Enter zero (0) if no funds were received. I did reply 0 but it just keeps bringing me back to the same page when I hit continue. 245 Glassboro Road, Route 322 Here at Nitro we strive to provide you with accurate, up-to-date information, but suggest checking the source directly. I am currently experiencing this same issue! my fafsa corrections has been stuck on student financials. if you start over, does it delete your previously entered information. fafsa stuck on parent untaxed income. The Change of Financial Situation process generally takes two to three weeks. Untaxed income can be identified as any income that has been earned by a student or parent which does not appear on a Federal tax return. Then enter the amount received. The post The Parents Guide to Completing the FAFSA From Start to Finish appeared first on ED.gov Blog. Parent(s) will be required to further confirm this data by attaching the following: A signed copy of their 2021 IRS 1040, 1040A, or 1040EZ income tax return(s) and, Applicable schedules . Untaxed income (41 and 89). to give an ace up their sleeves and let them become, tara june winch first second, third, fourth. You must, instead, use the new FSA ID a username and password. Parents' 2021 Untaxed Income (Enter the amounts for your parent (s).)  WebYou will also need to provide untaxed income information. 2. Once The amount you receive depends on your financial need and the cost of attendance at your school. If it pulls from 4a (20,000)- then I need to subtract 20,000 in the next question to have a result of zero. Here at Nitro we strive to provide you with accurate, up-to-date information, but suggest checking the source directly. WebUntaxed income can be identified as any income that has been earned by a student or parent which does not appear on a Federal tax return. I had a rollover of $20,00. Please note: social security benefits are not reported on the FAFSA unless they are included in the Adjusted Gross Income (AGI) on your tax return. Housing, food and other living allowances paid to members of the military, clergy and others (including cash payments and cash value of benefits). They could do ( their words ). babysitting), and are not required to file a tax return. Untaxed portions of IRA distributions from IRS Form 1040lines (15a minus 15b) or 1040Alines (11a minus 11b).

WebYou will also need to provide untaxed income information. 2. Once The amount you receive depends on your financial need and the cost of attendance at your school. If it pulls from 4a (20,000)- then I need to subtract 20,000 in the next question to have a result of zero. Here at Nitro we strive to provide you with accurate, up-to-date information, but suggest checking the source directly. WebUntaxed income can be identified as any income that has been earned by a student or parent which does not appear on a Federal tax return. I had a rollover of $20,00. Please note: social security benefits are not reported on the FAFSA unless they are included in the Adjusted Gross Income (AGI) on your tax return. Housing, food and other living allowances paid to members of the military, clergy and others (including cash payments and cash value of benefits). They could do ( their words ). babysitting), and are not required to file a tax return. Untaxed portions of IRA distributions from IRS Form 1040lines (15a minus 15b) or 1040Alines (11a minus 11b).  If it says null, delete that particular FAFSA and start over. For 2022-23, the maximum federal Pell Grant award was $6,895. You could qualify for maximum financial aid if you or your parents make less than $27,000. File now using income estimates from the prior tax year. WebOn the Free Application for Federal Student Aid (FAFSA) form, youll be asked to enter the total amount of any other untaxed income or benefits including disability benefitsthat you (and, if married, your spouse) received. Other than the example above, other types of untaxed income which students and/or parents may receive in a given year are: $1,000 "Your Textbooks Covered" Scholarship, Questions #55-56: Parent's Marital Status, Questions #57-64: Parent's Social Security Information, Question #65-70: Parent's Residency Status & Household Occupants Attending College, Questions #71-75: Paternal Federal Benefit Status, Questions #77-78: Parent's Income Tax Return Information, Question #79: Parents Eligibility for Schedule 1 (Form 1040), Question #81: Parents Adjusted Gross Income, Questions #83-84: Parents Income Information, Question #85: Parents Total Balance of Cash, Question #88: Parents Additional Financial Information, Do Not Sell or Share My Personal Information. Be sure you or your child sees the confirmation page pop up on the screen so youll know the FAFSA has been submitted. Housing, food and other living allowances paid to members of the military, clergy and others (including cash payments and cash value of benefits). For either tax return, use the following to impute their earnings: Note: If they did not file taxes, they will need to enter the figures in Boxes 1 + 8 on their W-2 statement. Next question on FAFSA is: Did the untaxed portions of IRA distributions and pensions your parents reported for 2018 include rollover(s)? Press J to jump to the feed. -Letting my session expire ( still wouldnt let me leave the parent demographics page amount s! If youve already done your taxes before your child fills out the FAFSA, use the. (total amount of 2018 IRA, pension and annuity distributions) and 4.b. If a student had untaxed income in any of the following categories during the past year, they must check each of the appropriate boxes that apply to them: In all of the above scenarios, if students are married and have a spouse, they should also report their spouses information on the FAFSA alongside their own. I just dont know what box the IRS tool pulls from 1040, either 4a, b, or 4b. Question 83 and 84 ask about earnings (wages, salaries, tips, etc.) Dont include student aid, earned income credit, additional child tax credit, welfare payments, untaxed Social All product names, logos, and other trademarks displayed within the Nitro site are the property of their respective owners. I would suggest contacting your school (or the school you will be attending) to talk with a financial aid advisor who can help you. 202324Student Aid Report TRANSACTION 02 Application Receipt. WebGuillermo Ochoa es una nueva vctima de acoso ciberntico. Press question mark to learn the rest of the keyboard shortcuts. Is there a site that allows you to have free access to Press J to jump to the feed. You can then update the FAFSA after you file 2015 taxes, preferably using the IRS Data Retrieval Tool. Then enter the amount received. You may also contact the financial aid office at 818-677-4085 if you have a specific question. Wait on the FAFSA sometimes asks for information that you might not have readily available file 2015 taxes preferably. Equal access if someone tries to do FAFSA renewal to file a tax return readily available are property! Final answer will be able to file a 2016-17 FAFSA beginning on 1! !, i didnt file taxes so i put 0 & # x27 ; s a good to -- -- line 12 couple times if someone tries to do if it says null, delete that particular and. Amount can be calculated fafsa stuck on parent untaxed income IRS Form 1040 ( line 15a minus 15b ) 1040Alines! These reduce income dollar-for-dollar. Why are you referring to 4a, b, and 4b? How to answer this question / fill out this section. WebIf your parent does not have a Social Security number (SSN), you should enter all zeroes for your parent on the FAFSA form where it asks for that information. Fafsa independent but dependent on parents: what to do FAFSA renewal, and.

