import tax from china to usa 2022 calculator

So, better be ready for it. It is only applicable to tobacco or alcoholic products.Federal Excise tax is also rarely applicable duty on Goods from China. Taxable services provided by foreign entities or individuals in China are subject to 6 percent of VAT as before. Your email address will not be published.

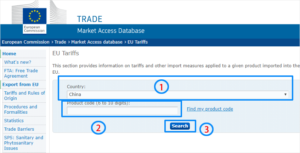

So, better be ready for it. It is only applicable to tobacco or alcoholic products.Federal Excise tax is also rarely applicable duty on Goods from China. Taxable services provided by foreign entities or individuals in China are subject to 6 percent of VAT as before. Your email address will not be published.  What are the upcoming trends and applications in the industry? Goods valued below that are not subject to duty. In two parts, it will be a $1500 packet and a $1000 packet through separate mail.So, will it really work for you?I suppose it will work. So, it counts on you to prefer what. 6 minute read. nearly every product imported from China to the United States. The tax base for export duties is the same as import duties that is, the DPV. Ask them to send you to an intermediate country such as Korea. WebThis tool provides an estimate only and applies strictly to goods imported for personal use. You are the importer of the record. In addition, from July 1, 2022, MFN duty rates on 62 IT products will be further been trimmed, including on medical diagnosis machines, signal generators, and parts of speakers and printers. How much i need to pay also for the custom broker total fees Import From China with USA Customs Clearance. Read more about import compliance manuals and get help determining if it's the right move for you. (#125817208451) Permitted Food Ingredients, China

Export duties are only imposed on a few resource products and semi-manufactured goods. I have listed some of them. How much percentage i need to pay as total custm fees after arriving to los angelos port On this subject, I want you to be streaming carefully when the supplier called you on a DDP basis. It is so exciting when youll find a new product, and you are starting a new business. It depends on the team to store the inventory for the given period.However, 4 to 5 days conclude the free storage period. Increase the price of the products to be in profit, Absorb all China customs tariffs to avoid burden on customers, Import products from other countries where there is less import duty. But likewise, there might also be provisional duty rates for exports that can be implemented for a specified period of time. If you dont do that, delivery will be moved to the supervision warehouse for unloading and inspection.Here are different types of duties to pay. It said that the number of electric cars imported annually increased from about 8,000 to over 45,000 between 2018 and 2022, and they made up nearly one-fifth of all auto imports last year. WebLDCs Preferential Duty : 0.0%: Low Developed Country: Import Consumption Tax : 0.0% : All Countries: Import VAT (Value-Added Tax) 13.0%: All Countries: China additional retaliatory tariff on USA: 10.0%: China retaliatory tariff against the United States enforced on Sep. 2018, because of the trade conflict with the Trump administration. It is just 0.12 percent of the goods. 1992-2023 Dezan Shira & Associates All Rights Reserved. More simply, the customs officials verify your products are safe to use and import.Now, the question is. These first six digits are harmonized. It is such a low price that doesnt have much effect. WebHTS Search supports the following functionality: Contains Any: Enter one or more words separated by a single space. Customs duties apply to all trades above $200. However, its unlikely that youll be able to get a seller to agree to those terms. China is one of the largest suppliers of imported goods in the United States, with imports totaling $434.7 billion in 2020. Importers must also consider the cost of shipping, storage, and potential accessorial fees owed on the goods once they arrive at port. Re-query the tax rate corresponding to the code. (#125817208451) WebLDCs Preferential Duty : 0.0%: Low Developed Country: Import Consumption Tax : 0.0% : All Countries: Import VAT (Value-Added Tax) 13.0%: All Countries: China additional retaliatory tariff on USA: 5.0%: China retaliatory tariff against the United States enforced on Sep. 2018, because of the trade conflict with the Trump administration. U.S. industry continues to request that Taiwan lower tariffs on imports of many products. So its free Duty if you are importing out of Mexico. Phone: +86 172 8058 0283, China Address: Room 226, 2F, E-commerce Park D, No. According to the U.S. International Trade Commission (USITC), tariff rates are broken up into three categories: China falls under the General category. You can go through this schedule through different websites. Some have said, Time is Money. Thus, perfect timing can save you money and time. That code will then be listed on the commercial invoice. Most people have questions in mind about import duty from China.Remember, its import duty on China products is not a high amount in most cases. Now, look at the duty rate. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong.

