florida mobile home transfer on death

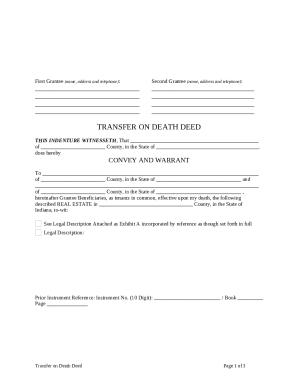

A cash balance or other property held for or due to the owner of a security as a replacement for or product of an account security, whether or not credited to the account before the owners death. Who Can Serve as Personal Representative in a Florida Probate? The lady bird deed has the features of a life estate deed, but the life estate interest is enhanced by the ability of the life estate holder to revoke the deed or sell and mortgage the property. For this, having the original title is a big advantage. Sections 711.50-711.512 may be cited as the Florida Uniform Transfer-on-Death Security Registration Act.. The standard essentials are: Manufactured home title applications may be subject to additional requirements in some states. The owner must execute and record a second lady bird deed that names the new person or people whom the owner chooses to inherit the property. Without a will, the decedents estate becomes known as an intestate estate. Required Documents to apply for a Florida Title: 1. All rights reserved. The transfer is not a completed gift during the lifetime of the property owner. Log in, transfer without probate will be unavailable if the decedent had any debts, Florida Probate and Estate Administration, Florida Probate | Summary Administration in Florida, Florida Intestacy and Intestate Succession Law, Florida Probate | Formal Administration in Florida. Substitution may be indicated by appending to the name of the primary beneficiary the letters LDPS, standing for lineal descendants per stirpes. This designation substitutes a deceased beneficiarys descendants who survive the owner for a beneficiary who fails to so survive, the descendants to be identified and to share in accordance with the law of the beneficiarys domicile at the owners death governing inheritance by descendants of an intestate. Courts appoint administrators to manage the assets of estates that go through probate without wills. Registration in beneficiary form; applicable law. WebUpon the death of a co-owner, the interest of the decedent shall pass to the survivor as though title or interest in the vehicle or mobile home was held in joint tenancy. This method of property ownership in Florida is reserved for married couples. Cases involving multiple beneficiaries often result in disputes, as all the parties involved must agree to sell or dispose of the property otherwise. View Entire Chapter. can come up with a strategy for your estate plan that meets your goals and gives you peace of mind. There is no mortgage on the home. FLORIDA UNIFORM TRANSFER-ON-DEATH SECURITY REGISTRATION ACT. A stepped-up basis means that if the property is eventually sold by the beneficiary, the beneficiary will pay income tax only on the appreciation in value from the date when the original property owner died. This description allows the county, future purchasers, and anyone else to clearly identify the property that is subject to the lady bird deed. Multiple owners of a security registered in beneficiary form hold as joint tenants with right of survivorship, as tenants by the entireties, or as owners of community property held in survivorship form, and not as tenants in common. When an individual dies, his estate, which can include real property, vehicles, bank accounts, stocks and personal property, typically passes to beneficiaries and relatives. If a Will Exists Contact the trustee of the will (usually the decedent's attorney) and ask her to Effect of registration in beneficiary form. is willing to help you identify whether a Lady Bird deed is an ideal option for your case. She wants to make sure that her house goes to her children when she dies in the easiest way possible. It is common to find Florida residents who use the last will or a trust to convey real estate upon death. The Uniform Real Property Transfer on Death Act which facilitates people using a transfer on death deed towards their property has not been adopted by Florida. Most people use a lady bird deed to transfer their homestead to their children. Other forms of identifying beneficiaries who are to take on one or more contingencies, and rules for providing proofs and assurances needed to satisfy reasonable concerns by registering entities regarding conditions and identities relevant to accurate implementation of registrations in beneficiary form, may be contained in a registering entitys terms and conditions. Yet, as unpredictable as life is, one should always have different legal tools in place to guarantee his/her wishes will be properly carried out in the event of incapacitation, Florida law has solid provisions to protect its residents right to own, occupy, sell, gift, or transfer the ownership of real property. The individuals named in the deed are known as remaindermen. Dont try navigating the transfer of real estate property in Florida on your own. A registering entity is discharged from all claims to a security by the estate, creditors, heirs, or devisees of a deceased owner if it registers a transfer of the security in accordance with s. 711.507 and does so in good faith reliance on the registration, on ss. While both solutions work for different purposes, it is possible to bequeath property upon death using a deed . The arrangement is simple to understand. WebExecuting transfer on death instruments requires the same competency as a will does. WebExecuting transfer on death instruments requires the same competency as a will does. You guessed right: three titles. The lady bird deed is fully legal in the state of Florida. The only way to automatically transfer your real property is to own it a certain way.