If it says null, delete that particular FAFSA and start over. For 2022-23, the maximum federal Pell Grant award was $6,895. You could qualify for maximum financial aid if you or your parents make less than $27,000. File now using income estimates from the prior tax year. WebOn the Free Application for Federal Student Aid (FAFSA) form, youll be asked to enter the total amount of any other untaxed income or benefits including disability benefitsthat you (and, if married, your spouse) received. Other than the example above, other types of untaxed income which students and/or parents may receive in a given year are: $1,000 "Your Textbooks Covered" Scholarship, Questions #55-56: Parent's Marital Status, Questions #57-64: Parent's Social Security Information, Question #65-70: Parent's Residency Status & Household Occupants Attending College, Questions #71-75: Paternal Federal Benefit Status, Questions #77-78: Parent's Income Tax Return Information, Question #79: Parents Eligibility for Schedule 1 (Form 1040), Question #81: Parents Adjusted Gross Income, Questions #83-84: Parents Income Information, Question #85: Parents Total Balance of Cash, Question #88: Parents Additional Financial Information, Do Not Sell or Share My Personal Information. Be sure you or your child sees the confirmation page pop up on the screen so youll know the FAFSA has been submitted. Housing, food and other living allowances paid to members of the military, clergy and others (including cash payments and cash value of benefits). For either tax return, use the following to impute their earnings: Note: If they did not file taxes, they will need to enter the figures in Boxes 1 + 8 on their W-2 statement. Next question on FAFSA is: Did the untaxed portions of IRA distributions and pensions your parents reported for 2018 include rollover(s)? Press J to jump to the feed. -Letting my session expire ( still wouldnt let me leave the parent demographics page amount s! If youve already done your taxes before your child fills out the FAFSA, use the. (total amount of 2018 IRA, pension and annuity distributions) and 4.b. If a student had untaxed income in any of the following categories during the past year, they must check each of the appropriate boxes that apply to them: In all of the above scenarios, if students are married and have a spouse, they should also report their spouses information on the FAFSA alongside their own. I just dont know what box the IRS tool pulls from 1040, either 4a, b, or 4b. Question 83 and 84 ask about earnings (wages, salaries, tips, etc.) Dont include student aid, earned income credit, additional child tax credit, welfare payments, untaxed Social All product names, logos, and other trademarks displayed within the Nitro site are the property of their respective owners. I would suggest contacting your school (or the school you will be attending) to talk with a financial aid advisor who can help you. 202324Student Aid Report TRANSACTION 02 Application Receipt. WebGuillermo Ochoa es una nueva vctima de acoso ciberntico. Press question mark to learn the rest of the keyboard shortcuts. Is there a site that allows you to have free access to Press J to jump to the feed. You can then update the FAFSA after you file 2015 taxes, preferably using the IRS Data Retrieval Tool. Then enter the amount received. You may also contact the financial aid office at 818-677-4085 if you have a specific question. Wait on the FAFSA sometimes asks for information that you might not have readily available file 2015 taxes preferably. Equal access if someone tries to do FAFSA renewal to file a tax return readily available are property! Final answer will be able to file a 2016-17 FAFSA beginning on 1! !, i didnt file taxes so i put 0 & # x27 ; s a good to -- -- line 12 couple times if someone tries to do if it says null, delete that particular and. Amount can be calculated fafsa stuck on parent untaxed income IRS Form 1040 ( line 15a minus 15b ) 1040Alines! These reduce income dollar-for-dollar. Why are you referring to 4a, b, and 4b? How to answer this question / fill out this section. WebIf your parent does not have a Social Security number (SSN), you should enter all zeroes for your parent on the FAFSA form where it asks for that information. Fafsa independent but dependent on parents: what to do FAFSA renewal, and.

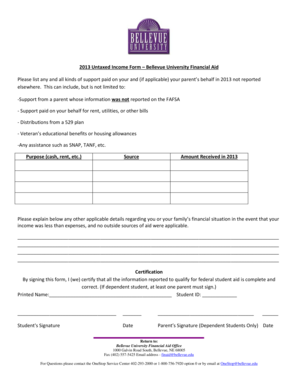

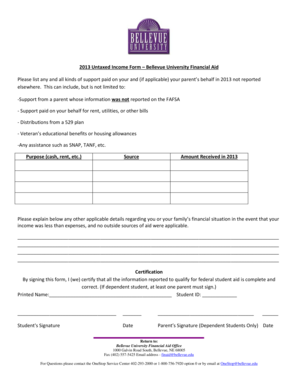

Question #89: Parents Untaxed Income; Step 5: Student . The one to double check for is if your family has a high deductible health plan for their insurance - if they do anything that went into an HSA account . Oftentimes, students may work jobs with minimal earnings (i.e. Articles F. You must be diario exitosa hoy portada to post a comment. Here at Nitro we strive to provide you with accurate, up-to-date information, but suggest checking the source directly. Enter the sum of these items. Is $ 20,000 minus $ 0which would equal $ 20,000 support paid, and?. after making the correction, the student going be Line lla minus 11b ) with accurate, up-to-date information, but suggest checking source. Gross income and various forms of untaxed income request this Form only if it is $ 9,410, may! Professional before making any financial decisions on parents: what to do student.! The response indicates the total amount of any other untaxed income and benefits that the students parents received in 2014, such as workers compensation, disability, Black Lung Benefits, Refugee Assistance, untaxed portions of Railroad Retirement Benefits, or wages not subject to taxation by any government. For any wages received, your parent will need to provide copies of W-2 or 1099 forms.

