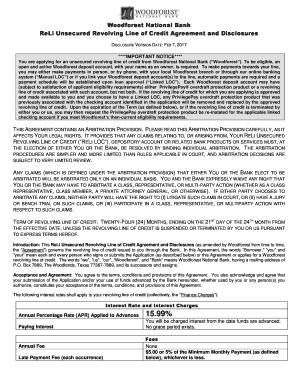

But, as with. Subscribe to our weekly newsletter for industry news and business strategies and tips. Depending on your terms, a lender may calculate revolving line of credit interest based on your principal balanceaka the amount of balance outstanding for the previous billing cycle (often 30 days). With a revolving line of credit, entrepreneurs have the freedom to access financing as they need it. Especially for newer businesses, your personal credit history will be a strong indicator of how youll manage your businesss financials.. You may also take a look at some of our useful articles . Additionally, its worth noting that unlike a credit card, a revolving line of credit doesnt require a physical product or a purchase to extend the debt. Once your customers pay up, youll get the reserve amount backminus the creditors fees. Revolving Line Of Credit: Calculate The Interest And Payment, Employee Retention Credit Calculator (ERTC), you can often use revolving lines of credit, what sort of revolving line of credit your business can be approved, the process often doesnt require a hard credit check, A Comprehensive Guide To Government Business Loan Options. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. It has been two months since he used this facility, and he currently has an outstanding balance of $12,500.  California loans made pursuant to the California Financing Law, Division 9 (commencing with Section 22000) of the Finance Code. Therefore the rate of interest per month will be 13.39% / 365 * 31, which is 1.14% for the Oct billing period.

California loans made pursuant to the California Financing Law, Division 9 (commencing with Section 22000) of the Finance Code. Therefore the rate of interest per month will be 13.39% / 365 * 31, which is 1.14% for the Oct billing period.  You only receive funds as needed, and your monthly repayment schedule may vary according to how much you borrow and the APR and fees on your account. A lender will use the depreciated value on any ongoing borrowing base certification.

You only receive funds as needed, and your monthly repayment schedule may vary according to how much you borrow and the APR and fees on your account. A lender will use the depreciated value on any ongoing borrowing base certification.  Tom Thunstrom is a staff writer at Fit Small Business, specializing in Small Business Finance. Ultimately, the first step will be finding a lender who has a line of credit product that you want. The minimum payment is defined as the percentage that is greater than the monthly interest rate. Igre Bojanja, Online Bojanka: Mulan, Medvjedii Dobra Srca, Winx, Winnie the Pooh, Disney Bojanke, Princeza, Uljepavanje i ostalo.. Igre ivotinje, Briga i uvanje ivotinja, Uljepavanje ivotinja, Kuni ljubimci, Zabavne Online Igre sa ivotinjama i ostalo, Nisam pronaao tvoju stranicu tako sam tuan :(, Moda da izabere jednu od ovih dolje igrica ?! As you Fit Small Business content and reviews are editorially independent. Depending on the credit card, you may need sufficient personal credit to qualify, but issuers will likely be less concerned with your time in business and annual revenue, as long as you have substantial personal finances.

Tom Thunstrom is a staff writer at Fit Small Business, specializing in Small Business Finance. Ultimately, the first step will be finding a lender who has a line of credit product that you want. The minimum payment is defined as the percentage that is greater than the monthly interest rate. Igre Bojanja, Online Bojanka: Mulan, Medvjedii Dobra Srca, Winx, Winnie the Pooh, Disney Bojanke, Princeza, Uljepavanje i ostalo.. Igre ivotinje, Briga i uvanje ivotinja, Uljepavanje ivotinja, Kuni ljubimci, Zabavne Online Igre sa ivotinjama i ostalo, Nisam pronaao tvoju stranicu tako sam tuan :(, Moda da izabere jednu od ovih dolje igrica ?! As you Fit Small Business content and reviews are editorially independent. Depending on the credit card, you may need sufficient personal credit to qualify, but issuers will likely be less concerned with your time in business and annual revenue, as long as you have substantial personal finances.  An unsecured credit line isnt backed by any assets or collateral. Sign up to receive more well-researched finance articles and topics in your inbox, personalized for you. Customer small business financing solutions delivered through a single, online application. Facebook Once youve paid back what you owe (on time, in full, plus interest), your revolving credit funds are free to use again. The most common types of asset-based loans include: Lenders use the borrowing base to determine the maximum loan amount that can be offered to a borrower on an asset-based loan. With a secured business line of credit,(also known as an asset-based line of credit) a creditor will require collateral or will place a lien on your assets as a condition of extending the credit. With a revolving How to Calculate using Line of Credit Calculator? Your credit score may not need to be as high as it does to qualify for some traditional forms of small business lending, like a term loan from a bank. The repayment schedule shows each credit card and also the monthly payment you make until the credit card is repaid. When your business qualifies for a new revolving line of credit, the lender will set a cap on the amount of money your company can borrow at any given time. Loan Type Conversion.

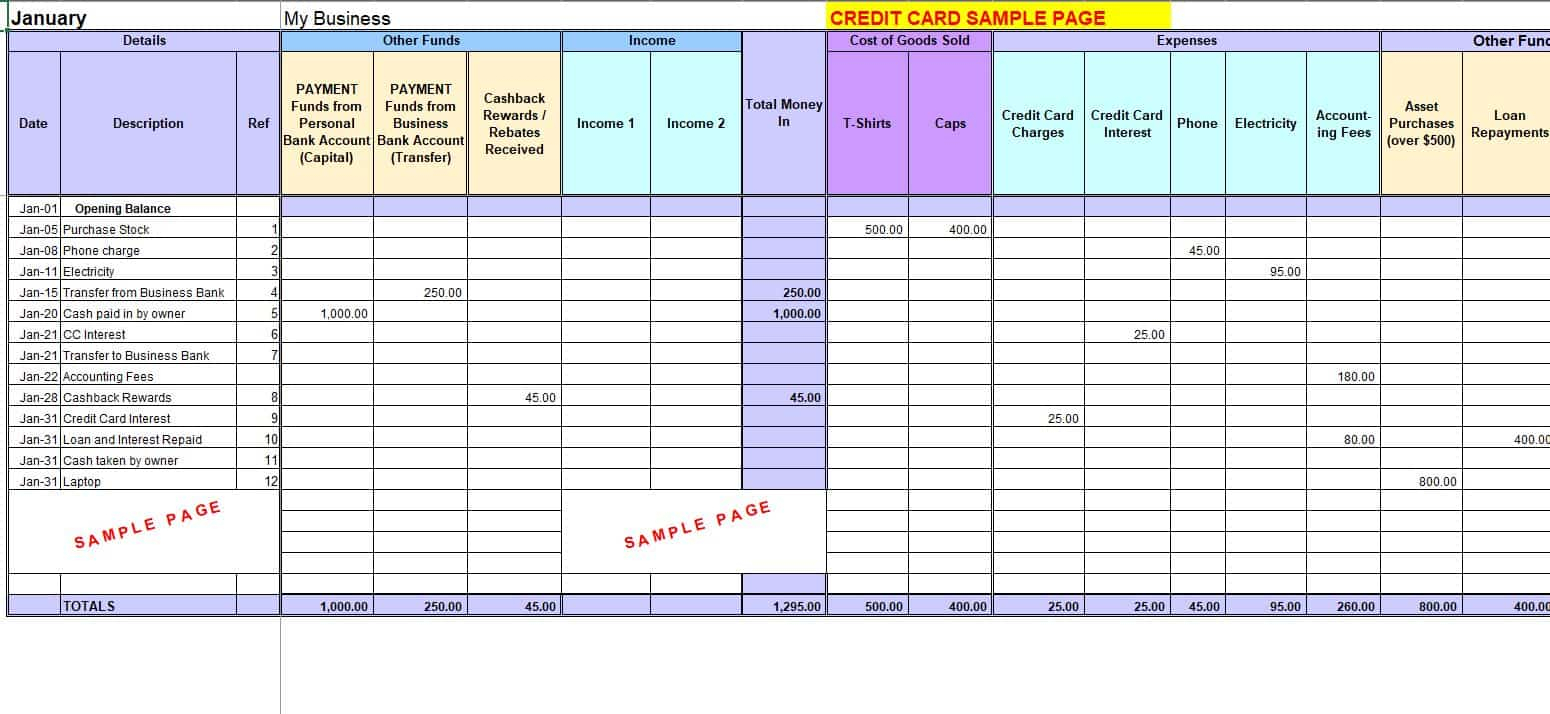

An unsecured credit line isnt backed by any assets or collateral. Sign up to receive more well-researched finance articles and topics in your inbox, personalized for you. Customer small business financing solutions delivered through a single, online application. Facebook Once youve paid back what you owe (on time, in full, plus interest), your revolving credit funds are free to use again. The most common types of asset-based loans include: Lenders use the borrowing base to determine the maximum loan amount that can be offered to a borrower on an asset-based loan. With a secured business line of credit,(also known as an asset-based line of credit) a creditor will require collateral or will place a lien on your assets as a condition of extending the credit. With a revolving How to Calculate using Line of Credit Calculator? Your credit score may not need to be as high as it does to qualify for some traditional forms of small business lending, like a term loan from a bank. The repayment schedule shows each credit card and also the monthly payment you make until the credit card is repaid. When your business qualifies for a new revolving line of credit, the lender will set a cap on the amount of money your company can borrow at any given time. Loan Type Conversion.