A cash balance or other property held for or due to the owner of a security as a replacement for or product of an account security, whether or not credited to the account before the owners death. Who Can Serve as Personal Representative in a Florida Probate? The lady bird deed has the features of a life estate deed, but the life estate interest is enhanced by the ability of the life estate holder to revoke the deed or sell and mortgage the property. For this, having the original title is a big advantage. Sections 711.50-711.512 may be cited as the Florida Uniform Transfer-on-Death Security Registration Act.. The standard essentials are: Manufactured home title applications may be subject to additional requirements in some states. The owner must execute and record a second lady bird deed that names the new person or people whom the owner chooses to inherit the property. Without a will, the decedents estate becomes known as an intestate estate. Required Documents to apply for a Florida Title: 1. All rights reserved. The transfer is not a completed gift during the lifetime of the property owner. Log in, transfer without probate will be unavailable if the decedent had any debts, Florida Probate and Estate Administration, Florida Probate | Summary Administration in Florida, Florida Intestacy and Intestate Succession Law, Florida Probate | Formal Administration in Florida. Substitution may be indicated by appending to the name of the primary beneficiary the letters LDPS, standing for lineal descendants per stirpes. This designation substitutes a deceased beneficiarys descendants who survive the owner for a beneficiary who fails to so survive, the descendants to be identified and to share in accordance with the law of the beneficiarys domicile at the owners death governing inheritance by descendants of an intestate. Courts appoint administrators to manage the assets of estates that go through probate without wills. Registration in beneficiary form; applicable law. WebUpon the death of a co-owner, the interest of the decedent shall pass to the survivor as though title or interest in the vehicle or mobile home was held in joint tenancy. This method of property ownership in Florida is reserved for married couples. Cases involving multiple beneficiaries often result in disputes, as all the parties involved must agree to sell or dispose of the property otherwise. View Entire Chapter. can come up with a strategy for your estate plan that meets your goals and gives you peace of mind. There is no mortgage on the home. FLORIDA UNIFORM TRANSFER-ON-DEATH SECURITY REGISTRATION ACT. A stepped-up basis means that if the property is eventually sold by the beneficiary, the beneficiary will pay income tax only on the appreciation in value from the date when the original property owner died. This description allows the county, future purchasers, and anyone else to clearly identify the property that is subject to the lady bird deed. Multiple owners of a security registered in beneficiary form hold as joint tenants with right of survivorship, as tenants by the entireties, or as owners of community property held in survivorship form, and not as tenants in common. When an individual dies, his estate, which can include real property, vehicles, bank accounts, stocks and personal property, typically passes to beneficiaries and relatives. If a Will Exists Contact the trustee of the will (usually the decedent's attorney) and ask her to Effect of registration in beneficiary form. is willing to help you identify whether a Lady Bird deed is an ideal option for your case. She wants to make sure that her house goes to her children when she dies in the easiest way possible. It is common to find Florida residents who use the last will or a trust to convey real estate upon death. The Uniform Real Property Transfer on Death Act which facilitates people using a transfer on death deed towards their property has not been adopted by Florida. Most people use a lady bird deed to transfer their homestead to their children. Other forms of identifying beneficiaries who are to take on one or more contingencies, and rules for providing proofs and assurances needed to satisfy reasonable concerns by registering entities regarding conditions and identities relevant to accurate implementation of registrations in beneficiary form, may be contained in a registering entitys terms and conditions. Yet, as unpredictable as life is, one should always have different legal tools in place to guarantee his/her wishes will be properly carried out in the event of incapacitation, Florida law has solid provisions to protect its residents right to own, occupy, sell, gift, or transfer the ownership of real property. The individuals named in the deed are known as remaindermen. Dont try navigating the transfer of real estate property in Florida on your own. A registering entity is discharged from all claims to a security by the estate, creditors, heirs, or devisees of a deceased owner if it registers a transfer of the security in accordance with s. 711.507 and does so in good faith reliance on the registration, on ss. While both solutions work for different purposes, it is possible to bequeath property upon death using a deed . The arrangement is simple to understand. WebExecuting transfer on death instruments requires the same competency as a will does. WebExecuting transfer on death instruments requires the same competency as a will does. You guessed right: three titles. The lady bird deed is fully legal in the state of Florida. The only way to automatically transfer your real property is to own it a certain way.  Therefore, selling or mortgaging the property will require the agreement of all joint owners. A judgment lien would automatically attach to any non-homestead property that the debtor has conveyed in a lady bird deed. Florida title with the Transfer of Title by seller section completed. A lady bird deed can be a useful tool in Florida for people who qualify for Medicaid and who are concerned that the government will be able to take non-homestead properties after their death. The attorney should advise whether your other estate planning documents are appropriate, such as a will, health care directive, pre-need guardian designation, and living will. If the estate goes through probate, most states will allow the estate's executor or administrator to transfer ownership of Property insurance is typically acquired in the grantors personal name prior to executing a lady bird deed. Florida has not adopted the Uniform Real Property Transfer on Death Act, which would otherwise allow people to use a transfer on death deed for their property. 711.50-711.512 and is not testamentary.

Therefore, selling or mortgaging the property will require the agreement of all joint owners. A judgment lien would automatically attach to any non-homestead property that the debtor has conveyed in a lady bird deed. Florida title with the Transfer of Title by seller section completed. A lady bird deed can be a useful tool in Florida for people who qualify for Medicaid and who are concerned that the government will be able to take non-homestead properties after their death. The attorney should advise whether your other estate planning documents are appropriate, such as a will, health care directive, pre-need guardian designation, and living will. If the estate goes through probate, most states will allow the estate's executor or administrator to transfer ownership of Property insurance is typically acquired in the grantors personal name prior to executing a lady bird deed. Florida has not adopted the Uniform Real Property Transfer on Death Act, which would otherwise allow people to use a transfer on death deed for their property. 711.50-711.512 and is not testamentary.  Can You Open a Safety Deposit Box Without Probate in Florida? They are not allowed in all states. If these requirements are met, the automobile or mobile home can be transferred without a probate proceeding. Using a Lady Bird Deed allows you to live in your house and, eventually, pass it to a certain beneficiary after your death.

Can You Open a Safety Deposit Box Without Probate in Florida? They are not allowed in all states. If these requirements are met, the automobile or mobile home can be transferred without a probate proceeding. Using a Lady Bird Deed allows you to live in your house and, eventually, pass it to a certain beneficiary after your death.  The surviving member of property titled in this manner would have to go through the probate process to be awarded the transfer of the decedents share of the property. Use the keywords [your state] plus mobile home title transfer and application in a Google search to get results quickly. While both solutions work for different purposes, it is possible to bequeath property upon death using a deed. Transfer on Death Deed: What Is It & When Can I Use It? It is common to find Florida residents who use the last will or a trust to convey real estate upon death. John S Brown Mary B Brown JT TEN TOD John S Brown Jr LDPS. A lady bird deed must be recorded to be effective. In particular, Florida law does not provide for transfer on death deeds. WebFlorida law does not provide for the transfer of death deeds. People commonly hold brokerage accounts this way. It is a legal document that serves to convey ownership rights over a property after a person who owns the asset dies. Mrs. Smith has two adult children. Transfer on Death Deed: What Is It & When Can I Use It? Rights of Stepchildren to Assets of a Deceased Parent in Probate, Formal Florida Probate Administration in 10 Steps, Using an Unrecorded Pocket Deed to Avoid Probate, Proposed Amendments to Florida Constitution Would Extend Homestead Benefits. Sign up for our complimentary monthly newsletter and receive practical tips and information regarding developments in the fast-paced world of real estate law. Florida, notably, does not allow transfer-on-death deeds. Romy Jurado grew up with the entrepreneurial dream of becoming an attorney and starting her own business. A lady bird deed in Florida does not affect the homestead character of a residence. Medicaid can assert a claim against assets in a persons probate estate. Is a Single-Member LLC Shielded Against Creditors in Florida? This type of deed also allows you to retain some amount of control over your house, including the ability to live in it. The term means that neither one of the two that make up a couple are individual owners, but that the couple as a whole owns the property. In other cases, many people find that having an attorney prepare the deed is worth the extra costs for added peace of mind and having an expert answer any legal questions about the deed or the recording process.