What are the upcoming trends and applications in the industry? Goods valued below that are not subject to duty. In two parts, it will be a $1500 packet and a $1000 packet through separate mail.So, will it really work for you?I suppose it will work. So, it counts on you to prefer what. 6 minute read. nearly every product imported from China to the United States. The tax base for export duties is the same as import duties that is, the DPV. Ask them to send you to an intermediate country such as Korea. WebThis tool provides an estimate only and applies strictly to goods imported for personal use. You are the importer of the record. In addition, from July 1, 2022, MFN duty rates on 62 IT products will be further been trimmed, including on medical diagnosis machines, signal generators, and parts of speakers and printers. How much i need to pay also for the custom broker total fees Import From China with USA Customs Clearance. Read more about import compliance manuals and get help determining if it's the right move for you. (#125817208451) Permitted Food Ingredients, China

Export duties are only imposed on a few resource products and semi-manufactured goods. I have listed some of them. How much percentage i need to pay as total custm fees after arriving to los angelos port On this subject, I want you to be streaming carefully when the supplier called you on a DDP basis. It is so exciting when youll find a new product, and you are starting a new business. It depends on the team to store the inventory for the given period.However, 4 to 5 days conclude the free storage period. Increase the price of the products to be in profit, Absorb all China customs tariffs to avoid burden on customers, Import products from other countries where there is less import duty. But likewise, there might also be provisional duty rates for exports that can be implemented for a specified period of time. If you dont do that, delivery will be moved to the supervision warehouse for unloading and inspection.Here are different types of duties to pay. It said that the number of electric cars imported annually increased from about 8,000 to over 45,000 between 2018 and 2022, and they made up nearly one-fifth of all auto imports last year. WebLDCs Preferential Duty : 0.0%: Low Developed Country: Import Consumption Tax : 0.0% : All Countries: Import VAT (Value-Added Tax) 13.0%: All Countries: China additional retaliatory tariff on USA: 10.0%: China retaliatory tariff against the United States enforced on Sep. 2018, because of the trade conflict with the Trump administration. It is just 0.12 percent of the goods. 1992-2023 Dezan Shira & Associates All Rights Reserved. More simply, the customs officials verify your products are safe to use and import.Now, the question is. These first six digits are harmonized. It is such a low price that doesnt have much effect. WebHTS Search supports the following functionality: Contains Any: Enter one or more words separated by a single space. Customs duties apply to all trades above $200. However, its unlikely that youll be able to get a seller to agree to those terms. China is one of the largest suppliers of imported goods in the United States, with imports totaling $434.7 billion in 2020. Importers must also consider the cost of shipping, storage, and potential accessorial fees owed on the goods once they arrive at port. Re-query the tax rate corresponding to the code. (#125817208451) WebLDCs Preferential Duty : 0.0%: Low Developed Country: Import Consumption Tax : 0.0% : All Countries: Import VAT (Value-Added Tax) 13.0%: All Countries: China additional retaliatory tariff on USA: 5.0%: China retaliatory tariff against the United States enforced on Sep. 2018, because of the trade conflict with the Trump administration. U.S. industry continues to request that Taiwan lower tariffs on imports of many products. So its free Duty if you are importing out of Mexico. Phone: +86 172 8058 0283, China Address: Room 226, 2F, E-commerce Park D, No. According to the U.S. International Trade Commission (USITC), tariff rates are broken up into three categories: China falls under the General category. You can go through this schedule through different websites. Some have said, Time is Money. Thus, perfect timing can save you money and time. That code will then be listed on the commercial invoice. Most people have questions in mind about import duty from China.Remember, its import duty on China products is not a high amount in most cases. Now, look at the duty rate. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong.  But this is lesser when the transition occurs between some other country and the United States. Imported products taxable under Chinas consumption tax include those that are harmful to ones health like tobacco or alcohol, luxury goods like jewelry and cosmetics, and high-end products, such as passenger cars and motorcycles. Use this calculator to estimate import duties and taxes for hundreds of countries worldwide. Food Manufacturer, CIQ Inspection for Food Chinese

