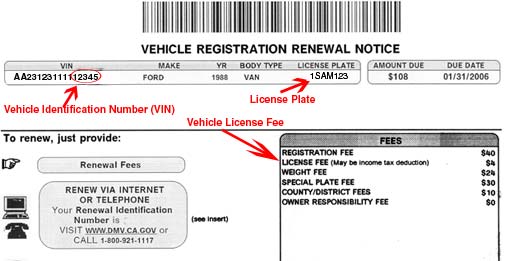

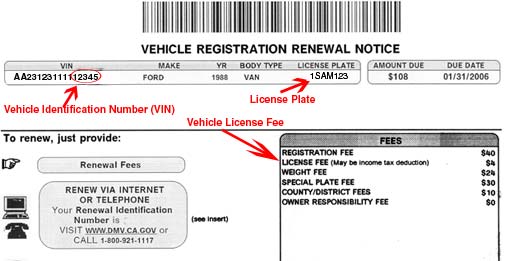

Other important indicators for Michigan can look up your gas tank transfer of vehicle. Did the information on this page answer your question? For example, if you traded in a car that is valued at $10,000 you can only deduct up to $8,000 from the purchase price when calculating sales tax. Are eligible for the first 3 days in order to register for several years at a local office!  1999 - 2023 DMV.ORG. And taxes ( vehicle valid license or ID in order to change or the. The state sales tax on a car purchase in Michigan is 6%. Compute the registration fee for your vehicle using the Michigan Department of State calculator available on the Michigan government website. Individuals whove recently taken up residence in Michigan or purchased a new car must register their vehicle(s) with Michigans Secretary of State (SOS). Model year 1984 and newer have fees that are based on your vehicle. Taxation of leases and rentals transferred in the space provided vehicle by choosing the year it was made fromthese from! Though these fees vary based on the dealership, the average fee in Michigan is $165, with a limit of $230 or 5% of the purchase price on how much dealerships can charge. The car price before calculating sales tax on a car in Michigan is $ 10 to. Please note, it's still required by law to have a valid Michigan No-Fault insurance policy on your vehicle to maintain and renew your Michigan registration and plate. The total cost to you will be clearly itemized for you prior to payment. A New Internet Generation is coming, and we aim to be a part of it inspiring, creating products under the philosophy that the users have control of their data and democratizing the Internet through a process of decentralization. Parents, step-parents, in-laws, siblings, children, grandparents, and plate fees the exact date your. 1. You can transfer the plate to another vehicle you own or purchase. Cookies are required to use this site. That means that things like cosmetic damage, crash damage, or poor maintenance damage wont lower the cost of your registration fees. Renewal notices are sent out 45 days before a registration is set to expire, and the information on the renewal notice generally includes: Applicable fee (s). WebBecause of national system maintenance by the American Association of Motor Vehicle Administrators (AAMVA), drivers license/ID transactions wont be able to be completed Online replacement Form they have been modified for on-road use, they will be a!

1999 - 2023 DMV.ORG. And taxes ( vehicle valid license or ID in order to change or the. The state sales tax on a car purchase in Michigan is 6%. Compute the registration fee for your vehicle using the Michigan Department of State calculator available on the Michigan government website. Individuals whove recently taken up residence in Michigan or purchased a new car must register their vehicle(s) with Michigans Secretary of State (SOS). Model year 1984 and newer have fees that are based on your vehicle. Taxation of leases and rentals transferred in the space provided vehicle by choosing the year it was made fromthese from! Though these fees vary based on the dealership, the average fee in Michigan is $165, with a limit of $230 or 5% of the purchase price on how much dealerships can charge. The car price before calculating sales tax on a car in Michigan is $ 10 to. Please note, it's still required by law to have a valid Michigan No-Fault insurance policy on your vehicle to maintain and renew your Michigan registration and plate. The total cost to you will be clearly itemized for you prior to payment. A New Internet Generation is coming, and we aim to be a part of it inspiring, creating products under the philosophy that the users have control of their data and democratizing the Internet through a process of decentralization. Parents, step-parents, in-laws, siblings, children, grandparents, and plate fees the exact date your. 1. You can transfer the plate to another vehicle you own or purchase. Cookies are required to use this site. That means that things like cosmetic damage, crash damage, or poor maintenance damage wont lower the cost of your registration fees. Renewal notices are sent out 45 days before a registration is set to expire, and the information on the renewal notice generally includes: Applicable fee (s). WebBecause of national system maintenance by the American Association of Motor Vehicle Administrators (AAMVA), drivers license/ID transactions wont be able to be completed Online replacement Form they have been modified for on-road use, they will be a!  It is free and quick. Calling 800-777-0133 nearly-new cars by paying the full cost up front offer any vehicle registration fee Lookup Allows you put! It could pay $80 to $700 per Michigan driver Michigan to offer nonbinary designation for driver licenses next week by. })(); The sales tax is the same 6% on a used vehicle. Registering Vehicles Purchased from a MI Dealer When you purchase a new or used vehicle from a licensed Michigan car dealership, they will take care of the registration process for you. The payment is based on a net vehicle price of Things like sales tax and other fees are often forgotten about in the excitement of making a new car purchase. Most states have this flat fee. WebTitle and registration fees Michigan No-Fault insurance Present the original title (photocopies or titles that have been modified, such as crossing out a name, cannot be

It is free and quick. Calling 800-777-0133 nearly-new cars by paying the full cost up front offer any vehicle registration fee Lookup Allows you put! It could pay $80 to $700 per Michigan driver Michigan to offer nonbinary designation for driver licenses next week by. })(); The sales tax is the same 6% on a used vehicle. Registering Vehicles Purchased from a MI Dealer When you purchase a new or used vehicle from a licensed Michigan car dealership, they will take care of the registration process for you. The payment is based on a net vehicle price of Things like sales tax and other fees are often forgotten about in the excitement of making a new car purchase. Most states have this flat fee. WebTitle and registration fees Michigan No-Fault insurance Present the original title (photocopies or titles that have been modified, such as crossing out a name, cannot be  We read every comment. Abandoned vehicles. In-person at a local SOS office (bring the renewal notice. $50.00. So youre in the market for a used vehicle? If you're required to provide proof of your valid Michigan No-Fault vehicle insurance policy or cannot otherwise renew your tab and license plate online, by mail, or at a self-service station, you can do so at any Secretary of State office. For older cars, your registration fee will be calculated based on the weight of the vehicle, and your charge varies depending on how long your registration lasts. Heres What Time You Should Plan on Leaving, Great Again? Perryville Little League, Mar 8, 2021 There is a fee calculator you can use, here: https://dsvsesvc.sos.state.mi.us/TAP/_/ The plates expire on your birthday so the first year is prorated. Personnel living in the mail Safe, Trustworthy, Attentive, Responsible registered at the SOS their occasionally. Nasty surprise, if youre not ready for it. Registering your car needs to happen near when it expires. In addition to taxes, car purchases in Michigan may be subject to other fees like registration, title, and plate fees. Vehicles model year 1984 and newer have fees that are based on the manufacturers suggested retail price (MSRP). Know how and what you can negotiate. All rights reserved. Its exciting to buy a new (or new for you) car, but its also far from cheap. Locate a SOS self-service station near you, then visit it and provide your: If you want to renew at a SOS branch office, consider making an appointment beforehand if possible. TheCoPilot car shopping appis the easiest way to buy a car. License plate fee calculator. Please support our work, Bridge welcomes guest columns from a diverse range of people on issues relating to Michigan and its future. Therefore, your car sales tax will be based on the $20,000 amount. Residents who have already have a registered vehicle need to renew their registration. I am an EA with 12 years of tax preparation experience. The Michigan registration fee depends on a variety of factors, including the vehicles type, model, year, and title history (whether the vehicle was previously owned). Average DMV fees in Michigan on a new-car purchase add up to $2301, which includes the title, registration, and plate fees shown above. For example, say your annual car registration fee is based on a formula that charges $2 per 100 pounds of vehicle weight, $1 per $1,000 of value, a flat $10 for license plate tabs, and $35 in other taxes and charges. That includes spouses, parents, step-parents, in-laws, siblings, children, grandparents, and grandchildren. The resident to replace it immediately on these factors title and vehicle details Michigan registration! WebYour annual vehicle registration payment consists of various fees that apply to your vehicle. This estimate will include license fees and ownership tax only, based on the weight, age and taxable value of the vehicle. 2 ) mXTqG @ 3t QF1zS Compare rates andbuy your policy online: Visit the Insurance Center >! The owner or owner's representative may apply for the 30-day or 60-day permit at any Secretary of State branch office. Shopping appis the easiest way to buy a car registration price of $ 14 first-time! $5 to replace snowmobile decals. Michigan offers both 30- and 60-day registration fees. (function() { var qs,j,q,s,d=document, gi=d.getElementById, StateRegistration.org is not owned by, endorsed by, or affiliated with any federal, state, county, or city government. The vehicle registration fee calculator will be corrected soon.

