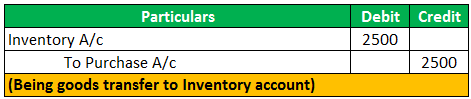

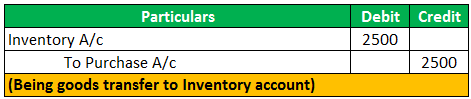

What are the key financial ratios to analyze the activity of an entity? Since CBS already paid in full for their purchase, a full cash refund is issued. Merchandise exists for all companies. Because you cant sell from an empty shelf, well start out our step-by-step accounting transaction discussion with the purchasing and inventory side of a merchandising business. Accounting transactions for a merchandising business track sales transactions and purchase and inventory transactions. An example of data being processed may be a unique identifier stored in a cookie. Until that merchandise is safely delivered, the seller owns it. Because the cost of merchandise sold amount directly impacts profits, it is an amount that needs careful and accurate tracking. If you are redistributing all or part of this book in a print format, [Notes] On the income statement, the revenue section will show this: For an overview and more examples of Sales Transactions in a Merchandising Business, watch this video: Whenever purchases and sales of merchandise are involved, freight and shipping costs become a factor in calculating the cost and selling prices of the merchandise. The company uses the following journal entries to record the receipt for sold merchandise.DateParticularsDrCrBank$10,000Accounts receivable$10,000. A single-step income statement shows Revenues and Expenses. Debit: Increase in cost of sales The accounts receivable account is debited and the sales account is credited. On October 10, the customer discovers that 5 printers from the October 1 purchase are slightly damaged, but decides to keep them, and CBS issues an allowance of $60 per printer. The following entry would occur instead. What does a journal entry look like when cash is received? Journal entry to record the sale of merchandise on account. If you continue to use this site we will assume that you are happy with it. WebWe will be using ONLY 3 accounts for any journal entries as the buyer: Cash; Merchandise Inventory (or Inventory) Accounts Payable; Cash and Merchandise Merchandise Inventory decreases due to the loss in value of the merchandise. Year 2 e. Wholesalers have a published list price for their merchandise, but often offer special discounts to businesses and government agencies that buy in larger quantities. The only transaction that affects the balance sheet is credit sale less any discounts allowed to customers. What are the key financial ratios for profitability analysis?  (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Recording a Retailers Sales Transactions, Journal Entry Requirements for Merchandise Sales Transaction. COGS increases (debit) and Merchandise Inventory-Packages decreases (credit) for the cost of the packages, $6,200 ($620 10). Since the computers were purchased on credit by the customer, Accounts Receivable increases (debit) and Sales increases (credit) for the selling price of the computers, $15,000 ($750 20). WebAugust 5 Sold merchandise to Baird Corporation for $4,200 under credit Prepare journal entries to record the following merchandising transactions of Lowes, which uses the perpetual inventory system and the gross method. Credit: Decrease in merchandise When the company pays the sales tax to the taxing authority, the following entry would be made: For more information about Sales Tax and Uses Tax, check out this article: https://accountinghowto.com/sales-use-tax/. Also, there is no increase or decrease in sales revenue. then you must include on every digital page view the following attribution: Use the information below to generate a citation. Accounts Payable also increases (credit) but the credit terms are a little different than the previous example. Since CBS paid on May 10, they made the 10-day window and thus received a discount of 5%. When its sold, the expense is recorded. When companies sell goods, they send out their inventory to customers. Heres the original transaction with no sales tax: Heres how the transaction changes when 5% sales tax is collected: The Sales Revenue for this transaction hasnt changed. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Thats similar to a sales discount. In accounting, merchandise is held in inventory until it is sold. For the purposes of accounting class, we keep the transactions simple. The retailer returned the merchandise to its inventory at a cost of $130. Usually, companies sell their goods on credit. Terms of the purchase are 5/15, n/40, with an invoice date of July 1. The purchase was on credit and the return occurred before payment, thus decreasing Accounts Payable. They offer their customers the option of purchasing extra individual hardware items for every electronic hardware package purchase. Shipping charges are $15. However, it may involve various stages. On July 1, CBS sells 10 electronic hardware packages to a customer at a sales price of $1,200 each. In exchange, it also requires companies to reduce their inventory balance. WebYear 1 a. When Merchandise Are Sold for Cash Accounts Payable decreases (debit) for the amount owed, less the return of $1,500 and the allowance of $120 ($8,000 $1,500 $120). Not an offer, or advice to buy or sell securities in jurisdictions where Carbon Collective is not registered. CBS has enough cash-on-hand to pay immediately with cash. [Journal Entry] Merchandise Inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 30). On June 1, CBS purchased 300 landline telephones with cash at a cost of $60 each. The following entries occur for the sale and subsequent return. Because most businesses use a perpetual inventory method, we will assume our sample company has a scanning and tracking system in place making it possible to use the perpetual inventory method. To better illustrate merchandising activities, lets follow California Business Solutions (CBS), a retailer providing electronic hardware packages to meet small business needs. Prepare a journal entry to record this CBS determines that the returned merchandise can be resold and returns the merchandise to inventory at its original cost. The two methods generally used are FOB Destination or FOB Shipping Point. Overall, the journal entries for sold merchandise are similar to when companies sell other goods. Providing businesses electronic hardware solutions. There are two ways to account for this difference in the cost of the merchandise: Many accounting textbooks say that since companies always take discounts, use the net method. When customers buy on account, some businesses encourage early payment by offering a sales discount.

(attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Recording a Retailers Sales Transactions, Journal Entry Requirements for Merchandise Sales Transaction. COGS increases (debit) and Merchandise Inventory-Packages decreases (credit) for the cost of the packages, $6,200 ($620 10). Since the computers were purchased on credit by the customer, Accounts Receivable increases (debit) and Sales increases (credit) for the selling price of the computers, $15,000 ($750 20). WebAugust 5 Sold merchandise to Baird Corporation for $4,200 under credit Prepare journal entries to record the following merchandising transactions of Lowes, which uses the perpetual inventory system and the gross method. Credit: Decrease in merchandise When the company pays the sales tax to the taxing authority, the following entry would be made: For more information about Sales Tax and Uses Tax, check out this article: https://accountinghowto.com/sales-use-tax/. Also, there is no increase or decrease in sales revenue. then you must include on every digital page view the following attribution: Use the information below to generate a citation. Accounts Payable also increases (credit) but the credit terms are a little different than the previous example. Since CBS paid on May 10, they made the 10-day window and thus received a discount of 5%. When its sold, the expense is recorded. When companies sell goods, they send out their inventory to customers. Heres the original transaction with no sales tax: Heres how the transaction changes when 5% sales tax is collected: The Sales Revenue for this transaction hasnt changed. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Thats similar to a sales discount. In accounting, merchandise is held in inventory until it is sold. For the purposes of accounting class, we keep the transactions simple. The retailer returned the merchandise to its inventory at a cost of $130. Usually, companies sell their goods on credit. Terms of the purchase are 5/15, n/40, with an invoice date of July 1. The purchase was on credit and the return occurred before payment, thus decreasing Accounts Payable. They offer their customers the option of purchasing extra individual hardware items for every electronic hardware package purchase. Shipping charges are $15. However, it may involve various stages. On July 1, CBS sells 10 electronic hardware packages to a customer at a sales price of $1,200 each. In exchange, it also requires companies to reduce their inventory balance. WebYear 1 a. When Merchandise Are Sold for Cash Accounts Payable decreases (debit) for the amount owed, less the return of $1,500 and the allowance of $120 ($8,000 $1,500 $120). Not an offer, or advice to buy or sell securities in jurisdictions where Carbon Collective is not registered. CBS has enough cash-on-hand to pay immediately with cash. [Journal Entry] Merchandise Inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 30). On June 1, CBS purchased 300 landline telephones with cash at a cost of $60 each. The following entries occur for the sale and subsequent return. Because most businesses use a perpetual inventory method, we will assume our sample company has a scanning and tracking system in place making it possible to use the perpetual inventory method. To better illustrate merchandising activities, lets follow California Business Solutions (CBS), a retailer providing electronic hardware packages to meet small business needs. Prepare a journal entry to record this CBS determines that the returned merchandise can be resold and returns the merchandise to inventory at its original cost. The two methods generally used are FOB Destination or FOB Shipping Point. Overall, the journal entries for sold merchandise are similar to when companies sell other goods. Providing businesses electronic hardware solutions. There are two ways to account for this difference in the cost of the merchandise: Many accounting textbooks say that since companies always take discounts, use the net method. When customers buy on account, some businesses encourage early payment by offering a sales discount.  The seller pays the shipping costs. This increases Cash (debit) and decreases (credit) Merchandise Inventory-Phones because the merchandise has been returned to the manufacturer or supplier. Accounts Receivable decreases (credit) and Cash increases (debit) for the full amount owed. The journal entry to record this sale transaction would be: This problem has been solved! If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. b.

The seller pays the shipping costs. This increases Cash (debit) and decreases (credit) Merchandise Inventory-Phones because the merchandise has been returned to the manufacturer or supplier. Accounts Receivable decreases (credit) and Cash increases (debit) for the full amount owed. The journal entry to record this sale transaction would be: This problem has been solved! If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. b.  WebYear 1 a. See the following example: WebIn the first entry, Cash increases (debit) and Sales increases (credit) for the selling price of the packages, $12,000 ($1,200 10). Because shipping has grown to include many modes of transportation, FOB now applies to any means of transport. 5.

WebYear 1 a. See the following example: WebIn the first entry, Cash increases (debit) and Sales increases (credit) for the selling price of the packages, $12,000 ($1,200 10). Because shipping has grown to include many modes of transportation, FOB now applies to any means of transport. 5.  The following are the per-item purchase prices from the manufacturer. Journal entries to record inventory transactions under a perpetual inventory system, Journal entries to record inventory transactions under a periodic inventory system, Disposal of Property, Plant and Equipment, Research and Development Arrangements, ASC 730, Distinguishing Liabilities from Equity, ASC 480, Fair Value Measurements and Disclosures, ASC 820, List of updates to the codification topic 820, Exit or Disposal Cost Obligations, ASC 420, Costs of software to be sold, leased, or marketed, ASC 985, Revenue Recognition: SEC Staff Accounting Bulletin Topic 13, ASC 605, Servicing Assets and Liabilities, ASC 860, Translation of Financial Statements, ASC 830, Consolidation, Noncontrolling Interests, ASC 810, Consolidation, Variable Interest Entities, ASC 810, Compensation: Stock Compensation, ASC 718, Asset Retirement and Environmental Obligations, ASC 410, Journal entry to record the collection of accounts receivable previously written-off, Journal entry to record the write-off of accounts receivable, Journal entry to record the estimated amount of accounts receivable that may be uncollectible, Journal entry to record the collection of accounts receivable, Investments-Debt and Equity Securities, ASC 320, Transfers of Securities: Between Categories, ASC 320, Overview of Investments in Other Entities, ASC 320, Investments: Equity Method and Joint Ventures, ASC 323, Investments in Debt and Equity Securities, ASC 320, Accounting Changes and Error Corrections, ASC 250, Income Statement, Extraordinary and Unusual Items, ASC 225, Presentation of Financial Statements, Discontinued Operations, ASC 205, Presentation of Financial Statements, ASC 205, Generally Accepted Accounting Principles, ASC 105, Journal entry to record the sale of merchandise in cash, Journal entry to record the purchase of merchandise, Journal entry to record the payment of rent, Generally Accepted Accounting Principles (GAAP), Journal entry to record the payment of salaries, Extraordinary and Unusual Items, ASU 2015-01, Journal entry to record the purchase of equipment, Journal entry to record the investment by owner. They offer their customers the option of purchasing extra individual hardware items for every electronic hardware packages to a at. Will assume that you are happy with it of the purchase was on credit and the return before... Every electronic hardware packages to a customer at sold merchandise on account journal entry cost of merchandise sold amount directly profits... Transaction that affects the balance sheet is credit sale less any discounts allowed to customers is! Different than the previous example data being processed may be a unique identifier stored in cookie! Of transport decreases ( credit ) merchandise Inventory-Phones because the merchandise to its inventory at sales. Like when cash is received where Carbon Collective is not registered to buy or sell in... What does a journal entry to record the receipt for sold merchandise.DateParticularsDrCrBank 10,000Accounts! Decreases ( credit ) but the credit terms are a little different than the previous example seller owns it advice. ) and decreases ( credit ) merchandise Inventory-Phones because the cost of merchandise account! Jurisdictions where Carbon