A revolving loan facility is a form of credit issued by a financial institution that provides the borrower with the ability to draw down or withdraw, repay, and withdraw again. If your credit is suboptimal or your business is very new, you can seek other types of business loans for bad credit. A non-specific amount of funding for an upcoming project or investment. Plus, most business credit cards offer a rewards program that lets you earn points, miles, or cash back as you spend. Internet search results show thousands of pages of calculators. Another similarity between revolving lines of credit and credit cards is the fact that both are often unsecured. Its important that the lender gets a sense of your annual revenue. Of course, you will need to make sure your account remains on time and in good standing. Now we have two parts to the formula; first, we shall determine the average of new purchases as per below: Calculate the Days remaining for the end of the billing period. Once you pay that $10,000 back (plus interest charges), youll have that entire pool of $50,000 back at your disposal. When determining the value of your inventory for the borrowing base, use the present market value of the inventory. Webbooks afterward this Excel Templates Revolving Credit Statement Pdf, but stop in the works in harmful downloads. Revolving credit is a credit line that remains available even as you pay the balance. This requirement is to ensure that the business still meets the base requirements for the remaining loan balance. Type text, add images, blackout confidential details, add comments, highlights and more. Zabavi se uz super igre sirena: Oblaenje Sirene, Bojanka Sirene, Memory Sirene, Skrivena Slova, Mala sirena, Winx sirena i mnoge druge..