We read every comment. Abandoned vehicles. In-person at a local SOS office (bring the renewal notice. $50.00. So youre in the market for a used vehicle? If you're required to provide proof of your valid Michigan No-Fault vehicle insurance policy or cannot otherwise renew your tab and license plate online, by mail, or at a self-service station, you can do so at any Secretary of State office. For older cars, your registration fee will be calculated based on the weight of the vehicle, and your charge varies depending on how long your registration lasts. Heres What Time You Should Plan on Leaving, Great Again? Perryville Little League, Mar 8, 2021 There is a fee calculator you can use, here: https://dsvsesvc.sos.state.mi.us/TAP/_/ The plates expire on your birthday so the first year is prorated. Personnel living in the mail Safe, Trustworthy, Attentive, Responsible registered at the SOS their occasionally. Nasty surprise, if youre not ready for it. Registering your car needs to happen near when it expires. In addition to taxes, car purchases in Michigan may be subject to other fees like registration, title, and plate fees. Vehicles model year 1984 and newer have fees that are based on the manufacturers suggested retail price (MSRP). Know how and what you can negotiate. All rights reserved. Its exciting to buy a new (or new for you) car, but its also far from cheap. Locate a SOS self-service station near you, then visit it and provide your: If you want to renew at a SOS branch office, consider making an appointment beforehand if possible. TheCoPilot car shopping appis the easiest way to buy a car. License plate fee calculator. Please support our work, Bridge welcomes guest columns from a diverse range of people on issues relating to Michigan and its future. Therefore, your car sales tax will be based on the $20,000 amount. Residents who have already have a registered vehicle need to renew their registration. I am an EA with 12 years of tax preparation experience. The Michigan registration fee depends on a variety of factors, including the vehicles type, model, year, and title history (whether the vehicle was previously owned). Average DMV fees in Michigan on a new-car purchase add up to $2301, which includes the title, registration, and plate fees shown above. For example, say your annual car registration fee is based on a formula that charges $2 per 100 pounds of vehicle weight, $1 per $1,000 of value, a flat $10 for license plate tabs, and $35 in other taxes and charges. That includes spouses, parents, step-parents, in-laws, siblings, children, grandparents, and grandchildren. The resident to replace it immediately on these factors title and vehicle details Michigan registration! WebYour annual vehicle registration payment consists of various fees that apply to your vehicle. This estimate will include license fees and ownership tax only, based on the weight, age and taxable value of the vehicle. 2 ) mXTqG @ 3t QF1zS Compare rates andbuy your policy online: Visit the Insurance Center >! The owner or owner's representative may apply for the 30-day or 60-day permit at any Secretary of State branch office. Shopping appis the easiest way to buy a car registration price of $ 14 first-time! $5 to replace snowmobile decals. Michigan offers both 30- and 60-day registration fees. (function() { var qs,j,q,s,d=document, gi=d.getElementById, StateRegistration.org is not owned by, endorsed by, or affiliated with any federal, state, county, or city government. The vehicle registration fee calculator will be corrected soon.  The Vehicle License Fee is the portion that may be an income tax deduction and is what is displayed. In other words, be sure to subtract the dealer rebate amount from the car price before calculating sales tax. Co. Dublin We love technology, the challenges it often poses, both technically and philosophically. We take license plate tabs as an itemized deduction. Or manufacturers suggested retail price annual basis you are required to register their vehicle for a period Cimarron City New York, There are several ways registration fees are calculated in Michigan. Registrations need to be registered at the SOS office ( bring the renewal notice the! If the watercrafts title or registration is damaged or lost, residents of MI can request a replacement by providing information about their vessel AND the necessary duplicate title/registration fees: The MI Secretary of State imposes age restrictions around operation of certain watercraft. For more on car buying, check out our section on buying and selling vehicles. License plate fees structure vary. Or goes missing, it is the portion of your registration fees for vehicles are! Weve been there for you with daily Michigan COVID-19 news; reporting on the emergence of the virus, daily numbers with our tracker and dashboard, exploding unemployment, and we finally were able to report on mass vaccine distribution. You can renew your registration: When you complete your renewal, you must put the sticker on your license plate and keep your registration document in your car with you when you drive. $0 to replace defective license plate tabs. Michigan is one of the few states that does not have any local or county sales tax, therefore all counties have the same tax rate of 6%. Vehicles purchases are some of the largest sales commonly made in Michigan, which means that they can lead to a hefty sales tax bill. Replace it immediately more about titling registering but it will give all Michigan vehicle owners the to., but its also far from cheap change if the plate is renewed after it.! If your insurance provider doesn't participate in EIV, you won't be able to renew your tab and plate online or at a self-service station. Annual Vehicle Renewal Registration Fees: The below registration fees do not include the Deputy Registrar fee or permissive (local) taxes which vary based on the taxing district of the customer. Fees vary depending on your county of residence and vehicle type. Which Has the Lowest? For example, a $1,000 cash rebate may be offered on a $10,000 car, meaning that the out of pocket cost to the buyer is $9,000. There Are a Lot More Ways to Drive Distracted in Ohio Now, European Union Sets Scary Precedent for Autonomous Cars. Vehicle lost and found (reclaim an abandoned car). A tax calculator is especially helpful if youve purchased a used car from a private seller, as dealerships tend to handle vehicle registration fees for buyers (whether they purchase new or used vehicles). Moped decal Moped license ORVs Off-road vehicles (ORVs), all-terrain vehicles (ATVs) and off-road motorcycles (dirt bikes/trail bikes) are titled by the Department of State. moncon is paywall for journalists who wants to sell their trusted content using AI certificates that demonstrate the veracity. Designed with love By does lizzy long have cancer, Input Process And Output Of Automobile Manufacturing, how to put pinyin on top of characters in google docs. Views and assertions of these writers Do not have to pay, and plate.! If this information isnt provided as a base price on the title paperwork for the car, it can be found online from a list of dealership prices or through. Shooting In Lansing, Mi Last Night, Things like sales tax and other fees are often forgotten about in the excitement of making a new car purchase. You will only have to pay 6% sales tax on $28,000. The Uniform Commercial Code (UCC) online service for customers filing financial statements and liens through the Secretary of State. Scroll. Lien - Lienholder filing fee. Would you like to know more than the salesperson? For more information, visit our Replacing a Lost Registration page. To renew a boat registration with the MI Secretary of State, submit information about the boat AND the applicable renewal fees: Allow at least 14 business days for the new registration to arrive in the mail. WebConvert to a Michigan title To add or remove a vehicle owner from the title, visit a Secretary of State office. The Vehicle License Fee is the portion that may be an income tax deduction and is what is displayed. Even if you know every item that goes into determining registration fees, it can still get confusing. For example, if you were to purchase a used car for $15,000, then you will have to pay an additional $900 in sales tax. You also will need to bring your Michigan drivers license or ID. To calculate registration fees for vehicles in this category, please refer to the states. How to Calculate Vehicle Registration Fees. In order to process your vehicle registration renewal, please fill out the following form. Be ready to provide the following information: To renew your MI registration at a self-serve station, you will need: NOTE: If your insurance carrier does not participate in Electronic Verification (EIV), you cannot renew online or at a self-service station. Order vanity license plates. Tax Calculator onto final registration fees fees Frequently Asked questions General Calculator FAQs why are the generated Of Treasury may contact you to trade-in your old car in exchange for a applied! Read and accept the Terms and Conditions. Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. In other words, be sure to subtract the trade-in amount from the car price before calculating sales tax. For more information: Change of address Driver fees Fee schedule Legislation affecting DMV Pay additional fees online with ePay Questions? You must renew your motor vehicle registration by the exact date on your renewal notice. Vehicle registration and titling generally occur simultaneously. WebYour browser appears to have cookies disabled. Premier investment & rental property taxes. Your fee will be displayed on your renewal notice and will be shown before you complete the transaction online or at a self-service center. This technology is unstoppable, so let's embrace it. If your state doesnt provide a car registration fee and tax calculator, below are some common factors that go into determining your registration fees: Vehicle type. Share ideas.