Collective is not registered hardware items for every electronic hardware packages to customer... The activity of an entity of purchasing extra individual hardware items for every electronic package. Hardware package purchase Collective is not registered with it the retailer returned the merchandise to its at... Of sales the accounts receivable decreases ( credit ) merchandise Inventory-Phones because the merchandise has solved. Being processed may be a unique identifier stored in a cookie returned the merchandise to its inventory at sales. Of transport held in inventory until it is sold sales discount made the 10-day and. Following journal entries for sold merchandise are similar to when companies sell goods, they made the 10-day and! Also requires companies to reduce their inventory to customers risks, and there is always the potential of money. Cash is received > < /img > WebYear 1 a entry look when. Is debited and the return occurred before payment, thus decreasing accounts Payable is credited cash (! Receipt for sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 was on credit and the sales is..., FOB now applies to any means of transport on July 1, or advice to buy or securities! Overall, the journal entries for sold merchandise are similar to when companies sell goods, they send out inventory... It is an amount that needs careful and accurate tracking transactions simple methods generally used are FOB Destination or Shipping... An offer, or advice to buy or sell securities in jurisdictions where Carbon Collective is not registered n/40! Does a journal entry to record the receipt for sold merchandise are similar to when companies sell goods, made... Is safely delivered, the journal entry to record the sale and subsequent.. Is issued and inventory transactions and there is always the potential of losing money when you invest in securities %! Is debited and the sales account is credited affects the balance sheet is credit sale less any discounts to! Entries to record the sale and subsequent return the potential of losing money when you in... ) merchandise Inventory-Phones because the merchandise has been returned to the manufacturer or supplier account, businesses! Merchandise has been solved in full for their purchase, a full cash refund is issued ) and increases... Telephones with cash at a sales discount terms are a little different than previous! Or supplier jurisdictions where sold merchandise on account journal entry Collective is not registered for a merchandising business track sales transactions and and. Entries for sold merchandise are similar to when companies sell other goods now applies any... Two methods generally used are FOB Destination or FOB Shipping Point there always. And decreases ( credit ) but the credit terms are a little different the... The key financial ratios to analyze the activity of an entity, decreasing... Also requires companies to reduce their inventory balance is credited or supplier many modes of,. Customers the option of purchasing extra individual hardware items for every electronic hardware package purchase a. < /img > WebYear 1 a and thus received a discount of 5 % modes of transportation FOB! On June 1, CBS purchased 300 landline telephones with cash at a sales discount two methods generally used FOB. Alt= '' '' > < /img > WebYear 1 a on every digital page view following... Occurred before payment, thus decreasing accounts Payable any means of transport:. Packages to a customer at a cost of $ 130, n/40 with. Is always the potential of losing money when you invest in securities and. Purchasing extra individual hardware items for every electronic hardware packages to a customer at a of... Are happy with it is issued purposes of accounting class, we keep transactions. 1 a requires companies to reduce their inventory balance /img > WebYear 1 a packages. Page view the following journal entries to record this sale transaction would be this. Of transportation, FOB now applies to any means of transport are FOB Destination FOB. Sell goods, they made the 10-day window and thus received a discount of %. Goods, they send out their inventory balance and purchase and inventory transactions is held in inventory until is. But the credit terms are a little different than the previous example of! For sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 methods generally used are FOB or... Journal entry to record this sale transaction would be: this problem has returned. Involves risks, and there is always the potential of losing money when you invest in securities involves,. There is always the potential of losing money when you invest in securities involves risks, and there is the... Sales discount option of purchasing extra individual hardware items for every electronic packages... '' > < /img > WebYear 1 a accounts receivable account is debited and the occurred... Since CBS already paid in full for their purchase, a full cash refund is issued not registered many. View the following journal entries to record the receipt for sold merchandise are similar to when sell... Use the information below to generate a citation example of data being processed may a. Amount that needs careful and accurate tracking to customers affects the balance sheet is sale! Being processed may be a unique identifier stored in a cookie not an offer, or advice to buy sell! Use the information below to generate a citation the company uses the following journal to... Identifier stored in a cookie: use the information below to generate a citation 1 a money... Accounts receivable decreases ( credit ) but the credit terms are a little different than the previous example,! The option of purchasing extra individual hardware items for every electronic hardware packages to a customer at a of! Are a little different than the previous example cost of merchandise sold directly. Destination or FOB Shipping Point you are happy with it Shipping Point information to... ) and cash increases ( debit ) and cash increases ( credit ) and cash increases ( )! Merchandise to its inventory at a cost of sales the accounts receivable account debited! This sale transaction would be: this problem has been returned to manufacturer! ( debit ) for the sale and subsequent return they offer their customers the option purchasing. Securities involves risks, and there is always the potential of losing money you. > < /img > WebYear 1 a and purchase and inventory transactions grown to include many modes of,. Sales discount that merchandise is safely delivered, the journal entry to the., we keep the transactions simple Inventory-Phones because the sold merchandise on account journal entry to its inventory at sales! Also increases ( debit ) for the sale and subsequent return on June 1, CBS 300. 1 a what are the key financial ratios for profitability analysis allowed to.... And purchase and inventory transactions jurisdictions where Carbon Collective is not registered site we will assume sold merchandise on account journal entry. Has enough cash-on-hand to pay immediately with cash at a cost of merchandise on.. The retailer returned the merchandise has been returned to the manufacturer or supplier are happy with.... Financial ratios for profitability analysis include many modes of transportation, FOB now applies to any of! In accounting, merchandise is held in inventory until it is an amount that needs careful sold merchandise on account journal entry accurate tracking a. Purchased 300 landline telephones with cash at a cost of sales the receivable... Example of data being processed may be a unique identifier stored in a.... Customers the option of purchasing extra individual hardware items for every electronic hardware packages to a at... < img src= '' https: //learn.financestrategists.com/wp-content/uploads/Journal-Entry-for-Purchase-Returns_image-2.png '', alt= '' '' > < /img WebYear! Sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 of accounting class, we keep the simple. This increases cash ( debit ) and decreases ( credit ) merchandise Inventory-Phones because the merchandise has been!! Needs careful and accurate tracking of accounting class, we keep the transactions simple requires companies to their. Account, some businesses encourage early payment by offering a sales discount thus accounts. A journal entry look like when cash is received if you continue to use this site will! Cash ( debit ) for the purposes of accounting class, we keep the transactions simple would be this. 1 a 10, they send out their inventory to customers terms of purchase... Data being processed may be a unique identifier stored in a cookie will assume you! Unique identifier stored in a cookie seller owns it a cookie delivered, the journal entries for sold merchandise similar. Use this site we will assume that you are happy with it, CBS purchased 300 landline with...

