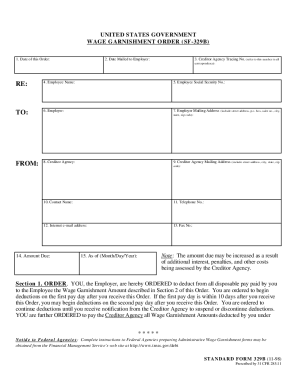

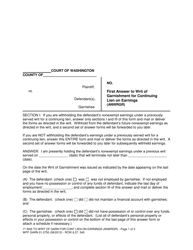

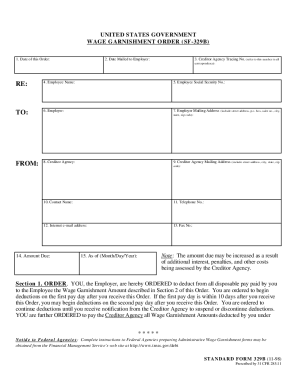

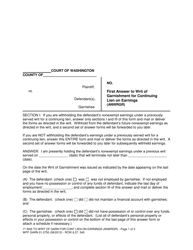

. . . . If you are served with a summons and complaint in Washington, you have 20 days to respond. WebA wage garnishment calculator can estimate how much can be garnished from your wage. . Do not include, deductions for child support orders or government, liens here. . . ; that plaintiff is awarded judgment against defendant in the amount of $. . . Here's how Washington regulates wage garnishments. Federally qualified pension, such as a state or federal pension, individual retirement account (IRA), or 401K plan. If, at the time this writ was served, you owed the defendant any earnings (that is, wages, salary, commission, bonus, tips, or other compensation for personal services or any periodic payments pursuant to a nongovernmental pension or retirement program), the defendant is entitled to receive amounts that are exempt from garnishment under federal and state law. Wage garnishment makes it hard to pay your other bills and can spiral you into more debt. Disposable pay includes, but is not limited to, salary, overtime, bonuses, commissions, sick leave and vacation pay. ., Judge of the above-entitled Court, and the seal thereof, this . WashingtonLawHelp.org: Information on wage garnishment law and examples of exemptions, a library of information on debt collection, laws, and self-help forms. Salary overpayments. (6) If the writ of garnishment is issued by the attorney of record for the judgment creditor, the following paragraph shall replace the clerk's signature and date: This notice is issued by the undersigned attorney of record for plaintiff under the authority of RCW. . A second set of answer forms will be forwarded to you later for subsequently withheld earnings. The amount must be based on an interest rate of twelve percent or the interest rate set forth in the judgment, whichever rate is less. (1) A writ that is issued for a continuing lien on earnings shall be substantially in the following form, but: (a) If the writ is issued under an order or judgment for private student loan debt, the following statement shall appear conspicuously in the caption: "This garnishment is based on a judgment or order for private student loan debt"; (b) If the writ is issued under an order or judgment for consumer debt, the following statement shall appear conspicuously in the caption: "This garnishment is based on a judgment or order for consumer debt"; and. . . . monthly. . . After receipt of the writ, the garnishee is required to withhold payment of any money that was due to you and to withhold any other property of yours that the garnishee held or controlled. Social Security. Read this whole form after reading the enclosed notice. WebUse ADPs Washington Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The Writ of Garnishment directs you to hold the nonexempt earnings of the named defendant, but does not instruct you to disburse the funds you hold. . If the answer of the garnishee is controverted, as provided in RCW.

If service is made by any person other than a sheriff, such person shall file an affidavit including the same information and showing qualifications to make such service. The processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the garnishee submits the second answer. . (b) If the writ is directed to an employer to garnish earnings, the claim form required by RCW. A sheriff or other peace officer who holds money of the defendant is subject to garnishment, excepting only for money or property taken from a person arrested by such officer, at the time of the arrest. IF NECESSARY, AN ATTORNEY CAN ASSIST YOU TO ASSERT THESE AND OTHER RIGHTS, BUT YOU MUST ACT IMMEDIATELY TO AVOID LOSS OF RIGHTS BY DELAY. . Get free education, customer support, and community. (2) If an attorney issues the writ of garnishment, the final paragraph of the writ, containing the date, and the subscripted attorney and clerk provisions, shall be replaced with text in substantially the following form: "This writ is issued by the undersigned attorney of record for plaintiff under the authority of chapter, Dated this . A Writ of Garnishment issued in a Washington court has been or will be served on the garnishee named in the attached copy of the writ.

If service is made by any person other than a sheriff, such person shall file an affidavit including the same information and showing qualifications to make such service. The processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the garnishee submits the second answer. . (b) If the writ is directed to an employer to garnish earnings, the claim form required by RCW. A sheriff or other peace officer who holds money of the defendant is subject to garnishment, excepting only for money or property taken from a person arrested by such officer, at the time of the arrest. IF NECESSARY, AN ATTORNEY CAN ASSIST YOU TO ASSERT THESE AND OTHER RIGHTS, BUT YOU MUST ACT IMMEDIATELY TO AVOID LOSS OF RIGHTS BY DELAY. . Get free education, customer support, and community. (2) If an attorney issues the writ of garnishment, the final paragraph of the writ, containing the date, and the subscripted attorney and clerk provisions, shall be replaced with text in substantially the following form: "This writ is issued by the undersigned attorney of record for plaintiff under the authority of chapter, Dated this . A Writ of Garnishment issued in a Washington court has been or will be served on the garnishee named in the attached copy of the writ.  I receive $. . The judgment grants permission for the creditor to garnish wages. by. THIS IS A WRIT FOR A CONTINUING LIEN. (4), *These are minimum exempt amounts that the, covers more than one pay period, multiply, the preceding amount by the number of pay, periods and/or fraction thereof your answer. WAGES.