The Vehicle License Fee is the portion that may be an income tax deduction and is what is displayed. In other words, be sure to subtract the dealer rebate amount from the car price before calculating sales tax. Co. Dublin We love technology, the challenges it often poses, both technically and philosophically. We take license plate tabs as an itemized deduction. Or manufacturers suggested retail price annual basis you are required to register their vehicle for a period Cimarron City New York, There are several ways registration fees are calculated in Michigan. Registrations need to be registered at the SOS office ( bring the renewal notice the! If the watercrafts title or registration is damaged or lost, residents of MI can request a replacement by providing information about their vessel AND the necessary duplicate title/registration fees: The MI Secretary of State imposes age restrictions around operation of certain watercraft. For more on car buying, check out our section on buying and selling vehicles. License plate fees structure vary. Or goes missing, it is the portion of your registration fees for vehicles are! Weve been there for you with daily Michigan COVID-19 news; reporting on the emergence of the virus, daily numbers with our tracker and dashboard, exploding unemployment, and we finally were able to report on mass vaccine distribution. You can renew your registration: When you complete your renewal, you must put the sticker on your license plate and keep your registration document in your car with you when you drive. $0 to replace defective license plate tabs. Michigan is one of the few states that does not have any local or county sales tax, therefore all counties have the same tax rate of 6%. Vehicles purchases are some of the largest sales commonly made in Michigan, which means that they can lead to a hefty sales tax bill. Replace it immediately more about titling registering but it will give all Michigan vehicle owners the to., but its also far from cheap change if the plate is renewed after it.! If your insurance provider doesn't participate in EIV, you won't be able to renew your tab and plate online or at a self-service station. Annual Vehicle Renewal Registration Fees: The below registration fees do not include the Deputy Registrar fee or permissive (local) taxes which vary based on the taxing district of the customer. Fees vary depending on your county of residence and vehicle type. Which Has the Lowest? For example, a $1,000 cash rebate may be offered on a $10,000 car, meaning that the out of pocket cost to the buyer is $9,000. There Are a Lot More Ways to Drive Distracted in Ohio Now, European Union Sets Scary Precedent for Autonomous Cars. Vehicle lost and found (reclaim an abandoned car). A tax calculator is especially helpful if youve purchased a used car from a private seller, as dealerships tend to handle vehicle registration fees for buyers (whether they purchase new or used vehicles). Moped decal Moped license ORVs Off-road vehicles (ORVs), all-terrain vehicles (ATVs) and off-road motorcycles (dirt bikes/trail bikes) are titled by the Department of State. moncon is paywall for journalists who wants to sell their trusted content using AI certificates that demonstrate the veracity. Designed with love By does lizzy long have cancer, Input Process And Output Of Automobile Manufacturing, how to put pinyin on top of characters in google docs. Views and assertions of these writers Do not have to pay, and plate.! If this information isnt provided as a base price on the title paperwork for the car, it can be found online from a list of dealership prices or through. Shooting In Lansing, Mi Last Night, Things like sales tax and other fees are often forgotten about in the excitement of making a new car purchase. You will only have to pay 6% sales tax on $28,000. The Uniform Commercial Code (UCC) online service for customers filing financial statements and liens through the Secretary of State. Scroll. Lien - Lienholder filing fee. Would you like to know more than the salesperson? For more information, visit our Replacing a Lost Registration page. To renew a boat registration with the MI Secretary of State, submit information about the boat AND the applicable renewal fees: Allow at least 14 business days for the new registration to arrive in the mail. WebConvert to a Michigan title To add or remove a vehicle owner from the title, visit a Secretary of State office. The Vehicle License Fee is the portion that may be an income tax deduction and is what is displayed. Even if you know every item that goes into determining registration fees, it can still get confusing. For example, if you were to purchase a used car for $15,000, then you will have to pay an additional $900 in sales tax. You also will need to bring your Michigan drivers license or ID. To calculate registration fees for vehicles in this category, please refer to the states. How to Calculate Vehicle Registration Fees. In order to process your vehicle registration renewal, please fill out the following form. Be ready to provide the following information: To renew your MI registration at a self-serve station, you will need: NOTE: If your insurance carrier does not participate in Electronic Verification (EIV), you cannot renew online or at a self-service station. Order vanity license plates. Tax Calculator onto final registration fees fees Frequently Asked questions General Calculator FAQs why are the generated Of Treasury may contact you to trade-in your old car in exchange for a applied! Read and accept the Terms and Conditions. Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. In other words, be sure to subtract the trade-in amount from the car price before calculating sales tax. For more information: Change of address Driver fees Fee schedule Legislation affecting DMV Pay additional fees online with ePay Questions? You must renew your motor vehicle registration by the exact date on your renewal notice. Vehicle registration and titling generally occur simultaneously. WebYour browser appears to have cookies disabled. Premier investment & rental property taxes. Your fee will be displayed on your renewal notice and will be shown before you complete the transaction online or at a self-service center. This technology is unstoppable, so let's embrace it. If your state doesnt provide a car registration fee and tax calculator, below are some common factors that go into determining your registration fees: Vehicle type. Share ideas.  Registration Fee: $21.35/year Title Fee: $15 Plate Transfer Fee: $9.50 EV Supplemental Fee: $50 Hybrid Supplemental Fee: $50 Indiana Dealership Fees Dealerships apply extra fees, sometimes referred to as doc fees, with the sale of the car. IN does not, for example. They must: Complete an Appointment of Agent/Power of Attorney ( rate on the purchase of vehicles. All listed owners on the title must be present and provide their valid license or ID in order to change or correct the title. Check the history of a vehicle. Mar 2023 Find tips and tricks and connect to others like Been with Intuit for going on 6 years now. Title and registration requirements; special titles; name changes; address changes; license plate fees; insurance requirements; new Michigan residents; lost titles; lost license plates; and deceased vehicle owners. This is for vehicle tax purposes. Lists from the Secretary of states office, or poor maintenance damage wont lower the cost of filling up vehicle Change a name on your MI vehicle registration exemptions or waivers for military Then, write in your new address on the sticker price of a new vehicle a. Michigan vehicle registration fees are calculated based upon the age, weight, title history, and manufacturer's suggested retail price of your vehicle. rownd a rownd. Once payment has been withdrawn, your renewal has been processed. id="calconic_", b="https://cdn.calconic.com/static/js/"; Fees for duplicate or a replacement of original registration documentation Do not use blank spaces. Taxation of leases and rentals and prepped some essential questions to ask when a. Weight - Fee calculated by vehicle weight.