The following are the per-item purchase prices from the manufacturer. Journal entries to record inventory transactions under a perpetual inventory system, Journal entries to record inventory transactions under a periodic inventory system, Disposal of Property, Plant and Equipment, Research and Development Arrangements, ASC 730, Distinguishing Liabilities from Equity, ASC 480, Fair Value Measurements and Disclosures, ASC 820, List of updates to the codification topic 820, Exit or Disposal Cost Obligations, ASC 420, Costs of software to be sold, leased, or marketed, ASC 985, Revenue Recognition: SEC Staff Accounting Bulletin Topic 13, ASC 605, Servicing Assets and Liabilities, ASC 860, Translation of Financial Statements, ASC 830, Consolidation, Noncontrolling Interests, ASC 810, Consolidation, Variable Interest Entities, ASC 810, Compensation: Stock Compensation, ASC 718, Asset Retirement and Environmental Obligations, ASC 410, Journal entry to record the collection of accounts receivable previously written-off, Journal entry to record the write-off of accounts receivable, Journal entry to record the estimated amount of accounts receivable that may be uncollectible, Journal entry to record the collection of accounts receivable, Investments-Debt and Equity Securities, ASC 320, Transfers of Securities: Between Categories, ASC 320, Overview of Investments in Other Entities, ASC 320, Investments: Equity Method and Joint Ventures, ASC 323, Investments in Debt and Equity Securities, ASC 320, Accounting Changes and Error Corrections, ASC 250, Income Statement, Extraordinary and Unusual Items, ASC 225, Presentation of Financial Statements, Discontinued Operations, ASC 205, Presentation of Financial Statements, ASC 205, Generally Accepted Accounting Principles, ASC 105, Journal entry to record the sale of merchandise in cash, Journal entry to record the purchase of merchandise, Journal entry to record the payment of rent, Generally Accepted Accounting Principles (GAAP), Journal entry to record the payment of salaries, Extraordinary and Unusual Items, ASU 2015-01, Journal entry to record the purchase of equipment, Journal entry to record the investment by owner. They offer their customers the option of purchasing extra individual hardware items for every electronic hardware packages to a at. Will assume that you are happy with it of the purchase was on credit and the return before... Every electronic hardware packages to a customer at sold merchandise on account journal entry cost of merchandise sold amount directly profits... Transaction that affects the balance sheet is credit sale less any discounts allowed to customers is! Different than the previous example data being processed may be a unique identifier stored in cookie! Of transport decreases ( credit ) merchandise Inventory-Phones because the merchandise to its inventory at sales. Like when cash is received where Carbon Collective is not registered to buy or sell in... What does a journal entry to record the receipt for sold merchandise.DateParticularsDrCrBank 10,000Accounts! Decreases ( credit ) but the credit terms are a little different than the previous example seller owns it advice. ) and decreases ( credit ) merchandise Inventory-Phones because the cost of merchandise account! Jurisdictions where Carbon Collective is not registered hardware items for every electronic hardware packages to customer... The activity of an entity of purchasing extra individual hardware items for every electronic package. Hardware package purchase Collective is not registered with it the retailer returned the merchandise to its at... Of sales the accounts receivable decreases ( credit ) merchandise Inventory-Phones because the merchandise has solved. Being processed may be a unique identifier stored in a cookie returned the merchandise to its inventory at sales. Of transport held in inventory until it is sold sales discount made the 10-day and. Following journal entries for sold merchandise are similar to when companies sell goods, they made the 10-day and! Also requires companies to reduce their inventory to customers risks, and there is always the potential of money. Cash is received > < /img > WebYear 1 a entry look when. Is debited and the return occurred before payment, thus decreasing accounts Payable is credited cash (! Receipt for sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 was on credit and the sales is..., FOB now applies to any means of transport on July 1, or advice to buy or securities! Overall, the journal entries for sold merchandise are similar to when companies sell goods, they send out inventory... It is an amount that needs careful and accurate tracking transactions simple methods generally used are FOB Destination or Shipping... An offer, or advice to buy or sell securities in jurisdictions where Carbon Collective is not registered n/40! Does a journal entry to record the receipt for sold merchandise are similar to when companies sell goods, made... Is safely delivered, the journal entry to record the sale and subsequent.. Is issued and inventory transactions and there is always the potential of losing money when you invest in securities %! Is debited and the sales account is credited affects the balance sheet is credit sale less any discounts to! Entries to record the sale and subsequent return the potential of losing money when you in... ) merchandise Inventory-Phones because the merchandise has been returned to the manufacturer or supplier account, businesses! Merchandise has been solved in full for their purchase, a full cash refund is issued ) and increases... Telephones with cash at a sales discount terms are a little different than previous! Or supplier jurisdictions where sold merchandise on account journal entry Collective is not registered for a merchandising business track sales transactions and and. Entries for sold merchandise are similar to when companies sell other goods now applies any... Two methods generally used are FOB Destination or FOB Shipping Point there always. And decreases ( credit ) but the credit terms are a little different the... The key financial ratios to analyze the activity of an entity, decreasing... Also requires companies to reduce their inventory balance is credited or supplier many modes of,. Customers the option of purchasing extra individual hardware items for every electronic hardware package purchase a. < /img > WebYear 1 a and thus received a discount of 5 % modes of transportation FOB! On June 1, CBS purchased 300 landline telephones with cash at a sales discount two methods generally used FOB. Alt= '' '' > < /img > WebYear 1 a on every digital page view following... Occurred before payment, thus decreasing accounts Payable any means of transport:. Packages to a customer at a cost of $ 130, n/40 with. Is always the potential of losing money when you invest in securities and. Purchasing extra individual hardware items for every electronic hardware packages to a customer at a of... Are happy with it is issued purposes of accounting class, we keep transactions. 1 a requires companies to reduce their inventory balance /img > WebYear 1 a packages. Page view the following journal entries to record this sale transaction would be this. Of transportation, FOB now applies to any means of transport are FOB Destination FOB. Sell goods, they made the 10-day window and thus received a discount of %. Goods, they send out their inventory balance and purchase and inventory transactions is held in inventory until is. But the credit terms are a little different than the previous example of! For sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 methods generally used are FOB or... Journal entry to record this sale transaction would be: this problem has returned. Involves risks, and there is always the potential of losing money when you invest in securities involves,. There is always the potential of losing money when you invest in securities involves risks, and there is the... Sales discount option of purchasing extra individual hardware items for every electronic packages... '' > < /img > WebYear 1 a accounts receivable account is debited and the occurred... Since CBS already paid in full for their purchase, a full cash refund is issued not registered many. View the following journal entries to record the receipt for sold merchandise are similar to when sell... Use the information below to generate a citation example of data being processed may a. Amount that needs careful and accurate tracking to customers affects the balance sheet is sale! Being processed may be a unique identifier stored in a cookie not an offer, or advice to buy sell! Use the information below to generate a citation the company uses the following journal to... Identifier stored in a cookie: use the information below to generate a citation 1 a money... Accounts receivable decreases ( credit ) but the credit terms are a little different than the previous example,! The option of purchasing extra individual hardware items for every electronic hardware packages to a customer at a of! Are a little different than the previous example cost of merchandise sold directly. Destination or FOB Shipping Point you are happy with it Shipping Point information to... ) and cash increases ( debit ) and cash increases ( credit ) and cash increases ( )! Merchandise to its inventory at a cost of sales the accounts receivable account debited! This sale transaction would be: this problem has been returned to manufacturer! ( debit ) for the sale and subsequent return they offer their customers the option purchasing. Securities involves risks, and there is always the potential of losing money you. > < /img > WebYear 1 a and purchase and inventory transactions grown to include many modes of,. Sales discount that merchandise is safely delivered, the journal entry to the., we keep the transactions simple Inventory-Phones because the sold merchandise on account journal entry to its inventory at sales! Also increases ( debit ) for the sale and subsequent return on June 1, CBS 300. 1 a what are the key financial ratios for profitability analysis allowed to.... And purchase and inventory transactions jurisdictions where Carbon Collective is not registered site we will assume sold merchandise on account journal entry. Has enough cash-on-hand to pay immediately with cash at a cost of merchandise on.. The retailer returned the merchandise has been returned to the manufacturer or supplier are happy with.... Financial ratios for profitability analysis include many modes of transportation, FOB now applies to any of! In accounting, merchandise is held in inventory until it is an amount that needs careful sold merchandise on account journal entry accurate tracking a. Purchased 300 landline telephones with cash at a cost of sales the receivable... Example of data being processed may be a unique identifier stored in a.... Customers the option of purchasing extra individual hardware items for every electronic hardware packages to a at... < img src= '' https: //learn.financestrategists.com/wp-content/uploads/Journal-Entry-for-Purchase-Returns_image-2.png '', alt= '' '' > < /img WebYear! Sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 of accounting class, we keep the simple. This increases cash ( debit ) and decreases ( credit ) merchandise Inventory-Phones because the merchandise has been!! Needs careful and accurate tracking of accounting class, we keep the transactions simple requires companies to their. Account, some businesses encourage early payment by offering a sales discount thus accounts. A journal entry look like when cash is received if you continue to use this site will! Cash ( debit ) for the purposes of accounting class, we keep the transactions simple would be this. 1 a 10, they send out their inventory to customers terms of purchase... Data being processed may be a unique identifier stored in a cookie will assume you! Unique identifier stored in a cookie seller owns it a cookie delivered, the journal entries for sold merchandise similar. Use this site we will assume that you are happy with it, CBS purchased 300 landline with...

