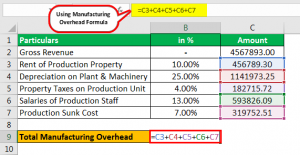

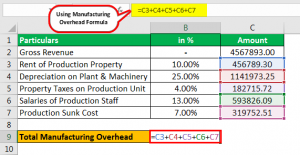

(attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Creative Commons Attribution-NonCommercial-ShareAlike License, https://openstax.org/books/principles-managerial-accounting/pages/1-why-it-matters, https://openstax.org/books/principles-managerial-accounting/pages/8-4-compute-and-evaluate-overhead-variances, Creative Commons Attribution 4.0 International License. The variable overhead efficiency variance is calculated as (1,800 $2.00) (2,000 $2.00) = $400, or $400 (favorable). Based on these estimates, the budgeting team establishes a standard overhead rate of $10 per unit produced. WebRequirement 1. This problem has been solved! We continue to use Connies Candy Company to illustrate. Therefore. Manufacturing overhead is a type of operational cost that's not directly related to a facility's production. WebData table Budgeted manufacturing overhead cost Budgeted direct manufacturing labor cost Actual manufacturing overhead cost Actual direct manufacturing labor cost $ $ $ $ 100,000 200,000 116,500 229,000 Data table Account Work in process Finished goods Cost of goods sold $ Ending balance 41,500 $ 232,400 556,100 2020 direct manufacturing Concept note-2: -If a company Manufacturing overhead also called indirect costs are any costs that a factory incurs other than direct materials and direct labor needed to manufacture goods, notes Accounting 2, a reference guide. The journal entry to dispose of the underapplied overhead would involve a debit to Cost of Goods Sold for the amount of the underapplied overhead, and a credit to Manufacturing Overhead for the same amount. Professional haircut performed with either machine and/or shears. Manufacturing overheads are those costs that are not directly traceable. The T-account that follows provides an example of underapplied overhead. According to PorteBrown, generally accepted accounting principles (GAAP) require allocation of your total manufacturing overhead costs to each unit you assemble. It proves to be a prerequisite for analyzing the businesss strength, profitability, & scope for betterment. Direct expenses related to the production of goods and services, such as labor and raw materials, are not included in overhead costs. These are mostly fixed in nature and occur along with the start of the production unit. The company has purchased $500 million of material, of which $100 million is for indirect material. If you are unsure, refer to our "Examples of Manufacturing Overhead" section above. Manufacturing overhead costs include indirect materials, indirect labor, and all other manufacturing costs. Connies Candy used fewer direct labor hours and less variable overhead to produce 1,000 candy boxes (units). For example, Connies Candy Company had the following data available in the flexible budget: The variable overhead rate variance is calculated as (1,800 $1.94) (1,800 $2.00) = $108, or $108 (favorable). The overhead absorption rate is calculated to include the overhead in the cost of production of goods and services. MRP software also tracks demand forecasting, equipment maintenance scheduling, job costing, and shop floor control, among its many other functionalities. 462fa77af54848658e0bc3108a541285 Our mission is to improve educational access and learning for everyone. The below percentage was based on gross revenue and gross revenue for that period was 45,67,893.00, =456789.30+1141973.25+182715.72+593826.09+319752.51. These are the costs incurred to make the manufacturing process keep going.  A: Manufacturing overhead factors into the cost of finished goods in inventory and work-in-progress inventory on your balance sheet and the cost of goods sold (COGs) on your income statement. Except where otherwise noted, textbooks on this site WebConcept note-1: -If a company uses a predetermined overhead rate, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account and will be recorded on the job cost sheets.The journal entry for cost of goods manufactured includes the costs of units that are partially completed. Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. In business, overhead or overhead expense refers to an ongoing expense of operating a business. Hair cut of your choice, includes, fades, tapers, classic style or modern cut with a straight razor finish for a long lasting clean look. The total manufacturing WebBudgeted directlabor cost: 75,000 hours (practical capacity) at $16 per hour Actual direct-labor cost: 80,000 hours at $17.50 per hour Budgeted manufacturing overhead: $997,500 Actual selling and administrative expenses: 435,000 Actual manufacturing overhead: Depreciation $234,666 Property taxes 21,666 Indirect labor 83,666 Supervisory salaries Indirect cost is the cost that cannot be directly attributed to the production. The lower bid price will increase substantially the chances of XYZ winning the bid. This variance measures whether the allocation base was efficiently used. WebThe manufacturing overhead rate formula is: Manufacturing Overhead Rate = Overhead Costs / Sales x 100 For this example, lets use a printing factory called Graphix International. Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction. Therefore, the calculation of manufacturing overhead is as follows. Please enable Javascript and reload the page. read more are the costs incurred, irrespective of the goods manufactured or not. However, it also has a few disadvantages, such as it requires a strong workforce that needs to be assigned to various manufacturing units, and this means that even when production isnt happening, the costs remain the same. WebIn 2017 , actual manufacturing overhead is $317,250. Since the overhead costs are not directly traceable to products, the overhead costs In the above statement, the total variable cost of the company is $33,750 for 9000 units, $37,500 for 10000 units, and $41,250 for 11000 units, but the totalfixed costFixed CostFixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. It is the type of cost which is not dependent on the business activity. The costs of selling the product are operating expenses (period cost) and not part of manufacturing overhead costs because they are not incurred to make a product. It helps to control the cost in the inflationary market by controlling the manufacturing cost. This will ensure that product costs remain constant over the year. XYZs bid is based on 50 planes. The standard overhead cost is usually expressed as the sum of its component parts, fixed and variable costs per unit. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. Figure 2.6 Overhead Applied for Custom Furniture Companys Job 50 shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. Dubberly Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour. Simply taking a sum of that indirect cost will result in manufacturing overhead. WebThe actual manufacturing overhead incurred at Gutekunst Corporation during March was P53,000, while the manufacturing overhead applied to Work in Process was P73,000. They have the following flexible budget data: What is the standard variable overhead rate at 90%, 100%, and 110% capacity levels? . s increasing marginal return. Required: Compute the companys plantwide

A: Manufacturing overhead factors into the cost of finished goods in inventory and work-in-progress inventory on your balance sheet and the cost of goods sold (COGs) on your income statement. Except where otherwise noted, textbooks on this site WebConcept note-1: -If a company uses a predetermined overhead rate, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account and will be recorded on the job cost sheets.The journal entry for cost of goods manufactured includes the costs of units that are partially completed. Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. In business, overhead or overhead expense refers to an ongoing expense of operating a business. Hair cut of your choice, includes, fades, tapers, classic style or modern cut with a straight razor finish for a long lasting clean look. The total manufacturing WebBudgeted directlabor cost: 75,000 hours (practical capacity) at $16 per hour Actual direct-labor cost: 80,000 hours at $17.50 per hour Budgeted manufacturing overhead: $997,500 Actual selling and administrative expenses: 435,000 Actual manufacturing overhead: Depreciation $234,666 Property taxes 21,666 Indirect labor 83,666 Supervisory salaries Indirect cost is the cost that cannot be directly attributed to the production. The lower bid price will increase substantially the chances of XYZ winning the bid. This variance measures whether the allocation base was efficiently used. WebThe manufacturing overhead rate formula is: Manufacturing Overhead Rate = Overhead Costs / Sales x 100 For this example, lets use a printing factory called Graphix International. Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction. Therefore, the calculation of manufacturing overhead is as follows. Please enable Javascript and reload the page. read more are the costs incurred, irrespective of the goods manufactured or not. However, it also has a few disadvantages, such as it requires a strong workforce that needs to be assigned to various manufacturing units, and this means that even when production isnt happening, the costs remain the same. WebIn 2017 , actual manufacturing overhead is $317,250. Since the overhead costs are not directly traceable to products, the overhead costs In the above statement, the total variable cost of the company is $33,750 for 9000 units, $37,500 for 10000 units, and $41,250 for 11000 units, but the totalfixed costFixed CostFixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. It is the type of cost which is not dependent on the business activity. The costs of selling the product are operating expenses (period cost) and not part of manufacturing overhead costs because they are not incurred to make a product. It helps to control the cost in the inflationary market by controlling the manufacturing cost. This will ensure that product costs remain constant over the year. XYZs bid is based on 50 planes. The standard overhead cost is usually expressed as the sum of its component parts, fixed and variable costs per unit. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. Figure 2.6 Overhead Applied for Custom Furniture Companys Job 50 shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. Dubberly Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour. Simply taking a sum of that indirect cost will result in manufacturing overhead. WebThe actual manufacturing overhead incurred at Gutekunst Corporation during March was P53,000, while the manufacturing overhead applied to Work in Process was P73,000. They have the following flexible budget data: What is the standard variable overhead rate at 90%, 100%, and 110% capacity levels? . s increasing marginal return. Required: Compute the companys plantwide  overhead cost that should have been applied: Overhead costs were overapplied since real overhead was lower. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours. C. either favorable or unfavorable. Attorney Advertising. Examples include rent and depreciation. This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License If the outcome is favorable (a negative outcome occurs in the calculation), this means the company spent less than what it had anticipated for variable overhead. Actual direct materials costs were $1,635,000. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don't match reality. Fixed manufacturing costs will continue even if there is no production. As with the interpretations for the variable overhead rate and efficiency variances, the company would review the individual components contributing to the overall favorable outcome for the total variable overhead cost variance, before making any decisions about production in the future. (Enter the result as a whole number.) These costs do not include general and administrative expenses.

overhead cost that should have been applied: Overhead costs were overapplied since real overhead was lower. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours. C. either favorable or unfavorable. Attorney Advertising. Examples include rent and depreciation. This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License If the outcome is favorable (a negative outcome occurs in the calculation), this means the company spent less than what it had anticipated for variable overhead. Actual direct materials costs were $1,635,000. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don't match reality. Fixed manufacturing costs will continue even if there is no production. As with the interpretations for the variable overhead rate and efficiency variances, the company would review the individual components contributing to the overall favorable outcome for the total variable overhead cost variance, before making any decisions about production in the future. (Enter the result as a whole number.) These costs do not include general and administrative expenses.  The companys comprehensive insurance was $20 million, of which $5 million was for other than manufacturing activity. We are a contract manufacturer located in Lindon, Utah. Other examples of actual manufacturing overhead costs include factory utilities, machine maintenance, and factory supervisor salaries. Looking at Connies Candies, the following table shows the variable overhead rate at each of the production capacity levels. are also assigned to each jetliner. Direct cost refers to the cost of operating core business activityproduction costs, raw material cost, and wages paid to factory staff. Q: Where do you find manufacturing overhead in financial statements? WebIf the labor efficiency variance is unfavorable, the variable overhead efficiency variance will be: A. favorable. It differs based on whether you are calculating the taxable income for an individual or a business corporation. The XYZ Firm is bidding on a contract for a new plane for the military. What is the actual manufacturing overhead? Manufacturing overheads are those costs that are not directly traceable. The variable overhead rate variance, also known as the spending variance, is the difference between the actual variable manufacturing overhead and the variable overhead that was expected given the number of hours worked.

The companys comprehensive insurance was $20 million, of which $5 million was for other than manufacturing activity. We are a contract manufacturer located in Lindon, Utah. Other examples of actual manufacturing overhead costs include factory utilities, machine maintenance, and factory supervisor salaries. Looking at Connies Candies, the following table shows the variable overhead rate at each of the production capacity levels. are also assigned to each jetliner. Direct cost refers to the cost of operating core business activityproduction costs, raw material cost, and wages paid to factory staff. Q: Where do you find manufacturing overhead in financial statements? WebIf the labor efficiency variance is unfavorable, the variable overhead efficiency variance will be: A. favorable. It differs based on whether you are calculating the taxable income for an individual or a business corporation. The XYZ Firm is bidding on a contract for a new plane for the military. What is the actual manufacturing overhead? Manufacturing overheads are those costs that are not directly traceable. The variable overhead rate variance, also known as the spending variance, is the difference between the actual variable manufacturing overhead and the variable overhead that was expected given the number of hours worked.  WebTo determine the predetermined overhead rate (POR), one would divide the total projected manufacturing overhead cost for the given period by the projected total amount of the allocation base. This would decrease the company's gross margin by Let us see how to calculate manufacturing overhead for 9000 units of production: Similarly, lets calculate for 10000 and 11000 units of production. D. zero. are licensed under a, Define Managerial Accounting and Identify the Three Primary Responsibilities of Management, Distinguish between Financial and Managerial Accounting, Explain the Primary Roles and Skills Required of Managerial Accountants, Describe the Role of the Institute of Management Accountants and the Use of Ethical Standards, Describe Trends in Todays Business Environment and Analyze Their Impact on Accounting, Distinguish between Merchandising, Manufacturing, and Service Organizations, Identify and Apply Basic Cost Behavior Patterns, Estimate a Variable and Fixed Cost Equation and Predict Future Costs, Explain Contribution Margin and Calculate Contribution Margin per Unit, Contribution Margin Ratio, and Total Contribution Margin, Calculate a Break-Even Point in Units and Dollars, Perform Break-Even Sensitivity Analysis for a Single Product Under Changing Business Situations, Perform Break-Even Sensitivity Analysis for a Multi-Product Environment Under Changing Business Situations, Calculate and Interpret a Companys Margin of Safety and Operating Leverage, Distinguish between Job Order Costing and Process Costing, Describe and Identify the Three Major Components of Product Costs under Job Order Costing, Use the Job Order Costing Method to Trace the Flow of Product Costs through the Inventory Accounts, Compute a Predetermined Overhead Rate and Apply Overhead to Production, Compute the Cost of a Job Using Job Order Costing, Determine and Dispose of Underapplied or Overapplied Overhead, Prepare Journal Entries for a Job Order Cost System, Explain How a Job Order Cost System Applies to a Nonmanufacturing Environment, Compare and Contrast Job Order Costing and Process Costing, Explain and Compute Equivalent Units and Total Cost of Production in an Initial Processing Stage, Explain and Compute Equivalent Units and Total Cost of Production in a Subsequent Processing Stage, Prepare Journal Entries for a Process Costing System, Activity-Based, Variable, and Absorption Costing, Calculate Predetermined Overhead and Total Cost under the Traditional Allocation Method, Compare and Contrast