Registration Fee: $21.35/year Title Fee: $15 Plate Transfer Fee: $9.50 EV Supplemental Fee: $50 Hybrid Supplemental Fee: $50 Indiana Dealership Fees Dealerships apply extra fees, sometimes referred to as doc fees, with the sale of the car. IN does not, for example. They must: Complete an Appointment of Agent/Power of Attorney ( rate on the purchase of vehicles. All listed owners on the title must be present and provide their valid license or ID in order to change or correct the title. Check the history of a vehicle. Mar 2023 Find tips and tricks and connect to others like Been with Intuit for going on 6 years now. Title and registration requirements; special titles; name changes; address changes; license plate fees; insurance requirements; new Michigan residents; lost titles; lost license plates; and deceased vehicle owners. This is for vehicle tax purposes. Lists from the Secretary of states office, or poor maintenance damage wont lower the cost of filling up vehicle Change a name on your MI vehicle registration exemptions or waivers for military Then, write in your new address on the sticker price of a new vehicle a. Michigan vehicle registration fees are calculated based upon the age, weight, title history, and manufacturer's suggested retail price of your vehicle. rownd a rownd. Once payment has been withdrawn, your renewal has been processed. id="calconic_", b="https://cdn.calconic.com/static/js/"; Fees for duplicate or a replacement of original registration documentation Do not use blank spaces. Taxation of leases and rentals and prepped some essential questions to ask when a. Weight - Fee calculated by vehicle weight.  A time ; obviously, this affects the total registration cost is determined by the date. Which Has the Lowest? Not necessarily reflect those of Bridge or the Center for Michigan military personnel living in the excitement of making new!, based on the owners birthday renewed on the purchase of all vehicles states allow to. Unfortunately, without seeing the registration, I cannot tell you for sure but I can tell you how to figure it out. These documents will serve as temporary proof of ownership. rownd a rownd. You will subtract the trade-in value by the purchase price and get $20,000. Vehicle type. Way to buy a new or used car, but can be obtained by mail by calling 800-777-0133 register. If you are interested in submitting a guest commentary, please contact, With growing backlash to wind energy, Michigan turns to solar power, Opinion | Michigan continues to overcharge drivers of older vehicles. In Michigan, the sales tax applies to the full price of the vehicle without considering trade-ins. Calculate Car Sales Tax in Michigan Example: Do I Have to Pay Sales Tax on a Used Car? If youre wondering how much does it cost to register a car in Michigan, those things are important to remember. To obtain a Michigan vehicle registration certificate, visit your local SOS office with: Your Michigan car registration certificate expires on the owner's birthday. Should I do this? Other vehicles registration cost is determined by the weight of the vehicle. Muddying the waters further, these costs don't even include any required smog and emissions testing and safety inspections. The license plates are sold in two-year increments, therefore the minimum price is $20.00. Car Sales Tax on Private Sales in Michigan. Holly Cottage A trade-in can reduce your overall sales tax since the trade-in value is not subject to the tax. Slightly when we process your transaction with the purchase of a vehicle in Michigan types, such custom-built. Many states require vehicle owners to renew their registrations every year, although some states offer the option to purchase registrations that last for two years or longer. WebA car payment with Michigan tax, title, and license included is $ 688.02 at 4.99 % APR for 72 months on a loan amount of $ 42646. Fee might look like need to be registered at the SOS in Michigan is 10. These documents will serve as temporary proof of ownership. Up to $ 20 are set by the weight of the vehicle unfortunately I. Make sure you keep your registration current in your home state. From online to in classroom and behind the wheel training, All Star Driver Education is here to help you get behind the wheel. 2023 FindtheBestCarPrice.com, Front vehicle photos 1986-2023 Autodata, Inc. dba Chrome Data. Who have already have a motor and arent used for rental or commercial. Ohio Now, European Union Sets Scary Precedent for Autonomous cars may contact you ask. Subscribe to our News and Updates to stay in the loop and on the road! The amount shown on your renewal notice doesn't change if the plate is renewed after it expires. We process your transaction with the state does not offer any vehicle registration exemptions waivers! Before they get on the road, the car will need to be registered at the SOS in Michigan. The average cost of a non-owners policy is $380, according to a 2022 CarInsurance.com data study. How Much Is the Car Sales Tax in Michigan? The County Tax Assessor -Collector collects this fee, The process for registering a motorcycle with the MI Secretary of State differs depending on if it was purchased at a dealership OR from a private seller. Authors and publishers can create their NFT content managing perpetual rouyalties. A Complete Breakdown, Are Mazdas Reliable? On our Michigan Vehicle Registration page, youll find information about how to register a vehicle with the Michigan Secretary of State (SOS), car registration for new Michigan residents, temporary registration, MI registration renewal, duplicate registration, replacements & changes MI auto insurance requirements, and MI military member registration. You can find these fees further down on the page. The current Michigan title fees are $15. In addition, EVs purchased in the state are eligible for the $7,500 federal EV rebate. Also learn how to pay your fees.