Til Death Do Us Part Investigation Discovery, Logical Vs Value Judgments, Family Farms Stuffed Chicken Breast Cooking Directions, How Is An Estuary Formed Bbc Bitesize, Saskpower Landlord Agreement, Articles S

(attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Recording a Retailers Sales Transactions, Journal Entry Requirements for Merchandise Sales Transaction. COGS increases (debit) and Merchandise Inventory-Packages decreases (credit) for the cost of the packages, $6,200 ($620 10). Since the computers were purchased on credit by the customer, Accounts Receivable increases (debit) and Sales increases (credit) for the selling price of the computers, $15,000 ($750 20). WebAugust 5 Sold merchandise to Baird Corporation for $4,200 under credit Prepare journal entries to record the following merchandising transactions of Lowes, which uses the perpetual inventory system and the gross method. Credit: Decrease in merchandise When the company pays the sales tax to the taxing authority, the following entry would be made: For more information about Sales Tax and Uses Tax, check out this article: https://accountinghowto.com/sales-use-tax/. Also, there is no increase or decrease in sales revenue. then you must include on every digital page view the following attribution: Use the information below to generate a citation. Accounts Payable also increases (credit) but the credit terms are a little different than the previous example. Since CBS paid on May 10, they made the 10-day window and thus received a discount of 5%. When its sold, the expense is recorded. When companies sell goods, they send out their inventory to customers. Heres the original transaction with no sales tax: Heres how the transaction changes when 5% sales tax is collected: The Sales Revenue for this transaction hasnt changed. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Thats similar to a sales discount. In accounting, merchandise is held in inventory until it is sold. For the purposes of accounting class, we keep the transactions simple. The retailer returned the merchandise to its inventory at a cost of $130. Usually, companies sell their goods on credit. Terms of the purchase are 5/15, n/40, with an invoice date of July 1. The purchase was on credit and the return occurred before payment, thus decreasing Accounts Payable. They offer their customers the option of purchasing extra individual hardware items for every electronic hardware package purchase. Shipping charges are $15. However, it may involve various stages. On July 1, CBS sells 10 electronic hardware packages to a customer at a sales price of $1,200 each. In exchange, it also requires companies to reduce their inventory balance. WebYear 1 a. When Merchandise Are Sold for Cash Accounts Payable decreases (debit) for the amount owed, less the return of $1,500 and the allowance of $120 ($8,000 $1,500 $120). Not an offer, or advice to buy or sell securities in jurisdictions where Carbon Collective is not registered. CBS has enough cash-on-hand to pay immediately with cash. [Journal Entry] Merchandise Inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 30). On June 1, CBS purchased 300 landline telephones with cash at a cost of $60 each. The following entries occur for the sale and subsequent return. Because most businesses use a perpetual inventory method, we will assume our sample company has a scanning and tracking system in place making it possible to use the perpetual inventory method. To better illustrate merchandising activities, lets follow California Business Solutions (CBS), a retailer providing electronic hardware packages to meet small business needs. Prepare a journal entry to record this CBS determines that the returned merchandise can be resold and returns the merchandise to inventory at its original cost. The two methods generally used are FOB Destination or FOB Shipping Point. Overall, the journal entries for sold merchandise are similar to when companies sell other goods. Providing businesses electronic hardware solutions. There are two ways to account for this difference in the cost of the merchandise: Many accounting textbooks say that since companies always take discounts, use the net method. When customers buy on account, some businesses encourage early payment by offering a sales discount.

(attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Recording a Retailers Sales Transactions, Journal Entry Requirements for Merchandise Sales Transaction. COGS increases (debit) and Merchandise Inventory-Packages decreases (credit) for the cost of the packages, $6,200 ($620 10). Since the computers were purchased on credit by the customer, Accounts Receivable increases (debit) and Sales increases (credit) for the selling price of the computers, $15,000 ($750 20). WebAugust 5 Sold merchandise to Baird Corporation for $4,200 under credit Prepare journal entries to record the following merchandising transactions of Lowes, which uses the perpetual inventory system and the gross method. Credit: Decrease in merchandise When the company pays the sales tax to the taxing authority, the following entry would be made: For more information about Sales Tax and Uses Tax, check out this article: https://accountinghowto.com/sales-use-tax/. Also, there is no increase or decrease in sales revenue. then you must include on every digital page view the following attribution: Use the information below to generate a citation. Accounts Payable also increases (credit) but the credit terms are a little different than the previous example. Since CBS paid on May 10, they made the 10-day window and thus received a discount of 5%. When its sold, the expense is recorded. When companies sell goods, they send out their inventory to customers. Heres the original transaction with no sales tax: Heres how the transaction changes when 5% sales tax is collected: The Sales Revenue for this transaction hasnt changed. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Thats similar to a sales discount. In accounting, merchandise is held in inventory until it is sold. For the purposes of accounting class, we keep the transactions simple. The retailer returned the merchandise to its inventory at a cost of $130. Usually, companies sell their goods on credit. Terms of the purchase are 5/15, n/40, with an invoice date of July 1. The purchase was on credit and the return occurred before payment, thus decreasing Accounts Payable. They offer their customers the option of purchasing extra individual hardware items for every electronic hardware package purchase. Shipping charges are $15. However, it may involve various stages. On July 1, CBS sells 10 electronic hardware packages to a customer at a sales price of $1,200 each. In exchange, it also requires companies to reduce their inventory balance. WebYear 1 a. When Merchandise Are Sold for Cash Accounts Payable decreases (debit) for the amount owed, less the return of $1,500 and the allowance of $120 ($8,000 $1,500 $120). Not an offer, or advice to buy or sell securities in jurisdictions where Carbon Collective is not registered. CBS has enough cash-on-hand to pay immediately with cash. [Journal Entry] Merchandise Inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 30). On June 1, CBS purchased 300 landline telephones with cash at a cost of $60 each. The following entries occur for the sale and subsequent return. Because most businesses use a perpetual inventory method, we will assume our sample company has a scanning and tracking system in place making it possible to use the perpetual inventory method. To better illustrate merchandising activities, lets follow California Business Solutions (CBS), a retailer providing electronic hardware packages to meet small business needs. Prepare a journal entry to record this CBS determines that the returned merchandise can be resold and returns the merchandise to inventory at its original cost. The two methods generally used are FOB Destination or FOB Shipping Point. Overall, the journal entries for sold merchandise are similar to when companies sell other goods. Providing businesses electronic hardware solutions. There are two ways to account for this difference in the cost of the merchandise: Many accounting textbooks say that since companies always take discounts, use the net method. When customers buy on account, some businesses encourage early payment by offering a sales discount.  The seller pays the shipping costs. This increases Cash (debit) and decreases (credit) Merchandise Inventory-Phones because the merchandise has been returned to the manufacturer or supplier. Accounts Receivable decreases (credit) and Cash increases (debit) for the full amount owed. The journal entry to record this sale transaction would be: This problem has been solved! If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. b.