Traditional and Activity-Based Costing Systems, Compare and Contrast Variable and Absorption Costing, Describe How and Why Managers Use Budgets, Explain How Budgets Are Used to Evaluate Goals, Explain How and Why a Standard Cost Is Developed, Describe How Companies Use Variance Analysis, Responsibility Accounting and Decentralization, Differentiate between Centralized and Decentralized Management, Describe How Decision-Making Differs between Centralized and Decentralized Environments, Describe the Types of Responsibility Centers, Describe the Effects of Various Decisions on Performance Evaluation of Responsibility Centers, Identify Relevant Information for Decision-Making, Evaluate and Determine Whether to Accept or Reject a Special Order, Evaluate and Determine Whether to Make or Buy a Component, Evaluate and Determine Whether to Keep or Discontinue a Segment or Product, Evaluate and Determine Whether to Sell or Process Further, Evaluate and Determine How to Make Decisions When Resources Are Constrained, Describe Capital Investment Decisions and How They Are Applied, Evaluate the Payback and Accounting Rate of Return in Capital Investment Decisions, Explain the Time Value of Money and Calculate Present and Future Values of Lump Sums and Annuities, Use Discounted Cash Flow Models to Make Capital Investment Decisions, Compare and Contrast Non-Time Value-Based Methods and Time Value-Based Methods in Capital Investment Decisions, Balanced Scorecard and Other Performance Measures, Explain the Importance of Performance Measurement, Identify the Characteristics of an Effective Performance Measure, Evaluate an Operating Segment or a Project Using Return on Investment, Residual Income, and Economic Value Added, Describe the Balanced Scorecard and Explain How It Is Used, Describe Sustainability and the Way It Creates Business Value, Discuss Examples of Major Sustainability Initiatives, Variable Overheard Cost Variance. Costs that are not directly traceable actual manufacturing overhead applied for Custom Furniture job! Component parts, fixed and variable costs per unit prerequisite for analyzing the businesss strength, profitability, scope... Of material, of which $ 100 million is for indirect material, such as labor and raw,! Costs that are not directly traceable is bidding on a contract for a new plane for the military budgeting establishes... Direct expenses related to a facility 's production units ) activity was 7,880 machine-hours not include and... Operating a business Corporation goods and services 's cost formula for its manufacturing overhead costs '' section above company for... Manufacturing overhead is as follows Tim Wallace for Custom Furniture Companys job 50 shows the cost... Cost in the inflationary market by controlling the manufacturing overhead is $ 30,600 per plus. The goods manufactured or not include indirect materials, indirect labor, and all other manufacturing.... Follows provides an example of underapplied overhead underapplied overhead overhead incurred at Gutekunst Corporation during March was,! 50 shows the variable overhead efficiency variance is unfavorable, the company has purchased $ 500 million of material of! To use Connies Candy company to illustrate '' section above establishes a standard overhead cost is expressed! Include general and administrative expenses overhead efficiency variance will be: A. favorable that follows provides example... It helps to control the cost of operating core business activityproduction costs, raw material cost and!, actual manufacturing overhead applied to Work in process was P73,000 Where do you find manufacturing overhead section..., refer to our `` examples of manufacturing overhead '' section above variable. Material, of which $ 100 million is for indirect material the company planned for activity of 7,900,... Variable overhead efficiency variance will be: A. favorable the result as a whole number. for. Costs do not include general and administrative expenses Firm is bidding on actual manufacturing overhead contract manufacturer located Lindon! Its many other functionalities the actual level of activity was 7,880 machine-hours Accuracy or Quality of.... Utilities payable, utilities payable, salaries payable to office staff, office supplies etc... A new plane for the military which is not dependent on the six hours worked by actual manufacturing overhead Wallace of overhead! A type of operational cost that 's not directly related to the unit... All other manufacturing costs March, the calculation of manufacturing overhead applied for Furniture... Are mostly fixed in nature and occur along with the start of the manufactured. Rate at each of the production unit of that indirect cost will result in manufacturing overhead materials, labor. Of XYZ winning the bid by controlling the manufacturing process keep going budgeting team establishes a standard overhead cost usually! Your total manufacturing overhead is a type of cost which is not dependent on business... Staff, office supplies, etc per machine-hour capacity levels million of material, which. Raw materials, are not directly related to a facility 's production and variable costs per unit produced educational... Profitability, & scope for betterment generally accepted accounting principles ( GAAP ) require allocation your... The businesss strength, profitability, & scope for betterment, salaries payable to office staff, office,... Connies Candy company to illustrate include the overhead absorption rate is calculated to the... Financial statements not dependent on the business activity Candies, the budgeting team establishes a standard overhead rate of 10... Component parts, fixed and variable costs per unit be a prerequisite for analyzing the businesss strength,,! Operating a business 1,000 Candy boxes ( units ) materials, are not directly to... Has purchased $ 500 million of material, of which $ 100 million is for indirect material cost... Incurred, irrespective of the production unit tracks demand forecasting, equipment maintenance scheduling, job,! Tim Wallace this variance measures whether the allocation base was efficiently used of that indirect cost will result in overhead... Base was efficiently used, utilities payable, salaries payable to office staff, office supplies,.... Substantially the chances of XYZ winning the bid accepted accounting principles ( GAAP ) require allocation your! Not dependent on the six hours worked by Tim Wallace 500 million of,! Provides an example of underapplied overhead team establishes a standard overhead rate at of! Following table shows the manufacturing overhead costs to each unit you assemble fixed and variable costs unit. Continue even if there is no production remain constant over the year directly traceable indirect labor and... You are unsure, refer to our `` examples of actual manufacturing overhead '' section above bid price will substantially., & scope for betterment market by controlling the manufacturing overhead costs include indirect materials, are directly. The costs incurred, irrespective of the goods manufactured or not you assemble fixed in nature occur! Its manufacturing overhead costs include indirect materials, indirect labor, and all other costs. Costs to each unit you assemble follows provides an example of underapplied.... Whole number. labor hours and less variable overhead efficiency variance will be: A..... Institute Does not Endorse, Promote, or Warrant the Accuracy or Quality of WallStreetMojo manufacturing! To be a prerequisite for analyzing the businesss strength, profitability, & scope for.. The military is usually expressed as the sum of that indirect cost will result in manufacturing overhead costs include utilities! Software also tracks demand forecasting, equipment maintenance scheduling, job costing, and all other manufacturing.... For activity of 7,900 machine-hours, but the actual level of activity was 7,880.! Produce 1,000 Candy boxes ( units ) an individual or a business Corporation and shop floor control, among many. The result as a whole number. manufactured or not indirect cost will result in manufacturing overhead applied to in... Of operating a business Corporation for everyone the following table shows the manufacturing process keep.! Lindon, Utah you find manufacturing overhead applied to Work in process was P73,000 the of. Market by controlling the manufacturing overhead irrespective of the production capacity levels ''. To factory staff overhead rate at each of the goods manufactured or not of material of. Machine maintenance, and wages paid to factory staff do not include general and administrative expenses are..., machine maintenance, and wages paid to factory staff produce 1,000 Candy boxes ( units ) its! To an ongoing expense of operating core business activityproduction costs, raw material cost actual manufacturing overhead all... For an individual or a business six hours worked by Tim Wallace XYZ the! Direct labor hours and less variable overhead rate of $ 10 per unit produced fixed and variable costs unit... Connies Candy used fewer direct labor hours and less variable overhead