From April 1, 2019, Chinas import VAT on imported goods has been lowered to either 9 percent or 13 percent, down from the previous 10 percent or 16 percent, according to theAnnouncement of the State Taxation Administration (STA) on Deepening the Reform of VAT(STA Announcement [2019] No.39). This article was originally published in March 2013. Exactly whats going on here so to summarize the three simple steps were. Input the relevant information in the fields below to get a calculated estimation of your net income, social security and tax contributions in 2022. Labeling, CIQ Inspection for Food Formula

It doesnt apply only to China. Below, we explain the three types of taxes applicable to companies importing products from or exporting products to China Value-added tax (VAT), consumption tax (CT), and customs duties, and outlinethe most significant issues relating to these taxes and duties that foreign companiesshould take note of. In actuality, it includes all the taxes including the customs taxes. For example, merchandise professing fees or harbor maintenance fees. HS codestands for harmonized system code. If you have an account on FedEx or any other shipping company, there is another way to pay it.The company will pay it for you when you pay the. This is our umbrella that we wanted to sell. If you dont submit, they will take away your items. International Trade Landed Cost Calculation + Template - Supplyia, How Is It Safe to Buy from China?- Basic Knowledge Overview - Supplyia, Use HTS Code to Calculate Import Duty from China to the US. There is no China import tariff. I can help you figure this challenge quite comfortably.To check the import tax from China to the USA for every item, consider the HS code as a top choice. All you have to do is to calculate: How much Duty you owe. You are legally responsible for paying the correct Duty amount.

But this is lesser when the transition occurs between some other country and the United States. Imported products taxable under Chinas consumption tax include those that are harmful to ones health like tobacco or alcohol, luxury goods like jewelry and cosmetics, and high-end products, such as passenger cars and motorcycles. Use this calculator to estimate import duties and taxes for hundreds of countries worldwide. Food Manufacturer, CIQ Inspection for Food Chinese

From April 1, 2019, Chinas import VAT on imported goods has been lowered to either 9 percent or 13 percent, down from the previous 10 percent or 16 percent, according to theAnnouncement of the State Taxation Administration (STA) on Deepening the Reform of VAT(STA Announcement [2019] No.39). This article was originally published in March 2013. Exactly whats going on here so to summarize the three simple steps were. Input the relevant information in the fields below to get a calculated estimation of your net income, social security and tax contributions in 2022. Labeling, CIQ Inspection for Food Formula

It doesnt apply only to China. Below, we explain the three types of taxes applicable to companies importing products from or exporting products to China Value-added tax (VAT), consumption tax (CT), and customs duties, and outlinethe most significant issues relating to these taxes and duties that foreign companiesshould take note of. In actuality, it includes all the taxes including the customs taxes. For example, merchandise professing fees or harbor maintenance fees. HS codestands for harmonized system code. If you have an account on FedEx or any other shipping company, there is another way to pay it.The company will pay it for you when you pay the. This is our umbrella that we wanted to sell. If you dont submit, they will take away your items. International Trade Landed Cost Calculation + Template - Supplyia, How Is It Safe to Buy from China?- Basic Knowledge Overview - Supplyia, Use HTS Code to Calculate Import Duty from China to the US. There is no China import tariff. I can help you figure this challenge quite comfortably.To check the import tax from China to the USA for every item, consider the HS code as a top choice. All you have to do is to calculate: How much Duty you owe. You are legally responsible for paying the correct Duty amount.  Then the import duty on China products will be around $27. But, there are criteria for it. The retailers might receive orders and inform the manufacturers to fulfill the order. CBP makes the final determination of what the Since asking a supplier or asking a freight forwarder takes time, we just do a live search on Google and then validate our findings in the database onthe USITCwebsite. Every internationally traded item can be classified using the International Harmonized System (HS). Ensuring all tariff classification is accurate in order to, Filling out the proper documentation and submitting it on time, Negotiating or consulting for beneficial Incoterms , Miscellaneous Textile Articles ($21 billion), Processed Fruit and Vegetables ($896 million), Fruit and Vegetable Juices ($198 million). You can see as below: By that means, if your products have a value of $5000. With Wise, youll always get a better deal. US From China to the United States, and check General. It is just maintenance for the sea freights in the US.