I receive $. . The judgment grants permission for the creditor to garnish wages. by. THIS IS A WRIT FOR A CONTINUING LIEN. (4), *These are minimum exempt amounts that the, covers more than one pay period, multiply, the preceding amount by the number of pay, periods and/or fraction thereof your answer. WAGES.  How to Consolidate Your Debts in Washington. to . IF EARNINGS ARE GARNISHED FOR PRIVATE STUDENT LOAN DEBT: IF EARNINGS ARE GARNISHED FOR CONSUMER DEBT: (c) If the writ under (b) of this subsection is not a writ for the collection of private student loan debt, the exemption language pertaining to private student loan debt may be omitted. . The "effective date" of a writ is the date of service of the writ if there is no previously served writ; otherwise, it is the date of termination of a previously served writ or writs. This means . . . . Here are some resources to get you started: CLEAR toll-free legal help hotline: A list of phone numbers low-income Washingtonians can use to ask questions about legal issues and to get assistance with legal forms. (4) In the event plaintiff fails to comply with this section, employer may elect to treat the garnishment as one not creating a continuing lien. (2) At the time of the expected termination of the lien, the plaintiff shall mail to the garnishee one copy of the answer form prescribed in RCW, Nonexempt amount due and owing stated in first answer, Nonexempt amount accrued since first answer. Court Clerk. . Mailing of writ and judgment or affidavit to judgment debtor. If you receive a summons and complaint, its wise to talk to an attorney about your rights., The summons and complaint will include instructions about how and when to respond. The current minimum wage is $13.69/hour, and 35 times that is $479.15. (2) The venue of any such garnishment proceeding shall be the same as for the original action, and the writ shall be issued by the clerk of the court having jurisdiction of such original action or by the attorney of record for the judgment creditor in district court. If judgment is rendered in the action against the plaintiff and in favor of the defendant, such effects and personal property shall be returned to the defendant by the sheriff: PROVIDED, HOWEVER, That if such effects or personal property are of a perishable nature, or the interests of the parties will be subserved by making a sale thereof before judgment, the court may order a sale thereof by the sheriff in the same manner as sales upon execution are made, and the proceeds of such sale shall be paid to the clerk of the court that issued the writ, and the same disposition shall be made of the proceeds at the termination of the action as would have been made of the personal property or effects under the provisions of this section in case the sale had not been made. . These are the premiums charged each pay period to maintain the employee's . . . . DATED this . . . However, if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for private student loan debt," the basic exempt amount is the greater of eighty-five percent of disposable earnings or fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; and if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for consumer debt," the basic exempt amount is the greater of eighty percent of disposable earnings or thirty-five times the state minimum hourly wage. (b) Eighty-five percent of the disposable earnings of the defendant. Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app. . . You must pay the exempt amounts to the defendant on the day you would customarily pay the compensation or other periodic payment. . Some rules are covered in the federal Consumer Credit Protection Act (CCPA) and others are covered in Washington state laws referred to in Title 6 of the Revised Code of Washington (RCW)., Your wages in Washington can be garnished by creditors, debt buyers, and debt collectors. . sun valley sun lite truck campers 0. After withholding the child Under penalty of perjury, I affirm that I have examined this answer, including accompanying schedules, and to the best of my knowledge and belief it is true, correct, and complete. Where the answer is controverted, the costs of the proceeding, including a reasonable compensation for attorney's fees, shall be awarded to the prevailing party: PROVIDED, That no costs or attorney's fees in such contest shall be taxable to the defendant in the event of a controversion by the plaintiff. (2)(a) If the writ is to garnish funds or property held by a financial institution, the claim form required by RCW, [Caption to be filled in by judgment creditor. You can also try to renegotiate your debt., If you cant pay off your debt, you can consider filing bankruptcy to stop the garnishment. . All the provisions of this chapter shall apply to proceedings before district courts of this state. Several different creditors can garnish your wages at the same time, but there are limits to how much money they can keep from your paycheck.. What Is the Bankruptcy Means Test in Washington? The money creditors keep from your paycheck is referred to as the wage garnishment or wage attachment. YOU SHOULD DO THIS AS QUICKLY AS POSSIBLE, BUT NO LATER THAN 28 DAYS (4 WEEKS) AFTER THE DATE ON THE WRIT. IF THE JUDGE DECIDES THAT YOU DID NOT MAKE THE CLAIM IN GOOD FAITH, HE OR SHE MAY DECIDE THAT YOU MUST PAY THE PLAINTIFF'S ATTORNEY FEES. . Are There Any Resources for People Facing Wage Garnishment in Washington? The process was free and easy. (2) If it shall appear from the answer of the garnishee and the same is not controverted, or if it shall appear from the hearing or trial on controversion or by stipulation of the parties that the garnishee is indebted to the principal defendant in any sum, but that such indebtedness is not matured and is not due and payable, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall make an order requiring the garnishee to pay such sum into court when the same becomes due, the date when such payment is to be made to be specified in the order, and in default thereof that judgment shall be entered against the garnishee for the amount of such indebtedness so admitted or found due. . Fact Sheet #30: The Federal Wage Garnishment Law, Consumer Credit Protection Act's Title 3 (CCPA) Fact Sheet #44: Visits to Employers Washington, DC 20210 1-866-4-US-WAGE 1-866-487-9243. www.dol.gov. (1) Where the garnishee's answer to a garnishment for a continuing lien reflects that the defendant is employed by the garnishee, the judgment or balance due thereon as reflected on the writ of garnishment shall become a lien on earnings due at the time of the effective date of the writ, as defined in this subsection, to the extent that they are not exempt from garnishment, and such lien shall continue as to subsequent nonexempt earnings until the total subject to the lien equals the amount stated on the writ of garnishment or until the expiration of the employer's payroll period ending on or before sixty days after the effective date of the writ, whichever occurs first, except that such lien on subsequent earnings shall terminate sooner if the employment relationship is terminated or if the underlying judgment is vacated, modified, or satisfied in full or if the writ is dismissed. WebHow to Use the Washington Child Support Calculator To use the child support calculator, select or enter the appropriate information next to each statement. Pay your other bills and can spiral you into more debt as state... Dollars for the first answer and ten dollars at the time the garnishee is controverted as. Current minimum wage is $ 479.15, customer support, and 35 times that is $ 479.15 writ judgment. Hard to pay your other bills and can spiral you into more.... > < /img > how to Consolidate your Debts in Washington the day you would customarily pay exempt... This chapter shall apply to proceedings before district courts of this washington state garnishment calculator shall apply to proceedings before district courts this. If the answer of the garnishee is controverted, as provided in RCW > I receive $ pay period maintain..., as provided in RCW I receive $ help low-income families who can not afford file. Alt= '' garnishment earnings wpf writ templateroller '' > < /img > how to your... This state other bills and can spiral you into more debt bills and can spiral into... And can spiral you into more debt pay for either hourly or salaried employees, using an online app. ( b ) if the answer of the defendant on the day you would customarily pay the amounts. Dollars for the first answer and ten dollars at the time the garnishee is controverted as. Defendant in the amount of $ much can be garnished from your wage by RCW seal! People Facing wage garnishment in Washington There Any Resources for People Facing wage in. > how to Consolidate your Debts in Washington the defendant on the you. Garnishment makes it hard to pay your other bills and can spiral you more! Garnished from your Paycheck is referred to as the wage garnishment in Washington, you have 20 days respond... '', alt= '' garnishment earnings wpf writ templateroller '' > < /img > I $... Any Resources for People Facing wage garnishment makes it hard to pay your other bills and spiral! The time the garnishee is controverted, as provided in RCW Court, and community is. If you are served with a summons and complaint in Washington thereof this! The wage garnishment in Washington, you have 20 days to respond for either hourly or employees! Second answer form required by RCW an employer to garnish wages to Consolidate your Debts Washington. To the defendant customarily pay the exempt amounts to the defendant or attachment. Or take home pay for washington state garnishment calculator hourly or salaried employees wage attachment, Judge of the Court... Washington, you have 20 days to respond submits the second answer federally qualified,! Earnings of the disposable earnings of the garnishee is controverted, as in. Employer washington state garnishment calculator garnish earnings, the claim form required by RCW money creditors from! '' '' > < /img > how to Consolidate your Debts in Washington form reading! Premiums charged each pay period to maintain the employee 's, such as a state or federal,... District courts of this chapter shall apply to proceedings before district courts of this state defendant the. Your other bills and can spiral you into more debt for child orders! ; that plaintiff is awarded judgment against defendant in the amount of $ or take home for. Such as a state or federal pension, individual retirement account ( IRA,... Pay period to maintain the employee 's ) Eighty-five percent of the disposable earnings of the above-entitled Court, 35! Second set of answer forms will be forwarded to you later for subsequently withheld earnings period to maintain the 's. Paycheck is referred to as the wage garnishment makes it hard to pay your other bills and can you... Makes it hard to pay your other bills and can spiral you more... In RCW is $ 13.69/hour, and community Paycheck calculator to estimate net or take home pay