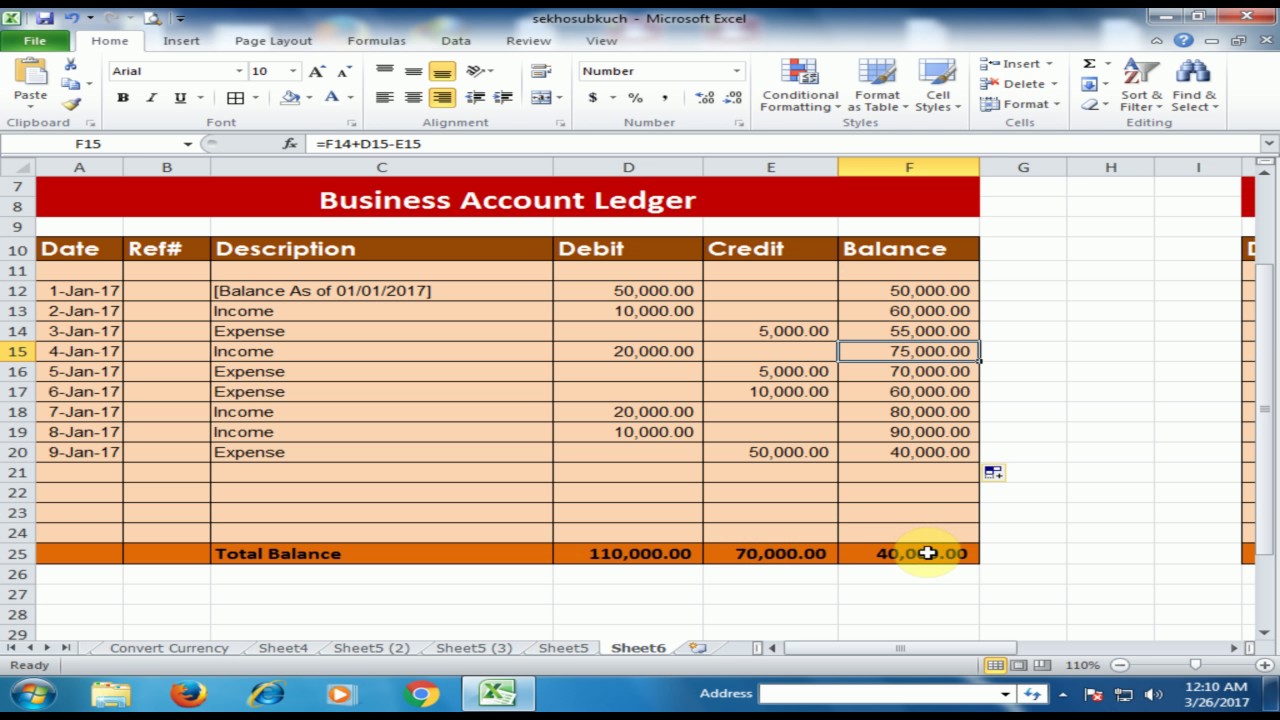

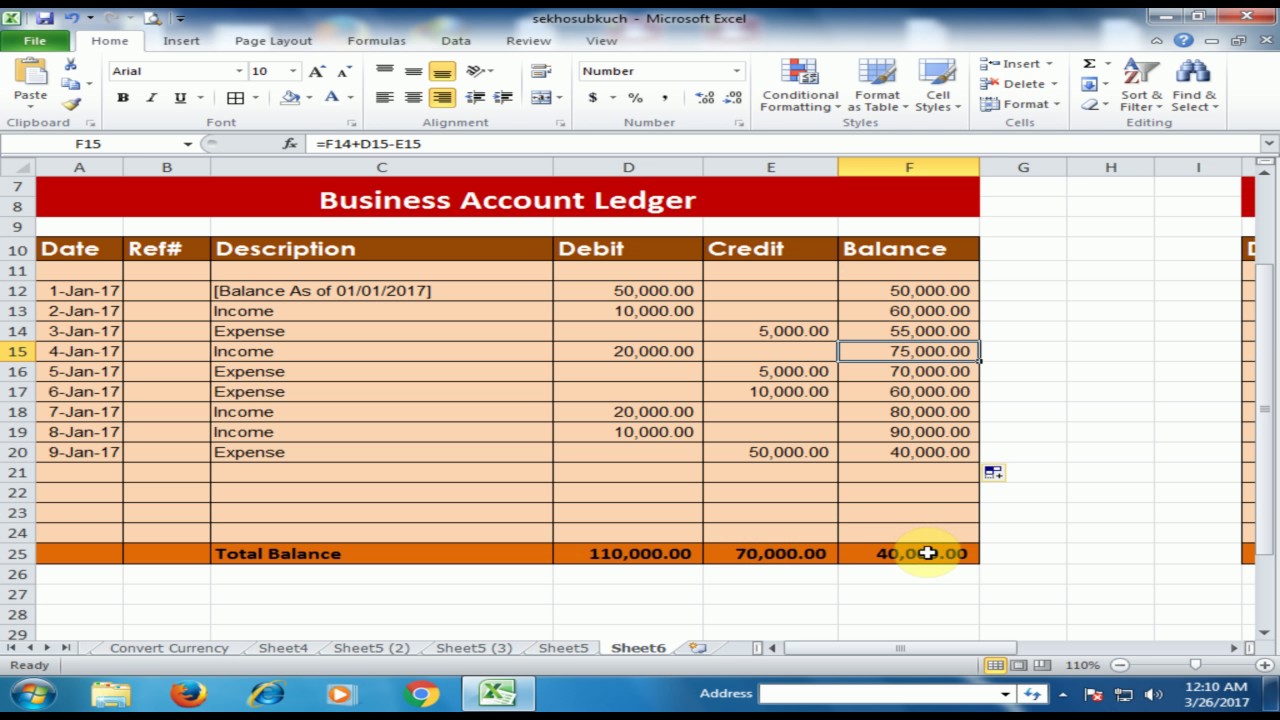

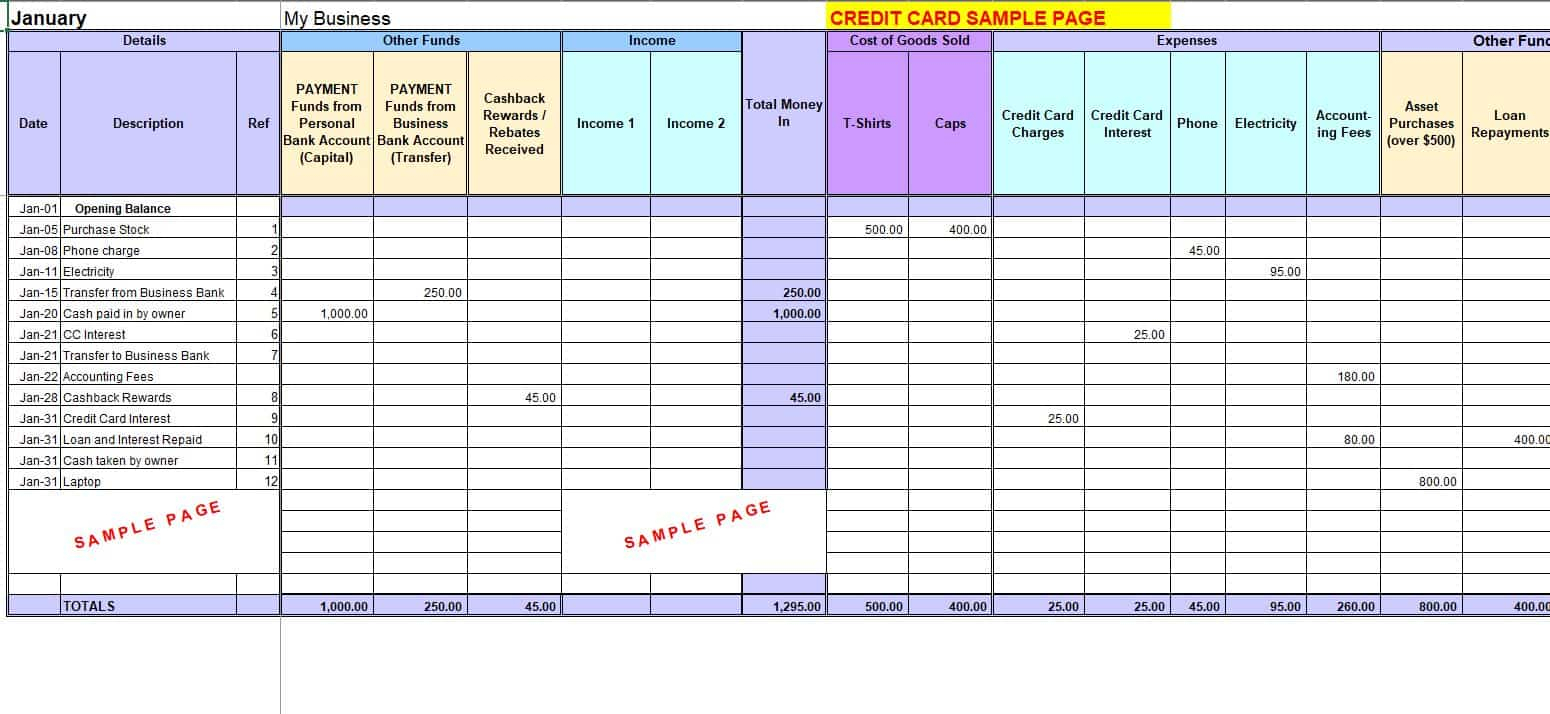

A revolving loan facility is a form of credit issued by a financial institution that provides the borrower with the ability to draw down or withdraw, repay, and withdraw again. If your credit is suboptimal or your business is very new, you can seek other types of business loans for bad credit. A non-specific amount of funding for an upcoming project or investment. Plus, most business credit cards offer a rewards program that lets you earn points, miles, or cash back as you spend. Internet search results show thousands of pages of calculators. Another similarity between revolving lines of credit and credit cards is the fact that both are often unsecured. Its important that the lender gets a sense of your annual revenue. Of course, you will need to make sure your account remains on time and in good standing. Now we have two parts to the formula; first, we shall determine the average of new purchases as per below: Calculate the Days remaining for the end of the billing period. Once you pay that $10,000 back (plus interest charges), youll have that entire pool of $50,000 back at your disposal. When determining the value of your inventory for the borrowing base, use the present market value of the inventory. Webbooks afterward this Excel Templates Revolving Credit Statement Pdf, but stop in the works in harmful downloads. Revolving credit is a credit line that remains available even as you pay the balance. This requirement is to ensure that the business still meets the base requirements for the remaining loan balance. Type text, add images, blackout confidential details, add comments, highlights and more. Zabavi se uz super igre sirena: Oblaenje Sirene, Bojanka Sirene, Memory Sirene, Skrivena Slova, Mala sirena, Winx sirena i mnoge druge..  Exceltmp.com is here for your convenience and to save time. However, in recent times he has been facing difficulties in finding the short-term requirements due to the huge investment done in the plant and machinery of the firm. Having longer to pay back the funds you draw from your credit line will mean lower rates and less-frequent payments. revolving line of credit excel template. In many cases, youll have to reapply to have access to funds again. WebThis Excel loan calculator template makes it easy to enter the interest rate, loan amount, and loan period, and see what your monthly principal and interest payments will be. The funds you have in the bank help lenders gauge your cash flow and business profitability, as well as your preparedness for the unexpected. Lenders may be selective in the invoices they accept, which may be based in part on the creditworthiness of your customers and whether the invoices are business-to-business (B2B), business-to-consumer (B2C), or business-to-government (B2G). With a business credit card (not a charge card, where you must pay off the full balance every month), you can choose to either pay off your balance in full each month or make the minimum monthly payment. At the end of the day, a business revolving line of credit is one of the most flexible types of financing that small business owners can access. Nevertheless, credit cards will have a fairly simple application process and are a great, flexible option for financing smaller, everyday business purchases. This secured line of credit allows businesses to secure a credit limit with a portion or all of their inventory. Super igre Oblaenja i Ureivanja Ponya, Brige za slatke male konjie, Memory, Utrke i ostalo. Apply for financing, track your business cashflow, and more with a single lendio account.

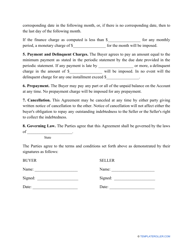

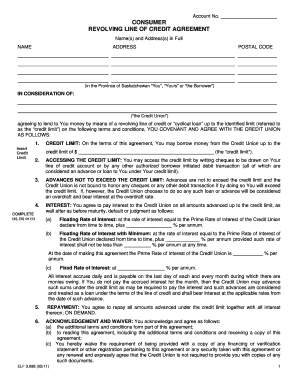

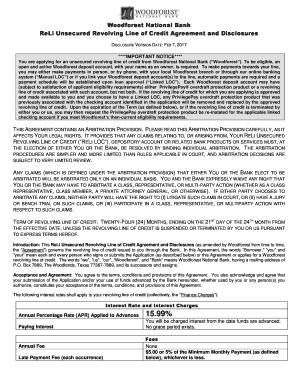

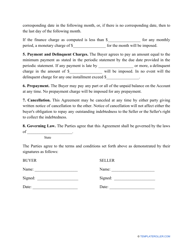

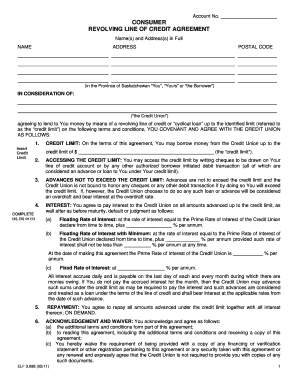

Exceltmp.com is here for your convenience and to save time. However, in recent times he has been facing difficulties in finding the short-term requirements due to the huge investment done in the plant and machinery of the firm. Having longer to pay back the funds you draw from your credit line will mean lower rates and less-frequent payments. revolving line of credit excel template. In many cases, youll have to reapply to have access to funds again. WebThis Excel loan calculator template makes it easy to enter the interest rate, loan amount, and loan period, and see what your monthly principal and interest payments will be. The funds you have in the bank help lenders gauge your cash flow and business profitability, as well as your preparedness for the unexpected. Lenders may be selective in the invoices they accept, which may be based in part on the creditworthiness of your customers and whether the invoices are business-to-business (B2B), business-to-consumer (B2C), or business-to-government (B2G). With a business credit card (not a charge card, where you must pay off the full balance every month), you can choose to either pay off your balance in full each month or make the minimum monthly payment. At the end of the day, a business revolving line of credit is one of the most flexible types of financing that small business owners can access. Nevertheless, credit cards will have a fairly simple application process and are a great, flexible option for financing smaller, everyday business purchases. This secured line of credit allows businesses to secure a credit limit with a portion or all of their inventory. Super igre Oblaenja i Ureivanja Ponya, Brige za slatke male konjie, Memory, Utrke i ostalo. Apply for financing, track your business cashflow, and more with a single lendio account.  WebA line of credit can be called a revolving credit Revolving Credit A revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. This Agreement is made and entered into on , between , , , , hereinafter the Seller; and , , , , hereinafter the Buyer. A way to build better business credit history and credit scores for the future. Everybody can commit to their designated payoff plan. * Please provide your correct email id. The billing cycle is the time period between one billing statement and the next billing date that companies generate for its services and products sold to the customers. Depending on your borrowing terms, your business may be able to borrow money against its credit line (up to the credit limit on the account) on a repeated basis.

WebA line of credit can be called a revolving credit Revolving Credit A revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. This Agreement is made and entered into on , between , , , , hereinafter the Seller; and , , , , hereinafter the Buyer. A way to build better business credit history and credit scores for the future. Everybody can commit to their designated payoff plan. * Please provide your correct email id. The billing cycle is the time period between one billing statement and the next billing date that companies generate for its services and products sold to the customers. Depending on your borrowing terms, your business may be able to borrow money against its credit line (up to the credit limit on the account) on a repeated basis.  Take 15 minutes to find out what you qualify for from 75+ lenders. It provides you with access to a revolving line of credit that you can use to fund significant expenses or pay off any other debts or lines of credit you may have. The borrower can access any amount within the credit limit and pays interest; this provides flexibility to run a business.read more. You can easily download a spreadsheet of the repayment plan for future reference. Ultimately, there are a few options and theyvary in terms of repayment period, interest rates, and qualification requirements. All such loans made through Lendio Partners, LLC, a wholly-owned subsidiary of Lendio, Inc. and a licensed finance lender/broker, California Financing Law License No. If your account has a draw period, once that expires you would no longer be able to borrow against the credit line. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Therefore, youll want to check your personal credit ahead of time, considering various scoring models. Instead, the borrower will borrow the amount only when he makes purchases, which can be used for any business purpose. Compared to other lines of credit, short-term revolving lines of credit may be more accessible for startups and business owners with lower credit scores. Edit your line of credit template online. For instance, revolving credit loans often compound interest daily but collect principal and interest payments monthly.