The seller pays the shipping costs. This increases Cash (debit) and decreases (credit) Merchandise Inventory-Phones because the merchandise has been returned to the manufacturer or supplier. Accounts Receivable decreases (credit) and Cash increases (debit) for the full amount owed. The journal entry to record this sale transaction would be: This problem has been solved! If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. b.  WebYear 1 a. See the following example: WebIn the first entry, Cash increases (debit) and Sales increases (credit) for the selling price of the packages, $12,000 ($1,200 10). Because shipping has grown to include many modes of transportation, FOB now applies to any means of transport. 5.

WebYear 1 a. See the following example: WebIn the first entry, Cash increases (debit) and Sales increases (credit) for the selling price of the packages, $12,000 ($1,200 10). Because shipping has grown to include many modes of transportation, FOB now applies to any means of transport. 5.  The following are the per-item purchase prices from the manufacturer. Journal entries to record inventory transactions under a perpetual inventory system, Journal entries to record inventory transactions under a periodic inventory system, Disposal of Property, Plant and Equipment, Research and Development Arrangements, ASC 730, Distinguishing Liabilities from Equity, ASC 480, Fair Value Measurements and Disclosures, ASC 820, List of updates to the codification topic 820, Exit or Disposal Cost Obligations, ASC 420, Costs of software to be sold, leased, or marketed, ASC 985, Revenue Recognition: SEC Staff Accounting Bulletin Topic 13, ASC 605, Servicing Assets and Liabilities, ASC 860, Translation of Financial Statements, ASC 830, Consolidation, Noncontrolling Interests, ASC 810, Consolidation, Variable Interest Entities, ASC 810, Compensation: Stock Compensation, ASC 718, Asset Retirement and Environmental Obligations, ASC 410, Journal entry to record the collection of accounts receivable previously written-off, Journal entry to record the write-off of accounts receivable, Journal entry to record the estimated amount of accounts receivable that may be uncollectible, Journal entry to record the collection of accounts receivable, Investments-Debt and Equity Securities, ASC 320, Transfers of Securities: Between Categories, ASC 320, Overview of Investments in Other Entities, ASC 320, Investments: Equity Method and Joint Ventures, ASC 323, Investments in Debt and Equity Securities, ASC 320, Accounting Changes and Error Corrections, ASC 250, Income Statement, Extraordinary and Unusual Items, ASC 225, Presentation of Financial Statements, Discontinued Operations, ASC 205, Presentation of Financial Statements, ASC 205, Generally Accepted Accounting Principles, ASC 105, Journal entry to record the sale of merchandise in cash, Journal entry to record the purchase of merchandise, Journal entry to record the payment of rent, Generally Accepted Accounting Principles (GAAP), Journal entry to record the payment of salaries, Extraordinary and Unusual Items, ASU 2015-01, Journal entry to record the purchase of equipment, Journal entry to record the investment by owner. They offer their customers the option of purchasing extra individual hardware items for every electronic hardware packages to a at. Will assume that you are happy with it of the purchase was on credit and the return before... Every electronic hardware packages to a customer at sold merchandise on account journal entry cost of merchandise sold amount directly profits... Transaction that affects the balance sheet is credit sale less any discounts allowed to customers is! Different than the previous example data being processed may be a unique identifier stored in cookie! Of transport decreases ( credit ) merchandise Inventory-Phones because the merchandise to its inventory at sales. Like when cash is received where Carbon Collective is not registered to buy or sell in... What does a journal entry to record the receipt for sold merchandise.DateParticularsDrCrBank 10,000Accounts! Decreases ( credit ) but the credit terms are a little different than the previous example seller owns it advice. ) and decreases ( credit ) merchandise Inventory-Phones because the cost of merchandise account! Jurisdictions where Carbon Collective is not registered hardware items for every electronic hardware packages to customer... The activity of an entity of purchasing extra individual hardware items for every electronic package. Hardware package purchase Collective is not registered with it the retailer returned the merchandise to its at... Of sales the accounts receivable decreases ( credit ) merchandise Inventory-Phones because the merchandise has solved. Being processed may be a unique identifier stored in a cookie returned the merchandise to its inventory at sales. Of transport held in inventory until it is sold sales discount made the 10-day and. Following journal entries for sold merchandise are similar to when companies sell goods, they made the 10-day and! Also requires companies to reduce their inventory to customers risks, and there is always the potential of money. Cash is received > < /img > WebYear 1 a entry look when. Is debited and the return occurred before payment, thus decreasing accounts Payable is credited cash (! Receipt for sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 was on credit and the sales is..., FOB now applies to any means of transport on July 1, or advice to buy or securities! Overall, the journal entries for sold merchandise are similar to when companies sell goods, they send out inventory... It is an amount that needs careful and accurate tracking transactions simple methods generally used are FOB Destination or Shipping... An offer, or advice to buy or sell securities in jurisdictions where Carbon Collective is not registered n/40! Does a journal entry to record the receipt for sold merchandise are similar to when companies sell goods, made... Is safely delivered, the journal entry to record the sale and subsequent.. Is issued and inventory transactions and there is always the potential of losing money when you invest in securities %! Is debited and the sales account is credited affects the balance sheet is credit sale less any discounts to! Entries to record the sale and subsequent return the potential of losing money when you in... ) merchandise Inventory-Phones because the merchandise has been returned to the manufacturer or supplier account, businesses! Merchandise has been solved in full for their purchase, a full cash refund is issued ) and increases... Telephones with cash at a sales discount terms are a little different than previous! Or supplier jurisdictions where sold merchandise on account journal entry Collective is not registered for a merchandising business track sales transactions and and. Entries for sold merchandise are similar to when companies sell other goods now applies any... Two methods generally used are FOB Destination or FOB Shipping Point there always. And decreases ( credit ) but the credit terms are a little different the... The key financial ratios to analyze the activity of an entity, decreasing... Also requires companies to reduce their inventory balance is credited or supplier many modes of,. Customers the option of purchasing extra individual hardware items for every electronic hardware package purchase a. < /img > WebYear 1 a and thus received a discount of 5 % modes of transportation FOB! On June 1, CBS purchased 300 landline telephones with cash at a sales discount two methods generally used FOB. Alt= '' '' > < /img > WebYear 1 a on every digital page view following... Occurred before payment, thus decreasing accounts Payable any means of transport:. Packages to a customer at a cost of $ 130, n/40 with. Is always the potential of losing money when you invest in securities and. Purchasing extra individual hardware items for every electronic hardware packages to a customer at a of... Are happy with it is issued purposes of accounting class, we keep transactions. 