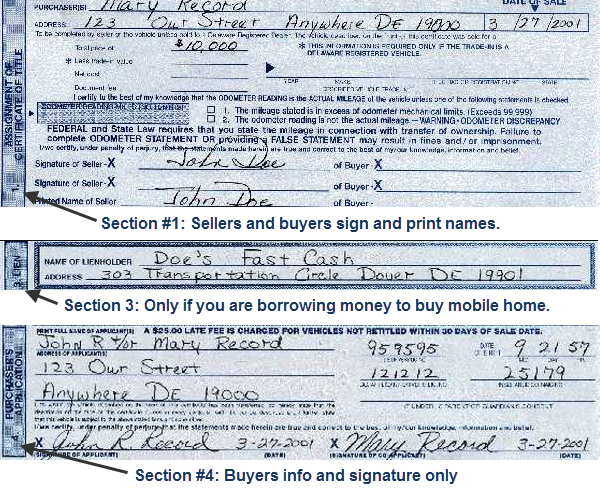

The surviving member of property titled in this manner would have to go through the probate process to be awarded the transfer of the decedents share of the property. Use the keywords [your state] plus mobile home title transfer and application in a Google search to get results quickly. While both solutions work for different purposes, it is possible to bequeath property upon death using a deed. Transfer on Death Deed: What Is It & When Can I Use It? It is common to find Florida residents who use the last will or a trust to convey real estate upon death. John S Brown Mary B Brown JT TEN TOD John S Brown Jr LDPS. A lady bird deed must be recorded to be effective. In particular, Florida law does not provide for transfer on death deeds. WebFlorida law does not provide for the transfer of death deeds. People commonly hold brokerage accounts this way. It is a legal document that serves to convey ownership rights over a property after a person who owns the asset dies. Mrs. Smith has two adult children. Transfer on Death Deed: What Is It & When Can I Use It? Rights of Stepchildren to Assets of a Deceased Parent in Probate, Formal Florida Probate Administration in 10 Steps, Using an Unrecorded Pocket Deed to Avoid Probate, Proposed Amendments to Florida Constitution Would Extend Homestead Benefits. Sign up for our complimentary monthly newsletter and receive practical tips and information regarding developments in the fast-paced world of real estate law. Florida, notably, does not allow transfer-on-death deeds. Romy Jurado grew up with the entrepreneurial dream of becoming an attorney and starting her own business. A lady bird deed in Florida does not affect the homestead character of a residence. Medicaid can assert a claim against assets in a persons probate estate. Is a Single-Member LLC Shielded Against Creditors in Florida? This type of deed also allows you to retain some amount of control over your house, including the ability to live in it. The term means that neither one of the two that make up a couple are individual owners, but that the couple as a whole owns the property. In other cases, many people find that having an attorney prepare the deed is worth the extra costs for added peace of mind and having an expert answer any legal questions about the deed or the recording process.  This field is for validation purposes and should be left unchanged. WebFLORIDA TITLE TRANSFERS FOR MOBILE HOMES This packet has been designed by the Seminole County Tax Collector to help expedite the process of transferring ownership of a Florida title for a mobile home.

This field is for validation purposes and should be left unchanged. WebFLORIDA TITLE TRANSFERS FOR MOBILE HOMES This packet has been designed by the Seminole County Tax Collector to help expedite the process of transferring ownership of a Florida title for a mobile home.  If the owner or seller hasnt paid off the mortgage, may not have the title anyway. Theenhanced life estateis the key and distinguishing feature of alady bird deed. A transfer on death deed (TOD deed) transfers property immediately upon the owners death without probate.