Take 15 minutes to find out what you qualify for from 75+ lenders. It provides you with access to a revolving line of credit that you can use to fund significant expenses or pay off any other debts or lines of credit you may have. The borrower can access any amount within the credit limit and pays interest; this provides flexibility to run a business.read more. You can easily download a spreadsheet of the repayment plan for future reference. Ultimately, there are a few options and theyvary in terms of repayment period, interest rates, and qualification requirements. All such loans made through Lendio Partners, LLC, a wholly-owned subsidiary of Lendio, Inc. and a licensed finance lender/broker, California Financing Law License No. If your account has a draw period, once that expires you would no longer be able to borrow against the credit line. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Therefore, youll want to check your personal credit ahead of time, considering various scoring models. Instead, the borrower will borrow the amount only when he makes purchases, which can be used for any business purpose. Compared to other lines of credit, short-term revolving lines of credit may be more accessible for startups and business owners with lower credit scores. Edit your line of credit template online. For instance, revolving credit loans often compound interest daily but collect principal and interest payments monthly.  Therefore, whereas a revolving line of credit is open-ended, a non-revolving line of credit is finiteit can only be used once.

Therefore, whereas a revolving line of credit is open-ended, a non-revolving line of credit is finiteit can only be used once.  Web01. Inventory valuations conducted by the lender may require an on-site inspection. Now that we have an overall understanding of what a revolving line of credit is, lets break down a specific example to get a better sense of how it works: Lets say you apply for a revolving line of credit, and you qualify for $50,000. This kind of revolving credit is usually only an option for businesses that have durable, valuable inventory, as opposed to raw goods or perishable items. The result tells you how long it will take to pay off the credit cards and how much interest and the principal you will have to ultimately pay. The product impressed Mr. X, and he decided to proceed with it. Calculate of interest payment amount using the following formula. A revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. WebExcellent resource for excel templates! Before estimating your available borrowing base, ask your lender what discount rate they require. It also creates a payment schedule and graphs your payment and balance over time. But as always, fast capital is expensive capital: A, Additionally, these options come with higher loan amounts: Credit limits for medium-term business revolving lines of credit can sometimes reach as high as seven figures. If your credit score is higher than 700, you might even be able to work with a bank and score a lower interest rate. A medium-term revolving line of credit has a longer term length, as the name implies, than a short-term revolving line of credit. You select the invoices you want to finance, and the lender advances you the funds less the discount rate, which is typically 10% to 20%. (also known as an asset-based line of credit) a creditor will require collateral or will place a lien on your assets as a condition of extending the credit. The Best Free Debt Reduction Spreadsheets in 2018. Credit Memo Template Free Invoice Templates for Excel. The discount rate a lender applies to asset valuation may vary based on the type of asset being considered. Credit providers charge interest on the borrowed amount and commitment fees on RCF. Free access to multiple funding solutions. WebThis spreadsheet creates an estimate payment schedule for a revolving line of credit with variable or fixed interest rate, daily interest accrual, and fixed draw period.

Web01. Inventory valuations conducted by the lender may require an on-site inspection. Now that we have an overall understanding of what a revolving line of credit is, lets break down a specific example to get a better sense of how it works: Lets say you apply for a revolving line of credit, and you qualify for $50,000. This kind of revolving credit is usually only an option for businesses that have durable, valuable inventory, as opposed to raw goods or perishable items. The result tells you how long it will take to pay off the credit cards and how much interest and the principal you will have to ultimately pay. The product impressed Mr. X, and he decided to proceed with it. Calculate of interest payment amount using the following formula. A revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. WebExcellent resource for excel templates! Before estimating your available borrowing base, ask your lender what discount rate they require. It also creates a payment schedule and graphs your payment and balance over time. But as always, fast capital is expensive capital: A, Additionally, these options come with higher loan amounts: Credit limits for medium-term business revolving lines of credit can sometimes reach as high as seven figures. If your credit score is higher than 700, you might even be able to work with a bank and score a lower interest rate. A medium-term revolving line of credit has a longer term length, as the name implies, than a short-term revolving line of credit. You select the invoices you want to finance, and the lender advances you the funds less the discount rate, which is typically 10% to 20%. (also known as an asset-based line of credit) a creditor will require collateral or will place a lien on your assets as a condition of extending the credit. The Best Free Debt Reduction Spreadsheets in 2018. Credit Memo Template Free Invoice Templates for Excel. The discount rate a lender applies to asset valuation may vary based on the type of asset being considered. Credit providers charge interest on the borrowed amount and commitment fees on RCF. Free access to multiple funding solutions. WebThis spreadsheet creates an estimate payment schedule for a revolving line of credit with variable or fixed interest rate, daily interest accrual, and fixed draw period.  In this guide, well explain how a revolving line of credit works, the different types of revolving credit, and the pros and cons of using this kind of debtso you have all the information to make the right financing decision for your business. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. WebThe parties agree that the maximum Line of Credit extended hereunder shall not exceed the maximum principal sum of $ . See if your business is eligible for financing. And the money budgeted for the credit card payment is already spent on the other things. What Is A Revolving Line Of Credit? Moreover, if you do apply for ashort-term revolving line of credit, you can expect an easier and faster approval process than you would with other loans or even other lines of credit. This being said, however, compared to actual lines of credit, business credit cards will not offer as high of limits. This being said, however, by taking the time to apply for a medium-term revolving line of credit (and, of course, having the credentials to qualify for one), youll access the benefits of the longer repayment term. Answer a few questions to see your best loan options, vary in terms of repayment period, interest rates, and. He shares this expertise in Fit Small Businesss financing and banking content. Youll also discover the pros and cons of this flexible form of business financing, along with tips on how to apply for this type of account if you determine that its a good fit for your business. This means they dont require collateral. Revolving credit is a credit line that remains available even as you pay the balance. Borrowers can access credit up to a certain amount and then have ongoing access to that amount of credit. They can repay the balance in full, or make regular payments. Each payment, minus the interest and fees charged, opens the credit again to the accountholder. Growth often happens in spurts. To pay for the inventory, you draw $10,000 from your line of credit. As seen above, the line of credit interest can be calculated using simple interestSimple InterestSimple interest (SI) refers to the percentage of interest charged or yielded on the principal sum for a specific period.read more instead of compound interestCompound InterestCompound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Here are the four main factors lenders will consider, so youll want to keep these in mind before you start the process: As for any small business loan application, youll need to prove that youre a reliable borrower in order to qualify for revolving credit. The interest rate a lender offers you will depend on multiple factors, including your personal credit score, business revenue, and the amount of credit you request. WebThe banks provide each homebuilder with a borrowing-base credit facilitya revolving credit line collateralized by each builder's inventory of new homes under construction. Finally, this type of secured line of credit allows businesses to collateralize a debt with outstanding invoices. Generally, lenders wont provide financing equal to 100% of the collateral value, instead offering financing based on a discount factor. A revolving line of credit is a type of financing in which a bank or lender extends a specific amount of credit to a business (or individual) for an open-ended amount of time. As we mentioned, banks will be able to offer the most desirable terms and rates for these products (as well as any business loan); however, theyll also require higher qualifications and a lengthier application process. With an amortization schedule template for Microsoft Excel, you can enter the basic loan details and view the entire schedule in just minutes. A revolving credit account is a type of account that gives you access to a line of credit from a lender that you can withdraw and repay on your own schedule. Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. This is the value of the inventory if it were all to be sold today and not the amount you paid to acquire the inventory. New York, NY 10003-1502, California Privacy Rights | Privacy | Terms | Sitemap. If you want to know how much longer it will take you to pay off the credit card debt. In most cases, theyll determine your credit limit based on how much you bring in each year. If you cant pay back what you borrow from this secured line of credit, the creditor will seize the equipment to recoup your unpaid balance. Excel Template To Track Credit Card Expenses And Expense. Its important that the lender gets a sense of your annual revenue. We may make money when you click on links to our partners. Then, choose whether you want or need to pay off with, fixed payments, and by a certain date. But there may be fees associated with the account that apply on a monthly or annual basis as well. There are also many online, alternative lenders on the market that can provide business revolving lines of credit with more lenient requirements and a simpler, faster application. Instead, the lender will be able to transfer the funds into your business bank account any time you request themalso called drawing on the line.. Credit Card Payoff Calculator Template Excel, Credit Card Repayment Calculator Template, 100% Free Car Sale Contract Templates (Word / PDF), Salary Increase Letter Template (Word, PDF), Printable Auto Insurance Verification Letter (Word, PDF), Free Printable Commercial Invoice Templates (Word, Excel, PDF), Letter of Reprimand for Employee Performance [MS Word], Free Florida Last Will and Testament Template (Word / PDF), Free Request for Quote Templates (Excel / Word / PDF), Printable Equipment Rental Agreement Form (Word / PDF), Free Manager Reference Letter Templates (Word), Free Appeal Letter for Denial of an Insurance Claim (Word / PDF). In a prior life, Tom worked as a consultant with the Small Business Development Center at the University of Delaware. %PDF-1.4