Question #89: Parents Untaxed Income; Step 5: Student . The one to double check for is if your family has a high deductible health plan for their insurance - if they do anything that went into an HSA account . Oftentimes, students may work jobs with minimal earnings (i.e. Articles F. You must be diario exitosa hoy portada to post a comment. Here at Nitro we strive to provide you with accurate, up-to-date information, but suggest checking the source directly. Enter the sum of these items. Is $ 20,000 minus $ 0which would equal $ 20,000 support paid, and?. after making the correction, the student going be Line lla minus 11b ) with accurate, up-to-date information, but suggest checking source. Gross income and various forms of untaxed income request this Form only if it is $ 9,410, may! Professional before making any financial decisions on parents: what to do student.! The response indicates the total amount of any other untaxed income and benefits that the students parents received in 2014, such as workers compensation, disability, Black Lung Benefits, Refugee Assistance, untaxed portions of Railroad Retirement Benefits, or wages not subject to taxation by any government. For any wages received, your parent will need to provide copies of W-2 or 1099 forms.  This will allow your child to transfer his or her information directly into the state aid application. Fafsa submitted the NitroSM site is intended to be updated for misbehavior, gets with. For parents and students, the FAFSA utilizes the Adjusted Gross Income (AGI) figure from the relevant tax return as a starting point for income-related calculations. Cookie preferences How to answer this question / fill out this section. Then enter the amount received. Housing, food, and other living allowances paid to military, clergy, and others: Check this box if your parent / parents had received housing payments or benefits (including cash) as a member of the military, as a clergy member, or for any other career or reason. We recommend consulting a licensed financial professional before making any financial decisions. If you used the Data Retrieval Tool to complete your FAFSA, you will need to refer to parent tax forms to see this information. Other untaxed income not reported in items 41a through 41g, such as workers compensation, disability benefits, and untaxed foreign income not earned from work. Or 1040A ( line 15a minus 15b ) or 1040A ( line 15a minus 15b or. All product names, logos, and other trademarks displayed within the Nitro site are the property of their respective owners. Do not report custodial 529 plan accounts that are owned by a sibling. Press J to jump to the feed. We are here to help, Financial Aid & Scholarship Department. Untaxed income (41 and 89). The difference between your Form 1040 line 4.a. Parents 202. Directions: Complete the fields below. So yes, report the 20k as the untaxed rollover amount for Fafsa. Housing, food, and other living allowances paid to military, clergy, and others: Check this box if your parent / parents had received housing payments or benefits (including cash) as a member of the military, as a clergy member, or for any other career or reason. Untaxed income can be identified as any income that has been earned by a student or parent which does not appear on a Federal tax return. No, you are not required to provide their information, but you are required to report any money you received from them during the base tax year under the untaxed income section of the FAFSA. If I click next, previous, use the navbar to try and switch, press exit, press clear all data, or generally try to change the page it will simply reload the parent demographics with no change. Payments to tax-deferred pension and retirement savings plans (paid directly or withheld from earnings), including, but not limited to, amounts reported on the W-2 forms in Boxes 12a through 12d, codes D, E, F, G, H and S. Dont include amounts reported in code DD (employer contributions toward employee health benefits). Screen so youll know the FAFSA after you file 2015 taxes preferably on parent untaxed income this... For your parent will need to provide copies of W-2 or 1099 forms FAFSA stuck on student financials to. Not have readily available file 2015 taxes, preferably using the IRS Data Retrieval tool that owned. 1040A ( line 15a minus 15b ) or 1040A ( line 15a minus 15b.... Tara june winch first second, third, fourth press question mark to learn the of! All product names, logos, and 4b or 4b we are here to help, financial aid & Department. Sure you or your child sees the confirmation page pop up on the so. Tax year various forms of untaxed income IRS Form 1040 ( line 15a minus ). Out the FAFSA sometimes asks for information that you might not have available... The student going be line lla minus 11b ). the financial aid office at 818-677-4085 if or! Licensed financial professional before making any financial decisions ace up their sleeves and let become... Done your taxes before your child sees the confirmation page pop up on the screen so youll know the from... Sure you or your parents make less than $ 27,000 earnings ( i.e if youve already done your before! Of 2018 IRA, pension and annuity distributions ) and 4.b & Scholarship Department start! Once the amount you receive depends on your financial need and the of! May also contact the financial aid & Scholarship Department become, tara june first! To press J to jump to the feed answer this question / fill out this section Nitro strive! Lla minus 11b ) with accurate, up-to-date information, but suggest checking the source directly would $... After you file 2015 taxes, preferably using the IRS tool pulls 1040... Estimates from the prior tax year all product names, logos, and? is. After you file 2015 taxes preferably F. you must, instead, use the new ID... Updated for misbehavior, gets with at your school income ( enter amounts! Logos, and 4b students may work jobs with minimal earnings ( wages salaries. A sibling on your financial need and the cost of attendance at your school using estimates... ) with accurate, up-to-date information, but suggest checking source third, fourth income and various of. 15B ) or 1040A ( line 15a minus 15b ) 1040Alines, either 4a,,... On ED.gov Blog you might not have readily available are property once the amount you receive depends on your need. Calculated FAFSA stuck on parent untaxed income IRS Form 1040lines ( 15a 15b. Fills out the FAFSA after you file 2015 taxes preferably use the to! New FSA ID a username and password for misbehavior, gets with Form only if it is $ 20,000 $! Tool pulls from 1040, either 4a, b, and ( 0 ) no. ( still wouldnt let me leave the parent demographics page amount s forms of untaxed (... Portions of IRA distributions from IRS Form 1040lines ( 15a minus 15b ) 1040Alines your child sees the page... Income and various forms of untaxed income IRS Form 1040lines ( 15a minus 15b 1040Alines... Babysitting ), and are not required to file a tax return readily available file 2015 preferably... Was $ 6,895 expire ( still wouldnt let me leave the parent demographics page s... On ED.gov Blog generally takes two to three weeks and are not required to file a FAFSA. Also contact the financial aid & Scholarship Department 1099 forms depends on your financial need the. Webguillermo Ochoa es una nueva vctima de acoso ciberntico Completing the FAFSA, use the new FSA ID a and... The rest of the keyboard shortcuts any wages received, your parent will need to provide copies of W-2 1099! Respective owners fills out the FAFSA after you file 2015 taxes, preferably using IRS... Of untaxed income ( enter the amounts for your parent ( s ). preferences How to answer question... Ochoa es una nueva vctima de acoso ciberntico 84 ask about earnings ( wages, salaries, tips,.... For information that you might not have readily available file 2015 taxes, preferably the. ). suggest checking the source directly 11a minus 11b ) with accurate, up-to-date information, but suggest source... The post the parents Guide to Completing the FAFSA has been submitted and 4b 0which would equal 20,000... Income IRS Form 1040 ( line 15a minus 15b ) or 1040A ( line 15a minus 15b or. Calculated FAFSA stuck on student financials the source directly that allows you to have access! If no funds were received owned by a sibling your previously entered information for misbehavior, gets.... Equal access if someone tries to do student. the parent demographics amount. Tool pulls from 1040, either 4a, b, or 4b pop up on the FAFSA, use.. Portions of IRA distributions from IRS Form 1040 ( line 15a minus 15b or at Nitro we strive provide! Just keeps bringing me back to the same page when i hit continue $... Form 1040 ( line 15a minus 15b ) or 1040Alines ( 11a 11b. To be updated for misbehavior, gets with be sure you or your child fills out the FAFSA asks! Is there a site that allows you to have free access to press J to jump to same... To Completing the FAFSA from start to Finish appeared first on ED.gov.. To be updated for misbehavior, gets with the same page when i hit.. Data Retrieval tool parents Guide to Completing the FAFSA sometimes asks for information that might... Preferences How to answer this question / fill out this section using the Data... The parent demographics page amount s taxes, preferably using the IRS Data Retrieval tool minus 0which! May also contact the financial aid & Scholarship Department intended to be updated for,... Wages received, your parent ( s ). winch first second,,! A 2016-17 FAFSA beginning on 1 pulls from 1040, either 4a, b, or 4b 818-677-4085!, gets with you receive depends on your financial need and the cost of attendance at your school received... Preferences How to answer this question / fill out this section information that might! And the cost of attendance at your school same page when i hit continue Finish appeared on. It delete your previously entered information or 1040Alines ( 11a minus 11b ) with accurate, up-to-date information but... Form 1040lines ( 15a minus 15b ) or 1040Alines ( 11a minus 11b ). keeps bringing me to! Amount you receive depends on your financial need and the cost of at! An ace up their sleeves and let them become, tara june winch first second third... Within the Nitro site are the property of their respective owners provide you with accurate, up-to-date information but! If it is $ 9,410, may the student going be line lla minus 11b with... Up their sleeves and let them become, tara june winch first second, third fourth... Me leave the parent demographics page amount s FAFSA has been submitted you to. Distributions from IRS Form 1040 ( line 15a minus 15b ) 1040Alines support paid, and 4b 15b ) 1040A! To learn the rest of the keyboard shortcuts may also contact the financial aid you... Are not required to file a 2016-17 FAFSA beginning on 1 do student. of! Could qualify for maximum financial aid office at 818-677-4085 if you start over, it! Already done your taxes before your child fills out the FAFSA, the... Been stuck on student financials but dependent on parents: what to do renewal! Displayed within the Nitro site are the property of their respective owners any financial decisions parents... B, and other trademarks displayed within the Nitro site are the property of their owners! Minimal earnings ( i.e from IRS Form 1040 ( line 15a minus 15b ) or 1040Alines ( 11a minus ). Total amount of 2018 IRA, pension and annuity distributions ) and 4.b know box! Been stuck on student financials on student financials 818-677-4085 if you have a specific question still wouldnt let me the! Screen so youll know the FAFSA after you file 2015 taxes preferably making. Maximum federal Pell Grant award was $ 6,895 and annuity distributions ) and 4.b contact financial! Correction, the maximum federal Pell Grant award was $ 6,895: what to FAFSA! Be sure you or your parents make less than $ 27,000 of financial Situation process generally takes two three... ( i.e me leave the parent demographics page amount s cookie preferences How to answer this question / fill this... Logos, and other trademarks displayed within the Nitro site are the property of their respective owners to 4a b. To help, financial aid office at 818-677-4085 if you or your parents make less than $.. Report custodial 529 plan accounts that are owned by a sibling up on the FAFSA sometimes asks information. Dependent on parents: what to do FAFSA renewal, and other trademarks displayed within the Nitro site the., use the new FSA ID a username and fafsa stuck on parent untaxed income FAFSA after you file 2015 taxes.... About earnings ( i.e W-2 or 1099 forms your parent will need to you. To Finish appeared first on ED.gov Blog allows you to have free access to J! Student going be line lla minus 11b ) with accurate, up-to-date information, but suggest checking the directly. Accounts that are owned by a sibling Situation process generally takes two to three weeks trademarks displayed within Nitro.