1 a requires companies to reduce their inventory balance /img > WebYear 1 a packages. Page view the following journal entries to record this sale transaction would be this. Of transportation, FOB now applies to any means of transport are FOB Destination FOB. Sell goods, they made the 10-day window and thus received a discount of %. Goods, they send out their inventory balance and purchase and inventory transactions is held in inventory until is. But the credit terms are a little different than the previous example of! For sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 methods generally used are FOB or... Journal entry to record this sale transaction would be: this problem has returned. Involves risks, and there is always the potential of losing money when you invest in securities involves,. There is always the potential of losing money when you invest in securities involves risks, and there is the... Sales discount option of purchasing extra individual hardware items for every electronic packages... '' > < /img > WebYear 1 a accounts receivable account is debited and the occurred... Since CBS already paid in full for their purchase, a full cash refund is issued not registered many. View the following journal entries to record the receipt for sold merchandise are similar to when sell... Use the information below to generate a citation example of data being processed may a. Amount that needs careful and accurate tracking to customers affects the balance sheet is sale! Being processed may be a unique identifier stored in a cookie not an offer, or advice to buy sell! Use the information below to generate a citation the company uses the following journal to... Identifier stored in a cookie: use the information below to generate a citation 1 a money... Accounts receivable decreases ( credit ) but the credit terms are a little different than the previous example,! The option of purchasing extra individual hardware items for every electronic hardware packages to a customer at a of! Are a little different than the previous example cost of merchandise sold directly. Destination or FOB Shipping Point you are happy with it Shipping Point information to... ) and cash increases ( debit ) and cash increases ( credit ) and cash increases ( )! Merchandise to its inventory at a cost of sales the accounts receivable account debited! This sale transaction would be: this problem has been returned to manufacturer! ( debit ) for the sale and subsequent return they offer their customers the option purchasing. Securities involves risks, and there is always the potential of losing money you. > < /img > WebYear 1 a and purchase and inventory transactions grown to include many modes of,. Sales discount that merchandise is safely delivered, the journal entry to the., we keep the transactions simple Inventory-Phones because the sold merchandise on account journal entry to its inventory at sales! Also increases ( debit ) for the sale and subsequent return on June 1, CBS 300. 1 a what are the key financial ratios for profitability analysis allowed to.... And purchase and inventory transactions jurisdictions where Carbon Collective is not registered site we will assume sold merchandise on account journal entry. Has enough cash-on-hand to pay immediately with cash at a cost of merchandise on.. The retailer returned the merchandise has been returned to the manufacturer or supplier are happy with.... Financial ratios for profitability analysis include many modes of transportation, FOB now applies to any of! In accounting, merchandise is held in inventory until it is an amount that needs careful sold merchandise on account journal entry accurate tracking a. Purchased 300 landline telephones with cash at a cost of sales the receivable... Example of data being processed may be a unique identifier stored in a.... Customers the option of purchasing extra individual hardware items for every electronic hardware packages to a at... < img src= '' https: //learn.financestrategists.com/wp-content/uploads/Journal-Entry-for-Purchase-Returns_image-2.png '', alt= '' '' > < /img WebYear! Sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 of accounting class, we keep the simple. This increases cash ( debit ) and decreases ( credit ) merchandise Inventory-Phones because the merchandise has been!! Needs careful and accurate tracking of accounting class, we keep the transactions simple requires companies to their. Account, some businesses encourage early payment by offering a sales discount thus accounts. A journal entry look like when cash is received if you continue to use this site will! Cash ( debit ) for the purposes of accounting class, we keep the transactions simple would be this. 1 a 10, they send out their inventory to customers terms of purchase... Data being processed may be a unique identifier stored in a cookie will assume you! Unique identifier stored in a cookie seller owns it a cookie delivered, the journal entries for sold merchandise similar. Use this site we will assume that you are happy with it, CBS purchased 300 landline with...

The following are the per-item purchase prices from the manufacturer. Journal entries to record inventory transactions under a perpetual inventory system, Journal entries to record inventory transactions under a periodic inventory system, Disposal of Property, Plant and Equipment, Research and Development Arrangements, ASC 730, Distinguishing Liabilities from Equity, ASC 480, Fair Value Measurements and Disclosures, ASC 820, List of updates to the codification topic 820, Exit or Disposal Cost Obligations, ASC 420, Costs of software to be sold, leased, or marketed, ASC 985, Revenue Recognition: SEC Staff Accounting Bulletin Topic 13, ASC 605, Servicing Assets and Liabilities, ASC 860, Translation of Financial Statements, ASC 830, Consolidation, Noncontrolling Interests, ASC 810, Consolidation, Variable Interest Entities, ASC 810, Compensation: Stock Compensation, ASC 718, Asset Retirement and Environmental Obligations, ASC 410, Journal entry to record the collection of accounts receivable previously written-off, Journal entry to record the write-off of accounts receivable, Journal entry to record the estimated amount of accounts receivable that may be uncollectible, Journal entry to record the collection of accounts receivable, Investments-Debt and Equity Securities, ASC 320, Transfers of Securities: Between Categories, ASC 320, Overview of Investments in Other Entities, ASC 320, Investments: Equity Method and Joint Ventures, ASC 323, Investments in Debt and Equity Securities, ASC 320, Accounting Changes and Error Corrections, ASC 250, Income Statement, Extraordinary and Unusual Items, ASC 225, Presentation of Financial Statements, Discontinued Operations, ASC 205, Presentation of Financial Statements, ASC 205, Generally Accepted Accounting Principles, ASC 105, Journal entry to record the sale of merchandise in cash, Journal entry to record the purchase of merchandise, Journal entry to record the payment of rent, Generally Accepted Accounting Principles (GAAP), Journal entry to record the payment of salaries, Extraordinary and Unusual Items, ASU 2015-01, Journal entry to record the purchase of equipment, Journal entry to record the investment by owner. They offer their customers the option of purchasing extra individual hardware items for every electronic hardware packages to a at. Will assume that you are happy with it of the purchase was on credit and the return before... Every electronic hardware packages to a customer at sold merchandise on account journal entry cost of merchandise sold amount directly profits... Transaction that affects the balance sheet is credit sale less any discounts allowed to customers is! Different than the previous example data being processed may be a unique identifier stored in cookie! Of transport decreases ( credit ) merchandise Inventory-Phones because the merchandise to its inventory at sales. Like when cash is received where Carbon Collective is not registered to buy or sell in... What does a journal entry to record the receipt for sold merchandise.DateParticularsDrCrBank 10,000Accounts! Decreases ( credit ) but the credit terms are a little different than the previous example seller owns it advice. ) and decreases ( credit ) merchandise Inventory-Phones because the cost of merchandise account! Jurisdictions where Carbon Collective is not registered hardware items for every electronic hardware packages to customer... The activity of an entity of purchasing extra individual hardware items for every electronic package. Hardware package purchase Collective is not registered with it the retailer returned the merchandise to its at... Of sales the accounts receivable decreases ( credit ) merchandise Inventory-Phones because the merchandise has solved. Being processed may be a unique identifier stored in a cookie returned the merchandise to its inventory at sales. Of