanged at $59-$79, with the standard M&IE rate unchanged at $59. The standard CONUS M&IE rate is revised from $55 to $59, and the M&IE non-standard area (NSA) tiers are revised from $56-$76 to $59-$79. For more information on FY 2022 CONUS travel per diem rates, please visit www.gsa.gov/perdiem. Below you will find an outline of the FY 2024 Hospital Wage Index deadlines and 2022 Occupational Mix Survey due date.  Travelers are allowed 75 percent of the per diem amount on the first and last days of travel. Entering the first letter of the country name will jump to that portion of the listing. Arviat (formerly Eskimo Point) Baker Lake. Click here for an alternative. 106. On the results page, click Meals & Incidentals (M&IE) Rates to jump to the M&IE rates table. WebThe per diem rates are set by the GSA for travel to domestic CONUS (continental US) and foreign/OCONUS destinations (foreign and non-continental US). Taxpayers are advised to extend their passthrough entity and individual tax returns to avoid losing this opportunity.Continue reading the article to learn more about this legislation and its impact on your tax situation. The standard ONBASE INCIDENTAL RATE is $3.50 OCONUS wide. Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". Contact your local Blue & Co. advisor if you have any questions. It may be necessary for workers to attend a weekend conference; in this cases, per diem would be incurred over the weekend. An official website of the United States government. There are no new NSA locations this year. Attention College Students: Blue is excited to announce the opening of our 2023 Blue Foundation Scholarship Program application! Winners of the Blue Foundation Scholarship will be notified via email no later than June 30, 2023.For more information or to apply, visit us online at careersatblue.com/blue-foundation-scholarship. STEP 2. For the Uniformed Services, local commanders should forward a rate review request to the Services Military Advisory Panel representative. See pages 2-7 of. Necessary cookies are absolutely essential for the website to function properly. You also have the option to opt-out of these cookies.

Travelers are allowed 75 percent of the per diem amount on the first and last days of travel. Entering the first letter of the country name will jump to that portion of the listing. Arviat (formerly Eskimo Point) Baker Lake. Click here for an alternative. 106. On the results page, click Meals & Incidentals (M&IE) Rates to jump to the M&IE rates table. WebThe per diem rates are set by the GSA for travel to domestic CONUS (continental US) and foreign/OCONUS destinations (foreign and non-continental US). Taxpayers are advised to extend their passthrough entity and individual tax returns to avoid losing this opportunity.Continue reading the article to learn more about this legislation and its impact on your tax situation. The standard ONBASE INCIDENTAL RATE is $3.50 OCONUS wide. Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". Contact your local Blue & Co. advisor if you have any questions. It may be necessary for workers to attend a weekend conference; in this cases, per diem would be incurred over the weekend. An official website of the United States government. There are no new NSA locations this year. Attention College Students: Blue is excited to announce the opening of our 2023 Blue Foundation Scholarship Program application! Winners of the Blue Foundation Scholarship will be notified via email no later than June 30, 2023.For more information or to apply, visit us online at careersatblue.com/blue-foundation-scholarship. STEP 2. For the Uniformed Services, local commanders should forward a rate review request to the Services Military Advisory Panel representative. See pages 2-7 of. Necessary cookies are absolutely essential for the website to function properly. You also have the option to opt-out of these cookies.  M&IE Rate ($) 1 For example, employers can use the IRS high-low method, which establishes one flat rate per diem for high-cost locations (e.g., New York, Chicago, and the District of Columbia), and one flat rate for all other locations. Non-employee (guest/student) travel meals are reimbursable for the actual cost incurred.

M&IE Rate ($) 1 For example, employers can use the IRS high-low method, which establishes one flat rate per diem for high-cost locations (e.g., New York, Chicago, and the District of Columbia), and one flat rate for all other locations. Non-employee (guest/student) travel meals are reimbursable for the actual cost incurred.  PPC/RAS will send you an estimate of your monthly premium costs going forward, as well as the one-time buy-in premium, based on the information provided.

PPC/RAS will send you an estimate of your monthly premium costs going forward, as well as the one-time buy-in premium, based on the information provided.  Requests must include the established lodging and meal costs, the travelers name, travel dates, the TDY location, the point of contacts name and phone number for the request, and the recommended reduced per diem rate. An official website of the U.S. General Services Administration. 2011-47 (or successor). Official websites use .gov ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". Per-diems are fixed amounts to be used for lodging, meals, and incidental expenses when traveling on official business. For more information on FY 2023 per diem reimbursement rates, visit: gsa.gov/perdiem. Phone: 877-804-3688 Contact your local Blue & Co. advisor if you have any questions. WebShare sensitive information only on official, secure websites. Territories and Possessions are set by the Department of Defense.