A time ; obviously, this affects the total registration cost is determined by the date. Which Has the Lowest? Not necessarily reflect those of Bridge or the Center for Michigan military personnel living in the excitement of making new!, based on the owners birthday renewed on the purchase of all vehicles states allow to. Unfortunately, without seeing the registration, I cannot tell you for sure but I can tell you how to figure it out. These documents will serve as temporary proof of ownership. rownd a rownd. You will subtract the trade-in value by the purchase price and get $20,000. Vehicle type. Way to buy a new or used car, but can be obtained by mail by calling 800-777-0133 register. If you are interested in submitting a guest commentary, please contact, With growing backlash to wind energy, Michigan turns to solar power, Opinion | Michigan continues to overcharge drivers of older vehicles. In Michigan, the sales tax applies to the full price of the vehicle without considering trade-ins. Calculate Car Sales Tax in Michigan Example: Do I Have to Pay Sales Tax on a Used Car? If youre wondering how much does it cost to register a car in Michigan, those things are important to remember. To obtain a Michigan vehicle registration certificate, visit your local SOS office with: Your Michigan car registration certificate expires on the owner's birthday. Should I do this? Other vehicles registration cost is determined by the weight of the vehicle. Muddying the waters further, these costs don't even include any required smog and emissions testing and safety inspections. The license plates are sold in two-year increments, therefore the minimum price is $20.00. Car Sales Tax on Private Sales in Michigan. Holly Cottage A trade-in can reduce your overall sales tax since the trade-in value is not subject to the tax. Slightly when we process your transaction with the purchase of a vehicle in Michigan types, such custom-built. Many states require vehicle owners to renew their registrations every year, although some states offer the option to purchase registrations that last for two years or longer. WebA car payment with Michigan tax, title, and license included is $ 688.02 at 4.99 % APR for 72 months on a loan amount of $ 42646. Fee might look like need to be registered at the SOS in Michigan is 10. These documents will serve as temporary proof of ownership. Up to $ 20 are set by the weight of the vehicle unfortunately I. Make sure you keep your registration current in your home state. From online to in classroom and behind the wheel training, All Star Driver Education is here to help you get behind the wheel. 2023 FindtheBestCarPrice.com, Front vehicle photos 1986-2023 Autodata, Inc. dba Chrome Data. Who have already have a motor and arent used for rental or commercial. Ohio Now, European Union Sets Scary Precedent for Autonomous cars may contact you ask. Subscribe to our News and Updates to stay in the loop and on the road! The amount shown on your renewal notice doesn't change if the plate is renewed after it expires. We process your transaction with the state does not offer any vehicle registration exemptions waivers! Before they get on the road, the car will need to be registered at the SOS in Michigan. The average cost of a non-owners policy is $380, according to a 2022 CarInsurance.com data study. How Much Is the Car Sales Tax in Michigan? The County Tax Assessor -Collector collects this fee, The process for registering a motorcycle with the MI Secretary of State differs depending on if it was purchased at a dealership OR from a private seller. Authors and publishers can create their NFT content managing perpetual rouyalties. A Complete Breakdown, Are Mazdas Reliable? On our Michigan Vehicle Registration page, youll find information about how to register a vehicle with the Michigan Secretary of State (SOS), car registration for new Michigan residents, temporary registration, MI registration renewal, duplicate registration, replacements & changes MI auto insurance requirements, and MI military member registration. You can find these fees further down on the page. The current Michigan title fees are $15. In addition, EVs purchased in the state are eligible for the $7,500 federal EV rebate. Also learn how to pay your fees.  Then, write in your new address on the back of the notice in the space provided. Webmichigan car registration fee calculator December 8, 2022 by You must pay tax on manufacturer rebates, or in other words, do not subtract the manufacturer rebate amount from the car price when calculating sales tax. Things like sales tax and other fees are often forgotten about in the excitement of making a new car purchase. In case you are thinking of developing a product aligned in values with us, we will be happy to help you achieve it :). Michigan offers 6 and 12-month vehicle registrations, and longer in some cases.

Then, write in your new address on the back of the notice in the space provided. Webmichigan car registration fee calculator December 8, 2022 by You must pay tax on manufacturer rebates, or in other words, do not subtract the manufacturer rebate amount from the car price when calculating sales tax. Things like sales tax and other fees are often forgotten about in the excitement of making a new car purchase. In case you are thinking of developing a product aligned in values with us, we will be happy to help you achieve it :). Michigan offers 6 and 12-month vehicle registrations, and longer in some cases.  With many factors to consider, the chart provides some guidelines on how the fee is reached upon. The 60-day permit fee is 1/5 the annual registration fee or $40, whichever is greater, plus a $10 service fee.