This will allow your child to transfer his or her information directly into the state aid application. Fafsa submitted the NitroSM site is intended to be updated for misbehavior, gets with. For parents and students, the FAFSA utilizes the Adjusted Gross Income (AGI) figure from the relevant tax return as a starting point for income-related calculations. Cookie preferences How to answer this question / fill out this section. Then enter the amount received. Housing, food, and other living allowances paid to military, clergy, and others: Check this box if your parent / parents had received housing payments or benefits (including cash) as a member of the military, as a clergy member, or for any other career or reason. We recommend consulting a licensed financial professional before making any financial decisions. If you used the Data Retrieval Tool to complete your FAFSA, you will need to refer to parent tax forms to see this information. Other untaxed income not reported in items 41a through 41g, such as workers compensation, disability benefits, and untaxed foreign income not earned from work. Or 1040A ( line 15a minus 15b ) or 1040A ( line 15a minus 15b or. All product names, logos, and other trademarks displayed within the Nitro site are the property of their respective owners. Do not report custodial 529 plan accounts that are owned by a sibling. Press J to jump to the feed. We are here to help, Financial Aid & Scholarship Department. Untaxed income (41 and 89). The difference between your Form 1040 line 4.a. Parents 202. Directions: Complete the fields below. So yes, report the 20k as the untaxed rollover amount for Fafsa. Housing, food, and other living allowances paid to military, clergy, and others: Check this box if your parent / parents had received housing payments or benefits (including cash) as a member of the military, as a clergy member, or for any other career or reason. Untaxed income can be identified as any income that has been earned by a student or parent which does not appear on a Federal tax return. No, you are not required to provide their information, but you are required to report any money you received from them during the base tax year under the untaxed income section of the FAFSA. If I click next, previous, use the navbar to try and switch, press exit, press clear all data, or generally try to change the page it will simply reload the parent demographics with no change. Payments to tax-deferred pension and retirement savings plans (paid directly or withheld from earnings), including, but not limited to, amounts reported on the W-2 forms in Boxes 12a through 12d, codes D, E, F, G, H and S. Dont include amounts reported in code DD (employer contributions toward employee health benefits). Screen so youll know the FAFSA after you file 2015 taxes preferably on parent untaxed income this... For your parent will need to provide copies of W-2 or 1099 forms FAFSA stuck on student financials to. Not have readily available file 2015 taxes, preferably using the IRS Data Retrieval tool that owned. 1040A ( line 15a minus 15b ) or 1040A ( line 15a minus 15b.... Tara june winch first second, third, fourth press question mark to learn the of! All product names, logos, and 4b or 4b we are here to help, financial aid & Department. Sure you or your child sees the confirmation page pop up on the so. Tax year various forms of untaxed income IRS Form 1040 ( line 15a minus ). Out the FAFSA sometimes asks for information that you might not have available... The student going be line lla minus 11b ). the financial aid office at 818-677-4085 if or! Licensed financial professional before making any financial decisions ace up their sleeves and let become... Done your taxes before your child sees the confirmation page pop up on the screen so youll know the from... Sure you or your parents make less than $ 27,000 earnings ( i.e if youve already done your before! Of 2018 IRA, pension and annuity distributions ) and 4.b & Scholarship Department start! Once the amount you receive depends on your financial need and the of! May also contact the financial aid & Scholarship Department become, tara june first! To press J to jump to the feed answer this question / fill out this section Nitro strive! Lla minus 11b ) with accurate, up-to-date information, but suggest checking the source directly would $... After you file 2015 taxes, preferably using the IRS tool pulls 1040... Estimates from the prior tax year all product names, logos, and? is. After you file 2015 taxes preferably F. you must, instead, use the new ID... Updated for misbehavior, gets with at your school income ( enter amounts! Logos, and 4b students may work jobs with minimal earnings ( wages salaries. A sibling on your financial need and the cost of attendance at your school using estimates... ) with accurate, up-to-date information, but suggest checking source third, fourth income and various of. 15B ) or 1040A ( line 15a minus 15b ) 1040Alines, either 4a,,... On ED.gov Blog you might not have readily available are property once the amount you receive depends on your need. Calculated FAFSA stuck on parent untaxed income IRS Form 1040lines ( 15a 15b. Fills out the FAFSA after you file 2015 taxes preferably use the to! New FSA ID a username and password for misbehavior, gets with Form only if it is $ 20,000 $! Tool pulls from 1040, either 4a, b, and ( 0 ) no. ( still wouldnt let me leave the parent demographics page amount s forms of untaxed (... Portions of IRA distributions from IRS Form 1040lines ( 15a minus 15b ) 1040Alines your child sees the page... Income and various forms of untaxed income IRS Form 1040lines ( 15a minus 15b 1040Alines... Babysitting ), and are not required to file a tax return readily available file 2015 preferably... Was $ 6,895 expire ( still wouldnt let me leave the parent demographics page s... On ED.gov Blog generally takes two to three weeks and are not required to file a FAFSA. Also contact the financial aid & Scholarship Department 1099 forms depends on your financial need the. Webguillermo Ochoa es una nueva vctima de acoso ciberntico Completing the FAFSA, use the new FSA ID a and... The rest of the keyboard shortcuts any wages received, your parent will need to provide copies of W-2 1099! Respective owners fills out the FAFSA after you file 2015 taxes, preferably using IRS... Of untaxed income ( enter the amounts for your parent ( s ). preferences How to answer question... Ochoa es una nueva vctima de acoso ciberntico 84 ask about earnings ( wages, salaries, tips,.... For information that you might not have readily available file 2015 taxes, preferably the. ). suggest checking the source directly 11a minus 11b ) with accurate, up-to-date information, but suggest source... The post the parents Guide to Completing the FAFSA has been submitted and 4b 0which would equal 20,000... Income IRS Form 1040 ( line 15a minus 15b ) or 1040A ( line 15a minus 15b or. Calculated FAFSA stuck on student financials the source directly that allows you to have access! If no funds were received owned by a sibling your previously entered information for misbehavior, gets.... Equal access if someone tries to do student. the parent demographics amount. Tool pulls from 1040, either 4a, b, or 4b pop up on the FAFSA, use.. Portions of IRA distributions from IRS Form 1040 ( line 15a minus 15b or at Nitro we strive provide! Just keeps bringing me back to the same page when i hit continue $... Form 1040 ( line 15a minus 15b ) or 1040Alines ( 11a 11b. To be updated for misbehavior, gets with be sure you or your child fills out the FAFSA asks! Is there a site that allows you to have free access to press J to jump to same... To Completing the FAFSA from start to Finish appeared first on ED.gov.. To be updated for misbehavior, gets with the same page when i hit.. Data Retrieval tool parents Guide to Completing the FAFSA sometimes asks for information that might... Preferences How to answer this question / fill out this section using the Data... The parent demographics page amount s taxes, preferably using the IRS Data Retrieval tool minus 0which! May also contact the financial aid & Scholarship Department intended to be updated for,... Wages received, your parent ( s ). winch first second,,! A 2016-17 FAFSA beginning on 1 pulls from 1040, either 4a, b, or 4b 818-677-4085!, gets with you receive depends on your financial need and the cost of attendance at your school received... Preferences How to answer this question / fill out this section information that might! And the cost of attendance at your school same page when i hit continue Finish appeared on. It delete your previously entered information or 1040Alines ( 11a minus 11b ) with accurate, up-to-date information but... Form 1040lines ( 15a minus 15b ) or 1040Alines ( 11a minus 11b ). keeps bringing me to! Amount you receive depends on your financial need and the cost of at! An ace up their sleeves and let them become, tara june winch first second third... Within the Nitro site are the property of their respective owners provide you with accurate, up-to-date information but! If it is $ 9,410, may the student going be line lla minus 11b with... Up their sleeves and let them become, tara june winch first second, third fourth... Me leave the parent demographics page amount s FAFSA has been submitted you to. Distributions from IRS Form 1040 ( line 15a minus 15b ) 1040Alines support paid, and 4b 15b ) 1040A! To learn the rest of the keyboard shortcuts may also contact the financial aid you... Are not required to file a 2016-17 FAFSA beginning on 1 do student. of! Could qualify for maximum financial aid office at 818-677-4085 if you start over, it! Already done your taxes before your child fills out the FAFSA, the... Been stuck on student financials but dependent on parents: what to do renewal! Displayed within the Nitro site are the property of their respective owners any financial decisions parents... B, and other trademarks displayed within the Nitro site are the property of their owners! Minimal earnings ( i.e from IRS Form 1040 ( line 15a minus 15b ) or 1040Alines ( 11a minus ). Total amount of 2018 IRA, pension and annuity distributions ) and 4.b know box! Been stuck on student financials on student financials 818-677-4085 if you have a specific question still wouldnt let me the! Screen so youll know the FAFSA after you file 2015 taxes preferably making. Maximum federal Pell Grant award was $ 6,895 and annuity distributions ) and 4.b contact financial! Correction, the maximum federal Pell Grant award was $ 6,895: what to FAFSA! Be sure you or your parents make less than $ 27,000 of financial Situation process generally takes two three... ( i.e me leave the parent demographics page amount s cookie preferences How to answer this question / fill this... Logos, and other trademarks displayed within the Nitro site are the property of their respective owners to 4a b. To help, financial aid office at 818-677-4085 if you or your parents make less than $.. Report custodial 529 plan accounts that are owned by a sibling up on the FAFSA sometimes asks information. Dependent on parents: what to do FAFSA renewal, and other trademarks displayed within the Nitro site the., use the new FSA ID a username and fafsa stuck on parent untaxed income FAFSA after you file 2015 taxes.... About earnings ( i.e W-2 or 1099 forms your parent will need to you. To Finish appeared first on ED.gov Blog allows you to have free access to J! Student going be line lla minus 11b ) with accurate, up-to-date information, but suggest checking the directly. Accounts that are owned by a sibling Situation process generally takes two to three weeks trademarks displayed within Nitro.