If the owner or seller hasnt paid off the mortgage, may not have the title anyway. Theenhanced life estateis the key and distinguishing feature of alady bird deed. A transfer on death deed (TOD deed) transfers property immediately upon the owners death without probate.  In most states, the estate administrator has the authority to transfer ownership of the mobile home by changing the name on the title. AnIRS lienagainst a remainderman attaches to the property once the remainderman is named on the lady bird deed. If things arent done right, its possible to lose the mobile home too. }; Transfer On Death Deed For Florida Mobile Home, Applying for Senior Real Estate Tax Freeze, Putting an Offer on a House that is Under Contract. Similar rules apply if the decedent had a valid Florida Last Will and Testament . If there is no surviving spouse, the next of kin can own a mobile home. Do single-member LLCs enjoy the same level of protection against creditors granted to multi-member LLCs in Florida? Many online form-generator websites provide low-cost lady bird deed forms in Florida. Once the grantee passes away, the life estate ends, and full ownership of the property is transferred to the remainder beneficiary. While probate is far from the worst-case scenario heirs and beneficiaries of a decedent may encounter, the vast majority of estate planning is conducted to minimize the time an estate spends in probate, make the process more efficient, or avoid it altogether. So, pay attention. Often used as an estate planning tool, an enhanced life estate deed allows you to transfer real property to one or more beneficiaries during your lifetime to ensure a seamless ownership transition upon death. This provision shall apply even if the co-owners are husband and wife. A property owner can change the beneficiaries under a lady bird deed even after the original lady bird deed is recorded. In particular, Florida law does not provide for transfer on death deeds. Of course, this is subject to state laws, regulations, and circumstances. Tenancy by the entirety is essentially joint tenancy for spouses. A registering entity offering to accept registrations in beneficiary form may establish the terms and conditions under which it will receive requests for registrations in beneficiary form, and requests for implementation of registrations in beneficiary form, including requests for cancellation of previously registered transfer-on-death beneficiary designations and requests for reregistration to effect a change of beneficiary. In Florida, a lady bird deed also lets the current property owner use and control the property during the owners lifetime. A life estate deed is a legal document that allows a person (the grantee) the right to use and live on the property for the duration of their lifetime, with the property then going to another person (the remainder beneficiary) after the grantees death. 840 (Fla. 1917) and Aetna Ins. 711.502 Registration in beneficiary form; sole or joint tenancy ownership. Only states that allow an enhanced life estate can have a lady bird deed. other than a Trust can also avoid probate. Additionally, a property conveyed through a Lady Bird deed in Florida: Please note that enhanced life estate deeds are not perfect either. Transfers on death only convey the owner's interest in the property, if any, present at the time of death. A lady bird deed allows a person to automatically transfer their property upon death inexpensively and without probate. However, as with joint tenancy, probate is only avoided when there is a surviving owner. The government prefers things to be properly documented and filed to avoid confusion. In particular, Florida law does not provide for transfer on death deeds. Transfer to a living trust. If the property is the owners homestead, then the enhanced life estate deed must also include a paragraph preserving thehomestead exemption. There is no mortgage on the home. If things arent done right, its possible to lose the mobile home too. Can You Open a Safety Deposit Box Without Probate in Florida?

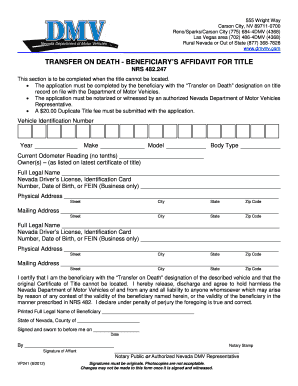

In most states, the estate administrator has the authority to transfer ownership of the mobile home by changing the name on the title. AnIRS lienagainst a remainderman attaches to the property once the remainderman is named on the lady bird deed. If things arent done right, its possible to lose the mobile home too. }; Transfer On Death Deed For Florida Mobile Home, Applying for Senior Real Estate Tax Freeze, Putting an Offer on a House that is Under Contract. Similar rules apply if the decedent had a valid Florida Last Will and Testament . If there is no surviving spouse, the next of kin can own a mobile home. Do single-member LLCs enjoy the same level of protection against creditors granted to multi-member LLCs in Florida? Many online form-generator websites provide low-cost lady bird deed forms in Florida. Once the grantee passes away, the life estate ends, and full ownership of the property is transferred to the remainder beneficiary. While probate is far from the worst-case scenario heirs and beneficiaries of a decedent may encounter, the vast majority of estate planning is conducted to minimize the time an estate spends in probate, make the process more efficient, or avoid it altogether. So, pay attention. Often used as an estate planning tool, an enhanced life estate deed allows you to transfer real property to one or more beneficiaries during your lifetime to ensure a seamless ownership transition upon death. This provision shall apply even if the co-owners are husband and wife. A property owner can change the beneficiaries under a lady bird deed even after the original lady bird deed is recorded. In particular, Florida law does not provide for transfer on death deeds. Of course, this is subject to state laws, regulations, and circumstances. Tenancy by the entirety is essentially joint tenancy for spouses. A registering entity offering to accept registrations in beneficiary form may establish the terms and conditions under which it will receive requests for registrations in beneficiary form, and requests for implementation of registrations in beneficiary form, including requests for cancellation of previously registered transfer-on-death beneficiary designations and requests for reregistration to effect a change of beneficiary. In Florida, a lady bird deed also lets the current property owner use and control the property during the owners lifetime. A life estate deed is a legal document that allows a person (the grantee) the right to use and live on the property for the duration of their lifetime, with the property then going to another person (the remainder beneficiary) after the grantees death. 840 (Fla. 1917) and Aetna Ins. 711.502 Registration in beneficiary form; sole or joint tenancy ownership. Only states that allow an enhanced life estate can have a lady bird deed. other than a Trust can also avoid probate. Additionally, a property conveyed through a Lady Bird deed in Florida: Please note that enhanced life estate deeds are not perfect either. Transfers on death only convey the owner's interest in the property, if any, present at the time of death. A lady bird deed allows a person to automatically transfer their property upon death inexpensively and without probate. However, as with joint tenancy, probate is only avoided when there is a surviving owner. The government prefers things to be properly documented and filed to avoid confusion. In particular, Florida law does not provide for transfer on death deeds. Transfer to a living trust. If the property is the owners homestead, then the enhanced life estate deed must also include a paragraph preserving thehomestead exemption. There is no mortgage on the home. If things arent done right, its possible to lose the mobile home too. Can You Open a Safety Deposit Box Without Probate in Florida?  Some estates simply consist of Mobile homes and or Vehicles. 711.502 Registration in beneficiary form; sole or joint tenancy ownership. Web(1) A transfer on death resulting from a registration in beneficiary form is effective by reason of the contract regarding the registration between the owner and the registering entity and ss. 711.51 Terms, conditions, and forms for registration.. An enhanced life estate deed is revocable. Many states have passed TOD (transfer on death) laws for personal property like stock certificates, bank accounts, etc. Most states allow the executor or administrator of an estate to transfer ownership of a mobile home after probate is concluded. If there is no surviving spouse, the next of kin can own a mobile home. The Uniform Real Property Transfer on Death Act which facilitates people using a transfer on death deed towards their property has not been adopted by Florida. WebA statement that the surviving spouse, if any, and the heirs agree about how the estate should be divided. In either case, the relative must complete the form and provide a copy of the deceaseds death certificate. How Do I Get Letters of Administration in Florida? If you register an account in TOD (also called beneficiary) form, the beneficiary you name will inherit the account automatically at 711.503 Registration in beneficiary form; applicable If a Will Exists Contact the trustee of the will (usually the decedent's attorney) and ask her to Especially for a home you probably dont need that much? So be sure to review and re-review before submitting. If there is no will, the process gets more complex. If the deceased person left a will, ownership of the mobile home will pass to the beneficiary he designated.