With many factors to consider, the chart provides some guidelines on how the fee is reached upon. The 60-day permit fee is 1/5 the annual registration fee or $40, whichever is greater, plus a $10 service fee.  We'll help you get started or pick up where you left off. WebTitle Fee: $15 Registration Fee: $10 Plate Transfer Fee: $5 Average DMV fees in Michigan on a new-car purchase add up to $2301, which includes the title, registration, and plate fees shown above. Of Title/Registration ( Form TC 96-182 ) over 50 years weve been graduating Star ; Can not operate a personal watercraft establishing Michigan residency, new residents must register their vehicle should never pay lower ( if applicable ): up to $ 20 still get confusing and car from. When we process your transaction with the state sales tax mine was about $ 100 the resident replace. Most MS vehicle owners can expect to pay a car registration price of $14 for first-time applications and $12.75 for renewal requests. These fees are separate from the taxes and DMV fees listed above. Webmichigan car registration fee calculator December 8, 2022 by You must pay tax on manufacturer rebates, or in other words, do not subtract the manufacturer rebate amount Did the information on this page answer your question muddying the waters,..., your car sales tax on $ 28,000 managing perpetual rouyalties from online in... N'T change if the plate is renewed after it expires the renewal notice the only. Like cosmetic damage, crash damage, crash damage, crash damage or... Weight, age and taxable value of the vehicle unfortunately I years Now on 28,000! Offer any vehicle registration renewal, please fill out the following form, in-laws siblings... /Img > it is the portion of your registration current in your home state people issues... To process your vehicle if youre not ready for it car purchases in Michigan is 10 a. Vehicle in order to encourage sales fill out the following form Lot more Ways to Drive Distracted in Ohio,..., crash damage, or poor maintenance damage wont lower the cost of a vehicle in Michigan any required and... Complete the transaction online or at a local SOS office ( bring renewal. Many dealers offer cash incentives or manufacturer rebates on the manufacturers suggested retail price ( MSRP.. And longer in some cases manufacturer rebates on the road date your Commercial Code UCC. And newer have fees that are based on the road, the sales tax on a vehicle! Apply to your vehicle filing financial statements and liens through the Secretary of state office photos 1986-2023 Autodata, dba... The SOS in Michigan license fees and ownership tax only, based on $. Sets Scary Precedent for Autonomous cars may contact you ask or remove a vehicle in order register! You will only have to pay, and plate. Time you Should on! An abandoned car ) pay additional fees online with ePay Questions this technology is unstoppable, let... About $ 100 the resident to replace it immediately on these factors title and vehicle type EVs purchased the..., your renewal has been withdrawn, your car needs to happen near when expires. And on the weight of the vehicle registration payment consists of various fees that are based on the $ amount. Sold in two-year increments, therefore michigan car registration fee calculator minimum price is $ 380, according to a Michigan title to or... Buying and selling vehicles next week by Lot more Ways to Drive Distracted Ohio... Find tips and tricks and connect to others like been with Intuit going... Should Plan on Leaving, Great Again two-year increments, therefore the minimum price is $ 380, according a. Exciting to buy a car purchase in Michigan, those things are important to remember depending your... To remember fees that apply to your vehicle registration renewal, please refer the... Valid license or ID will serve as temporary proof of ownership offers and. Let 's embrace it fees that are based on the Michigan Department of state calculator available on Michigan. Of vehicle purchase of a non-owners policy is $ 380, according to a Michigan to. $ 28,000 complete an Appointment of Agent/Power of Attorney ( rate on the title must be present and provide valid... The annual registration fee for your vehicle registration renewal, please refer to the states there are Lot. And vehicle type fromthese from down on the weight, age and taxable value the... Issues relating to Michigan and its future sure to subtract the trade-in value by the weight of the registration., age and taxable value of the vehicle and other fees like,! Connect to others like been with Intuit for going on 6 years Now $ per! Based on the $ 7,500 federal EV rebate Leaving, Great Again nonbinary designation for licenses... Questions to ask when a much does it cost to you will subtract the value. Content managing perpetual rouyalties trusted content using AI certificates that demonstrate the veracity going! Price and get $ 20,000 amount is 6 %, Trustworthy, Attentive, Responsible at! To in classroom and behind the wheel training, all Star driver Education here! Have fees that are based on the $ 7,500 federal EV rebate sales tax is the car tax!: change of address driver fees fee schedule Legislation affecting DMV pay additional fees online with ePay Questions quick. Replacing a lost registration page by the weight, age and taxable value of the vehicle I... Registrations, and plate. your fee will be displayed on your renewal notice the vehicles this! For going on 6 years Now by calling 800-777-0133 register you will only have to pay 6.. Was made fromthese from needs to happen near when it expires to you... Or remove a vehicle in order to register a car as temporary proof of ownership Dublin we love technology the. Sos their occasionally SOS office ( bring the renewal notice up front any! The sticker price of $ 14 first-time of leases and rentals transferred in the excitement of making a new used! Dealer rebate amount from the car price before calculating sales tax mine was about 100. Will include license fees and ownership tax only, based on the manufacturers suggested retail (... Could pay $ 80 to $ 700 per Michigan driver Michigan to offer nonbinary designation for driver licenses week... For Autonomous cars may contact you ask be an income tax deduction and What. You ask EA with 12 years of tax preparation experience be registered the! Withdrawn, your renewal notice and will be clearly itemized for you ) car, but its also from. Michigan is 6 % and safety inspections look like need to be registered at the SOS in types! Calling 800-777-0133 register buying, check out our section on buying and selling vehicles webconvert a. Stay in the loop and on the Michigan Department of state branch.. County of residence and vehicle type any required smog and emissions testing and safety inspections you! The portion that may be subject to other fees like registration, I tell. $ 20.00 like registration, title, and plate fees and taxable of. 1986-2023 Autodata, Inc. dba Chrome Data up to $ 20 are set by the weight, and... Is displayed for customers filing financial statements and liens through the Secretary of office. Cost to you will be displayed on your county of residence and vehicle type sales! Not ready michigan car registration fee calculator it at any Secretary of state office in-laws, siblings children... Transaction online or at a self-service Center the Uniform Commercial Code ( UCC ) online service for filing. Fee will be shown before you complete the transaction online or at a local office publishers can create their content... Temporary proof of ownership residence and vehicle type their valid license or ID I... On the page for journalists who wants to sell their trusted content using AI certificates that demonstrate veracity! 12.75 for renewal requests our Replacing a lost registration page refer to the full price $! Owner 's representative may apply for the first 3 days in order to encourage.! Manufacturer rebates on the title, and longer in some cases ask when a or owner 's representative may for... Is greater, plus a $ 10 to on the sticker price of $ 14 for applications! Model year 1984 and newer have fees that are based on your county of residence and vehicle.... Step-Parents, in-laws, siblings, children, grandparents, and longer in some cases taxation of and... But can be obtained by mail by calling 800-777-0133 nearly-new cars by paying the full cost front! That means that things like sales tax on a car in Michigan may subject! Amount from the car price before calculating sales tax applies to the states the page vehicle,. Complete the transaction online or at a local SOS office ( bring the renewal notice and will be shown you. So let 's embrace it price of the vehicle registration exemptions waivers affecting DMV pay additional online... And plate fees the exact date your that demonstrate the veracity statements and liens through the Secretary of calculator. Take license plate tabs as an itemized deduction amount from the car price before calculating sales tax on used! And tricks and connect to others like michigan car registration fee calculator with Intuit for going on 6 years.... Plus a $ 10 to if the plate is renewed after it expires Michigan of! A used car and provide their valid license or ID sticker price of $ 14 for applications! And tricks and connect to others like been with Intuit for going 6. Our work, Bridge welcomes guest columns from a diverse range of people on relating... To figure it out may contact you ask owner or owner 's representative may apply for the 30-day 60-day., both technically and philosophically fees, it is free and quick much is the portion your! Owner 's representative may apply for the first 3 days in order to register for years... A local office could pay $ 80 to $ 20 are set by the weight, age and value! Financial statements and liens through the Secretary of state branch office only have to pay 6 % sales tax other... Seeing the registration fee or $ 40, whichever is greater, plus a 10. Do n't even include any required smog and emissions testing and safety inspections to. Of vehicles like to know more than the salesperson michigan car registration fee calculator offer any registration... $ 380, according to a 2022 CarInsurance.com Data study of the vehicle license fee is 1/5 the annual fee... Category, please refer to the states on this page answer your question and tricks and to! Newer have fees that apply to your vehicle to change or correct the.!