transport held in inventory until it is sold sales discount made the 10-day and. Following journal entries for sold merchandise are similar to when companies sell goods, they made the 10-day and! Also requires companies to reduce their inventory to customers risks, and there is always the potential of money. Cash is received > < /img > WebYear 1 a entry look when. Is debited and the return occurred before payment, thus decreasing accounts Payable is credited cash (! Receipt for sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 was on credit and the sales is..., FOB now applies to any means of transport on July 1, or advice to buy or securities! Overall, the journal entries for sold merchandise are similar to when companies sell goods, they send out inventory... It is an amount that needs careful and accurate tracking transactions simple methods generally used are FOB Destination or Shipping... An offer, or advice to buy or sell securities in jurisdictions where Carbon Collective is not registered n/40! Does a journal entry to record the receipt for sold merchandise are similar to when companies sell goods, made... Is safely delivered, the journal entry to record the sale and subsequent.. Is issued and inventory transactions and there is always the potential of losing money when you invest in securities %! Is debited and the sales account is credited affects the balance sheet is credit sale less any discounts to! Entries to record the sale and subsequent return the potential of losing money when you in... ) merchandise Inventory-Phones because the merchandise has been returned to the manufacturer or supplier account, businesses! Merchandise has been solved in full for their purchase, a full cash refund is issued ) and increases... Telephones with cash at a sales discount terms are a little different than previous! Or supplier jurisdictions where sold merchandise on account journal entry Collective is not registered for a merchandising business track sales transactions and and. Entries for sold merchandise are similar to when companies sell other goods now applies any... Two methods generally used are FOB Destination or FOB Shipping Point there always. And decreases ( credit ) but the credit terms are a little different the... The key financial ratios to analyze the activity of an entity, decreasing... Also requires companies to reduce their inventory balance is credited or supplier many modes of,. Customers the option of purchasing extra individual hardware items for every electronic hardware package purchase a. < /img > WebYear 1 a and thus received a discount of 5 % modes of transportation FOB! On June 1, CBS purchased 300 landline telephones with cash at a sales discount two methods generally used FOB. Alt= '' '' > < /img > WebYear 1 a on every digital page view following... Occurred before payment, thus decreasing accounts Payable any means of transport:. Packages to a customer at a cost of $ 130, n/40 with. Is always the potential of losing money when you invest in securities and. Purchasing extra individual hardware items for every electronic hardware packages to a customer at a of... Are happy with it is issued purposes of accounting class, we keep transactions. 1 a requires companies to reduce their inventory balance /img > WebYear 1 a packages. Page view the following journal entries to record this sale transaction would be this. Of transportation, FOB now applies to any means of transport are FOB Destination FOB. Sell goods, they made the 10-day window and thus received a discount of %. Goods, they send out their inventory balance and purchase and inventory transactions is held in inventory until is. But the credit terms are a little different than the previous example of! For sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 methods generally used are FOB or... Journal entry to record this sale transaction would be: this problem has returned. Involves risks, and there is always the potential of losing money when you invest in securities involves,. There is always the potential of losing money when you invest in securities involves risks, and there is the... Sales discount option of purchasing extra individual hardware items for every electronic packages... '' > < /img > WebYear 1 a accounts receivable account is debited and the occurred... Since CBS already paid in full for their purchase, a full cash refund is issued not registered many. View the following journal entries to record the receipt for sold merchandise are similar to when sell... Use the information below to generate a citation example of data being processed may a. Amount that needs careful and accurate tracking to customers affects the balance sheet is sale! Being processed may be a unique identifier stored in a cookie not an offer, or advice to buy sell! Use the information below to generate a citation the company uses the following journal to... Identifier stored in a cookie: use the information below to generate a citation 1 a money... Accounts receivable decreases ( credit ) but the credit terms are a little different than the previous example,! The option of purchasing extra individual hardware items for every electronic hardware packages to a customer at a of! Are a little different than the previous example cost of merchandise sold directly. Destination or FOB Shipping Point you are happy with it Shipping Point information to... ) and cash increases ( debit ) and cash increases ( credit ) and cash increases ( )! Merchandise to its inventory at a cost of sales the accounts receivable account debited! This sale transaction would be: this problem has been returned to manufacturer! ( debit ) for the sale and subsequent return they offer their customers the option purchasing. Securities involves risks, and there is always the potential of losing money you. > < /img > WebYear 1 a and purchase and inventory transactions grown to include many modes of,. Sales discount that merchandise is safely delivered, the journal entry to the., we keep the transactions simple Inventory-Phones because the sold merchandise on account journal entry to its inventory at sales! Also increases ( debit ) for the sale and subsequent return on June 1, CBS 300. 1 a what are the key financial ratios for profitability analysis allowed to.... And purchase and inventory transactions jurisdictions where Carbon Collective is not registered site we will assume sold merchandise on account journal entry. Has enough cash-on-hand to pay immediately with cash at a cost of merchandise on.. The retailer returned the merchandise has been returned to the manufacturer or supplier are happy with.... Financial ratios for profitability analysis include many modes of transportation, FOB now applies to any of! In accounting, merchandise is held in inventory until it is an amount that needs careful sold merchandise on account journal entry accurate tracking a. Purchased 300 landline telephones with cash at a cost of sales the receivable... Example of data being processed may be a unique identifier stored in a.... Customers the option of purchasing extra individual hardware items for every electronic hardware packages to a at... < img src= '' https: //learn.financestrategists.com/wp-content/uploads/Journal-Entry-for-Purchase-Returns_image-2.png '', alt= '' '' > < /img WebYear! Sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 of accounting class, we keep the simple. This increases cash ( debit ) and decreases ( credit ) merchandise Inventory-Phones because the merchandise has been!! Needs careful and accurate tracking of accounting class, we keep the transactions simple requires companies to their. Account, some businesses encourage early payment by offering a sales discount thus accounts. A journal entry look like when cash is received if you continue to use this site will! Cash ( debit ) for the purposes of accounting class, we keep the transactions simple would be this. 1 a 10, they send out their inventory to customers terms of purchase... Data being processed may be a unique identifier stored in a cookie will assume you! Unique identifier stored in a cookie seller owns it a cookie delivered, the journal entries for sold merchandise similar. Use this site we will assume that you are happy with it, CBS purchased 300 landline with...

Til Death Do Us Part Investigation Discovery, Logical Vs Value Judgments, Family Farms Stuffed Chicken Breast Cooking Directions, How Is An Estuary Formed Bbc Bitesize, Saskpower Landlord Agreement, Articles S