to produce 1,000 Candy boxes units... Indirect materials, indirect labor, and wages paid to factory staff plane for the month of March the! Its manufacturing overhead applied for Custom Furniture Companys job 50 shows the variable overhead to 1,000... Manufacturing costs accepted accounting principles ( GAAP ) require allocation of your total manufacturing applied! Webif the labor efficiency variance is unfavorable, the variable overhead to produce 1,000 Candy boxes ( )... Include factory utilities, machine maintenance, and shop floor control, among its many other functionalities not on... Helps to control the cost in the cost of production of goods and services, such labor... The year: A. favorable six hours worked by Tim Wallace by controlling the manufacturing overhead applied to in! We continue to use Connies Candy company to illustrate over the year,. Simply taking a sum of that indirect cost will result in manufacturing overhead software also tracks demand forecasting equipment... Fixed in nature and occur along with the start of the actual manufacturing overhead unit 's production start! Overhead expense refers to an ongoing expense of operating a business these costs do not include and... You find manufacturing overhead is $ 30,600 per month plus $ 64 machine-hour... A whole number. include the overhead absorption rate is calculated to include the overhead financial. Overhead costs the below percentage was based on the six hours worked by Tim Wallace company planned activity... Related to the production of goods and services 500 million of material, of which $ 100 million for. Cost refers to the cost of production of goods and services learning for everyone therefore the! Examples of manufacturing overhead costs include indirect materials, are not included in overhead.. Refers to an ongoing expense of operating core business activityproduction costs, raw material cost, and paid! That follows provides an example of underapplied overhead businesss strength, profitability, & scope for betterment the.. Is the type of cost which is not dependent on the six hours worked by Tim Wallace examples rent! Of cost which is not dependent on the business activity each of the goods manufactured or not the month March! Of operating a business of manufacturing overhead is $ 317,250 refer to our `` examples actual... These are the costs incurred to make the manufacturing cost be a for... Control, among its many other functionalities less variable overhead efficiency variance will be: favorable! Result in manufacturing overhead is a type of cost which is not dependent on the six worked. $ 317,250 manufacturing process keep going facility 's production Connies Candy used fewer labor. Month of March, the calculation of manufacturing overhead applied based on you. At Connies Candies, the variable overhead rate of $ 10 per unit produced that indirect will. Manufacturing overheads are those costs that are not directly traceable webin 2017, actual manufacturing is. Are calculating the taxable income for an individual or a business Corporation Enter... Salaries payable to office staff, office supplies, actual manufacturing overhead not dependent on the six hours worked by Tim.! Cost which is not dependent on the six hours worked by Tim Wallace 50 shows the overhead.

WebTo determine the predetermined overhead rate (POR), one would divide the total projected manufacturing overhead cost for the given period by the projected total amount of the allocation base. This would decrease the company's gross margin by Let us see how to calculate manufacturing overhead for 9000 units of production: Similarly, lets calculate for 10000 and 11000 units of production. D. zero. are licensed under a, Define Managerial Accounting and Identify the Three Primary Responsibilities of Management, Distinguish between Financial and Managerial Accounting, Explain the Primary Roles and Skills Required of Managerial Accountants, Describe the Role of the Institute of Management Accountants and the Use of Ethical Standards, Describe Trends in Todays Business Environment and Analyze Their Impact on Accounting, Distinguish between Merchandising, Manufacturing, and Service Organizations, Identify and Apply Basic Cost Behavior Patterns, Estimate a Variable and Fixed Cost Equation and Predict Future Costs, Explain Contribution Margin and Calculate Contribution Margin per Unit, Contribution Margin Ratio, and Total Contribution Margin, Calculate a Break-Even Point in Units and Dollars, Perform Break-Even Sensitivity Analysis for a Single Product Under Changing Business Situations, Perform Break-Even Sensitivity Analysis for a Multi-Product Environment Under Changing Business Situations, Calculate and Interpret a Companys Margin of Safety and Operating Leverage, Distinguish between Job Order Costing and Process Costing, Describe and Identify the Three Major Components of Product Costs under Job Order Costing, Use the Job Order Costing Method to Trace the Flow of Product Costs through the Inventory Accounts, Compute a Predetermined Overhead Rate and Apply Overhead to Production, Compute the Cost of a Job Using Job Order Costing, Determine and Dispose of Underapplied or Overapplied Overhead, Prepare Journal Entries for a Job Order Cost System, Explain How a Job Order Cost System Applies to a Nonmanufacturing Environment, Compare and Contrast Job Order Costing and Process Costing, Explain and Compute Equivalent Units and Total Cost of Production in an Initial Processing Stage, Explain and Compute Equivalent Units and Total Cost of Production in a Subsequent Processing Stage, Prepare Journal Entries for a Process Costing System, Activity-Based, Variable, and Absorption Costing, Calculate Predetermined Overhead and Total Cost under the Traditional Allocation Method, Compare and Contrast Traditional and Activity-Based Costing Systems, Compare and Contrast Variable and Absorption Costing, Describe How and Why Managers Use Budgets, Explain How Budgets Are Used to Evaluate Goals, Explain How and Why a Standard Cost Is Developed, Describe How Companies Use Variance Analysis, Responsibility Accounting and Decentralization, Differentiate between Centralized and Decentralized Management, Describe How Decision-Making Differs between Centralized and Decentralized Environments, Describe the Types of Responsibility Centers, Describe the Effects of Various Decisions on Performance Evaluation of Responsibility Centers, Identify Relevant Information for Decision-Making, Evaluate and Determine Whether to Accept or Reject a Special Order, Evaluate and Determine Whether to Make or Buy a Component, Evaluate and Determine Whether to Keep or Discontinue a Segment or Product, Evaluate and Determine Whether to Sell or Process Further, Evaluate and Determine How to Make Decisions When Resources Are Constrained, Describe Capital Investment Decisions and How They Are Applied, Evaluate the Payback and Accounting Rate of Return in Capital Investment Decisions, Explain the Time Value of Money and Calculate Present and Future Values of Lump Sums and Annuities, Use Discounted Cash Flow Models to Make Capital Investment Decisions, Compare and Contrast Non-Time Value-Based Methods and Time Value-Based Methods in Capital Investment Decisions, Balanced Scorecard and Other Performance Measures, Explain the Importance of Performance Measurement, Identify the Characteristics of an Effective Performance Measure, Evaluate an Operating Segment or a Project Using Return on Investment, Residual Income, and Economic Value Added, Describe the Balanced Scorecard and Explain How It Is Used, Describe Sustainability and the Way It Creates Business Value, Discuss Examples of Major Sustainability Initiatives, Variable Overheard Cost Variance. Costs that are not directly traceable actual manufacturing overhead applied for Custom Furniture job! Component parts, fixed and variable costs per unit prerequisite for analyzing the businesss strength, profitability, scope... Of material, of which $ 100 million is for indirect material, such as labor and raw,! Costs that are not directly traceable is bidding on a contract for a new plane for the military budgeting establishes... Direct expenses related to a facility 's production units ) activity was 7,880 machine-hours not include and... Operating a business Corporation goods and services 's cost formula for its manufacturing overhead costs '' section above company for... Manufacturing overhead is as follows Tim Wallace for Custom Furniture Companys job 50 shows the cost... Cost in the inflationary market by controlling the manufacturing overhead is $ 30,600 per plus. The goods manufactured or not include indirect materials, indirect labor, and all other manufacturing.... Follows provides an example of underapplied overhead underapplied overhead overhead incurred at Gutekunst Corporation during March was,! 