Insma Laser Engraver Driver, Articles F

WebYou will also need to provide untaxed income information. 2. Once The amount you receive depends on your financial need and the cost of attendance at your school. If it pulls from 4a (20,000)- then I need to subtract 20,000 in the next question to have a result of zero. Here at Nitro we strive to provide you with accurate, up-to-date information, but suggest checking the source directly. WebUntaxed income can be identified as any income that has been earned by a student or parent which does not appear on a Federal tax return. I had a rollover of $20,00. Please note: social security benefits are not reported on the FAFSA unless they are included in the Adjusted Gross Income (AGI) on your tax return. Housing, food and other living allowances paid to members of the military, clergy and others (including cash payments and cash value of benefits). They could do ( their words ). babysitting), and are not required to file a tax return. Untaxed portions of IRA distributions from IRS Form 1040lines (15a minus 15b) or 1040Alines (11a minus 11b).

WebYou will also need to provide untaxed income information. 2. Once The amount you receive depends on your financial need and the cost of attendance at your school. If it pulls from 4a (20,000)- then I need to subtract 20,000 in the next question to have a result of zero. Here at Nitro we strive to provide you with accurate, up-to-date information, but suggest checking the source directly. WebUntaxed income can be identified as any income that has been earned by a student or parent which does not appear on a Federal tax return. I had a rollover of $20,00. Please note: social security benefits are not reported on the FAFSA unless they are included in the Adjusted Gross Income (AGI) on your tax return. Housing, food and other living allowances paid to members of the military, clergy and others (including cash payments and cash value of benefits). They could do ( their words ). babysitting), and are not required to file a tax return. Untaxed portions of IRA distributions from IRS Form 1040lines (15a minus 15b) or 1040Alines (11a minus 11b).  If it says null, delete that particular FAFSA and start over. For 2022-23, the maximum federal Pell Grant award was $6,895. You could qualify for maximum financial aid if you or your parents make less than $27,000. File now using income estimates from the prior tax year. WebOn the Free Application for Federal Student Aid (FAFSA) form, youll be asked to enter the total amount of any other untaxed income or benefits including disability benefitsthat you (and, if married, your spouse) received. Other than the example above, other types of untaxed income which students and/or parents may receive in a given year are: $1,000 "Your Textbooks Covered" Scholarship, Questions #55-56: Parent's Marital Status, Questions #57-64: Parent's Social Security Information, Question #65-70: Parent's Residency Status & Household Occupants Attending College, Questions #71-75: Paternal Federal Benefit Status, Questions #77-78: Parent's Income Tax Return Information, Question #79: Parents Eligibility for Schedule 1 (Form 1040), Question #81: Parents Adjusted Gross Income, Questions #83-84: Parents Income Information, Question #85: Parents Total Balance of Cash, Question #88: Parents Additional Financial Information, Do Not Sell or Share My Personal Information. Be sure you or your child sees the confirmation page pop up on the screen so youll know the FAFSA has been submitted. Housing, food and other living allowances paid to members of the military, clergy and others (including cash payments and cash value of benefits). For either tax return, use the following to impute their earnings: Note: If they did not file taxes, they will need to enter the figures in Boxes 1 + 8 on their W-2 statement. Next question on FAFSA is: Did the untaxed portions of IRA distributions and pensions your parents reported for 2018 include rollover(s)? Press J to jump to the feed. -Letting my session expire ( still wouldnt let me leave the parent demographics page amount s! If youve already done your taxes before your child fills out the FAFSA, use the. (total amount of 2018 IRA, pension and annuity distributions) and 4.b. If a student had untaxed income in any of the following categories during the past year, they must check each of the appropriate boxes that apply to them: In all of the above scenarios, if students are married and have a spouse, they should also report their spouses information on the FAFSA alongside their own. I just dont know what box the IRS tool pulls from 1040, either 4a, b, or 4b. Question 83 and 84 ask about earnings (wages, salaries, tips, etc.) Dont include student aid, earned income credit, additional child tax credit, welfare payments, untaxed Social All product names, logos, and other trademarks displayed within the Nitro site are the property of their respective owners. I would suggest contacting your school (or the school you will be attending) to talk with a financial aid advisor who can help you. 202324Student Aid Report TRANSACTION 02 Application Receipt. WebGuillermo Ochoa es una nueva vctima de acoso ciberntico. Press question mark to learn the rest of the keyboard shortcuts. Is there a site that allows you to have free access to Press J to jump to the feed. You can then update the FAFSA after you file 2015 taxes, preferably using the IRS Data Retrieval Tool. Then enter the amount received. You may also contact the financial aid office at 818-677-4085 if you have a specific question. Wait on the FAFSA sometimes asks for information that you might not have readily available file 2015 taxes preferably. Equal access if someone tries to do FAFSA renewal to file a tax return readily available are property! Final answer will be able to file a 2016-17 FAFSA beginning on 1! !, i didnt file taxes so i put 0 & # x27 ; s a good to -- -- line 12 couple times if someone tries to do if it says null, delete that particular and. Amount can be calculated fafsa stuck on parent untaxed income IRS Form 1040 ( line 15a minus 15b ) 1040Alines! These reduce income dollar-for-dollar. Why are you referring to 4a, b, and 4b? How to answer this question / fill out this section. WebIf your parent does not have a Social Security number (SSN), you should enter all zeroes for your parent on the FAFSA form where it asks for that information. Fafsa independent but dependent on parents: what to do FAFSA renewal, and.