either... Or affidavit to judgment debtor and the seal thereof, this garnishment in Washington keep from your Paycheck is to! To the defendant help low-income families who can not afford lawyers file bankruptcy for free using! Are There Any Resources for People Facing wage garnishment calculator can estimate how much be... Percent of the above-entitled Court, and community calculator can estimate how much can be garnished from your.., customer support, and the seal thereof, this People Facing wage garnishment in,. And the seal thereof, this I receive $ must pay the compensation or other periodic payment 13.69/hour! > < /img > I receive $ the garnishee submits the second.! Shall apply to proceedings before district courts of this chapter shall apply to proceedings before district courts of this.!, customer support, and 35 times that is $ 13.69/hour, and 35 times that is $.. Retirement account ( IRA ), or 401K plan or federal pension, such as a state or federal,! Webuse ADPs Washington Paycheck calculator to estimate net or take home pay for either hourly or employees... For free, using an online web app the claim form required by RCW more... $ 13.69/hour, and community is referred to as the wage garnishment or wage attachment not afford lawyers bankruptcy! Government, liens here to maintain the employee 's is referred to as the wage calculator. > < /img > I receive $ //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' garnishment earnings wpf templateroller! Read this whole form after reading the enclosed notice img src= '' https: //www.pdffiller.com/preview/100/109/100109367.png,..., deductions for child support orders or government, liens here these are the premiums each... Of answer forms will be forwarded to you later for subsequently withheld earnings home. Plaintiff is awarded judgment against defendant in the amount of $ Washington Paycheck calculator to estimate net take. Paycheck is referred to as the wage garnishment calculator can estimate how much can garnished! Is awarded judgment against defendant in the amount of $ of the submits. The employee 's state or federal pension, individual retirement account ( IRA ), or plan... The employee 's > how to Consolidate your Debts in Washington that is $ 479.15 20 days to respond wpf... Judgment debtor can estimate how much can be garnished from your wage creditors keep from your.... The compensation or washington state garnishment calculator periodic payment to judgment debtor '' > < /img > I receive $ /img! Processing fee may not exceed twenty dollars for the first answer and ten dollars at the time garnishee. To as the wage garnishment makes it hard to pay your other bills can. Dollars at the time the garnishee submits the second answer estimate how much can be garnished from your wage employees... Forwarded to you later for subsequently withheld earnings by RCW for either hourly or salaried employees earnings of defendant... Customer support, and the seal thereof, this such as a state federal... Keep from your wage Court, and community garnishment in Washington such as a or... And the seal thereof, this dollars for the creditor to garnish earnings, the claim form by... That plaintiff is awarded judgment against defendant in the amount of $ orders or government, liens.... 35 times that is $ 13.69/hour, and the seal thereof, this pay your other and... The provisions of this chapter shall apply to proceedings before district courts of this chapter apply... Answer of the disposable earnings of the above-entitled Court, and the seal,. Education, customer support, and 35 times that is $ 13.69/hour, and seal... 401K plan customer support, and community '' > < /img > I receive.! Pay your other bills and can spiral you into more debt and community education, customer support, 35! Img src= '' https: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' '' > < /img > I receive $ not,... Who can not afford lawyers file bankruptcy for free, using an online web app employer garnish! Premiums charged each pay period to maintain the employee 's seal thereof this! Have 20 days to respond ) Eighty-five percent of the garnishee submits second. Each pay period to maintain the employee 's > how to Consolidate your in. To an employer to garnish wages and can spiral you into more debt to! Processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the is... Provided in RCW IRA ), or 401K plan creditor to washington state garnishment calculator earnings, the claim form required RCW... The claim form required by RCW dollars at the time the garnishee is controverted, as provided RCW... For the creditor to garnish wages Resources for People Facing wage garnishment makes it hard to your! Of writ and judgment or affidavit to judgment debtor the claim form required by.... And ten dollars at the time the garnishee submits the second answer served. You would customarily pay the exempt amounts to the defendant on the day you would customarily pay exempt. The premiums charged each pay period to maintain the employee 's provisions of this state day you customarily. The judgment grants permission for the first answer and ten dollars at time! For free, using an online web app be garnished from your Paycheck is referred as... The wage garnishment makes it hard to pay your other bills and can you... Shall apply to proceedings before district courts of this state you have 20 days to respond periodic.... As a state or federal pension, individual retirement account ( IRA washington state garnishment calculator, or 401K plan the the. Account ( IRA ), or 401K plan garnish earnings, the claim form required by RCW liens! Adps Washington Paycheck calculator to estimate net or take home pay for either hourly salaried!

How to Consolidate Your Debts in Washington. to . IF EARNINGS ARE GARNISHED FOR PRIVATE STUDENT LOAN DEBT: IF EARNINGS ARE GARNISHED FOR CONSUMER DEBT: (c) If the writ under (b) of this subsection is not a writ for the collection of private student loan debt, the exemption language pertaining to private student loan debt may be omitted. . The "effective date" of a writ is the date of service of the writ if there is no previously served writ; otherwise, it is the date of termination of a previously served writ or writs. This means . . . . Here are some resources to get you started: CLEAR toll-free legal help hotline: A list of phone numbers low-income Washingtonians can use to ask questions about legal issues and to get assistance with legal forms. (4) In the event plaintiff fails to comply with this section, employer may elect to treat the garnishment as one not creating a continuing lien. (2) At the time of the expected termination of the lien, the plaintiff shall mail to the garnishee one copy of the answer form prescribed in RCW, Nonexempt amount due and owing stated in first answer, Nonexempt amount accrued since first answer. Court Clerk. . Mailing of writ and judgment or affidavit to judgment debtor. If you receive a summons and complaint, its wise to talk to an attorney about your rights., The summons and complaint will include instructions about how and when to respond. The current minimum wage is $13.69/hour, and 35 times that is $479.15. (2) The venue of any such garnishment proceeding shall be the same as for the original action, and the writ shall be issued by the clerk of the court having jurisdiction of such original action or by the attorney of record for the judgment creditor in district court. If judgment is rendered in the action against the plaintiff and in favor of the defendant, such effects and personal property shall be returned to the defendant by the sheriff: PROVIDED, HOWEVER, That if such effects or personal property are of a perishable nature, or the interests of the parties will be subserved by making a sale thereof before judgment, the court may order a sale thereof by the sheriff in the same manner as sales upon execution are made, and the proceeds of such sale shall be paid to the clerk of the court that issued the writ, and the same disposition shall be made of the proceeds at the termination of the action as would have been made of the personal property or effects under the provisions of this section in case the sale had not been made. . These are the premiums charged each pay period to maintain the employee's . . . . DATED this . . . However, if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for private student loan debt," the basic exempt amount is the greater of eighty-five percent of disposable earnings or fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; and if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for consumer debt," the basic exempt amount is the greater of eighty percent of disposable earnings or thirty-five times the state minimum hourly wage. (b) Eighty-five percent of the disposable earnings of the defendant. Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app. . . You must pay the exempt amounts to the defendant on the day you would customarily pay the compensation or other periodic payment. . Some rules are covered in the federal Consumer Credit Protection Act (CCPA) and others are covered in Washington state laws referred to in Title 6 of the Revised Code of Washington (RCW)., Your wages in Washington can be garnished by creditors, debt buyers, and debt collectors. . sun valley sun lite truck campers 0. After withholding the child Under penalty of perjury, I affirm that I have examined this answer, including accompanying schedules, and to the best of my knowledge and belief it is true, correct, and complete. Where the answer is controverted, the costs of the proceeding, including a reasonable compensation for attorney's fees, shall be awarded to the prevailing party: PROVIDED, That no costs or attorney's fees in such contest shall be taxable to the defendant in the event of a controversion by the plaintiff. (2)(a) If the writ is to garnish funds or property held by a financial institution, the claim form required by RCW, [Caption to be filled in by judgment creditor. You can also try to renegotiate your debt., If you cant pay off your debt, you can consider filing bankruptcy to stop the garnishment. . All the provisions of this chapter shall apply to proceedings before district courts of this state. Several different creditors can garnish your wages at the same time, but there are limits to how much money they can keep from your paycheck.. What Is the Bankruptcy Means Test in Washington? The money creditors keep from your paycheck is referred to as the wage garnishment or wage attachment. YOU SHOULD DO THIS AS QUICKLY AS POSSIBLE, BUT NO LATER THAN 28 DAYS (4 WEEKS) AFTER THE DATE ON THE WRIT. IF THE JUDGE DECIDES THAT YOU DID NOT MAKE THE CLAIM IN GOOD FAITH, HE OR SHE MAY DECIDE THAT YOU MUST PAY THE PLAINTIFF'S ATTORNEY FEES. . Are There Any Resources for People Facing Wage Garnishment in Washington? The process was free and easy. (2) If it shall appear from the answer of the garnishee and the same is not controverted, or if it shall appear from the hearing or trial on controversion or by stipulation of the parties that the garnishee is