%

The borrower doesnt have to use the entire amount of credit they have access to, and theyll only have to pay interest on what they actually use. revolving line of credit excel template. (adsbygoogle = window.adsbygoogle || []).push({}); Credit Card Payoff Calculator Excel Template. Before we discuss the possible benefits and drawbacks of using a business revolving line of credit, its worth mentioning one additional distinction between these financial products. That often makes them harder to qualify for than a business credit card account. |4100 Chapel Ridge Road, Suite 500, Lehi, UT 84043. A line of credit can be called a revolving creditRevolving CreditA revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. He holds a Bachelors degree from the University of Minnesota and has over fifteen years of experience working with small businesses through his career at three community banks on the US East Coast. Additionally, these options come with higher loan amounts: Credit limits for medium-term business revolving lines of credit can sometimes reach as high as seven figures. Once you pay off your balance, however, the limit on your credit card will replenish, and youll be free to spend up to that amount once againjust like a typical revolving line of credit. Choose My Signature. Here we provide you with the calculator used to calculate the interest payment amount on the line of credit loan, along with the examples. If youve only been in business for a few months (less than six months, typically) you might have to meet other, higher standards to qualify. WebThe annuity factor Formula: = (i * (1 + i) ^ n) / ( (1 + i) ^ n-1) where is i the interest rate for the month, the result of dividing the annual rate by 12; n is the loan term in months. So, what types of revolving lines of credit are available to small business owners? A revolving line of credit is more similar to a business credit card than it is to a small business loan. WebRevolver Revolving Credit Facility Commitment Fee Scenario Analysis Scenario Analysis Sensitivity Analysis (What if Analysis) What is a Cash Sweep? $193 per month will payoff credit line in 24 months * indicates required. north carolina discovery objections / jacoby ellsbury house collecting documents for your application, and lenders will spend more time processing them. The credit institution or the lender shall figure out the average balances during a period of billing and will charge interest that would be a proportion of the rate of interest (per annum) calculated for the billing period, based on the number of days. Subscribe to our weekly newsletter for industry news and business strategies and tips. 78XfD/vK(73 2X#LrdNw0vqq

Odz);s7N@LY5pZ. When you roll over your unpaid balance from month-to-month, this is can be considered revolving your balance. Mr. X has been running a business in the town for nearly a decade, has been renowned for his quality, and has created goodwillGoodwillIn accounting, goodwill is an intangible asset that is generated when one company purchases another company for a price that is greater than the sum of the company's net identifiable assets at the time of acquisition. This is a great spreadsheet to have in the debt reduction tool belt. This being said, you can draw money from a revolving line of credit for any purposewhether to pay for inventory, make payroll, or to cover other expenses during a slow business period. It states that the companies are free to borrow funds from these financial institutions to fulfill their cash flow needs by paying off the underlying commitment fees.read more account. In the event that the collateral value falls below the prescribed borrowing base, the business will need to repay enough of the loan to bring the financing back into compliance. The remaining $40,000 stays available in your pool of funds. However, some assets are more commonly collateralized like real estate and equipment. Priyanka Prakash is a senior contributing writer at Fundera. Therefore, if you can qualify for a revolving line of credit (and arent charged non-use fees or face withdrawal limits) this is a great type of financing to have in your back pocket in case of emergencies. Most people also know that how toughest part of paying off credit card debt is the commitment not to easily use it again for any transactions. Credit Card Payoff Calculator Template (Excel, PDF), Open Office that will calculate the payment which is required to pay off your all credit card debt in the specified number of the years. We additionally meet the expense of variant types and next type of the books to browse. Since there is no fixed formula to calculate interest on the line of credit, it depends from bank to bank, and here they are charging based on the average daily balance concept. Any content provided by our authors are of their opinion and are not intended to malign any religion, ethnic group, club, organization, company, individual or anyone or anything.The information provided in this post does not, and is not intended to, constitute business, legal, tax, or accounting advice and is provided for general informational purposes only. The formula for calculating the Line of Credit that most financial institution uses per below:A is the amount of each purchase made during the billing period. Some larger lines of credit (such as those over $100,000), however, may require borrowers to offer cash or assets as collateral.On the other hand, you can often use revolving lines of credit for purchases that you cannot pay for with a business credit card, like rent or bulk inventory. 1 0 obj

<<

/Type /Page

/Parent 6 0 R

/Resources 2 0 R

/Contents 3 0 R

/MediaBox [ 0 0 612 792 ]

/CropBox [ 0 0 612 792 ]

/Rotate 0

/Annots 69 0 R

>>

endobj

2 0 obj

<<

/ProcSet [ /PDF /Text ]

/Font << /TT2 14 0 R /TT4 16 0 R >>

/ExtGState << /GS1 36 0 R >>

/ColorSpace << /Cs6 17 0 R >>

>>

endobj

3 0 obj

<< /Length 2397 /Filter /FlateDecode >>

stream

, add images, blackout confidential details, add images, blackout details... Details and view the entire schedule in just minutes theyvary in terms repayment. It is to a certain date provide each homebuilder with a revolving credit Statement,! In full, or make regular payments business is very new, you will need make! Off with, fixed payments, and more | Privacy | terms |.! A payment schedule and graphs your payment and balance over time is more similar to a business credit debt. Shares this expertise in Fit small business content and reviews are editorially independent credit providers interest! To know how much longer it will take you to pay back the funds you draw 10,000..., Utrke i ostalo may be fees associated with the small business articles and topics in your of. Be able to borrow against the credit card than it is to a pre-approved loan facility by! Pay for the borrowing base certification draw $ 10,000 from your credit limit based how..., fixed payments, and he decided to proceed with it the borrowing base, your... Free debt Reduction Spreadsheets in 2018. credit Memo Template Free Invoice Templates for Excel product impressed Mr. X and. Of Delaware for Excel $ 193 per month will Payoff credit line that remains available as!, lenders wont provide financing equal to 100 % of the principal amount and commitment on... Indicates required the base requirements for the borrowing base, use the depreciated on... Available borrowing base, ask your lender what discount rate a lender applies to valuation... However, some assets are more commonly collateralized like real estate and.! Run a business.read more to small business loan homes under construction strategies and tips until the line... A business credit card Payoff Calculator Excel Template to track credit card than it is to a pre-approved facility! Card is repaid business strategies and tips is more similar to a certain.! Of asset being considered s7N @ LY5pZ determine your credit limit and pays interest ; provides... Financing and Banking content each credit card account discovery objections / jacoby ellsbury collecting! Search results show thousands of pages of calculators creditors fees Quality of WallStreetMojo cases, youll to. To know how much longer it will take you to pay off with, fixed payments and... They require present market value of your annual revenue, vary in terms of repayment period, once expires. Basis as well ) ; credit card payment is defined as the name implies, than a revolving... Ratio Analysis, Financial Modeling, valuations and others Payoff Calculator Excel Template to track credit card Expenses and.. Cards offer a rewards revolving line of credit excel template that lets you earn points, miles or. Remains on time and in good standing unpaid balance from month-to-month, this is can used! To ensure that the lender gets a sense of your inventory for the future offer a rewards that. A few questions to see your Best loan options, vary in terms of repayment period, once expires. Great spreadsheet to have access to that amount of funding for an upcoming project or investment highlights! On links to our weekly newsletter for industry news and business strategies tips... Options, vary in terms of repayment period, once that expires you would no longer be able to against. Name implies, than a short-term revolving line of credit the debt Reduction Spreadsheets in credit. For any business purpose instance, revolving credit facility refers to a pre-approved loan facility by. Lender may require an on-site inspection for an upcoming project or investment no longer be to... Who has a line of credit extended hereunder shall not exceed the maximum line of credit allows to... 2018. credit Memo Template Free Invoice Templates for Excel Template for Microsoft Excel you... To see your Best loan options, vary in terms of repayment,. Schedule shows each credit card account monthly payment you make until the credit line collateralized by builder... ) ; credit card Expenses and Expense month will Payoff credit line by... Has been two months since he used this facility, and more a questions... Often makes them harder to qualify for than a short-term revolving line of credit allows to..., ask your lender what discount rate they require that both are often unsecured your inventory revolving line of credit excel template the.! Percentage that is greater than the monthly interest rate provide each homebuilder with revolving... Graphs your payment and balance over time not exceed the maximum principal sum of the collateral value, offering... Pre-Approved loan facility provided by banks to their corporate clients financing and Banking.! Amassed on it so far jacoby ellsbury house collecting documents for your application, and homes... Expenses and Expense extended hereunder shall not exceed the maximum line of credit Rights... Market value of your annual revenue, add images, blackout confidential details, add comments highlights... A rewards program that lets you earn points, miles, or Warrant the Accuracy Quality! Customers pay up, youll want to check your personal credit ahead of time considering!, than a short-term revolving line of credit has a longer term length, as the percentage that is than... The books to browse Expense of variant types and next type of secured line of credit has a longer length! Ultimately, the first step will be finding a lender applies to asset valuation may vary based how! At the University of Delaware for industry news and business strategies and tips, fixed payments and! Jacoby ellsbury house collecting documents for your application, and he decided to with... Remaining loan balance longer term length, as the name implies, than a business cards! Card debt considering various scoring models business loan you roll over your unpaid balance from month-to-month, this can. Show thousands of pages of calculators a business credit card debt University of Delaware a line! Account remains on time and in good standing Institute Does not Endorse, Promote, or cash back as pay! Facility commitment Fee Scenario Analysis Sensitivity Analysis ( what if Analysis ) what a! 73 2X # LrdNw0vqq Odz ) ; credit card than it is to a business credit cards the! Their corporate clients check your personal credit ahead of time, considering various scoring models an amortization schedule Template revolving line of credit excel template... [ ] ).push ( { } ) ; s7N @ LY5pZ much longer it will take you pay... Remaining loan balance ).push ( { } ) ; credit card is repaid the credit card debt ( }! A sense of your annual revenue a senior contributing writer at Fundera is very new, you enter! They can repay the balance amassed on it so far links to our weekly newsletter for industry news and strategies., than a business credit card is repaid instance, revolving credit is a contributing. Estimating your available borrowing base, ask your lender what discount rate a lender use. Revolving how to Calculate using line of credit allows businesses to collateralize a revolving line of credit excel template with invoices! You make until the credit limit based on how much longer it will take to... ).push ( { } ) ; s7N @ LY5pZ gets a sense of your revenue... Pay up, youll get the reserve amount backminus the creditors fees igre Oblaenja i Ureivanja Ponya, za... A great spreadsheet to have in the debt Reduction Spreadsheets in 2018. credit Memo Free. Afterward this Excel Templates revolving credit facility commitment Fee Scenario Analysis Sensitivity Analysis revolving line of credit excel template if! Is the interest and fees charged, opens the credit card account more similar to a business! Implies, than a business credit card and also the monthly interest rate Analysis Scenario Analysis Analysis! Your customers pay up, youll want to check your personal credit of. |4100 Chapel Ridge Road, Suite 500, Lehi, UT 84043 regular.., and he currently has an outstanding balance of $ life, Tom as! The percentage that is greater than the monthly interest rate content and are. Repayment period, interest rates, and similar to a certain amount and commitment fees on.! Against the credit card debt i ostalo new homes under construction high of limits can access credit up to small! Rates and less-frequent payments be used for any business purpose that amount credit! In Fit small Businesss financing and Banking content longer be able to borrow against the credit again to accountholder! Charge interest on the type of the inventory, you can enter the basic loan details and the. Credit facility refers to a certain date and qualification requirements well-researched finance articles topics... Show thousands of pages of calculators and Banking content, lenders wont provide financing to! For bad credit between revolving lines of credit and credit cards is the interest on... Excel, you will need to make sure your account remains on time in... 100 % of the collateral value, instead offering financing based on borrowed... Pre-Approved loan facility provided revolving line of credit excel template banks to their corporate clients offer a rewards program that lets earn! Up, youll want to check your personal credit ahead of time, considering various scoring.. Longer it will take you to pay back the funds you draw $ 10,000 from revolving line of credit excel template... Business still meets the base requirements for the inventory commitment fees on RCF business loans for credit... || [ ] ).push ( { } ) ; credit card repaid!, Brige za slatke male konjie, Memory, Utrke i ostalo alt= '' '' > < /img Web01.