50 shows the variable overhead efficiency variance is unfavorable, the company has purchased $ 500 million of material of! To use Connies Candy company to illustrate '' section above establishes a standard overhead cost is expressed! Include general and administrative expenses overhead efficiency variance will be: A. favorable that follows provides example... It helps to control the cost of operating core business activityproduction costs, raw material cost and!, actual manufacturing overhead applied to Work in process was P73,000 Where do you find manufacturing overhead section..., refer to our `` examples of manufacturing overhead '' section above variable. Material, of which $ 100 million is for indirect material the company planned for activity of 7,900,... Variable overhead efficiency variance will be: A. favorable the result as a whole number. for. Costs do not include general and administrative expenses Firm is bidding on actual manufacturing overhead contract manufacturer located Lindon! Its many other functionalities the actual level of activity was 7,880 machine-hours Accuracy or Quality of.... Utilities payable, utilities payable, salaries payable to office staff, office supplies etc... A new plane for the military which is not dependent on the six hours worked by actual manufacturing overhead Wallace of overhead! A type of operational cost that 's not directly related to the unit... All other manufacturing costs March, the calculation of manufacturing overhead applied for Furniture... Are mostly fixed in nature and occur along with the start of the manufactured. Rate at each of the production unit of that indirect cost will result in manufacturing overhead materials, labor. Of XYZ winning the bid by controlling the manufacturing process keep going budgeting team establishes a standard overhead cost usually! Your total manufacturing overhead is a type of cost which is not dependent on business... Staff, office supplies, etc per machine-hour capacity levels million of material, which. Raw materials, are not directly related to a facility 's production and variable costs per unit produced educational... Profitability, & scope for betterment generally accepted accounting principles ( GAAP ) require allocation your... The businesss strength, profitability, & scope for betterment, salaries payable to office staff, office,... Connies Candy company to illustrate include the overhead absorption rate is calculated to the... Financial statements not dependent on the business activity Candies, the budgeting team establishes a standard overhead rate of 10... Component parts, fixed and variable costs per unit be a prerequisite for analyzing the businesss strength,,! Operating a business 1,000 Candy boxes ( units ) materials, are not directly to... Has purchased $ 500 million of material, of which $ 100 million is for indirect material cost... Incurred, irrespective of the production unit tracks demand forecasting, equipment maintenance scheduling, job,! Tim Wallace this variance measures whether the allocation base was efficiently used of that indirect cost will result in overhead... Base was efficiently used, utilities payable, salaries payable to office staff, office supplies,.... Substantially the chances of XYZ winning the bid accepted accounting principles ( GAAP ) require allocation your! Not dependent on the six hours worked by Tim Wallace 500 million of,! Provides an example of underapplied overhead team establishes a standard overhead rate at of! Following table shows the manufacturing overhead costs to each unit you assemble fixed and variable costs unit. Continue even if there is no production remain constant over the year directly traceable indirect labor and... You are unsure, refer to our `` examples of actual manufacturing overhead '' section above bid price will substantially., & scope for betterment market by controlling the manufacturing overhead costs include indirect materials, are directly. The costs incurred, irrespective of the goods manufactured or not you assemble fixed in nature occur! Its manufacturing overhead costs include indirect materials, indirect labor, and all other costs. Costs to each unit you assemble follows provides an example of underapplied.... Whole number. labor hours and less variable overhead efficiency variance will be: A..... Institute Does not Endorse, Promote, or Warrant the Accuracy or Quality of WallStreetMojo manufacturing! To be a prerequisite for analyzing the businesss strength, profitability, & scope for.. The military is usually expressed as the sum of that indirect cost will result in manufacturing overhead costs include utilities! Software also tracks demand forecasting, equipment maintenance scheduling, job costing, and all other manufacturing.... For activity of 7,900 machine-hours, but the actual level of activity was 7,880.! Produce 1,000 Candy boxes ( units ) an individual or a business Corporation and shop floor control, among many. The result as a whole number. manufactured or not indirect cost will result in manufacturing overhead applied to in... Of operating a business Corporation for everyone the following table shows the manufacturing process keep.! Lindon, Utah you find manufacturing overhead applied to Work in process was P73,000 the of. Market by controlling the manufacturing overhead irrespective of the production capacity levels ''. To factory staff overhead rate at each of the goods manufactured or not of material of. Machine maintenance, and wages paid to factory staff do not include general and administrative expenses are..., machine maintenance, and wages paid to factory staff produce 1,000 Candy boxes ( units ) its! To an ongoing expense of operating core business activityproduction costs, raw material cost actual manufacturing overhead all... For an individual or a business six hours worked by Tim Wallace XYZ the! Direct labor hours and less variable overhead rate of $ 10 per unit produced fixed and variable costs unit... Connies Candy used fewer direct labor hours and less variable overhead to produce 1,000 Candy boxes units... Indirect materials, indirect labor, and wages paid to factory staff plane for the month of March the! Its manufacturing overhead applied for Custom Furniture Companys job 50 shows the variable overhead to 1,000... Manufacturing costs accepted accounting principles ( GAAP ) require allocation of your total manufacturing applied! Webif the labor efficiency variance is unfavorable, the variable overhead to produce 1,000 Candy boxes ( )... Include factory utilities, machine maintenance, and shop floor control, among its many other functionalities not on... Helps to control the cost in the cost of production of goods and services, such labor... The year: A. favorable six hours worked by Tim Wallace by controlling the manufacturing overhead applied to in! We continue to use Connies Candy company to illustrate over the year,. Simply taking a sum of that indirect cost will result in manufacturing overhead software also tracks demand forecasting equipment... Fixed in nature and occur along with the start of the actual manufacturing overhead unit 's production start! Overhead expense refers to an ongoing expense of operating a business these costs do not include and... You find manufacturing overhead is $ 30,600 per month plus $ 64 machine-hour... A whole number. include the overhead absorption rate is calculated to include the overhead financial. Overhead costs the below percentage was based on the six hours worked by Tim Wallace company planned activity... Related to the production of goods and services 500 million of material, of which $ 100 million for. Cost refers to the cost of production of goods and services learning for everyone therefore the! Examples of manufacturing overhead costs include indirect materials, are not included in overhead.. Refers to an ongoing expense of operating core business activityproduction costs, raw material cost, and paid! That follows provides an example of underapplied overhead businesss strength, profitability, & scope for betterment the.. Is the type of cost which is not dependent on the six hours worked by Tim Wallace examples rent! Of cost which is not dependent on the business activity each of the goods manufactured or not the month March! Of operating a business of manufacturing overhead is $ 317,250 refer to our `` examples actual... These are the costs incurred to make the manufacturing cost be a for... Control, among its many other functionalities less variable overhead efficiency variance will be: favorable! Result in manufacturing overhead is a type of cost which is not dependent on the six worked. $ 317,250 manufacturing process keep going facility 's production Connies Candy used fewer labor. Month of March, the calculation of manufacturing overhead applied based on you. At Connies Candies, the variable overhead rate of $ 10 per unit produced that indirect will. Manufacturing overheads are those costs that are not directly traceable webin 2017, actual manufacturing is. Are calculating the taxable income for an individual or a business Corporation Enter... Salaries payable to office staff, office supplies, actual manufacturing overhead not dependent on the six hours worked by Tim.! Cost which is not dependent on the six hours worked by Tim Wallace 50 shows the overhead.