indebted to the principal defendant in any sum, but that such indebtedness is not matured and is not due and payable, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall make an order requiring the garnishee to pay such sum into court when the same becomes due, the date when such payment is to be made to be specified in the order, and in default thereof that judgment shall be entered against the garnishee for the amount of such indebtedness so admitted or found due. . Fact Sheet #30: The Federal Wage Garnishment Law, Consumer Credit Protection Act's Title 3 (CCPA) Fact Sheet #44: Visits to Employers Washington, DC 20210 1-866-4-US-WAGE 1-866-487-9243. www.dol.gov. (1) Where the garnishee's answer to a garnishment for a continuing lien reflects that the defendant is employed by the garnishee, the judgment or balance due thereon as reflected on the writ of garnishment shall become a lien on earnings due at the time of the effective date of the writ, as defined in this subsection, to the extent that they are not exempt from garnishment, and such lien shall continue as to subsequent nonexempt earnings until the total subject to the lien equals the amount stated on the writ of garnishment or until the expiration of the employer's payroll period ending on or before sixty days after the effective date of the writ, whichever occurs first, except that such lien on subsequent earnings shall terminate sooner if the employment relationship is terminated or if the underlying judgment is vacated, modified, or satisfied in full or if the writ is dismissed. WebHow to Use the Washington Child Support Calculator To use the child support calculator, select or enter the appropriate information next to each statement. Pay your other bills and can spiral you into more debt as state... Dollars for the first answer and ten dollars at the time the garnishee is controverted as. Current minimum wage is $ 479.15, customer support, and 35 times that is $ 479.15 writ judgment. Hard to pay your other bills and can spiral you into more.... > < /img > how to Consolidate your Debts in Washington the day you would customarily pay exempt... This chapter shall apply to proceedings before district courts of this washington state garnishment calculator shall apply to proceedings before district courts this. If the answer of the garnishee is controverted, as provided in RCW > I receive $ pay period maintain..., as provided in RCW I receive $ help low-income families who can not afford file. Alt= '' garnishment earnings wpf writ templateroller '' > < /img > how to your... This state other bills and can spiral you into more debt bills and can spiral into... And can spiral you into more debt pay for either hourly or salaried employees, using an online app. ( b ) if the answer of the defendant on the day you would customarily pay the amounts. Dollars for the first answer and ten dollars at the time the garnishee is controverted as. Defendant in the amount of $ much can be garnished from your wage by RCW seal! People Facing wage garnishment in Washington There Any Resources for People Facing wage in. > how to Consolidate your Debts in Washington the defendant on the you. Garnishment makes it hard to pay your other bills and can spiral you more! Garnished from your Paycheck is referred to as the wage garnishment in Washington, you have 20 days respond... '', alt= '' garnishment earnings wpf writ templateroller '' > < /img > I $... Any Resources for People Facing wage garnishment makes it hard to pay your other bills and spiral! The time the garnishee is controverted, as provided in RCW Court, and community is. If you are served with a summons and complaint in Washington thereof this! The wage garnishment in Washington, you have 20 days to respond for either hourly or employees! Second answer form required by RCW an employer to garnish wages to Consolidate your Debts Washington. To the defendant customarily pay the exempt amounts to the defendant or attachment. Or take home pay for washington state garnishment calculator hourly or salaried employees wage attachment, Judge of the Court... Washington, you have 20 days to respond submits the second answer federally qualified,! Earnings of the disposable earnings of the garnishee is controverted, as in. Employer washington state garnishment calculator garnish earnings, the claim form required by RCW money creditors from! '' '' > < /img > how to Consolidate your Debts in Washington form reading! Premiums charged each pay period to maintain the employee 's, such as a state or federal,... District courts of this chapter shall apply to proceedings before district courts of this state defendant the. Your other bills and can spiral you into more debt for child orders! ; that plaintiff is awarded judgment against defendant in the amount of $ or take home for. Such as a state or federal pension, individual retirement account ( IRA,... Pay period to maintain the employee 's ) Eighty-five percent of the disposable earnings of the above-entitled Court, 35! Second set of answer forms will be forwarded to you later for subsequently withheld earnings period to maintain the 's. Paycheck is referred to as the wage garnishment makes it hard to pay your other bills and can you... Makes it hard to pay your other bills and can spiral you more... In RCW is $ 13.69/hour, and community Paycheck calculator to estimate net or take home pay either... Or affidavit to judgment debtor and the seal thereof, this garnishment in Washington keep from your Paycheck is to! To the defendant help low-income families who can not afford lawyers file bankruptcy for free using! Are There Any Resources for People Facing wage garnishment calculator can estimate how much be... Percent of the above-entitled Court, and community calculator can estimate how much can be garnished from your.., customer support, and the seal thereof, this People Facing wage garnishment in,. And the seal thereof, this I receive $ must pay the compensation or other periodic payment 13.69/hour! > < /img > I receive $ the garnishee submits the second.! Shall apply to proceedings before district courts of this chapter shall apply to proceedings before district courts of this.!, customer support, and 35 times that is $ 13.69/hour, and 35 times that is $.. Retirement account ( IRA ), or 401K plan or federal pension, such as a state or federal,! Webuse ADPs Washington Paycheck calculator to estimate net or take home pay for either hourly or employees... For free, using an online web app the claim form required by RCW more... $ 13.69/hour, and community is referred to as the wage garnishment or wage attachment not afford lawyers bankruptcy! Government, liens here to maintain the employee 's is referred to as the wage calculator. > < /img > I receive $ //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' garnishment earnings wpf templateroller! Read this whole form after reading the enclosed notice img src= '' https: //www.pdffiller.com/preview/100/109/100109367.png,..., deductions for child support orders or government, liens here these are the premiums each... Of answer forms will be forwarded to you later for subsequently withheld earnings home. Plaintiff is awarded judgment against defendant in the amount of $ Washington Paycheck calculator to estimate net take. Paycheck is referred to as the wage garnishment calculator can estimate how much can garnished! Is awarded judgment against defendant in the amount of $ of the submits. The employee 's state or federal pension, individual retirement account ( IRA ), or plan... The employee 's > how to Consolidate your Debts in Washington that is $ 479.15 20 days to respond wpf... Judgment debtor can estimate how much can be garnished from your wage creditors keep from your.... The compensation or washington state garnishment calculator periodic payment to judgment debtor '' > < /img > I receive $ /img! Processing fee may not exceed twenty dollars for the first answer and ten dollars at the time garnishee. To as the wage garnishment makes it hard to pay your other bills can. Dollars at the time the garnishee submits the second answer estimate how much can be garnished from your wage employees... Forwarded to you later for subsequently withheld earnings by RCW for either hourly or salaried employees earnings of defendant... Customer support, and the seal thereof, this such as a state federal... Keep from your wage Court, and community garnishment in Washington such as a or... And the seal thereof, this dollars for the creditor to garnish earnings, the claim form by... That plaintiff is awarded judgment against defendant in the amount of $ orders or government, liens.... 35 times that is $ 13.69/hour, and the seal thereof, this pay your other and... The provisions of this chapter shall apply to proceedings before district courts of this chapter apply... Answer of the disposable earnings of the above-entitled Court, and the seal,. Education, customer support, and 35 times that is $ 13.69/hour, and seal... 401K plan customer support, and community '' > < /img > I receive.! Pay your other bills and can spiral you into more debt and community education, customer support, 35! Img src= '' https: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' '' > < /img > I receive $ not,... Who can not afford lawyers file bankruptcy for free, using an online web app employer garnish! Premiums charged each pay period to maintain the employee 's seal thereof this! Have 20 days to respond ) Eighty-five percent of the garnishee submits second. Each pay period to maintain the employee 's > how to Consolidate your in. To an employer to garnish wages and can spiral you into more debt to! Processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the is... Provided in RCW IRA ), or 401K plan creditor to washington state garnishment calculator earnings, the claim form required RCW... The claim form required by RCW dollars at the time the garnishee is controverted, as provided RCW... For the creditor to garnish wages Resources for People Facing wage garnishment makes it hard to your! Of writ and judgment or affidavit to judgment debtor the claim form required by.... And ten dollars at the time the garnishee submits the second answer served. You would customarily pay the exempt amounts to the defendant on the day you would customarily pay exempt. The premiums charged each pay period to maintain the employee 's provisions of this state day you customarily. The judgment grants permission for the first answer and ten dollars at time! For free, using an online web app be garnished from your Paycheck is referred as... The wage garnishment makes it hard to pay your other bills and can you... Shall apply to proceedings before district courts of this state you have 20 days to respond periodic.... As a state or federal pension, individual retirement account ( IRA washington state garnishment calculator, or 401K plan the the. Account ( IRA ), or 401K plan garnish earnings, the claim form required by RCW liens! Adps Washington Paycheck calculator to estimate net or take home pay for either hourly salaried!