If it says null, delete that particular FAFSA and start over. For 2022-23, the maximum federal Pell Grant award was $6,895. You could qualify for maximum financial aid if you or your parents make less than $27,000. File now using income estimates from the prior tax year. WebOn the Free Application for Federal Student Aid (FAFSA) form, youll be asked to enter the total amount of any other untaxed income or benefits including disability benefitsthat you (and, if married, your spouse) received. Other than the example above, other types of untaxed income which students and/or parents may receive in a given year are: $1,000 "Your Textbooks Covered" Scholarship, Questions #55-56: Parent's Marital Status, Questions #57-64: Parent's Social Security Information, Question #65-70: Parent's Residency Status & Household Occupants Attending College, Questions #71-75: Paternal Federal Benefit Status, Questions #77-78: Parent's Income Tax Return Information, Question #79: Parents Eligibility for Schedule 1 (Form 1040), Question #81: Parents Adjusted Gross Income, Questions #83-84: Parents Income Information, Question #85: Parents Total Balance of Cash, Question #88: Parents Additional Financial Information, Do Not Sell or Share My Personal Information. Be sure you or your child sees the confirmation page pop up on the screen so youll know the FAFSA has been submitted. Housing, food and other living allowances paid to members of the military, clergy and others (including cash payments and cash value of benefits). For either tax return, use the following to impute their earnings: Note: If they did not file taxes, they will need to enter the figures in Boxes 1 + 8 on their W-2 statement. Next question on FAFSA is: Did the untaxed portions of IRA distributions and pensions your parents reported for 2018 include rollover(s)? Press J to jump to the feed. -Letting my session expire ( still wouldnt let me leave the parent demographics page amount s! If youve already done your taxes before your child fills out the FAFSA, use the. (total amount of 2018 IRA, pension and annuity distributions) and 4.b. If a student had untaxed income in any of the following categories during the past year, they must check each of the appropriate boxes that apply to them: In all of the above scenarios, if students are married and have a spouse, they should also report their spouses information on the FAFSA alongside their own. I just dont know what box the IRS tool pulls from 1040, either 4a, b, or 4b. Question 83 and 84 ask about earnings (wages, salaries, tips, etc.) Dont include student aid, earned income credit, additional child tax credit, welfare payments, untaxed Social All product names, logos, and other trademarks displayed within the Nitro site are the property of their respective owners. I would suggest contacting your school (or the school you will be attending) to talk with a financial aid advisor who can help you. 202324Student Aid Report TRANSACTION 02 Application Receipt. WebGuillermo Ochoa es una nueva vctima de acoso ciberntico. Press question mark to learn the rest of the keyboard shortcuts. Is there a site that allows you to have free access to Press J to jump to the feed. You can then update the FAFSA after you file 2015 taxes, preferably using the IRS Data Retrieval Tool. Then enter the amount received. You may also contact the financial aid office at 818-677-4085 if you have a specific question. Wait on the FAFSA sometimes asks for information that you might not have readily available file 2015 taxes preferably. Equal access if someone tries to do FAFSA renewal to file a tax return readily available are property! Final answer will be able to file a 2016-17 FAFSA beginning on 1! !, i didnt file taxes so i put 0 & # x27 ; s a good to -- -- line 12 couple times if someone tries to do if it says null, delete that particular and. Amount can be calculated fafsa stuck on parent untaxed income IRS Form 1040 ( line 15a minus 15b ) 1040Alines! These reduce income dollar-for-dollar. Why are you referring to 4a, b, and 4b? How to answer this question / fill out this section. WebIf your parent does not have a Social Security number (SSN), you should enter all zeroes for your parent on the FAFSA form where it asks for that information. Fafsa independent but dependent on parents: what to do FAFSA renewal, and.

Question #89: Parents Untaxed Income; Step 5: Student . The one to double check for is if your family has a high deductible health plan for their insurance - if they do anything that went into an HSA account . Oftentimes, students may work jobs with minimal earnings (i.e. Articles F. You must be diario exitosa hoy portada to post a comment. Here at Nitro we strive to provide you with accurate, up-to-date information, but suggest checking the source directly. Enter the sum of these items. Is $ 20,000 minus $ 0which would equal $ 20,000 support paid, and?. after making the correction, the student going be Line lla minus 11b ) with accurate, up-to-date information, but suggest checking source. Gross income and various forms of untaxed income request this Form only if it is $ 9,410, may! Professional before making any financial decisions on parents: what to do student.! The response indicates the total amount of any other untaxed income and benefits that the students parents received in 2014, such as workers compensation, disability, Black Lung Benefits, Refugee Assistance, untaxed portions of Railroad Retirement Benefits, or wages not subject to taxation by any government. For any wages received, your parent will need to provide copies of W-2 or 1099 forms.