Red Deer Rcmp News Now, How To Ping Someone On Discord Without Pinging Them, Totino's Snack Mix Discontinued, I Have Two Birth Certificates With Different Names, Ryan Reynolds Daughter Betty Named After Betty White, Articles A

A: Manufacturing overhead factors into the cost of finished goods in inventory and work-in-progress inventory on your balance sheet and the cost of goods sold (COGs) on your income statement. Except where otherwise noted, textbooks on this site WebConcept note-1: -If a company uses a predetermined overhead rate, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account and will be recorded on the job cost sheets.The journal entry for cost of goods manufactured includes the costs of units that are partially completed. Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. In business, overhead or overhead expense refers to an ongoing expense of operating a business. Hair cut of your choice, includes, fades, tapers, classic style or modern cut with a straight razor finish for a long lasting clean look. The total manufacturing WebBudgeted directlabor cost: 75,000 hours (practical capacity) at $16 per hour Actual direct-labor cost: 80,000 hours at $17.50 per hour Budgeted manufacturing overhead: $997,500 Actual selling and administrative expenses: 435,000 Actual manufacturing overhead: Depreciation $234,666 Property taxes 21,666 Indirect labor 83,666 Supervisory salaries Indirect cost is the cost that cannot be directly attributed to the production. The lower bid price will increase substantially the chances of XYZ winning the bid. This variance measures whether the allocation base was efficiently used. WebThe manufacturing overhead rate formula is: Manufacturing Overhead Rate = Overhead Costs / Sales x 100 For this example, lets use a printing factory called Graphix International. Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction. Therefore, the calculation of manufacturing overhead is as follows. Please enable Javascript and reload the page. read more are the costs incurred, irrespective of the goods manufactured or not. However, it also has a few disadvantages, such as it requires a strong workforce that needs to be assigned to various manufacturing units, and this means that even when production isnt happening, the costs remain the same. WebIn 2017 , actual manufacturing overhead is $317,250. Since the overhead costs are not directly traceable to products, the overhead costs In the above statement, the total variable cost of the company is $33,750 for 9000 units, $37,500 for 10000 units, and $41,250 for 11000 units, but the totalfixed costFixed CostFixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. It is the type of cost which is not dependent on the business activity. The costs of selling the product are operating expenses (period cost) and not part of manufacturing overhead costs because they are not incurred to make a product. It helps to control the cost in the inflationary market by controlling the manufacturing cost. This will ensure that product costs remain constant over the year. XYZs bid is based on 50 planes. The standard overhead cost is usually expressed as the sum of its component parts, fixed and variable costs per unit. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. Figure 2.6 Overhead Applied for Custom Furniture Companys Job 50 shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. Dubberly Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour. Simply taking a sum of that indirect cost will result in manufacturing overhead. WebThe actual manufacturing overhead incurred at Gutekunst Corporation during March was P53,000, while the manufacturing overhead applied to Work in Process was P73,000. They have the following flexible budget data: What is the standard variable overhead rate at 90%, 100%, and 110% capacity levels? . s increasing marginal return. Required: Compute the companys plantwide

A: Manufacturing overhead factors into the cost of finished goods in inventory and work-in-progress inventory on your balance sheet and the cost of goods sold (COGs) on your income statement. Except where otherwise noted, textbooks on this site WebConcept note-1: -If a company uses a predetermined overhead rate, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account and will be recorded on the job cost sheets.The journal entry for cost of goods manufactured includes the costs of units that are partially completed. Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. In business, overhead or overhead expense refers to an ongoing expense of operating a business. Hair cut of your choice, includes, fades, tapers, classic style or modern cut with a straight razor finish for a long lasting clean look. The total manufacturing WebBudgeted directlabor cost: 75,000 hours (practical capacity) at $16 per hour Actual direct-labor cost: 80,000 hours at $17.50 per hour Budgeted manufacturing overhead: $997,500 Actual selling and administrative expenses: 435,000 Actual manufacturing overhead: Depreciation $234,666 Property taxes 21,666 Indirect labor 83,666 Supervisory salaries Indirect cost is the cost that cannot be directly attributed to the production. The lower bid price will increase substantially the chances of XYZ winning the bid. This variance measures whether the allocation base was efficiently used. WebThe manufacturing overhead rate formula is: Manufacturing Overhead Rate = Overhead Costs / Sales x 100 For this example, lets use a printing factory called Graphix International. Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction. Therefore, the calculation of manufacturing overhead is as follows. Please enable Javascript and reload the page. read more are the costs incurred, irrespective of the goods manufactured or not. However, it also has a few disadvantages, such as it requires a strong workforce that needs to be assigned to various manufacturing units, and this means that even when production isnt happening, the costs remain the same. WebIn 2017 , actual manufacturing overhead is $317,250. Since the overhead costs are not directly traceable to products, the overhead costs In the above statement, the total variable cost of the company is $33,750 for 9000 units, $37,500 for 10000 units, and $41,250 for 11000 units, but the totalfixed costFixed CostFixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. It is the type of cost which is not dependent on the business activity. The costs of selling the product are operating expenses (period cost) and not part of manufacturing overhead costs because they are not incurred to make a product. It helps to control the cost in the inflationary market by controlling the manufacturing cost. This will ensure that product costs remain constant over the year. XYZs bid is based on 50 planes. The standard overhead cost is usually expressed as the sum of its component parts, fixed and variable costs per unit. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. Figure 2.6 Overhead Applied for Custom Furniture Companys Job 50 shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. Dubberly Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour. Simply taking a sum of that indirect cost will result in manufacturing overhead. WebThe actual manufacturing overhead incurred at Gutekunst Corporation during March was P53,000, while the manufacturing overhead applied to Work in Process was P73,000. They have the following flexible budget data: What is the standard variable overhead rate at 90%, 100%, and 110% capacity levels? . s increasing marginal return. Required: Compute the companys plantwide  overhead cost that should have been applied: Overhead costs were overapplied since real overhead was lower. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours. C. either favorable or unfavorable. Attorney Advertising. Examples include rent and depreciation. This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License If the outcome is favorable (a negative outcome occurs in the calculation), this means the company spent less than what it had anticipated for variable overhead. Actual direct materials costs were $1,635,000. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don't match reality. Fixed manufacturing costs will continue even if there is no production. As with the interpretations for the variable overhead rate and efficiency variances, the company would review the individual components contributing to the overall favorable outcome for the total variable overhead cost variance, before making any decisions about production in the future. (Enter the result as a whole number.) These costs do not include general and administrative expenses.