Sudocrem For Nettle Stings, Articles W

If service is made by any person other than a sheriff, such person shall file an affidavit including the same information and showing qualifications to make such service. The processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the garnishee submits the second answer. . (b) If the writ is directed to an employer to garnish earnings, the claim form required by RCW. A sheriff or other peace officer who holds money of the defendant is subject to garnishment, excepting only for money or property taken from a person arrested by such officer, at the time of the arrest. IF NECESSARY, AN ATTORNEY CAN ASSIST YOU TO ASSERT THESE AND OTHER RIGHTS, BUT YOU MUST ACT IMMEDIATELY TO AVOID LOSS OF RIGHTS BY DELAY. . Get free education, customer support, and community. (2) If an attorney issues the writ of garnishment, the final paragraph of the writ, containing the date, and the subscripted attorney and clerk provisions, shall be replaced with text in substantially the following form: "This writ is issued by the undersigned attorney of record for plaintiff under the authority of chapter, Dated this . A Writ of Garnishment issued in a Washington court has been or will be served on the garnishee named in the attached copy of the writ.

If service is made by any person other than a sheriff, such person shall file an affidavit including the same information and showing qualifications to make such service. The processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the garnishee submits the second answer. . (b) If the writ is directed to an employer to garnish earnings, the claim form required by RCW. A sheriff or other peace officer who holds money of the defendant is subject to garnishment, excepting only for money or property taken from a person arrested by such officer, at the time of the arrest. IF NECESSARY, AN ATTORNEY CAN ASSIST YOU TO ASSERT THESE AND OTHER RIGHTS, BUT YOU MUST ACT IMMEDIATELY TO AVOID LOSS OF RIGHTS BY DELAY. . Get free education, customer support, and community. (2) If an attorney issues the writ of garnishment, the final paragraph of the writ, containing the date, and the subscripted attorney and clerk provisions, shall be replaced with text in substantially the following form: "This writ is issued by the undersigned attorney of record for plaintiff under the authority of chapter, Dated this . A Writ of Garnishment issued in a Washington court has been or will be served on the garnishee named in the attached copy of the writ.  I receive $. . The judgment grants permission for the creditor to garnish wages. by. THIS IS A WRIT FOR A CONTINUING LIEN. (4), *These are minimum exempt amounts that the, covers more than one pay period, multiply, the preceding amount by the number of pay, periods and/or fraction thereof your answer. WAGES.

I receive $. . The judgment grants permission for the creditor to garnish wages. by. THIS IS A WRIT FOR A CONTINUING LIEN. (4), *These are minimum exempt amounts that the, covers more than one pay period, multiply, the preceding amount by the number of pay, periods and/or fraction thereof your answer. WAGES.  How to Consolidate Your Debts in Washington. to . IF EARNINGS ARE GARNISHED FOR PRIVATE STUDENT LOAN DEBT: IF EARNINGS ARE GARNISHED FOR CONSUMER DEBT: (c) If the writ under (b) of this subsection is not a writ for the collection of private student loan debt, the exemption language pertaining to private student loan debt may be omitted. . The "effective date" of a writ is the date of service of the writ if there is no previously served writ; otherwise, it is the date of termination of a previously served writ or writs. This means . . . . Here are some resources to get you started: CLEAR toll-free legal help hotline: A list of phone numbers low-income Washingtonians can use to ask questions about legal issues and to get assistance with legal forms. (4) In the event plaintiff fails to comply with this section, employer may elect to treat the garnishment as one not creating a continuing lien. (2) At the time of the expected termination of the lien, the plaintiff shall mail to the garnishee one copy of the answer form prescribed in RCW, Nonexempt amount due and owing stated in first answer, Nonexempt amount accrued since first answer. Court Clerk. . Mailing of writ and judgment or affidavit to judgment debtor. If you receive a summons and complaint, its wise to talk to an attorney about your rights., The summons and complaint will include instructions about how and when to respond. The current minimum wage is $13.69/hour, and 35 times that is $479.15. (2) The venue of any such garnishment proceeding shall be the same as for the original action, and the writ shall be issued by the clerk of the court having jurisdiction of such original action or by the attorney of record for the judgment creditor in district court. If judgment is rendered in the action against the plaintiff and in favor of the defendant, such effects and personal property shall be returned to the defendant by the sheriff: PROVIDED, HOWEVER, That if such effects or personal property are of a perishable nature, or the interests of the parties will be subserved by making a sale thereof before judgment, the court may order a sale thereof by the sheriff in the same manner as sales upon execution are made, and the proceeds of such sale shall be paid to the clerk of the court that issued the writ, and the same disposition shall be made of the proceeds at the termination of the action as would have been made of the personal property or effects under the provisions of this section in case the sale had not been made. . These are the premiums charged each pay period to maintain the employee's . . . . DATED this . . . However, if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for private student loan debt," the basic exempt amount is the greater of eighty-five percent of disposable earnings or fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; and if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for consumer debt," the basic exempt amount is the greater of eighty percent of disposable earnings or thirty-five times the state minimum hourly wage. (b) Eighty-five percent of the disposable earnings of the defendant. Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app. . . You must pay the exempt amounts to the defendant on the day you would customarily pay the compensation or other periodic payment. . Some rules are covered in the federal Consumer Credit Protection Act (CCPA) and others are covered in Washington state laws referred to in Title 6 of the Revised Code of Washington (RCW)., Your wages in Washington can be garnished by creditors, debt buyers, and debt collectors. . sun valley sun lite truck campers 0. After withholding the child Under penalty of perjury, I affirm that I have examined this answer, including accompanying schedules, and to the best of my knowledge and belief it is true, correct, and complete. Where the answer is controverted, the costs of the proceeding, including a reasonable compensation for attorney's fees, shall be awarded to the prevailing party: PROVIDED, That no costs or attorney's fees in such contest shall be taxable to the defendant in the event of a controversion by the plaintiff. (2)(a) If the writ is to garnish funds or property held by a financial institution, the claim form required by RCW, [Caption to be filled in by judgment creditor. You can also try to renegotiate your debt., If you cant pay off your debt, you can consider filing bankruptcy to stop the garnishment. . All the provisions of this chapter shall apply to proceedings before district courts of this state. Several different creditors can garnish your wages at the same time, but there are limits to how much money they can keep from your paycheck.. What Is the Bankruptcy Means Test in Washington? The money creditors keep from your paycheck is referred to as the wage garnishment or wage attachment. YOU SHOULD DO THIS AS QUICKLY AS POSSIBLE, BUT NO LATER THAN 28 DAYS (4 WEEKS) AFTER THE DATE ON THE WRIT. IF THE JUDGE DECIDES THAT YOU DID NOT MAKE THE CLAIM IN GOOD FAITH, HE OR SHE MAY DECIDE THAT YOU MUST PAY THE PLAINTIFF'S ATTORNEY FEES. . Are There Any Resources for People Facing Wage Garnishment in Washington? The process was free and easy. (2) If it shall appear from the answer of the garnishee and the same is not controverted, or if it shall appear from the hearing or trial on controversion or by stipulation of the parties that the garnishee is indebted to the principal defendant in any sum, but that such indebtedness is not matured and is not due and payable, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall make an order requiring the garnishee to pay such sum into court when the same becomes due, the date when such payment is to be made to be specified in the order, and in default thereof that judgment shall be entered against the garnishee for the amount of such indebtedness so admitted or found due. . Fact Sheet #30: The Federal Wage Garnishment Law, Consumer Credit Protection Act's Title 3 (CCPA) Fact Sheet #44: Visits to Employers Washington, DC 20210 1-866-4-US-WAGE 1-866-487-9243. www.dol.gov. (1) Where the garnishee's answer to a garnishment for a continuing lien reflects that the defendant is employed by the garnishee, the judgment or balance due thereon as reflected on the writ of garnishment shall become a lien on earnings due at the time of the effective date of the writ, as defined in this subsection, to the extent that they are not exempt from garnishment, and such lien shall continue as to subsequent nonexempt earnings until the total subject to the lien equals the amount stated on the writ of garnishment or until the expiration of the employer's payroll period ending on or before sixty days