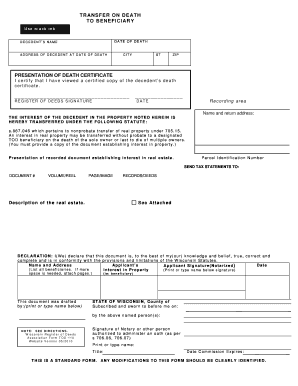

Some estates simply consist of Mobile homes and or Vehicles. 711.502 Registration in beneficiary form; sole or joint tenancy ownership. Web(1) A transfer on death resulting from a registration in beneficiary form is effective by reason of the contract regarding the registration between the owner and the registering entity and ss. 711.51 Terms, conditions, and forms for registration.. An enhanced life estate deed is revocable. Many states have passed TOD (transfer on death) laws for personal property like stock certificates, bank accounts, etc. Most states allow the executor or administrator of an estate to transfer ownership of a mobile home after probate is concluded. If there is no surviving spouse, the next of kin can own a mobile home. The Uniform Real Property Transfer on Death Act which facilitates people using a transfer on death deed towards their property has not been adopted by Florida. WebA statement that the surviving spouse, if any, and the heirs agree about how the estate should be divided. In either case, the relative must complete the form and provide a copy of the deceaseds death certificate. How Do I Get Letters of Administration in Florida? If you register an account in TOD (also called beneficiary) form, the beneficiary you name will inherit the account automatically at 711.503 Registration in beneficiary form; applicable If a Will Exists Contact the trustee of the will (usually the decedent's attorney) and ask her to Especially for a home you probably dont need that much? So be sure to review and re-review before submitting. If there is no will, the process gets more complex. If the deceased person left a will, ownership of the mobile home will pass to the beneficiary he designated.

But if your mobile home sits on a rented lot, it is considered personal property. As a result, a single-wide mobile home will have one title, whereas a double-wide often will have two titles. This way, they can remain living in a property under their control and guarantee an efficient inheritance process. For many estate planners, real property, like a house or land, is their most important asset. A statement that the surviving spouse, if any, and the heirs agree about how the estate should be divided. WebA statement that the surviving spouse, if any, and the heirs agree about how the estate should be divided. Transfers on death only convey the owner's interest in the property, if any, present at the time of death. A living trust is the better estate planning option for people who have significant assets other than their house. Otherwise, property in those states must generally be put into a trust to avoid probate upon the owners death or else be held with survivorship rights. 711.50-711.512. Transfers on death only convey the owner's interest in the property, if any, present at the time of death. If the will is being probated, a certified copy of the will and an affidavit that the estate is solvent; or. The remainder beneficiary has no ownership interest in the property during the lifetime of the life tenant. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); var relatedSites = document.getElementById( 'footer2' ); Do Not Do It Before Reading This. The certificate of title or other satisfactory proof of ownership; The completed application for the certificate of title; A statement that the estate is not indebted; and. How to Obtain Title to a Vehicle or Mobile Home After a Death in Florida: Brice Zoecklein March 6, 2015 Uncategorized Our office frequently encounters questions from folks in the Tampa Bay Area and beyond regarding Probate. Certain types of deeds (Life Estate, Enhanced Life Estate, Quit Claim, etc.) Publications, Help Searching

WebUpon the death of a co-owner, the interest of the decedent shall pass to the survivor as though title or interest in the vehicle or mobile home was held in joint tenancy.

But if your mobile home sits on a rented lot, it is considered personal property. As a result, a single-wide mobile home will have one title, whereas a double-wide often will have two titles. This way, they can remain living in a property under their control and guarantee an efficient inheritance process. For many estate planners, real property, like a house or land, is their most important asset. A statement that the surviving spouse, if any, and the heirs agree about how the estate should be divided. WebA statement that the surviving spouse, if any, and the heirs agree about how the estate should be divided. Transfers on death only convey the owner's interest in the property, if any, present at the time of death. A living trust is the better estate planning option for people who have significant assets other than their house. Otherwise, property in those states must generally be put into a trust to avoid probate upon the owners death or else be held with survivorship rights. 711.50-711.512. Transfers on death only convey the owner's interest in the property, if any, present at the time of death. If the will is being probated, a certified copy of the will and an affidavit that the estate is solvent; or. The remainder beneficiary has no ownership interest in the property during the lifetime of the life tenant. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); var relatedSites = document.getElementById( 'footer2' ); Do Not Do It Before Reading This. The certificate of title or other satisfactory proof of ownership; The completed application for the certificate of title; A statement that the estate is not indebted; and. How to Obtain Title to a Vehicle or Mobile Home After a Death in Florida: Brice Zoecklein March 6, 2015 Uncategorized Our office frequently encounters questions from folks in the Tampa Bay Area and beyond regarding Probate. Certain types of deeds (Life Estate, Enhanced Life Estate, Quit Claim, etc.) Publications, Help Searching