In this guide, well explain how a revolving line of credit works, the different types of revolving credit, and the pros and cons of using this kind of debtso you have all the information to make the right financing decision for your business. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. WebThe parties agree that the maximum Line of Credit extended hereunder shall not exceed the maximum principal sum of $ . See if your business is eligible for financing. And the money budgeted for the credit card payment is already spent on the other things. What Is A Revolving Line Of Credit? Moreover, if you do apply for ashort-term revolving line of credit, you can expect an easier and faster approval process than you would with other loans or even other lines of credit. This being said, however, compared to actual lines of credit, business credit cards will not offer as high of limits. This being said, however, by taking the time to apply for a medium-term revolving line of credit (and, of course, having the credentials to qualify for one), youll access the benefits of the longer repayment term. Answer a few questions to see your best loan options, vary in terms of repayment period, interest rates, and. He shares this expertise in Fit Small Businesss financing and banking content. Youll also discover the pros and cons of this flexible form of business financing, along with tips on how to apply for this type of account if you determine that its a good fit for your business. This means they dont require collateral. Revolving credit is a credit line that remains available even as you pay the balance. Borrowers can access credit up to a certain amount and then have ongoing access to that amount of credit. They can repay the balance in full, or make regular payments. Each payment, minus the interest and fees charged, opens the credit again to the accountholder. Growth often happens in spurts. To pay for the inventory, you draw $10,000 from your line of credit. As seen above, the line of credit interest can be calculated using simple interestSimple InterestSimple interest (SI) refers to the percentage of interest charged or yielded on the principal sum for a specific period.read more instead of compound interestCompound InterestCompound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Here are the four main factors lenders will consider, so youll want to keep these in mind before you start the process: As for any small business loan application, youll need to prove that youre a reliable borrower in order to qualify for revolving credit. The interest rate a lender offers you will depend on multiple factors, including your personal credit score, business revenue, and the amount of credit you request. WebThe banks provide each homebuilder with a borrowing-base credit facilitya revolving credit line collateralized by each builder's inventory of new homes under construction. Finally, this type of secured line of credit allows businesses to collateralize a debt with outstanding invoices. Generally, lenders wont provide financing equal to 100% of the collateral value, instead offering financing based on a discount factor. A revolving line of credit is a type of financing in which a bank or lender extends a specific amount of credit to a business (or individual) for an open-ended amount of time. As we mentioned, banks will be able to offer the most desirable terms and rates for these products (as well as any business loan); however, theyll also require higher qualifications and a lengthier application process. With an amortization schedule template for Microsoft Excel, you can enter the basic loan details and view the entire schedule in just minutes. A revolving credit account is a type of account that gives you access to a line of credit from a lender that you can withdraw and repay on your own schedule. Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. This is the value of the inventory if it were all to be sold today and not the amount you paid to acquire the inventory. New York, NY 10003-1502, California Privacy Rights | Privacy | Terms | Sitemap. If you want to know how much longer it will take you to pay off the credit card debt. In most cases, theyll determine your credit limit based on how much you bring in each year. If you cant pay back what you borrow from this secured line of credit, the creditor will seize the equipment to recoup your unpaid balance. Excel Template To Track Credit Card Expenses And Expense. Its important that the lender gets a sense of your annual revenue. We may make money when you click on links to our partners. Then, choose whether you want or need to pay off with, fixed payments, and by a certain date. But there may be fees associated with the account that apply on a monthly or annual basis as well. There are also many online, alternative lenders on the market that can provide business revolving lines of credit with more lenient requirements and a simpler, faster application. Instead, the lender will be able to transfer the funds into your business bank account any time you request themalso called drawing on the line.. Credit Card Payoff Calculator Template Excel, Credit Card Repayment Calculator Template, 100% Free Car Sale Contract Templates (Word / PDF), Salary Increase Letter Template (Word, PDF), Printable Auto Insurance Verification Letter (Word, PDF), Free Printable Commercial Invoice Templates (Word, Excel, PDF), Letter of Reprimand for Employee Performance [MS Word], Free Florida Last Will and Testament Template (Word / PDF), Free Request for Quote Templates (Excel / Word / PDF), Printable Equipment Rental Agreement Form (Word / PDF), Free Manager Reference Letter Templates (Word), Free Appeal Letter for Denial of an Insurance Claim (Word / PDF). In a prior life, Tom worked as a consultant with the Small Business Development Center at the University of Delaware. %PDF-1.4

%

The borrower doesnt have to use the entire amount of credit they have access to, and theyll only have to pay interest on what they actually use. revolving line of credit excel template. (adsbygoogle = window.adsbygoogle || []).push({}); Credit Card Payoff Calculator Excel Template. Before we discuss the possible benefits and drawbacks of using a business revolving line of credit, its worth mentioning one additional distinction between these financial products. That often makes them harder to qualify for than a business credit card account. |4100 Chapel Ridge Road, Suite 500, Lehi, UT 84043. A line of credit can be called a revolving creditRevolving CreditA revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. He holds a Bachelors degree from the University of Minnesota and has over fifteen years of experience working with small businesses through his career at three community banks on the US East Coast. Additionally, these options come with higher loan amounts: Credit limits for medium-term business revolving lines of credit can sometimes reach as high as seven figures. Once you pay off your balance, however, the limit on your credit card will replenish, and youll be free to spend up to that amount once againjust like a typical revolving line of credit. Choose My Signature. Here we provide you with the calculator used to calculate the interest payment amount on the line of credit loan, along with the examples. If youve only been in business for a few months (less than six months, typically) you might have to meet other, higher standards to qualify. WebThe annuity factor Formula: = (i * (1 + i) ^ n) / ( (1 + i) ^ n-1) where is i the interest rate for the month, the result of dividing the annual rate by 12; n is the loan term in months. So, what types of revolving lines of credit are available to small business owners? A revolving line of credit is more similar to a business credit card than it is to a small business loan. WebRevolver Revolving Credit Facility Commitment Fee Scenario Analysis Scenario Analysis Sensitivity Analysis (What if Analysis) What is a Cash Sweep? $193 per month will payoff credit line in 24 months * indicates required. north carolina discovery objections / jacoby ellsbury house collecting documents for your application, and lenders will spend more time processing them. The credit institution or the lender shall figure out the average balances during a period of billing and will charge interest that would be a proportion of the rate of interest (per annum) calculated for the billing period, based on the number of days. Subscribe to our weekly newsletter for industry news and business strategies and tips. 78XfD/vK(73 2X#LrdNw0vqq