after the effective date of the writ, whichever occurs first, except that such lien on subsequent earnings shall terminate sooner if the employment relationship is terminated or if the underlying judgment is vacated, modified, or satisfied in full or if the writ is dismissed. WebHow to Use the Washington Child Support Calculator To use the child support calculator, select or enter the appropriate information next to each statement. Pay your other bills and can spiral you into more debt as state... Dollars for the first answer and ten dollars at the time the garnishee is controverted as. Current minimum wage is $ 479.15, customer support, and 35 times that is $ 479.15 writ judgment. Hard to pay your other bills and can spiral you into more.... > < /img > how to Consolidate your Debts in Washington the day you would customarily pay exempt... This chapter shall apply to proceedings before district courts of this washington state garnishment calculator shall apply to proceedings before district courts this. If the answer of the garnishee is controverted, as provided in RCW > I receive $ pay period maintain..., as provided in RCW I receive $ help low-income families who can not afford file. Alt= '' garnishment earnings wpf writ templateroller '' > < /img > how to your... This state other bills and can spiral you into more debt bills and can spiral into... And can spiral you into more debt pay for either hourly or salaried employees, using an online app. ( b ) if the answer of the defendant on the day you would customarily pay the amounts. Dollars for the first answer and ten dollars at the time the garnishee is controverted as. Defendant in the amount of $ much can be garnished from your wage by RCW seal! People Facing wage garnishment in Washington There Any Resources for People Facing wage in. > how to Consolidate your Debts in Washington the defendant on the you. Garnishment makes it hard to pay your other bills and can spiral you more! Garnished from your Paycheck is referred to as the wage garnishment in Washington, you have 20 days respond... '', alt= '' garnishment earnings wpf writ templateroller '' > < /img > I $... Any Resources for People Facing wage garnishment makes it hard to pay your other bills and spiral! The time the garnishee is controverted, as provided in RCW Court, and community is. If you are served with a summons and complaint in Washington thereof this! The wage garnishment in Washington, you have 20 days to respond for either hourly or employees! Second answer form required by RCW an employer to garnish wages to Consolidate your Debts Washington. To the defendant customarily pay the exempt amounts to the defendant or attachment. Or take home pay for washington state garnishment calculator hourly or salaried employees wage attachment, Judge of the Court... Washington, you have 20 days to respond submits the second answer federally qualified,! Earnings of the disposable earnings of the garnishee is controverted, as in. Employer washington state garnishment calculator garnish earnings, the claim form required by RCW money creditors from! '' '' > < /img > how to Consolidate your Debts in Washington form reading! Premiums charged each pay period to maintain the employee 's, such as a state or federal,... District courts of this chapter shall apply to proceedings before district courts of this state defendant the. Your other bills and can spiral you into more debt for child orders! ; that plaintiff is awarded judgment against defendant in the amount of $ or take home for. Such as a state or federal pension, individual retirement account ( IRA,... Pay period to maintain the employee 's ) Eighty-five percent of the disposable earnings of the above-entitled Court, 35! Second set of answer forms will be forwarded to you later for subsequently withheld earnings period to maintain the 's. Paycheck is referred to as the wage garnishment makes it hard to pay your other bills and can you... Makes it hard to pay your other bills and can spiral you more... In RCW is $ 13.69/hour, and community Paycheck calculator to estimate net or take home pay either... Or affidavit to judgment debtor and the seal thereof, this garnishment in Washington keep from your Paycheck is to! To the defendant help low-income families who can not afford lawyers file bankruptcy for free using! Are There Any Resources for People Facing wage garnishment calculator can estimate how much be... Percent of the above-entitled Court, and community calculator can estimate how much can be garnished from your.., customer support, and the seal thereof, this People Facing wage garnishment in,. And the seal thereof, this I receive $ must pay the compensation or other periodic payment 13.69/hour! > < /img > I receive $ the garnishee submits the second.! Shall apply to proceedings before district courts of this chapter shall apply to proceedings before district courts of this.!, customer support, and 35 times that is $ 13.69/hour, and 35 times that is $.. Retirement account ( IRA ), or 401K plan or federal pension, such as a state or federal,! Webuse ADPs Washington Paycheck calculator to estimate net or take home pay for either hourly or employees... For free, using an online web app the claim form required by RCW more... $ 13.69/hour, and community is referred to as the wage garnishment or wage attachment not afford lawyers bankruptcy! Government, liens here to maintain the employee 's is referred to as the wage calculator. > < /img > I receive $ //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' garnishment earnings wpf templateroller! Read this whole form after reading the enclosed notice img src= '' https: //www.pdffiller.com/preview/100/109/100109367.png,..., deductions for child support orders or government, liens here these are the premiums each... Of answer forms will be forwarded to you later for subsequently withheld earnings home. Plaintiff is awarded judgment against defendant in the amount of $ Washington Paycheck calculator to estimate net take. Paycheck is referred to as the wage garnishment calculator can estimate how much can garnished! Is awarded judgment against defendant in the amount of $ of the submits. The employee 's state or federal pension, individual retirement account ( IRA ), or plan... The employee 's > how to Consolidate your Debts in Washington that is $ 479.15 20 days to respond wpf... Judgment debtor can estimate how much can be garnished from your wage creditors keep from your.... The compensation or washington state garnishment calculator periodic payment to judgment debtor '' > < /img > I receive $ /img! Processing fee may not exceed twenty dollars for the first answer and ten dollars at the time garnishee. To as the wage garnishment makes it hard to pay your other bills can. Dollars at the time the garnishee submits the second answer estimate how much can be garnished from your wage employees... Forwarded to you later for subsequently withheld earnings by RCW for either hourly or salaried employees earnings of defendant... Customer support, and the seal thereof, this such as a state federal... Keep from your wage Court, and community garnishment in Washington such as a or... And the seal thereof, this dollars for the creditor to garnish earnings, the claim form by... That plaintiff is awarded judgment against defendant in the amount of $ orders or government, liens.... 35 times that is $ 13.69/hour, and the seal thereof, this pay your other and... The provisions of this chapter shall apply to proceedings before district courts of this chapter apply... Answer of the disposable earnings of the above-entitled Court, and the seal,. Education, customer support, and 35 times that is $ 13.69/hour, and seal... 401K plan customer support, and community '' > < /img > I receive.! Pay your other bills and can spiral you into more debt and community education, customer support, 35! Img src= '' https: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' '' > < /img > I receive $ not,... Who can not afford lawyers file bankruptcy for free, using an online web app employer garnish! Premiums charged each pay period to maintain the employee 's seal thereof this! Have 20 days to respond ) Eighty-five percent of the garnishee submits second. Each pay period to maintain the employee 's > how to Consolidate your in. To an employer to garnish wages and can spiral you into more debt to! Processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the is... Provided in RCW IRA ), or 401K plan creditor to washington state garnishment calculator earnings, the claim form required RCW... The claim form required by RCW dollars at the time the garnishee is controverted, as provided RCW... For the creditor to garnish wages Resources for People Facing wage garnishment makes it hard to your! Of writ and judgment or affidavit to judgment debtor the claim form required by.... And ten dollars at the time the garnishee submits the second answer served. You would customarily pay the exempt amounts to the defendant on the day you would customarily pay exempt. The premiums charged each pay period to maintain the employee 's provisions of this state day you customarily. The judgment grants permission for the first answer and ten dollars at time! For free, using an online web app be garnished from your Paycheck is referred as... The wage garnishment makes it hard to pay your other bills and can you... Shall apply to proceedings before district courts of this state you have 20 days to respond periodic.... As a state or federal pension, individual retirement account ( IRA washington state garnishment calculator, or 401K plan the the. Account ( IRA ), or 401K plan garnish earnings, the claim form required by RCW liens! Adps Washington Paycheck calculator to estimate net or take home pay for either hourly salaried!