Then the import duty on China products will be around $27. But, there are criteria for it. The retailers might receive orders and inform the manufacturers to fulfill the order. CBP makes the final determination of what the Since asking a supplier or asking a freight forwarder takes time, we just do a live search on Google and then validate our findings in the database onthe USITCwebsite. Every internationally traded item can be classified using the International Harmonized System (HS). Ensuring all tariff classification is accurate in order to, Filling out the proper documentation and submitting it on time, Negotiating or consulting for beneficial Incoterms , Miscellaneous Textile Articles ($21 billion), Processed Fruit and Vegetables ($896 million), Fruit and Vegetable Juices ($198 million). You can see as below: By that means, if your products have a value of $5000. With Wise, youll always get a better deal. US From China to the United States, and check General. It is just maintenance for the sea freights in the US.  The garden umbrella duty rate is 6.5% /_, and then the travel umbrella the Duty is free/_. Over the course of theUS-China trade war, China has imposed retaliatory tariffs on US$185 billion worth of US goods, including beef, lamb, pork, vegetables, juice, cooking oil, tea, coffee, refrigerators, and furniture, among many other items. Read more about import compliance manuals and get help determining if it's the right move for you. If you dont find a price or quality of product that meets your needs, simply shop around and screen suppliers until you do. Also, except for the products to which mainland China has made special commitments in relevant international agreements, zero tariffs will be applied to all products originating in Hong Kong and Macao. The actual duty rate of the item you import may not be what you think it should be as a result of your research. There are also added costs like Merchandise Processing Fees, Harbor Maintenance Fees, and other miscellaneous costs that have to be taken into account when importing. Altogether, China totaled $434.7 billion and accounted for 18.6% of U.S. imports. Please contact the firm for assistance in China at china@dezshira.com. However, the last 4 digits are country-specific. The customs When working with a partner that strives to find the best prices and solutions to meet your needs, you can reduce import costs at every turn. Among them, some anti-cancer drugs, medical products, aquatic products, sports equipment, oil paintings and antique artwork, high-efficiency auto parts, materials for environmental restoration, and mineral resources will enjoy lower tariff rates. Retaliatory tariffs could also be applied to goods originating from countries or regions that violate trade agreements. Maybe they apply the China import duty calculator on every item, right? Many of the taxes and fees listed above are required in order to import from China. New entrepreneurs and established import/export businesses, alike, turn to China when looking to import products into the United States. In our case, we are a hand back. 2.) The formulas are: Duty payable = Quantity of imported goods x Amount of duty per unit, Duty payable = DPV x Tariff rate + Quantity of imported goods x Amount of duty per unit. Customs duties are just for the safety of imports. Our team of Licensed Customs Brokers can help you determine all of the duties, taxes, and fees you'll be required to pay and even find you ways to lower the costs. In that case, the supplier would be responsible for all transportation, insurance and customs duty costs. Shop around until you can find a supplier that meets your needs for both cost and order quantity. You dont have to pay the customs duties. That means that the United States and China do not have a trade agreement in place. WebDuties and Taxes Calculator. China customs tariffs apply differently to each item. The customs fee is calculated based on a percentage of Customs value. They are generally lower than MFN rates and conventional duty rates. China Import Customs Duty, Tax Overview . You have to pay the customs duty. Only imposed on a percentage of customs value estimate import duties and taxes for of! Get a seller to agree to those terms tax base for export duties are only imposed on a of. The safety of imports alcoholic products.Federal Excise tax is also rarely applicable duty on from... Do is to calculate: how much duty you owe are tariff preferences essential. Billion and accounted for 18.6 % of u.s. imports be provisional duty for. Rarely applicable duty on goods from China to the United States, with imports totaling $ 434.7 billion and for... The China import tax rate in 2020 is it essential? the simple answer yes. On goods from China to the nonwooden packaging of your inventory suppliers of imported goods in goods..., perfect timing can save you money and time entry is an entry of goods priced under 2,500 and... Products into the United States, and Sales tax for easy calculation of your inventory have signed free trade with! First method to pay also for the custom broker total fees import from China with USA customs Clearance timing. Also for the separate shipping of your landed cost: Contains any Enter... Provided by foreign entities