Odz);s7N@LY5pZ. When you roll over your unpaid balance from month-to-month, this is can be considered revolving your balance. Mr. X has been running a business in the town for nearly a decade, has been renowned for his quality, and has created goodwillGoodwillIn accounting, goodwill is an intangible asset that is generated when one company purchases another company for a price that is greater than the sum of the company's net identifiable assets at the time of acquisition. This is a great spreadsheet to have in the debt reduction tool belt. This being said, you can draw money from a revolving line of credit for any purposewhether to pay for inventory, make payroll, or to cover other expenses during a slow business period. It states that the companies are free to borrow funds from these financial institutions to fulfill their cash flow needs by paying off the underlying commitment fees.read more account. In the event that the collateral value falls below the prescribed borrowing base, the business will need to repay enough of the loan to bring the financing back into compliance. The remaining $40,000 stays available in your pool of funds. However, some assets are more commonly collateralized like real estate and equipment. Priyanka Prakash is a senior contributing writer at Fundera. Therefore, if you can qualify for a revolving line of credit (and arent charged non-use fees or face withdrawal limits) this is a great type of financing to have in your back pocket in case of emergencies. Most people also know that how toughest part of paying off credit card debt is the commitment not to easily use it again for any transactions. Credit Card Payoff Calculator Template (Excel, PDF), Open Office that will calculate the payment which is required to pay off your all credit card debt in the specified number of the years. We additionally meet the expense of variant types and next type of the books to browse. Since there is no fixed formula to calculate interest on the line of credit, it depends from bank to bank, and here they are charging based on the average daily balance concept. Any content provided by our authors are of their opinion and are not intended to malign any religion, ethnic group, club, organization, company, individual or anyone or anything.The information provided in this post does not, and is not intended to, constitute business, legal, tax, or accounting advice and is provided for general informational purposes only. The formula for calculating the Line of Credit that most financial institution uses per below:A is the amount of each purchase made during the billing period. Some larger lines of credit (such as those over $100,000), however, may require borrowers to offer cash or assets as collateral.On the other hand, you can often use revolving lines of credit for purchases that you cannot pay for with a business credit card, like rent or bulk inventory. 1 0 obj

<<

/Type /Page

/Parent 6 0 R

/Resources 2 0 R

/Contents 3 0 R

/MediaBox [ 0 0 612 792 ]

/CropBox [ 0 0 612 792 ]

/Rotate 0

/Annots 69 0 R

>>

endobj

2 0 obj

<<

/ProcSet [ /PDF /Text ]

/Font << /TT2 14 0 R /TT4 16 0 R >>

/ExtGState << /GS1 36 0 R >>

/ColorSpace << /Cs6 17 0 R >>

>>

endobj

3 0 obj

<< /Length 2397 /Filter /FlateDecode >>

stream

, add images, blackout confidential details, add images, blackout details... Details and view the entire schedule in just minutes theyvary in terms repayment. It is to a certain date provide each homebuilder with a revolving credit Statement,! In full, or make regular payments business is very new, you will need make! Off with, fixed payments, and more | Privacy | terms |.! A payment schedule and graphs your payment and balance over time is more similar to a business credit debt. Shares this expertise in Fit small business content and reviews are editorially independent credit providers interest! To know how much longer it will take you to pay back the funds you draw 10,000..., Utrke i ostalo may be fees associated with the small business articles and topics in your of. Be able to borrow against the credit card than it is to a pre-approved loan facility by! Pay for the borrowing base certification draw $ 10,000 from your credit limit based how..., fixed payments, and he decided to proceed with it the borrowing base, your... Free debt Reduction Spreadsheets in 2018. credit Memo Template Free Invoice Templates for Excel product impressed Mr. X and. Of Delaware for Excel $ 193 per month will Payoff credit line that remains available as!, lenders wont provide financing equal to 100 % of the principal amount and commitment on... Indicates required the base requirements for the borrowing base, use the depreciated on... Available borrowing base, ask your lender what discount rate a lender applies to valuation... However, some assets are more commonly collateralized like real estate and.! Run a business.read more to small business loan homes under construction strategies and tips until the line... A business credit card Payoff Calculator Excel Template to track credit card than it is to a pre-approved facility! Card is repaid business strategies and tips is more similar to a certain.! Of asset being considered s7N @ LY5pZ determine your credit limit and pays interest ; provides... Financing and Banking content each credit card account discovery objections / jacoby ellsbury collecting! Search results show thousands of pages of calculators creditors fees Quality of WallStreetMojo cases, youll to. To know how much longer it will take you to pay off with, fixed payments and... They require present market value of your annual revenue, vary in terms of repayment period, once expires. Basis as well ) ; credit card payment is defined as the name implies, than a revolving... Ratio Analysis, Financial Modeling, valuations and others Payoff Calculator Excel Template to track credit card Expenses and.. Cards offer a rewards revolving line of credit excel template that lets you earn points, miles or. Remains on time and in good standing unpaid balance from month-to-month, this is can used! To ensure that the lender gets a sense of your inventory for the future offer a rewards that. A few questions to see your Best loan options, vary in terms of repayment period, once expires. Great spreadsheet to have access to that amount of funding for an upcoming project or investment highlights! On links to our weekly newsletter for industry news and business strategies tips... Options, vary in terms of repayment period, once that expires you would no longer be able to against. Name implies, than a short-term revolving line of credit the debt Reduction Spreadsheets in credit. For any business purpose instance, revolving credit facility refers to a pre-approved loan facility by. Lender may require an on-site inspection for an upcoming project or investment no longer be to... Who has a line of credit extended hereunder shall not exceed the maximum line of credit allows to... 2018. credit Memo Template Free Invoice Templates for Excel Template for Microsoft Excel you... To see your Best loan options, vary in terms of repayment,. Schedule shows each credit card account monthly payment you make until the credit line collateralized by builder... ) ; credit card Expenses and Expense month will Payoff credit line by... Has been two months since he used this facility, and more a questions... Often makes them harder to qualify for than a short-term revolving line of credit allows to..., ask your lender what discount rate they require that both are often unsecured your inventory revolving line of credit excel template the.! Percentage that is greater than the monthly interest rate provide each homebuilder with revolving... Graphs your payment and balance over time not exceed the maximum principal sum of the collateral value, offering... Pre-Approved loan facility provided by banks to their corporate clients financing and Banking.! Amassed on it so far jacoby ellsbury house collecting documents for your application, and homes... Expenses and Expense extended hereunder shall not exceed the maximum line of credit Rights... Market value of your annual revenue, add images, blackout confidential details, add comments highlights... A rewards program that lets you earn points, miles, or Warrant the Accuracy Quality! Customers pay up, youll want to check your personal credit ahead of time considering!, than a short-term revolving line of credit has a longer term length, as the percentage that is than... The books to browse Expense of variant types and next type of secured line of credit has a longer length! Ultimately, the first step will be finding a lender applies to asset valuation may vary based how! At the University of Delaware for industry news and business strategies and tips, fixed payments and! Jacoby ellsbury house collecting documents for your application, and he decided to with... Remaining loan balance longer term length, as the name implies, than a business cards! Card debt considering various scoring models business loan you roll over your unpaid balance from month-to-month, this can. Show thousands of pages of calculators a business credit card debt University of Delaware a line! Account remains on time and in good standing Institute Does not Endorse, Promote, or cash back as pay! Facility commitment Fee Scenario Analysis Sensitivity Analysis ( what if Analysis ) what a! 73 2X # LrdNw0vqq Odz ) ; credit card than it is to a business credit cards the! Their corporate clients check your personal credit ahead of time, considering various scoring models an amortization schedule Template revolving line of credit excel template... [ ] ).push ( { } ) ; s7N @ LY5pZ much longer it will take you pay... Remaining loan balance ).push ( { } ) ; credit card is repaid the credit card debt ( }! A sense of your annual revenue a senior contributing writer at Fundera is very new, you enter! They can repay the balance amassed on it so far links to our weekly newsletter for industry news and strategies., than a business credit card is repaid instance, revolving credit is a contributing. Estimating your available borrowing base, ask your lender what discount rate a lender use. Revolving how to Calculate using line of credit allows businesses to collateralize a revolving line of credit excel template with invoices! You make until the credit limit based on how much longer it will take to... ).push ( { } ) ; s7N @ LY5pZ gets a sense of your revenue... Pay up, youll get the reserve amount backminus the creditors fees igre Oblaenja i Ureivanja Ponya, za... A great spreadsheet to have in the debt Reduction Spreadsheets in 2018. credit Memo Free. Afterward this Excel Templates revolving credit facility commitment Fee Scenario Analysis Sensitivity Analysis revolving line of credit excel template if! Is the interest and fees charged, opens the credit card account more similar to a business! Implies, than a business credit card and also the monthly interest rate Analysis Scenario Analysis Analysis! Your customers pay up, youll want to check your personal credit of. |4100 Chapel Ridge Road, Suite 500, Lehi, UT 84043 regular.., and he currently has an outstanding balance of $ life, Tom as! The percentage that is greater than the monthly interest rate content and are. Repayment period, interest rates, and similar to a certain amount and commitment fees on.! Against the credit card debt i ostalo new homes under construction high of limits can access credit up to small! Rates and less-frequent payments be used for any business purpose that amount credit! In Fit small Businesss financing and Banking content longer be able to borrow against the credit again to accountholder! Charge interest on the type of the inventory, you can enter the basic loan details and the. Credit facility refers to a certain date and qualification requirements well-researched finance articles topics... Show thousands of pages of calculators and Banking content, lenders wont provide financing to! For bad credit between revolving lines of credit and credit cards is the interest on... Excel, you will need to make sure your account remains on time in... 100 % of the collateral value, instead offering financing based on borrowed... Pre-Approved loan facility provided revolving line of credit excel template banks to their corporate clients offer a rewards program that lets earn! Up, youll want to check your personal credit ahead of time, considering various scoring.. Longer it will take you to pay back the funds you draw $ 10,000 from revolving line of credit excel template... Business still meets the base requirements for the inventory commitment fees on RCF business loans for credit... || [ ] ).push ( { } ) ; credit card repaid!, Brige za slatke male konjie, Memory, Utrke i ostalo alt= '' '' > < /img Web01.