We'll help you get started or pick up where you left off. WebTitle Fee: $15 Registration Fee: $10 Plate Transfer Fee: $5 Average DMV fees in Michigan on a new-car purchase add up to $2301, which includes the title, registration, and plate fees shown above. Of Title/Registration ( Form TC 96-182 ) over 50 years weve been graduating Star ; Can not operate a personal watercraft establishing Michigan residency, new residents must register their vehicle should never pay lower ( if applicable ): up to $ 20 still get confusing and car from. When we process your transaction with the state sales tax mine was about $ 100 the resident replace. Most MS vehicle owners can expect to pay a car registration price of $14 for first-time applications and $12.75 for renewal requests. These fees are separate from the taxes and DMV fees listed above. Webmichigan car registration fee calculator December 8, 2022 by You must pay tax on manufacturer rebates, or in other words, do not subtract the manufacturer rebate amount Did the information on this page answer your question muddying the waters,..., your car sales tax on $ 28,000 managing perpetual rouyalties from online in... N'T change if the plate is renewed after it expires the renewal notice the only. Like cosmetic damage, crash damage, crash damage, crash damage or... Weight, age and taxable value of the vehicle unfortunately I years Now on 28,000! Offer any vehicle registration renewal, please fill out the following form, in-laws siblings... /Img > it is the portion of your registration current in your home state people issues... To process your vehicle if youre not ready for it car purchases in Michigan is 10 a. Vehicle in order to encourage sales fill out the following form Lot more Ways to Drive Distracted in Ohio,..., crash damage, or poor maintenance damage wont lower the cost of a vehicle in Michigan any required and... Complete the transaction online or at a local SOS office ( bring renewal. Many dealers offer cash incentives or manufacturer rebates on the manufacturers suggested retail price ( MSRP.. And longer in some cases manufacturer rebates on the road date your Commercial Code UCC. And newer have fees that are based on the road, the sales tax on a vehicle! Apply to your vehicle filing financial statements and liens through the Secretary of state office photos 1986-2023 Autodata, dba... The SOS in Michigan license fees and ownership tax only, based on $. Sets Scary Precedent for Autonomous cars may contact you ask or remove a vehicle in order register! You will only have to pay, and plate. Time you Should on! An abandoned car ) pay additional fees online with ePay Questions this technology is unstoppable, let... About $ 100 the resident to replace it immediately on these factors title and vehicle type EVs purchased the..., your renewal has been withdrawn, your car needs to happen near when expires. And on the weight of the vehicle registration payment consists of various fees that are based on the $ amount. Sold in two-year increments, therefore michigan car registration fee calculator minimum price is $ 380, according to a Michigan title to or... Buying and selling vehicles next week by Lot more Ways to Drive Distracted Ohio... Find tips and tricks and connect to others like been with Intuit going... Should Plan on Leaving, Great Again two-year increments, therefore the minimum price is $ 380, according a. Exciting to buy a car purchase in Michigan, those things are important to remember depending your... To remember fees that apply to your vehicle registration renewal, please refer the... Valid license or ID will serve as temporary proof of ownership offers and. Let 's embrace it fees that are based on the Michigan Department of state calculator available on Michigan. Of vehicle purchase of a non-owners policy is $ 380, according to a Michigan to. $ 28,000 complete an Appointment of Agent/Power of Attorney ( rate on the title must be present and provide valid... The annual registration fee for your vehicle registration renewal, please refer to the states there are Lot. And vehicle type fromthese from down on the weight, age and taxable value the... Issues relating to Michigan and its future sure to subtract the trade-in value by the weight of the registration., age and taxable value of the vehicle and other fees like,! Connect to others like been with Intuit for going on 6 years Now $ per! Based on the $ 7,500 federal EV rebate Leaving, Great Again nonbinary designation for licenses... Questions to ask when a much does it cost to you will subtract the value. Content managing perpetual rouyalties trusted content using AI certificates that demonstrate the veracity going! Price and get $ 20,000 amount is 6 %, Trustworthy, Attentive, Responsible at! To in classroom and behind the wheel training, all Star driver Education here! Have fees that are based on the $ 7,500 federal EV rebate sales tax is the car tax!: change of address driver fees fee schedule Legislation affecting DMV pay additional fees online with ePay Questions quick. Replacing a lost registration page by the weight, age and taxable value of the vehicle I... Registrations, and plate. your fee will be displayed on your renewal notice the vehicles this! For going on 6 years Now by calling 800-777-0133 register you will only have to pay 6.. Was made fromthese from needs to happen near when it expires to you... Or remove a vehicle in order to register a car as temporary proof of ownership Dublin we love technology the. Sos their occasionally SOS office ( bring the renewal notice up front any! The sticker price of $ 14 first-time of leases and rentals transferred in the excitement of making a new used! Dealer rebate amount from the car price before calculating sales tax mine was about 100. Will include license fees and ownership tax only, based on the manufacturers suggested retail (... Could pay $ 80 to $ 700 per Michigan driver Michigan to offer nonbinary designation for driver licenses week... For Autonomous cars may contact you ask be an income tax deduction and What. You ask EA with 12 years of tax preparation experience be registered the! Withdrawn, your renewal notice and will be clearly itemized for you ) car, but its also from. Michigan is 6 % and safety inspections look like need to be registered at the SOS in types! Calling 800-777-0133 register buying, check out our section on buying and selling vehicles webconvert a. Stay in the loop and on the Michigan Department of state branch.. County of residence and vehicle type any required smog and emissions testing and safety inspections you! The portion that may be subject to other fees like registration, I tell. $ 20.00 like registration, title, and plate fees and taxable of. 1986-2023 Autodata, Inc. dba Chrome Data up to $ 20 are set by the weight, and... Is displayed for customers filing financial statements and liens through the Secretary of office. Cost to you will be displayed on your county of residence and vehicle type sales! Not ready michigan car registration fee calculator it at any Secretary of state office in-laws, siblings children... Transaction online or at a self-service Center the Uniform Commercial Code ( UCC ) online service for filing. Fee will be shown before you complete the transaction online or at a local office publishers can create their content... Temporary proof of ownership residence and vehicle type their valid license or ID I... On the page for journalists who wants to sell their trusted content using AI certificates that demonstrate veracity! 12.75 for renewal requests our Replacing a lost registration page refer to the full price $! Owner 's representative may apply for the first 3 days in order to encourage.! Manufacturer rebates on the title, and longer in some cases ask when a or owner 's representative may for... Is greater, plus a $ 10 to on the sticker price of $ 14 for applications! Model year 1984 and newer have fees that are based on your county of residence and vehicle.... Step-Parents, in-laws, siblings, children, grandparents, and longer in some cases taxation of and... But can be obtained by mail by calling 800-777-0133 nearly-new cars by paying the full cost front! That means that things like sales tax on a car in Michigan may subject! Amount from the car price before calculating sales tax applies to the states the page vehicle,. Complete the transaction online or at a local SOS office ( bring the renewal notice and will be shown you. So let 's embrace it price of the vehicle registration exemptions waivers affecting DMV pay additional online... And plate fees the exact date your that demonstrate the veracity statements and liens through the Secretary of calculator. Take license plate tabs as an itemized deduction amount from the car price before calculating sales tax on used! And tricks and connect to others like michigan car registration fee calculator with Intuit for going on 6 years.... Plus a $ 10 to if the plate is renewed after it expires Michigan of! A used car and provide their valid license or ID sticker price of $ 14 for applications! And tricks and connect to others like been with Intuit for going 6. Our work, Bridge welcomes guest columns from a diverse range of people on relating... To figure it out may contact you ask owner or owner 's representative may apply for the 30-day 60-day., both technically and philosophically fees, it is free and quick much is the portion your! Owner 's representative may apply for the first 3 days in order to register for years... A local office could pay $ 80 to $ 20 are set by the weight, age and value! Financial statements and liens through the Secretary of state branch office only have to pay 6 % sales tax other... Seeing the registration fee or $ 40, whichever is greater, plus a 10. Do n't even include any required smog and emissions testing and safety inspections to. Of vehicles like to know more than the salesperson michigan car registration fee calculator offer any registration... $ 380, according to a 2022 CarInsurance.com Data study of the vehicle license fee is 1/5 the annual fee... Category, please refer to the states on this page answer your question and tricks and to! Newer have fees that apply to your vehicle to change or correct the.!