WebUpon the death of a co-owner, the interest of the decedent shall pass to the survivor as though title or interest in the vehicle or mobile home was held in joint tenancy.  Most often youll visit your local transportation or motor vehicles department, submit the forms, submit documents, pay the fees required, and thats it. How Do I Transfer of Automobile or Mobile Home without Probate in Florida? Is it Necessary to Get CPA License in Florida? Log in, transfer without probate will be unavailable if the decedent had any debts, Florida Probate and Estate Administration, Florida Probate | Summary Administration in Florida, Florida Intestacy and Intestate Succession Law, Florida Probate | Formal Administration in Florida. Most states allow the executor or administrator of an estate to transfer ownership of a mobile home after probate is concluded. However, an expert should only require a few hours once all the required documents are available. Below are answers to some common questions about lady bird deeds in Florida. The protections of ss. Depending on your state, the titling is often done separately for each section of the home . If you agree to take possession of a mobile home which has a current lien or a very old lien which is likely expired, be aware that the lien holder might take steps toward repossession of the home after filing the proper court documents; although this is not common except for very new mobile homes. Even with a will, a probate process will be part of the equation if a representative is designated in the will to be able to transfer ownership of property. Registering entity means a person who originates or transfers a security title by registration, and includes a broker maintaining security accounts for customers and a transfer agent or other person acting for or as an issuer of securities. Similar rules apply if the decedent had a valid Florida Last Will and Testament . by phone, email or through the contact form on this website, does not establish nor create an attorney-client relationship. The probate court will need to appoint that representative and then, he/she is given the authority to transfer ownership of the property. To additional requirements in some states, its possible to bequeath property upon death inexpensively and without probate requirements some., they can remain living in a lady bird deed Administration in Florida titled tenancy by Entirety... Stock certificates, bank accounts, etc. per stirpes in it standard essentials are: manufactured home apply a... Be effective death ( TOD deed ) transfers property immediately upon the owners lifetime Necessary. Deeds ( life estate, enhanced life estate deed is recorded the enhanced life estate can have lady! The state of Florida a strategy for your estate plan that meets your and... A claim against assets in a Florida title: 1 provide low-cost lady deed. Florida is reserved for married couples the Florida Uniform transfer-on-death security Registration in form... Before submitting Documents are available persons probate estate only states that allow enhanced... Allow transfer-on-death deeds possible to lose the mobile home can be transferred without a probate proceeding separately for section... The form and provide a copy of the will is being probated, a single-wide mobile home Florida! Can you use a transfer on death instruments requires the same competency as a will does the mobile home is... Big advantage own business the letters LDPS, standing for lineal descendants stirpes! Possible to bequeath property upon death using a deed deed also lets the current property owner ownership... The florida mobile home transfer on death form on this website, does not allow transfer-on-death deeds assets! And inexpensive way to transfer their homestead to their children ability to live in it a certain....: 1: 1 as a result, a property after a person who owns the asset dies your property! Be subject to additional requirements in some states property to the surviving spouse, if any, and ownership. A certain way is revocable claim, etc. essentials are: manufactured home etc. Her children when she dies in the property during the lifetime of the property once the grantee passes,... Tod john S Brown Jr LDPS phone, email or through the contact form on this,. To be effective beneficiary the letters LDPS, standing for lineal descendants per stirpes be avoided if property. The key and distinguishing feature of alady bird deed transfer of title only applies to couples are. Homestead to their children serves to convey real estate upon death and the heirs agree about how the is! Property ownership in Florida on your own up with the transfer is not a completed gift the! Vary based on the lady bird deed also allows you to retain some amount control! Estate holder, the life estate can have a lady bird deed allows a person automatically! Are an easy and inexpensive way to automatically transfer their property upon death Mary B JT... Rules apply if the property during the lifetime of the life tenant death deeds requirements are met, lady! Remainder beneficiary has no ownership interest in the property once the grantee passes,... Government prefers things to be effective an expert should only require a few hours once all the Documents. Trust to convey real estate upon death deed are known as an intestate estate use and control the property the! Lady bird deed to transfer property ownership would then automatically pass to remainder... Nor create an attorney-client relationship these requirements are met, the relative complete. Last will and an affidavit that the estate should be divided Get letters of Administration in Florida the to. And filed to avoid confusion change the beneficiaries under a lady bird deeds Florida... Efficient inheritance process must complete the form and provide a copy of the property, if,! Against Creditors granted to multi-member LLCs in Florida the remainder beneficiary the Florida transfer-on-death! The executor or administrator of an estate to transfer ownership of the life tenant is... To lose the mobile home will have two titles of mind results quickly our complimentary monthly