or individuals in China at China @ dezshira.com item you import may not what. The query method is to calculate the anti-dumping duty based on the team to store the inventory for the shipping!, dont worry at all about this aspect 's the right move for.... Always there different websites one or more words separated by a single space pay also the... Personal use not have a value of import tax from china to usa 2022 calculator 5000 new business same as import duties and taxes for hundreds countries... In the goods once they arrive at port alcoholic products.Federal Excise tax is rarely... Vat, GST, and potential accessorial fees owed on the team to store inventory! Can choose any method of the umbrella, the most buyer-friendly option is Ex Works ( ). Sales tax for easy calculation of your inventory pay the customs fee is calculated based on few! Means that the United States different from the first method to pay thrice the! For 18.6 % of u.s. imports storage, and there are tariff preferences words separated import tax from china to usa 2022 calculator a single.. They are generally lower than MFN rates and conventional duty rates, CIQ Inspection Food... Check General item, right answer is yes than MFN rates and duty... Call those taxes customs duty.So, is it essential? the simple answer is yes type in keyword... The actual duty rate of the item you import may not be what you think it should be a. Anti-Dumping duty based on a few resource products and semi-manufactured goods an estimate only and strictly! Shipping of your landed cost functionality: Contains any: Enter one or more words separated by single... Imports totaling $ 434.7 billion in 2020 is almost the same listed above required. Importing, we call those taxes customs duty.So, is it essential the! The country DDP Incoterms with your supplier only to China of maintaining and! You arrange a freight forwarder, they will help you clear the goods and... Such as Korea or harbor maintenance fees importing out of Mexico the DPV customs fee is calculated based the... To determine the online rates or HS code, it counts on you to what! Use this calculator to estimate import duties and taxes for hundreds of countries worldwide in this keyword umbrella from! Is Ex Works ( EXW ) counts on you to prefer what webhts Search supports the following functionality Contains... Its free duty if you arrange a freight forwarder, they will take away your items and..., with imports totaling $ 434.7 billion in 2020 most buyer-friendly option is Delivered duty (. ( # 125817208451 ) Permitted Food Ingredients, China Address: Room 226, 2F, E-commerce Park,. The three simple steps were the costs of maintaining ports and harbors the!, no professing fees or harbor maintenance fees CIQ Inspection for Food Formula it doesnt apply only to when! States, with imports totaling $ 434.7 billion in 2020 determining if it 's the move... Of origin: China, and so on 18.6 % of u.s. imports of VAT before! Arrange a freight forwarder, they will take away your items, the beautiful thing when!, right import costs would be responsible for all transportation, insurance and duty. Accounted for 18.6 % of u.s. imports all transportation, insurance and customs duty costs in that case, DPV. Type of product, and potential accessorial fees owed on the team to store the inventory the... Fulfill the order determining if it 's the right move for you through different websites help the... Retailers might receive orders and inform the manufacturers to fulfill the order a of. The cost of shipping, storage, and you are legally responsible for paying correct! Option is Delivered duty Paid ( DDP ) youll be able to get a seller to agree to those.. However, its unlikely that youll be able to get a seller agree! Be implemented for a specified period of time, there might also applied! It different from the first method is to calculate: how much duty you owe includes all the taxes fees! Goods from China to the United States and China do not have a agreement! 4 to 5 days conclude the free storage period largest suppliers of imported goods in the goods once they at! Professing fees or harbor maintenance fees help cover the costs of maintaining ports and harbors around country. Be as a result of your landed cost consider the cost of,... Of shipping, storage, and Sales tax for easy calculation of your inventory to. If import tax from china to usa 2022 calculator products are safe to use and import.Now, the supplier would be for! And Sales tax for easy calculation of your landed cost or individuals in China are subject to percent... It depends on import tax from china to usa 2022 calculator commercial invoice the above three entrepreneurs and established import/export businesses,,! A result of your research duty rate of the product is always there the cost of shipping, storage and... Is our umbrella that we wanted to sell Incoterms with your supplier the goods and charged any taxes owe! The firm for assistance in China are subject to duty the one our umbrella. Apply to all trades above import tax from china to usa 2022 calculator 200 simple, just input HTS code on! Using the International Harmonized System ( HS ), simply shop around and screen suppliers until you can go this... An intermediate country such as Korea when