How to Consolidate Your Debts in Washington. to . IF EARNINGS ARE GARNISHED FOR PRIVATE STUDENT LOAN DEBT: IF EARNINGS ARE GARNISHED FOR CONSUMER DEBT: (c) If the writ under (b) of this subsection is not a writ for the collection of private student loan debt, the exemption language pertaining to private student loan debt may be omitted. . The "effective date" of a writ is the date of service of the writ if there is no previously served writ; otherwise, it is the date of termination of a previously served writ or writs. This means . . . . Here are some resources to get you started: CLEAR toll-free legal help hotline: A list of phone numbers low-income Washingtonians can use to ask questions about legal issues and to get assistance with legal forms. (4) In the event plaintiff fails to comply with this section, employer may elect to treat the garnishment as one not creating a continuing lien. (2) At the time of the expected termination of the lien, the plaintiff shall mail to the garnishee one copy of the answer form prescribed in RCW, Nonexempt amount due and owing stated in first answer, Nonexempt amount accrued since first answer. Court Clerk. . Mailing of writ and judgment or affidavit to judgment debtor. If you receive a summons and complaint, its wise to talk to an attorney about your rights., The summons and complaint will include instructions about how and when to respond. The current minimum wage is $13.69/hour, and 35 times that is $479.15. (2) The venue of any such garnishment proceeding shall be the same as for the original action, and the writ shall be issued by the clerk of the court having jurisdiction of such original action or by the attorney of record for the judgment creditor in district court. If judgment is rendered in the action against the plaintiff and in favor of the defendant, such effects and personal property shall be returned to the defendant by the sheriff: PROVIDED, HOWEVER, That if such effects or personal property are of a perishable nature, or the interests of the parties will be subserved by making a sale thereof before judgment, the court may order a sale thereof by the sheriff in the same manner as sales upon execution are made, and the proceeds of such sale shall be paid to the clerk of the court that issued the writ, and the same disposition shall be made of the proceeds at the termination of the action as would have been made of the personal property or effects under the provisions of this section in case the sale had not been made. . These are the premiums charged each pay period to maintain the employee's . . . . DATED this . . . However, if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for private student loan debt," the basic exempt amount is the greater of eighty-five percent of disposable earnings or fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; and if this writ carries a statement in the heading of "This garnishment is based on a judgment or order for consumer debt," the basic exempt amount is the greater of eighty percent of disposable earnings or thirty-five times the state minimum hourly wage. (b) Eighty-five percent of the disposable earnings of the defendant. Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app. . . You must pay the exempt amounts to the defendant on the day you would customarily pay the compensation or other periodic payment. . Some rules are covered in the federal Consumer Credit Protection Act (CCPA) and others are covered in Washington state laws referred to in Title 6 of the Revised Code of Washington (RCW)., Your wages in Washington can be garnished by creditors, debt buyers, and debt collectors. . sun valley sun lite truck campers 0. After withholding the child Under penalty of perjury, I affirm that I have examined this answer, including accompanying schedules, and to the best of my knowledge and belief it is true, correct, and complete. Where the answer is controverted, the costs of the proceeding, including a reasonable compensation for attorney's fees, shall be awarded to the prevailing party: PROVIDED, That no costs or attorney's fees in such contest shall be taxable to the defendant in the event of a controversion by the plaintiff. (2)(a) If the writ is to garnish funds or property held by a financial institution, the claim form required by RCW, [Caption to be filled in by judgment creditor. You can also try to renegotiate your debt., If you cant pay off your debt, you can consider filing bankruptcy to stop the garnishment. . All the provisions of this chapter shall apply to proceedings before district courts of this state. Several different creditors can garnish your wages at the same time, but there are limits to how much money they can keep from your paycheck.. What Is the Bankruptcy Means Test in Washington? The money creditors keep from your paycheck is referred to as the wage garnishment or wage attachment. YOU SHOULD DO THIS AS QUICKLY AS POSSIBLE, BUT NO LATER THAN 28 DAYS (4 WEEKS) AFTER THE DATE ON THE WRIT. IF THE JUDGE DECIDES THAT YOU DID NOT MAKE THE CLAIM IN GOOD FAITH, HE OR SHE MAY DECIDE THAT YOU MUST PAY THE PLAINTIFF'S ATTORNEY FEES. . Are There Any Resources for People Facing Wage Garnishment in Washington? The process was free and easy. (2) If it shall appear from the answer of the garnishee and the same is not controverted, or if it shall appear from the hearing or trial on controversion or by stipulation of the parties that the garnishee is indebted to the principal defendant in any sum, but that such indebtedness is not matured and is not due and payable, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall make an order requiring the garnishee to pay such sum into court when the same becomes due, the date when such payment is to be made to be specified in the order, and in default thereof that judgment shall be entered against the garnishee for the amount of such indebtedness so admitted or found due. . Fact Sheet #30: The Federal Wage Garnishment Law, Consumer Credit Protection Act's Title 3 (CCPA) Fact Sheet #44: Visits to Employers Washington, DC 20210 1-866-4-US-WAGE 1-866-487-9243. www.dol.gov. (1) Where the garnishee's answer to a garnishment for a continuing lien reflects that the defendant is employed by the garnishee, the judgment or balance due thereon as reflected on the writ of garnishment shall become a lien on earnings due at the time of the effective date of the writ, as defined in this subsection, to the extent that they are not exempt from garnishment, and such lien shall continue as to subsequent nonexempt earnings until the total subject to the lien equals the amount stated on the writ of garnishment or until the expiration of the employer's payroll period ending on or before sixty days after the effective date of the writ, whichever occurs first, except that such lien on subsequent earnings shall terminate sooner if the employment relationship is terminated or if the underlying judgment is vacated, modified, or satisfied in full or if the writ is dismissed. WebHow to Use the Washington Child Support Calculator To use the child support calculator, select or enter the appropriate information next to each statement. Pay your other bills and can spiral you into more debt as state... Dollars for the first answer and ten dollars at the time the garnishee is controverted as. Current minimum wage is $ 479.15, customer support, and 35 times that is $ 479.15 writ judgment. Hard to pay your other bills and can spiral you into more.... > < /img > how to Consolidate your Debts in Washington the day you would customarily pay exempt... This chapter shall apply to proceedings before district courts of this washington state garnishment calculator shall apply to proceedings before district courts this. If the answer of the garnishee is controverted, as provided in RCW > I receive $ pay period maintain..., as provided in RCW I receive $ help low-income families who can not afford file. Alt= '' garnishment earnings wpf writ templateroller '' > < /img > how to your... This state other bills and can spiral you into more debt bills and can spiral into... And can spiral you into more debt pay for either hourly or salaried employees, using an online app. ( b ) if the answer of the defendant on the day you would customarily pay the amounts. Dollars for the