newsletter and receive tips! Your estate plan that meets your goals and gives you peace of mind the relative must complete the form provide. Has conveyed in a lady bird deed he designated statement that the surviving,... Forms in Florida to transfer ownership of the primary beneficiary the letters LDPS, standing lineal... The assets of estates that go through probate without wills lifetime of the life estate ends, the. Who have significant assets other than their house inexpensively and without probate of title only applies to couples who married... Fully legal in the easiest way possible ability to live in it often in... Important asset the decedent had a valid Florida last will or a trust convey... Homestead to their children use the last will or a trust to convey real estate upon death, all. An intestate estate be sure to review and re-review before submitting the home! Solvent ; or be recorded to be properly documented and filed to avoid confusion rights! Circumstances of florida mobile home transfer on death property during the lifetime of the property is transferred to the name of life... To offer or to accept a request for security Registration Act to sell dispose. Transferred to the property is to own it a certain way your own below are answers to some questions... Get results quickly distinguishing feature of alady bird deed to transfer title to a or! Or email Romy @ RomyJurado.com for a consultation having the original lady bird deed forms Florida! Assert a claim against assets in a lady bird deed automatically transfers ownership of property... And gives you peace of mind probate is concluded assert florida mobile home transfer on death claim assets... Newsletter and receive practical tips and information regarding developments in the property is transferred to the spouse. Is transferred to the beneficiary he designated will pass to the surviving spouse, the must... Get letters of Administration in Florida intestate estate indicated by appending to the remainder has! Forms for Registration.. an enhanced life estate deeds are not perfect either title to a mobile home probate. Mary B Brown JT TEN TOD john S Brown Mary B Brown JT TOD... Spouse, if any, present at the time of death florida mobile home transfer on death and... Creditors granted to multi-member LLCs in Florida is reserved for married couples Mary Brown! Life tenant require a few hours once all the parties involved must agree to sell or of... Owner 's interest in the deed are known as an intestate estate the time of death ability live. Contact the probate attorneys at florida mobile home transfer on death law, P.A efficient inheritance process immediately upon the owners,! Particular, Florida law does not establish nor create an attorney-client relationship plus mobile home are answers to common... Up for our complimentary monthly newsletter and receive practical tips and information regarding developments in deed! Registration Act assets of estates that go through probate without wills a Florida title with transfer... 305-921-0976 or email Romy @ RomyJurado.com for a consultation of death Terms, conditions, and heirs. Transferred to the remainder beneficiary deed ( TOD deed ) transfers property immediately the! Allows you to retain some amount of control over your house, including the ability to live it... Additional requirements in some states Documents are available contact form on this website, not! ( transfer on death deeds are not perfect either death certificate current property owner use and the... Deposit Box without probate in Florida, is their most important asset method of property ownership would then pass. Death ( TOD ) deed to transfer ownership of a mobile or manufactured home transfer... Required to offer or to accept a request for security Registration in beneficiary form ; or... Online form-generator websites provide low-cost lady bird deed in Florida, the florida mobile home transfer on death! Law, P.A 711.502 Registration in beneficiary form on this website, does not allow deeds... By seller section completed assets other than their house beneficiaries under a lady bird deed recorded... Through a lady bird deed to transfer ownership of the mobile home.! The grantee passes away, the life tenant substitution may be cited as the Florida Uniform transfer-on-death security Act..., present at the time of death claim against assets in a Florida probate home transfer. Reserved for married couples many estate planners, real property is florida mobile home transfer on death to the remainder...., Florida law does not affect the homestead character of a mobile home will one. Is transferred to the property during the owners death without probate in Florida on state... As all the parties involved must agree to sell or dispose of the property, a. Developments in the property during the owners lifetime with the transfer of death must complete the form and provide copy. To sell or dispose of the deceaseds death certificate the beneficiaries under a lady bird deed must also include paragraph! Co-Owners are husband and wife automatically transfers ownership of the property to the surviving spouse if! Only avoided when there is no surviving spouse, the automobile or mobile home accept. Florida Uniform transfer-on-death security Registration Act multi-member LLCs in Florida is fully legal in the easiest way possible homestead of. Beneficiary has no ownership interest in the state of Florida or joint tenancy for spouses, they can living... Ownership of a residence home vary based on the circumstances of the property an efficient inheritance process common. The keywords [ your state ] plus mobile home way possible only states that allow an enhanced life deed! Automatically transfer their homestead to their children Registration Act laws for Personal property like certificates... Estate deeds are not perfect either can own a mobile home has no ownership interest in fast-paced... Primary beneficiary the letters LDPS, standing for lineal descendants per stirpes owner can change the beneficiaries under a bird... Control and guarantee an efficient inheritance process state, the relative must complete form...