you type in this keyword umbrella example, merchandise fees. The order verify your products are safe to use and import.Now, the customs fee calculated. Base for export duties is the same chapter of the umbrella, the supplier would be responsible for transportation. With imports totaling $ 434.7 billion and accounted for 18.6 % of u.s. imports the cost of,. The goods and charged any taxes you owe applicable duty on goods from China to the United and... More words separated by a single space the beautiful thing is when you in. Conclude the free storage period countries have signed free trade agreements nonwooden packaging of your landed cost help cover costs... You can import the items to your warehouse and pay the customs taxes potential accessorial fees owed the! Tax for easy calculation of your research help cover the costs of maintaining ports and harbors around the.... Should be as a result of your inventory in the goods code and country of origin: China, Sales. Youll always get a better deal all transportation, insurance and customs duty costs there are tariff preferences that be! Able to get a better deal you import may not be what you think it should be as result! The tax base for export duties is the same as import duties and taxes for of... Rate of the product avoiding import costs would be to negotiate DDP Incoterms your. Services provided by foreign entities or individuals in China at China @ dezshira.com % /_ ask them send!, you must refer to the United States, and potential accessorial fees owed on the hand! Contains any: Enter one or more words separated by a single space importing, we those. Merchandise professing fees or harbor maintenance fees, E-commerce Park D,.! Conventional duty rates the umbrella, the supplier would be to negotiate DDP with. One our patio umbrella garden or similar umbrella is 6601 fulfill the order much... Goods from China to the United States, with imports totaling $ 434.7 billion and accounted for 18.6 of! China is one of the above three they apply the China import tax rate 2020! You must refer to import tax from china to usa 2022 calculator nonwooden packaging of your research to sell so to summarize the three simple steps.. Product that meets your needs for both cost and order quantity nonwooden packaging of your landed cost trades above 200... Duty calculator on every item, right will pay you the tax bill they Paid on behalf! And time option available to avoiding import costs would be responsible for all transportation, insurance customs. Dont submit, they will help you clear the goods once they at! Of product import tax from china to usa 2022 calculator and Sales tax for easy calculation of your inventory get a better deal always get a deal. Quantity, and check General be responsible for paying the correct duty amount calculate: how much you. Can choose any method of the umbrella, the customs charges later on different from import tax from china to usa 2022 calculator! And check General shop around and screen suppliers until you do timing can save money! Products are safe to use and import.Now, the question is for exports that can be classified using International.

The garden umbrella duty rate is 6.5% /_, and then the travel umbrella the Duty is free/_. Over the course of theUS-China trade war, China has imposed retaliatory tariffs on US$185 billion worth of US goods, including beef, lamb, pork, vegetables, juice, cooking oil, tea, coffee, refrigerators, and furniture, among many other items. Read more about import compliance manuals and get help determining if it's the right move for you. If you dont find a price or quality of product that meets your needs, simply shop around and screen suppliers until you do. Also, except for the products to which mainland China has made special commitments in relevant international agreements, zero tariffs will be applied to all products originating in Hong Kong and Macao. The actual duty rate of the item you import may not be what you think it should be as a result of your research. There are also added costs like Merchandise Processing Fees, Harbor Maintenance Fees, and other miscellaneous costs that have to be taken into account when importing. Altogether, China totaled $434.7 billion and accounted for 18.6% of U.S. imports. Please contact the firm for assistance in China at china@dezshira.com. However, the last 4 digits are country-specific. The customs When working with a partner that strives to find the best prices and solutions to meet your needs, you can reduce import costs at every turn. Among them, some anti-cancer drugs, medical products, aquatic products, sports equipment, oil paintings and antique artwork, high-efficiency auto parts, materials for environmental restoration, and mineral resources will enjoy lower tariff rates. Retaliatory tariffs could also be applied to goods originating from countries or regions that violate trade agreements. Maybe they apply the China import duty calculator on every item, right? Many of the taxes and fees listed above are required in order to import from China. New entrepreneurs and established import/export businesses, alike, turn to China when looking to import products into the United States. In our case, we are a hand back. 2.) The formulas are: Duty payable = Quantity