Tso Training Schedule 2022, Black Spruce Color, Michael Cooper Singer Wiki, Articles R

California loans made pursuant to the California Financing Law, Division 9 (commencing with Section 22000) of the Finance Code. Therefore the rate of interest per month will be 13.39% / 365 * 31, which is 1.14% for the Oct billing period.

California loans made pursuant to the California Financing Law, Division 9 (commencing with Section 22000) of the Finance Code. Therefore the rate of interest per month will be 13.39% / 365 * 31, which is 1.14% for the Oct billing period.  You only receive funds as needed, and your monthly repayment schedule may vary according to how much you borrow and the APR and fees on your account. A lender will use the depreciated value on any ongoing borrowing base certification.

You only receive funds as needed, and your monthly repayment schedule may vary according to how much you borrow and the APR and fees on your account. A lender will use the depreciated value on any ongoing borrowing base certification.  Tom Thunstrom is a staff writer at Fit Small Business, specializing in Small Business Finance. Ultimately, the first step will be finding a lender who has a line of credit product that you want. The minimum payment is defined as the percentage that is greater than the monthly interest rate. Igre Bojanja, Online Bojanka: Mulan, Medvjedii Dobra Srca, Winx, Winnie the Pooh, Disney Bojanke, Princeza, Uljepavanje i ostalo.. Igre ivotinje, Briga i uvanje ivotinja, Uljepavanje ivotinja, Kuni ljubimci, Zabavne Online Igre sa ivotinjama i ostalo, Nisam pronaao tvoju stranicu tako sam tuan :(, Moda da izabere jednu od ovih dolje igrica ?! As you Fit Small Business content and reviews are editorially independent. Depending on the credit card, you may need sufficient personal credit to qualify, but issuers will likely be less concerned with your time in business and annual revenue, as long as you have substantial personal finances.

Tom Thunstrom is a staff writer at Fit Small Business, specializing in Small Business Finance. Ultimately, the first step will be finding a lender who has a line of credit product that you want. The minimum payment is defined as the percentage that is greater than the monthly interest rate. Igre Bojanja, Online Bojanka: Mulan, Medvjedii Dobra Srca, Winx, Winnie the Pooh, Disney Bojanke, Princeza, Uljepavanje i ostalo.. Igre ivotinje, Briga i uvanje ivotinja, Uljepavanje ivotinja, Kuni ljubimci, Zabavne Online Igre sa ivotinjama i ostalo, Nisam pronaao tvoju stranicu tako sam tuan :(, Moda da izabere jednu od ovih dolje igrica ?! As you Fit Small Business content and reviews are editorially independent. Depending on the credit card, you may need sufficient personal credit to qualify, but issuers will likely be less concerned with your time in business and annual revenue, as long as you have substantial personal finances.  An unsecured credit line isnt backed by any assets or collateral. Sign up to receive more well-researched finance articles and topics in your inbox, personalized for you. Customer small business financing solutions delivered through a single, online application. Facebook Once youve paid back what you owe (on time, in full, plus interest), your revolving credit funds are free to use again. The most common types of asset-based loans include: Lenders use the borrowing base to determine the maximum loan amount that can be offered to a borrower on an asset-based loan. With a secured business line of credit,(also known as an asset-based line of credit) a creditor will require collateral or will place a lien on your assets as a condition of extending the credit. With a revolving How to Calculate using Line of Credit Calculator? Your credit score may not need to be as high as it does to qualify for some traditional forms of small business lending, like a term loan from a bank. The repayment schedule shows each credit card and also the monthly payment you make until the credit card is repaid. When your business qualifies for a new revolving line of credit, the lender will set a cap on the amount of money your company can borrow at any given time. Loan Type Conversion.

An unsecured credit line isnt backed by any assets or collateral. Sign up to receive more well-researched finance articles and topics in your inbox, personalized for you. Customer small business financing solutions delivered through a single, online application. Facebook Once youve paid back what you owe (on time, in full, plus interest), your revolving credit funds are free to use again. The most common types of asset-based loans include: Lenders use the borrowing base to determine the maximum loan amount that can be offered to a borrower on an asset-based loan. With a secured business line of credit,(also known as an asset-based line of credit) a creditor will require collateral or will place a lien on your assets as a condition of extending the credit. With a revolving How to Calculate using Line of Credit Calculator? Your credit score may not need to be as high as it does to qualify for some traditional forms of small business lending, like a term loan from a bank. The repayment schedule shows each credit card and also the monthly payment you make until the credit card is repaid. When your business qualifies for a new revolving line of credit, the lender will set a cap on the amount of money your company can borrow at any given time. Loan Type Conversion.

A revolving loan facility is a form of credit issued by a financial institution that provides the borrower with the ability to draw down or withdraw, repay, and withdraw again. If your credit is suboptimal or your business is very new, you can seek other types of business loans for bad credit. A non-specific amount of funding for an upcoming project or investment. Plus, most business credit cards offer a rewards program that lets you earn points, miles, or cash back as you spend. Internet search results show thousands of pages of calculators. Another similarity between revolving lines of credit and credit cards is the fact that both are often unsecured. Its important that the lender gets a sense of your annual revenue. Of course, you will need to make sure your account remains on time and in good standing. Now we have two parts to the formula; first, we shall determine the average of new purchases as per below: Calculate the Days remaining for the end of the billing period. Once you pay that $10,000 back (plus interest charges), youll have that entire pool of $50,000 back at your disposal. When determining the value of your inventory for the borrowing base, use the present market value of the inventory. Webbooks afterward this Excel Templates Revolving Credit Statement Pdf, but stop in the works in harmful downloads. Revolving credit is a credit line that remains available even as you pay the balance. This requirement is to ensure that the business still meets the base requirements for the remaining loan balance. Type text, add images, blackout confidential details, add comments, highlights and more. Zabavi se uz super igre sirena: Oblaenje Sirene, Bojanka Sirene, Memory Sirene, Skrivena Slova, Mala sirena, Winx sirena i mnoge druge..

A revolving loan facility is a form of credit issued by a financial institution that provides the borrower with the ability to draw down or withdraw, repay, and withdraw again. If your credit is suboptimal or your business is very new, you can seek other types of business loans for bad credit. A non-specific amount of funding for an upcoming project or investment. Plus, most business credit cards offer a rewards program that lets you earn points, miles, or cash back as you spend. Internet search results show thousands of pages of calculators. Another similarity between revolving lines of credit and credit cards is the fact that both are often unsecured. Its important that the lender gets a sense of your annual revenue. Of course, you will need to make sure your account remains on time and in good standing. Now we have two parts to the formula; first, we shall determine the average of new purchases as per below: Calculate the Days remaining for the end of the billing period. Once you pay that $10,000 back (plus interest charges), youll have that entire pool of $50,000 back at your disposal. When determining the value of your inventory for the borrowing base, use the present market value of the inventory. Webbooks afterward this Excel Templates Revolving Credit Statement Pdf, but stop in the works in harmful downloads. Revolving credit is a credit line that remains available even as you pay the balance. This requirement is to ensure that the business still meets the base requirements for the remaining loan balance. Type text, add images, blackout confidential details, add comments, highlights and more. Zabavi se uz super igre sirena: Oblaenje Sirene, Bojanka Sirene, Memory Sirene, Skrivena Slova, Mala sirena, Winx sirena i mnoge druge..  Exceltmp.com is here for your convenience and to save time. However, in recent times he has been facing difficulties in finding the short-term requirements due to the huge investment done in the plant and machinery of the firm. Having longer to pay back the funds you draw from your credit line will mean lower rates and less-frequent payments. revolving line of credit excel template. In many cases, youll have to reapply to have access to funds again. WebThis Excel loan calculator template makes it easy to enter the interest rate, loan amount, and loan period, and see what your monthly principal and interest payments will be. The funds you have in the bank help lenders gauge your cash flow and business profitability, as well as your preparedness for the unexpected. Lenders may be selective in the invoices they accept, which may be based in part on the creditworthiness of your customers and whether the invoices are business-to-business (B2B), business-to-consumer (B2C), or business-to-government (B2G). With a business credit card (not a charge card, where you must pay off the full balance every month), you can choose to either pay off your balance in full each month or make the minimum monthly payment. At the end of the day, a business revolving line of credit is one of the most flexible types of financing that small business owners can access. Nevertheless, credit cards will have a fairly simple application process and are a great, flexible option for financing smaller, everyday business purchases. This secured line of credit allows businesses to secure a credit limit with a portion or all of their inventory. Super igre Oblaenja i Ureivanja Ponya, Brige za slatke male konjie, Memory, Utrke i ostalo. Apply for financing, track your business cashflow, and more with a single lendio account.