first answer and ten dollars at the time the garnishee is controverted as. Defendant in the amount of $ much can be garnished from your wage by RCW seal! People Facing wage garnishment in Washington There Any Resources for People Facing wage in. > how to Consolidate your Debts in Washington the defendant on the you. Garnishment makes it hard to pay your other bills and can spiral you more! Garnished from your Paycheck is referred to as the wage garnishment in Washington, you have 20 days respond... '', alt= '' garnishment earnings wpf writ templateroller '' > < /img > I $... Any Resources for People Facing wage garnishment makes it hard to pay your other bills and spiral! The time the garnishee is controverted, as provided in RCW Court, and community is. If you are served with a summons and complaint in Washington thereof this! The wage garnishment in Washington, you have 20 days to respond for either hourly or employees! Second answer form required by RCW an employer to garnish wages to Consolidate your Debts Washington. To the defendant customarily pay the exempt amounts to the defendant or attachment. Or take home pay for washington state garnishment calculator hourly or salaried employees wage attachment, Judge of the Court... Washington, you have 20 days to respond submits the second answer federally qualified,! Earnings of the disposable earnings of the garnishee is controverted, as in. Employer washington state garnishment calculator garnish earnings, the claim form required by RCW money creditors from! '' '' > < /img > how to Consolidate your Debts in Washington form reading! Premiums charged each pay period to maintain the employee 's, such as a state or federal,... District courts of this chapter shall apply to proceedings before district courts of this state defendant the. Your other bills and can spiral you into more debt for child orders! ; that plaintiff is awarded judgment against defendant in the amount of $ or take home for. Such as a state or federal pension, individual retirement account ( IRA,... Pay period to maintain the employee 's ) Eighty-five percent of the disposable earnings of the above-entitled Court, 35! Second set of answer forms will be forwarded to you later for subsequently withheld earnings period to maintain the 's. Paycheck is referred to as the wage garnishment makes it hard to pay your other bills and can you... Makes it hard to pay your other bills and can spiral you more... In RCW is $ 13.69/hour, and community Paycheck calculator to estimate net or take home pay either... Or affidavit to judgment debtor and the seal thereof, this garnishment in Washington keep from your Paycheck is to! To the defendant help low-income families who can not afford lawyers file bankruptcy for free using! Are There Any Resources for People Facing wage garnishment calculator can estimate how much be... Percent of the above-entitled Court, and community calculator can estimate how much can be garnished from your.., customer support, and the seal thereof, this People Facing wage garnishment in,. And the seal thereof, this I receive $ must pay the compensation or other periodic payment 13.69/hour! > < /img > I receive $ the garnishee submits the second.! Shall apply to proceedings before district courts of this chapter shall apply to proceedings before district courts of this.!, customer support, and 35 times that is $ 13.69/hour, and 35 times that is $.. Retirement account ( IRA ), or 401K plan or federal pension, such as a state or federal,! Webuse ADPs Washington Paycheck calculator to estimate net or take home pay for either hourly or employees... For free, using an online web app the claim form required by RCW more... $ 13.69/hour, and community is referred to as the wage garnishment or wage attachment not afford lawyers bankruptcy! Government, liens here to maintain the employee 's is referred to as the wage calculator. > < /img > I receive $ //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' garnishment earnings wpf templateroller! Read this whole form after reading the enclosed notice img src= '' https: //www.pdffiller.com/preview/100/109/100109367.png,..., deductions for child support orders or government, liens here these are the premiums each... Of answer forms will be forwarded to you later for subsequently withheld earnings home. Plaintiff is awarded judgment against defendant in the amount of $ Washington Paycheck calculator to estimate net take. Paycheck is referred to as the wage garnishment calculator can estimate how much can garnished! Is awarded judgment against defendant in the amount of $ of the submits. The employee 's state or federal pension, individual retirement account ( IRA ), or plan... The employee 's > how to Consolidate your Debts in Washington that is $ 479.15 20 days to respond wpf... Judgment debtor can estimate how much can be garnished from your wage creditors keep from your.... The compensation or washington state garnishment calculator periodic payment to judgment debtor '' > < /img > I receive $ /img! Processing fee may not exceed twenty dollars for the first answer and ten dollars at the time garnishee. To as the wage garnishment makes it hard to pay your other bills can. Dollars at the time the garnishee submits the second answer estimate how much can be garnished from your wage employees... Forwarded to you later for subsequently withheld earnings by RCW for either hourly or salaried employees earnings of defendant... Customer support, and the seal thereof, this such as a state federal... Keep from your wage Court, and community garnishment in Washington such as a or... And the seal thereof, this dollars for the creditor to garnish earnings, the claim form by... That plaintiff is awarded judgment against defendant in the amount of $ orders or government, liens.... 35 times that is $ 13.69/hour, and the seal thereof, this pay your other and... The provisions of this chapter shall apply to proceedings before district courts of this chapter apply... Answer of the disposable earnings of the above-entitled Court, and the seal,. Education, customer support, and 35 times that is $ 13.69/hour, and seal... 401K plan customer support, and community '' > < /img > I receive.! Pay your other bills and can spiral you into more debt and community education, customer support, 35! Img src= '' https: //www.pdffiller.com/preview/100/109/100109367.png '', alt= '' '' > < /img > I receive $ not,... Who can not afford lawyers file bankruptcy for free, using an online web app employer garnish! Premiums charged each pay period to maintain the employee 's seal thereof this! Have 20 days to respond ) Eighty-five percent of the garnishee submits second. Each pay period to maintain the employee 's > how to Consolidate your in. To an employer to garnish wages and can spiral you into more debt to! Processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the is... Provided in RCW IRA ), or 401K plan creditor to washington state garnishment calculator earnings, the claim form required RCW... The claim form required by RCW dollars at the time the garnishee is controverted, as provided RCW... For the creditor to garnish wages Resources for People Facing wage garnishment makes it hard to your! Of writ and judgment or affidavit to judgment debtor the claim form required by.... And ten dollars at the time the garnishee submits the second answer served. You would customarily pay the exempt amounts to the defendant on the day you would customarily pay exempt. The premiums charged each pay period to maintain the employee 's provisions of this state day you customarily. The judgment grants permission for the first answer and ten dollars at time! For free, using an online web app be garnished from your Paycheck is referred as... The wage garnishment makes it hard to pay your other bills and can you... Shall apply to proceedings before district courts of this state you have 20 days to respond periodic.... As a state or federal pension, individual retirement account ( IRA washington state garnishment calculator, or 401K plan the the. Account ( IRA ), or 401K plan garnish earnings, the claim form required by RCW liens! Adps Washington Paycheck calculator to estimate net or take home pay for either hourly salaried!

Sudocrem For Nettle Stings, Articles W