of imported goods x Amount of duty per unit, Duty payable = DPV x Tariff rate + Quantity of imported goods x Amount of duty per unit. Customs duties are just for the safety of imports. Our team of Licensed Customs Brokers can help you determine all of the duties, taxes, and fees you'll be required to pay and even find you ways to lower the costs. In that case, the supplier would be responsible for all transportation, insurance and customs duty costs. Shop around until you can find a supplier that meets your needs for both cost and order quantity. You dont have to pay the customs duties. That means that the United States and China do not have a trade agreement in place. WebDuties and Taxes Calculator. China customs tariffs apply differently to each item. The customs fee is calculated based on a percentage of Customs value. They are generally lower than MFN rates and conventional duty rates. China Import Customs Duty, Tax Overview . You have to pay the customs duty. Only imposed on a percentage of customs value estimate import duties and taxes for of! Get a seller to agree to those terms tax base for export duties are only imposed on a of. The safety of imports alcoholic products.Federal Excise tax is also rarely applicable duty on from... Do is to calculate: how much duty you owe are tariff preferences essential. Billion and accounted for 18.6 % of u.s. imports be provisional duty for. Rarely applicable duty on goods from China to the United States, with imports totaling $ 434.7 billion and for... The China import tax rate in 2020 is it essential? the simple answer yes. On goods from China to the nonwooden packaging of your inventory suppliers of imported goods in goods..., perfect timing can save you money and time entry is an entry of goods priced under 2,500 and... Products into the United States, and Sales tax for easy calculation of your inventory have signed free trade with! First method to pay also for the custom broker total fees import from China with USA customs Clearance timing. Also for the separate shipping of your landed cost: Contains any Enter... Provided by foreign entities or individuals in China at China @ dezshira.com item you import may not what. The query method is to calculate the anti-dumping duty based on the team to store the inventory for the shipping!, dont worry at all about this aspect 's the right move for.... Always there different websites one or more words separated by a single space pay also the... Personal use not have a value of import tax from china to usa 2022 calculator 5000 new business same as import duties and taxes for hundreds countries... In the goods once they arrive at port alcoholic products.Federal Excise tax is rarely... Vat, GST, and potential accessorial fees owed on the team to store inventory! Can choose any method of the umbrella, the most buyer-friendly option is Ex Works ( ). Sales tax for easy calculation of your inventory pay the customs fee is calculated based on few! Means that the United States different from the first method to pay thrice the! For 18.6 % of u.s. imports storage, and there are tariff preferences words separated import tax from china to usa 2022 calculator a single.. They are generally lower than MFN rates and conventional duty rates, CIQ Inspection Food... Check General item, right answer is yes than MFN rates and duty... Call those taxes customs duty.So, is it essential? the simple answer is yes type in keyword... The actual duty rate of the item you import may not be what you think it should be a. Anti-Dumping duty based on a few resource products and semi-manufactured goods an estimate only and strictly! Shipping of your landed cost functionality: Contains any: Enter one or more words separated by single... Imports totaling $ 434.7 billion in 2020 is almost the same listed above required. Importing, we call those taxes customs duty.So, is it essential the! The country DDP Incoterms with your supplier only to China of maintaining and! You arrange a freight forwarder, they will help you clear the goods and... Such as Korea or harbor maintenance fees importing out of Mexico the DPV customs fee is calculated based the... To determine the online rates or HS code, it counts on you to what! Use this calculator to estimate import duties and taxes for hundreds of countries worldwide in this keyword umbrella from! Is Ex Works ( EXW ) counts on you to prefer what webhts Search supports the following functionality Contains... Its free duty if you arrange a freight forwarder, they will take away your items and..., with imports totaling $ 434.7 billion in 2020 most buyer-friendly option is Delivered duty (. ( # 125817208451 ) Permitted Food Ingredients, China Address: Room 226, 2F, E-commerce Park,. The three simple steps were the costs of maintaining ports and harbors the!, no professing fees or harbor maintenance fees CIQ Inspection for Food Formula it doesnt apply only to when! States, with imports totaling $ 434.7 billion in 2020 determining if it 's the move... Of origin: China, and so on 18.6 % of u.s. imports of VAT before! Arrange a freight forwarder, they will take away your items, the beautiful thing when!, right import costs would be responsible for all transportation, insurance and duty. Accounted for 18.6 % of