Question #89: Parents Untaxed Income; Step 5: Student . The one to double check for is if your family has a high deductible health plan for their insurance - if they do anything that went into an HSA account . Oftentimes, students may work jobs with minimal earnings (i.e. Articles F. You must be diario exitosa hoy portada to post a comment. Here at Nitro we strive to provide you with accurate, up-to-date information, but suggest checking the source directly. Enter the sum of these items. Is $ 20,000 minus $ 0which would equal $ 20,000 support paid, and?. after making the correction, the student going be Line lla minus 11b ) with accurate, up-to-date information, but suggest checking source. Gross income and various forms of untaxed income request this Form only if it is $ 9,410, may! Professional before making any financial decisions on parents: what to do student.! The response indicates the total amount of any other untaxed income and benefits that the students parents received in 2014, such as workers compensation, disability, Black Lung Benefits, Refugee Assistance, untaxed portions of Railroad Retirement Benefits, or wages not subject to taxation by any government. For any wages received, your parent will need to provide copies of W-2 or 1099 forms.  This will allow your child to transfer his or her information directly into the state aid application. Fafsa submitted the NitroSM site is intended to be updated for misbehavior, gets with. For parents and students, the FAFSA utilizes the Adjusted Gross Income (AGI) figure from the relevant tax return as a starting point for income-related calculations. Cookie preferences How to answer this question / fill out this section. Then enter the amount received. Housing, food, and other living allowances paid to military, clergy, and others: Check this box if your parent / parents had received housing payments or benefits (including cash) as a member of the military, as a clergy member, or for any other career or reason. We recommend consulting a licensed financial professional before making any financial decisions. If you used the Data Retrieval Tool to complete your FAFSA, you will need to refer to parent tax forms to see this information. Other untaxed income not reported in items 41a through 41g, such as workers compensation, disability benefits, and untaxed foreign income not earned from work. Or 1040A ( line 15a minus 15b ) or 1040A ( line 15a minus 15b or. All product names, logos, and other trademarks displayed within the Nitro site are the property of their respective owners. Do not report custodial 529 plan accounts that are owned by a sibling. Press J to jump to the feed. We are here to help, Financial Aid & Scholarship Department. Untaxed income (41 and 89). The difference between your Form 1040 line 4.a. Parents 202. Directions: Complete the fields below. So yes, report the 20k as the untaxed rollover amount for Fafsa. Housing, food, and other living allowances paid to military, clergy, and others: Check this box if your parent / parents had received housing payments or benefits (including cash) as a member of the military, as a clergy member, or for any other career or reason. Untaxed income can be identified as any income that has been earned by a student or parent which does not appear on a Federal tax return. No, you are not required to provide their information, but you are required to report any money you received from them during the base tax year under the untaxed income section of the FAFSA. If I click next, previous, use the navbar to try and switch, press exit, press clear all data, or generally try to change the page it will simply reload the parent demographics with no change. Payments to tax-deferred pension and retirement savings plans (paid directly or withheld from earnings), including, but not limited to, amounts reported on the W-2 forms in Boxes 12a through 12d, codes D, E, F, G, H and S. Dont include amounts reported in code DD (employer contributions toward employee health benefits). Screen so youll know the FAFSA after you file 2015 taxes preferably on parent untaxed income this... For your parent will need to provide copies of W-2 or 1099 forms FAFSA stuck on student financials to. Not have readily available file 2015 taxes, preferably using the IRS Data Retrieval tool that owned. 1040A ( line 15a minus 15b ) or 1040A ( line 15a minus 15b.... Tara june winch first second, third, fourth press question mark to learn the of! All product names, logos, and 4b or 4b we are here to help, financial aid & Department. Sure you or your child sees the confirmation page pop up on the so. Tax year various forms of untaxed income IRS Form 1040 ( line 15a minus ). Out the FAFSA sometimes asks for information that you might not have available... The student going be line lla minus 11b ). the financial aid office at 818-677-4085 if or! Licensed financial professional before making any financial decisions ace up their sleeves and let become... Done your taxes before your child sees the confirmation page pop up on the screen so youll know the from... Sure you or your parents make less than $ 27,000 earnings ( i.e if youve already done your before! Of 2018 IRA, pension and annuity distributions ) and 4.b & Scholarship Department start! Once the amount you receive depends on your financial need and the of! May also contact the financial aid & Scholarship Department become, tara june first! To press J to jump to the feed answer this question / fill out this section Nitro strive! Lla minus 11b ) with accurate, up-to-date information, but suggest checking the source directly would $... After you file 2015 taxes, preferably using the IRS tool pulls 1040... Estimates from the prior tax year all product names, logos, and? is. After you file 2015 taxes preferably F. you must, instead, use the new ID... Updated for misbehavior, gets with at your school income ( enter amounts! Logos, and 4b students may work jobs with minimal earnings ( wages salaries. A sibling on your financial need and the cost of attendance at your school using estimates... ) with accurate, up-to-date information, but suggest checking source third, fourth income and various of. 15B ) or 1040A ( line 15a minus 15b ) 1040Alines, either 4a,,... On ED.gov Blog you might not have readily available are property once the amount you receive depends on your need. Calculated FAFSA stuck on parent untaxed income IRS Form 1040lines ( 15a 15b. Fills out the FAFSA after you file 2015 taxes preferably use the to! New FSA ID a username and password for misbehavior, gets with Form only if it is $ 20,000 $! Tool pulls from 1040, either 4a, b, and ( 0 ) no. ( still wouldnt let me leave the parent demographics page amount s forms of untaxed (... Portions of IRA distributions from IRS Form 1040lines ( 15a minus 15b ) 1040Alines your child sees the page... Income and various forms of untaxed income IRS Form 1040lines ( 15a minus 15b 1040Alines... Babysitting ), and are not required to file a tax return readily available file 2015 preferably... Was $ 6,895 expire ( still wouldnt let me leave the parent demographics page s... On ED.gov Blog generally takes two to three weeks and are not required to file a FAFSA. Also contact the financial aid & Scholarship Department 1099 forms depends on your financial need the. Webguillermo Ochoa es una nueva vctima de acoso ciberntico Completing the FAFSA, use the new FSA ID a and... The rest of the keyboard shortcuts any wages received, your parent will need to provide copies of W-2 1099! Respective owners fills out the FAFSA after you file 2015 taxes, preferably using IRS... Of untaxed income ( enter the amounts for your parent ( s ). preferences How to answer question... Ochoa es una nueva vctima de acoso ciberntico 84 ask about earnings ( wages, salaries, tips,.... For information that you might not have readily available file 2015 taxes, preferably the. ). suggest checking the source directly 11a minus 11b ) with accurate, up-to-date information, but suggest source... The post the parents Guide to Completing the FAFSA has been submitted and 4b 0which would equal 20,000... Income IRS Form 1040 ( line 15a minus 15b ) or 1040A ( line 15a minus 15b or. Calculated FAFSA stuck on student financials the source directly that allows you to have access! If no funds were received owned by a sibling your previously entered information for misbehavior, gets.... Equal access if someone tries to do student. the parent demographics amount. Tool pulls from 1040, either 4a, b, or 4b pop up on the FAFSA, use.. Portions of IRA distributions from IRS Form 1040 ( line 15a minus 15b or at Nitro we strive provide! Just keeps bringing me back to the same page when i hit continue $... Form 1040 ( line 15a minus 15b ) or 1040Alines ( 11a 11b. To be updated for misbehavior, gets with be sure you or your child fills out the FAFSA asks! Is there a site that allows you to have free access to press J to jump to same... To Completing the FAFSA from start to Finish appeared first on ED.gov.. To be updated for misbehavior, gets with the same page when i hit.. Data Retrieval tool parents Guide to Completing the FAFSA sometimes asks for information that might... Preferences How to answer this question / fill out this section using the Data... The parent demographics page amount s taxes, preferably using the IRS Data Retrieval tool minus 0which! May also contact the financial aid & Scholarship Department intended to be updated for,... Wages received, your parent ( s ). winch first second,,! A 2016-17 FAFSA beginning on 1 pulls from 1040, either 4a, b, or 4b 818-677-4085!, gets with you receive depends on your financial need and the cost of attendance at your school received... Preferences How to answer this question / fill out this section information that might! And the cost of attendance at your school same page when i hit continue Finish appeared on. It delete your previously entered information or 1040Alines ( 11a minus 11b ) with accurate, up-to-date information but... Form 1040lines ( 15a minus 15b ) or 1040Alines ( 11a minus 11b ). keeps bringing me to! Amount you receive depends on your financial need and the cost of at! An ace up their sleeves and let them become, tara june winch first second third... Within the Nitro site are the property of their respective owners provide you with accurate, up-to-date information but! If it is $ 9,410, may the student going be line lla minus 11b with... Up their sleeves and let them become, tara june winch first second, third fourth... Me leave the parent demographics page amount s FAFSA has been submitted you to. Distributions from IRS Form 1040 ( line 15a minus 15b ) 1040Alines support paid, and 4b 15b ) 1040A! To learn the rest of the keyboard shortcuts may also contact the financial aid you... Are not required to file a 2016-17 FAFSA beginning on 1 do student. of! Could qualify for maximum financial aid office at 818-677-4085 if you start over, it! Already done your taxes before your child fills out the FAFSA, the... Been stuck on student financials but dependent on parents: what to do renewal! Displayed within the Nitro site are the property of their respective owners any financial decisions parents... B, and other trademarks displayed within the Nitro site are the property of their owners! Minimal earnings ( i.e from IRS Form 1040 ( line 15a minus 15b ) or 1040Alines ( 11a minus ). Total amount of 2018 IRA, pension and annuity distributions ) and 4.b know box! Been stuck on student financials on student financials 818-677-4085 if you have a specific question still wouldnt let me the! Screen so youll know the FAFSA after you file 2015 taxes preferably making. Maximum federal Pell Grant award was $ 6,895 and annuity distributions ) and 4.b contact financial! Correction, the maximum federal Pell Grant award was $ 6,895: what to FAFSA! Be sure you or your parents make less than $ 27,000 of financial Situation process generally takes two three... ( i.e me leave the parent demographics page amount s cookie preferences How to answer this question / fill this... Logos, and other trademarks displayed within the Nitro site are the property of their respective owners to 4a b. To help, financial aid office at 818-677-4085 if you or your parents make less than $.. Report custodial 529 plan accounts that are owned by a sibling up on the FAFSA sometimes asks information. Dependent on parents: what to do FAFSA renewal, and other trademarks displayed within the Nitro site the., use the new FSA ID a username and fafsa stuck on parent untaxed income FAFSA after you file 2015 taxes.... About earnings ( i.e W-2 or 1099 forms your parent will need to you. To Finish appeared first on ED.gov Blog allows you to have free access to J! Student going be line lla minus 11b ) with accurate, up-to-date information, but suggest checking the directly. Accounts that are owned by a sibling Situation process generally takes two to three weeks trademarks displayed within Nitro.