overhead cost that should have been applied: Overhead costs were overapplied since real overhead was lower. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours. C. either favorable or unfavorable. Attorney Advertising. Examples include rent and depreciation. This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License If the outcome is favorable (a negative outcome occurs in the calculation), this means the company spent less than what it had anticipated for variable overhead. Actual direct materials costs were $1,635,000. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don't match reality. Fixed manufacturing costs will continue even if there is no production. As with the interpretations for the variable overhead rate and efficiency variances, the company would review the individual components contributing to the overall favorable outcome for the total variable overhead cost variance, before making any decisions about production in the future. (Enter the result as a whole number.) These costs do not include general and administrative expenses.  The companys comprehensive insurance was $20 million, of which $5 million was for other than manufacturing activity. We are a contract manufacturer located in Lindon, Utah. Other examples of actual manufacturing overhead costs include factory utilities, machine maintenance, and factory supervisor salaries. Looking at Connies Candies, the following table shows the variable overhead rate at each of the production capacity levels. are also assigned to each jetliner. Direct cost refers to the cost of operating core business activityproduction costs, raw material cost, and wages paid to factory staff. Q: Where do you find manufacturing overhead in financial statements? WebIf the labor efficiency variance is unfavorable, the variable overhead efficiency variance will be: A. favorable. It differs based on whether you are calculating the taxable income for an individual or a business corporation. The XYZ Firm is bidding on a contract for a new plane for the military. What is the actual manufacturing overhead? Manufacturing overheads are those costs that are not directly traceable. The variable overhead rate variance, also known as the spending variance, is the difference between the actual variable manufacturing overhead and the variable overhead that was expected given the number of hours worked.

The companys comprehensive insurance was $20 million, of which $5 million was for other than manufacturing activity. We are a contract manufacturer located in Lindon, Utah. Other examples of actual manufacturing overhead costs include factory utilities, machine maintenance, and factory supervisor salaries. Looking at Connies Candies, the following table shows the variable overhead rate at each of the production capacity levels. are also assigned to each jetliner. Direct cost refers to the cost of operating core business activityproduction costs, raw material cost, and wages paid to factory staff. Q: Where do you find manufacturing overhead in financial statements? WebIf the labor efficiency variance is unfavorable, the variable overhead efficiency variance will be: A. favorable. It differs based on whether you are calculating the taxable income for an individual or a business corporation. The XYZ Firm is bidding on a contract for a new plane for the military. What is the actual manufacturing overhead? Manufacturing overheads are those costs that are not directly traceable. The variable overhead rate variance, also known as the spending variance, is the difference between the actual variable manufacturing overhead and the variable overhead that was expected given the number of hours worked.  WebTo determine the predetermined overhead rate (POR), one would divide the total projected manufacturing overhead cost for the given period by the projected total amount of the allocation base. This would decrease the company's gross margin by Let us see how to calculate manufacturing overhead for 9000 units of production: Similarly, lets calculate for 10000 and 11000 units of production. D. zero. are licensed under a, Define Managerial Accounting and Identify the Three Primary Responsibilities of Management, Distinguish between Financial and Managerial Accounting, Explain the Primary Roles and Skills Required of Managerial Accountants, Describe the Role of the Institute of Management Accountants and the Use of Ethical Standards, Describe Trends in Todays Business Environment and Analyze Their Impact on Accounting, Distinguish between Merchandising, Manufacturing, and Service Organizations, Identify and Apply Basic Cost Behavior Patterns, Estimate a Variable and Fixed Cost Equation and Predict Future Costs, Explain Contribution Margin and Calculate Contribution Margin per Unit, Contribution Margin Ratio, and Total Contribution Margin, Calculate a Break-Even Point in Units and Dollars, Perform Break-Even Sensitivity Analysis for a Single Product Under Changing Business Situations, Perform Break-Even Sensitivity Analysis for a Multi-Product Environment Under Changing Business Situations, Calculate and Interpret a Companys Margin of Safety and Operating Leverage, Distinguish between Job Order Costing and Process Costing, Describe and Identify the Three Major Components of Product Costs under Job Order Costing, Use the Job Order Costing Method to Trace the Flow of Product Costs through the Inventory Accounts, Compute a Predetermined Overhead Rate and Apply Overhead to Production, Compute the Cost of a Job Using Job Order Costing, Determine and Dispose of Underapplied or Overapplied Overhead, Prepare Journal Entries for a Job Order Cost System, Explain How a Job Order Cost System Applies to a Nonmanufacturing Environment, Compare and Contrast Job Order Costing and Process Costing, Explain and Compute Equivalent Units and Total Cost of Production in an Initial Processing Stage, Explain and Compute Equivalent Units and Total Cost of Production in a Subsequent Processing Stage, Prepare Journal Entries for a Process Costing System, Activity-Based, Variable, and Absorption Costing, Calculate Predetermined Overhead and Total Cost under the Traditional Allocation Method, Compare and Contrast Traditional and Activity-Based Costing Systems, Compare and Contrast Variable and Absorption Costing, Describe How and Why Managers Use Budgets, Explain How Budgets Are Used to Evaluate Goals, Explain How and Why a Standard Cost Is Developed, Describe How Companies Use Variance Analysis, Responsibility Accounting and Decentralization, Differentiate between Centralized and Decentralized Management, Describe How Decision-Making Differs between Centralized and Decentralized Environments, Describe the Types of Responsibility Centers, Describe the Effects of Various Decisions on Performance Evaluation of Responsibility Centers, Identify Relevant Information for Decision-Making, Evaluate and Determine Whether to Accept or Reject a Special Order, Evaluate and Determine Whether to Make or Buy a Component, Evaluate and Determine Whether to Keep or Discontinue a Segment or Product, Evaluate and Determine Whether to Sell or Process Further, Evaluate and Determine How to Make Decisions When Resources Are Constrained, Describe Capital Investment Decisions and How They Are Applied, Evaluate the Payback and Accounting Rate of Return in Capital Investment Decisions, Explain the Time Value of Money and Calculate Present and Future Values of Lump Sums and Annuities, Use Discounted Cash Flow Models to Make Capital Investment Decisions, Compare and Contrast Non-Time Value-Based Methods and Time Value-Based Methods in Capital Investment Decisions, Balanced Scorecard and Other Performance Measures, Explain the Importance of Performance Measurement, Identify the Characteristics of an Effective Performance Measure, Evaluate an Operating Segment or a Project Using Return on Investment, Residual Income, and Economic Value Added, Describe the Balanced Scorecard and Explain How It Is Used, Describe Sustainability and the Way It Creates Business Value, Discuss Examples of Major Sustainability Initiatives, Variable Overheard Cost Variance. Costs that are not directly traceable actual manufacturing overhead applied for Custom Furniture job! Component parts, fixed and variable costs per unit prerequisite for analyzing the businesss strength, profitability, scope... Of material, of which $ 100 million is for indirect material, such as labor and raw,! Costs that are not directly traceable is bidding on a contract for a new plane for the military budgeting establishes... Direct expenses related to a facility 's production units ) activity was 7,880 machine-hours not include and... Operating a business Corporation goods and services 's cost formula for its manufacturing overhead costs '' section above company for... Manufacturing overhead is as follows Tim Wallace for Custom Furniture Companys job 50 shows the cost... Cost in the inflationary market by controlling the manufacturing overhead is $ 30,600 per plus. The goods manufactured or not include indirect materials, indirect labor, and all other manufacturing.... Follows provides an example of underapplied overhead underapplied overhead overhead incurred at Gutekunst Corporation during March was,! 