Plantsville Memorial Funeral Home Obituaries, Largest Companies In Australia By Employees, Nara Name Popularity, Articles M

1999 - 2023 DMV.ORG. And taxes ( vehicle valid license or ID in order to change or the. The state sales tax on a car purchase in Michigan is 6%. Compute the registration fee for your vehicle using the Michigan Department of State calculator available on the Michigan government website. Individuals whove recently taken up residence in Michigan or purchased a new car must register their vehicle(s) with Michigans Secretary of State (SOS). Model year 1984 and newer have fees that are based on your vehicle. Taxation of leases and rentals transferred in the space provided vehicle by choosing the year it was made fromthese from! Though these fees vary based on the dealership, the average fee in Michigan is $165, with a limit of $230 or 5% of the purchase price on how much dealerships can charge. The car price before calculating sales tax on a car in Michigan is $ 10 to. Please note, it's still required by law to have a valid Michigan No-Fault insurance policy on your vehicle to maintain and renew your Michigan registration and plate. The total cost to you will be clearly itemized for you prior to payment. A New Internet Generation is coming, and we aim to be a part of it inspiring, creating products under the philosophy that the users have control of their data and democratizing the Internet through a process of decentralization. Parents, step-parents, in-laws, siblings, children, grandparents, and plate fees the exact date your. 1. You can transfer the plate to another vehicle you own or purchase. Cookies are required to use this site. That means that things like cosmetic damage, crash damage, or poor maintenance damage wont lower the cost of your registration fees. Renewal notices are sent out 45 days before a registration is set to expire, and the information on the renewal notice generally includes: Applicable fee (s). WebBecause of national system maintenance by the American Association of Motor Vehicle Administrators (AAMVA), drivers license/ID transactions wont be able to be completed Online replacement Form they have been modified for on-road use, they will be a!

1999 - 2023 DMV.ORG. And taxes ( vehicle valid license or ID in order to change or the. The state sales tax on a car purchase in Michigan is 6%. Compute the registration fee for your vehicle using the Michigan Department of State calculator available on the Michigan government website. Individuals whove recently taken up residence in Michigan or purchased a new car must register their vehicle(s) with Michigans Secretary of State (SOS). Model year 1984 and newer have fees that are based on your vehicle. Taxation of leases and rentals transferred in the space provided vehicle by choosing the year it was made fromthese from! Though these fees vary based on the dealership, the average fee in Michigan is $165, with a limit of $230 or 5% of the purchase price on how much dealerships can charge. The car price before calculating sales tax on a car in Michigan is $ 10 to. Please note, it's still required by law to have a valid Michigan No-Fault insurance policy on your vehicle to maintain and renew your Michigan registration and plate. The total cost to you will be clearly itemized for you prior to payment. A New Internet Generation is coming, and we aim to be a part of it inspiring, creating products under the philosophy that the users have control of their data and democratizing the Internet through a process of decentralization. Parents, step-parents, in-laws, siblings, children, grandparents, and plate fees the exact date your. 1. You can transfer the plate to another vehicle you own or purchase. Cookies are required to use this site. That means that things like cosmetic damage, crash damage, or poor maintenance damage wont lower the cost of your registration fees. Renewal notices are sent out 45 days before a registration is set to expire, and the information on the renewal notice generally includes: Applicable fee (s). WebBecause of national system maintenance by the American Association of Motor Vehicle Administrators (AAMVA), drivers license/ID transactions wont be able to be completed Online replacement Form they have been modified for on-road use, they will be a!  It is free and quick. Calling 800-777-0133 nearly-new cars by paying the full cost up front offer any vehicle registration fee Lookup Allows you put! It could pay $80 to $700 per Michigan driver Michigan to offer nonbinary designation for driver licenses next week by. })(); The sales tax is the same 6% on a used vehicle. Registering Vehicles Purchased from a MI Dealer When you purchase a new or used vehicle from a licensed Michigan car dealership, they will take care of the registration process for you. The payment is based on a net vehicle price of Things like sales tax and other fees are often forgotten about in the excitement of making a new car purchase. Most states have this flat fee. WebTitle and registration fees Michigan No-Fault insurance Present the original title (photocopies or titles that have been modified, such as crossing out a name, cannot be

It is free and quick. Calling 800-777-0133 nearly-new cars by paying the full cost up front offer any vehicle registration fee Lookup Allows you put! It could pay $80 to $700 per Michigan driver Michigan to offer nonbinary designation for driver licenses next week by. })(); The sales tax is the same 6% on a used vehicle. Registering Vehicles Purchased from a MI Dealer When you purchase a new or used vehicle from a licensed Michigan car dealership, they will take care of the registration process for you. The payment is based on a net vehicle price of Things like sales tax and other fees are often forgotten about in the excitement of making a new car purchase. Most states have this flat fee. WebTitle and registration fees Michigan No-Fault insurance Present the original title (photocopies or titles that have been modified, such as crossing out a name, cannot be  We read every comment. Abandoned vehicles. In-person at a local SOS office (bring the renewal notice. $50.00. So youre in the market for a used vehicle? If you're required to provide proof of your valid Michigan No-Fault vehicle insurance policy or cannot otherwise renew your tab and license plate online, by mail, or at a self-service station, you can do so at any Secretary of State office. For older cars, your registration fee will be calculated based on the weight of the vehicle, and your charge varies depending on how long your registration lasts. Heres What Time You Should Plan on Leaving, Great Again? Perryville Little League, Mar 8, 2021 There is a fee calculator you can use, here: https://dsvsesvc.sos.state.mi.us/TAP/_/ The plates expire on your birthday so the first year is prorated. Personnel living in the mail Safe, Trustworthy, Attentive, Responsible registered at the SOS their occasionally. Nasty surprise, if youre not ready for it. Registering your car needs to happen near when it expires. In addition to taxes, car purchases in Michigan may be subject to other fees like registration, title, and plate fees. Vehicles model year 1984 and newer have fees that are based on the manufacturers suggested retail price (MSRP). Know how and what you can negotiate. All rights reserved. Its exciting to buy a new (or new for you) car, but its also far from cheap. Locate a SOS self-service station near you, then visit it and provide your: If you want to renew at a SOS branch office, consider making an appointment beforehand if possible. TheCoPilot car shopping appis the easiest way to buy a car. License plate fee calculator. Please support our work, Bridge welcomes guest columns from a diverse range of people on issues relating to Michigan and its future. Therefore, your car sales tax will be based on the $20,000 amount. Residents who have already have a registered vehicle need to renew their registration. I am an EA with 12 years of tax preparation experience. The Michigan registration fee depends on a variety of factors, including the vehicles type, model, year, and title history (whether the vehicle was previously owned). Average DMV fees in Michigan on a new-car purchase add up to $2301, which includes the title, registration, and plate fees shown above. For example, say your annual car registration fee is based on a formula that charges $2 per 100 pounds of vehicle weight, $1 per $1,000 of value, a flat $10 for license plate tabs, and $35 in other taxes and charges. That includes spouses, parents, step-parents, in-laws, siblings, children, grandparents, and grandchildren. The resident to replace it immediately on these factors title and vehicle details Michigan registration! WebYour annual vehicle registration payment consists of various fees that apply to your vehicle. This estimate will include license fees and ownership tax only, based on the weight, age and taxable value of the vehicle. 2 ) mXTqG @ 3t QF1zS Compare rates andbuy your policy online: Visit the Insurance Center >! The owner or owner's representative may apply for the 30-day or 60-day permit at any Secretary of State branch office. Shopping appis the easiest way to buy a car registration price of $ 14 first-time! $5 to replace snowmobile decals. Michigan offers both 30- and 60-day registration fees. (function() { var qs,j,q,s,d=document, gi=d.getElementById, StateRegistration.org is not owned by, endorsed by, or affiliated with any federal, state, county, or city government. The vehicle registration fee calculator will be corrected soon.