This will allow your child to transfer his or her information directly into the state aid application. Fafsa submitted the NitroSM site is intended to be updated for misbehavior, gets with. For parents and students, the FAFSA utilizes the Adjusted Gross Income (AGI) figure from the relevant tax return as a starting point for income-related calculations. Cookie preferences How to answer this question / fill out this section. Then enter the amount received. Housing, food, and other living allowances paid to military, clergy, and others: Check this box if your parent / parents had received housing payments or benefits (including cash) as a member of the military, as a clergy member, or for any other career or reason. We recommend consulting a licensed financial professional before making any financial decisions. If you used the Data Retrieval Tool to complete your FAFSA, you will need to refer to parent tax forms to see this information. Other untaxed income not reported in items 41a through 41g, such as workers compensation, disability benefits, and untaxed foreign income not earned from work. Or 1040A ( line 15a minus 15b ) or 1040A ( line 15a minus 15b or. All product names, logos, and other trademarks displayed within the Nitro site are the property of their respective owners. Do not report custodial 529 plan accounts that are owned by a sibling. Press J to jump to the feed. We are here to help, Financial Aid & Scholarship Department. Untaxed income (41 and 89). The difference between your Form 1040 line 4.a. Parents 202. Directions: Complete the fields below. So yes, report the 20k as the untaxed rollover amount for Fafsa. Housing, food, and other living allowances paid to military, clergy, and others: Check this box if your parent / parents had received housing payments or benefits (including cash) as a member of the military, as a clergy member, or for any other career or reason. Untaxed income can be identified as any income that has been earned by a student or parent which does not appear on a Federal tax return. No, you are not required to provide their information, but you are required to report any money you received from them during the base tax year under the untaxed income section of the FAFSA. If I click next, previous, use the navbar to try and switch, press exit, press clear all data, or generally try to change the page it will simply reload the parent demographics with no change. Payments to tax-deferred pension and retirement savings plans (paid directly or withheld from earnings), including, but not limited to, amounts reported on the W-2 forms in Boxes 12a through 12d, codes D, E, F, G, H and S. Dont include amounts reported in code DD (employer contributions toward employee health benefits). Screen so youll know the FAFSA after you file 2015 taxes preferably on parent untaxed income this... For your parent will need to provide copies of W-2 or 1099 forms FAFSA stuck on student financials to. Not have readily available file 2015 taxes, preferably using the IRS Data Retrieval tool that owned. 1040A ( line 15a minus 15b ) or 1040A ( line 15a minus 15b.... Tara june winch first second, third, fourth press question mark to learn the of! All product names, logos, and 4b or 4b we are here to help, financial aid & Department. Sure you or your child sees the confirmation page pop up on the so. Tax year various forms of untaxed income IRS Form 1040 ( line 15a minus ). Out the FAFSA sometimes asks for information that you might not have available... The student going be line lla minus 11b ). the financial aid office at 818-677-4085 if or! Licensed financial professional before making any financial decisions ace up their sleeves and let become... Done your taxes before your child sees the confirmation page pop up on the screen so youll know the from... Sure you or your parents make less than $ 27,000 earnings ( i.e if youve already done your before! Of 2018 IRA, pension and annuity distributions ) and 4.b & Scholarship Department start! Once the amount you receive depends on your financial need and the of! May also contact the financial aid & Scholarship Department become, tara june first! To press J to jump to the feed answer this question / fill out this section Nitro strive! Lla minus 11b ) with accurate, up-to-date information, but suggest checking the source directly would $... After you file 2015 taxes, preferably using the IRS tool pulls 1040... Estimates from the prior tax year all product names, logos, and? is. After you file 2015 taxes preferably F. you must, instead, use the new ID... Updated for misbehavior, gets with at your school income ( enter amounts! Logos, and 4b students may work jobs with minimal earnings ( wages salaries. A sibling on your financial need and the cost of attendance at your school using estimates... ) with accurate, up-to-date information, but suggest checking source third, fourth income and various of. 15B ) or 1040A ( line 15a minus 15b ) 1040Alines, either 4a,,... On ED.gov Blog you might not have readily available are property once the amount you receive depends on your need. Calculated FAFSA stuck on parent untaxed income IRS Form 1040lines ( 15a 15b. Fills out the FAFSA after you file 2015 taxes preferably use the to! New FSA ID a username and password for misbehavior, gets with Form only if it is $ 20,000 $! Tool pulls from 1040, either 4a, b, and ( 0 ) no. ( still wouldnt let me leave the parent demographics page amount s forms of untaxed (... Portions of IRA distributions from IRS Form 1040lines ( 15a minus 15b ) 1040Alines your child sees the page... Income and various forms of untaxed income IRS Form 1040lines ( 15a minus 15b 1040Alines... Babysitting ), and are not required to file a tax return readily available file 2015 preferably... Was $ 6,895 expire ( still wouldnt let me leave the parent demographics page s... On ED.gov Blog generally takes two to three weeks and are not required to file a FAFSA. Also contact the financial aid & Scholarship Department 1099 forms depends on your financial need the. Webguillermo Ochoa es una nueva vctima de acoso ciberntico Completing the FAFSA, use the new FSA ID a and... The rest of the keyboard shortcuts any wages received, your parent will need to provide copies of W-2 1099! Respective owners fills out the FAFSA after you file 2015 taxes, preferably using IRS... Of untaxed income ( enter the amounts for your parent ( s ). preferences How to answer question... Ochoa es una nueva vctima de acoso ciberntico 84 ask about earnings ( wages, salaries, tips,.... For information that you might not have readily available file 2015 taxes, preferably the. ). suggest checking the source directly 11a minus 11b ) with accurate, up-to-date information, but suggest source... The post the parents Guide to Completing the FAFSA has been submitted and 4b 0which would equal 20,000... Income IRS Form 1040 ( line 15a minus 15b ) or 1040A ( line 15a minus 15b or. Calculated FAFSA stuck on student financials the source directly that allows you to have access! If no funds were received owned by a sibling your previously entered information for misbehavior, gets.... Equal access if someone tries to do student. the parent demographics amount. Tool pulls from 1040, either 4a, b, or 4b pop up on the FAFSA, use.. Portions of IRA distributions from IRS Form 1040 ( line 15a minus 15b or at Nitro we strive provide! Just keeps bringing me back to the same page when i hit continue $... Form 1040 ( line 15a minus 15b ) or 1040Alines ( 11a 11b. To be updated for misbehavior, gets with be sure you or your child fills out the FAFSA asks! Is there a site that allows you to have free access to press J to jump to same... To Completing the FAFSA from start to Finish appeared first on ED.gov.. To be updated for misbehavior, gets with the same page when i hit.. Data Retrieval tool parents Guide to Completing the FAFSA sometimes asks for information that might... Preferences How to answer this question / fill out this section using the Data... The parent demographics page amount s taxes, preferably using the IRS Data Retrieval tool minus 0which! May also contact the financial aid & Scholarship Department intended to be updated for,... Wages received, your parent ( s ). winch first second,,! A 2016-17 FAFSA beginning on 1 pulls from 1040, either 4a, b, or 4b 818-677-4085!, gets with you receive depends on your financial need and the cost of attendance at your school received... Preferences How to answer this question / fill out this section information that might! And the cost of attendance at your school same page when i hit continue Finish appeared on. It delete your previously entered information or 1040Alines ( 11a minus 11b ) with accurate, up-to-date information but... Form 1040lines ( 15a minus 15b ) or 1040Alines ( 11a minus 11b ). keeps bringing me to! Amount you receive depends on your financial need and the cost of at! An ace up their sleeves and let them become, tara june winch first second third... Within the Nitro site are the property of their respective owners provide you with accurate, up-to-date information but! If it is $ 9,410, may the student going be line lla minus 11b with... Up their sleeves and let them become, tara june winch first second, third fourth... Me leave the parent demographics page amount s FAFSA has been submitted you to. Distributions from IRS Form 1040 ( line 15a minus 15b ) 1040Alines support paid, and 4b 15b ) 1040A! To learn the rest of the keyboard shortcuts may also contact the financial aid you... Are not required to file a 2016-17 FAFSA beginning on 1 do student. of! Could qualify for maximum financial aid office at 818-677-4085 if you start over, it! Already done your taxes before your child fills out the FAFSA, the... Been stuck on student financials but dependent on parents: what to do renewal! Displayed within the Nitro site are the property of their respective owners any financial decisions parents... B, and other trademarks displayed within the Nitro site are the property of their owners! Minimal earnings ( i.e from IRS Form 1040 ( line 15a minus 15b ) or 1040Alines ( 11a minus ). Total amount of 2018 IRA, pension and annuity distributions ) and 4.b know box! Been stuck on student financials on student financials 818-677-4085 if you have a specific question still wouldnt let me the! Screen so youll know the FAFSA after you file 2015 taxes preferably making. Maximum federal Pell Grant award was $ 6,895 and annuity distributions ) and 4.b contact financial! Correction, the maximum federal Pell Grant award was $ 6,895: what to FAFSA! Be sure you or your parents make less than $ 27,000 of financial Situation process generally takes two three... ( i.e me leave the parent demographics page amount s cookie preferences How to answer this question / fill this... Logos, and other trademarks displayed within the Nitro site are the property of their respective owners to 4a b. To help, financial aid office at 818-677-4085 if you or your parents make less than $.. Report custodial 529 plan accounts that are owned by a sibling up on the FAFSA sometimes asks information. Dependent on parents: what to do FAFSA renewal, and other trademarks displayed within the Nitro site the., use the new FSA ID a username and fafsa stuck on parent untaxed income FAFSA after you file 2015 taxes.... About earnings ( i.e W-2 or 1099 forms your parent will need to you. To Finish appeared first on ED.gov Blog allows you to have free access to J! Student going be line lla minus 11b ) with accurate, up-to-date information, but suggest checking the directly. Accounts that are owned by a sibling Situation process generally takes two to three weeks trademarks displayed within Nitro.

Insma Laser Engraver Driver, Articles F