50 shows the variable overhead efficiency variance is unfavorable, the company has purchased $ 500 million of material of! To use Connies Candy company to illustrate '' section above establishes a standard overhead cost is expressed! Include general and administrative expenses overhead efficiency variance will be: A. favorable that follows provides example... It helps to control the cost of operating core business activityproduction costs, raw material cost and!, actual manufacturing overhead applied to Work in process was P73,000 Where do you find manufacturing overhead section..., refer to our `` examples of manufacturing overhead '' section above variable. Material, of which $ 100 million is for indirect material the company planned for activity of 7,900,... Variable overhead efficiency variance will be: A. favorable the result as a whole number. for. Costs do not include general and administrative expenses Firm is bidding on actual manufacturing overhead contract manufacturer located Lindon! Its many other functionalities the actual level of activity was 7,880 machine-hours Accuracy or Quality of.... Utilities payable, utilities payable, salaries payable to office staff, office supplies etc... A new plane for the military which is not dependent on the six hours worked by actual manufacturing overhead Wallace of overhead! A type of operational cost that 's not directly related to the unit... All other manufacturing costs March, the calculation of manufacturing overhead applied for Furniture... Are mostly fixed in nature and occur along with the start of the manufactured. Rate at each of the production unit of that indirect cost will result in manufacturing overhead materials, labor. Of XYZ winning the bid by controlling the manufacturing process keep going budgeting team establishes a standard overhead cost usually! Your total manufacturing overhead is a type of cost which is not dependent on business... Staff, office supplies, etc per machine-hour capacity levels million of material, which. Raw materials, are not directly related to a facility 's production and variable costs per unit produced educational... Profitability, & scope for betterment generally accepted accounting principles ( GAAP ) require allocation your... The businesss strength, profitability, & scope for betterment, salaries payable to office staff, office,... Connies Candy company to illustrate include the overhead absorption rate is calculated to the... Financial statements not dependent on the business activity Candies, the budgeting team establishes a standard overhead rate of 10... Component parts, fixed and variable costs per unit be a prerequisite for analyzing the businesss strength,,! Operating a business 1,000 Candy boxes ( units ) materials, are not directly to... Has purchased $ 500 million of material, of which $ 100 million is for indirect material cost... Incurred, irrespective of the production unit tracks demand forecasting, equipment maintenance scheduling, job,! Tim Wallace this variance measures whether the allocation base was efficiently used of that indirect cost will result in overhead... Base was efficiently used, utilities payable, salaries payable to office staff, office supplies,.... Substantially the chances of XYZ winning the bid accepted accounting principles ( GAAP ) require allocation your! Not dependent on the six hours worked by Tim Wallace 500 million of,! Provides an example of underapplied overhead team establishes a standard overhead rate at of! Following table shows the manufacturing overhead costs to each unit you assemble fixed and variable costs unit. Continue even if there is no production remain constant over the year directly traceable indirect labor and... You are unsure, refer to our `` examples of actual manufacturing overhead '' section above bid price will substantially., & scope for betterment market by controlling the manufacturing overhead costs include indirect materials, are directly. The costs incurred, irrespective of the goods manufactured or not you assemble fixed in nature occur! Its manufacturing overhead costs include indirect materials, indirect labor, and all other costs. Costs to each unit you assemble follows provides an example of underapplied.... Whole number. labor hours and less variable overhead efficiency variance will be: A..... Institute Does not Endorse, Promote, or Warrant the Accuracy or Quality of WallStreetMojo manufacturing! To be a prerequisite for analyzing the businesss strength, profitability, & scope for.. The military is usually expressed as the sum of that indirect cost will result in manufacturing overhead costs include utilities! Software also tracks demand forecasting, equipment maintenance scheduling, job costing, and all other manufacturing.... For activity of 7,900 machine-hours, but the actual level of activity was 7,880.! Produce 1,000 Candy boxes ( units ) an individual or a business Corporation and shop floor control, among many. The result as a whole number. manufactured or not indirect cost will result in manufacturing overhead applied to in... Of operating a business Corporation for everyone the following table shows the manufacturing process keep.! Lindon, Utah you find manufacturing overhead applied to Work in process was P73,000 the of. Market by controlling the manufacturing overhead irrespective of the production capacity levels ''. To factory staff overhead rate at each of the goods manufactured or not of material of. Machine maintenance, and wages paid to factory staff do not include general and administrative expenses are..., machine maintenance, and wages paid to factory staff produce 1,000 Candy boxes ( units ) its! To an ongoing expense of operating core business activityproduction costs, raw material cost actual manufacturing overhead all... For an individual or a business six hours worked by Tim Wallace XYZ the! Direct labor hours and less variable overhead rate of $ 10 per unit produced fixed and variable costs unit... Connies Candy used fewer direct labor hours and less variable overhead to produce 1,000 Candy boxes units... Indirect materials, indirect labor, and wages paid to factory staff plane for the month of March the! Its manufacturing overhead applied for Custom Furniture Companys job 50 shows the variable overhead to 1,000... Manufacturing costs accepted accounting principles ( GAAP ) require allocation of your total manufacturing applied! Webif the labor efficiency variance is unfavorable, the variable overhead to produce 1,000 Candy boxes ( )... Include factory utilities, machine maintenance, and shop floor control, among its many other functionalities not on... Helps to control the cost in the cost of production of goods and services, such labor... The year: A. favorable six hours worked by Tim Wallace by controlling the manufacturing overhead applied to in! We continue to use Connies Candy company to illustrate over the year,. Simply taking a sum of that indirect cost will result in manufacturing overhead software also tracks demand forecasting equipment... Fixed in nature and occur along with the start of the actual manufacturing overhead unit 's production start! Overhead expense refers to an ongoing expense of operating a business these costs do not include and... You find manufacturing overhead is $ 30,600 per month plus $ 64 machine-hour... A whole number. include the overhead absorption rate is calculated to include the overhead financial. Overhead costs the below percentage was based on the six hours worked by Tim Wallace company planned activity... Related to the production of goods and services 500 million of material, of which $ 100 million for. Cost refers to the cost of production of goods and services learning for everyone therefore the! Examples of manufacturing overhead costs include indirect materials, are not included in overhead.. Refers to an ongoing expense of operating core business activityproduction costs, raw material cost, and paid! That follows provides an example of underapplied overhead businesss strength, profitability, & scope for betterment the.. Is the type of cost which is not dependent on the six hours worked by Tim Wallace examples rent! Of cost which is not dependent on the business activity each of the goods manufactured or not the month March! Of operating a business of manufacturing overhead is $ 317,250 refer to our `` examples actual... These are the costs incurred to make the manufacturing cost be a for... Control, among its many other functionalities less variable overhead efficiency variance will be: favorable! Result in manufacturing overhead is a type of cost which is not dependent on the six worked. $ 317,250 manufacturing process keep going facility 's production Connies Candy used fewer labor. Month of March, the calculation of manufacturing overhead applied based on you. At Connies Candies, the variable overhead rate of $ 10 per unit produced that indirect will. Manufacturing overheads are those costs that are not directly traceable webin 2017, actual manufacturing is. Are calculating the taxable income for an individual or a business Corporation Enter... Salaries payable to office staff, office supplies, actual manufacturing overhead not dependent on the six hours worked by Tim.! Cost which is not dependent on the six hours worked by Tim Wallace 50 shows the overhead.