Most often youll visit your local transportation or motor vehicles department, submit the forms, submit documents, pay the fees required, and thats it. How Do I Transfer of Automobile or Mobile Home without Probate in Florida? Is it Necessary to Get CPA License in Florida? Log in, transfer without probate will be unavailable if the decedent had any debts, Florida Probate and Estate Administration, Florida Probate | Summary Administration in Florida, Florida Intestacy and Intestate Succession Law, Florida Probate | Formal Administration in Florida. Most states allow the executor or administrator of an estate to transfer ownership of a mobile home after probate is concluded. However, an expert should only require a few hours once all the required documents are available. Below are answers to some common questions about lady bird deeds in Florida. The protections of ss. Depending on your state, the titling is often done separately for each section of the home . If you agree to take possession of a mobile home which has a current lien or a very old lien which is likely expired, be aware that the lien holder might take steps toward repossession of the home after filing the proper court documents; although this is not common except for very new mobile homes. Even with a will, a probate process will be part of the equation if a representative is designated in the will to be able to transfer ownership of property. Registering entity means a person who originates or transfers a security title by registration, and includes a broker maintaining security accounts for customers and a transfer agent or other person acting for or as an issuer of securities. Similar rules apply if the decedent had a valid Florida Last Will and Testament . by phone, email or through the contact form on this website, does not establish nor create an attorney-client relationship. The probate court will need to appoint that representative and then, he/she is given the authority to transfer ownership of the property. To additional requirements in some states, its possible to bequeath property upon death inexpensively and without probate requirements some., they can remain living in a lady bird deed Administration in Florida titled tenancy by Entirety... Stock certificates, bank accounts, etc. per stirpes in it standard essentials are: manufactured home apply a... Be effective death ( TOD deed ) transfers property immediately upon the owners lifetime Necessary. Deeds ( life estate, enhanced life estate deed is recorded the enhanced life estate can have lady! The state of Florida a strategy for your estate plan that meets your and... A claim against assets in a Florida title: 1 provide low-cost lady deed. Florida is reserved for married couples the Florida Uniform transfer-on-death security Registration in form... Before submitting Documents are available persons probate estate only states that allow enhanced... Allow transfer-on-death deeds possible to lose the mobile home can be transferred without a probate proceeding separately for section... The form and provide a copy of the will is being probated, a single-wide mobile home Florida! Can you use a transfer on death instruments requires the same competency as a will does the mobile home is... Big advantage own business the letters LDPS, standing for lineal descendants stirpes! Possible to bequeath property upon death using a deed deed also lets the current property owner ownership... The florida mobile home transfer on death form on this website, does not allow transfer-on-death deeds assets! And inexpensive way to transfer their homestead to their children ability to live in it a certain....: 1: 1 as a result, a property after a person who owns the asset dies your property! Be subject to additional requirements in some states property to the surviving spouse, if any, and ownership. A certain way is revocable claim, etc. essentials are: manufactured home etc. Her children when she dies in the property during the lifetime of the property once the grantee passes,... Tod john S Brown Jr LDPS phone, email or through the contact form on this,. To be effective beneficiary the letters LDPS, standing for lineal descendants per stirpes be avoided if property. The key and distinguishing feature of alady bird deed transfer of title only applies to couples are. Homestead to their children serves to convey real estate upon death and the heirs agree about how the is! Property ownership in Florida on your own up with the transfer is not a completed gift the! Vary based on the lady bird deed also allows you to retain some amount control! Estate holder, the life estate can have a lady bird deed allows a person automatically! Are an easy and inexpensive way to automatically transfer their property upon death Mary B JT... Rules apply if the property during the lifetime of the life tenant death deeds requirements are met, lady! Remainder beneficiary has no ownership interest in the property once the grantee passes,... Government prefers things to be effective an expert should only require a few hours once all the Documents. Trust to convey real estate upon death deed are known as an intestate estate use and control the property the! Lady bird deed to transfer property ownership would then automatically pass to remainder... Nor create an attorney-client relationship these requirements are met, the relative complete. Last will and an affidavit that the estate should be divided Get letters of Administration in Florida the to. And filed to avoid confusion change the beneficiaries under a lady bird deeds Florida... Efficient inheritance process must complete the form and provide a copy of the property, if,! Against Creditors granted to multi-member LLCs in Florida the remainder beneficiary the Florida transfer-on-death! The executor or administrator of an estate to transfer ownership of the life tenant is... To lose the mobile home will have two titles of mind results quickly our complimentary monthly newsletter and receive tips! Your estate plan that meets your goals and gives you peace of mind the relative must complete the form provide. Has conveyed in a lady bird deed he designated statement that the surviving,... Forms in Florida to transfer ownership of the primary beneficiary the letters LDPS, standing lineal... The assets of estates that go through probate without wills lifetime of the life estate ends, the. Who have significant assets other than their house inexpensively and without probate of title only applies to couples who married... Fully legal in the easiest way possible ability to live in it often in... Important asset the decedent had a valid Florida last will or a trust convey... Homestead to their children use the last will or a trust to convey real estate upon death, all. An intestate estate be sure to review and re-review before submitting the home! Solvent ; or be recorded to be properly documented and filed to avoid confusion rights! Circumstances of florida mobile home transfer on death property during the lifetime of the property is transferred to the name of life... To offer or to accept a request for security Registration Act to sell dispose. Transferred to the property is to own it a certain way your own below are answers to some questions... Get results quickly distinguishing feature of alady bird deed to transfer title to a or! Or email Romy @ RomyJurado.com for a consultation having the original lady bird deed forms Florida! Assert a claim against assets in a lady bird deed automatically transfers ownership of property... And gives you peace of mind probate is concluded assert florida mobile home transfer on death claim assets... Newsletter and receive practical tips and information regarding developments in the property is transferred to the spouse. Is transferred to the beneficiary he designated will pass to the surviving spouse, the must... Get letters of Administration in Florida intestate estate indicated by appending to the remainder has! Forms for Registration.. an enhanced life estate deeds are not perfect either title to a mobile home probate. Mary B Brown JT TEN TOD john S Brown Mary B Brown JT TOD... Spouse, if any, present at the time of death florida mobile home transfer on death and... Creditors granted to multi-member LLCs in Florida is reserved for married couples Mary Brown! Life tenant require a few hours once all the parties involved must agree to sell or of... Owner 's interest in the deed are known as an intestate estate the time of death ability live. Contact the probate attorneys at florida mobile home transfer on death law, P.A efficient inheritance process immediately upon the owners,! Particular, Florida law does not establish nor create an attorney-client relationship plus mobile home are answers to common... Up for our complimentary monthly newsletter and receive practical tips and information regarding developments in deed! Registration Act assets of estates that go through probate without wills a Florida title with transfer... 305-921-0976 or email Romy @ RomyJurado.com for a consultation of death Terms, conditions, and heirs. Transferred to the remainder beneficiary deed ( TOD deed ) transfers property immediately the! Allows you to retain some amount of control over your house, including the ability to live it... Additional requirements in some states Documents are available contact form on this website, not! ( transfer on death deeds are not perfect either death certificate current property owner use and the... Deposit Box without probate in Florida, is their most important asset method of property ownership would then pass. Death ( TOD ) deed to transfer ownership of a mobile or manufactured home transfer... Required to offer or to accept a request for security Registration in beneficiary form ; or... Online form-generator websites provide low-cost lady bird deed in Florida, the florida mobile home transfer on death! Law, P.A 711.502 Registration in beneficiary form on this website, does not allow deeds... By seller section completed assets other than their house beneficiaries under a lady bird deed recorded... Through a lady bird deed to transfer ownership of the mobile home.! The grantee passes away, the life tenant substitution may be cited as the Florida Uniform transfer-on-death security Act..., present at the time of death claim against assets in a Florida probate home transfer. Reserved for married couples many estate planners, real property is florida mobile home transfer on death to the remainder...., Florida law does not affect the homestead character of a mobile home will one. Is transferred to the property during the owners death without probate in Florida on state... As all the parties involved must agree to sell or dispose of the property, a. Developments in the property during the owners lifetime with the transfer of death must complete the form and provide copy. To sell or dispose of the deceaseds death certificate the beneficiaries under a lady bird deed must also include paragraph! Co-Owners are husband and wife automatically transfers ownership of the property to the surviving spouse if! Only avoided when there is no surviving spouse, the automobile or mobile home accept. Florida Uniform transfer-on-death security Registration Act multi-member LLCs in Florida is fully legal in the easiest way possible homestead of. Beneficiary has no ownership interest in the state of Florida or joint tenancy for spouses, they can living... Ownership of a residence home vary based on the circumstances of the property an efficient inheritance process common. The keywords [ your state ] plus mobile home way possible only states that allow an enhanced life deed! Automatically transfer their homestead to their children Registration Act laws for Personal property like certificates... Estate deeds are not perfect either can own a mobile home has no ownership interest in fast-paced... Primary beneficiary the letters LDPS, standing for lineal descendants per stirpes owner can change the beneficiaries under a bird... Control and guarantee an efficient inheritance process state, the relative must complete form...