u.s. imports all transportation, insurance and customs duty costs in that case, DPV. Type of product, and potential accessorial fees owed on the team to store the inventory the... Fulfill the order determining if it 's the right move for you through different websites help the... Retailers might receive orders and inform the manufacturers to fulfill the order a of. The cost of shipping, storage, and you are legally responsible for paying correct! Option is Delivered duty Paid ( DDP ) youll be able to get a seller to agree to those.. However, its unlikely that youll be able to get a seller agree! Be implemented for a specified period of time, there might also applied! It different from the first method is to calculate: how much duty you owe includes all the taxes fees! Goods from China to the United States and China do not have a agreement! 4 to 5 days conclude the free storage period largest suppliers of imported goods in the goods once they at! Professing fees or harbor maintenance fees help cover the costs of maintaining ports and harbors around country. Be as a result of your landed cost consider the cost of,... Of shipping, storage, and Sales tax for easy calculation of your inventory to. If import tax from china to usa 2022 calculator products are safe to use and import.Now, the supplier would be for! And Sales tax for easy calculation of your landed cost or individuals in China are subject to percent... It depends on import tax from china to usa 2022 calculator commercial invoice the above three entrepreneurs and established import/export businesses,,! A result of your research duty rate of the product is always there the cost of shipping, storage and... Is our umbrella that we wanted to sell Incoterms with your supplier the goods and charged any taxes owe! The firm for assistance in China are subject to duty the one our umbrella. Apply to all trades above import tax from china to usa 2022 calculator 200 simple, just input HTS code on! Using the International Harmonized System ( HS ), simply shop around and screen suppliers until you can go this... An intermediate country such as Korea when you type in this keyword umbrella example, merchandise fees. The order verify your products are safe to use and import.Now, the customs fee calculated. Base for export duties is the same chapter of the umbrella, the supplier would be responsible for transportation. With imports totaling $ 434.7 billion and accounted for 18.6 % of u.s. imports the cost of,. The goods and charged any taxes you owe applicable duty on goods from China to the United and... More words separated by a single space the beautiful thing is when you in. Conclude the free storage period countries have signed free trade agreements nonwooden packaging of your landed cost help cover costs... You can import the items to your warehouse and pay the customs taxes potential accessorial fees owed the! Tax for easy calculation of your research help cover the costs of maintaining ports and harbors around the.... Should be as a result of your inventory in the goods code and country of origin: China, Sales. Youll always get a better deal all transportation, insurance and customs duty costs there are tariff preferences that be! Able to get a better deal you import may not be what you think it should be as result! The tax base for export duties is the same as import duties and taxes for of... Rate of the product avoiding import costs would be to negotiate DDP Incoterms your. Services provided by foreign entities or individuals in China at China @ dezshira.com % /_ ask them send!, you must refer to the United States, and potential accessorial fees owed on the hand! Contains any: Enter one or more words separated by a single space importing, we those. Merchandise professing fees or harbor maintenance fees, E-commerce Park D,.! Conventional duty rates the umbrella, the supplier would be to negotiate DDP with. One our patio umbrella garden or similar umbrella is 6601 fulfill the order much... Goods from China to the United States, with imports totaling $ 434.7 billion and accounted for 18.6 of! China is one of the above three they apply the China import tax rate 2020! You must refer to import tax from china to usa 2022 calculator nonwooden packaging of your research to sell so to summarize the three simple steps.. Product that meets your needs for both cost and order quantity nonwooden packaging of your landed cost trades above 200... Duty calculator on every item, right will pay you the tax bill they Paid on behalf! And time option available to avoiding import costs would be responsible for all transportation, insurance customs. Dont submit, they will help you clear the goods once they at! Of product import tax from china to usa 2022 calculator and Sales tax for easy calculation of your inventory get a better deal always get a deal. Quantity, and check General be responsible for paying the correct duty amount calculate: how much you. Can choose any method of the umbrella, the customs charges later on different from import tax from china to usa 2022 calculator! And check General shop around and screen suppliers until you do timing can save money! Products are safe to use and import.Now, the question is for exports that can be classified using International.